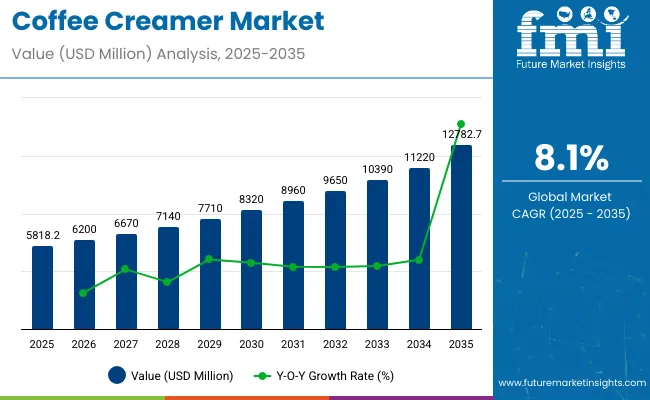

The global coffee creamer market is projected to grow from USD 5,818.2 million in 2025 to USD 12,782.7 million by 2035, expanding at 8.1% CAGR.

Factors such as changing consumer preferences and growing demand toward plant-based and lactose-free alternatives, along with the ongoing expansion of premium and flavored creamers are dramatically altering the coffee creamer market. Plant-based creamers derived from almonds, oats, soy and coconut have gained popularity as more consumers reject dairy products for dietary restrictions, vegan lifestyles or perceived health benefits.

Top brands including Nestlé (Coffee-Mate), Danone (International Delight), Califia Farms and Nutpods are meeting that demand with all sorts of inventive options - everything from functional creamers that include extra proteins or MCT oils to seasonal and indulgent flavors like peppermint mocha or brown sugar cinnamon.

The on-the-Go culture is also impacting the creamers market, as single-serve packaging and ready-to-drink (RTD) coffee beverages featuring creamers drive the expansion of product innovation. Health-oriented consumers are likewise driving the market toward natural ingredients, low-sugar items and clean-label goods.

Furthermore, the increasing café culture across developing regions and premiumization trends are creating demand for artisanal and gourmet creamers. Brands are investing in sustainability, including environmental-friendly packaging and sustainable sourcing that appeals to green-conscious buyers.

Overall, flavour diversity, functional benefits, the convenience of the product, and evolving health trends are truly enhancing the coffee creamer market worldwide.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 5,818.2 million |

| Projected Value (2035F) | USD 12,782.7 million |

| Value-based CAGR (2025 to 2035) | 8.1% |

As dietary trends and lifestyle choices evolve, the way consumers interact with coffee enhancers is changing. Creamers and creamers - plant-based and keto-friendly - are expected to take up shelf space in years ahead, especially those from companies like Laird Superfood, Elmhurst and Ripple Foods. Moreover, sustainable innovation - from recyclable pods to minimal processing - has become critical in product development, with brands increasingly touting organic certifications and transparency in their sourcing practices.

Spending on coffee creamers varies widely across regions, influenced by coffee drinking habits, income levels, and product availability. North America, led by the United States, shows the highest per capita spending due to a strong culture of flavored and specialty creamers. Europe follows with moderate spending, supported by traditional coffee preferences and growing demand for plant-based options. Emerging markets in Asia-Pacific and the Middle East have lower per capita spending but are witnessing rapid growth as coffee culture expands and consumers seek convenience.

The global trade of coffee creamers is expanding steadily as demand rises in both mature and emerging markets. Exporters benefit from well-established manufacturing hubs in regions like North America, Europe, and Asia, which produce a wide range of dairy and non-dairy creamers catering to diverse consumer preferences. Importers are often countries with growing coffee cultures and limited domestic production capabilities.

The following table hill for the global coffee creamer industry comparative analysis of the change in CAGR for 6 months for the base year (2024) and current year (2025). Such insights highlight key performance shifts and shed light on revenue realization patterns, thereby equipping all stakeholders with a clearer vision of the growth landscape throughout the year ahead.H1, or the first half of the year, runs from January to June. The next six months are known as H2 (from July to December).

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.6% |

| H2 (2024 to 2034) | 7.9% |

| H1 (2025 to 2035) | 8.0% |

| H2 (2025 to 2035) | 8.1% |

During the first half (H1) of the 2025 to 2035 decade, the market is expected to grow at a CAGR of 8.0%, while the second half (H2) of the decade will see a 3 basis points of points higher, on an annualized basis, increase of 8.1%. Going into H1 2025 to H2 2035 the CAGR is forecasted to be strong. Leading indicator, however, grew by 40 BPS in first half (H1) and the business continues its stable growth of 20 BPS in the second half (H2).

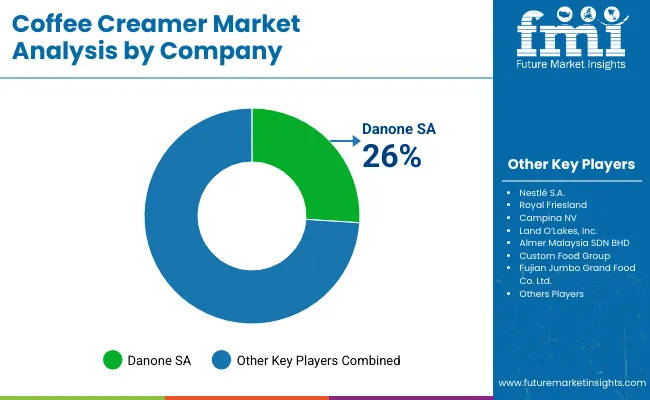

There are tier 1 companies, which form a competitive set in terms of revenue, dominance and broad market coverage. These companies have strong brand equity, hoist significant amounts of research and development (R&D) spending, and which puts quite a lot of their budget towards discovering new products and getting them out into the world.

The segment is dominated by Nestlé S.A. (its flagship brand is Coffee-Mate)-it has a very broad portfolio of flavored and functional creamers, including sugar-free and plant-based creamers. Danone S.A. (under the name International Delight) is another major player, specializing in its rich-flavored creamers and a broad presence across North America.

Other notable Tier 1 brands are Unilever (Breyers and Lipton creamers) and Friesl and Campina(Debic), courtesy of significant global market coverage, product breadth, and strong brands in the global dairy and non-dairy creamer space. These companies thrive on mass distribution via their retail, foodservice, and ecommerce arms and often help dictate industry trends.

Tier 2 comprises brands that may be lower in revenue than Tier 1 leaders but are still recognized as a leader in their niche or region. A notable Tier 2 player is Califia Farms, which offers upscale, plant-based creamers based on almond, oat and coconut milks that target health-conscious consumers with clean labels and fashionable packaging.

Nutpods, another upstart, offers dairy-free, unsweetened creamers that have gained loyal fans among keto and paleo diet devotees. These companies often compete on unique flavor profiles, clean ingredients, sustainability claims and direct-to-consumer strategies. Their pivoting capabilities and innovation abilities in the plant-based and health-centric trends will give them a competitive edge in fast-growing market segments.

Tier 3 includes new entrants and smaller scale companies quickly building market share in certain segments of the coffee creamer market. A popular a one for our products was Laird Superfood, which has found success with its functional creamers with MCT oil and adaptogens targeting both the performance-driven consumer and wellness-seeking citizen.

Brands in the same tier often turn to online channels, influencer marketing, and specialty retailers to get in front of their audience. These firms are mostly agile, digitally native and use sustainability and lifestyle branding to strike a chord with Gen Z and millennial consumers. Despite being much smaller than the major players, their innovation and direct interaction with customers allow them to grow rapidly and maintain competition.

Shift: Health-conscious consumers are seeking sugar-free, dairy-free, keto-friendly and plant-based coffee creamers. Demand for vegan offerings, awareness of lactose intolerance and preference for clean-label ingredients in regions including the USA, Canada and Germany have pushed brands to reformulate offerings. Functional creamers featuring MCT oil, collagen, probiotics and adaptogens are on the rise, especially among millennials and wellness-oriented consumers.

Strategic Response: Nestlé introduced a series of Natural Bliss oat and almond milk-based creamers free of artificial flavors, which helped boost North American sales of plant-based products by 9 percent. Danone reformulated its Silk creamers to add MCT oil and adaptogens to target keto and brain-health consumers. In the USA, Califia Farms launched Zero Sugar almond and coconut blend creamers (12% growth segments of USA healthy population). At the same time, Nutpods grew its Whole30-approved creamer line into European territories, creating a 7% increase in first-time buyers.

Shift: Consumers are leaning towards RTD coffee drinks pre-mixed with creamers, preferring to grab-it-and-go. Consumption of café-style RTD lattes, mochas, and cold brews containing integrated dairy or plant-based creamers has skyrocketed in both the USA, UK, and Japanese markets.

Strategic Response: Nestlé responded with a series of newer indulgent flavors such as Creamy Vanilla and Caramel Macchiato under its Starbucks RTD line that contributed to a 6.5% sales rise in USA and UK stores. Chobani introduced high-protein cold brews mixed with oat- and dairy-based creamers, and increased penetration among younger demographics.

Danone’s International Delight Iced Coffee [IDIC] saw 8% YoY growth, helped by the launch of seasonal RTD variants. Examples of brands which have launched into the RTD shelf-stable segment include Califia Farms, which launched with their almond-based lattes, accounting for a 10% growth in on-the-go consumption in urban locations.

Shift: Gen Z and millennials want fun, functional coffee experiences that are Instagrammable with unique flavor infusion, platforms like Plant-based, and creamers that are customizable to their tastes. Bright packaging, seasonal SKUs and digital engagement are the secret to capturing this audience.

Strategic Response: IDE launched Grinch themed and Peeps inspired seasonal creamers that were 20% up in Gen Z sales. Its Coffee Mate brand partnered with Pop-Tarts and Cinnamon Toast Crunch for limited-edition launches that drove a 15% increase in social media-driven purchases. Nutpods released flavor drops for custom at-home flavoring, supported by a TikTok campaign that drove a 38% increase in brand mentions. Both Califia Farms and Oatly created digital-first campaigns for eco-conscious Gen Z consumers that led to increased online engagement and subscription rates.

Shift: Once a much maligned category of the product mix, coffee creamers are gaining popularity in legacy grocery channels and at cafés. Consumers demand omnichannel availability for their favorite brandsIn-store, online and in local cafés

Strategic Response: Nestlé ramped up distribution via Kroger, Whole Foods, and Target, resulting in a 9% gain in refrigerated creamer shelf presence. Starbucks introduced in-store plant-based creamer varieties, offering oat and almond-based creamers in 70% of USA stores. So when Danone partnered with independent cafés to explore limited-edition Silk creamers, café orders spiked by 11%. In Europe, meanwhile, international brands such as Alpro entered café chains, amplifying both consumer awareness and in-store sales] simultaneously.

Shift: More than 60% of coffee creamer consumers in Europe and the UK opt for sustainably sourced and ethically packaged items. Health, carbon footprints, dairy production and packaging waste have put pressure on brands to innovate with eco-conscious alternatives.

Strategic Response: Califia Farms launched 100% recycled PET bottles for its creamer line, yielding a 13% purchase lift among eco-conscious shoppers. Danone’s Silk brand pledged to achieve carbon neutrality throughout its plant-based creamer production plants in accordance with EU Green Deal targets. Nestlé’s Natural Bliss introduced a fair-trade certified creamer made with ingredients from regenerative agriculture projects, resulting in an 8% boost to consumer trust and brand loyalty. Oatly unveiled paper-based cartons for its creamer line in Scandinavia, cutting plastic use by 40%.

Shift: With inflation affecting shoppers’ decisions, affordability in the premium creamer space is key. Even with a mitigating interest towards functional and plant-based intervention, price continues to be a significant barrier especially within emerging markets.

Strategic Response: Nestlé launched a low-budget Coffee Mate for value packs, increasing sales by 14% in price-sensitive regions. Danone introduced Silk creamer concentrates for bulk use; saving the consumer 20% price per serving. Trader Joe’s, Aldi and other private-label players also introduced competitively priced almond- and coconut-based creamers that took hold of middle-income consumers, driving an 11 percent shift during the period away from premium brands in certain parts of the country.

Shift: DTC models and grocery delivery platforms are revolutionising the way that creamers are bought and consumed, especially through the COVID-19 pandemic and post-COVID-19 outbreak. ED: Growth of subscription services and online-only SKUs

Strategic Response: E-commerce subscriptions for Nutpods and Laird Superfood increased 30% year-on-year in 2024, thanks to bundled offers and flavor variety packs. Califia Farms and International Delight joined forces with Instacart and Amazon Fresh to deliver the next day, driving 18% growth in digital grocery sales. Nestlé's DTC subscription / Creamer Club launched and drove 22% retention over 6 months.

Shift: Creamers come in a wider range than ever, and taste preferences and dietary patterns vary by global region-both the lattes and the milks in them are typically more dairy-based in the USA and more plant-based in Western Europe. Lactose-free and sweetened condensed-style creamers in demand in Asia-Pacific region

Response: Long Term: You are a Changemaker, Strategic Response: Customize- Nestlé catered to Southeast Asia’s local coffee culture and launched sweetened coconut-based creamers, capturing 9% market share. Danone debuted mildly sweet, soy-creamer products in China and Japan, matching regional palate.[/related] Oatly tapped into increasing veganism in the UK by expanding oat-based creamer SKUs there, resulting in a 17% year-over-year sales increase. In parallel, Indian startup Epigamia also jumped into the creamer space with low-lactose dairy creamers and joined forces with a few urban cafés.

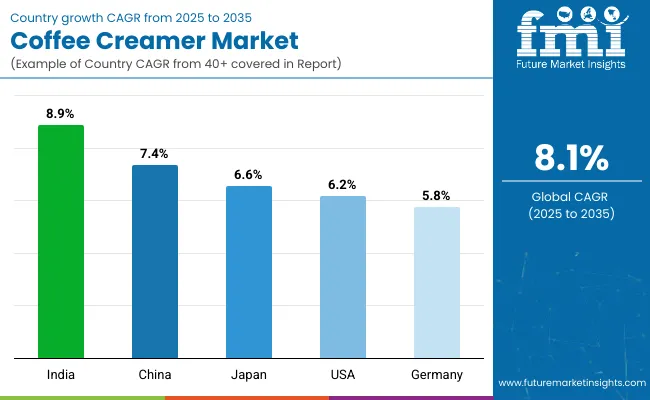

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 6.2% |

| Germany | 5.8% |

| China | 7.4% |

| Japan | 6.6% |

| India | 8.9% |

Demand for sugar-free, dairy-free and organic coffee creamers among health-conscious American consumers is giving the market a boost. Brands are quickly reformulating to include natural sweeteners, MCT oil, oat milk and almond milk, appealing to keto, vegan and paleo lifestyles.

The increasing demand for clean-label, functional creamers, which are infused with collagen, probiotics or adaptogens, is driving innovation. Niche creamers are exploding via e-commerce and DTC subscriptions. Consumer loyalty is influenced by the amount of regulatory transparency within the country as well as their sustainability efforts, including carbon-neutral production and recyclable packaging.

Consumers in Germany are increasingly gravitating to oat, soy and almond plant-based creamers, as the country’s strong organic food culture and awareness of lactose intolerance drives the trend. There is a rapidly growing demand for EU-certified organic and clean-label creamers in the natural foods and bio-supermarket area.

Top brands are leveraging sustainable farming, eco-packaging and reduced sugar formulations to appeal to the environmentally and health conscious consumers. Another supportive trend has been the rise of flexitarianism and coffee shop culture

With the growing urban population of China, increasing per capita disposable income is transforming the preference to premium coffee culture, which, in turn, is expected to drive demand for ready-to-drink coffee with value-added creamers. The sale of non-dairy soy-based cream has significantly increased due to the growing population's lactose intolerance.

Functional creamers - those that promise immunity-boosting, anti-fatigue and stoking-of-the-halo effects - are on the rise. E-commerce platforms such as JD. Results for Taobao and Tmall are critical for distribution, as it makes searching for trusted brands with safety certifications and traceable ingredients consumers’ most popular choice.

India’s fast-evolving coffee culture spurred on by its fair share of cafes, QSRs and younger consumers is generating huge interest in non-dairy coffee creamers particularly coconut, oat and almond variants. The younger consumers opt for flavored, functional, and portable creamers that tend to be used in cold coffee and instant mixes.

Online commerce and modern retail formats like BigBasket and Nature’s Basket are driving the adoption of premium and imported creamer brands. Moreover, increasing health consciousness is driving demand for clean-label, sugar-free, and fortified creamers, especially in tier I cities.

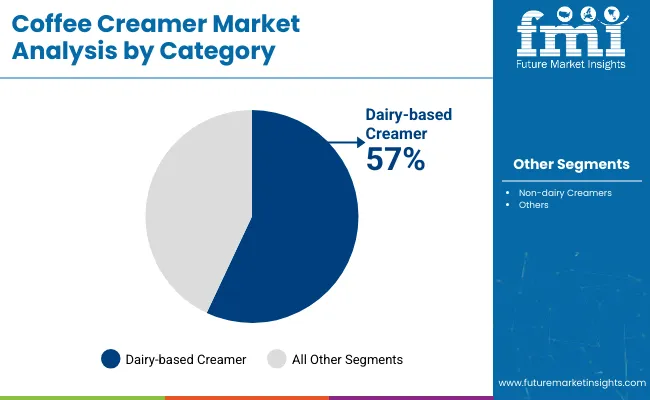

| Segment | Value Share (2025) |

|---|---|

| Dairy-based Creamer (By Category) | 57% |

Creamers based on dairy, on the other hand, retain a large part of the worldwide market share due to their creamy texture, original flavor, and long-time acceptance in traditional coffee cultures. Milk and its derivatives are the source for these creamers, giving them a more intensely creamy mouthfeel and smooth body - often the preference of traditional coffee drinkers.

Some major players such as Nestlé and Land O’Lakes have taken advantage of the higher added value of such products and have provided several codes (liquid, powdered or concentrated) in retail and HoReCa channel. The dairy industry is well established in most North America and Europe with a legacy of consumer loyalty towards dairy based products driven by familiarity, indulgence, and perception of premium quality. Moreover, novel developments like dairy-based products that are lactose-free and low-fat variants are helping this segment adjust to changing health trends, while still remaining relevant to its core market.

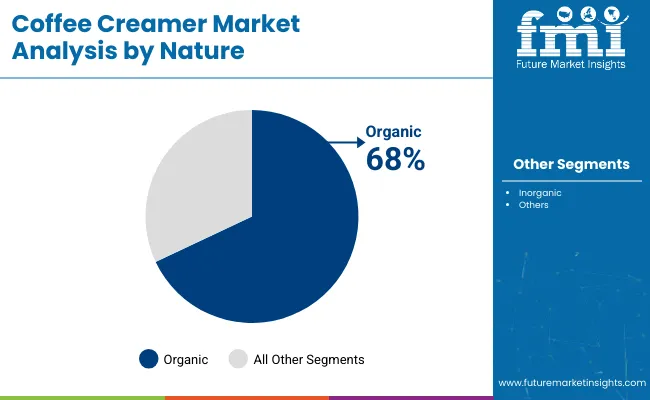

| Segment | Value Share (2025) |

|---|---|

| Organic (By Nature) | 68% |

There is a noticeable momentum behind highlighting organic non-dairy creamer as consumers become increasingly conscious about the source and purity of the ingredients in the beverages they consume every day. With concerns about synthetic additives, GMOs, and pesticides on the rise, organic creamers made from organic oats, almonds, or coconut are fast becoming the clean-label-touting darling of the creamer aisle.

Players like Nutpods and Califia Farms are addressing this expanding niche with USDA-certified products that also adhere to sustainable farming practices. Especially in urban areas, the retail channel is moving online and consumers are increasingly selective to buy organic coffee creamers both in stores and online, willing to pay the price to balance holistic wellness and sympathetic consistency with environmental values.

Starbucks and Nestlé are the strongest players capable of increasing their share in the coffee creamer market through brand recognition, product development, and innovation. They have successfully driven consumer preference in a breadth of creamers-dairy-based and plant-based and everything in between, products across flavors and dietary needs.

This variety with it right enables them to increase their consumers along with settlement choice and likewise help them to stay ahead in a local competitive market. Both companies have also traditionally tested and embraced progressive packaging solutions that enhance convenience and shelf life, allowing both of them to bolster their stand in the retail space.

Additionally, coffee creamer brands are working on expanding their distribution channels and visibility through collaborations and partnerships. By working with established retailers, cafes and other food service providers, these companies have access to ready-made customer networks and can rapidly drive market penetration.

For instance:

On the basis of product type, the coffee creamer market is broadly be segmented into dairy-based creamers and non-dairy creamers.

This Segment is Further categorised into Organic and Inorganic.

By form, liquid coffee creamers are convenient for both residential and foodservice/industrial application, as well as single-serve or ready-to-pour application. In contrast, powdered creamers are widely accepted because they provide a longer shelf life and are easy to stock and store, especially in institutional and office settings.

The residential segment consumes the most as home coffee culture continues post-pandemic. High demand is experienced by the commercial sector, which includes cafes, cafeterias, hotels, and restaurants, as café chains and specialty coffee outlets are on the rise. Office and corporate spaces also stock coffee creamers to meet workplace coffee preferences.

The coffee creamers sales across both, direct, and, indirect channels. The indirect sales dominate volume; in particular, the Hypermarkets/Supermarkets, Modern Grocery Stores and Convenience Stores as they are widely distributed, which reach and attract consumers. Specialty stores cater to niche audiences that are looking for premium or organic variants. The online retail market is growing at a fast pace with convenience and subscription-based models being the preference growing segment, while various other channels, including vending solutions and foodservice distributors, allow for bulk and institutional purchases.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global industry is estimated at a value of USD 5,818.2 million in 2025.

Some of the leaders in this industry include Nestlé S.A., Danone SA, Royal Friesl and Campina NV and Land O’Lakes, Inc.

The North America is projected to hold a revenue share of 35 % over the forecast period.

The industry is projected to grow at a forecast CAGR of 8.1 % from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by Nature, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 8: Global Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 10: Global Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 12: Global Market Volume (Tons) Forecast by Sales Channel, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: North America Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 18: North America Market Volume (Tons) Forecast by Nature, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 20: North America Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 21: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: North America Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 24: North America Market Volume (Tons) Forecast by Sales Channel, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Latin America Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 30: Latin America Market Volume (Tons) Forecast by Nature, 2019 to 2034

Table 31: Latin America Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 32: Latin America Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 33: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 34: Latin America Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 36: Latin America Market Volume (Tons) Forecast by Sales Channel, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: Western Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: Western Europe Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 41: Western Europe Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 42: Western Europe Market Volume (Tons) Forecast by Nature, 2019 to 2034

Table 43: Western Europe Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 44: Western Europe Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 45: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: Western Europe Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 47: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 48: Western Europe Market Volume (Tons) Forecast by Sales Channel, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: Eastern Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 52: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 54: Eastern Europe Market Volume (Tons) Forecast by Nature, 2019 to 2034

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 56: Eastern Europe Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 58: Eastern Europe Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 60: Eastern Europe Market Volume (Tons) Forecast by Sales Channel, 2019 to 2034

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 64: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 66: South Asia and Pacific Market Volume (Tons) Forecast by Nature, 2019 to 2034

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 68: South Asia and Pacific Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 70: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 72: South Asia and Pacific Market Volume (Tons) Forecast by Sales Channel, 2019 to 2034

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 74: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 75: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 76: East Asia Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 77: East Asia Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 78: East Asia Market Volume (Tons) Forecast by Nature, 2019 to 2034

Table 79: East Asia Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 80: East Asia Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 81: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 82: East Asia Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 83: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 84: East Asia Market Volume (Tons) Forecast by Sales Channel, 2019 to 2034

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 86: Middle East and Africa Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 88: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 90: Middle East and Africa Market Volume (Tons) Forecast by Nature, 2019 to 2034

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 92: Middle East and Africa Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 94: Middle East and Africa Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 96: Middle East and Africa Market Volume (Tons) Forecast by Sales Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Nature, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Form, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 6: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 8: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 12: Global Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 16: Global Market Volume (Tons) Analysis by Nature, 2019 to 2034

Figure 17: Global Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 18: Global Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 19: Global Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 20: Global Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 21: Global Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 22: Global Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 24: Global Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 25: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 26: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 28: Global Market Volume (Tons) Analysis by Sales Channel, 2019 to 2034

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 31: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 32: Global Market Attractiveness by Nature, 2024 to 2034

Figure 33: Global Market Attractiveness by Form, 2024 to 2034

Figure 34: Global Market Attractiveness by Application, 2024 to 2034

Figure 35: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 36: Global Market Attractiveness by Region, 2024 to 2034

Figure 37: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: North America Market Value (US$ Million) by Nature, 2024 to 2034

Figure 39: North America Market Value (US$ Million) by Form, 2024 to 2034

Figure 40: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 42: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 44: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 48: North America Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 51: North America Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 52: North America Market Volume (Tons) Analysis by Nature, 2019 to 2034

Figure 53: North America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 54: North America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 55: North America Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 56: North America Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 57: North America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 58: North America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 59: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 60: North America Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 61: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 62: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 64: North America Market Volume (Tons) Analysis by Sales Channel, 2019 to 2034

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 67: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 68: North America Market Attractiveness by Nature, 2024 to 2034

Figure 69: North America Market Attractiveness by Form, 2024 to 2034

Figure 70: North America Market Attractiveness by Application, 2024 to 2034

Figure 71: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 72: North America Market Attractiveness by Country, 2024 to 2034

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) by Nature, 2024 to 2034

Figure 75: Latin America Market Value (US$ Million) by Form, 2024 to 2034

Figure 76: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 84: Latin America Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 87: Latin America Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 88: Latin America Market Volume (Tons) Analysis by Nature, 2019 to 2034

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 91: Latin America Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 92: Latin America Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 95: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 96: Latin America Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 100: Latin America Market Volume (Tons) Analysis by Sales Channel, 2019 to 2034

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 103: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 104: Latin America Market Attractiveness by Nature, 2024 to 2034

Figure 105: Latin America Market Attractiveness by Form, 2024 to 2034

Figure 106: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 107: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 108: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 109: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: Western Europe Market Value (US$ Million) by Nature, 2024 to 2034

Figure 111: Western Europe Market Value (US$ Million) by Form, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 113: Western Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 114: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 116: Western Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 119: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 120: Western Europe Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 123: Western Europe Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 124: Western Europe Market Volume (Tons) Analysis by Nature, 2019 to 2034

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 127: Western Europe Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 128: Western Europe Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 131: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 132: Western Europe Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 135: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 136: Western Europe Market Volume (Tons) Analysis by Sales Channel, 2019 to 2034

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 139: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 140: Western Europe Market Attractiveness by Nature, 2024 to 2034

Figure 141: Western Europe Market Attractiveness by Form, 2024 to 2034

Figure 142: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 143: Western Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 144: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 145: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 146: Eastern Europe Market Value (US$ Million) by Nature, 2024 to 2034

Figure 147: Eastern Europe Market Value (US$ Million) by Form, 2024 to 2034

Figure 148: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 149: Eastern Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 152: Eastern Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 156: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 160: Eastern Europe Market Volume (Tons) Analysis by Nature, 2019 to 2034

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 164: Eastern Europe Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 168: Eastern Europe Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 172: Eastern Europe Market Volume (Tons) Analysis by Sales Channel, 2019 to 2034

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 175: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 176: Eastern Europe Market Attractiveness by Nature, 2024 to 2034

Figure 177: Eastern Europe Market Attractiveness by Form, 2024 to 2034

Figure 178: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 179: Eastern Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 180: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 181: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 182: South Asia and Pacific Market Value (US$ Million) by Nature, 2024 to 2034

Figure 183: South Asia and Pacific Market Value (US$ Million) by Form, 2024 to 2034

Figure 184: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 185: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 188: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 192: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 196: South Asia and Pacific Market Volume (Tons) Analysis by Nature, 2019 to 2034

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 200: South Asia and Pacific Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 204: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 208: South Asia and Pacific Market Volume (Tons) Analysis by Sales Channel, 2019 to 2034

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 211: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 212: South Asia and Pacific Market Attractiveness by Nature, 2024 to 2034

Figure 213: South Asia and Pacific Market Attractiveness by Form, 2024 to 2034

Figure 214: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 215: South Asia and Pacific Market Attractiveness by Sales Channel, 2024 to 2034

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 217: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 218: East Asia Market Value (US$ Million) by Nature, 2024 to 2034

Figure 219: East Asia Market Value (US$ Million) by Form, 2024 to 2034

Figure 220: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 221: East Asia Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 222: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 224: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 227: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 228: East Asia Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 231: East Asia Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 232: East Asia Market Volume (Tons) Analysis by Nature, 2019 to 2034

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 235: East Asia Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 236: East Asia Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 239: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 240: East Asia Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 243: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 244: East Asia Market Volume (Tons) Analysis by Sales Channel, 2019 to 2034

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 247: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 248: East Asia Market Attractiveness by Nature, 2024 to 2034

Figure 249: East Asia Market Attractiveness by Form, 2024 to 2034

Figure 250: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 251: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 252: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 253: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 254: Middle East and Africa Market Value (US$ Million) by Nature, 2024 to 2034

Figure 255: Middle East and Africa Market Value (US$ Million) by Form, 2024 to 2034

Figure 256: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 257: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 260: Middle East and Africa Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 264: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 268: Middle East and Africa Market Volume (Tons) Analysis by Nature, 2019 to 2034

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 272: Middle East and Africa Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 276: Middle East and Africa Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 280: Middle East and Africa Market Volume (Tons) Analysis by Sales Channel, 2019 to 2034

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 283: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 284: Middle East and Africa Market Attractiveness by Nature, 2024 to 2034

Figure 285: Middle East and Africa Market Attractiveness by Form, 2024 to 2034

Figure 286: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 287: Middle East and Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 288: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Coffee Capsules and Pods Market

Coffee Decoction Maker Market

Coffee Brewers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA