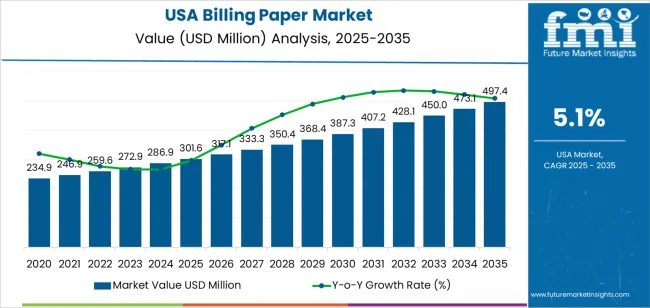

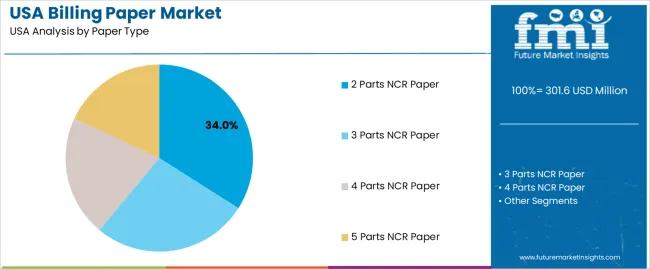

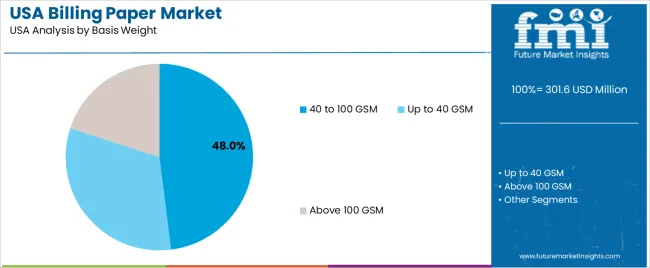

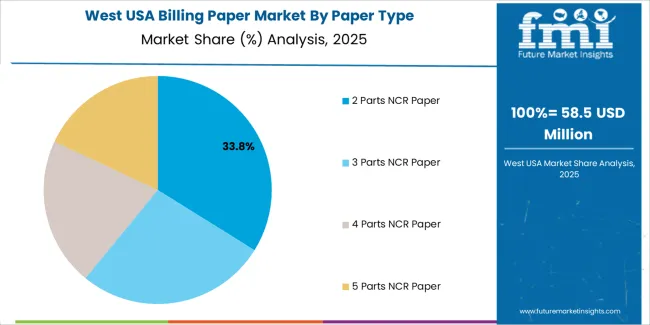

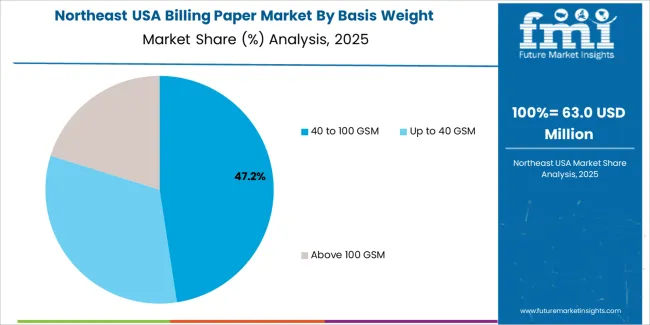

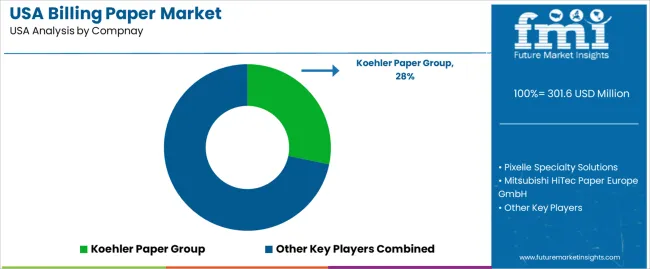

In 2025, demand for billing paper in the USA is valued at USD 301.6 million and is projected to reach USD 497.4 million by 2035 at a CAGR of 5.1%. Early growth reflects continued reliance on physical transaction records across retail, healthcare, banking, and government documentation despite wider digital adoption. Two-part NCR paper holds the largest share at 34%, followed by three-part formats at 27%, indicating that multi-copy documentation remains central to point-of-sale and logistics workflows. Basis weights between 40 and 100 GSM account for 48% of use due to compatibility with high speed printers. Carbonless paper represents 36% of total product demand, ahead of thermal at 26%, reflecting balanced use across billing and receipts.

From 2030 onward, market expansion is shaped by application mix rather than transaction volume growth. Retail remains the largest use segment at 29%, followed by e-commerce and packaging at 21% as fulfillment documentation scales with online order volumes. Banking holds 16% share through internal records and customer documentation, while government and legal at 12% and healthcare at 11% remain stable institutional users. Recycled and eco-friendly paper accounts for 16% of product demand, reflecting procurement preferences rather than structural substitution. Key suppliers serving the USA include Koehler Paper Group, Pixelle Specialty Solutions, Mitsubishi HiTec Paper Europe GmbH, Krpa Holding CZ, A.S., and Nekoosa Coated Products, LLC. Competitive positioning centers on coating consistency, jam-free runnability, security features, and long-term supply reliability for high-volume institutional buyers.

The overall demand for billing paper in USA increases from USD 301.6 million in 2025 to USD 317.1 million by 2030, adding USD 15.5 million in absolute value. This phase reflects structurally steady growth anchored in regulated billing requirements across utilities, healthcare, logistics, retail receipts, and financial services. Demand remains supported by high transaction volumes in physical invoicing, point-of-sale documentation, and compliance-driven recordkeeping. While digital billing continues expanding, a large installed base of legacy systems, legal documentation needs, and hybrid paper-digital workflows sustains baseline consumption. Growth during this period remains volume anchored, with limited pricing flexibility and stable procurement cycles across institutional buyers.

From 2030 to 2035, the market expands from USD 317.1 million to USD 497.4 million, adding a substantially larger USD 180.3 million in the second half of the decade. This back weighted acceleration reflects rising paper usage in logistics documentation, healthcare claims processing, and multi-channel retail as physical and digital billing coexist at scale. Increased paper adoption in secondary distribution hubs, warehouse operations, and regional healthcare systems supports higher throughput demand. At the same time, value per ton rises due to quality upgrades, thermal coating adoption, and archival-grade specifications, shifting growth from pure volume expansion toward compliance-driven value escalation.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 301.6 million |

| Forecast Value (2035) | USD 497.4 million |

| Forecast CAGR (2025–2035) | 5.1% |

Demand for billing paper in the USA has long been supported by traditional invoicing, receipts, and print-out certification systems used across utilities, telecommunications, retail, and financial services. Even with rising digital adoption, many businesses continued to rely on hard-copy bills and statements due to regulatory compliance, customer preference, and print-based archival needs. Paper billing offered tangible record-keeping for audits, customer disputes, and long-term documentation. Small businesses, rental-based services, and rural providers often maintained paper billing systems because customers lacked reliable digital access or preferred physical records. These factors maintained steady baseline demand despite broader digital shifts.

Future demand for billing paper in the USA will likely shrink as digital billing, electronic invoicing, and online account management become universal. Regulatory and corporate push for paperless transactions will further reduce reliance on printed bills and receipts. Customers increasingly prefer digital statements to avoid clutter and enable easier storage and access. Advances in secure digital authentication, archiving, and e-document formats will address compliance and audit needs that previously required physical documents. However, certain segments such as legal services, government notices, medical billing, and audiences with limited internet access may continue using paper billing. Overall demand for billing paper will decline gradually, with residual usage in niche sectors where printed documentation remains legally or culturally preferred.

The demand for billing paper in the USA is structured by paper type and basis weight. Two parts NCR paper accounts for 34% of total demand, followed by three parts, four parts, and five parts NCR paper used in multi copy documentation. By basis weight, the 40 to 100 GSM segment represents 48.0% of total consumption, followed by grades below 40 GSM and above 100 GSM. Demand behavior is shaped by print clarity needs, sheet durability, carbonless transfer efficiency, and handling volume in transactional environments. These segments reflect how documentation practices and printer compatibility guide purchasing patterns across commercial, logistics, retail, and institutional billing operations in the USA.

Two parts NCR paper accounts for 34% of total billing paper demand in the USA. This dominance reflects its widespread use in standard invoice, receipt, delivery note, and service documentation where one original and one duplicate copy are sufficient. It supports efficient transaction recording while minimizing paper consumption and storage requirements. The format is widely adopted across retail counters, courier services, healthcare billing desks, and utility service operations.

Two parts NCR paper is also preferred due to compatibility with dot matrix and impact printers still used in many billing environments. Lower sheet volume per transaction reduces operating costs for businesses managing high transaction frequency. Inventory handling and document sorting also remain simpler with two sheet formats. These cost efficiency, USAbility, and equipment compatibility factors sustain two parts NCR paper as the leading paper type in the USA billing paper segment.

The 40 to 100 GSM basis weight segment accounts for 48.0% of total billing paper demand in the USA. This dominance reflects its balance between strength, print clarity, and carbonless transfer performance. Papers in this range withstand repeated handling without tearing while maintaining reliable image transfer between multiple NCR layers. This GSM range supports consistent performance in high speed billing and transaction printing environments.

Papers below 40 GSM are more prone to curling and damage, while those above 100 GSM increase material cost without significant functional benefit for most billing applications. The 40 to 100 GSM range also performs well in thermal and impact printing systems used across retail and logistics facilities. These durability, print performance, and cost control advantages position the 40 to 100 GSM range as the dominant basis weight category for billing paper demand in the USA.

Demand for billing paper in the USA is driven by the scale of transaction-heavy sectors such as retail, utilities, healthcare, logistics, and financial services that still rely on printed records for compliance and customer documentation. Hospitals, insurance providers, and utility companies continue to issue large volumes of physical statements where regulatory retention and customer preference require paper formats. Independent retailers, fuel stations, and service centers also sustain steady usage of invoicing and receipt paper. Despite digital billing growth, the need for physical proof of transaction remains structurally embedded across many regulated and legacy-driven USA industries.

In the USA, retail chains generate high continuous demand for billing paper through POS receipts, return documentation, and warranty records. Healthcare providers issue printed bills, explanation-of-benefits forms, and payment summaries due to insurance coordination and patient documentation rules. Utility companies depend on mailed billing for customers lacking digital access or opting for paper records. Small businesses in automotive service, repairs, and hospitality also rely heavily on printed invoices for customer trust and dispute resolution. These operational workflows keep billing paper embedded in daily transactional processes.

Billing paper demand in the USA faces growing pressure from electronic invoicing, digital wallets, and automated payment platforms. Large enterprises push customers toward paperless billing to reduce postage and storage costs. Environmental policies and corporate sustainability targets encourage reduced paper consumption. Price volatility in pulp and thermal coatings compresses margins for paper suppliers. Some municipalities restrict excessive receipt printing. Consumer acceptance of digital receipts continues to rise among younger demographics. These technological, cost, and environmental forces gradually erode high-growth potential even as baseline demand remains large.

Billing paper demand in the USA is shifting toward security-enhanced and application-specific formats rather than simple volume growth. Fraud-resistant papers, watermarking, and tamper-evident coatings gain favor in banking, healthcare, and government use. Thermal billing paper evolves with longer image retention and BPA-free coatings. Hybrid billing models combine digital delivery with optional printed statements, sustaining selective demand. Short-run customized billing and on-demand printing support decentralized business operations. These trends show billing paper transitioning from mass commodity use toward controlled, compliance-driven, and security-focused consumption.

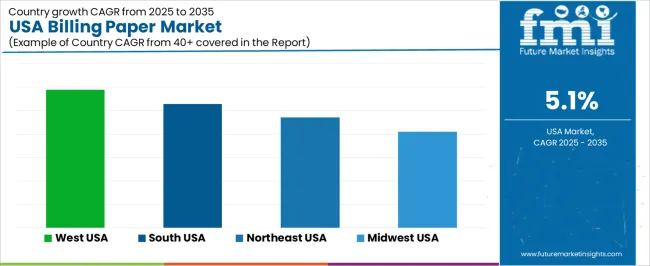

| Region | CAGR (%) |

|---|---|

| West | 5.9% |

| South | 5.3% |

| Northeast | 4.7% |

| Midwest | 4.1% |

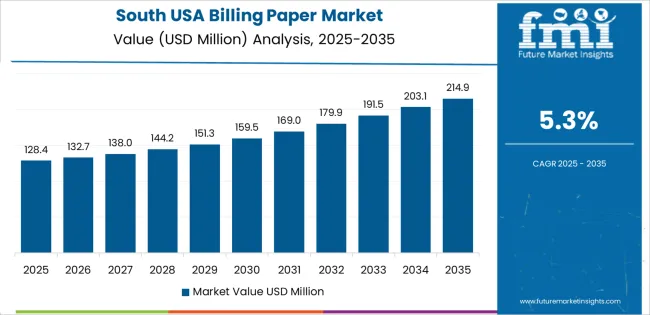

The demand for billing paper in the USA is projected to grow across all regions, with the highest growth in the West at 5.9% CAGR. This growth may be driven by expanding healthcare, retail, and utility billing sectors requiring printed invoices and records, especially in rapidly growing western states. The South, at 5.3%, shows steady growth likely supported by increasing business activity, regional service providers, and rising administrative paperwork. The Northeast at 4.7% reflects more stable demand in established commercial hubs. The Midwest, with 4.1% growth, indicates slower but consistent demand, possibly tied to slower population growth and more established billing infrastructures.

Growth in the West reflects a CAGR of 5.9% through 2035 for billing paper demand, supported by high transaction volumes across retail, healthcare, and utility billing systems. Large service sector footprints in metropolitan areas generate steady usage of receipt rolls and invoice paper. Healthcare networks continue to rely on printed billing for patient documentation and insurance processing. Small business activity across hospitality and foodservice also sustains point of sale paper consumption. Demand remains operationally driven rather than discretionary, with bulk procurement tied closely to daily transaction throughput across commercial and public service organizations.

The South advances at a CAGR of 5.3% through 2035 for billing paper demand, driven by expanding small business formation, population growth, and broad retail and service sector activity. Grocery chains, fuel stations, and regional service providers generate continuous receipt printing requirements. Public sector offices and municipal utilities maintain printed customer records for compliance and audits. Lower digital payment penetration in rural areas supports continued paper based billing. Demand remains volume oriented, with distributors supplying high turnover consumables for daily commercial, institutional, and community service operations.

The Northeast records a CAGR of 4.7% through 2035 for billing paper demand, shaped by dense urban commercial activity, healthcare administration, and regulated utility services. Hospitals, clinics, and insurance administrators maintain structured printed records for compliance and reconciliation. Transit systems and parking services also contribute to steady ticket and receipt printing. High service sector concentration offsets gradual digital migration. Demand remains stability driven, with institutional consumption providing consistent base load even as retail transactions increasingly shift toward electronic receipts across metropolitan business environments.

The Midwest expands at a CAGR of 4.1% through 2035 for billing paper demand, supported by regional retail networks, manufacturing administration, and public service billing operations. Warehousing, logistics, and agricultural supply chains rely on printed invoices and shipment documentation. Family owned retail outlets sustain consistent receipt paper usage. Schools, local governments, and healthcare providers maintain printed records for audits and reporting. Demand remains operational and predictable, guided by steady commercial activity and slower digital transition across smaller towns and mixed rural urban service economies.

Demand for billing paper in the USA remains driven by sectors that require physical receipts, invoices, statements, and transactional documentation despite growing digitalisation. Industries such as retail, healthcare, utilities, banking, and logistics continue to rely on printed documents for record keeping, compliance, audits, and customer service. The persistence of point of sale systems, printed billing for household utilities, and regulatory or tax reporting requirements support stable demand. At the same time, some users value the tangibility, traceability and accepted legal status of paper based records. Specialty paper grades including thermal rolls, carbonless forms, and fine quality invoice sheets meet diverse needs across commercial, financial, and institutional applications.

Major suppliers active in the USA billing paper market include Kohler Paper Group, Pixelle Specialty Solutions, Mitsubishi HiTec Paper Europe GmbH, Krpa Holding CZ, A.S., and Nekoosa Coated Products, LLC. These firms provide a range of paper formats from receipt rolls and invoice sheets to coated specialty papers—tailored for point of sale, financial and institutional billing. Their roles in supply chain logistics, production capacity, and product variety help ensure availability across small businesses, large retailers, and service providers. This mix of global and regional producers sustains a competitive landscape that caters to both commodity grade and specialized billing paper requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Paper Type | 2 Parts NCR Paper, 3 Parts NCR Paper, 4 Parts NCR Paper, 5 Parts NCR Paper |

| Basis Weight | 40 to 100 GSM, Up to 40 GSM, Above 100 GSM |

| Product Type | Carbonless Paper (NCR), Thermal Paper, Recycled and Eco-friendly Paper, Bond Paper, Security/Watermarked Paper |

| Application | Retail, E-commerce & Packaging, Banking, Government & Legal Documentation, Healthcare, Educational |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Koehler Paper Group, Pixelle Specialty Solutions, Mitsubishi HiTec Paper Europe GmbH, Krpa Holding CZ, A.S., Nekoosa Coated Products, LLC |

| Additional Attributes | Dollar value distribution by paper type, basis weight, and product type; regional CAGR projections; two parts NCR paper leads with 34% share due to high usage in standard transactional documentation; 40–100 GSM basis weight leads 48% of consumption for optimal print clarity and durability; carbonless paper leads 36% ahead of thermal at 26%; growth from 2030–2035 is back-weighted, driven by logistics documentation, healthcare claims, and multi-channel retail expansion; hybrid billing workflows support selective ongoing demand; supply focus includes coating consistency, jam-free printing, and archival-grade specifications. |

The demand for billing paper in USA is estimated to be valued at USD 301.6 million in 2025.

The market size for the billing paper in USA is projected to reach USD 497.4 million by 2035.

The demand for billing paper in USA is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in billing paper in USA are 2 parts ncr paper, 3 parts ncr paper, 4 parts ncr paper and 5 parts ncr paper.

In terms of basis weight, 40 to 100 gsm segment is expected to command 48.0% share in the billing paper in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Billing Paper Market Analysis - Growth & Industry Trends 2025 to 2035

USA Micro Flute Paper Market Report – Trends, Demand & Industry Outlook 2025-2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Demand for Filter Paper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Paper Loading Machine in USA Size and Share Forecast Outlook 2025 to 2035

USA Flexible Laminated Paper Market Growth – Trends & Forecast 2024-2034

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA