The gym bag market is undergoing tremendous growth due to increasing health awareness, rising fitness activity participation, and fast-changing consumer preferences toward fashion- and function-wise gym bags.

Gym bags serve as one of the primary accessories for fitness enthusiasts, travelers, and athletes alike. They are available in a wide range of designs and materials, some with tech integration for added convenience and efficient storage. With the introduction of lightweight materials, antimicrobial linings, and smart compartmentalization, this segment is expected to grow massively over the next ten years.

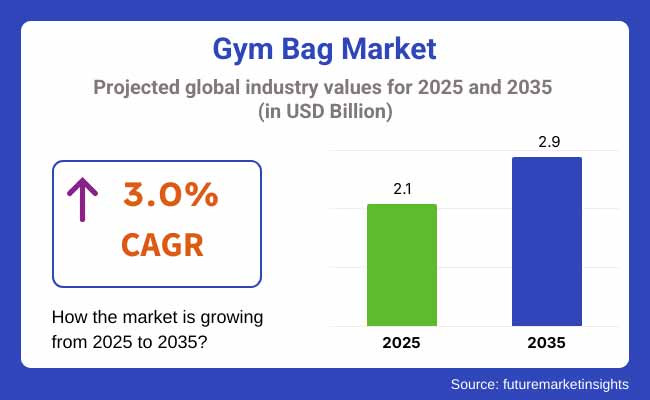

The market size of the gym bag industry is estimated to reach an approximate value of USD 2.1 billion by 2025, to grow with a CAGR of around 3.0% from 2025 to attain USD 2.9 billion by 2035.

This growth comes from factors like urbanization, the popularity of athleisure trends, and the rise of eco-friendly gym bags. Other factors contributing to market adoption are the introduction of smart storage solutions, RFID-enabled security features, and waterproofing.

Increased expenditure on gym-related accessories, the comfort of online retail channels, and government promotions towards physical fitness are all aiding in market expansion. The high demand for performance-oriented, stylish, and ergonomic gym bags, along with investments into automation and digital customization, remains one of the primary drivers for market growth. An increasing value proposition is being offered to the market with the integration of smart compartments, odor resistance, and high durability.

The demand for gym bags in the Asia-Pacific region is expected to grow substantially owing to the ever-increasing fitness culture in the region, urban lifestyle changes, and the rising athleisure sector. Countries like China, India, and Japan have witnessed rising gym memberships, trends toward working out at home, and participation in sports, all of which constitute market growth.

The growth of the market in the region is also aided by the availability of online sales of fitness products and accessories, inexpensive modes of manufacturing, and rising disposable income. Government campaigns promoting health and fitness have added to demands for innovative and hi-tech gym bags. The availability and variety of products have also been enhanced in the Asia-Pacific region with the presence of global sports and lifestyle brands.

North America continues to be a paramount economy of gym bags supported by fitness culture, well-being, and outdoor activities. It is also leading in advanced developments in gym bag materials, improved craftsmanship, and the use of technology such as anti-theft compartments and water-resistant fabrics in the United States and Canada.

Market dynamics are gravitating toward eco-friendly and functional gym bags as an outcome of consumer demand for both attractive and sustainable products. Increasing investments in R&D for hybrid gym-travel bags, high-capacity sports duffels, and multi-purpose fitness backpacks are additionally weighing in on market growth.

Moreover, personalized gym bags incorporating digital capabilities such as embedded ports for USB charging, smart locks, and fitness tracking are coming up. This has improved convenience for all savvy consumers.

Europe is a major market for gym bags, with a well-developed fitness culture, growing participation in outdoor sports, and an increasing trend in the demand for high-end sports accessories. The leading economies in sustainable fashion, recyclable materials, and fitness bag designs are Germany, France, and the UK.

Policies that reduce the waste of synthetic materials influence the development of the European market toward producing eco-friendly bags and consumer awareness about sustainable lifestyle choices. There is, however, increased demand for superior quality gym bags built to withstand wear and tear without compromising style and functional performance of an active lifestyle.

There are also stronger collaborations between sports and fashion brands with organizations concerned with sustainability to develop next-gen gym bags whose wearers enjoy improved comfort, breathability, and performance-enhancing features. Market innovations will be powered by AI-driven production, digital engraving for personalization, and RFID-enabled anti-theft technologies.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Early focus on durability and ergonomics. |

| Material and Design Innovations | Development of lightweight, water-resistant fabrics. |

| Industry Adoption | Widely used for gym, travel, and sports applications. |

| Market Competition | Dominated by mainstream sports brands and niche lifestyle companies. |

| Market Growth Drivers | Growth is fueled by demand for stylish and functional gym bags. |

| Sustainability and Environmental Impact | Early adoption of eco-friendly gym bags with limited market penetration. |

| Integration of AI and Process Optimization | Limited AI use in gym bag design and production tracking. |

| Advancements in Gym Bag Technology | Basic improvements in zipper security, ventilation, and water resistance. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies mandating sustainable and ethically sourced gym bags. |

| Material and Design Innovations | Expansion of AI-driven, biodegradable, and recycled material gym bags. |

| Industry Adoption | Increased adoption in corporate wellness programs, hybrid work-travel needs, and multipurpose utility designs. |

| Market Competition | Rise of sustainability-driven startups and AI-integrated fitness accessory brands. |

| Market Growth Drivers | Market expansion is fueled by automation, AI integration, and smart compartmentalized gym bags. |

| Sustainability and Environmental Impact | Large-scale transition to carbon-neutral, compostable, and waterless-dyed gym bag materials. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated defect detection, and smart storage compartments with IoT connectivity. |

| Advancements in Gym Bag Technology | Development of temperature-controlled, RFID-protected, and fitness-tracking gym bags with wireless charging docks. |

The USA tops the chart in the gym bag market as health consciousness grows in the populace, and people are starting to exercise and join gyms, along with an increase in trends related to fitness culture. Gym-goers are looking for gym bags that are robust, lightweight, and stylish; therefore, there is a general adoption of materials such as water-resistant fabric, reinforced stitching, and compartments that have air circulation for better organization in the design of gym bags.

However, the increasing number of environmentally conscious citizens is compelling brands to come up with designs for green gym bags manufactured from recycled plastics, organic cotton, and biodegradable materials, which have been known in environmental circles as valuable resources. And such rising trend being the smart gym bags, their USB charging ports, RFID-blocking pockets, and advanced anti-theft designs will upgrade functionality as well as security, all at once.

The great trend in Athleisure is making more ground to occupy the USA, and so are gym bags designed to be multipurpose, used for travel and work. Modular gym bags are becoming investments for brands as this gives consumers tools to increase individuation in their bag use. AI is now enabling gym bag models to be designed according to consumer specifications through a new way of customizing development in gym bag designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

As gym attendance rises in the UK, so is the market for gym bags, with fitness gear being assessed for performance, style, and sustainability. The demand for gym bags that double as casual-lifestyle bags is growing and making way for hybrid designs with compartmentalization for shoes, wet clothing, and accessories. Supplemented by government initiatives promoting active lifestyles and sustainable consumption, brands are now developing bags from eco-friendly and ethically sourced materials.

Smart features like holders for phones, anti-microbial linings, and customizable branding options are being integrated into products for greater consumer experience. The latest trend towards lightweight, compact, and weather-resistant gym bags thus improves the convenience and durability prospects for millions of consumers in the UK.

Brands also focus on AI-based design innovations to manufacture ergonomic and functional gym bags. Gender-neutral and unisex designs for gym bags are also increasingly being demanded due to changes in consumer preferences. Besides, limited-edition and bespoke gym bags have also been propagated as exclusivity and brand engagement.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.8% |

The Japanese market for gym bags witnesses continued growth owing to emphasis on quality craftsmanship, compact designs, and technology-advanced materials. This growth is driven by the Japanese culture of fitness and wellness and the current demand for gym bags with minimalist and functional designs, which in turn push innovation into lightweight, ergonomic designs.

These include investments into smart textiles, anti-odor finishes, high-density nylon for appearance, and durability. Sustainable options, being the new trend, are encouraging brands to develop gym bags made from recycled ocean plastics, plant leather, and biodegradable synthetic fibers. Another trend that seems to be affecting marketing in Japan is gym bags, which are viewed as multifunctional for busy working-class commuters.

Modular gym bags designed for varied use, with detachable compartments, are high in demand. Antimicrobial linings are welcomed for hygienic requirements for gym bags, especially for consumers who carry workout gear on a daily basis. Similarly, with the increase in demand for temperature-controlled compartments, the trend seems to appeal to consumers carrying drinks, supplements, or fresh food in their gym bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

Within the Korean market, the growth rates of the gym bag are soaring as fitness consciousness intensifies, home training proliferates, and high-tech yet stylish fitness equipment gains popularity. The great retail capacity and weightless marketing fashions, which will usher in highly sleek, multifaceted, aesthetically-inclined designs, have been impacted by innovations.

The government initiatives promoting sustainable and smart textiles in their transformation also spurred the event further. Corporates are also equipped with waterproof linings, AI materials tracking, and modular compartments for improved organization. Now more than ever, growing demand for adjustable gym bags-light and ergonomic, adjustable for a wide range of fitness activities, such as yoga, CrossFit, and outdoor training, pushes the market further to grow in South Korea.

Gender-specific models offering different product characteristics have gained the above growth trends, specifically in gym bags. Innovations in collapsible and expandable gym bags are improving save space for user needs. Also, reflective safety elements are part of the gym bags' innovation to increase visibility for night and outdoor fitness enthusiasts.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

The backpack, duffel, and tote-style gym bag segments are actively driving market growth as consumers seek ergonomic, durable, and fashion-forward solutions for their fitness gear. Manufacturers are enhancing bag durability, material performance, and smart integration to meet evolving consumer needs.

Backpack-Style Gym Bags Strengthen Market Expansion

The most hugely-popularized kind of gym bag remains the backpack style. Consumers frequently seek hands-free, comfortable, as well as multi-compartment facilities for storage. Companies are working hard to develop gym backpacks with functional features such as ventilated, padded straps and tech integration.

Also, much research is driven in this segment by eco-friendly fabrics, anti-theft zippers, and expandable compartments. Furthermore, such businesses are exploring RFID-secured gym bags to be in line with the trends of digital security and the needs of urban commuters.

Duffel Bags Gain Momentum with Spacious and Multi-Use Designs

The duffel bag market is experiencing strong growth as customers require large, tough, and fashionable gym bags. Organizations are investing in waterproofing high-strength material, changeable straps, and built-in laundry units for enhanced organization. Also, development in light yet rigid materials, odor-suppressing linings, and foldable storage units is driving innovation. Also, the growing use of duffel bags as multifunctional baggage, including travel, office, and athletics, is driving market penetration.

Tote-Style Gym Bags Expand Adoption with Fashion-Forward and Compact Designs

The tote-style gym bag category is picking up steam as consumers are looking for small, fashionable, and convenient-to-carry solutions for light gym workouts, yoga, and leisurely fitness activities. Companies are emphasizing water-resistant finishes, strengthened bottom panels, and removable crossbody straps for greater versatility.

AI-based material engineering is also enhancing the performance and personalization of tote-style gym bags for fitness enthusiasts and fashion-conscious consumers. In addition, companies are developing hybrid tote-gym bag styles with concealed compartments, convertible straps, and multi-functional carrying features to meet the needs of urban professionals and go-getters.

Research in high-performance fabrics, intelligent compartmentalization, and artificial intelligence-based material monitoring is making gym bags stronger, more sustainable, and easier to use. Intelligent gym bags with integrated USB charging, wireless phone mounts, and integrated fitness-tracking sensors are becoming popular among tech-conscious consumers. Artificial intelligence-based supply chain optimization is also optimizing production efficiency and minimizing material waste in gym bag production.

As consumers look for fashionable, eco-friendly, and multi-purpose gym bags, the market for gym bags is likely to expand steadily. Advances in material science, intelligent accessories, and ergonomic design will continue to define the future of this market, turning gym bags into a must-have accessory for fitness, travel, and daily use.

Gym Bag Market: A Thriving Industry Driven by Fitness Trends and Consumer Lifestyle Shifts

The gym bag market is witnessing significant growth as fitness-conscious consumers increasingly prioritize convenience, functionality, and style in their workout accessories. Gym bags have evolved beyond simple storage solutions to include features such as separate compartments for shoes and wet clothes, ventilation systems, and smart technology integrations. With the global smart fitness industry booming and a growing number of people adopting active lifestyles, the demand for durable and stylish gym bags is surging.

The rising emphasis on health and wellness, coupled with the popularity of gym memberships, home workouts, and outdoor fitness activities, is fueling the demand for high-quality gym bags. Athleisure trends and the increasing influence of social media on consumer choices are also shaping purchasing decisions. Consumers seek gym bags that are not only practical but also align with their personal style, leading brands to offer innovative designs, premium materials, and multifunctional features.

Gym bag manufacturers are focusing on enhancing product durability and utility by incorporating water-resistant fabrics, antimicrobial linings, and reinforced zippers. Smart gym bags equipped with USB charging ports, RFID-blocking pockets, and built-in fitness tracking compartments are gaining popularity among tech-savvy consumers. Additionally, eco-friendly materials such as recycled polyester and organic cotton are being introduced to cater to the rising demand for sustainable products.

The growing awareness of environmental sustainability has led to increased demand for eco-friendly gym bags. Companies are incorporating recycled plastics, biodegradable fabrics, and ethical labor practices in their manufacturing processes. Brands that prioritize sustainable sourcing and minimal environmental impact are attracting environmentally conscious consumers, further driving the market growth.

The market for gym bags is very competitive, and incumbent players as well as new entrants are emphasizing product differentiation and promotional strategies. They are utilizing celebrity endorsements, influencer partnerships, and promotional advertising to target more audiences. Collaborations with sports apparel companies, gyms, and fitness studios are also aiding brands in establishing their market base.

Besides, selective partnerships with fitness influencers and social fitness communities on social media are further enhancing brand visibility. Firms are also turning to direct-to-consumer business models to drive profits and own brand messaging. Growth into emerging markets, especially in Asia and Latin America, is becoming a major growth strategy.

The use of AI-powered customer insights is allowing brands to tailor marketing and enhance customer retention. In addition, the use of virtual reality (VR) shopping experiences is boosting online sales and engagement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Nike Inc. | 12-16% |

| Adidas AG | 10-14% |

| Under Armour Inc. | 8-12% |

| Puma SE | 6-10% |

| VF Corporation | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nike Inc. | Develops high-performance gym bags with cutting-edge designs and sustainability initiatives. |

| Adidas AG | Focuses on innovative and stylish gym bags made from eco-friendly materials. |

| Under Armour Inc. | Specializes in durable and functional gym bags designed for high-intensity workouts. |

| Puma SE | Offers a blend of sporty and fashionable gym bags catering to athleisure trends. |

| VF Corporation | Invests in premium quality and versatile gym bags for everyday and fitness use. |

Key Company Insights

Other Key Players (45-55% Combined)

Several brands contribute to the growing gym bag market, including:

The overall market size for the Gym Bag Market was USD 2.1 Billion in 2025.

The Gym Bag Market is expected to reach USD 2.9 Billion in 2035.

The market will be driven by the rise in fitness-conscious consumers, growing gym memberships, increasing outdoor workout activities, and athleisure trends. The integration of smart technology, sustainability initiatives, and innovative design elements will also contribute to growth.

Key challenges include intense market competition, fluctuating raw material costs, and the rising demand for eco-friendly alternatives. Supply chain disruptions and counterfeit products also pose concerns for established brands.

North America and Europe are expected to lead the market due to strong fitness trends and premium brand preferences. The Asia-Pacific region is also witnessing significant growth due to increasing urbanization, disposable incomes, and health-conscious lifestyles.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Bag Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Bag Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Bag Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Bag Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Bag Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Bag Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Bag Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Bag Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Bag Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Bag Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Bag Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Bag Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Bag Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Bag Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Bag Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Bag Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Bag Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Bag Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Bag Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Bag Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Bag Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Bag Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Bag Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Bag Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Bag Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Bag Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Bag Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Bag Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Bag Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Bag Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Bag Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Bag Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Bag Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Bag Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Bag Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Bag Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Bag Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Bag Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Bag Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Bag Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Bag Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Bag Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Bag Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Bag Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Bag Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Bag Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Bag Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Bag Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Bag Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Bag Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Bag Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Bag Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Bag Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Bag Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Bag Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Bag Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Bag Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Bag Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Bag Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Bag Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Bag Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Bag Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Bag Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Bag Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bag Feed Seal Pouch Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Gym Apparel Market Size and Share Forecast Outlook 2025 to 2035

Bag in Tube Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Gym Shoes Market Size and Share Forecast Outlook 2025 to 2035

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Bottle Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Box Filler Market Insights - Growth & Forecast 2025 to 2035

Bag Market Insights - Growth & Demand 2025 to 2035

Bag Clips Market Insights – Demand, Trends & Forecast 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA