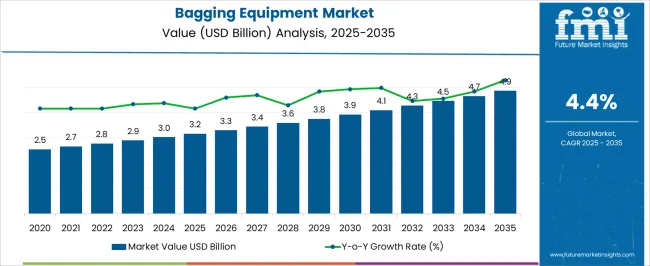

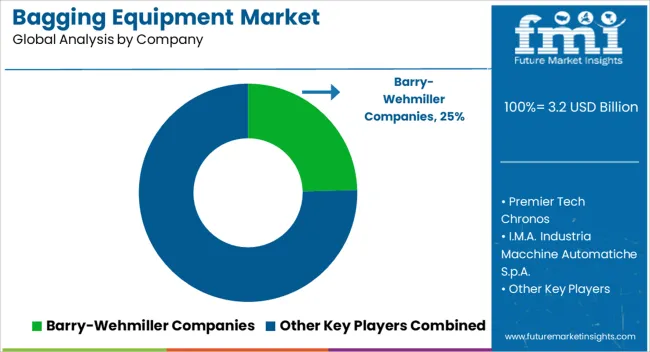

The Bagging Equipment Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Bagging Equipment Market Estimated Value in (2025 E) | USD 3.2 billion |

| Bagging Equipment Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The bagging equipment market is expanding steadily as industries focus on improving packaging efficiency, reducing labor dependency, and enhancing accuracy in material handling. Rising demand from food and beverage, agriculture, and construction materials has accelerated the adoption of advanced bagging systems that ensure speed, consistency, and reduced operational downtime.

Automation and digital integration are playing a pivotal role in boosting productivity while minimizing human error. Sustainability trends are further driving investments in equipment compatible with eco friendly packaging materials.

The outlook remains positive as manufacturers emphasize innovation in precision dosing, user friendly interfaces, and adaptive technologies that address both small scale and large scale industrial requirements.

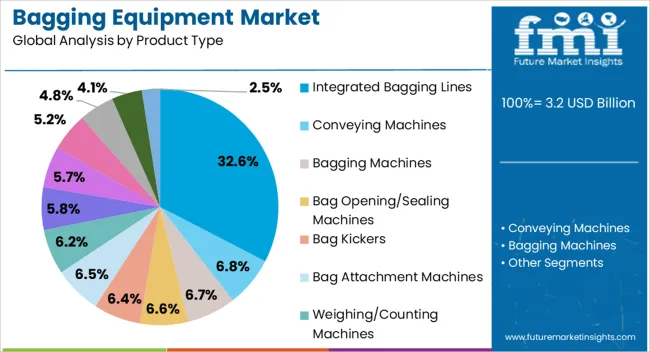

The integrated bagging lines segment is expected to account for 32.60% of total revenue by 2025 within the product type category, making it the leading segment. This share is driven by the ability of integrated systems to combine multiple packaging functions such as weighing, filling, sealing, and labeling into a single streamlined process.

The efficiency gains achieved by reducing manual intervention and improving throughput have significantly increased adoption across industries that manage high production volumes.

Integration also minimizes maintenance complexity and enhances system reliability, making it a preferred choice for operations aiming to reduce downtime and improve packaging consistency.

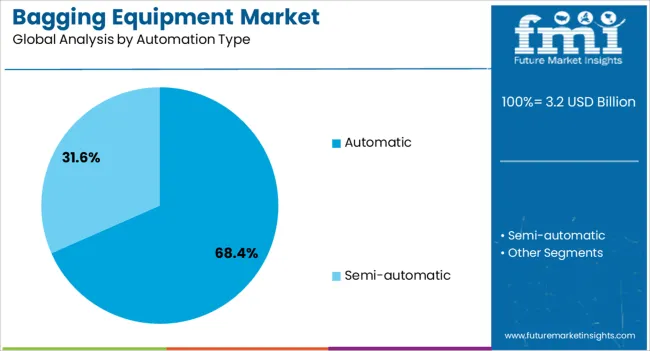

The automatic segment is projected to capture 68.40% of market revenue by 2025 within the automation type category, reflecting its dominance in the industry. Automatic systems are being increasingly implemented due to their ability to improve packaging speed, accuracy, and consistency.

Rising labor costs and the need for safe, hygienic, and high volume operations have further strengthened adoption. The shift toward Industry 4.0 practices and the integration of IoT enabled monitoring systems have enhanced the functionality of automatic bagging equipment, providing real time performance data and predictive maintenance.

This has established automatic systems as the preferred solution for both efficiency and long term cost effectiveness.

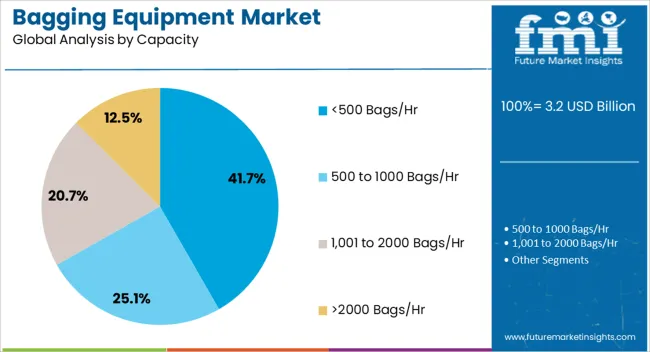

The less than 500 bags per hour segment is anticipated to hold 41.70% of market revenue by 2025 within the capacity category, making it the largest contributor. This segment is favored by small to medium scale industries that require flexible, cost effective, and space efficient solutions for moderate production volumes.

It is particularly suitable for niche manufacturers and operations with variable product lines, where adaptability and lower capital investment are essential.

The ability to provide reliable performance while maintaining manageable operating costs has positioned this capacity range as the most widely adopted, catering to diverse sectors that prioritize efficiency without large scale infrastructure investments.

Along with the driving factors, the market also faces sure restrain factors, including

High capital investment: The initial cost of acquiring bagging equipment is high, and this could be a barrier for smaller businesses that cannot afford the capital investment. It can hinder the growth of the bagging equipment market.

Maintenance and operational costs: The maintenance and operational costs of bagging equipment are high, which can be challenging for some businesses. It can affect the adoption of bagging equipment in various industries.

Availability of alternatives: There are alternatives to bagging equipment, such as manual packaging, which can be cheaper for small-scale operations to restrain market growth.

COVID-19 impact: Like many other industries, the global market has been affected by the Covid-19 pandemic. The disruption in supply chains and decreased demand for certain products has LED to a decline in the global market.

Lack of skilled workforce: The operation of bagging equipment requires skilled workers, and the shortage of such workers can hinder the growth of the bagging equipment market. The lack of trained professionals in the industry can affect the adoption of bagging equipment.

| Attributes | Details |

|---|---|

| Market CAGR (2025 to 2035) | 4.4% |

| Market Valuation (2025) | USD 2.9 billion |

| Market Valuation (2035) | USD 4.5 billion |

The food and beverage, pharmaceutical, and chemical industries mainly drove the market. It required efficient and high-speed bagging solutions to improve its manufacturing processes.

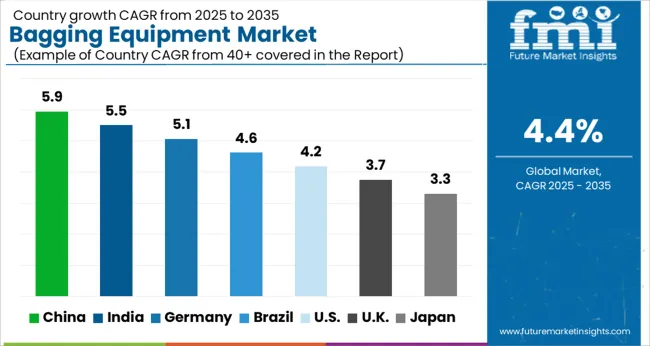

According to Future Market Insights reports, the market is expected to record a CAGR of around 4.4% from 2025 to 2035. Asia Pacific is a significantly growing market due to the increasing demand for packaging solutions in emerging economies such as China and India.

The rising awareness about sustainability and eco-friendly packaging is also expected to boost the demand for innovative and environment-friendly bagging equipment solutions in the market.

Short Term (2025 to 2029): The growing consumer demand for sustainable, high-quality bagging equipment is increasing the market size in this time frame. Manufacturers in developed countries are expanding and improving bagging equipment by adopting several marketing tactics to drive the market size.

Medium Term (2029 to 2035): The increase in advanced technologies and rapid urbanization are propelling the market size. The key companies are investing considerable amounts in innovating unique products to attract consumers' attention is fueling the market size.

Long Term (2035 to 2035): Rising research & development activities, huge investments, government supports, and present critical players are advancing the market size. The growing popularity of environment-friendly bagging equipment due to rising environmental concerns advancing market opportunities.

Based on automation type, the fully automatic segment dominates the global market by securing a higher share during the forecast period. The fully automatic bagging equipment offers high-speed and efficient solutions, reducing labor costs and increasing productivity.

Additionally, fully automatic bagging equipment can handle various bag sizes and materials. It is a popular choice across various industries, including food and beverage, pharmaceutical, chemical, etc.

Semi-automatic bagging equipment is widely used, particularly in small and medium-scale industries. However, fully automatic bagging equipment is becoming increasingly popular due to its advantages over semi-automatic.

The demand for fully automatic bagging equipment is expected to grow in the coming years due to its faster and more efficient solutions. However, the cost of fully automatic bagging equipment is generally higher than semi-automatic equipment, which may limit its adoption due to limited budgets.

The food and beverage sector dominates the global market in terms of end-use. It is because bagging equipment is widely used in the food and beverage industry for packaging various products such as snacks, cereal, tea, and others.

The pharmaceutical industry is another significant end-user of bagging equipment. This sector rises due to its stringent packaging requirements, including a sterile environment, accurate dosing, and tamper-evident packaging. The chemical industry also uses bagging equipment for packaging and handling powders and granular materials.

However, the food and beverage industry accounts for a maximum share of the market. The food & beverages sector is increasing due to changing consumer preferences and the need for more efficient packaging solutions. The growing trend towards sustainable and eco-friendly packaging is also expected to drive the demand for innovative, eco-friendly bagging equipment solutions.

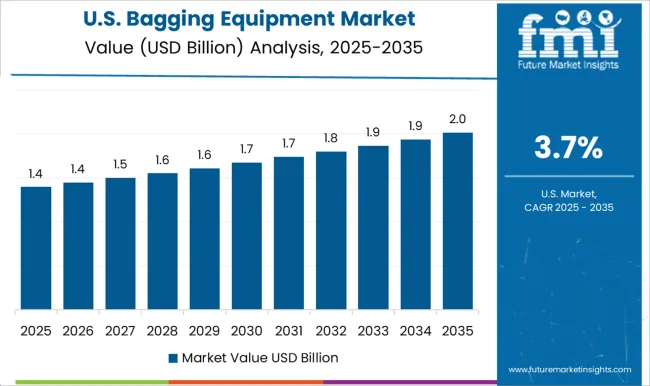

The market in the United States is mainly driven by the country's manufacturing industry, including the food and beverage, pharmaceutical, and chemical industries, by 2035.

According to a report, the market in the United States was valued at around USD 2.5 billion in 2020. The market is expected to register a CAGR of around 4.2% from 2020 to 2025.

The growing demand for packaged food and beverages drives this sector's demand for bagging equipment. The bagging equipment is a more efficient and advanced packaging solution.

The pharmaceutical industry is another significant end-user of bagging equipment in the United States. The increasing demand for personalized medicines and other specialty drugs is driving the industry's demand for more advanced and automated bagging solutions.

The chemical industry, further, is a significant end-user of bagging equipment in the United States. The industry requires bagging equipment for packaging and handling various powders and granular materials.

China's bagging equipment market has seen steady growth in recent years, driven by the country's strong manufacturing industry and increasing demand for automation in various sectors. Bagging equipment packages products in bags or pouches and can be found in food and beverage, pharmaceuticals, and chemicals.

In China, several domestic manufacturers produce bagging equipment, as well as international companies with a presence in the market. Some key players in the market include Beijing Huihong Machinery, Anhui Zengran Packaging Technology, and Shanghai Xinyue Machinery.

Factors driving growth in the market in China include the increasing need for efficient and automated packaging solutions and the country's focus on improving its manufacturing capabilities and productivity. However, the market is also faced with challenges such as increasing competition and rising raw materials and labor costs.

Overall, China's bagging equipment market is expected to grow in the coming years, driven by increased demand for automation, technological advancements, and expanding manufacturing industry.

The market in India is driven by the country's strong manufacturing industry and increasing demand for automation in various sectors. Bagging equipment packages products in bags or pouches and can be found in food and beverage, pharmaceuticals, and chemicals.

In India, several domestic manufacturers produce bagging equipment, as well as international companies with a presence in the market. A few of the leading players in the market include Nichrome India Ltd., Adelphi Group, and All-Fill India Pvt. Ltd.

Factors driving growth in the Indian market include the increasing need for efficient and automated packaging solutions and its manufacturing capabilities and productivity. However, the market is also faced with challenges such as increasing competition and rising raw materials and labor costs.

Overall, India's bagging equipment market is expected to grow in the coming years, driven by increased demand for automation, technological advancements, and expanding manufacturing industry.

The global market is highly competitive and is characterized by the presence of both domestic and international players. A few of the key players operating in this market include

Premier Tech Chronos: A Canadian company that provides bagging equipment, among other packaging solutions, for industries such as agriculture, food, and industrial.

I.M.A. Industria Macchine Automatiche S.p.A.: An Italian company that provides packaging solutions, including bagging equipment, for industries such as pharmaceuticals, cosmetics, and food.

The competition in the market is mainly driven by product innovation, pricing strategies, and expanding geographical reach. Companies in this market also improve their after-sales service to attract and retain customers. Additionally, mergers and acquisitions are expected as companies seek to expand their product portfolios and market presence.

Recent Development in the Market are

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC Countries, Türkiye, Northern Africa, and South Africa |

| Key Segments Covered | Product Type, Automation Type, Machine Type, Capacity, End Use, Region |

| Key Companies Profiled | Barry-Wehmiller Companies; Premier Tech Chronos; I.M.A. Industria Macchine Automatiche S.p.A.; Nichrome India Ltd.; All-Fill Inc.; Tokyo Automatic Machinery Works Ltd.; Robert Bosch GmbH; Omori Machinery Co. Ltd.; Webster Griffin Ltd.; Bossar Packaging S.A.; Fuji Machinery Co. Ltd.; Paglierani S.r.l.; RMGroup United kingdom Ltd.; Viking Masek Global Packaging Technologies; Bossar Packaging India Pvt. Ltd. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global bagging equipment market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the bagging equipment market is projected to reach USD 4.9 billion by 2035.

The bagging equipment market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in bagging equipment market are integrated bagging lines, conveying machines, bagging machines, bag opening/sealing machines, bag kickers, bag attachment machines, weighing/counting machines, standalone equipment, open mouth baggers, ffs machine, valve baggers, fibc bagging machines and others.

In terms of automation type, automatic segment to command 68.4% share in the bagging equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Bagging Machine Providers

Wicketed Bagging Machines Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Wicketed Bagging Machines Market

Automated Poly Bagging Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Automated Poly Bagging Machines Manufacturers

Pharmacy Accessory Bagging System (PABS) Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA