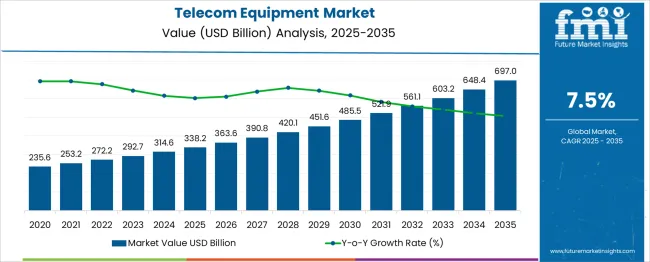

The Telecom Equipment Market is estimated to be valued at USD 338.2 billion in 2025 and is projected to reach USD 697.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. Growth Rate Volatility Index analysis based on yearly progression from 2020 to 2035 indicates a highly stable trend with minimal fluctuations. Early years show consistent percentage gains, moving from USD 235.6 billion in 2020 to 292.7 billion in 2023, averaging 7.2% to 7.7% growth, supported by 5G rollouts and core network upgrades.

From 2025 onward, growth stabilizes near 7.5%, as the market climbs to 363.6 billion in 2026, 390.8 billion in 2027, and 420.1 billion in 2028, reflecting a predictable pattern. Volatility remains low with percentage variation contained within a narrow range of 7.2%-7.8%, resulting in a coefficient of variation below 5%, signaling a steady market trajectory. Post-2030, incremental acceleration occurs as values reach 561.1 billion in 2033 and 697.0 billion in 2035, driven by large-scale deployment of 6G trials, fiber backhaul expansion, and open RAN adoption.

This low volatility profile ensures high visibility for strategic investments, enabling equipment vendors to plan capacity expansions, innovate in cloud-native solutions, and strengthen software-driven network capabilities without exposure to erratic demand cycles.

| Metric | Value |

|---|---|

| Telecom Equipment Market Estimated Value in (2025 E) | USD 338.2 billion |

| Telecom Equipment Market Forecast Value in (2035 F) | USD 697.0 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The telecom equipment market maintains a substantial position across several telecom-dependent parent segments. In the network infrastructure equipment market, telecom equipment accounts for 25–28 %, as operators continually upgrade switching and routing hardware to support capacity expansion. Within the wireless and mobile access equipment market, it captures 30–35 %, reflecting heavy investment in base stations, 5G deployment, and small cell densification.

For the fixed broadband and CPE market, the share is around 12–14 %, as home gateways and indoor routers form part of broader consumer device spending. In the data center and cloud interconnection equipment market, telecom gear represents 15–17 %, since optical transport and switching hardware underpin last-mile and backhaul links. In the IoT and edge communications hardware market, its share stands at 5–6 %, as telecom-branded gateway solutions support but do not dominate wider edge device ecosystems.

These shares reflect the market’s critical role in enabling connectivity across mobile, broadband, and enterprise networks. Demand remains strong, fueled by ongoing 5G rollouts, fiber deployments, and growth in edge computing. Innovations such as Open RAN, software-defined networking, and private 5G networks are shaping next-generation telecom infrastructure, reinforcing the sector’s influence across global digital transformation initiatives.

The telecom equipment market is undergoing transformative growth, propelled by the rapid rollout of next-generation networks, escalating demand for high-speed connectivity, and increasing investments in digital infrastructure. A notable shift toward data-centric services, cloud integration, and virtualization is reshaping traditional telecom paradigms and driving sustained demand for advanced equipment.

Growing mobile data consumption, coupled with regulatory pushes for broader coverage and improved network reliability, is accelerating modernization efforts globally. Hardware innovations, energy-efficient designs, and software-defined capabilities are enabling operators to optimize operational expenditures while expanding capacity.

Future growth is expected to be fueled by further 5G adoption, private network deployments, and the integration of artificial intelligence in network management, all of which are creating new avenues for expansion and long-term resilience in the industry.

The telecom equipment market is segmented by component, technology, infrastructure, end use, and geographic regions. The telecom equipment market is divided into Hardware, Software, and Services. The telecom equipment market is classified into 5G, 4G/LTE, and 2G & 3G. The telecom equipment market infrastructure is segmented into Wireless and Wired. The telecom equipment market is segmented by end use into Consumer electronics, BFSI, Retail, Media, Defense, and Others. Regionally, the telecom equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

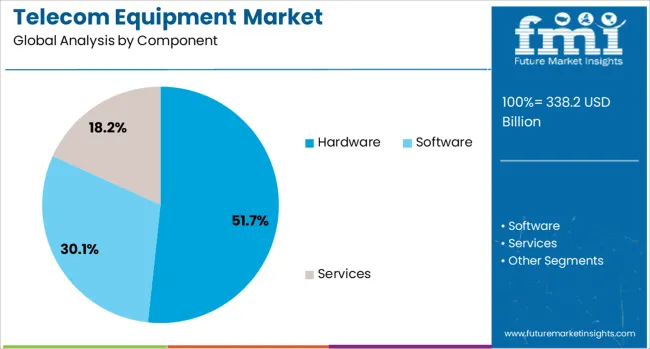

When segmented by component, hardware is projected to hold 51.70% of the total market revenue in 2025, establishing itself as the leading segment. This dominance is being driven by the essential nature of physical infrastructure in enabling connectivity and supporting the deployment of high-capacity networks.

Increasing operator investments in base stations, routers, antennas, and transmission equipment are sustaining demand for hardware as network traffic surges. The necessity of robust, scalable, and energy-efficient physical systems to accommodate higher data volumes and diverse use cases has further reinforced hardware’s preeminence.

Continuous innovations in materials, miniaturization, and modular designs are enhancing hardware longevity and operational efficiency, ensuring its continued relevance despite rising software influence. The hardware segment remains integral to delivering the performance and reliability demanded by both consumers and enterprises in a hyper-connected environment.

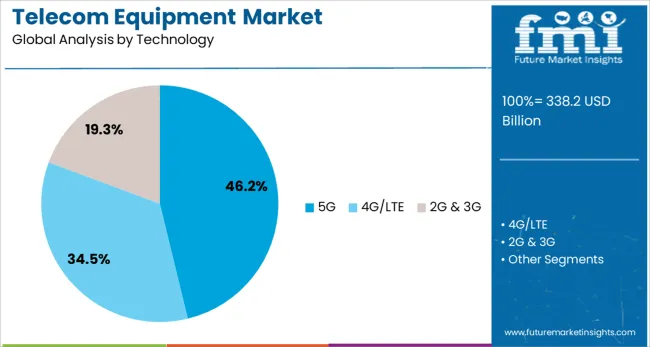

In terms of technology, 5G is anticipated to account for 46.2% of the market revenue share in 2025, marking it as the foremost technology segment. This leadership is attributed to widespread operator investments in next-generation networks to meet escalating demand for ultra-low latency, high-bandwidth, and massive device connectivity.

The proliferation of use cases such as smart cities, industrial automation, and immersive media is driving accelerated 5G deployments across regions. Infrastructure upgrades, spectrum auctions, and supportive policy frameworks are facilitating faster adoption of 5G equipment in both public and private networks.

Enhanced spectral efficiency, energy savings, and support for advanced applications like network slicing have positioned 5G as the cornerstone of future telecom strategies. The technology’s ability to deliver transformative benefits to consumers and industries alike has cemented its leading share in the market.

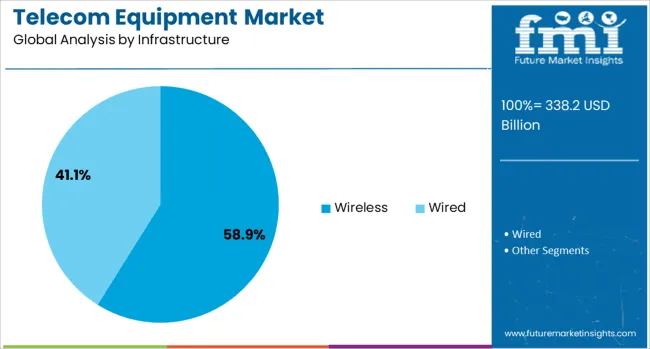

Segmenting by infrastructure shows that wireless is forecast to hold 58.9% of the market revenue in 2025, positioning it as the dominant infrastructure type. This preeminence is being driven by the rising adoption of mobile broadband services, increasing penetration of smartphones, and the shift toward flexible, on-the-go connectivity solutions.

Wireless networks have been prioritized over fixed alternatives due to their scalability, cost-effectiveness, and ability to bridge the digital divide in underserved regions. Investments in macro cells, small cells, and distributed antenna systems are strengthening wireless coverage and capacity to meet surging data traffic.

Operators’ focus on expanding 5G and preparing for future technologies like 6G is further amplifying the significance of wireless infrastructure. Its ability to deliver ubiquitous, reliable, and high-speed connectivity across diverse geographies has anchored its leadership in the telecom equipment market.

Telecom equipment comprises hardware such as network routers, switches, base stations, optical modules, and subscriber access devices used in telecommunications infrastructure. These systems are deployed by carriers, internet service providers, data center operators, and enterprise networks. Demand is driven by growing data traffic, network capacity expansion, and need for reliable connectivity. Suppliers offering high-performance, energy efficient devices with protocol interoperability and simplified deployment have been well positioned. Equipment that enables scalable deployment, minimal downtime, and efficient operations continues to influence procurement decisions among network operators and service providers.

Strong demand for telecom equipment has been supported by escalating data traffic volumes from mobile broadband, video streaming, and internet services. Expansion of fiber and wireless network infrastructure to underserved and enterprise markets has created demand for scalable routers, small cell platforms, and optical transport modules. Carriers pursuing network upgrades to support evolving bandwidth and latency requirements have accelerated equipment procurement. Emphasis on improving backhaul capacity and edge connectivity has strengthened interest in high-throughput, low-latency hardware. Demand for devices with robust interoperability across legacy and modern protocols has grown. Operators seeking efficient network operations continue to invest in resilient, high-performance infrastructure capable of sustaining increasing connectivity demands.

Market growth has been limited by high cost of advanced telecom equipment such as 5G base stations and high-density optical switches. Price-sensitive tier policies and capex constraints have led to extended decision cycles and competitive pressure on suppliers’ margins. Disruptions in component supply chains, especially semiconductors and fiber optics, have led to delays in equipment delivery schedules. Technical complexity associated with new network architectures has required specialized installation and staff training, increasing total deployment cost. Fragmented regulatory frameworks across regions have led to inconsistent certification requirements. Incompatibility between equipment from different vendors has added integration risk. Operators facing procurement budget limits have sometimes deferred infrastructure refresh plans.

Opportunities have emerged in enterprise network deployment, private 5G campus solutions, and interconnected edge infrastructure supporting IoT and real-time applications. Growth in data center construction and feeder links has created strong demand for optical transport and switching systems. Deployment of fixed wireless access platforms and small cell nodes in suburban and rural areas offers new avenues. Bundled solutions integrating hardware with software-based network orchestration and management tools have gained appeal among service providers. Collaborations with systems integrators and managed service vendors have opened recurring revenue streams. Leasing and financing models for infrastructure equipment delivery are being adopted to ease capital expenditure burdens, enabling wider adoption by mid-size operators and enterprise users.

Adoption of compact, high-density telecom equipment has accelerated, with modular switches and platform forms that deliver scalability and efficiency in limited space. Systems capable of hot-swapping and incremental port expansion have been favored. Interest in energy efficient designs with optimized cooling and low-power components has increased. Remote management features providing real-time system health metrics and firmware updates are gaining traction. Development of unified access devices supporting multiple wireless and fiber interfaces is influencing purchase decisions. Use of virtualization-friendly hardware that enables network slicing and multi-tenant support is rising. Preference for vendor platforms that support future upgrades via modular add-ons or firmware enhancements is shaping supplier road maps.

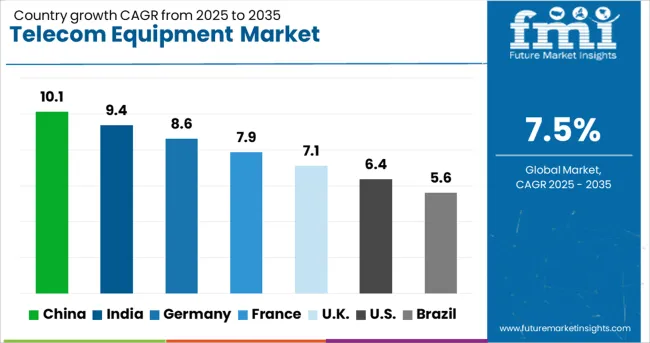

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The telecom equipment market is projected to grow at a CAGR of 7.5% between 2025 and 2035, driven by rapid 5G deployments, fiber-optic infrastructure expansion, and increasing demand for IoT-ready network devices. China leads at 10.1% CAGR, supported by large-scale base station rollouts and advanced optical networking solutions. India follows at 9.4%, fueled by rising mobile data consumption and rural connectivity programs. Among OECD nations, Germany posts 8.6%, emphasizing high-speed broadband and 5G core upgrades. France records 7.9%, focusing on digital infrastructure reinforcement and cloud-native network transformation. The United Kingdom grows at 7.1%, driven by dense urban network deployments and private 5G adoption in enterprises. Below are detailed insights for five leading markets.The report covers over 40 countries, with detailed insights for five profiled below.

China is forecast to achieve 10.1% CAGR, the highest among key markets, driven by aggressive 5G rollout plans and large-scale fiber network expansions. Domestic vendors are leading with integrated hardware and software solutions for core and edge networks. The country’s telecom operators are investing heavily in massive MIMO antennas, advanced base stations, and ultra-low latency routers to support growing data traffic. Cloud-based orchestration platforms are being adopted to enhance network automation and reduce operational costs. Export demand for Chinese-made telecom gear continues to rise in Asia and Africa, strengthening China’s global supply chain dominance. Deployment of 5G-enabled private networks in manufacturing zones is another significant growth factor.

India is expected to grow at a 9.4% CAGR, supported by rising data traffic, growing mobile penetration, and rapid fiberization initiatives. Telecom operators are investing in advanced radio access network (RAN) components and next-generation switching systems to meet capacity demands. The government-backed rural connectivity drive and affordable mobile broadband plans have increased demand for wireless equipment, including small cells and high-capacity towers. Network virtualization and software-defined solutions are gaining traction among leading operators to optimize cost and improve flexibility. Domestic manufacturing of telecom hardware is increasing under strategic initiatives, reducing dependency on imports and strengthening the country’s equipment ecosystem.

Germany is forecasted to register an 8.6% CAGR, driven by significant investments in fiber-optic networks and 5G infrastructure modernization. The focus on high-speed broadband deployment across residential and enterprise segments is strengthening demand for routers, optical transport systems, and advanced RAN hardware. Telecom operators are increasingly adopting cloud-native core network solutions to improve scalability and reduce latency for industrial applications. Enterprise demand for private 5G networks and edge computing platforms is creating opportunities for specialized equipment providers. Partnerships between equipment manufacturers and service providers are shaping integrated offerings to accelerate digital transformation in German industries.

France is expected to achieve a 7.9% CAGR, supported by expanding broadband coverage, 5G deployments, and network modernization initiatives by telecom operators. Equipment demand is rising for high-capacity routers, optical switches, and RAN components to support increasing video and IoT traffic. Telecom firms are investing in AI-driven network management systems to improve efficiency and service reliability. The growing adoption of virtualized and software-defined networking solutions in data centers creates new business prospects for equipment manufacturers. Deployment of 5G-enabled industrial connectivity platforms in the transport and logistics sectors adds another layer of growth potential in the French market.

The United Kingdom is projected to grow at a 7.1% CAGR, driven by rapid 5G network densification and full-fiber rollouts across metropolitan and rural areas. The push for low-latency connectivity to support smart city projects and cloud services is boosting the adoption of advanced network switches, routers, and RAN elements. Telecom operators are investing in small cell solutions and dynamic spectrum allocation to handle capacity surges in urban regions. Private 5G networks for enterprise applications in manufacturing and logistics are creating additional opportunities for equipment vendors. Partnerships between telecom operators and hyperscale cloud providers are shaping integrated network infrastructure strategies.

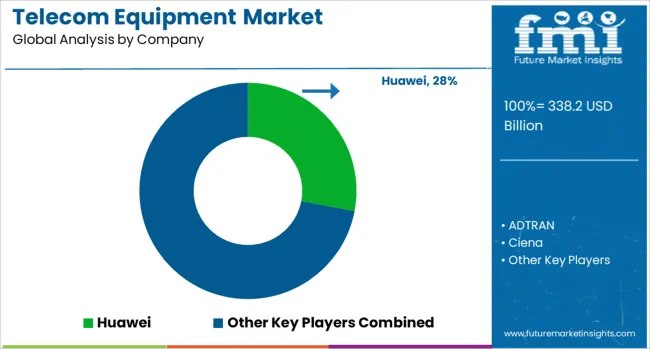

The telecom equipment market is highly competitive and dominated by global technology leaders such as Huawei, Ericsson, Nokia, Cisco, Samsung, ZTE, Ciena, Juniper, NEC, and ADTRAN. Huawei maintains a leading position through extensive product portfolios in wireless infrastructure, optical transport, and 5G technology, leveraging scale and strong R&D investments. Ericsson and Nokia compete closely in the mobile network domain, providing advanced 5G radio access solutions and end-to-end network management systems for global operators.

Cisco and Juniper dominate IP routing, switching, and enterprise networking segments, focusing on software-driven networking, cybersecurity, and virtualization. Samsung strengthens its position in 5G infrastructure, particularly in Asia and North America, with innovations in Open RAN technology. Ciena leads in optical networking and high-capacity transport systems, addressing bandwidth-intensive applications, while NEC emphasizes carrier-grade solutions for transmission and IP networking.

ZTE combines competitive pricing and full-spectrum solutions to capture market share in emerging regions, and ADTRAN specializes in broadband access equipment, particularly in fiber and fixed wireless applications. Market rivalry is intense due to rapid 5G deployment, the rise of edge computing, and growing investments in fiber infrastructure. Competitive differentiation depends on technology leadership, software integration, interoperability, and lifecycle services.

High entry barriers exist because of capital-intensive R&D, intellectual property, and stringent telecom standards. Strategic priorities include expanding 5G networks, adopting virtualization technologies, and enabling cloud-native architectures. Future competitiveness will rely on AI-powered network optimization, cybersecurity integration, and partnerships for Open RAN development, positioning technology-driven players to capture opportunities in next-generation connectivity and digital transformation globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 338.2 Billion |

| Component | Hardware, Software, and Services |

| Technology | 5G, 4G/LTE, and 2G & 3G |

| Infrastructure | Wireless and Wired |

| End Use | Consumer electronics, BFSI, Retail, Media, Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei, ADTRAN, Ciena, Cisco, Ericsson, Juniper, NEC, Nokia, Samsung, and ZTE |

| Additional Attributes | Dollar sales by product category (wireless infrastructure, IP networking, optical transport, broadband access) and application (mobile operators, enterprises, data centers), with demand driven by 5G rollouts, IoT connectivity, and rising broadband consumption. Regional trends indicate strong investments in Asia-Pacific and North America for large-scale 5G deployments, while Europe focuses on upgrading existing LTE and fiber networks. Innovation centers on Open RAN adoption, AI-enabled network analytics, and cloud-native platforms designed for high scalability, energy efficiency, and automation in telecom networks. |

The global telecom equipment market is estimated to be valued at USD 338.2 billion in 2025.

The market size for the telecom equipment market is projected to reach USD 697.0 billion by 2035.

The telecom equipment market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in telecom equipment market are hardware, _networking equipment, _transmission equipment, _automation and monitoring hardware, _others, software, _network management software, _monitoring software, _contact center software, _others and services.

In terms of technology, 5g segment to command 46.2% share in the telecom equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Analytics Market Size and Share Forecast Outlook 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Telecom Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

telecom-expense-management-market-market-value-analysis

Telecom Order Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Cloud Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Systems Market Size and Share Forecast Outlook 2025 to 2035

Telecom Wireless Data Market Size and Share Forecast Outlook 2025 to 2035

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Telecommunications Services Market - Growth & Forecast 2025 to 2035

Telecom Enterprise Services Market Analysis - Growth & Forecast through 2034

Telecom Service Assurance Market Trends – Size, Demand & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA