The garage equipment market is witnessing robust growth, supported by the rising number of vehicles in operation, increased demand for maintenance services, and advancements in automotive diagnostic technologies. Independent service providers are driving the market, offering cost-effective repair and maintenance solutions compared to authorized dealerships.

The expansion of vehicle inspection programs, stringent safety norms, and digital integration into diagnostic tools have further accelerated equipment adoption. The market is also benefiting from technological upgrades such as advanced wheel alignment systems, tire changers, and emission analyzers, which enhance operational efficiency.

With growing awareness among vehicle owners about preventive maintenance and the rise of electric and hybrid vehicles, the market is experiencing structural diversification. Looking forward, steady investments in modernizing workshops, coupled with the increasing adoption of connected garage systems, are expected to support sustained market growth.

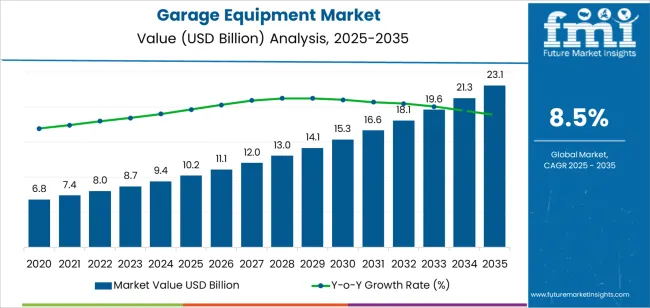

| Metric | Value |

|---|---|

| Garage Equipment Market Estimated Value in (2025 E) | USD 10.2 billion |

| Garage Equipment Market Forecast Value in (2035 F) | USD 23.1 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The market is segmented by Type, Application, Installation, Function, and Vehicle Type and region. By Type, the market is divided into Independent Garage and OEM-Authorized Garage. In terms of Application, the market is classified into Diagnostic & Testing Equipment, Body Shop Equipment, Emission Equipment, Lifting Equipment, Washing Equipment, Wheel & Tire Equipment, and Others. Based on Installation, the market is segmented into Fixed and Mobile. By Function, the market is divided into Electronic and Mechanical. By Vehicle Type, the market is segmented into Passenger Vehicle and Commercial Vehicle. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

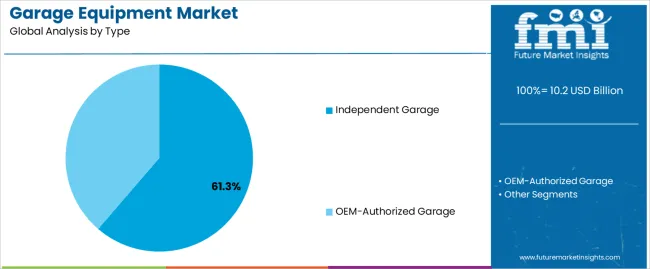

The independent garage segment dominates the type category with approximately 61.3% share, owing to its flexibility, competitive pricing, and accessibility to a wide customer base. Independent workshops cater to both new and used vehicle segments, offering a broad range of repair and maintenance services without brand restrictions.

The segment benefits from increasing vehicle ownership in emerging economies and the growing aftermarket service network. Consumer preference for quick service turnaround and affordable maintenance continues to strengthen demand for garage equipment among independent operators.

Moreover, the entry of multi-brand service chains has enhanced operational efficiency and technology adoption within this segment. With rising emphasis on service quality and customer convenience, the independent garage segment is expected to maintain its leading position through the forecast period.

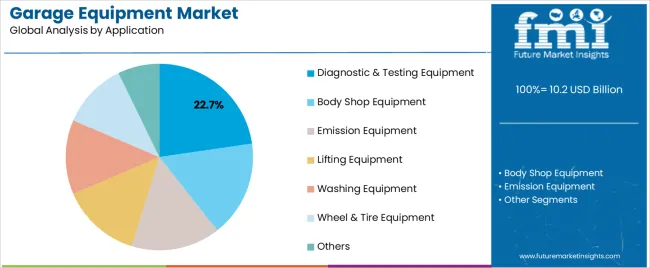

The diagnostic & testing equipment segment holds approximately 22.7% share in the application category, supported by the growing complexity of modern vehicles equipped with electronic control systems. Advanced diagnostic tools enable precise fault detection, emission analysis, and performance monitoring, reducing downtime and improving service efficiency.

The increasing prevalence of hybrid and electric vehicles has also expanded the need for sophisticated diagnostic systems capable of managing complex electrical architectures. The segment benefits from regulatory mandates emphasizing regular vehicle inspections and emission compliance.

Manufacturers are investing in developing user-friendly, software-integrated diagnostic tools compatible with multiple vehicle platforms. As workshops continue to digitize operations, the demand for diagnostic & testing equipment is projected to rise consistently.

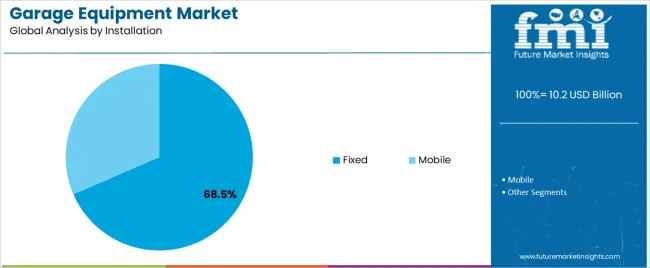

The fixed installation segment leads the installation category with approximately 68.5% share, attributed to its extensive use in high-volume workshops and permanent service facilities. Fixed equipment such as lifts, wheel balancers, and alignment systems are essential for efficient workflow and long-term operational stability.

The segment benefits from the expansion of multi-bay service centers and the standardization of garage layouts across global markets. Higher load capacity, durability, and integration capability with digital monitoring systems further support adoption.

While portable units are gaining traction for mobile service models, fixed installations remain the backbone of professional garages. With the continued rise in vehicle maintenance demand and workshop modernization efforts, the fixed segment is expected to retain its dominant position.

Based on the garage type, the OEM-authorized garage segment dominates the market and is expected to grow at an 8.3% CAGR through 2035. The segment’s rising popularity is attributed to the following reasons:

| Attributes | Details |

|---|---|

| Top Garage Type | OEM-authorized Garage |

| CAGR (2025 to 2035) | 8.3% |

Based on the application type, the body shop equipment segment dominates the garage equipment market. The segment is expected to grow at an 8.1% CAGR through 2035. This rising popularity is attributed to the following reasons:

| Attributes | Details |

|---|---|

| Top Application | Body Shop Equipment |

| CAGR (2025 to 2035) | 8.1% |

The section analyzes the garage equipment market by country, including the United States, the United Kingdom, China, Japan, and South Korea. The table presents the CAGR for each country, indicating the expected market growth through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 8.8% |

| United Kingdom | 9.7% |

| China | 8.9% |

| Japan | 10.1% |

| South Korea | 9.8% |

The United States dominates the garage equipment market in the North American region. It is expected to exhibit a CAGR of 8.8% until 2035.

The United Kingdom is the leading European country in the garage equipment market, and the market is predicted to register an annual growth rate of 9.7% through 2035.

China is another Asian country leading in the global garage equipment market. The Chinese market is anticipated to register a CAGR of 8.9% through 2035.

Japan is the leading Asian country in the global garage equipment market, and its demand is anticipated to register a CAGR of 10.1% through 2035.

South Korea is another Asian country in the global garage equipment market, and its demand is anticipated to register a CAGR of 9.8% through 2035.

Key market players are investing heavily in research and development to create advanced and innovative garage equipment solutions that cater to the changing needs of automotive service providers and vehicle owners.

Companies are increasingly using digitalization, automation, and connectivity to enhance garage equipment's accuracy, reliability, and efficiency, improving overall productivity and customer satisfaction.

Major players are expanding their global presence by forming strategic partnerships, collaborations, and acquisitions to access new markets and strengthen their presence in key regions. In addition, they are actively promoting and marketing their modern garage equipment solutions to create awareness among automotive service providers and end users

Recent Developments

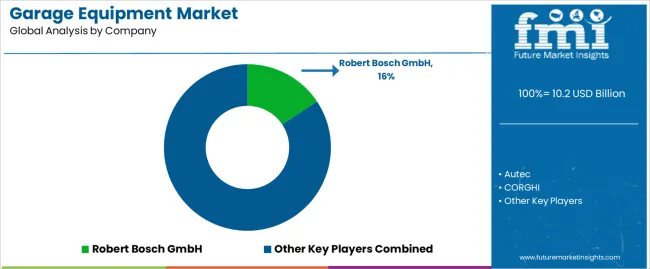

The global garage equipment market is estimated to be valued at USD 10.2 billion in 2025.

The market size for the garage equipment market is projected to reach USD 23.1 billion by 2035.

The garage equipment market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in garage equipment market are independent garage and oem-authorized garage.

In terms of application, diagnostic & testing equipment segment to command 22.7% share in the garage equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Garage Body Shop Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Garage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Garage and Service Station Market Trends - Growth & Forecast 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA