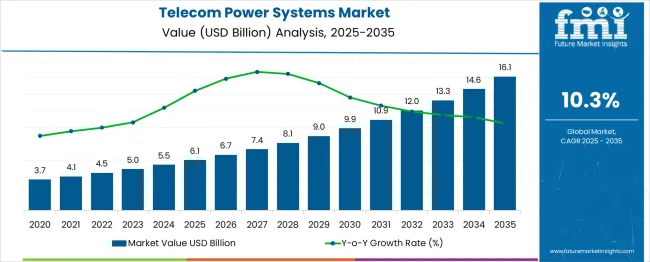

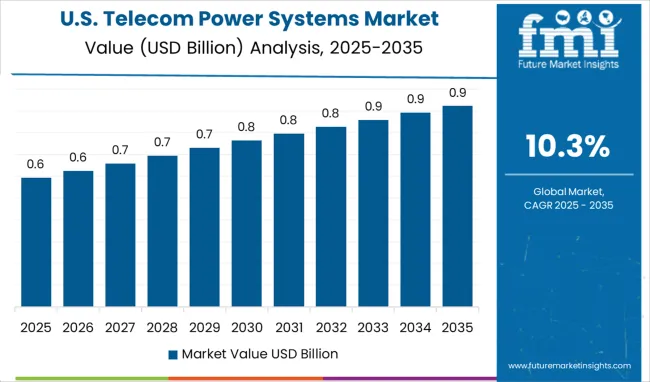

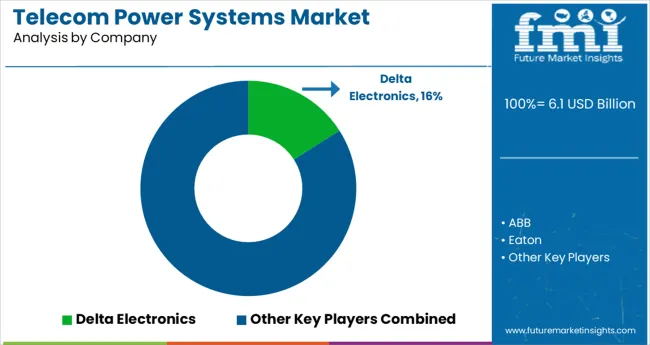

The Telecom Power Systems Market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 16.1 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period.

The telecom power systems market is undergoing steady expansion, driven by rising global data traffic, increased deployment of telecom infrastructure in remote areas, and the ongoing transition to 5G networks. Expanding mobile connectivity and fiber-optic backbones are requiring more robust and uninterrupted power supply systems across both urban and off-grid locations.

Telecom operators are prioritizing energy-efficient and modular power systems to reduce operational costs and environmental footprint. Supportive policy frameworks promoting hybrid and renewable power integration, particularly in developing regions, are enhancing the attractiveness of low-emission solutions.

Additionally, advancements in battery storage technologies and remote monitoring systems are enabling real-time diagnostics and maintenance efficiency, ensuring system reliability in mission-critical telecom operations. As network densification continues and edge computing infrastructure expands, demand for compact, intelligent, and scalable power systems is expected to further accelerate.

The market is segmented by Product Category, Power Source, and Application and region. By Product Category, the market is divided into Indoor Power Systems, Outdoor Power Systems, Rectifiers, DC/DC Converters, Controllers, Generators, Heat Management Systems, and Other Product Categories. In terms of Power Source, the market is classified into Diesel-Battery, Diesel-Solar, Diesel-Wind, and Multiple Sources.

Based on Application, the market is segmented into Data Communication, Fixed Line, Data Center, Internet & Broadband Access, and Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

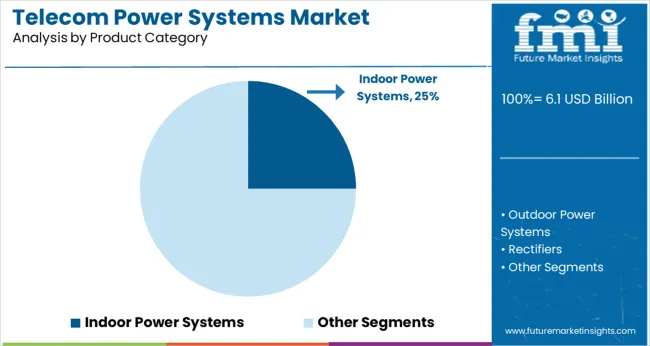

Indoor power systems are projected to contribute 25.00% of the overall market revenue in 2025, making them a significant product category in telecom infrastructure. This share is being sustained by the growth in centralized telecom sites and indoor equipment rooms, where environmental protection and controlled climate conditions are essential for system stability.

Indoor systems offer compact form factors, lower maintenance requirements, and better protection against environmental stressors. The trend toward centralized control systems, particularly in urban telecom installations and data centers, is reinforcing the relevance of indoor power solutions.

Additionally, ease of integration with network racks and compatibility with intelligent energy management modules are enhancing their preference among telecom service providers focused on infrastructure optimization.

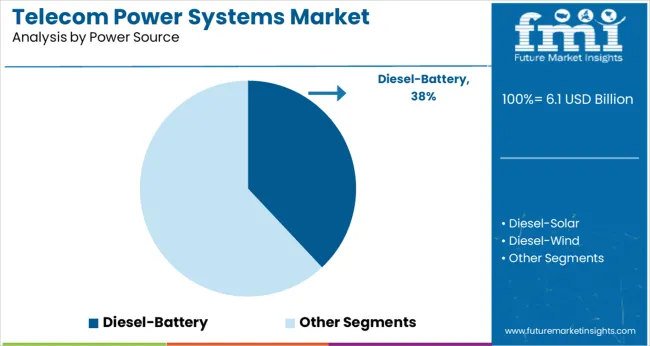

Diesel-battery hybrid systems are expected to lead the power source category with a 38.00% market share in 2025. This dominance is attributed to their operational reliability in areas with inconsistent grid supply and high energy demands.

Diesel generators provide continuous power backup, while battery systems improve fuel efficiency by minimizing generator runtime during low-load periods. This hybrid configuration not only reduces operational costs but also extends equipment life and reduces carbon emissions.

The flexibility to support both off-grid and semi-grid telecom sites has made diesel-battery systems a preferred solution, especially in emerging markets with uneven power infrastructure. Growing emphasis on reducing diesel dependency through intelligent battery management systems is expected to further optimize performance and sustainability in this segment.

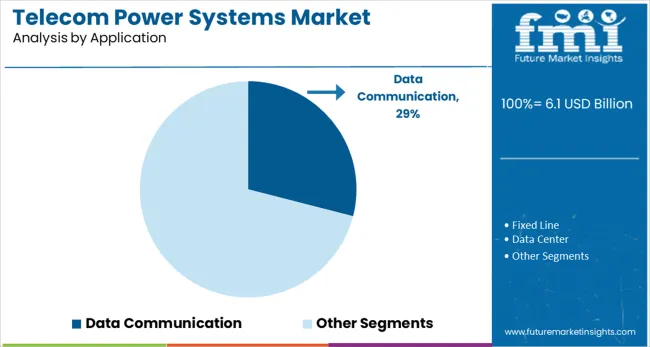

Data communication is forecast to hold 29.00% of the telecom power systems market share by 2025, making it one of the most prominent application areas. This is being driven by surging data consumption, cloud computing growth, and the global rollout of high-speed broadband networks.

Power systems used in data communication infrastructure must ensure uninterrupted uptime, low latency, and high energy efficiency to support sensitive and continuous data transfer. The expansion of edge data centers, fiber-optic exchanges, and 5G small cell networks has intensified the need for scalable and modular power solutions.

Additionally, integration of power redundancy features and remote energy monitoring technologies is enhancing operational resilience, making robust power systems indispensable in data-centric telecom environments.

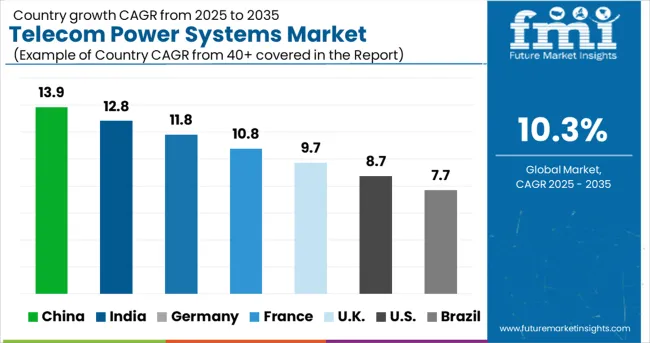

North America is currently the most dominating telecom power systems market. This is attributed to the region's strong telecommunication infrastructure and various telecom power system providers. The mobile penetration in this region is 94%, and the penetration for 4G-LTE was more than 73% as of January 2020. North America has been one of the early adopters of most of the most innovative technologies, including telecom technologies.

End users have a high demand for increased internet speeds which can be achieved by the usage of higher frequencies. Moreover, increasing the adoption of mobile towers is likely to assist in reducing the network coverage and ultimately reach the entire consumer base. Hence, this region witnesses an incredible advancement in these technologies, which is expected to eventually expand the global telecom power systems market size.

On the other hand, Asia Pacific is a growing market for telecom power systems, owing to the rapid digital transformation of several industries in developing economies. Furthermore, the growing cellular subscriber base in this region is causing telecom service providers to focus on expanding their telecommunication networks.

Being the region that accounts for the highest number of smartphone users for the past few years, owing to the increased deployment of telecom towers in rural and remote locations, it is evidently anticipated to drive the demand for telecom power systems.

Renewable energy-powered telecom power systems are an innovation that manufacturers focus on as businesses are increasing their focus on reducing the environmental impact and carbon footprint of their operations and creating growth avenues for the same. This power system allows businesses to reduce operational costs while meeting carbon emission targets significantly.

Several key manufacturers are offering various benefits expected to increase the demand for telecom power systems. For instance, the facility to add additional batteries has been implemented to provide power to the load for an extended period in the event of utility supply failure. Another interesting feature is the “automatic battery voltage temperature compensation”, which further extends the battery life and performance. Moreover, integral over-current protection devices are being administered to protect the system against overload faults.

End users can enjoy additional features such as LED indicators, which provide easy-to-read status of the unit and utility power conditions, and automatic periodic self-tests, which ensure the early detection of a battery that needs to be replaced. Regarding its serviceability, manufacturers provide the installation and maintenance of all components without access to the rear or sides of the cabinet. Additionally, if the UPS shuts down, the connected equipment automatically starts up upon the return of utility power. These factors are anticipated to contribute to the global telecom power systems market growth.

Sales of telecom power systems have risen due to a continuous rise in demand for uninterrupted telecom services.

Increased focus of telecom operators in their networks and long-established relationships with enterprise customers is also projected to contribute to the growth of the telecom power systems market share.

The report sheds light on the factors improving the sales of telecom power systems and, in turn, the opportunities for market players. However, the telecom power systems market also faces some challenges that might limit its market share and prevent it from reaching its potential.

Some key market trends promoting the demand for telecom power systems include increasing demand for energy-efficient devices coupled with the growing adoption of automation systems.

The large installation of telecom tower power systems, even in rural and remote areas, is one of the key factors driving the growth of telecom power system sales.

Also, the growing requirement for grid-based power solutions and wide implementation of green telecom power systems fuel the growth of the telecom power systems market.

Moreover, the increasing use of hybrid power systems by using renewable energy sources like solar and wind to reduce the amount of radiation of greenhouse gases is supporting the growth of telecom power systems.

The rapid growth in telecommunication infrastructure, especially in emerging economies, is the key factor driving the demand for telecom power systems.

Also, the deployment of telecom towers is increasing to meet the growing subscriber base, which is creating significant growth opportunities for the telecom power systems market.

Apart from this, the rising adoption of small cell power systems for LTE and LTE advances and upcoming telecommunication technologies are some of the key factors that are expected to drive the growth of the sales of telecom power systems.

In addition, the rising number of mobile data traffic and telecom operators approaches towards improving network coverage in rural and metropolitan areas are supporting the growth of the telecom power systems market.

On the basis of geography, North America is expected to capture a significant market share in the telecom power systems market, owing to the presence of various key telecom power systems providers in the region and strong telecommunication infrastructure in countries of the region.

The telecom power systems market in Europe and the Asia Pacific is expected to capture significant growth rates due to the increasing investment by countries of the region in improving telecom infrastructure and increasing number of telecom towers due to the high population growth rate established by a vast number of mobile users.

The telecom power systems market in Latin America and Middle East & Africa is also expected to witness high growth as the subscriber base is continuously increasing in these regions.

The telecom power systems market report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators, and governing factors, along with market attractiveness as per segment. The market report also maps the qualitative impact of various market factors on market segments and geographies.

The key players of the telecom power systems market are focusing on enhancing and adopting strategies like enhancing the durability, sizes and its use to thrive business. This is driving down the sales of telecom power systems.

Some of the key participating players indulged in the sales of telecom power systems are:

These leading players in the telecom power systems market are continuously focusing on introducing new products and upgrading their existing product lines in order to cater to the changing customer demands and to strengthen product differentiation strategy.

These market players are anticipated to drive the telecom power systems market by introducing new products and expanding geographically.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.26% from 2025 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Type, Component, Region |

| Regional scope | North America; Latin America; Western Europe; Eastern Europe; Japan; Asia Pacific; Middle East and Africa (MEA) |

| Country scope | USA, Canada, Mexico, Brazil, Germany, Italy, UK, Spain, France, Nordic countries, BENELUX, Russia, Poland, Japan, China, India, South Korea, ASEAN, Australia & New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

| Key companies profiled | ABB; Schneider Electric; Huawei; Eaton; and Delta Electronics |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global telecom power systems market is estimated to be valued at USD 6.1 billion in 2025.

It is projected to reach USD 16.1 billion by 2035.

The market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types are indoor power systems, outdoor power systems, rectifiers, dc/dc converters, controllers, generators, heat management systems and other product categories.

diesel-battery segment is expected to dominate with a 38.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Subsea Power Grid Systems Market Analysis - Size, Growth, and Forecast 2025 to 2035

Electric Powertrain Systems Market Size and Share Forecast Outlook 2025 to 2035

United States Telecom Tower Power System Market Trends & Forecast 2025 to 2035

Combined Heat and Power (CHP) Systems Market Growth - Trends & Forecast 2025 to 2035

Semiconductors in Solar PV Power Systems Market Growth - Trends & Forecast 2025 to 2035

Telecom Site Management Software Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA