The Japan aircraft ground support equipment market is anticipated to be valued at USD 250.42 million in 2025. It is expected to grow at a CAGR of 6.7% during the forecast period and reach a value of USD 478.98 million in 2035.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Size in 2025 | USD 250.42 Million |

| Projected Size in 2035 | USD 478.98 Million |

| CAGR (2025 to 2035) | 6.7% |

In 2024, Japan aircraft ground support equipment market experienced steady growth, driven by fleet expansion by major carriers, the demand for maximizing aircraft turnaround efficiency, and modernization of airports. Another notable trend was the increased procurement of electric GSE by key airport hubs such as Haneda and Narita, aligning with Japan's decarbonization vision. Airlines have largely focused on automated baggage handling and advanced aircraft tugs while minimizing the use of conventional diesel units. Rising passenger traffic led to increased investment in passenger boarding bridges and catering trucks.

Sustained growth is expected from 2025 onward, driven by automation and electrification trends. Environmentally friendly aviation operations will be encouraged by regulatory support, which will propel GSE manufacturers towards energy-efficient technologies. AI-controlled and remotely operated equipment will enhance operational efficiency by 2035. At the same time, regional airport expansions and ramped-up activities by low-cost carriers will keep the demand for ground-handling solutions active.

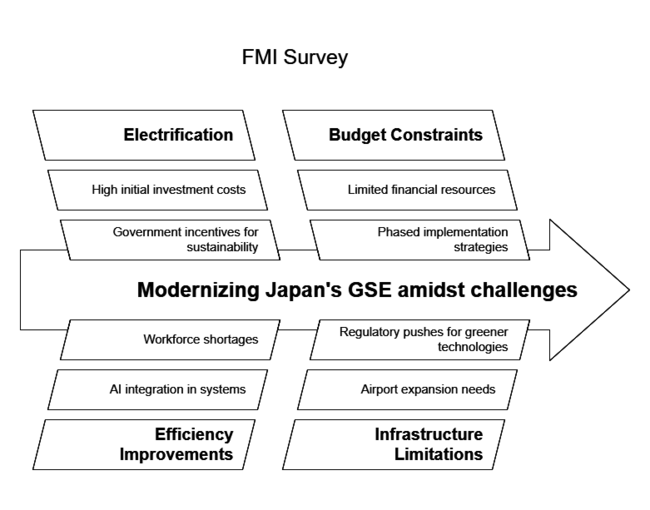

A recent survey conducted by FMI among key stakeholders in the industry revealed several critical trends shaping the industry. A majority of operators and airport authorities surveyed emphasized that electrification is getting much more important, with over 70% of respondents expecting to replace conventional diesel-operated GSE with electric options by the year 2030. This shift is driven by Japan's willingness to reduce the carbon footprint of the aviation sector with more government incentives for providing sustainable infrastructure investments.

Nearly 65% of stakeholders prioritized efficiency improvements, showing strong interest in AI-integrated baggage handling systems, remotely operated tugs, and automated passenger boarding bridges. Furthermore, in their discussions, stakeholders pointed out that workforce shortages specific to ground handling services are fast-tracking the introduction of such advanced solutions, particularly at airports with increasing traffic loads such as Haneda and Narita.

The survey showed further that budget constraints and infrastructure limitations continue to be among some of the greatest hurdles in modernizing GSE. Some 50% of respondents expressed that they were concerned about the high initial investment cost for electrification and automation. However, many airport operators and service providers are looking to develop partnerships with equipment manufacturers to allow phased implementation strategies and financial support models.

Despite challenges such as high initial investment costs, industry leaders anticipate steady long-term growth driven by regulatory incentives and technological advancements. The majority of respondents expect steady expansion in GSE procurement over the next decade, driven by increasing aircraft movements, airport expansions, and regulatory pushes for greener technologies. As the industry evolves, collaboration between airlines, airports, and GSE manufacturers will be critical to overcoming financial and operational barriers.

To gain deeper insights into Japan’s aircraft ground support equipment industry and explore strategic investment opportunities, connect with our experts today.

Stringent government regulations and sustainability initiatives shape the Japan aircraft ground support equipment industry. Policies promoting electrification, safety compliance, and efficiency enhancements are driving investments, while mandatory certifications ensure adherence to aviation standards for operational reliability and environmental responsibility.

| Country | Government Regulations & Certifications Impacting the GSE |

|---|---|

| Japan |

|

The airport service segment is expected to dominate the Japanese aircraft ground support equipment industry, holding a 54.3% share in 2024. Within this category, air start units play a crucial role in supporting aircraft operations at major airports. These units provide the necessary pneumatic power to start jet engines, ensuring seamless aircraft departures. The demand for air start units is rising with increasing flight frequencies at hubs like Haneda and Narita International Airports. Their adoption is further driven by airport modernization projects aimed at enhancing operational efficiency.

The electric segment is projected to account for 49.2% of the industry in 2024, driven by Japan’s push toward sustainable aviation solutions. Ground power units (GPUs) are among the fastest-growing electric GSE subsegments, replacing diesel-powered alternatives to reduce emissions and noise pollution. These units provide electricity to parked aircraft, improving energy efficiency and reducing fuel consumption. Advancements in battery technology are enhancing the reliability and operational longevity of electric GPUs, making them an attractive investment for airport authorities aiming to meet carbon reduction goals.

Leased GSE is emerging as the preferred ownership model, particularly for cost-intensive equipment like tugs and tractors. Airlines and ground-handling companies favor leasing to minimize capital investment while accessing the latest technology. Tugs and tractors play a vital role in maneuvering aircraft and baggage carts efficiently across airport grounds. The growing complexity of airport logistics and the need for flexible equipment solutions are encouraging operators to opt for leased tugs, ensuring uninterrupted ground handling services without high upfront costs.

The commercial segment remains dominant in the aircraft ground support equipment industry, with cargo handling operations witnessing significant growth. Cargo dollies, essential for efficient freight handling, enable smooth loading and unloading of cargo containers, reducing turnaround times for logistics providers. Rising air cargo volumes, particularly from international trade hubs, are accelerating investments in modern cargo dollies to improve supply chain efficiency and streamline airport logistics.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry experienced a steady recovery following the COVID-19 pandemic, with increasing domestic and international flight operations driving demand for GSE. | Industry expansion is expected to accelerate due to growing air traffic, airport expansions, and technological advancements in GSE. |

| Electrification efforts began gaining traction, but adoption remained limited due to high costs and infrastructure constraints. | Widespread adoption of electric GSE is anticipated, supported by improved battery technology and government sustainability incentives. |

| Key airports such as Haneda and Narita focused on modernization, leading to increased procurement of advanced ground-handling equipment. | Further investments in automation, AI-integrated systems, and smart airport solutions will enhance operational efficiency. |

| Leasing and rental models gained popularity, particularly for high-cost equipment like tugs and tractors, as airlines sought cost-effective solutions. | Leasing and rental services will expand further, allowing operators to acquire advanced GSE without significant upfront investments. |

| Cargo handling GSE demand surged due to the rise in e-commerce and global trade, increasing the need for efficient logistics solutions. | Continued growth in air cargo traffic will drive further demand for specialized GSE, including automated cargo loaders and transporters. |

Japan’s aircraft ground support equipment industry falls under the aviation infrastructure and logistics equipment category, closely linked to air transport, airport modernization, and global trade. This sector is highly influenced by macroeconomic factors such as economic growth, international trade, tourism, and technological advancements in aviation.

Between 2020 and 2024, Japan's aviation sector witnessed a steady recovery from pandemic-induced disruptions, with passenger and cargo traffic rebounding. Government investments in airport expansions, including projects at Haneda and Narita International Airports, fueled demand for advanced GSE. Additionally, the rise of e-commerce bolstered air freight, further driving the need for cargo-handling equipment.

From 2025 to 2035, Japan’s GSE industry is expected to benefit from increased air travel demand, airline fleet expansion, and regulatory mandates for sustainable aviation. The shift toward electric and hybrid GSE aligns with Japan’s carbon neutrality goals, prompting significant infrastructure upgrades. Moreover, automation and AI-driven solutions will enhance operational efficiency, reducing turnaround times and labor costs.

Despite positive growth prospects, challenges such as high capital costs and supply chain disruptions may slow the pace of GSE modernization. However, strong government support, technological innovation, and increasing international connectivity will position Japan’s GSE sector for sustained long-term growth.

Expansion into Regional Airports

While Haneda and Narita remain key hubs, regional airports like Kansai and Chubu Centrair are emerging as significant growth areas for GSE deployment. Increasing low-cost carrier (LCC) operations are driving demand for cost-efficient GSE. Stakeholders should develop scalable, space-efficient solutions tailored for smaller airports to enhance ground handling efficiency and reduce operational costs.

Investment in Next-Generation Electric GSE

Japan's carbon neutrality goals are driving widespread adoption of electric GSE, with regulatory incentives supporting the transition from diesel-powered equipment. Stakeholders should explore advancements in battery technology, including potential solid-state solutions, while investing in fast-charging infrastructure to improve operational efficiency. Collaborations with airport authorities can support pilot projects for electric GPUs, tugs, and belt loaders, ensuring smooth integration of sustainable equipment into existing airport operations.

Leasing &Pay-Per-use Business Models

High upfront GSE costs limit adoption, especially for smaller operators. Manufacturers should expand leasing, rental, and pay-per-use models to improve industry accessibility. Offering flexible financing options will drive faster adoption of advanced GSE, benefiting ground-handling providers by reducing capital investment while ensuring access to modern, high-performance equipment.

The Japan aircraft ground support equipment market in 2024 has experienced steady growth, driven by increased air traffic, airport modernization projects, and the expansion of low-cost carriers. Key players such as JBT Corporation, TLD Group, Textron GSE, Toyota Industries Corporation, and Tug Technologies Corporation have been actively implementing strategies to strengthen their presence and cater to the evolving needs of the aviation industry.

In 2024, JBT Corporation maintained its leadership in Japan's GSE sector with an estimated domestic share of 22-25% and a revenue range of approximately USD 190-220 million from Japan operations. The company has focused on expanding its electric and hybrid GSE offerings, aligning with Japan's push for greener airport operations. JBT has also introduced advanced telematics systems for real-time monitoring and predictive maintenance of its equipment, enhancing operational efficiency for airport operators. Additionally, JBT has secured several contracts with major Japanese airports, including Narita and Haneda, to supply baggage handling systems and aircraft de-icing equipment.

TLD Group, a global leader in GSE manufacturing, holds a 20-23% share in Japan, with a revenue share of around USD 200 million. In 2024, TLD launched a new range of electric tow tractors and ground power units, targeting Japan’s stringent emissions regulations. The company has also partnered with local distributors to improve after-sales service and reduce delivery times. TLD’s focus on innovation and sustainability has helped it secure contracts with regional airports, including Kansai and Chubu, further solidifying its position.

Textron GSE, a subsidiary of Textron Inc., holds a 15-18% share and a revenue share of approximately USD 160 million in 2024. The company has introduced a new line of compact and lightweight GSE designed to meet the space constraints of smaller Japanese airports. Textron has also invested in digital solutions, such as remote diagnostics and fleet management software, to enhance customer experience. In March 2024, Textron GSE announced a partnership with a Japanese aviation services provider to supply electric baggage carts and pushback tractors, as reported by Aviation Pros. This collaboration has strengthened Textron's presence in the region.

Toyota Industries Corporation, a prominent player in Japan’s GSE industry, holds a 12-15% share and a revenue share of around USD 120 million. In 2024, Toyota leveraged its expertise in electric vehicle technology to develop a new range of battery-powered GSE, including aircraft refuelers and cargo loaders. The company also expanded its service network across Japan, ensuring timely maintenance and support for its equipment. Toyota’s strong brand reputation and focus on sustainability have made it a preferred choice for domestic airlines and airport operators.

Tug Technologies Corporation, with an 8-10% share and a revenue share of approximately USD 95 million, has been actively pursuing growth in Japan’s GSE sector. In 2024, Tug Technologies launched a new line of hybrid GSE, combining diesel and electric power for improved efficiency and reduced emissions. Other key players collectively hold the remaining 15-20% share. The company has also focused on enhancing the safety features of its equipment, such as advanced collision avoidance systems and ergonomic designs. Tug Technologies’ emphasis on innovation and customer satisfaction has helped it gain traction in the competitive Japanese landscape.

Japan’s GSE industry in 2024 has also seen increased collaboration between domestic and international players. For instance, in February 2024, TLD Group entered into a joint venture with a Japanese engineering firm to develop customized GSE solutions for regional airports, as reported by Airport Technology. This partnership enabled TLD to tap into the growing demand for specialized equipment in smaller airports across Japan.

Overall, Japan’s aircraft ground support equipment industry in 2024 is characterized by a strong focus on sustainability, innovation, and customer-centric strategies. Leading players are leveraging technological advancements and strategic partnerships to address the evolving needs of the aviation industry. With further growth expected, these companies are well-positioned to capitalize on emerging opportunities and maintain their competitive edge.

By equipment, the industry is segmented into airport service, cargo loading, and passenger services.

In terms of ownership, the sector is segmented into leased GSE, owned GSE, and rental GSE.

By power, the industry is segmented into electric, hybrid, and non-electric.

In terms of application, the sector is bifurcated into commercial and defense.

Airport expansions, rising air traffic, increased cargo operations, and the shift toward electric and automated equipment for enhanced efficiency and sustainability fuel the demand.

Japan is prioritizing electric equipment due to stringent environmental policies, advancements in battery technology, and incentives promoting low-emission solutions at major airports.

Electric ground power units, tugs, and cargo loaders are growing rapidly due to their operational efficiency, cost savings, and alignment with sustainability goals.

High initial costs, infrastructure requirements for electric models, and the need for trained personnel to operate advanced equipment are key challenges.

Leasing minimizes upfront costs, provides access to the latest technology, and allows operators to upgrade equipment without major capital investment, making advanced GSE more accessible.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Equipment, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Ownership, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Power, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 11: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 12: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Equipment, 2018 to 2033

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 14: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Ownership, 2018 to 2033

Table 15: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2018 to 2033

Table 16: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Power, 2018 to 2033

Table 17: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 20: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Equipment, 2018 to 2033

Table 21: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 22: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Ownership, 2018 to 2033

Table 23: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2018 to 2033

Table 24: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Power, 2018 to 2033

Table 25: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 27: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 28: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Equipment, 2018 to 2033

Table 29: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 30: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Ownership, 2018 to 2033

Table 31: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2018 to 2033

Table 32: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Power, 2018 to 2033

Table 33: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 35: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 36: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Equipment, 2018 to 2033

Table 37: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 38: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Ownership, 2018 to 2033

Table 39: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2018 to 2033

Table 40: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Power, 2018 to 2033

Table 41: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 44: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Equipment, 2018 to 2033

Table 45: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 46: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Ownership, 2018 to 2033

Table 47: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2018 to 2033

Table 48: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Power, 2018 to 2033

Table 49: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 51: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 52: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Equipment, 2018 to 2033

Table 53: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 54: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Ownership, 2018 to 2033

Table 55: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2018 to 2033

Table 56: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Power, 2018 to 2033

Table 57: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Equipment, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Ownership, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Power, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Equipment, 2018 to 2033

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Power, 2018 to 2033

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Industry Analysis and Outlook Attractiveness by Equipment, 2023 to 2033

Figure 27: Industry Analysis and Outlook Attractiveness by Ownership, 2023 to 2033

Figure 28: Industry Analysis and Outlook Attractiveness by Power, 2023 to 2033

Figure 29: Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 31: Kanto Industry Analysis and Outlook Value (US$ Million) by Equipment, 2023 to 2033

Figure 32: Kanto Industry Analysis and Outlook Value (US$ Million) by Ownership, 2023 to 2033

Figure 33: Kanto Industry Analysis and Outlook Value (US$ Million) by Power, 2023 to 2033

Figure 34: Kanto Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 35: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 36: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Equipment, 2018 to 2033

Figure 37: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 38: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 39: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 40: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 41: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 42: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 43: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 44: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Power, 2018 to 2033

Figure 45: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 46: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 47: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 48: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 49: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 50: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 51: Kanto Industry Analysis and Outlook Attractiveness by Equipment, 2023 to 2033

Figure 52: Kanto Industry Analysis and Outlook Attractiveness by Ownership, 2023 to 2033

Figure 53: Kanto Industry Analysis and Outlook Attractiveness by Power, 2023 to 2033

Figure 54: Kanto Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 55: Chubu Industry Analysis and Outlook Value (US$ Million) by Equipment, 2023 to 2033

Figure 56: Chubu Industry Analysis and Outlook Value (US$ Million) by Ownership, 2023 to 2033

Figure 57: Chubu Industry Analysis and Outlook Value (US$ Million) by Power, 2023 to 2033

Figure 58: Chubu Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 59: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 60: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Equipment, 2018 to 2033

Figure 61: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 62: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 63: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 64: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 65: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 66: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 67: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 68: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Power, 2018 to 2033

Figure 69: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 70: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 71: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 73: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 74: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 75: Chubu Industry Analysis and Outlook Attractiveness by Equipment, 2023 to 2033

Figure 76: Chubu Industry Analysis and Outlook Attractiveness by Ownership, 2023 to 2033

Figure 77: Chubu Industry Analysis and Outlook Attractiveness by Power, 2023 to 2033

Figure 78: Chubu Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 79: Kinki Industry Analysis and Outlook Value (US$ Million) by Equipment, 2023 to 2033

Figure 80: Kinki Industry Analysis and Outlook Value (US$ Million) by Ownership, 2023 to 2033

Figure 81: Kinki Industry Analysis and Outlook Value (US$ Million) by Power, 2023 to 2033

Figure 82: Kinki Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 83: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 84: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Equipment, 2018 to 2033

Figure 85: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 86: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 87: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 88: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 89: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 90: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 91: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 92: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Power, 2018 to 2033

Figure 93: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 94: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 95: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 96: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 97: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 98: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 99: Kinki Industry Analysis and Outlook Attractiveness by Equipment, 2023 to 2033

Figure 100: Kinki Industry Analysis and Outlook Attractiveness by Ownership, 2023 to 2033

Figure 101: Kinki Industry Analysis and Outlook Attractiveness by Power, 2023 to 2033

Figure 102: Kinki Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 103: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Equipment, 2023 to 2033

Figure 104: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Ownership, 2023 to 2033

Figure 105: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Power, 2023 to 2033

Figure 106: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 107: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 108: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Equipment, 2018 to 2033

Figure 109: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 110: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 111: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 112: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 113: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 114: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 115: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 116: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Power, 2018 to 2033

Figure 117: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 118: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 119: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 120: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 121: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 122: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 123: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Equipment, 2023 to 2033

Figure 124: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Ownership, 2023 to 2033

Figure 125: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Power, 2023 to 2033

Figure 126: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 127: Tohoku Industry Analysis and Outlook Value (US$ Million) by Equipment, 2023 to 2033

Figure 128: Tohoku Industry Analysis and Outlook Value (US$ Million) by Ownership, 2023 to 2033

Figure 129: Tohoku Industry Analysis and Outlook Value (US$ Million) by Power, 2023 to 2033

Figure 130: Tohoku Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 131: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 132: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Equipment, 2018 to 2033

Figure 133: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 134: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 135: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 136: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 137: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 138: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 139: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 140: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Power, 2018 to 2033

Figure 141: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 142: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 143: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 144: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 145: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 146: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 147: Tohoku Industry Analysis and Outlook Attractiveness by Equipment, 2023 to 2033

Figure 148: Tohoku Industry Analysis and Outlook Attractiveness by Ownership, 2023 to 2033

Figure 149: Tohoku Industry Analysis and Outlook Attractiveness by Power, 2023 to 2033

Figure 150: Tohoku Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 151: Rest of Industry Analysis and Outlook Value (US$ Million) by Equipment, 2023 to 2033

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) by Ownership, 2023 to 2033

Figure 153: Rest of Industry Analysis and Outlook Value (US$ Million) by Power, 2023 to 2033

Figure 154: Rest of Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 155: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 156: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Equipment, 2018 to 2033

Figure 157: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 158: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 159: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 160: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 161: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 162: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 163: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 164: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Power, 2018 to 2033

Figure 165: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 166: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 167: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 168: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 169: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 170: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 171: Rest of Industry Analysis and Outlook Attractiveness by Equipment, 2023 to 2033

Figure 172: Rest of Industry Analysis and Outlook Attractiveness by Ownership, 2023 to 2033

Figure 173: Rest of Industry Analysis and Outlook Attractiveness by Power, 2023 to 2033

Figure 174: Rest of Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Japan Conference Room Solution Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA