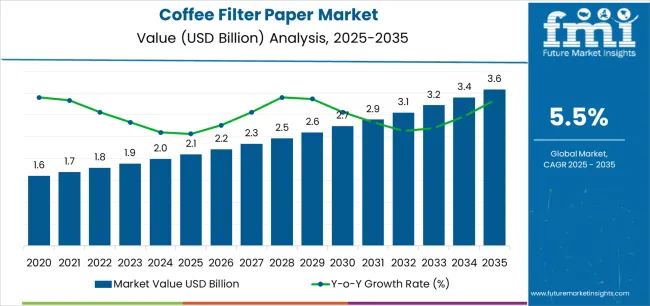

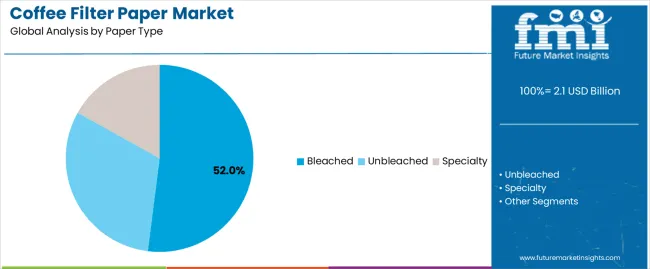

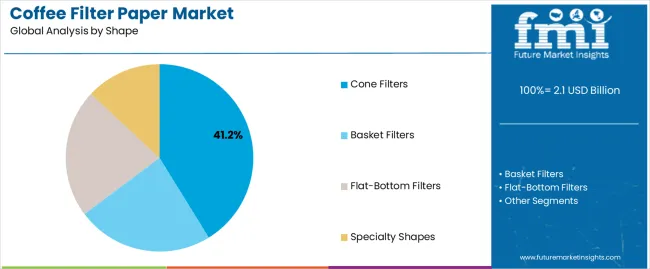

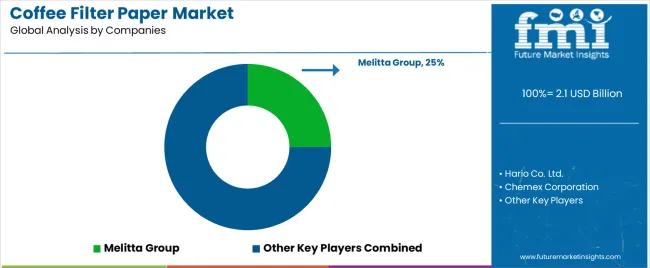

The coffee filter paper market is projected to grow from USD 2.1 billion in 2025 to USD 3.6 billion by 2035, registering a 5.5% CAGR as global coffee consumption rises and specialty brewing standards reshape filtration requirements across households, cafés, and food-service establishments. Bleached filter paper, holding 52% share, remains the dominant paper type due to superior taste neutrality, optimized pore structure, and consistent extraction clarity, while cone filters, at 41.2%, lead the shape segment as pour-over systems gain traction worldwide. Unbleached natural filters continue expanding as eco-certified options attract environmentally conscious buyers, and specialty filter formats strengthen premium adoption in third-wave cafés seeking precision extraction. Growth is reinforced by rising sales of premium home brewing equipment and commercial batch brewers that require consistent, high-flow-rate filtration media to maintain flavor standards.

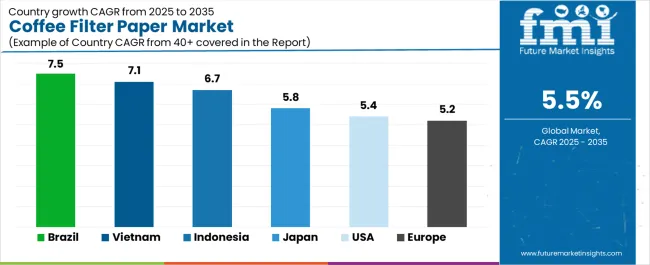

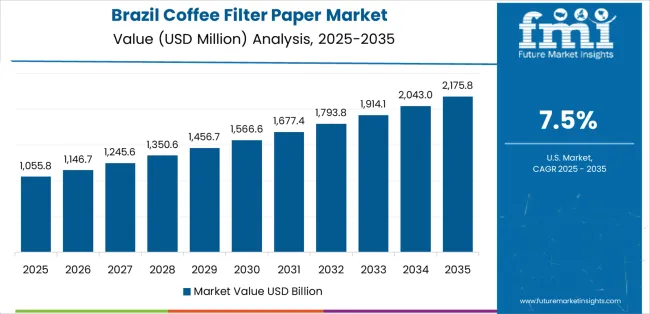

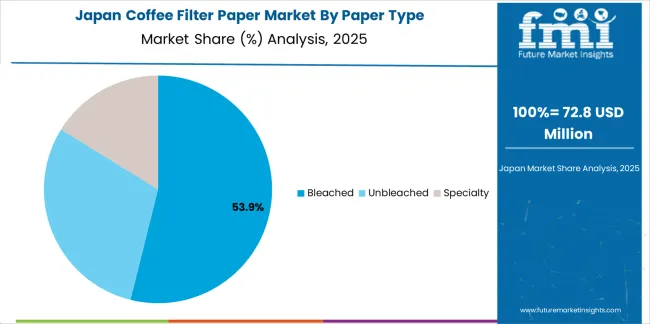

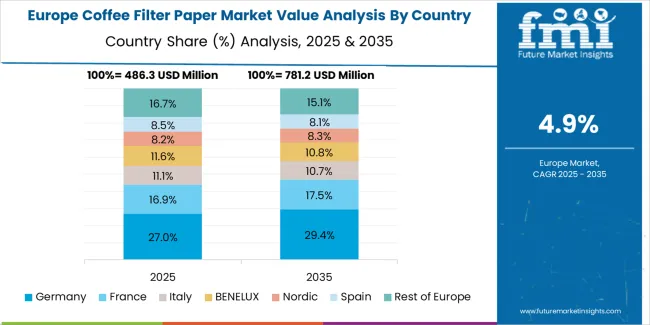

Regionally, Brazil (7.5% CAGR) and Vietnam (7.1% CAGR) drive the fastest expansion, propelled by deep coffee culture, café proliferation, and household brewing upgrades, while mature markets such as the United States (5.4%), Japan (5.8%), and major European countries show steady performance linked to established specialty coffee trends. Competitive intensity remains moderate, with leading companies, including Melitta Group, Hario Co. Ltd., Chemex Corporation, Filtropa, Rockline Industries, Ahlstrom-Munksjö, and Purico Group, focusing on filtration precision, sustainability certifications, flow-rate engineering, and equipment-compatible filter geometries to strengthen global market positioning.

A core dynamic driving the market is the rapid expansion of specialty coffee consumption. Pour-over brewing methods such as V60, Chemex, Kalita Wave, Melitta cone, and batch drip systems rely heavily on precision-engineered filter papers that support controlled extraction and consistent cup quality. Specialty roasters, cafés, and coffee chains increasingly specify filter types based on porosity, texture, grammage, and flow behavior to support flavor clarity, aroma retention, and sediment removal. As consumers become more educated about brewing techniques, demand for premium filters designed for particular roast profiles and equipment types continues to increase.

Product innovation continues to shape competitive dynamics. Manufacturers are developing filter papers with improved wet strength, tighter pore structures, enhanced fiber purity, and optimized texture for controlled saturation. Crepe patterns, thickness variations, and multi-layer paper constructions are engineered to influence drip speed and extraction time, making them essential tools for specialty brewing. Natural fiber filters with minimal processing are gaining attention among consumers seeking clean flavor profiles without chemical processing residues.

Regulatory and quality standards also influence product demand. Food-contact compliance, flavor neutrality, absence of chemical odors, and resistance to tearing under high water exposure are essential attributes for manufacturers. As roasters and cafés standardize quality controls, the need for highly consistent, lab-tested filter papers increases.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Bleached filter paper (white) | 48% | Premium quality, taste-neutral brewing |

| Unbleached filter paper (natural) | 32% | Eco-conscious consumers, organic segment | |

| Specialty filter paper (pour-over, cone) | 12% | Specialty coffee shops, enthusiasts | |

| Basket filters (standard drip) | 8% | Traditional drip coffee makers | |

| Future (3-5 yrs) | Premium specialty filters | 35-40% | Third-wave coffee movement, artisan brewing |

| Bleached high-performance paper | 30-35% | Advanced filtration, clarity optimization | |

| Unbleached eco-friendly options | 15-20% | Environmental consciousness, certification | |

| Custom-branded filters | 8-12% | Coffee shop chains, brand differentiation | |

| Subscription & convenience packs | 5-8% | Direct-to-consumer, e-commerce growth |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.1 billion |

| Market Forecast (2035) | USD 3.6 billion |

| Growth Rate | 5.5% CAGR |

| Leading Technology | Bleached Filter Paper |

| Primary Application | Household Brewing Segment |

The market demonstrates strong fundamentals with bleached filter paper systems capturing a dominant share through advanced filtration capabilities and coffee brewing optimization. Household brewing applications drive primary demand, supported by increasing coffee consumption and premium brewing equipment adoption requirements. Geographic expansion remains concentrated in developed markets with established coffee cultures, while emerging economies show accelerating adoption rates driven by coffee shop proliferation and rising quality standards.

Primary Classification: The market segments by paper type into bleached filter paper, unbleached filter paper, and specialty filter paper, representing the evolution from basic filtration materials to sophisticated brewing solutions for comprehensive coffee quality optimization.

Secondary Classification: Shape segmentation divides the market into cone filters, basket filters, flat-bottom filters, and specialty shapes, reflecting distinct requirements for brewing methods, coffee maker compatibility, and extraction optimization standards.

Tertiary Classification: Application segmentation covers household brewing, commercial coffee shops, office spaces, hospitality sector, and food service establishments, while material source spans virgin pulp, recycled fiber, and bamboo fiber categories.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by coffee culture expansion programs.

The segmentation structure reveals technology progression from standard filtration materials toward sophisticated brewing systems with enhanced purity and extraction capabilities, while application diversity spans from household coffee brewing to commercial coffee shop operations requiring precise filtration solutions.

Market Position: Bleached Filter Paper systems command the leading position in the coffee filter paper market with 52% market share through advanced filtration features, including superior taste neutrality, extraction efficiency, and coffee brewing optimization that enable coffee establishments to achieve optimal flavor clarity across diverse brewing and preparation environments.

Value Drivers: The segment benefits from coffee shop preference for reliable filtration systems that provide consistent brewing performance, enhanced flavor clarity, and quality optimization without introducing paper taste or affecting extraction characteristics. Advanced paper processing enables taste-neutral filtration, visual appeal, and integration with existing coffee equipment, where brewing performance and flavor consistency represent critical operational requirements.

Competitive Advantages: Bleached Filter Paper systems differentiate through proven brewing reliability, consistent filtration characteristics, and integration with premium coffee systems that enhance beverage quality while maintaining optimal extraction standards suitable for diverse specialty and commercial applications.

Key market characteristics:

Unbleached Filter Paper systems maintain a 33% market position in the coffee filter paper market due to their environmental appeal and natural processing advantages. These systems appeal to establishments requiring eco-friendly brewing materials with competitive pricing for environmentally-conscious coffee applications. Market growth is driven by consumer preference, emphasizing natural filtration solutions and environmental responsibility through optimized paper production.

Specialty Filter Paper systems capture 15% market share through specialized brewing requirements in third-wave coffee shops, pour-over applications, and artisan brewing operations. These establishments demand precision filtration systems capable of handling diverse brewing methods while providing exceptional extraction capabilities and brewing optimization.

Market Context: Cone Filter shapes demonstrate the 41.2% market share in the coffee filter paper due to widespread adoption of pour-over brewing systems and increasing focus on specialty coffee preparation, extraction optimization, and artisan brewing applications that maximize flavor extraction while maintaining clarity standards.

Appeal Factors: Cone filter operators prioritize extraction efficiency, brewing control, and integration with specialty coffee equipment that enables optimized brewing operations across multiple preparation methods. The segment benefits from substantial specialty coffee investment and third-wave coffee movement programs that emphasize the acquisition of cone filters for brewing optimization and flavor enhancement applications.

Growth Drivers: Specialty coffee expansion programs incorporate cone filters as standard equipment for pour-over operations, while coffee shop growth increases demand for precision brewing capabilities that comply with quality standards and minimize extraction complexity.

Market Challenges: Varying brewing methods and equipment compatibility may limit filter standardization across different coffee shops or brewing scenarios.

Application dynamics include:

Basket Filter applications capture market share through traditional brewing requirements in drip coffee makers, automatic brewing systems, and standard coffee preparation. These applications demand reliable filtration systems capable of operating with conventional equipment while providing effective brewing access and operational simplicity capabilities.

Flat-Bottom Filter applications account for market share, including commercial coffee operations, batch brewing systems, and high-volume preparation requiring consistent extraction capabilities for operational optimization and brewing efficiency.

Market Position: Household Brewing applications command significant market position with 6.2% CAGR through growing coffee consumption trends and home brewing equipment adoption for daily coffee preparation.

Value Drivers: This application segment provides the ideal combination of convenience and quality control, meeting requirements for personal coffee preferences, brewing flexibility, and home preparation without reliance on commercial establishments.

Growth Characteristics: The segment benefits from broad applicability across consumer demographics, premium coffee maker adoption, and established brewing programs that support widespread filter usage and operational convenience.

Market Context: Commercial Coffee Shops dominate the market with 6.8% CAGR, reflecting the primary demand source for coffee filter paper in beverage service and specialty coffee operations.

Business Model Advantages: Coffee shops provide direct market demand for premium filtration materials, driving quality standards and brewing innovation while maintaining taste consistency and customer satisfaction requirements.

Operational Benefits: Commercial applications include specialty brewing, quality assurance, and customer experience enhancement that drive consistent demand for filter paper while providing access to latest brewing technologies.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Specialty coffee movement & third-wave culture (artisan brewing, single-origin emphasis) | ★★★★★ | Premium brewing methods require high-quality filters with precise extraction; consumer willingness to pay for quality drives market value growth. |

| Driver | Growing home brewing adoption & premium coffee maker sales | ★★★★★ | COVID-19 accelerated home coffee preparation; quality-conscious consumers investing in equipment and premium filter papers for café-quality results at home. |

| Driver | Coffee shop proliferation & café culture expansion (emerging markets) | ★★★★☆ | Rapid growth of coffee shops in Asia-Pacific and Latin America; increased commercial demand for filter papers driving volume expansion. |

| Restraint | Competition from permanent metal filters & reusable alternatives | ★★★★☆ | Environmental concerns and convenience of reusable filters create substitution threat; reduces repeat purchase frequency for eco-conscious consumers. |

| Restraint | Price sensitivity in price-conscious markets & commodity nature of basic filters | ★★★☆☆ | Basic filter papers face commoditization pressure; limited differentiation in standard products constrains premium pricing opportunities. |

| Trend | Eco-friendly materials & biodegradable innovations (bamboo fiber, compostable options) | ★★★★★ | Environmental consciousness reshaping product development; chlorine-free bleaching and compostable certifications become competitive differentiators. |

| Trend | Direct-to-consumer subscription models & e-commerce convenience | ★★★★☆ | Subscription services for filter paper delivery; predictable revenue streams and customer loyalty through convenience-based business models. |

The coffee filter paper market demonstrates varied regional dynamics with Growth Leaders including Brazil (7.5% growth rate) and Vietnam (7.1% growth rate) driving expansion through coffee production heritage and consumption growth initiatives. Steady Performers encompass United States (5.4% growth rate), Japan (5.8% growth rate), and developed regions, benefiting from established coffee cultures and premium brewing adoption. Emerging Markets feature Indonesia (6.7% growth rate) and developing regions, where coffee shop expansion and brewing modernization support consistent growth patterns.

Regional synthesis reveals North American markets leading value generation through premium product adoption and specialty coffee culture, while Asian markets demonstrate highest volume growth supported by coffee shop proliferation and rising consumption trends. European markets show moderate growth driven by traditional coffee applications and quality enhancement integration.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| Brazil | 7.5% | Leverage local coffee culture; cost-effective premium filters | Currency volatility; price competition |

| Vietnam | 7.1% | Focus on café expansion; scalable products | Traditional brewing preferences; market education |

| United States | 5.4% | Premium specialty filters; subscription models | Reusable filter competition; market saturation |

| Japan | 5.8% | Precision engineering; pour-over excellence | Aging demographics; product perfectionism |

| Indonesia | 6.7% | Coffee shop growth; affordable quality | Infrastructure challenges; distribution complexity |

| Europe | 5.2% | Eco-friendly innovation; quality standards | Environmental regulations; diverse preferences |

Brazil establishes fastest market growth through deep coffee heritage and comprehensive coffee culture development, integrating advanced coffee filter paper as standard components in café operations and household brewing installations. The country's 7.5% growth rate reflects cultural affinity for coffee consumption and domestic coffee industry strength that mandates the use of quality filtration systems in commercial and residential facilities. Growth concentrates in major urban centers, including São Paulo, Rio de Janeiro, and Belo Horizonte, where coffee shop expansion showcases integrated filtration systems that appeal to coffee establishments seeking advanced brewing optimization capabilities and quality management applications.

Brazilian manufacturers are developing locally-produced filter solutions that combine domestic production advantages with quality operational features, including consistent extraction properties and enhanced brewing capabilities. Distribution channels through coffee equipment suppliers and supermarket distributors expand market access, while cultural coffee traditions support adoption across diverse commercial and household segments.

Strategic Market Indicators:

In Ho Chi Minh City, Hanoi, and Da Nang, coffee shops and beverage establishments are implementing coffee filter paper as standard equipment for brewing quality and customer satisfaction applications, driven by increasing coffee shop investment and consumption modernization programs that emphasize the importance of filtration quality. The market holds a 7.1% growth rate, supported by coffee culture expansion and urbanization programs that promote quality filter systems for commercial and household applications. Vietnamese operators are adopting filter solutions that provide consistent brewing performance and taste quality features, particularly appealing in urban regions where coffee quality and café experience represent critical consumer expectations.

Market expansion benefits from growing coffee consumption patterns and café proliferation that enable widespread adoption of quality filtration systems for commercial and residential applications. Technology adoption follows patterns established in food service equipment, where quality and value drive procurement decisions and operational deployment.

Market Intelligence Brief:

United States establishes market leadership through comprehensive specialty coffee programs and advanced coffee culture development, integrating coffee filter paper across commercial and household applications. The country's 5.4% growth rate reflects established coffee consumption patterns and mature brewing technology adoption that supports widespread use of premium filtration systems in coffee shops and home brewing facilities. Growth concentrates in major metropolitan areas, including Seattle, Portland, and San Francisco, where specialty coffee culture showcases mature filter deployment that appeals to coffee operators seeking proven brewing quality capabilities and extraction optimization applications.

American coffee establishments leverage established distribution networks and comprehensive product availability, including specialty filters and subscription services that create customer relationships and operational advantages. The market benefits from mature coffee culture and consumer willingness to invest in quality brewing materials that enhance coffee experience and flavor optimization.

Market Intelligence Brief:

Japan's advanced coffee culture market demonstrates sophisticated coffee filter paper deployment with documented brewing effectiveness in specialty coffee applications and household brewing facilities through integration with existing brewing systems and quality equipment infrastructure. The country leverages precision manufacturing expertise in paper technology and filtration systems integration to maintain a 5.8% growth rate. Urban centers, including Tokyo, Osaka, and Kyoto, showcase premium installations where filter papers integrate with comprehensive brewing platforms and quality management systems to optimize extraction operations and taste effectiveness.

Japanese manufacturers prioritize paper quality and brewing precision in filter development, creating demand for premium products with advanced features, including uniform thickness and optimized flow rates. The market benefits from established coffee appreciation culture and a willingness to invest in premium brewing materials that provide superior extraction benefits and compliance with quality standards.

Market Intelligence Brief:

Indonesia's market expansion benefits from diverse coffee demand, including café expansion in Jakarta and Surabaya, beverage establishment growth, and rising coffee consumption that increasingly incorporate filtration solutions for brewing quality applications. The country maintains a 6.7% growth rate, driven by urbanization and increasing recognition of filter paper benefits, including improved taste clarity and enhanced brewing consistency.

Market dynamics focus on affordable quality filter solutions that balance brewing performance with affordability considerations important to Indonesian coffee operators. Growing coffee shop proliferation creates continued demand for modern filtration systems in new establishment infrastructure and beverage service modernization projects.

Strategic Market Considerations:

The European coffee filter paper market is projected to grow from USD 0.7 billion in 2025 to USD 1.2 billion by 2035, registering a CAGR of 5.2% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, supported by its strong coffee culture and premium brewing equipment adoption.

United Kingdom follows with a 24.6% share in 2025, driven by specialty coffee shop expansion and home brewing trends. France holds a 19.8% share through traditional café culture and quality coffee applications. Italy commands a 13.2% share, while Spain accounts for 10.0% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.8% to 6.2% by 2035, attributed to increasing coffee consumption in Nordic countries and emerging café establishments implementing quality brewing programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global brands | Distribution reach, brand recognition, retail partnerships | Broad availability, consistent quality, consumer trust | Innovation speed; specialty segment responsiveness |

| Specialty innovators | Premium materials; eco-friendly solutions; artisan brewing focus | Quality leadership; third-wave alignment; premium positioning | Mass market penetration; price competition |

| Regional specialists | Local production, distribution networks, competitive pricing | Market proximity; cultural understanding; cost advantage | Technology gaps; international expansion |

| Private label players | Retailer partnerships, value positioning, volume production | Price competitiveness; shelf space access; volume scale | Brand loyalty; premium segment access |

| Niche artisan brands | Specialty coffee shops, custom solutions, branded filters | Coffee shop partnerships; differentiation; quality perception | Scalability limitations; distribution challenges |

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 billion |

| Paper Type | Bleached, Unbleached, Specialty |

| Shape | Cone Filters, Basket Filters, Flat-Bottom Filters, Specialty Shapes |

| Material Source | Virgin Pulp, Recycled Fiber, Bamboo Fiber |

| Application | Household Brewing, Commercial Coffee Shops, Office Spaces, Hospitality Sector, Food Service |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Brazil, Germany, Japan, United Kingdom, Vietnam, Canada, Indonesia, France, Australia, and 25+ additional countries |

| Key Companies Profiled | Good Ideas Inc., Gardener's Supply Company, Algreen Products, Enviro World Corporation, FCMP Outdoor, RTS Companies, Achla Designs, Exaco Trading Company, Rescue Brand, Koolatron Corporation |

| Additional Attributes | Dollar sales by paper type and shape categories, regional adoption trends across North America, East Asia, and Western Europe, competitive landscape with paper manufacturers and coffee equipment suppliers, consumer preferences for brewing quality and taste clarity, integration with coffee brewing systems and extraction optimization, innovations in filtration technology and material enhancement, and development of eco-friendly filter solutions with enhanced performance and brewing optimization capabilities. |

The global coffee filter paper market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the coffee filter paper market is projected to reach USD 3.6 billion by 2035.

The coffee filter paper market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in coffee filter paper market are bleached, unbleached and specialty.

In terms of shape, cone filters segment to command 41.2% share in the coffee filter paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Coffee Filter Paper Manufacturers

Industry Share Analysis for Filter Paper Companies

Filter Paper Market Trends – Growth, Demand & Forecast through 2035

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Demand for Filter Paper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Filter Paper in Japan Size and Share Forecast Outlook 2025 to 2035

Automotive Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Global Laboratory Filter Paper Market Growth – Trends & Forecast 2024-2034

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Filter Bag Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA