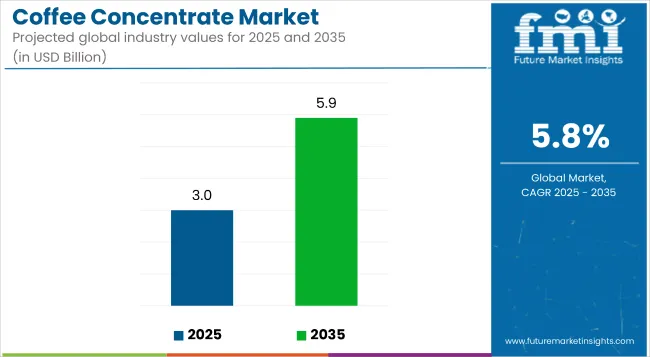

The global coffee concentrate market is valued at USD 3.0 billion in 2025 and is slated to reach USD 5.9 billion by 2035, reflecting a CAGR of 5.8%.

| Metric | Value |

|---|---|

| 2025 Market Value | USD 3.0 Billion |

| 2035 Market Value | USD 5.9 Billion |

| CAGR (2025 to 2035) | 5.8% |

Growth is expected to be driven by rising demand for convenient caffeine options, evolving consumer preferences for premium beverages, and the increasing influence of café culture. Additionally, the expansion of retail and e-commerce platforms is likely to facilitate higher product accessibility, contributing significantly to the market’s growth trajectory.

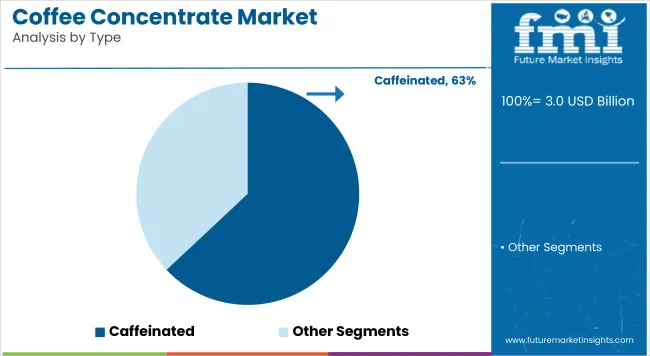

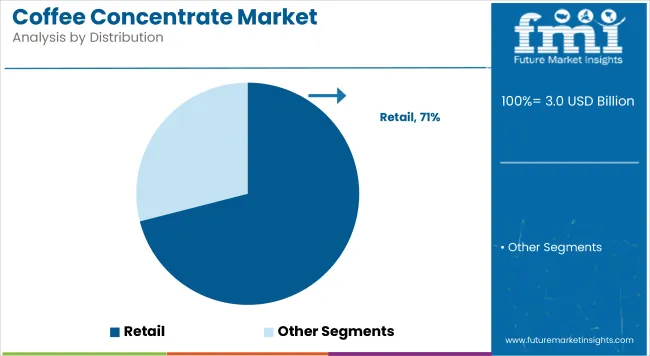

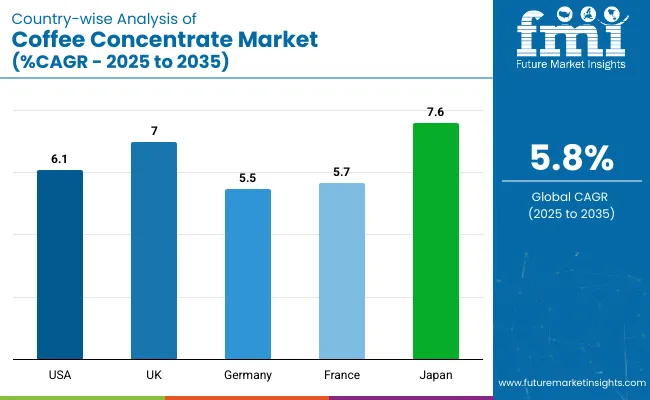

The USA will hold a significantmarket share due to the high availability of premium brands and high consumption. The UK is set to grow at a 7.0% CAGR, driven by busy lifestyles and demand for convenience. Japan will expand at 7.6%, supported by corporate coffee culture and health trends. Germany is expected to grow at 5.5%. Retail channels will lead the distribution segment at 71% share in 2025, and caffeinated concentrates will dominate with 63% market share in the type segment.

Recent innovations in the coffee concentrate market have been primarily focused on enhancing product convenience, flavor variety, and sustainability. Cold brew technologies are refined to produce smoother and more concentrated extracts, as seen in the launch of compact brewing systems like Torr Industries’ Hive Cafe. Flavor infusions, such as Monin’sMaple Pumpkin Cold Brew Coffee Concentrate, are introduced to cater to seasonal and specialty taste preferences.

The market holds a significant but niche share within its broader parent markets. It accounts for 4-6% of the overall coffee market, reflecting its growing popularity as a convenient and premium coffee format. Within the ready-to-drink (RTD) beverage market, coffee concentrates contribute around 3-5%, driven by increasing demand for quick and customizable coffee options.

In the cold brew coffee segment, coffee concentrates hold a stronger presence, representing roughly 10-12% due to their concentrated flavor and versatility. The market’s share in functional beverages and packaged beverages is smaller but expected to grow steadily as consumer preferences evolve.

The market segments include type, distribution channel, and region. The type segment covers caffeinated and decaffeinated variants. The distribution channel segment includes HoReCa and retail, with retail further divided into supermarkets/hypermarkets, specialty stores, convenience stores, and online retail. The regional segment includes North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The caffeinated segment is the most lucrative within the coffee concentrate market. It is projected to hold a dominant market share of approximately 63% in 2025.

The retail segment is the most lucrative distribution channel in the coffee concentrate market, expected to hold the largest share of around 71% in 2025.

The market is growing steadily, driven by increasing demand for convenient and premium coffee options, rising consumer preference for functional and ready-to-drink beverages, and advancements in brewing technologies, flavor innovations, and sustainable packaging solutions.

Recent Trends in the Coffee Concentrate Market

Challenges in the Coffee Concentrate Market

Japan is expected to lead growth in the market with the highest CAGR of 7.6% from 2025 to 2035, driven by corporate coffee culture and rising health awareness. The UK follows closely with a 7.0% CAGR, supported by busy lifestyles and strong retail presence.

France’s market is projected to grow at a steady 5.7%, influenced by flourishing café culture and health trends. Germany is anticipated to expand at around 5.5%, fueled by its established coffee culture and increasing focus on premium products. The USA market shows solid growth at 6.1%, backed by premium demand and retail expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

TheUSA coffee concentrate market is expected to grow at a CAGR of 6.1% from 2025 to 2035.

Sales of coffee concentrate in the UK are projected to grow at a CAGR of 7.0% during 2025 to 2035.

Germany’s coffee concentrate revenue is anticipated to expand steadily with a CAGR of approximately 5.5%.

Sales of coffee concentrate in France are expected to witness a CAGR of around 5.7% during 2025 to 2035.

Sales of coffee concentrate in Japan are forecasted to grow at a CAGR of 7.6% from 2025 to 2035.

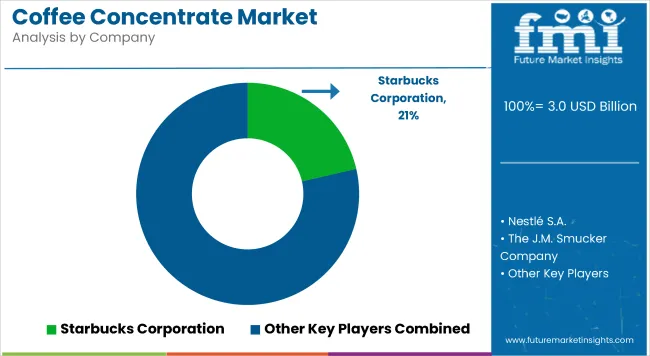

The market is moderately consolidated, with several tier-one companies holding significant market shares while a range of smaller specialty brands compete in niche segments. Leading players such as Starbucks Corporation, Nestlé S.A., and The J.M. Smucker Company have established strong footholds through innovation, extensive distribution networks, and strategic partnerships.

Top companies are competing primarily through product innovation, premiumization, and expansion into new markets. Pricing strategies are balanced with quality to cater to diverse consumer segments, from mass-market to artisanal coffee lovers.

Recent Coffee Concentrated Industry News

In January 2025, NESCAFÉ launched its first-ever liquid concentrate line, NESCAFÉ Espresso Concentrate, expanding its USA coffee portfolio. Addressing the growing demand for convenient at-home coffee solutions, this concentrate easily liquefies in milk or water, allowing consumers to quickly create exceptional café-style, iced espresso beverages.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.0 billion |

| Projected Market Size (2035) | USD 5.9 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Metric Tons |

| By Type | Caffeinated, Decaffeinated |

| By Distribution Channel | HoReCa, Retail (Supermarket/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Javy Coffee Company, The J.M. Smucker Company, Starbucks Corporation, Blue Bottle Coffee, Inc., Kohana Coffee, Nestlé S.A., Climpson & Sons, Monin, Grady’s Cold Brew, and Wandering Bear Coffee. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is valued at USD 3.0 billion in 2025.

The market is projected to grow at a CAGR of 5.8% during the forecast period.

The caffeinated segment holds the largest market share of approximately 63% in 2025.

Retail channels, especially supermarkets and hypermarkets, dominate with a 71% market share.

Japan is projected to grow at the highest CAGR of 7.6% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Coffee Capsules and Pods Market

Coffee Decoction Maker Market

Coffee Brewers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA