The Telecom Billing And Revenue Management Market is estimated to be valued at USD 19.2 billion in 2025 and is projected to reach USD 48.5 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Telecom Billing And Revenue Management Market Estimated Value in (2025 E) | USD 19.2 billion |

| Telecom Billing And Revenue Management Market Forecast Value in (2035 F) | USD 48.5 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The telecom billing and revenue management market is expanding steadily as operators focus on digital transformation, customer retention, and revenue assurance. Increasing subscriber volumes, coupled with the demand for real time billing, fraud management, and advanced analytics, have accelerated the adoption of modern billing platforms.

Software driven solutions are being enhanced through automation, AI, and cloud capabilities, which support flexible pricing models and personalized offerings. The rapid growth of data services, IoT connections, and 5G rollouts is further reinforcing the need for robust billing frameworks that can handle complex usage scenarios.

Cloud based deployments are gaining traction as operators seek scalability, cost efficiency, and faster implementation cycles. The market outlook remains positive, with continued emphasis on reducing revenue leakages, improving customer experience, and integrating advanced technologies into revenue management systems.

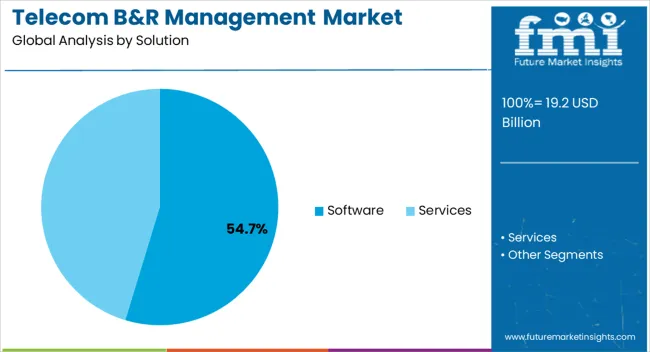

The software segment is expected to account for 54.70% of total market revenue by 2025 within the solution category, positioning it as the leading segment. Its dominance is driven by the ability to provide flexible and scalable billing systems that support convergent billing, policy management, and customer analytics.

The integration of AI and automation into software solutions has enabled operators to minimize errors, enhance efficiency, and deliver real time charging capabilities.

With the expansion of digital services and bundled offerings, reliance on robust software platforms has increased, solidifying this segment’s leadership in the market.

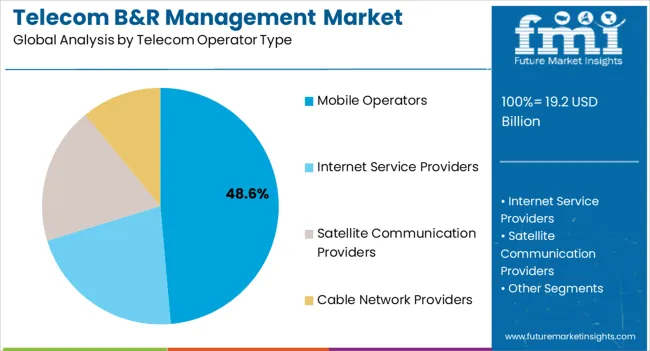

The mobile operators segment is projected to represent 48.60% of total revenue by 2025 within the telecom operator type category, making it the most prominent segment. This leadership is attributed to the rapid growth of mobile subscriptions, data consumption, and the rollout of 5G networks.

Mobile operators face heightened pressure to manage complex billing requirements, prepaid and postpaid plans, and value added services. Their investment in advanced billing and revenue management systems is further driven by the need to prevent revenue leakage and maintain competitive pricing structures.

These factors have reinforced mobile operators as the key contributors to market expansion.

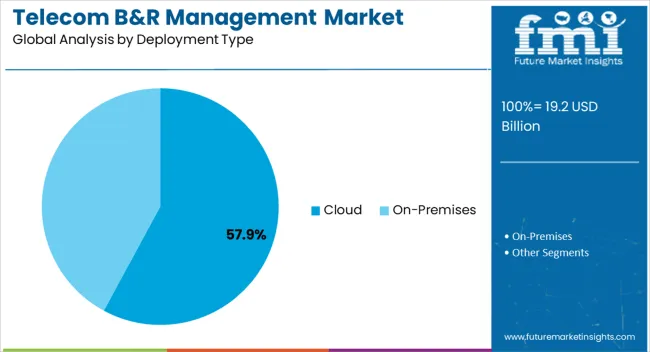

The cloud deployment segment is anticipated to hold 57.90% of total revenue by 2025 within the deployment type category, positioning it as the dominant segment. Cloud based billing solutions have been preferred for their scalability, lower upfront costs, and ease of integration with digital ecosystems.

Operators benefit from faster deployment cycles, improved flexibility, and reduced maintenance requirements compared to on premise systems. Furthermore, the ability of cloud platforms to support real time analytics and adapt to evolving customer demands has strengthened their adoption.

As telecom operators pursue cost efficiency and agility, the cloud segment continues to lead the market with substantial growth prospects.

The global market for Telecom Billing and Revenue Management expanded at a CAGR of 7.6% during 2020 to 2025. The market growth is projected to be augmented by the increased cohort of telecommunication services users. Besides, the surge in the various network providers transitioning to the 5G network services expedites the requirement of Telecom Billing and Revenue Management in the forthcoming years.

The global Telecom Billing and Revenue Management market is predicted to surge ahead at a CAGR of 9.7% and record sales worth USD 48.50 billion by the end of 2035. USA will continue to be the largest market throughout the analysis period accounting for over USD 7.3 billion absolute dollar opportunity in the coming 10-year epoch.

According to GSMA estimates, by 2025, around 60% of the smartphone unit sales will be compatible with e-Sims, with around 2-3 Billion smartphone connections across the world using e-Sims. All these attributes are anticipated to be advantageous to the revenue growth through Mobile Operators Segment.

| Segment | Software |

|---|---|

| 2025 Value Share in Global Market | 64.3% |

| Segment | Internet Service Providers |

|---|---|

| 2025 Value Share in Global Market | 34.4% |

The billing processes have become more intricate with the advent of new technologies and services in the telecom industry, such as 5G, IoT, and cloud-based solutions. Software solutions provide the flexibility and scalability required to handle complex billing scenarios efficiently.

Software solutions automate billing and revenue management tasks. They minimize errors and reduce the need for manual intervention. Telecom operators offer innovative pricing models. These include dynamic pricing, personalized plans, and real-time charging.

Software solutions enable real-time rating and charging. They help operators monetize services effectively and improve customer experiences. Advanced software solutions have robust analytics and reporting capabilities. They provide valuable insights into billing processes, customer behavior, and revenue streams for telecom operators.

With the increasing reliance on the Internet for various activities such as communication, entertainment, e-commerce, and cloud services, the demand for broadband and internet services has skyrocketed. Internet service providers have experienced significant growth in their customer base, leading to increased billing and revenue management requirements.

Internet services are typically billed based on usage, such as data consumption or bandwidth utilization. Internet service providers need accurate metering and rating capabilities to track and bill customers based on their actual usage. This requires advanced billing systems that can handle large volumes of usage data and generate accurate invoices accordingly.

Internet service providers often employ complex billing models. These models cater to the diverse needs of their customers. Internet service providers offer various pricing plans based on bandwidth, data usage, speed tiers, and bundled services. They often have different billing cycles and billing methods (prepaid or postpaid). Internet service providers also have distinct billing structures for residential and enterprise customers. Managing these complexities effectively requires sophisticated billing and revenue management solutions.

It is anticipated for the On-Premises Segment by Deployment Type of the Telecom Billing and Revenue Management Market to experience an accelerated CAGR of 9.2% in the forthcoming years. Among the key attributes being beneficial to this segment are the ready availability and reusability of the infrastructure, thus helping save the cost associated with significant infrastructural change.

The on-premises segment by deployment type is popular among large enterprises as they additionally provide them with the ability to have enhanced control over system and data coupled with a dedicated staff for IT support and maintenance.

Furthermore, the data security concerns associated with the On-Premises segment by deployment type of the Telecom Billing and Revenue Management Market tend to be minimal. All these attributes are anticipated to be advantageous for the On-Premises segment in the upcoming 10-year epoch.

In the forthcoming years, Asia-Pacific is estimated to be extensively lucrative for the Telecom Billing and Revenue Management Market. According to a recent report, published by the Global System for Mobile Communications, by 2025, the total volume of 5G mobile users will be 17.5 Million, illustrating 14% of the total mobile subscription in Asia-Pacific, specifically in the countries including Japan, South Korea, Singapore, and Australia. As of 2024, in Japan, NTT DOCOMO is providing 20 GB for USD 22.1 (3000 yen), following the government’s advice of introducing price cuts.

These price cuts have in turn paved the way for increasing the rate of 5G adoption among Japanese customers, which is advantageous to the Telecom Billing and Revenue Management Market.

As of April 2025, the customer cohort of the Telecom sector in India makes up a total of 27.8 Billion subscribers, including both wireless and wireline services, making it the second-largest around the globe. A recent report notes, that of the total FDI inflows, with a contribution of around 7%, the telecom industry makes up the third largest industry. It further states that the country is aiming for producing mobile phones worth USD 126 Billion by 2029.

A report released by the Ministry of Industry and Information Technology in China states that as of 2024, the telecom sector in China grew 8% year on year to reach a total valuation of 1.5 Tn yuan (USD 232.43 Billion).

The ministry further estimates that this pinnacle is achieved from the involvement of digital services like cloud computing, data, and big data centers. The report further stated that these digital services have contributed to 44.5% of the telecom sector’s revenue in 2024.

As of 2024, the country had approximately 48.5 Million 5G base stations, which make up 60% of the global 5G network. It is forecasted that these attributes will aid in propelling the Telecom Billing and Revenue Management Market in China to account for a CAGR of 8.8% by the end of 2035.

It is anticipated that during the forthcoming years, the telecom billing and revenue management market share of North America will be nearly 40% throughout the analysis period. In June 2025, Emersion Systems decided to accelerate its presence in North America.

Taking into account an article published by the GSMA, the United States has four main carriers, enabling network infrastructure services to around 139 MVNOs that are serving over 36 million active customers. Among the contributing factors is the United States FCC (Federal Communications Commission) Lifeline Program will enable low-income customers to have access to all the opportunities and security associated with phone service.

All these attributes are anticipated to work towards propelling the Telecom Billing and Revenue Management Market in the North-American region in the forthcoming years.

| Countries | 2025 Value Share in Global Market |

|---|---|

| United States | 18.2% |

| Germany | 7.3% |

| Japan | 5.4% |

The recent Infrastructure Investment and Jobs Act (IIJA) that was passed in November 2024, provides an extensive investment of approximately USD 65 billion to be used for the deployment of broadband.

The bulk of this investment is aimed toward the Broadband Equity, Access, and Deployment (BEAD) Program to be distributed between states and territories for financing broadband deployment by the National Telecommunications and Information Administration (NTIA). This act is anticipated to expedite the Telecom Billing and Revenue Management Industry extensively in the forthcoming years by expanding telecommunication infrastructure.

Taking into account statistics from a recent survey, by 2025, smartphone users in the United States are projected to increase to approximately 19.2 million. As of July 2025, four noteworthy bills associated with the telecommunications sector have been approved by the United States House of Representatives, a development that subsequently works to benefit the Telecom Billing and Revenue Management Industry.

The adoption of cloud-based solutions is a key trend in the United States telecom billing and revenue management market. Telecom operators in the United States are increasingly migrating their billing and revenue management systems to cloud-based platforms.

One of the primary and technologically sophisticated telecom sectors in Europe is found in Germany. The nation provides its residents with extensive coverage and fast access because of its well-developed infrastructure. German telecom service providers struggle to control intricate invoicing procedures and guarantee precise revenue management. The need for telecom billing and revenue management systems has been constantly increasing to meet these difficulties.

The market in Germany is expected to continue its growth trajectory in the coming years. The main factors influencing market development are the rising need for sophisticated billing systems, the rollout of 5G networks, and the emphasis on the customer experience. The industry's future is also projected to be shaped by the consolidation of services and the adoption of cloud-based and analytics-driven solutions.

Telecom companies in Japan are increasingly moving away from conventional on-premises billing systems and toward cloud-based ones. Operators can handle rising data volumes and swiftly roll out new services because of the scalability, flexibility, and cost-effectiveness of cloud-based billing and revenue management solutions.

In Japan, the rollout of 5G networks has raised the demand for sophisticated billing and revenue management systems that can handle the higher complexity and data quantities associated with 5G services. To enable creative pricing strategies and revenue potential, telecom operators are attempting to combine their current billing systems with 5G infrastructure. Therefore, the Japan telecom billing and revenue management market is projected to experience significant growth and transformation.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.4% |

| China | 8.4% |

| India | 12.4% |

The United Kingdom telecom billing and revenue management market has witnessed significant growth lately. A powerful digital change is taking place in the United Kingdom across several sectors, including telecoms. To improve customer experience, cut expenses, and increase revenue collection, United Kingdom telecom businesses are putting more emphasis on simplifying their billing and revenue management procedures.

The United Kingdom telecom market is seeing a rise in the need for personalized billing experiences such as itemized billing, self-service portals, and real-time use tracking. In this country, telecom providers are significantly moving toward business models based on subscriptions, such as bundles of services and pay-as-you-go contracts. This change necessitates flexible billing and revenue management systems that can deal with intricate pricing schemes, recurrent charges, and precise revenue recognition.

Leading telecom companies in China have been at the forefront of the implementation of 5G, actively extending their 5G networks throughout the nation. Telecom billing and revenue management solution suppliers now have a chance to offer cutting-edge systems that can manage the increasing complexity and varied service offerings connected with 5G technology.

The adoption of cloud-based billing solutions is expected to increase in China's telecom industry. The transition to cloud-based billing systems is anticipated to allow operators to quickly launch new services, improve consumer experiences, and increase operational agility. Hence, the China telecom billing and revenue management market is projected to witness significant growth driven by digital transformation, 5G adoption, and evolving customer expectations.

The need for data services is expected to grow as smartphone adoption, and internet usage in India continue to rise. India's 5G network deployment is about to change the telecom sector. To meet the specific needs of 5G networks, telecom operators are modernizing their billing and revenue management systems as part of their preparations for the rollout of 5G technology.

Telecom operators now have the opportunity to incorporate payment solutions into their billing systems. This enables consumers to pay their bills without interruption. The Indian government's drive for digital payments and the explosive expansion of mobile wallets and Unified Payments Interface (UPI) platforms make this possible.

Amdocs, Netcracker Technology (NEC Corporation), CSG Systems International, Oracle Corporation, Hewlett Packard Enterprise, Enghouse Networks (Enghouse Systems Ltd.), BearingPoint (BearingPoint Europe Holding B.V.), Zuora Inc., Apptus, Subex Ltd., Mahindra Comviva, Cerillion, Optiva, Huawei, Sterlite Technologies, Tecnotree, Emersion Systems (Novatti Group), CommScope Holding Company Group Inc., and Intracom Telecom are among the key players worldwide driving the competitive landscape of the market.

To expand their product portfolio and simultaneously capitalize on the growing market demand, many of these companies are adopting strategies such as mergers, acquisitions, and partnerships.

Some of the key developments in the telecom billing and revenue management market include:

The global telecom billing and revenue management market is estimated to be valued at USD 19.2 billion in 2025.

The market size for the telecom billing and revenue management market is projected to reach USD 48.5 billion by 2035.

The telecom billing and revenue management market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in telecom billing and revenue management market are software, mediation, billing and charging, partner and interconnect management, revenue assurance, fraud management, services, professional services and managed services.

In terms of telecom operator type, mobile operators segment to command 48.6% share in the telecom billing and revenue management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Billing and Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Subscription and Billing Management Market Insights – Forecast 2023-2033

Revenue Management Software Market Size and Share Forecast Outlook 2025 to 2035

Revenue Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Standby Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Telecom Site Management Software Market Size and Share Forecast Outlook 2025 to 2035

Demand for Billing Paper in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Telecom Network Infrastructure in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Telecom Network Infrastructure in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Billing Paper in USA Size and Share Forecast Outlook 2025 to 2035

Telecom Order Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

telecom-expense-management-market-market-value-analysis

Demand for Cash Management Services (CMS) in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cash Management Services (CMS) in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Trade Management Software in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Trade Management Software in USA Size and Share Forecast Outlook 2025 to 2035

Wire and Cable Management Market Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Battery Management System in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA