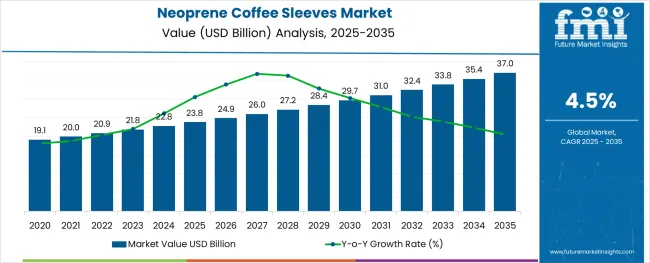

The neoprene coffee sleeves market is projected to grow from USD 23.8 billion in 2025 to USD 37 billion by 2035, expanding at a CAGR of 4.5%. Between 2020 and 2024, the market rose steadily from around USD 18.9 billion, supported by the surge in on-the-go beverage consumption and the global shift toward reusable, customizable cup accessories. In 2023, over 60% of coffee chains in North America reported offering branded neoprene sleeves as part of their sustainability or loyalty initiatives.

By 2025, more than 48% of neoprene sleeve demand is expected to stem from the foodservice and retail coffee sectors, particularly in the USA, China, and South Korea. The rise in boutique cafés and premium takeaway culture has driven the popularity of durable, heat-insulating sleeves that also serve as marketing tools. Custom printing and seasonal promotional campaigns continue to boost demand from beverage retailers and event organizers.

From 2026 through 2035, growth will be supported by rising eco-consciousness and regulatory pressures limiting single-use plastics. Reusable cup accessories, including neoprene sleeves, are gaining traction in Europe and Australia, where consumer preferences are shifting toward low-waste beverage habits. Rising raw material costs and competition from recycled fabric sleeves could moderate growth in cost-sensitive markets.

The neoprene coffee sleeves market plays a niche but rising role across multiple industries. Within the USD 300 billion global foodservice packaging space, sleeves made from neoprene represent 2-3%, favored for their insulation and reusability. In the USD 80 billion drinkware accessories market, neoprene sleeves account for 5-7%, driven by demand for custom-fit, branded, and heat-protective solutions.

Coffee chains and cafés allocate roughly 6-10% of their beverage presentation budgets to premium sleeves that support both branding and functionality. Within the fast-growing USD 70 billion sustainable packaging sector, around 3-5% of demand ties back to reusable neoprene formats that reduce single-use waste. Even in the USD 50 billion promotional merchandise industry, neoprene sleeves capture 4-6% share as customizable brand assets.

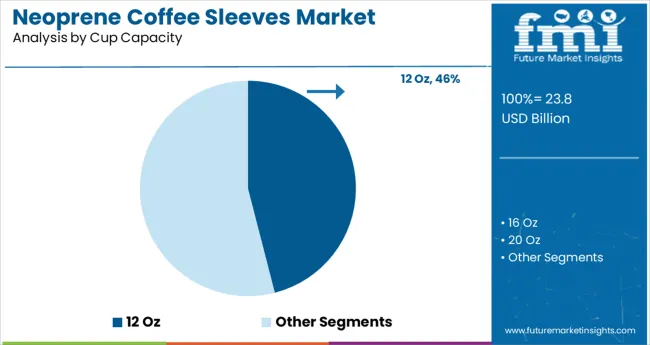

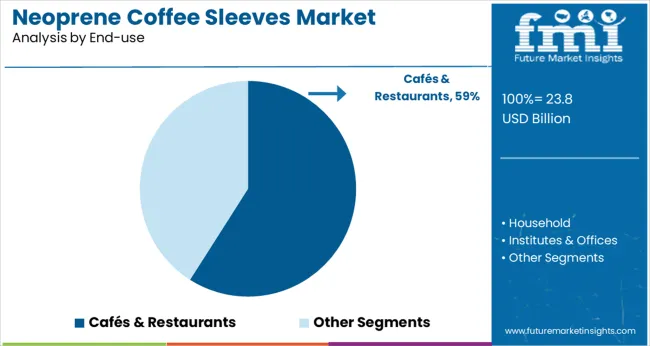

The neoprene coffee sleeves market is gaining traction across key segments like 12 Oz cups and café or restaurant end-use. Growth is driven by rising demand for reusable, heat-insulating, and branded beverage packaging solutions.

12 Oz cups are expected to dominate the neoprene coffee sleeves market with a 46% share by 2025. These medium-sized cups are widely used for serving standard coffee portions across coffee shops, food trucks, and convenience stores. Their compatibility with machine-dispensed beverages and takeaway-friendly sizing makes them a popular fit for daily commuters and busy consumers.

Cafés and restaurants are projected to lead the end-use segment with a 59% share by 2025. Premium establishments increasingly seek customizable, eco-conscious packaging options to enhance brand appeal. Neoprene sleeves are gaining traction as reusable, heat-resistant alternatives to disposable paper wraps.

The neoprene coffee sleeves market is evolving as brands prioritize reusability, thermal insulation, and custom branding. Demand is rising from specialty cafés, direct-to-consumer (DTC) startups, and corporate gifting channels. Production is shifting toward sublimation-ready, machine-washable sleeves that support higher margins and align with multi-use beverage accessory portfolios.

Customization-Driven Growth in DTC and Gifting Channels

Customized neoprene coffee sleeves accounted for 59% of online DTC sales by mid to 2025, driven by demand for monogrammed, event-branded, and influencer-collaboration designs. Vendors offering full-color sublimation printing reported 34% higher margins versus standard SKUs. Corporate gifting orders rose 41% YoY, especially for conference giveaways and employee welcome kits.

Repeat order frequency climbed 29% for SKUs bundled with reusable cups. Production runs of 500-2,000 units became the dominant segment, reducing lead times by 22% through digital proofing tools. As small businesses and event organizers seek cost-effective brand visibility, neoprene sleeves are becoming a preferred merchandising option with low MOQ and high tactile recall.

Machine-Washable Designs Expand Foodservice Adoption

Adoption of machine-washable neoprene sleeves in cafés and quick-service chains rose 36% in 2025, led by chains seeking alternatives to single-use cardboard wraps. High-durability SKUs with ≥300 wash cycles reduced sleeve replenishment frequency by 42% across pilot programs. Coffee shops offering loyalty perks for reusable sleeve use saw customer retention increase by 17%.

Heat retention improved by 24% versus pulp-based wraps, enhancing drink experience. POS displays promoting washable sleeves alongside reusable cups drove a 31% boost in upsell conversions. As chains pilot closed-loop accessory models, washable neoprene sleeves are emerging as operationally feasible, brand-aligned solutions in repeat beverage sales environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

| United States | 4.7% |

| Japan | 4.4% |

| United Kingdom | 4.3% |

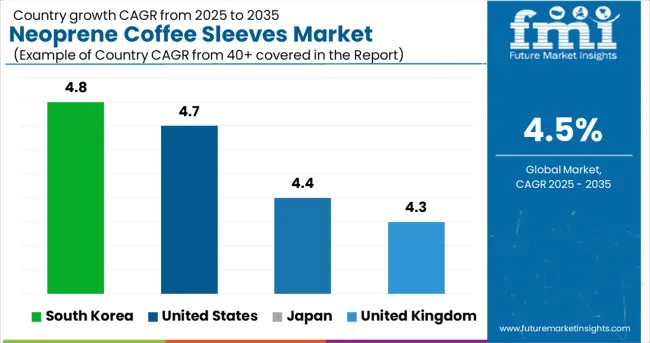

The neoprene coffee sleeves market is projected to grow at a global CAGR of 4.5% between 2025 and 2035. Among OECD nations, South Korea slightly surpasses the global rate with a 4.8% CAGR, bolstered by strong café culture and rising demand for sustainable beverage accessories. The USA closely follows at 4.7%, with major retail chains driving bulk procurement and branded customization trends.

Japan remains just below the global benchmark at 4.4%, where eco-packaging shifts are occurring slowly in comparison to broader market trends. The UK trails further at 4.3%, shaped by stable but less aggressive retail adoption and evolving environmental mandates. While BRICS and ASEAN members were not among the top contributors in this segment, their emerging interest in sustainable drinkware may influence long-term dynamics.

The report provides insights across 40+ countries. The four below are highlighted for their strategic influence and growth trajectory.

South Korea is forecast to grow at a CAGR of 4.8% from 2025 to 2035. During 2020 to 2024, the market was driven primarily by aesthetic coffee culture in Seoul and Busan. In the coming decade, a rising number of eco-conscious cafes and premium takeaway brands are integrating reusable neoprene sleeves into their packaging. Custom printing and influencer-led branding are fueling demand from Gen Z and millennial consumers.

The United States is projected to expand at a CAGR of 4.7% through 2035. Between 2020 and 2024, consumer focus on sustainability and heat protection led to moderate growth in reusable cup accessories. From 2025 onward, partnerships between independent roasters and lifestyle brands are set to boost neoprene sleeve adoption. Retailers are responding to demand with biodegradable and customizable sleeve options.

Japan’s market is poised to grow at a CAGR of 4.4% from 2025 to 2035. Between 2020 and 2024, demand was steady in commuter-focused cafés and convenience chains. Looking ahead, growing attention to product presentation and thermal retention is increasing sleeve use, particularly in busy urban centers. Local manufacturers are introducing compact, foldable designs to match Japan’s minimalist preferences.

The United Kingdom is expected to register a CAGR of 4.3% over the next decade. From 2020 to 2024, adoption remained modest, largely restricted to independent cafes. A stronger push for sustainable retail packaging and local council support for reusable solutions is accelerating market growth. Custom-designed sleeves are increasingly used by cafés for seasonal marketing and events.

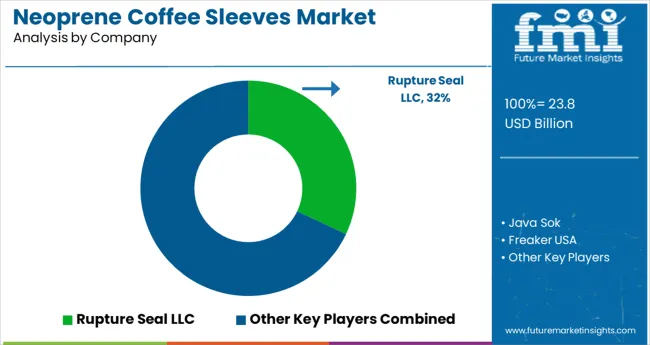

The neoprene coffee sleeves market is characterized by strong competition between customization-focused suppliers and promotional product firms. Rupture Seal LLC holds the dominant position with an estimated 32% market share, driven by large-scale B2B contracts and proprietary sealing sleeve technology. Java Sok follows with roughly 15-18%, leveraging its patented insulating sleeves and wide availability in retail outlets and e-commerce.

Freaker USA and Sleeve a Message target mid-sized businesses with custom branding, together making up around 12% of the market. Zazzle Inc. and Totally Promotional serve the promotional and event merchandise segment, while Etsy artisans capture a growing niche with personalized and handmade offerings. Smaller players like Neosleeve LLC and Discount Mugs fill regional and low-cost supply gaps.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 23.8 billion |

| Projected Market Size (2035) | USD 37 billion |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Cup Capacities Analyzed (Segment 1) | 12 Oz, 16 Oz, 20 Oz, 22 Oz, 24 Oz |

| End Uses Analyzed (Segment 2) | Cafés & Restaurants, Household, Institutes & Offices, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Rupture Seal LLC, Java Sok, Freaker USA, Sleeve a Message, Crooked Monkey, Zazzle Inc., Totally Promotional, Etsy Sellers & Artisans, Discount Mugs, Neosleeve LLC |

| Additional Attributes | Dollar sales by capacity and end use, increasing consumer demand for reusable beverage accessories, growing customization trends in branding and gifting, and expansion of eco-conscious sleeve designs for foodservice operators. |

Segmented by size into 12 Oz, 16 Oz, 20 Oz, 22 Oz, and 24 Oz cups.

Used across cafés and restaurants, households, institutes and offices, and other commercial or individual settings.

Analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East & Africa.

The market is valued at USD 23.8 billion in 2025.

The market is expected to reach USD 37 billion by 2035.

The market is projected to grow at a CAGR of 4.5% from 2025 to 2035.

The 12 Oz cup segment leads with a 46% share.

South Korea is projected to grow at the fastest CAGR of 4.8% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Neoprene Rubber Market

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Coffee Capsules and Pods Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA