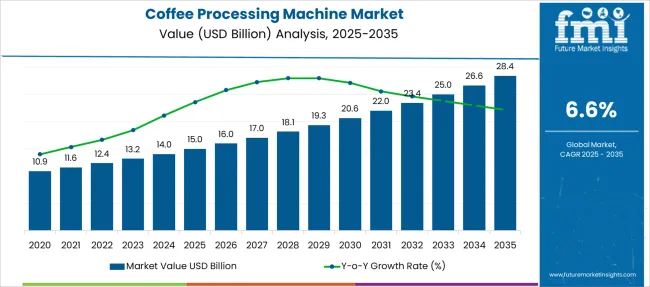

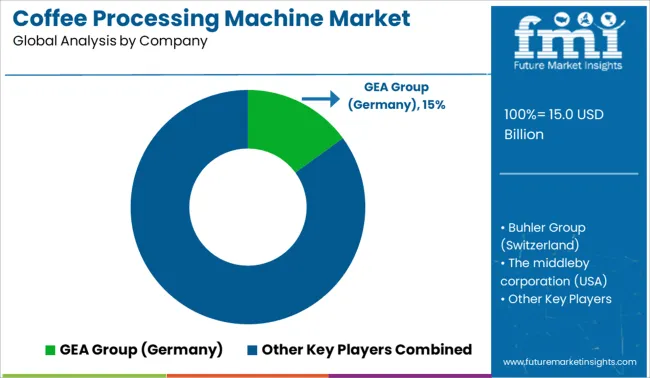

The Coffee Processing Machine Market is estimated to be valued at USD 15.0 billion in 2025 and is projected to reach USD 28.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Coffee Processing Machine Market Estimated Value in (2025 E) | USD 15.0 billion |

| Coffee Processing Machine Market Forecast Value in (2035 F) | USD 28.4 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The Coffee Processing Machine market is experiencing steady expansion, supported by the increasing demand for high-efficiency processing technologies within the coffee industry. This growth is being driven by the rising global consumption of coffee, especially in emerging markets where production and export capacity are expanding. Industry announcements and manufacturing company press releases have highlighted the increasing adoption of automated and energy-efficient machinery by both commercial roasters and small-scale producers.

Technological advancements in processing precision and reduced operational costs have played a vital role in encouraging investment across all stages of coffee production. The future outlook for this market appears promising as manufacturers focus on sustainability, product consistency, and traceability.

Investor communications and operational updates have emphasized that emphasis on quality control and digital integration into machine functions are further enhancing the value proposition of modern coffee processing systems As the specialty coffee trend grows and premium product lines expand, demand for modular and scalable processing equipment is expected to increase significantly.

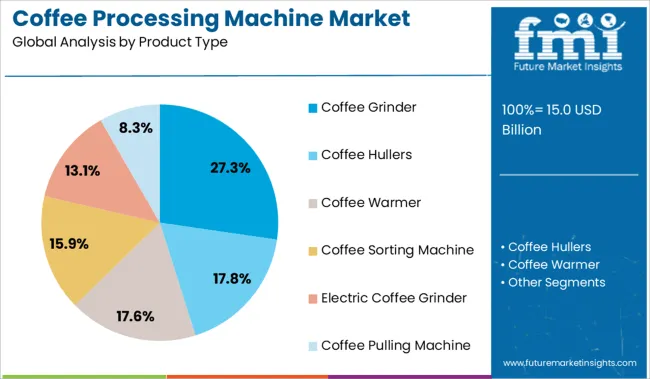

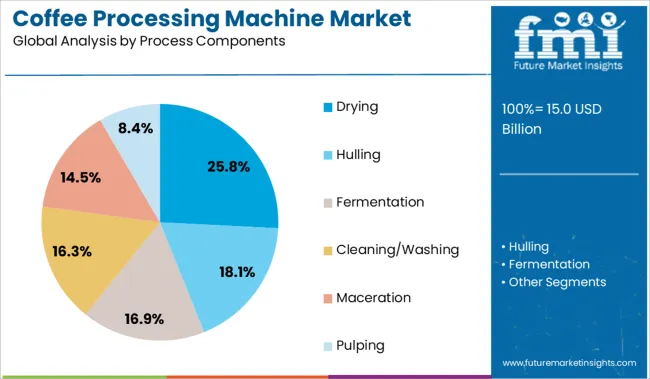

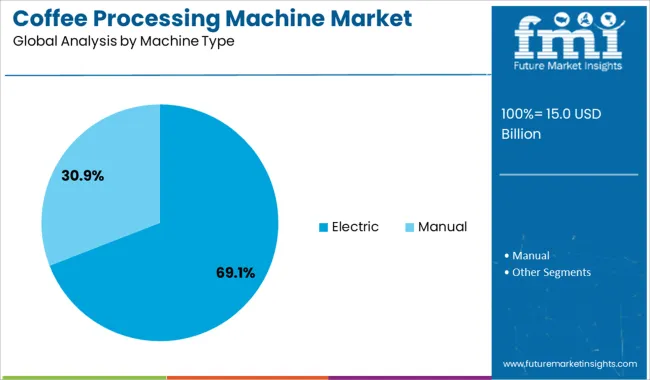

The market is segmented by Product Type, Process Components, and Machine Type and region. By Product Type, the market is divided into Coffee Grinder, Coffee Hullers, Coffee Warmer, Coffee Sorting Machine, Electric Coffee Grinder, and Coffee Pulling Machine. In terms of Process Components, the market is classified into Drying, Hulling, Fermentation, Cleaning/Washing, Maceration, and Pulping. Based on Machine Type, the market is segmented into Electric and Manual. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The coffee grinder segment is expected to account for 27.3% of the Coffee Processing Machine market revenue share in 2025, making it the leading product type. This dominance is being attributed to the critical role grinders play in preserving flavor quality and grind uniformity, which are essential factors in determining the final cup quality.

Industry-focused technical journals and equipment launch releases have pointed to increased demand for precision grinding across both commercial and artisanal coffee operations. Coffee grinders have gained preference due to their versatility in handling varying roast levels and origin-specific beans, supporting the needs of specialty coffee producers.

Furthermore, the market has witnessed a shift toward consistent grind size as a differentiator in quality, pushing the demand for advanced grinders that can be integrated with digital controls and automation features The expansion of on-demand grinding in cafes and retail packaging environments has further supported this segment’s leading share in the market.

The drying segment is anticipated to hold 25.8% of the Coffee Processing Machine market revenue share in 2025, positioning it among the most critical process components. This prominence is being driven by its fundamental role in reducing moisture content to optimal levels for storage, roasting, and transportation. Agricultural equipment reviews and processing technology news have indicated that advancements in temperature control and energy efficiency have elevated the performance of modern drying equipment.

As the industry moves toward uniform quality and reduced post-harvest losses, drying has become central to processing workflows, especially in regions prone to unpredictable climate conditions. Automated drying systems are increasingly preferred by producers seeking consistent batch quality and reduced labor dependency.

Press releases from agricultural machinery manufacturers have also noted an increase in adoption of eco-efficient dryers, aligning with sustainability targets These technical, operational, and regulatory drivers have positioned drying as an indispensable component of modern coffee processing.

The electric machine segment is projected to account for 69.1% of the Coffee Processing Machine market revenue share in 2025, establishing it as the leading machine type. This dominance is being supported by increasing automation requirements across both industrial and commercial-scale coffee processing facilities. Technical bulletins and corporate product updates have emphasized that electric machines offer superior control, reduced manual intervention, and consistent output, which are key priorities in meeting global production standards.

The adoption of electric processing equipment has been accelerated by the growing demand for smart features such as programmable settings, real-time monitoring, and energy optimization. Industry insights have also shown a shift toward compact electric machines for smallholder farmers and urban roasters aiming to upgrade from manual operations.

The scalability, operational safety, and lower maintenance requirements of electric machines have further reinforced their widespread preference These combined benefits have led to the segment’s commanding position in the overall market landscape.

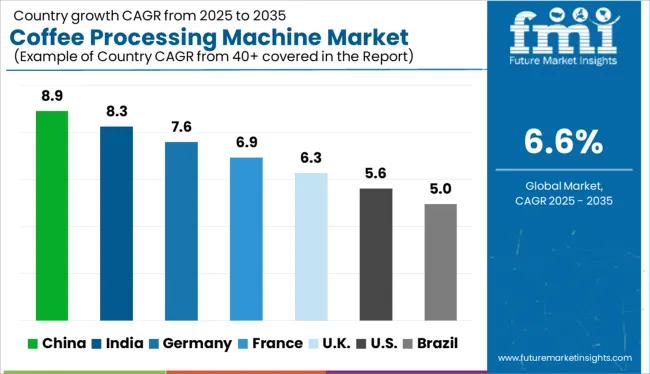

As per FMI, the global coffee processing machine market exhibited steady growth at a CAGR of 5.6% during the historical period. As coffee is considered to be a symbol of low fat and low calories, demand for coffee processing machines has increased over the past five years.

The ongoing expansion of coffeehouse chains such as Starbucks, Costa Coffee, Café Coffee Day, and Gloria Jean's Coffees is another crucial factor that is estimated to propel the need for coffee processing machines across the globe. Increasing concerns regarding health and wellness are also compelling people to shift to coffee from other sugary beverages.

A number of influential factors have been identified to stir the soup in the coffee processing machine market. Apart from the proliferating aspects prevailing in the market, analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can pose a challenge to the progression of the market.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS:

RESTRAINTS:

OPPORTUNITIES:

THREATS:

Acceptance of Single-serve Coffee Brew Systems to Propel Sales of Coffee Powder Grinding Machines in Brazil

Brazil produces the largest number of coffee beans in the world. The country alone produces nearly 40% of the world's total coffee, and many areas in Brazil have the best suitable climate for coffee production.

The coffee plantation covers about 27000 square kilometers of Brazil. The country has a lot of influence on the coffee-producing industry. Acceptance of single-serve coffee brew systems by consumers and increasing demand for certified coffee products are projected to push sales of coffee processing machines in Brazil during the forecast period.

Exponential Demand for Light Roasts in Finland to Augment Sales of Coffee Beans Drying Machines

Coffee is considered to be one of the most consumed beverages across Finland. Light roasts are set to be the most popular type of coffee in the country. Finland's per capita coffee consumption is the highest, i.e. 12 kg per capita. Citizens of Finland often drink coffee on special occasions and even post-church rituals are celebrated at coffee tables.

Finns typically drink three to five cups of coffee per day, and they prefer light-roasted filter coffee. The majority of coffee is consumed at home or at the office. Light-roasted coffee accounts for about 80% of all coffee consumption, though dark-roasted coffee has recently gained popularity in the country.

Rising Number of Starbucks Outlets in the US to Fuel the Need for Drum Roasting Machines

The US has the most Starbucks locations per capita, while McDonald's has rebranded many of its locations as McCafé's and Dunkin' Donuts. Coffee consumption is part of many people's morning routines in the country.

In coffeehouse supply chains in the US, producers and distributors work together to create a system that ensures high-quality coffee is available to consumers. Producers must carefully select and grow the best coffee beans, and distributors must select & store the beans properly in order to ensure they reach retailers in good condition.

Together, these factors would create a system that allows coffee to flow freely from the producer to the consumer. Thus, an increasing number of coffee outlets like McCafé and Starbucks in the US is expected to propel the demand for coffee processing machines.

Growing Demand for Instant Coffee in Germany to Impel Sales of Coffee Pulping Machines

Germany has the biggest coffee roasting industry among all other countries in Europe. In 2020 alone, Germany was responsible for approximately 26% of the total European consumption, with 367 tons of green coffee and instant coffee. Germany has the third-largest coffee market in the world after the US and Brazil, which would push the coffee processing machine market during the evaluation period.

Sales of Dry Coffee Huller Machines to Grow Astonishingly across the Globe

Based on product type, the coffee hullers segment is expected to remain at the forefront in the next ten years. A coffee huller is an instrument that is used in the process of hulling. In this process, coffee beans are separated from their parchment layer. It is a crucial step in coffee making. The hull or parchment is the paper-thin layer present at the surface of the bean. This machine gets the exact same size of coffee as wet-processed coffee.

Key companies in the global coffee processing machine market are adopting a wide range of strategies, including acquisitions and mergers, to strengthen their positions and channels of distribution worldwide. In addition, many significant companies are developing and launching new products to increase their capacity and establish themselves in the market.

Leading coffee processing machine companies are focusing on the market potential. They are investing huge sums in research & development activities, taking new distribution initiatives, launching unique products, and evaluating their strengths & weaknesses.

Some of the key players in the coffee processing industry are GEA Group (Germany), Buhler Group (Switzerland), The Middleby Corporation (USA), JBT Corporation (USA), Scolari Engineerings (Italy), Mckinnon, Bettcher Industries (USA), BAADER (Germany), Dover Corporation USA, BIgtem Makine (Turkey), Finis Meat and Coffee and Tea Processing B.V. (Netherlands), and Anko Food machine co. Ltd. (Taiwan) among others.

For instance,

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 15.0 billion |

| Projected Market Valuation (2035) | USD 28.4 billion |

| Value-based CAGR (2025 to 2035) | 6.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market analysis | Value (USD Million) |

| Key Regions Covered | North America; South America; Europe; Northern Europe |

| Key Countries Covered | USA, Finland, Colombia, Germany, Brazil |

| Key Segments Covered | Product Type, Machine Type, Process Components, Region |

| Key Companies Profiled | GEA Group (Germany); Buhler Group (Switzerland); JBT Corporation (USA); MIddleby Corporation (USA) |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics, Challenges, Strategic Growth Initiatives |

The global coffee processing machine market is estimated to be valued at USD 15.0 billion in 2025.

The market size for the coffee processing machine market is projected to reach USD 28.4 billion by 2035.

The coffee processing machine market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in coffee processing machine market are coffee grinder, coffee hullers, coffee warmer, coffee sorting machine, electric coffee grinder and coffee pulling machine.

In terms of process components, drying segment to command 25.8% share in the coffee processing machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Coffee Capsules and Pods Market

Coffee Decoction Maker Market

Coffee Brewers Market

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA