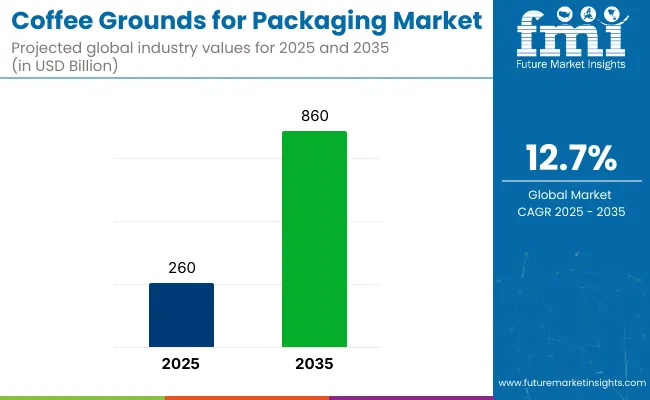

The coffee grounds for packaging market is likely to reach USD 860 billion by 2035, with a CAGR of 12.7% during the forecast period. The demand for coffee grounds as an alternative to plastic and synthetic packaging is increasing, particularly in the food, beverage, cosmetics, and retail sectors.

Key Industry Attributes

| Attribute | Detail |

|---|---|

| Industry Size (2025) | USD 260 billion |

| Industry Size (2035) | USD 860 billion |

| CAGR (2025 to 2035) | 12.7% |

Coffee grounds offer numerous benefits as they are biodegradable, renewable, and possess properties like moisture resistance and odor absorption. Growing consumer interest in eco-conscious products, combined with government initiatives to reduce plastic waste, is driving the adoption of coffee grounds-based packaging solutions across industries.

The coffee grounds for packaging industry holds a growing share within its parent markets. Within the packaging market, this segment accounts for approximately 1-2%, driven by its eco-friendly nature. In the coffee market, coffee grounds for packaging represent about 3-5%, as green trends encourage the repurposing of coffee waste.

The sustainable materials market contributes roughly 2-4%, fueled by the increasing focus on green alternatives in packaging. In the biodegradable packaging market, the share is about 1-3%, reflecting the growing interest in compostable solutions. The food and beverage market sees around 2-4% due to the demand for more environmentally conscious packaging options, particularly in premium and organic food sectors.

In an April 2025 interview with Rev1 Ventures, Katie Williamson, Founder & CEO of Unspent, shared, “Copoxee™ is the first plasticizer made entirely from waste materials… In lab tests, we’ve found manufacturers can use less of it to achieve the same or better results than soy-based alternatives.” She further explained, “This coffee waste-derived additive significantly improves the water and oxygen barrier properties of bioplastics-addressing two of the most critical challenges in bioplastic packaging.”

As companies explore alternatives to conventional materials, coffee grounds are gaining traction in packaging innovation. This shift reflects a broader movement toward finding innovative solutions that address pressing environmental concerns while maintaining product functionality.

The coffee grounds for packaging market is segmented by packaging type into rigid packaging, flexible packaging, paper-based packaging, molded packaging, and coated paper. By material composition, the industry includes coffee grounds combined with PLA, PHA, kraft paper, and starch.

Product format segmentation includes trays, cups, tubes, pouches, sleeves, wrappers, and inserts. End-use industries are categorized into food and beverage, personal care and cosmetics, retail and apparel, and consumer goods. Functional features include biodegradable, aroma-retaining, and textured finish.

The distribution channel segment includes OEMs, packaging converters, retail brands, and eCommerce. Industry analysis has been conducted across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

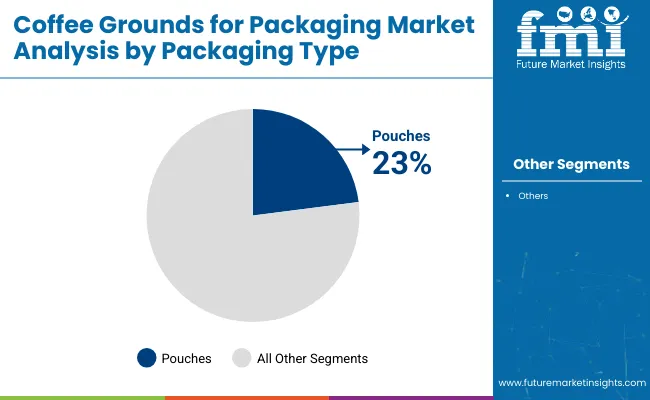

Pouches will hold a 23% market share in the coffee grounds for packaging industry by 2025. These flexible packaging options are highly valued for their convenience, cost-effectiveness, and versatility.

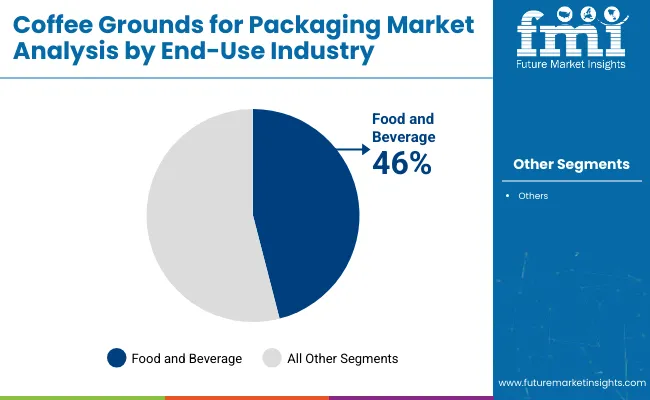

The food and beverage packaging segment is projected to account for 46% of the industry share in 2025.

The market is witnessing a shift towards combining coffee grounds with ecofriendly materials such as PLA (polylactic acid) and PHA (polyhydroxyalkanoates). These combinations account for a significant share of the industry, offering both eco-friendly and functional packaging solutions.

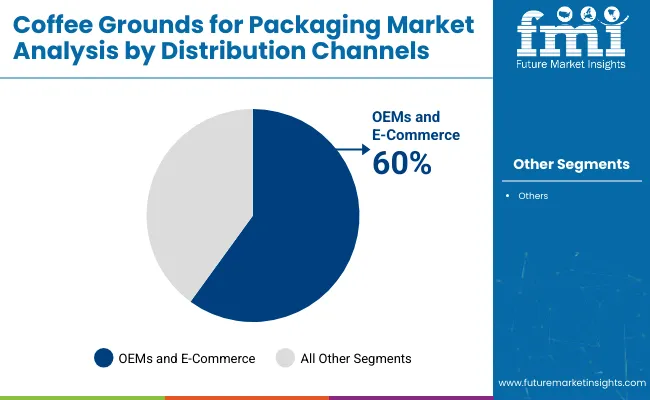

OEMs (Original Equipment Manufacturers) and e-commerce platforms are expected to dominate the distribution channels for coffee grounds-based packaging, accounting for approximately 60% of the market share in 2025.

The coffee grounds for packaging industry is experiencing growth due to increasing demand for eco-friendly alternatives. Innovations are being led by key players who are incorporating biodegradable materials, while regional trends show increasing adoption in food and beverage industries. This shift is driven by consumer demand for eco-friendly packaging and evolving regulations.

Emerging Trends and Breakthrough Innovations by Key Players in Coffee Grounds for Packaging

Challenges Facing Coffee Grounds for Packaging Market Growth

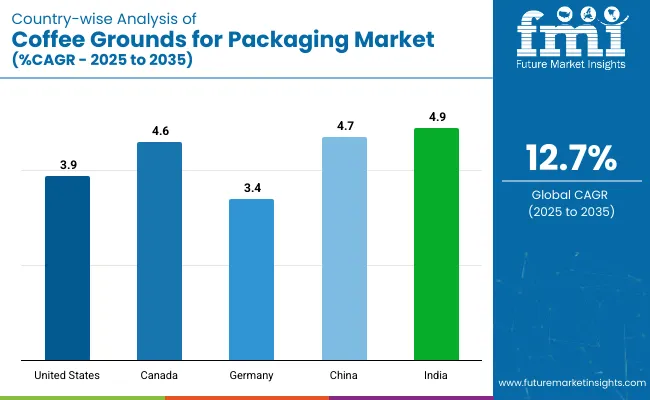

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| Canada | 4.6% |

| Germany | 3.4% |

| China | 4.7% |

| India | 4.9% |

The coffee grounds for packaging industry is witnessing steady growth across both developed and emerging economies. India leads the BRICS group with a 4.9% CAGR, driven by the expanding food and beverage sectors and growing demand for innovative packaging solutions.

China follows closely with a 4.7% CAGR, supported by its rapidly expanding consumer goods industry and an increasing focus on using alternative packaging materials. Among OECD countries, Canada shows the highest growth at 4.6% CAGR, fueled by consumer demand for eco-friendly packaging alternatives, particularly in food packaging.

The United States experiences steady growth at 3.9% CAGR, with rising interest in alternative packaging materials. Germany has the slowest growth within the OECD at 3.4% CAGR, reflecting moderate demand for coffee grounds-based packaging solutions.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The United States industry for coffee grounds in packaging is benefiting from federal regulations that encourage waste reduction and alternative material adoption. The growing demand for eco-friendly packaging solutions is supported by government incentives, with major companies exploring biodegradable packaging alternatives. As policies evolve, companies are increasingly integrating coffee grounds into their production processes to replace plastics in packaging.

The United Kingdom is advancing in coffee grounds-based packaging due to governmental policies aimed at cutting plastic usage. Policies promoting waste reduction and green packaging have accelerated innovation in the sector, with packaging companies focused on exploring new solutions. Consumer awareness and demand for environmentally friendly products further support this trend, positioning the UK as a key industry for coffee grounds-based packaging solutions.

Germany's packaging sector is benefiting from stringent waste management regulations that drive innovation in alternative packaging materials like coffee grounds. The country's robust recycling system encourages the use of biowaste for packaging solutions, with government incentives aiding companies in adopting these alternatives. Germany’s focus on environmental responsibility and technological development has accelerated growth in the coffee grounds packaging market.

South Korea’s focus on reducing plastic waste through regulatory measures has driven packaging companies to explore coffee grounds as a viable alternative. Government-backed incentives and initiatives encourage businesses to shift toward green packaging solutions. The country’s emphasis on technological advancements and its proactive stance on waste reduction policies ensure continued growth and adoption of coffee grounds-based materials in packaging.

India’s packaging industry is rapidly transitioning toward eco-friendly materials, aided by government policies that promote biodegradable packaging. As environmental concerns rise, India is exploring coffee grounds as a renewable resource for packaging solutions, with companies investing in these alternatives. Government initiatives and consumer demand are driving the adoption of coffee grounds for packaging, positioning India as a growing industry for this innovation.

The industry is home to both established players and emerging innovators, each focusing on strategic moves such as product launches, R&D, and partnerships. Premier Packaging LLC, Keenpac, and Huhtamäki are key players investing heavily in alternative materials and product innovation.

For instance, Huhtamäki’s commitment to developing biodegradable packaging alternatives demonstrates the sector’s growing focus on reducing environmental impact. The companies like Axilone and MM Packaging are exploring new packaging designs incorporating coffee grounds, working to provide both functional and eco-friendly packaging solutions.

The market remains relatively fragmented, with various emerging companies such as Packhelp and Coepto Group entering the space. This fragmentation creates barriers for new entrants, including high capital investment and the need for robust R&D capabilities to compete with established players. Companies also face challenges related to consumer acceptance and scalability of coffee grounds-based materials.

| Report Attributes | Details |

|---|---|

| Estimated Global Market Size (2025E) | USD 260 billion |

| Projected Global Industry Size (2035F) | USD 860 billion |

| Value-based CAGR (2025 to 2035) | 12.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and kilotons for volume |

| Packaging Type Analyzed | Rigid Packaging, Flexible Packaging, Paper-based Packaging, Molded Packaging, Coated Paper |

| Material Composition Studied | Coffee Grounds + PLA, Coffee Grounds + PHA, Coffee Grounds + Kraft Paper, Coffee Grounds + Starch |

| Product Format | Trays, Cups, Tubes, Pouches, Sleeves, Wrappers, Inserts |

| End-Use Industry Segmentation | Food & Beverage (Coffee Capsules, Snack Packs, Tea Boxes, Beverage Carriers), Personal Care & Cosmetics (Soap Boxes, Lip Balm Tubes, Gift Boxes), Retail & Apparel (Jewelry Boxes, Clothing Tags, Pouches), Consumer Goods (Electronics Packaging, DIY Kits) |

| Functional Features | Biodegradable, Aroma-retaining, Textured Finish |

| Distribution Channel | OEMs, Packaging Converters, Retail Brands, E-commerce |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, Brazil, Mexico, Australia, South Africa, GCC countries |

| Key Players | Premier Packaging LLC, Keenpac, Hunter Luxury, Axilone, Huhtamäki, MM Packaging, Graphic Packaging, coepto Group, Dome Printing, Packhelp |

| Additional Attributes | Dollar sales, share by packaging type and end user, surge in demand for green packaging solutions, increased adoption in personal care and food & beverage sectors, development of eco-friendly and biodegradable coffee-based materials, regional demand variations across North America, Europe, and Asia-Pacific, growing consumer preference for circular economy packaging, and a notable shift toward upcycled and compostable packaging innovations. |

The segment is categorized into Rigid Packaging, Flexible Packaging, Paper-based Packaging, Molded Packaging, and Coated Paper.

This includes combinations such as Coffee Grounds + PLA, Coffee Grounds + PHA, Coffee Grounds + Kraft Paper, and Coffee Grounds + Starch.

The industry has been divided into Trays, Cups, Tubes, Pouches, Sleeves, Wrappers, and Inserts.

This segment is further categorized into Food & Beverage(Coffee Capsules, Snack Packs, Tea Boxes, Beverage Carriers), Personal Care & Cosmetics(Soap Boxes, Lip Balm Tubes, Gift Boxes), Retail & Apparel(Jewelry Boxes, Eco-friendly Clothing Tags, Pouches), Consumer Goods (Electronics Packaging, Small Appliances, DIY Kits)

The segment includes Biodegradable, Aroma-retaining, and Textured Finish properties.

This includes OEMs, Packaging Converters, Retail Brands, and E-commerce.

Industry analysis has been conducted across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The industry is projected to grow from USD 260 billion in 2025 to USD 860 billion by 2035, registering a CAGR of 12.7%.

Pouches dominate with a 23% industry share, favored for their portability, convenience, and environmental alignment.

The food & beverage sector accounts for 46% of the industry share in 2025, driven by demand for compostable packaging in coffee capsules, snack packs, and tea boxes.

India is forecasted to lead with a CAGR of 4.9%, followed by China at 4.7%, fueled by policy support and expanding consumer goods industries.

Premier Packaging LLC leads with an 18% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA