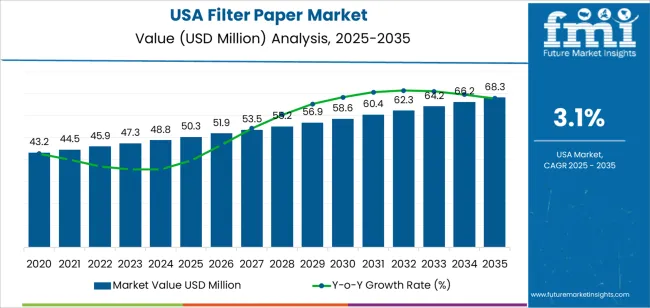

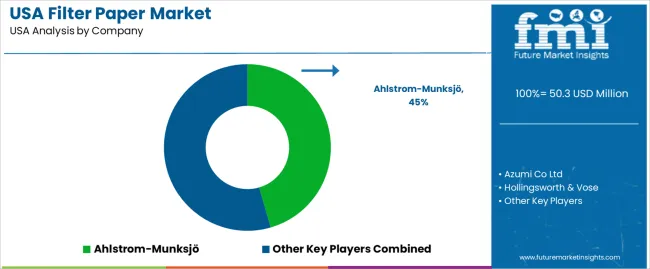

The demand for filter paper in the USA is expected to grow from USD 50.3 million in 2025 to USD 68.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.10%. Filter paper is widely used in laboratories, the food and beverage industry, pharmaceuticals, and water treatment, where its role in separating substances through filtration is crucial. The increasing demand for high-quality filtration solutions in various sectors, including research and healthcare, is expected to drive this growth. Advancements in filter paper technology, such as enhanced durability, precision, and increased functionality, will further contribute to the expansion of the filter paper industry.

The food and beverage industry, in particular, is a major driver of demand, where filter paper is essential in processes like brewing, coffee production, and juice filtration. The rising awareness of food quality and safety, combined with the growing trend of eco-friendly practices, will likely encourage the use of higher-quality filter papers. As industries focus on improving efficiency and product quality, demand for specialized filter papers with improved filtration capabilities will continue to rise. Innovations in eco-friendly, biodegradable filter paper materials will meet the growing consumer and regulatory demand for eco-friendly solutions.

Between 2025 and 2030, the demand for filter paper in the USA is expected to increase from USD 50.3 million to USD 53.5 million, reflecting steady growth. This growth momentum is driven by ongoing advancements in the filtration industry, with increased demand for filter papers in food and beverage processing, healthcare, and research sectors. The steady rise in demand can be attributed to both the need for higher performance filtration solutions and the adoption of eco-friendly materials. This phase will likely see consistent industry growth, supported by the expanding applications of filter paper across various industries.

From 2030 to 2035, the growth momentum is expected to accelerate, with the demand for filter paper projected to increase from USD 53.5 million to USD 68.5 million. This period will witness stronger growth due to the increasing emphasis on high-quality filtration systems in industries such as pharmaceuticals and environmental management. The rise in research and development, particularly in healthcare and biotechnology, will contribute to an uptick in demand for specialized filter papers. Advancements in eco-friendly and biodegradable filter papers will align with the growing preference for eco-friendly solutions, further enhancing growth momentum. As new applications emerge and industries adopt more advanced filtration technologies, the industry for filter paper will see continued, robust growth in the latter half of the forecast period.

| Metric | Value |

|---|---|

| Demand for Filter Paper in USA Value (2025) | USD 50.3 million |

| Demand for Filter Paper in USA Forecast Value (2035) | USD 68.5 million |

| Demand for Filter Paper in USA Forecast CAGR (2025 to 2035) | 3.10% |

The demand for filter paper in the USA is rising as laboratories, industrial processing plants, and environmental testing facilities increasingly require high‑quality filtration media. Filter paper is essential for applications such as chemical analysis, air and liquid filtration, quality control in food and beverage production, and environmental monitoring. As regulatory and operational standards tighten, the need for reliable filter paper products continues to expand.

In the industrial sector, manufacturing processes in pharmaceuticals, biotechnology, and electronics depend on filter paper to ensure purity and product integrity. These industries require consistent, high‑performance materials capable of handling complex filtration tasks. As production volumes increase and processes become more sophisticated, demand grows for specialized filter paper grades that meet technical specifications and testing requirements.

Environmental and regulatory drivers also play a significant role. With an increasing number of air‑ and water‑quality monitoring programs, laboratories and agencies rely on filter paper for sampling, diagnostics, and data collection. As awareness of environmental issues grows and enforcement of monitoring intensifies, filters are needed in greater quantities to support ongoing testing efforts.

Advancements in material science and filter‑paper manufacturing are contributing to uptake. Improved pore‑size consistency, greater strength, better chemical resistance and compatibility with automated systems make newer filter papers more effective and versatile. As user’s upgrade equipment and processes, the need for modern filtration media continues to rise, supporting steady growth through 2035.

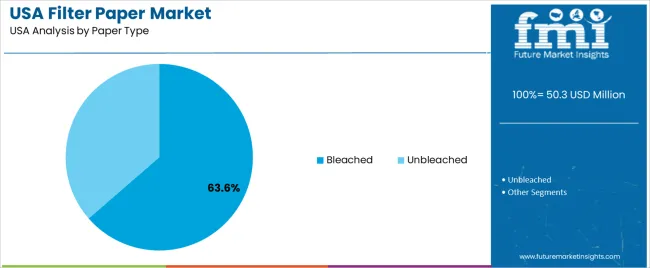

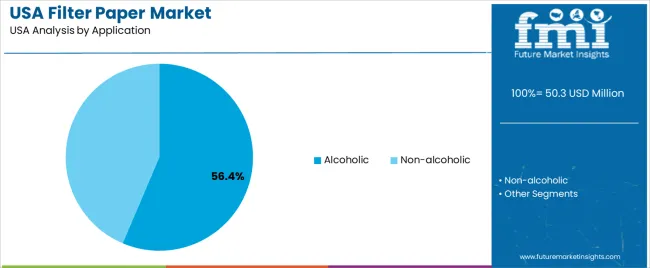

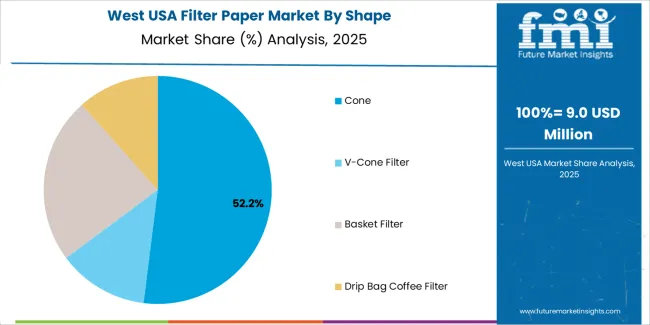

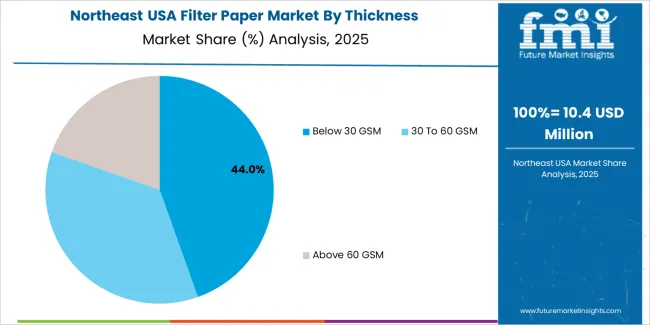

Demand for filter paper in the USA is segmented by paper type, application, shape, and thickness. By paper type, demand is divided into bleached and unbleached, with bleached holding the largest share at 63.6%. The demand is also segmented by application, including alcoholic and non-alcoholic, with alcoholic beverages leading the demand at 56%. In terms of shape, demand is divided into cone, V-cone filter, basket filter, and drip bag coffee filter. Regarding thickness, demand is divided into below 30 GSM, 30 to 60 GSM, and above 60 GSM. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Bleached filter paper accounts for 63.6% of the demand for filter paper in the USA. The bleaching process provides filter paper with superior purity and clarity, which is particularly important in applications where the quality of the final product is highly sensitive, such as in the production of alcoholic beverages and coffee. Bleached paper offers a clean, white appearance, which makes it ideal for use in filtering liquids, as it minimizes any potential contamination or discoloration of the product.

Bleached filter paper is more porous, allowing for better filtration efficiency, which enhances the overall quality of the filtration process. With industries such as food and beverage, pharmaceuticals, and laboratories demanding high-quality filtration solutions, bleached filter paper continues to dominate the industry due to its high performance, consistency, and ability to meet stringent industry standards.

Alcoholic beverages account for 56% of the demand for filter paper in the USA. The filtration process is essential in the production of alcoholic beverages like wine, beer, and spirits, where filter paper is used to remove impurities, clarify liquids, and enhance the final product’s taste and quality. In alcoholic beverage production, filter paper is used to separate solids such as yeast, grains, or fruit pulp, ensuring that the beverage remains clear and free of unwanted particles.

The growing popularity of craft beverages and the need for higher-quality filtration in the alcohol industry have driven the demand for filter paper in this sector. As consumer preferences continue to shift toward premium and artisanal alcoholic drinks, the demand for high-quality filtration solutions, including filter paper, will continue to grow, securing its leading position in the industry.

Key drivers include increasing use of filter paper in food & beverage (coffee, tea, juice) and laboratory/diagnostic applications, rising demand for high‑purity filtration in pharmaceuticals, growing resource efficiency focus prompting development of recyclable and biodegradable filter papers. Restraints include competition from alternative filtration technologies (membranes, synthetic filters), pressure on raw‑material costs (wood pulp, specialized fibres), and regulatory / certification hurdles for food‑contact or clinical‑grade filter papers.

Why is Demand for Filter Paper Growing in USA?

In USA, demand for filter paper is growing as industries such as beverage manufacturing, particularly coffee and specialty drinks, and laboratories require high-quality filtration papers to ensure clarity, taste, and analytical reliability. The expansion of the lab and pharmaceutical sectors is also boosting the demand for precision filter papers.

The trend toward resource efficiency is encouraging consumers and businesses to seek greener filter-paper options. As end-users become more focused on product purity, reliability, and eco-friendly materials, filter paper usage is increasing across both industrial and consumer-facing applications. This growing emphasis on environmental impact and quality control is further fueling the demand for advanced filter paper solutions.

How are Technological Innovations Driving Growth of Filter Paper in USA?

Technological innovations are advancing the demand for filter paper in USA by enhancing material performance and expanding its applications. Developments include more precise pore structures that improve filtration efficiency, as well as the introduction of biodegradable or plant-based fibers for eco-friendly alternatives. Coatings and treatments that enhance the durability and purity of filter papers are gaining traction, as are custom shapes and formats designed for specialized uses in beverages and laboratories.

These advancements make filter papers more effective, versatile, and aligned with resource efficiency goals, thus encouraging adoption across various industries. As the need for high-performance and eco-conscious products grows, the filter paper industry continues to evolve.

What are the Key Challenges Limiting Adoption of Filter Paper in USA?

Despite strong demand, several challenges limit the adoption of filter paper in USA. One primary issue is cost: premium or eco-friendly filter papers often come with higher prices than basic alternatives, which may deter cost-sensitive consumers. Another challenge is the competition from alternative filtration technologies, such as synthetic membranes, which can outperform traditional filter paper in certain applications.

Supply-chain constraints, including fluctuating costs and availability of raw materials like high-quality fibers, can also impact production. For applications in food and beverage industries, regulatory and food-safety certifications are required, which can slow the process of adoption due to time and cost factors.

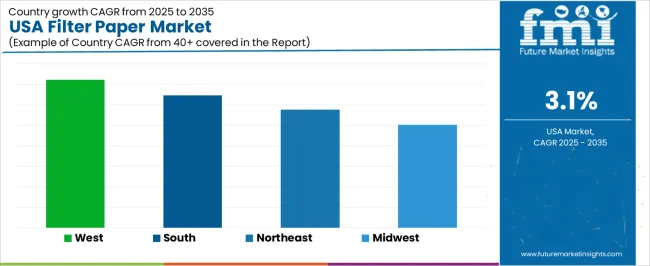

| Region | CAGR (%) |

|---|---|

| West | 3.6 |

| South | 3.2 |

| Northeast | 2.9 |

| Midwest | 2.5 |

Demand for filter paper in USA is growing across all regions, with the West leading at a 3.6% CAGR. This growth is driven by the region’s expanding industrial sectors and increasing use of filter paper in various applications such as laboratory testing, food processing, and pharmaceuticals. The South follows with a 3.2% CAGR, supported by the region’s robust manufacturing industry and growing need for filtration solutions in diverse sectors. The Northeast shows a 2.9% CAGR, with demand driven by its high concentration of research institutions and laboratories. The Midwest experiences moderate growth at 2.5%, with steady demand from industrial applications, including water treatment and manufacturing processes.

The West is experiencing the highest demand for filter paper in USA, with a 3.6% CAGR. This growth is primarily driven by the region’s expanding industrial sectors, particularly in areas like biotechnology, pharmaceuticals, and environmental testing. Cities like Los Angeles, San Francisco, and Seattle are hubs for these industries, where filter paper is increasingly used for a range of applications, from laboratory analysis to water filtration systems. As industrial processes grow more complex, the demand for high-quality, precise filtration solutions has risen.

The West's focus on research and development in environmental and scientific sectors contributes to the demand for filter paper. For example, water treatment facilities, pharmaceutical manufacturers, and food processing companies are increasingly adopting filter paper to meet quality and safety standards. With a strong emphasis on resource efficiency, the West is also driving the demand for eco-friendly filter papers, which align with broader trends toward environmentally conscious industrial practices. As the region continues to innovate in science, healthcare, and manufacturing, the need for filtration solutions like filter paper will remain strong.

The South is seeing strong demand for filter paper in USA, with a 3.2% CAGR. This growth is largely driven by the region’s diverse industrial landscape, which includes manufacturing, food processing, and agriculture. As industries in the South continue to grow and modernize, the need for filtration solutions has increased. Filter paper is widely used in these sectors for tasks such as product testing, quality control, and environmental monitoring. States like Texas, Georgia, and Florida are seeing increased investments in manufacturing and chemical processing, which in turn fuels the demand for filtration products.

The growing awareness of environmental concerns has led many businesses in the South to invest in cleaner, more efficient filtration systems, driving up demand for high-quality filter paper. The agricultural industry, a key driver in the South, also utilizes filter paper for various purposes, such as soil and water testing. As the South continues to expand its industrial base, the demand for filter paper is expected to remain robust, particularly in sectors that require rigorous quality control and compliance with environmental standards.

The Northeast is experiencing steady demand for filter paper in USA, with a 2.9% CAGR. This growth is driven by the region’s concentration of research institutions, universities, and healthcare facilities, which rely heavily on filter paper for laboratory work and various industrial applications. Cities like New York, Boston, and Philadelphia are centers for academic research, pharmaceuticals, and biotechnology, where filter paper plays an essential role in scientific testing, environmental analysis, and product development.

The Northeast’s well-established pharmaceutical and healthcare sectors further drive the demand for high-quality filter paper, particularly for clinical and laboratory use. The region’s focus on resource efficiency and environmental protection has increased the demand for eco-friendly and efficient filtration solutions. The rise in consumer and industrial awareness of environmental issues has led to greater adoption of filtration technologies that utilize biodegradable or recyclable filter paper. As these sectors continue to innovate and evolve, the demand for filter paper in the Northeast will remain strong, supported by ongoing advancements in research and development and environmental awareness.

The Midwest is experiencing moderate demand for filter paper in USA, with a 2.5% CAGR. The growth in this region is largely driven by its strong industrial base, particularly in sectors such as manufacturing, agriculture, and water treatment. The Midwest’s heavy reliance on industrial processes and agricultural operations has contributed to steady demand for filter paper for a variety of applications, including product filtration, water testing, and environmental monitoring. States like Illinois, Michigan, and Ohio are central to manufacturing industries where filter paper is essential for ensuring product purity and quality.

The demand for filter paper in the Midwest is also supported by the region’s expanding focus on environmental resource efficiency, with businesses increasingly looking for solutions that reduce waste and improve efficiency. The region’s commitment to improving water quality and addressing environmental concerns has led to greater use of filter paper in water treatment and filtration systems. As industries continue to grow and modernize, the demand for high-performance filter paper in the Midwest is expected to rise, though at a more moderate pace compared to other regions.

In the USA, demand for filter paper is driven by strong requirements in industries such as food & beverage, pharmaceuticals, chemical processing, and laboratory analytics. These filter papers are used for tasks like clarifying liquids, removing fine particulates, preparing samples, and supporting compliance with stringent quality standards. As advanced manufacturing, research activity, and regulatory demands grow, the role of high‑performance filter paper becomes increasingly important.

Key suppliers in this landscape include Ahlstrom‑Munksjö with a 45.5% share, Azumi Co Ltd, Hollingsworth & Vose, Thermo Fisher Scientific Inc., and Merck KGaA. These companies differentiate through their material science capabilities, multiple grades of pore size and filtration performance, global distribution networks and service to end‑users requiring validated processes. The dominance of Ahlstrom‑Munksjö reflects its scale and established infrastructure in the USA industry.

The competitive dynamics are influenced by several factors. First, innovation in performance such as higher retention, lower extractables, faster flow and chemical compatibility serves as a key differentiator. Second, regulatory obligations in sectors like pharma and food drive demand for certified papers, instrument compatibility and vendor reliability. Third, cost pressures and competition from alternative filtration technologies (e.g., membrane filters) represent ongoing challenges. Suppliers that combine technical excellence, supply‑chain responsiveness and cost‑effectiveness are best positioned to capture the growing demand for filter paper in the USA.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Shape | Cone, V-Cone Filter, Basket Filter, Drip Bag Coffee Filter |

| Thickness | Below 30 GSM, 30 To 60 GSM, Above 60 GSM |

| Paper Type | Bleached, Unbleached |

| Application | Alcoholic, Non-alcoholic |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Players Profiled | Ahlstrom-Munksjö, Azumi Co Ltd, Hollingsworth & Vose, Thermo Fisher Scientific Inc., Merck KGaA |

| Additional Attributes | Dollar sales are driven by paper types such as bleached and unbleached, with thicknesses ranging from below 30 GSM to above 60 GSM. The industry is segmented by applications in both alcoholic and non-alcoholic beverages. Regional trends reflect the strong demand across West, South, Northeast, and Midwest USA, particularly within the food and beverage sector. |

The demand for filter paper in usa is estimated to be valued at USD 50.3 million in 2025.

The market size for the filter paper in usa is projected to reach USD 68.3 million by 2035.

The demand for filter paper in usa is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in filter paper in usa are cone, v-cone filter, basket filter and drip bag coffee filter.

In terms of thickness, below 30 gsm segment is expected to command 45.2% share in the filter paper in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share Analysis for Filter Paper Companies

Filter Paper Market Trends – Growth, Demand & Forecast through 2035

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

USA Micro Flute Paper Market Report – Trends, Demand & Industry Outlook 2025-2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Demand for Filter Paper in Japan Size and Share Forecast Outlook 2025 to 2035

Automotive Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Global Laboratory Filter Paper Market Growth – Trends & Forecast 2024-2034

USA Flexible Laminated Paper Market Growth – Trends & Forecast 2024-2034

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Filter Bag Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA