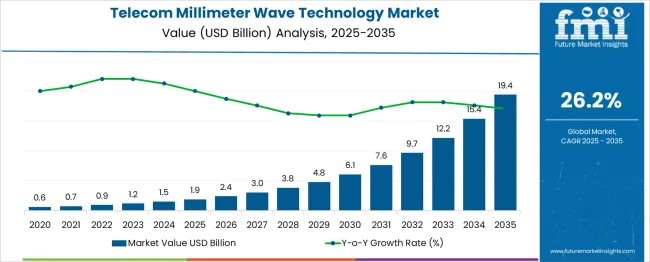

The Telecom Millimeter Wave Technology Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 19.4 billion by 2035, registering a compound annual growth rate (CAGR) of 26.2% over the forecast period. From 2025 to 2030, the market is expected to rise from USD 1.9 billion to USD 6.1 billion, driven by the increasing demand for high-speed wireless communication and the expansion of 5G networks globally. Year-on-year analysis indicates significant growth, with values reaching USD 2.4 billion in 2026 and USD 3.0 billion in 2027, supported by advancements in spectrum allocation and telecom infrastructure development. By 2028, the market is forecasted to reach USD 3.8 billion, progressing to USD 4.8 billion in 2029 and USD 6.1 billion by 2030. The surge in demand for ultra-low latency and high-bandwidth applications, including autonomous vehicles, smart cities, and IoT, will further drive market adoption. Technological innovations in mm Wave hardware, signal processing, and network architecture are expected to enhance performance and enable cost-effective deployment. These factors position millimeter wave technology as a key enabler of next-generation telecom infrastructure, supporting the transition to 5G and beyond.

| Metric | Value |

|---|---|

| Telecom Millimeter Wave Technology Market Estimated Value in (2025 E) | USD 1.9 billion |

| Telecom Millimeter Wave Technology Market Forecast Value in (2035 F) | USD 19.4 billion |

| Forecast CAGR (2025 to 2035) | 26.2% |

The telecom millimeter wave (mmWave) technology market is advancing rapidly, fueled by increasing data demand, 5G deployment acceleration, and growing need for high-capacity backhaul and fixed wireless solutions. Network densification strategies adopted by telecom operators are driving investment into mmWave to support ultra-low latency and multi-gigabit throughput, particularly in urban and high-density environments.

Strategic partnerships between infrastructure vendors and telecom providers, along with spectrum liberalization in several regions, are enabling the transition toward next-gen wireless communication. Innovations in silicon photonics, beamforming, and system-on-chip (SoC) design are making mmWave systems more power-efficient and commercially scalable.

Forward-looking government initiatives supporting spectrum allocation and the integration of mmWave in private networks and IoT ecosystems are expected to catalyze long-term market expansion.

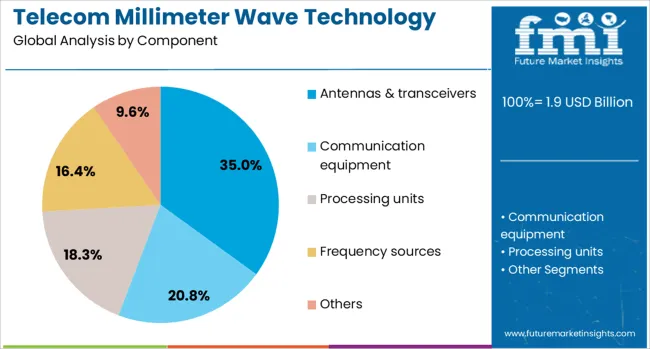

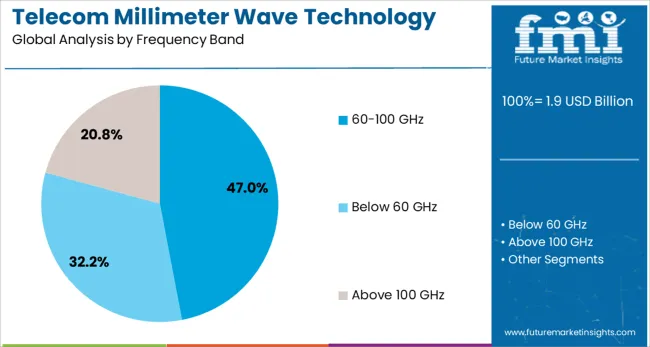

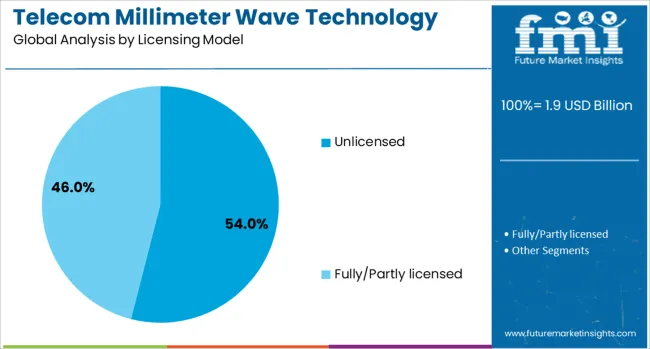

The telecom millimeter wave technology market is segmented by component, frequency band, licensing model, end use, and geographic regions. The telecom millimeter wave technology market is divided into Antennas & transceivers, Communication equipment, Processing units, Frequency sources, and others. In terms of frequency band, the telecom millimeter wave technology market is classified into 60-100 GHz, Below 60 GHz, and Above 100 GHz. Based on the licensing model, the telecom millimeter wave technology market is segmented into Unlicensed, Fully/Partly licensed. By end use, the telecom millimeter wave technology market is segmented into Telecom providers, Government and defense, Enterprises, and others. Regionally, the telecom millimeter wave technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Antennas and transceivers are projected to account for 35.0% of total revenue in the telecom millimeter wave technology market in 2025, making them the leading component segment. Their dominance is being driven by the need for high-gain, directional signal transmission and reception in mmWave frequencies, where signal attenuation is high.

The integration of phased-array antennas and MIMO transceivers has been essential for achieving the required beamforming and spatial multiplexing in 5G infrastructure. As operators transition to higher frequency deployments, compact and power-efficient antenna modules are increasingly being adopted in base stations, small cells, and user devices.

Continuous R&D investment into low-cost packaging and antenna-in-package solutions is further propelling adoption, especially in dense urban and enterprise-grade deployments.

The 60–100 GHz frequency band is expected to contribute 47.0% of the telecom millimeter wave market revenue in 2025, positioning it as the dominant frequency range. This range is gaining preference due to its ability to deliver ultra-high bandwidth and short-range, high-data-rate transmissions ideal for small cells, backhaul links, and point-to-point access.

The band is especially favored for urban densification and fixed wireless access, where fiber alternatives are economically or logistically impractical. Regulatory bodies in several countries have actively opened this spectrum for both licensed and unlicensed use, accelerating commercial deployments.

The compatibility of this band with advanced antenna technologies and its minimal cross-interference with lower frequency bands have made it a strategic choice for high-capacity telecom applications.

Unlicensed spectrum use is forecast to lead the market with a 54.0% revenue share in 2025, reflecting its widespread adoption for flexible and cost-effective network deployment. This segment’s growth is supported by the global trend toward deregulated access to high-frequency bands, particularly the 60 GHz V-band, which offers significant bandwidth for short-range high-speed connectivity.

Enterprises, telecom operators, and ISPs are leveraging unlicensed bands to deploy private networks, small cells, and last-mile wireless access without undergoing lengthy licensing processes. Lower operational costs, rapid time-to-market, and reduced regulatory complexity are reinforcing this model’s appeal.

As mmWave applications expand into campus networks, smart cities, and industrial IoT environments, unlicensed spectrum is expected to remain a cornerstone of agile and scalable telecom infrastructure.

The telecom millimeter wave (mmWave) technology market is expanding due to the increasing demand for high-speed internet and 5G infrastructure. Growth in 2024 and 2025 was driven by telecom companies deploying mmWave to enhance data throughput and support next-generation networks. Opportunities are evident in urban areas, where dense data traffic requires high-capacity solutions. Key trends include the rise of 5G fixed wireless access and integration of mmWave with edge computing. However, spectrum scarcity, high infrastructure costs, and regulatory challenges limit its full-scale implementation.

The primary growth driver is the rollout of 5G networks and the growing demand for faster, more reliable data services. In 2024 and 2025, telecom providers accelerated mmWave adoption in dense urban areas and industrial zones to support high-speed data transfer and low latency required for 5G applications. Fixed wireless access solutions leveraging mmWave technology emerged as viable alternatives to fiber-optic connections. These factors demonstrate that the increasing demand for high-capacity data services is driving significant market growth for mmWave technology in telecom networks.

Opportunities in urban environments and fixed wireless access (FWA) solutions are growing rapidly. In 2025, telecom providers expanded mmWave networks to densely populated areas to alleviate congestion and meet the demand for high-speed internet services. FWA solutions leveraging mmWave technology became an attractive alternative to wired broadband, especially in underserved areas. These developments suggest that telecom companies targeting urban hotspots and offering flexible, cost-effective wireless connectivity are well-positioned to capitalize on the increasing need for high-capacity networks.

Emerging trends include the deployment of mmWave for 5G connectivity and integration with edge computing. In 2024, mmWave technology played a key role in enhancing 5G speeds and supporting low-latency applications, especially in industries such as autonomous vehicles and smart cities. The integration of edge computing with mmWave networks further improved data processing capabilities, enabling real-time decision-making in IoT applications. These trends indicate a significant shift towards high-speed, distributed computing environments that rely on mmWave technology to meet the growing demands of the digital economy.

Key market restraints include regulatory hurdles and high infrastructure costs. In 2024 and 2025, telecom operators faced challenges in acquiring the necessary spectrum licenses, limiting the expansion of mmWave networks in certain regions. Additionally, the cost of deploying mmWave infrastructure, including base stations and small cell networks, remained high, making it challenging for smaller operators to enter the market. These barriers highlight the need for streamlined regulatory processes, cost-effective network solutions, and public-private partnerships to enable broader adoption of mmWave technology in telecom markets globally.

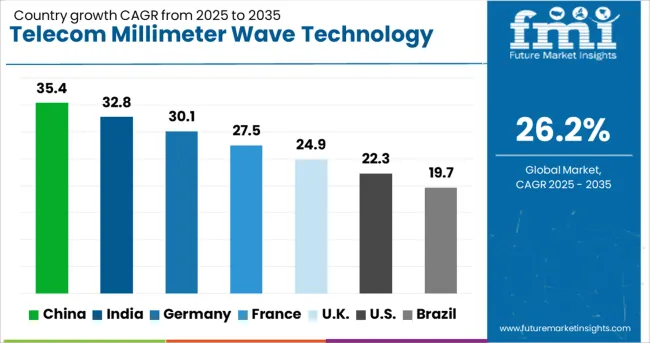

| Country | CAGR |

|---|---|

| China | 35.4% |

| India | 32.8% |

| Germany | 30.1% |

| France | 27.5% |

| UK | 24.9% |

| USA | 22.3% |

| Brazil | 19.7% |

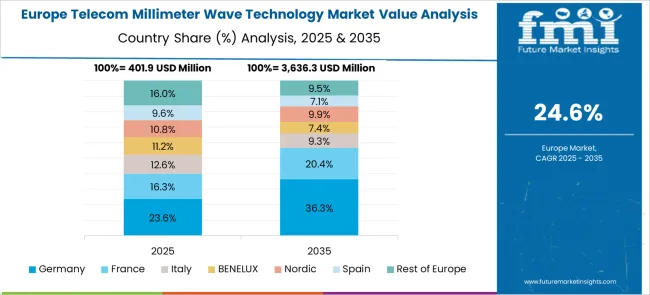

The global telecom millimeter wave (mmWave) technology market is projected to grow at 26.2% CAGR from 2025 to 2035. China leads with 35.4% CAGR, driven by massive 5G infrastructure rollout and increasing demand for high-speed wireless connectivity. India follows at 32.8%, supported by government initiatives to deploy 5G and enhance telecommunications coverage in rural and urban areas. France records 27.5% CAGR, focusing on next-generation 5G services and smart city connectivity. The United Kingdom grows at 24.9%, while the United States posts 22.3%, reflecting steady adoption in mature markets with a focus on ultra-fast broadband and wireless backhaul. Asia-Pacific leads in terms of growth, while Europe and North America focus on expanding 5G networks and urban connectivity solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The telecom millimeter wave technology market in China is forecasted to grow at 35.4% CAGR, driven by the country’s aggressive 5G rollout and government-backed smart city initiatives. Demand for high-frequency spectrum increases as telecom companies deploy 5G base stations in urban and rural areas. China’s leadership in manufacturing 5G-enabled devices and infrastructure components strengthens the demand for mmWave technologies in telecom backhaul, broadband expansion, and industrial automation. Integration with IoT devices and smart infrastructure further accelerates adoption.

The telecom millimeter wave technology market in India is projected to grow at 32.8% CAGR, supported by significant investments in 5G network expansion and the government’s Digital India initiative. Telecom operators adopt mmWave technology for high-speed connectivity, particularly in urban and semi-urban areas. Growing demand for ultra-fast internet speeds, combined with increasing smartphone penetration, accelerates market adoption. Rural connectivity and next-generation communication systems in remote areas further drive demand for high-capacity wireless solutions.

The telecom millimeter wave technology market in France is expected to grow at 27.5% CAGR, supported by nationwide 5G deployment and increasing government investment in digital infrastructure. French telecom operators prioritize mmWave solutions for ultra-fast internet services in both urban centers and rural areas. Demand for low-latency, high-speed connectivity increases with the rise of smart cities and autonomous vehicles. Additionally, France’s leadership in the EU’s 5G strategy accelerates the rollout of next-gen broadband services, further driving the adoption of mmWave technologies.

The telecom millimeter wave technology market in the United Kingdom is forecasted to grow at 24.9% CAGR, driven by government-led 5G initiatives and urban wireless connectivity solutions. With the UK aiming to be a leader in 5G technology, mmWave applications are expanding rapidly in metropolitan areas for high-speed internet services. The growing adoption of wireless backhaul for telecom networks and the increasing integration of mmWave in smart cities and broadband solutions further fuel market growth.

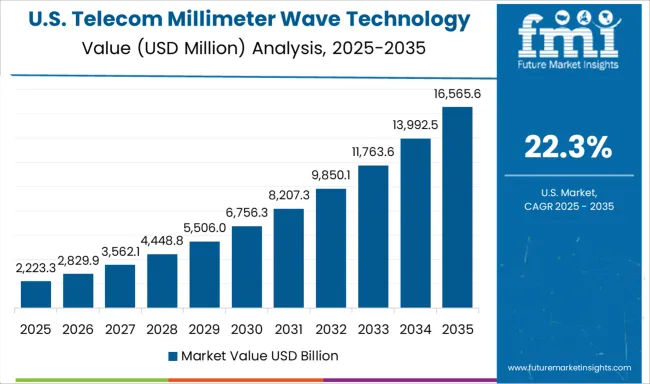

The telecom millimeter wave technology market in the United States is projected to grow at 22.3% CAGR, reflecting strong growth in 5G applications and high-speed internet services. With major telecom operators focusing on mmWave for enhanced broadband performance, demand increases for telecom backhaul and high-frequency spectrum solutions. The adoption of 5G-enabled mmWave devices and smart city infrastructure continues to expand, particularly in urban areas. Additionally, the rise of autonomous vehicles and industrial IoT solutions further stimulates the need for ultra-low latency and high-capacity wireless networks.

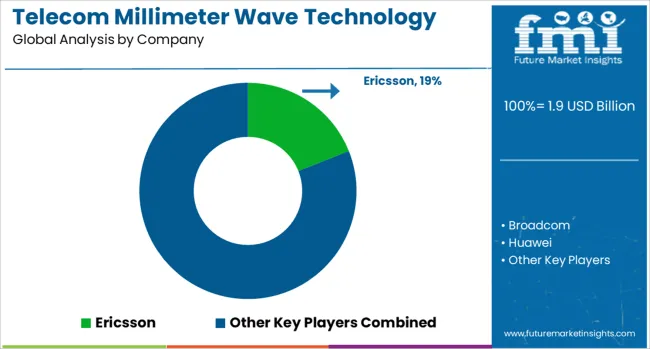

The telecom millimeter wave technology market is dominated by Ericsson, which secures its leadership through cutting-edge solutions designed for 5G wireless communication, high-capacity backhaul, and fixed wireless access. Ericsson’s dominance is reinforced by its extensive portfolio of millimeter wave-based equipment, strong global presence, and strategic partnerships with telecom operators to drive next-generation network deployments. Key players such as Huawei, Nokia, Qualcomm, Broadcom, and Keysight hold significant market shares by offering high-frequency chipsets, testing equipment, and communication systems optimized for millimeter wave spectrum use. These companies focus on ensuring low latency, high bandwidth, and seamless integration with 5G infrastructure.

Emerging players like L3Harris, Siklu Communication, NEC, and Millimeter Wave Products are expanding their market presence by targeting niche applications such as small-cell networks, point-to-point links, and advanced backhaul solutions. Their strategies include offering cost-effective, flexible solutions for both urban and rural deployments, as well as developing innovative antenna designs for better signal range and network reliability. Market growth is driven by the growing demand for high-speed data, expanding 5G rollouts, and the need for scalable millimeter wave solutions to meet the increasing capacity requirements of next-generation wireless networks. Advances in beamforming technology, spectrum management, and integration with IoT are expected to influence competitive dynamics globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Component | Antennas & transceivers, Communication equipment, Processing units, Frequency sources, and Others |

| Frequency Band | 60-100 GHz, Below 60 GHz, and Above 100 GHz |

| Licensing Model | Unlicensed and Fully/Partly licensed |

| End Use | Telecom providers, Government and defense, Enterprises, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ericsson, Broadcom, Huawei, Keysight, L3Harris, Millimeter Wave Products, NEC, Nokia, Qualcomm, and Siklu Communication |

| Additional Attributes | Dollar sales by frequency band (24–57 GHz, 57–86 GHz, 86–300 GHz) and application segment (telecommunications, automotive radar, satellite communication, military & defense). Segmentation by licensing model (licensed vs. unlicensed spectrum). Regional trends: North America leads, followed by Asia-Pacific and Europe. Innovations in beamforming, phased-array antennas, and smart city integration. |

The global telecom millimeter wave technology market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the telecom millimeter wave technology market is projected to reach USD 19.4 billion by 2035.

The telecom millimeter wave technology market is expected to grow at a 26.2% CAGR between 2025 and 2035.

The key product types in telecom millimeter wave technology market are antennas & transceivers, communication equipment, processing units, frequency sources and others.

In terms of frequency band, 60-100 ghz segment to command 47.0% share in the telecom millimeter wave technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

Millimeter Wave Sensors Market by Devices, Frequency Band, Application & Region Forecast till 2025 to 2035

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

Telecom Site Management Software Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Analytics Market Size and Share Forecast Outlook 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Waveguide Components and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Wavefront Aberrometers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

telecom-expense-management-market-market-value-analysis

Telecom Order Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Cloud Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA