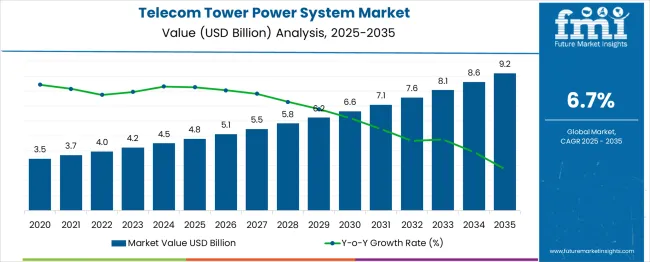

The global telecom tower power system market is projected to grow from USD 4.8 billion in 2025 to approximately USD 9.2 billion by 2035, recording an absolute increase of USD 4.4 billion over the forecast period. This translates into a total growth of 91.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.91X during the same period, supported by the rising demand for reliable telecommunications infrastructure and increasing deployment of cellular networks across emerging and developed markets worldwide.

Between 2025 and 2030, the telecom tower power system market is projected to expand from USD 4.8 billion to USD 6.7 billion, resulting in a value increase of USD 1.9 billion, which represents 43.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of 5G network infrastructure in global telecommunications markets, increasing tower densification requirements for enhanced coverage, and growing recognition among telecom operators about the importance of reliable power backup systems. Network infrastructure providers are expanding their power system capabilities to address the growing complexity of modern cellular tower operations and energy efficiency requirements.

From 2030 to 2035, the market is forecast to grow from USD 6.7 billion to USD 9.1 billion, adding another USD 2.5 billion, which constitutes 56.8% of the overall ten-year expansion. This period is expected to be characterized by expansion of renewable energy integration in tower power systems, deployment of advanced battery management technologies, and development of standardized efficiency protocols across different telecom operators. The growing adoption of edge computing infrastructure and IoT connectivity will drive demand for more sophisticated power management solutions and specialized technical expertise.

Between 2020 and 2025, the telecom tower power system market experienced steady expansion, driven by increasing mobile data consumption and growing regulatory emphasis on network reliability requirements. The market developed as telecom operators recognized the importance of advanced power management technologies for maintaining continuous network operations. Regulatory agencies and network operators began emphasizing proper backup power standards and efficiency procedures to ensure network availability and operational compliance.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.8 billion |

| Forecast Market Value (2035) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

Market expansion is being supported by the rapid increase in mobile network infrastructure deployment worldwide and the corresponding need for reliable power management solutions in cellular towers, base stations, and network equipment facilities. Modern telecommunications networks rely on continuous power supply and comprehensive backup systems to ensure proper functioning of 4G, 5G, and emerging network technologies including edge computing and IoT connectivity. Even minor power interruptions can require extensive backup power capabilities to maintain optimal network performance and service availability.

The growing complexity of network infrastructure and increasing energy efficiency requirements are driving demand for advanced power management systems from certified suppliers with appropriate technical capabilities. Telecom operators are increasingly requiring comprehensive power monitoring documentation and efficiency compliance to maintain operational standards and regulatory approval. Network reliability standards and operator specifications are establishing mandatory power system requirements that demand specialized equipment knowledge and proven performance reliability.

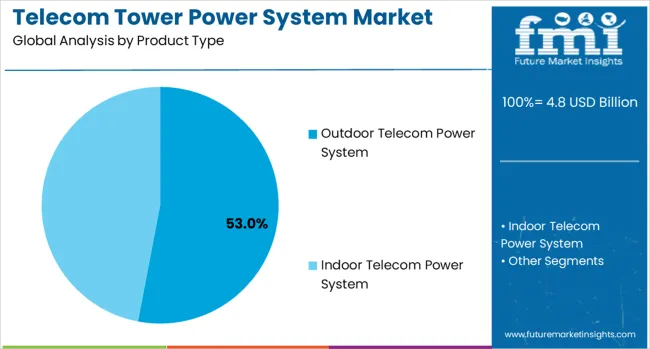

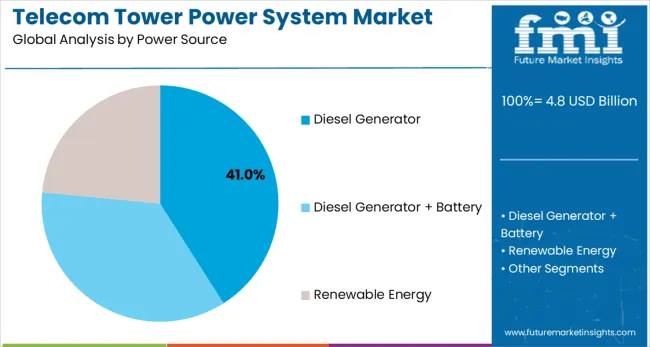

The market is segmented by product type, power source, and region. By product type, the market is divided into outdoor telecom power systems and indoor telecom power systems. By power source, the market is categorized into diesel generators, diesel generator plus battery combinations, and renewable energy systems such as solar, wind turbine, and biomass. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

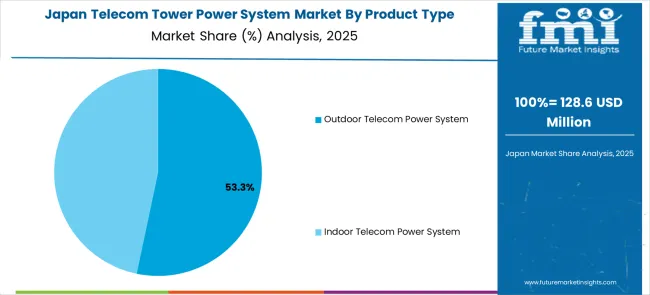

Outdoor telecom power systems are projected to account for 53% of the telecom tower power system market in 2025. This leading share is supported by the widespread deployment of outdoor cellular towers and the established infrastructure requirements for weather-resistant power management solutions. Outdoor systems provide robust performance capabilities using proven environmental protection standards, making them the preferred choice for most cellular tower and base station installations. The segment benefits from comprehensive industry standards and established reliability documentation from multiple telecom equipment suppliers.

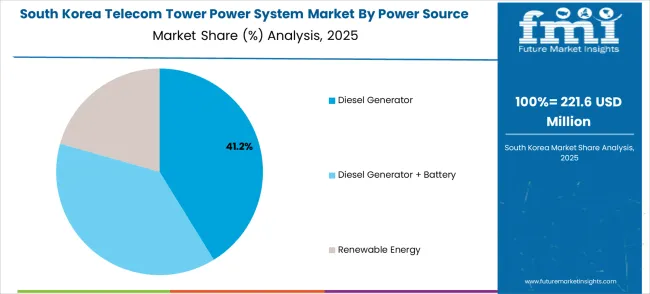

Diesel generators are expected to represent 41% of telecom tower power demand in 2025. This significant share reflects the proven reliability of diesel-based backup power systems and the established fuel infrastructure supporting remote tower locations. Modern telecom installations increasingly feature diesel generator systems that provide extended backup power capabilities while maintaining cost-effectiveness and operational flexibility. The segment benefits from established maintenance networks and comprehensive fuel supply chains across global telecom markets.

The telecom tower power system market is advancing steadily due to increasing network infrastructure expansion and growing recognition of power system reliability importance across telecommunications sectors. However, the market faces challenges including environmental regulations affecting diesel generator usage, need for continuous maintenance across diverse geographic locations, and varying power requirements across different network technologies. Sustainability efforts and efficiency certification programs continue to influence technology development and market growth patterns.

The growing deployment of renewable energy technologies is enabling sustainable power generation at remote tower sites, cellular base stations, and network infrastructure facilities. Hybrid power systems incorporating solar panels and wind generation provide reduced operational costs and environmental compliance while expanding deployment flexibility. These solutions are particularly valuable for telecom operators and infrastructure companies that require reliable power generation without fuel supply dependencies and environmental compliance concerns.

Modern power system manufacturers are incorporating sophisticated battery management systems and energy storage technologies that improve backup power duration and optimize charging efficiency throughout operational cycles. Integration of lithium-ion battery systems and intelligent power management enables enhanced backup capabilities and comprehensive performance monitoring. Advanced storage technologies also support next-generation telecom applications including 5G base stations and edge computing infrastructure requiring consistent power quality.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 8.2% |

| China | 6.8% |

| Germany | 6.3% |

| Japan | 6.2% |

| South Korea | 6.0% |

| United States | 5.7% |

| France | 5.5% |

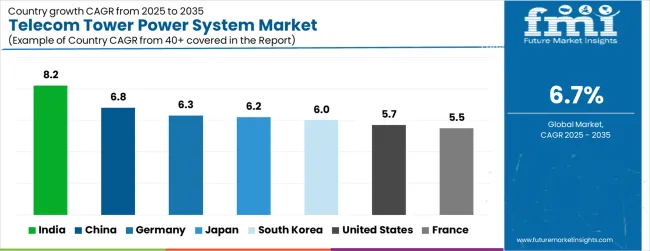

The telecom tower power system market is growing across global markets, with India leading at an 8.2% CAGR through 2035, driven by extensive mobile network expansion, rural connectivity initiatives, and increasing 5G infrastructure deployment across diverse geographic regions. China follows at 6.8%, supported by comprehensive telecommunications infrastructure development and advanced network technology integration programs. Germany grows steadily at 6.3%, emphasizing energy efficiency standards and sustainable power solutions for network infrastructure. Japan records 6.2%, focusing on advanced power management technologies and network reliability optimization. South Korea and the United States maintain moderate growth at 6.0% and 5.7% respectively, while France shows steady expansion at 5.5%. Overall, India and China emerge as the leading drivers of global telecom tower power system market growth.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from telecom tower power system in India is projected to exhibit the highest growth rate with a CAGR of 8.2% through 2035, driven by extensive mobile network expansion programs and increasing rural connectivity initiatives across diverse geographic and economic regions. The country's rapidly growing telecommunications subscriber base and expanding 5G infrastructure deployment are creating significant demand for reliable tower power management solutions. Major telecom operators and infrastructure companies are establishing comprehensive power system networks to support the growing population of cellular towers across urban centers, rural areas, and emerging industrial zones.

Revenue from telecom tower power system in China is expanding at a CAGR of 6.8%, supported by comprehensive telecommunications infrastructure development and growing integration of advanced network technologies into national connectivity programs. The country's established manufacturing capabilities and increasing 5G network deployment are driving demand for sophisticated power management systems. Telecom operators and infrastructure providers are gradually establishing capabilities to serve the growing population of advanced network applications and technology integration requirements.

Revenue from telecom tower power system in Germany is growing at a CAGR of 6.3%, driven by network infrastructure modernization and increasing emphasis on energy efficiency standards across telecommunications operations. The country's established telecommunications infrastructure is incorporating advanced power management capabilities to serve evolving network technology requirements and environmental compliance objectives. Telecom operators and equipment suppliers are investing in efficient power systems and monitoring technologies to address growing regulatory demands and operational optimization requirements.

Demand for telecom tower power system in Japan is projected to grow at a CAGR of 6.2%, supported by the country's emphasis on advanced technology integration and precision network reliability across telecommunications infrastructure systems. Japanese telecom operators are implementing comprehensive power management capabilities that support high-quality service delivery and advanced network performance standards. The market is characterized by focus on technological excellence, reliability optimization, and integration with comprehensive network management initiatives.

Demand for telecom tower power system in South Korea is expanding at a CAGR of 6.0%, driven by technology innovation leadership and growing integration of advanced network features across telecommunications infrastructure development. Korean telecom operators and technology companies are establishing comprehensive power system capabilities to serve cutting-edge network requirements and international technology standards. The market benefits from established technology manufacturing and increasing emphasis on network performance optimization following advanced service deployment activities.

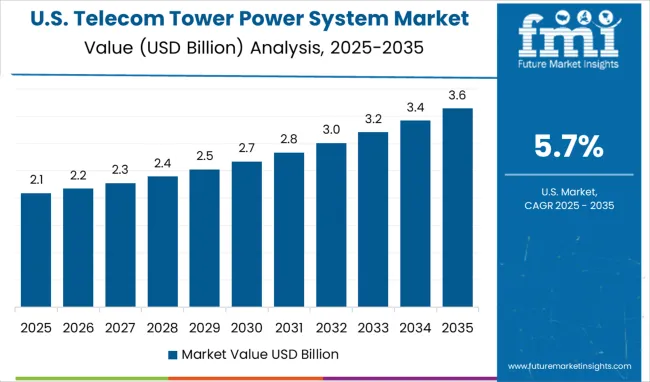

Demand for telecom tower power systems in the USA is projected to grow at a CAGR of 5.7%, supported by the country's leadership in telecommunications technology and focus on network modernization initiatives serving both domestic coverage and international technology standards. American telecom operators are implementing advanced power management solutions that meet stringent reliability requirements while supporting 5G network expansion and infrastructure upgrades. The market is characterized by emphasis on technological innovation, energy efficiency, and compliance with comprehensive telecommunications regulations.

Demand for telecom tower power systems in France is expanding at a CAGR of 5.5%, driven by established telecommunications infrastructure and increasing emphasis on network quality enhancement that serves European connectivity standards and rural coverage expansion initiatives. French telecom operators are implementing comprehensive power management solutions that meet strict European regulatory requirements while supporting sustainable energy practices and network reliability excellence. The market benefits from government support for telecommunications modernization and environmental sustainability standards.

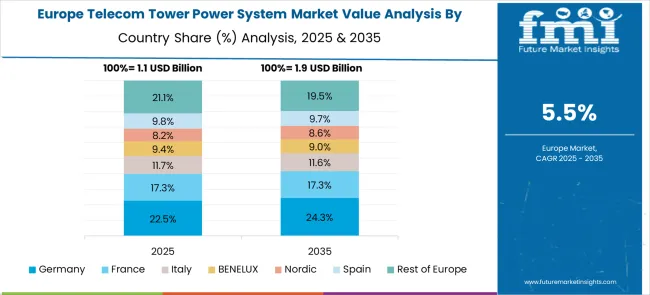

The telecom tower power system market in Europe is expected to experience steady growth over the forecast period 2025-2035, driven by 5G network deployment and renewable energy integration initiatives. Germany is projected to maintain its leadership position in the European market with a CAGR of 6.3%, supported by its robust telecommunications infrastructure and strong industrial base. France is anticipated to register a CAGR of 5.5%, reflecting moderate growth in telecom tower installations. The broader European market is expected to benefit from regulatory mandates for energy-efficient power systems and the transition towards sustainable telecom infrastructure.

The telecom tower power system market is defined by competition among established telecommunications equipment manufacturers, power system specialists, and industrial technology providers. Companies are investing in advanced power management technologies, energy-efficient systems, remote monitoring capabilities, and technical expertise to deliver reliable, cost-effective, and environmentally responsible power solutions. Strategic partnerships, technology innovation, and global market expansion are central to strengthening product portfolios and market presence.

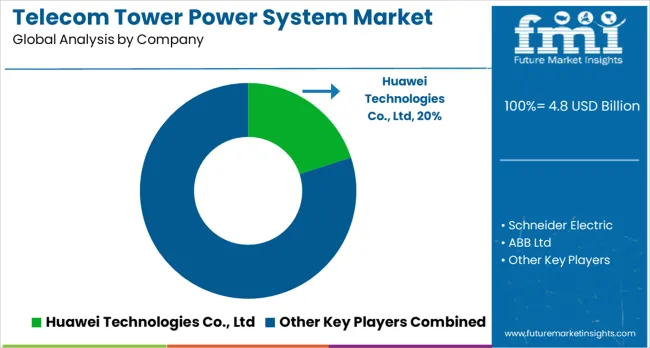

Huawei Technologies Co., Ltd, China-based with global operations, offers comprehensive telecom power system solutions with a focus on efficiency, reliability, and advanced network integration capabilities, maintaining a 20% market share. Schneider Electric, France, provides technologically advanced power management systems integrated with telecommunications infrastructure and building management applications. ABB Ltd, Switzerland, delivers specialized power solutions with standardized procedures and comprehensive industrial expertise.

Cummins Inc., United States, emphasizes robust generator technologies and comprehensive backup power systems for remote telecommunications applications. GE Energy/General Electric, United States, offers power solutions integrated into comprehensive energy management and industrial operations. These companies provide manufacturing expertise, technology innovation, and service reliability across global telecommunications markets, focusing on power system excellence, energy efficiency, and comprehensive network infrastructure support.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 4.8 billion |

| Product Type | Outdoor Telecom Power System and Indoor Telecom Power System |

| Power Source | Diesel Generator, Diesel Generator + Battery, and Renewable Energy |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Huawei Technologies Co., Ltd (20%), Schneider Electric, ABB Ltd, Cummins Inc., and GE Energy/General Electric |

| Additional Attributes | Dollar sales by product type, power source, and geography, regional demand trends across Asia-Pacific, North America, and Europe, competitive landscape with established manufacturers and emerging power technology providers, operator preferences for diesel versus renewable energy power sources, integration with 5G infrastructure and edge computing platforms, innovations in energy-efficient power management capabilities and hybrid energy systems, and adoption of remote monitoring solutions with predictive maintenance, performance optimization, and reliability enhancement features for improved telecommunications network availability. |

The global telecom tower power system market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the telecom tower power system market is projected to reach USD 9.2 billion by 2035.

The telecom tower power system market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in telecom tower power system market are outdoor telecom power system and indoor telecom power system.

In terms of power source, diesel generator segment to command 41.0% share in the telecom tower power system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

United States Telecom Tower Power System Market Trends & Forecast 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Analytics Market Size and Share Forecast Outlook 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Telecom Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

telecom-expense-management-market-market-value-analysis

Telecom Order Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Cloud Market Size and Share Forecast Outlook 2025 to 2035

Telecom Wireless Data Market Size and Share Forecast Outlook 2025 to 2035

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Telecommunications Services Market - Growth & Forecast 2025 to 2035

Telecom Enterprise Services Market Analysis - Growth & Forecast through 2034

Telecom Service Assurance Market Trends – Size, Demand & Forecast 2023-2033

Telecom API Platform Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA