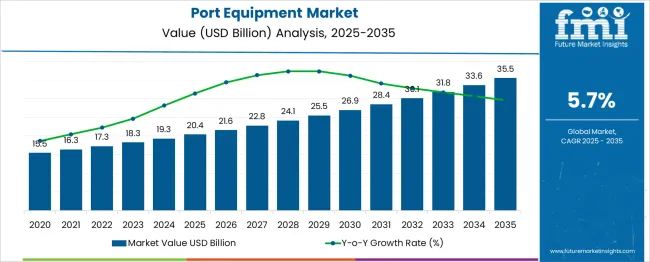

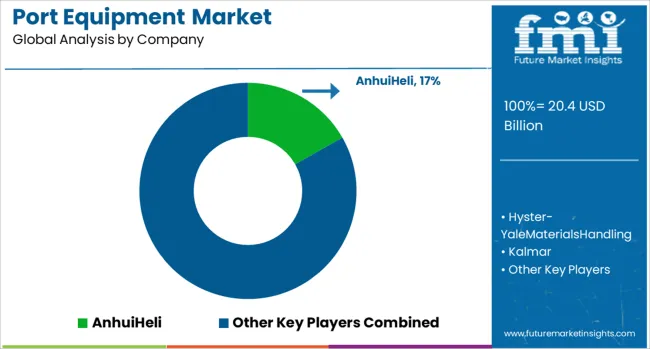

The Port Equipment Market is projected to grow from USD 20.4 billion in 2025 to USD 35.5 billion by 2035, registering a CAGR of 5.7% over the period. The market’s trajectory follows a clear transition along the maturity curve, moving from early adoption to scaling and eventually to consolidation. From 2020 to 2024, the early adoption phase saw expansion from USD 15.5 billion to USD 19.3 billion, driven by modernization programs, automation pilots, and targeted infrastructure upgrades. Adoption was deliberate as port authorities validated technologies before large-scale rollouts. Between 2025 and 2030, the scaling phase accelerated growth from USD 20.4 billion to USD 28.4 billion. This stage was characterized by widespread adoption of automated cranes, electrified yard equipment, and digitalized port operations, supported by higher investment intensity and rapid technology integration. From 2030 to 2035, the consolidation phase took shape, with the market expanding to USD 35.5 billion. Growth moderated as major facilities achieved equipment saturation, shifting the competitive focus toward service-based offerings, performance optimization, and lifecycle cost reduction rather than pure capacity addition. This pattern underscores the industry’s progression from technology introduction toward operational efficiency and long-term asset value maximization.

| Metric | Value |

|---|---|

| Port Equipment Market Estimated Value in (2025 E) | USD 20.4 billion |

| Port Equipment Market Forecast Value in (2035 F) | USD 35.5 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The port equipment market is advancing steadily, underpinned by the rapid globalization of trade, rising container traffic, and infrastructure modernization across key port hubs. Growing demand for efficient, safe, and reliable cargo handling systems is encouraging port authorities and operators to invest in technologically advanced machinery that enhances loading and unloading performance. Equipment retrofitting and port automation are being prioritized to reduce vessel turnaround times and improve terminal throughput.

Environmental regulations and emission reduction commitments are further propelling the adoption of cleaner propulsion systems and energy-efficient port operations. Additionally, digital transformation initiatives are promoting the integration of telemetry, remote diagnostics, and smart fleet management systems in port machinery.

Major investments in port capacity expansion across Asia, the Middle East, and Latin America are expected to significantly boost demand for scalable and hybrid port equipment platforms. Future outlook remains positive as port operators shift towards data-centric, eco-compliant, and modular systems that align with global shipping and logistics optimization strategies.

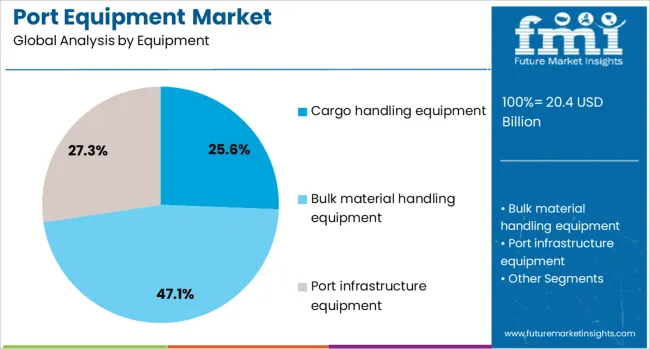

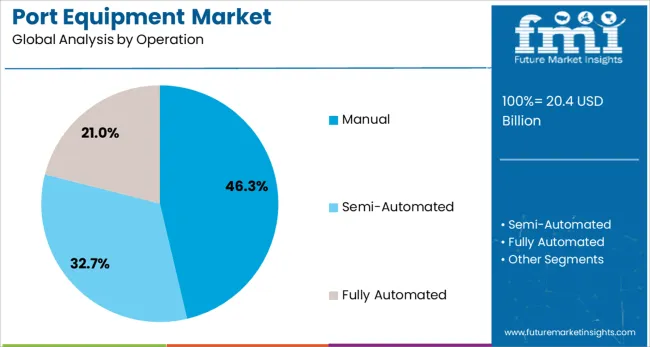

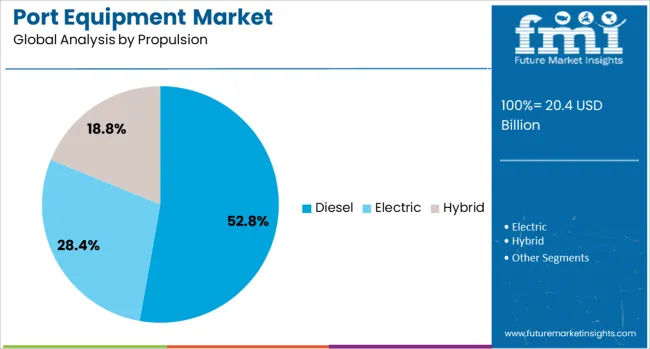

The port equipment market is segmented by equipment, operation propulsion, and geographic regions. By equipment of the port equipment market is divided into Cargo handling equipment, Bulk material handling equipment Port infrastructure equipment. In terms of operation of the port equipment market is classified into Manual, Semi-Automated Fully Automated. Based on propulsion of the port equipment market is segmented into Diesel, Electric Hybrid. Regionally, the port equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cargo handling equipment is projected to lead with a 25.6% revenue share in 2025, driven by increasing global seaborne trade volumes and demand for high-efficiency material handling at container terminals and dry bulk ports. This segment’s dominance has been reinforced by the growing need for equipment that can accommodate larger vessels and increased container throughput per hour.

Automation capabilities such as automated stacking cranes and rubber-tyred gantry cranes have gained significant attention due to their ability to minimize human error, enhance safety, and reduce operational costs. Manufacturers are equipping cargo handling machines with telematics and load optimization systems to improve asset utilization and reduce downtime.

Regulatory pressure to improve port efficiency and mitigate emissions is further encouraging investments in next-generation cargo handling systems. As the trend of consolidating cargo and increasing vessel sizes continues, the demand for flexible, scalable and remote-controlled cargo equipment is expected to remain strong, solidifying its leadership in the market.

Manual operation equipment is anticipated to maintain a leading position with a 46.3% revenue share in 2025, especially in emerging economies and small-to-medium port facilities. The segment’s resilience is attributed to cost-efficiency, ease of deployment, and reduced dependency on sophisticated infrastructure or digital capabilities. In regions with limited capital for full automation or semi-automated operations, manual equipment continues to fulfill essential loading, unloading, and container repositioning tasks effectively.

It remains a preferred option for ports dealing with diversified cargo types, where human intervention adds value in flexibility and adaptability. Moreover, smaller port operators often retain manual systems due to easier maintenance cycles, minimal downtime, and quick operator training protocols.

While automation is gaining ground in major port terminals, manual operations are expected to coexist, especially in low-volume and inland ports where infrastructure modernization is gradual. With continued trade expansion in less developed regions, demand for manually operated port equipment is expected to remain stable in the medium term.

Diesel propulsion is projected to account for 52.8% of the port equipment market revenue in 2025, retaining its dominant position due to long-standing infrastructure compatibility and proven reliability in heavy-duty operations. Diesel-powered equipment offers high torque performance and longer operational cycles, making it suitable for extended cargo handling tasks and adverse working conditions.

Port operators continue to rely on diesel systems where access to electrical charging infrastructure remains limited or cost-prohibitive. While environmental concerns and emission control regulations are accelerating the shift towards electric and hybrid alternatives, diesel remains deeply embedded in legacy fleets and remains cost-effective for high-load applications.

Ongoing innovations in diesel engine efficiency, exhaust treatment technologies, and fuel optimization systems have helped mitigate some environmental drawbacks, allowing compliance with Tier 4 and EU Stage V emission standards. In ports where electrification is yet to scale, diesel propulsion continues to offer operational consistency and lower transition costs, ensuring its continued relevance over the forecast period.

The market has been witnessing steady growth due to the increasing demand for efficient cargo handling, containerization, and logistics operations at maritime terminals. Port equipment, including cranes, reach stackers, forklifts, automated guided vehicles, and ship loaders, has been extensively deployed to improve productivity, reduce turnaround time, and enhance operational safety. Growth in global trade, expansion of port capacities, and modernization initiatives have contributed to market expansion. Technological advancements such as automation, remote operation, and predictive maintenance have increased equipment efficiency and reliability.

The adoption of automation and smart port solutions has significantly influenced the port equipment market. Automated container handling systems, robotic cranes, and driverless vehicles have been implemented to enhance operational efficiency and reduce human error. Real-time monitoring, predictive maintenance, and data analytics are employed to optimize equipment utilization and minimize downtime. Port authorities and terminal operators have been investing in fully automated container terminals to manage increasing cargo volumes with improved speed and accuracy. Integration with digital port management systems allows seamless coordination between ships, storage areas, and inland transportation. Additionally, smart energy management and eco-friendly designs for automated equipment contribute to environmental compliance. These advancements have been strengthening operational performance, cost-effectiveness, and safety, positioning automated technologies as a critical driver for the port equipment market.

Global trade growth and increased containerized cargo movement have been pivotal in driving demand for port equipment. The expansion of shipping routes, transshipment hubs, and deep-water ports has created a need for advanced handling solutions capable of managing larger vessels and heavier cargo. Container throughput growth has encouraged investments in gantry cranes, reach stackers, and terminal tractors for faster loading and unloading operations. Ports in emerging economies are undergoing modernization programs to accommodate growing imports and exports, particularly in Asia-Pacific, Latin America, and the Middle East. Equipment capable of handling multimodal transport requirements, such as rail-to-sea and road-to-sea transfers, has been prioritized. The surge in e-commerce and just-in-time delivery systems has further accelerated the demand for efficient and flexible port equipment solutions.

Environmental concerns and regulatory mandates have significantly shaped the port equipment market. Emission reduction requirements, noise control standards, and energy efficiency targets have driven the development of electric, hybrid, and low-emission machinery. Equipment manufacturers have focused on sustainable solutions, including regenerative braking systems, battery-powered vehicles, and optimized hydraulic systems to reduce fuel consumption. Regulatory oversight on occupational safety and operational standards has influenced design enhancements to improve operator safety and minimize workplace hazards. The push for environmentally friendly equipment is particularly pronounced in developed markets, where strict compliance guidelines are enforced. Adhering to these regulations has encouraged innovation while promoting the adoption of green and energy-efficient port equipment solutions globally.

Infrastructure development in emerging economies has presented substantial opportunities for the port equipment market. Expansion of new ports, modernization of existing terminals, and development of free trade zones have increased demand for advanced cargo handling equipment. Public-private partnerships and government funding in port modernization programs have facilitated capital investment in high-performance machinery. Regions such as Southeast Asia, Africa, and Latin America are witnessing rapid adoption of equipment capable of supporting growing container volumes and multimodal connectivity. Market players have been focusing on providing customized solutions, after-sales service, and operator training to improve equipment adoption and performance. The convergence of infrastructure development, trade facilitation policies, and technological upgrades continues to create opportunities for sustainable growth in the global port equipment market.

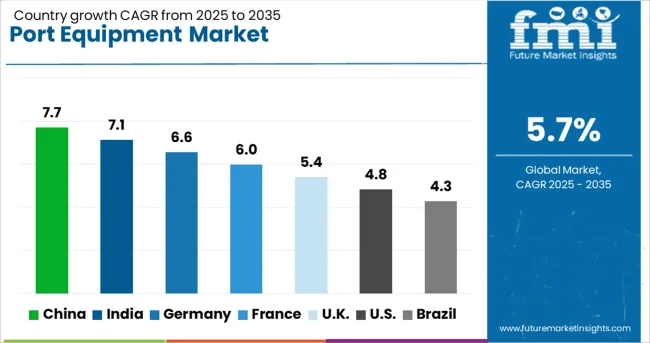

The market is projected to grow at a CAGR of 5.7% from 2025 to 2035, driven by global trade expansion, port infrastructure modernization, and the integration of automated handling systems. China is expected to lead with a 7.7% CAGR, supported by large-scale port upgrades and increasing container traffic. India follows at 7.1%, with growth fueled by government-led port development programs and rising cargo throughput. Germany, at 6.6%, benefits from advanced port technology adoption and efficient logistics systems. The U.K., growing at 5.4%, is driven by strategic port expansions and increased maritime trade. The U.S., at 4.8%, experiences steady demand due to ongoing modernization of coastal and inland ports. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China, estimated to grow at a CAGR of 7.7% between 2025 and 2035, is positioned for consistent expansion due to rising containerized trade volumes, expansion of mega ports, and accelerated automation adoption. Substantial government-led maritime infrastructure projects, coupled with an emphasis on enhancing operational efficiency, are stimulating demand for advanced cargo handling equipment. Integration of AI-powered monitoring systems, energy-efficient cranes, and autonomous guided vehicles is transforming port operations. The strong presence of domestic manufacturing capabilities, combined with strategic collaborations with international technology providers, is fostering innovation and driving large-scale deployment of modern port equipment.

India’s industry, projected to achieve a CAGR of 7.1% through 2035, is benefitting from strong policy support under programs such as Sagarmala and Bharatmala, which are accelerating port capacity expansion and efficiency enhancement. Increasing import and export activity in both bulk and containerized categories is driving the procurement of high-performance cranes, reach stackers, and conveyor systems. Private port operators are adopting advanced material handling solutions to improve vessel turnaround times and reduce operational bottlenecks. The market is also seeing greater interest in eco-friendly and automated equipment, with several large ports testing electric cranes and AI-enabled tracking systems for optimized cargo flow.

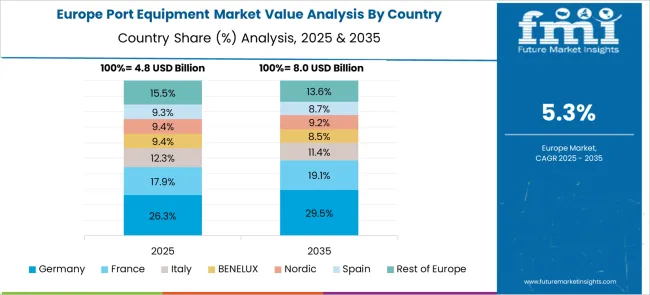

Germany is forecast to expand at a CAGR of 6.6% from 2025 to 2035, is being shaped by sustainability-driven modernization and high levels of automation. Ports such as Hamburg and Bremerhaven are investing in electrified cranes, automated guided vehicles, and AI-based yard management systems to improve operational output while lowering emissions. The strong focus on digitization aligns with broader European transport efficiency goals, positioning Germany as a hub for smart port technology deployment. Collaborative research and development between equipment suppliers, port operators, and academic institutions is further advancing energy-efficient and data-driven solutions in cargo handling operations.

The United Kingdom’s industry, growing at an expected CAGR of 5.4% through 2035, is witnessing modernization efforts driven by port expansion, trade route diversification, and efficiency optimization. Major ports including Felixstowe and Southampton are upgrading to faster ship-to-shore cranes, automated stacking cranes, and intelligent cargo management systems. Investments are increasingly targeting low-emission equipment and digital control systems to enhance real-time operational visibility. Strategic alliances between global equipment providers and UK port authorities are enabling faster adoption of smart and sustainable cargo handling solutions, enhancing competitiveness in European trade corridors.

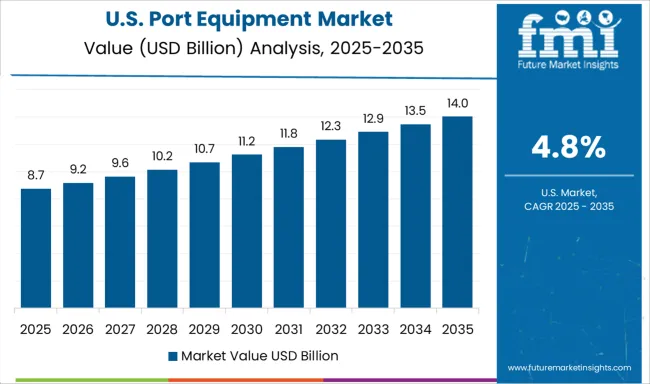

The United States market, anticipated to expand at a CAGR of 4.8% between 2025 and 2035, is driven by infrastructure funding, containerized trade growth, and sustainability objectives. Federal and state-level initiatives are supporting the deployment of hybrid and fully electric cranes, along with smart diagnostic and maintenance systems. Increasing intermodal connectivity is encouraging the integration of advanced cargo handling technology to reduce delays and enhance throughput efficiency. Competitive pressures from global trade hubs are prompting U.S. ports to invest in high-capacity, technology-enabled port machinery to maintain market relevance and operational resilience.

The market is dominated by globally recognized manufacturers offering advanced cargo handling solutions to support the growing demand for efficient maritime trade operations. Anhui Heli has established a strong foothold with its range of forklifts and material handling machinery that cater to diverse port logistics requirements. Hyster-Yale Materials Handling is known for its durable lift trucks and tailored solutions, ensuring operational efficiency in high-volume port environments. Kalmar and Konecranes are leading innovators, delivering automated stacking cranes, reach stackers, and straddle carriers with advanced digital control systems to optimize throughput.

Liebherr Group provides a broad portfolio of mobile harbor cranes, ship-to-shore cranes, and container handling equipment, focusing on high capacity and reliability. Sany Heavy Industry leverages its engineering expertise to supply cost-effective and robust port machinery for both domestic and international markets. Shanghai Zhenhua Heavy Industries (ZPMC) remains the largest supplier of ship-to-shore cranes worldwide, known for its large-scale custom-built solutions for major ports. Terex adds to the competitive landscape with versatile equipment designed for container terminals and bulk material handling. These manufacturers continue to invest in automation, electrification, and remote monitoring technologies, aiming to improve port efficiency, reduce environmental impact, and meet the increasing demands of global cargo volumes.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.4 Billion |

| Equipment | Cargo handling equipment, Bulk material handling equipment, and Port infrastructure equipment |

| Operation | Manual, Semi-Automated, and Fully Automated |

| Propulsion | Diesel, Electric, and Hybrid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AnhuiHeli, Hyster-YaleMaterialsHandling, Kalmar, Konecranes, LiebherrGroup, Sany Heavy Industry, Shanghai Zhenhua Heavy Industries(ZPMC), and Terex |

| Additional Attributes | Dollar sales by equipment type and application sector, demand dynamics across container handling, bulk cargo, and port logistics operations, regional trends in adoption across Asia-Pacific, North America, and Europe, innovation in automation, remote control systems, and energy-efficient machinery, environmental impact of fuel consumption, emissions, and equipment lifecycle, and emerging use cases in smart port development, digital twin simulations, and green cargo handling solutions. |

The global port equipment market is estimated to be valued at USD 20.4 billion in 2025.

The market size for the port equipment market is projected to reach USD 35.5 billion by 2035.

The port equipment market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in port equipment market are cargo handling equipment, _ship-to-shore (sts) cranes, _rubber-tired gantry (rtg) cranes, _straddle carrier, _others, bulk material handling equipment, _ship loaders & unloaders, _hoppers & grabs, _conveyor systems, _bucket wheel reclaimers, port infrastructure equipment, _mooring systems, _dredging equipment, _floating cranes and _winches & capstans.

In terms of operation, manual segment to command 46.3% share in the port equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kids Sports Equipment and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Portable Gas Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Water Sports Equipment Market Size and Share Forecast Outlook 2025 to 2035

Optical Transport Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Korea Aircraft Ground Support Equipment Market – Trends & Forecast 2025-2035

Japan Aircraft Ground Support Equipment Market Analysis & Forecast by Equipment, Ownership, Power, Application, and Region Through 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Aircraft Ground Support Equipment Market Analysis by Equipment, Power, Ownership, Application and Region: Forecast for 2025 to 2035

Portable Audiometer Calibration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Crushers Market Size and Share Forecast Outlook 2025 to 2035

Port Fuel Injection Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA