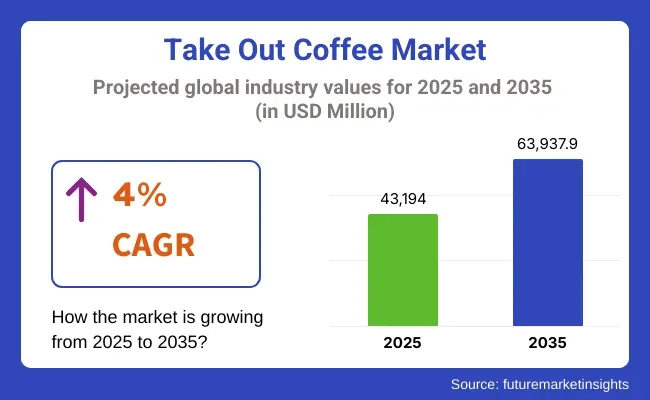

The take out coffee market is expected to rise from USD 43,194 Million in 2025 to USD 63,937.9 Million by 2035, with an annual growth rate of 4%. More people are becoming aware of high-quality coffee, which is boosting the market.

Coffee delivery services are growing, and new ways to make coffee are coming out. These changes help the market grow. Also, new types of coffee, such as organic, plant-based, and special function coffees are coming out. These new products are bringing in more and different customers.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 43,194 Million |

| Market Value (2035F) | USD 63,937.9 Million |

| CAGR (2025 to 2035) | 4% |

The take-out coffee market will see big growth from 2025 to 2035. More people living in cities, new habits, and a growing love for easy-to-get drinks will fuel this change. With packed days and busy lives, more and more folks choose take-out coffee.

Coffee chains, special coffee shops, and fast food places are growing thanks to this trend. Moreover, new green packaging and online ordering are transforming the market. These changes give people quicker and more eco-friendly ways to enjoy their coffee.

The take-out coffee market is growing fast. City living is on the rise, and more people want specialty coffee. The need for quick and easy options is also up. In terms of how coffee gets to customers, cafes, coffee shops, and fast-food places lead the way. Ground coffee is the top choice because it is flexible, tastes fresh, and people like it a lot.

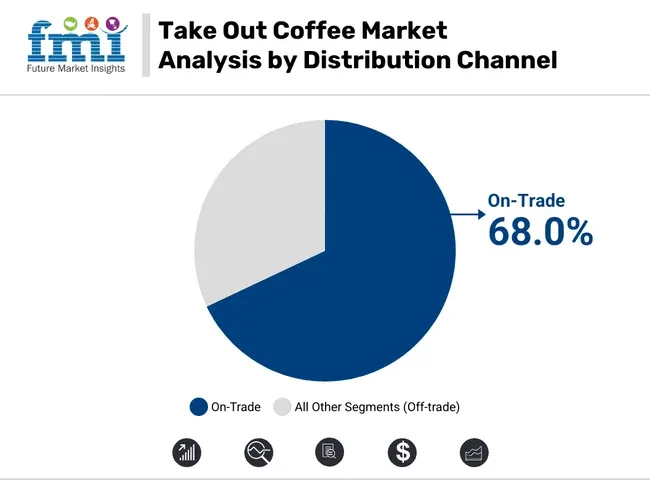

| Distribution Channel | Market Share (2025) |

|---|---|

| On-Trade | 68.0% |

On-Trade Channel Leads Market Demand for Freshly Brewed, High-Quality Coffee

The On-Trade part leads the market. Coffee shops, unique cafés, and fast-food spots pull in folks who want fresh, top-notch coffee. The love for fancy coffee, new coffee trends, and online ordering have boosted this part even more.

There are more and more coffee chains, small cafés, and office coffee setups. This helps the market grow. New tech in coffee machines, better coffee sources, and AI that makes coffee just the way you like it are also changing the future of this coffee market part.

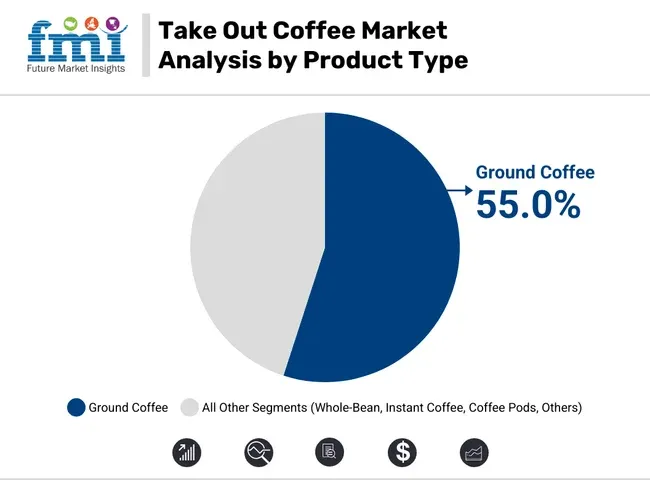

| Product Type | Market Share (2025) |

|---|---|

| Ground Coffee | 55.0% |

Ground Coffee Leads Market Demand for Versatile and Freshly Brewed Coffee

Ground coffee is the favorite because it is easy and good. Many love it in cafes, work places, and at home. People like ground coffee for its full smell, many ways to brew, and always good in many machines.

More people now want special ground coffee, organic, and single-origin kinds. This rise is due to changes in tastes and premium trends. New ideas in green packing, freshness, and smart roasting improve quality and make it last longer.

Challenge

Sustainability Concerns and High Packaging Waste

The disposable coffee cup and packaging waste is one of the biggest problems in the take out coffee market. As millions of single-use cups are thrown away every day, sustainability issues are on the rise.

Also, due to stricter policies by the governments and regulatory bodies on plastic usage, many coffee brands are welcoming recyclable, biodegradable and reusable packaging solutions. But adapting to sustainable substitutes increases costs, which presents an obstacle to small coffee companies and chains.

Opportunity

Expansion of Digital Ordering and Subscription Models

Beyond offering better products, the integration of technology into the coffee industry opens up new avenues for growth. Mobile apps, contactless payments, and AI-powered ordering systems have changed the functionality of the customers. Whereas subscription-based coffee models promise coffee delivery every day or on a weekly basis, both offering convenience and cost savings, these models for coffee consumption are booming.

Moreover, partnerships with food delivery services and innovations in smart coffee vending machines further enhance accessibility and offer a more interactive experience for customers. Tech investments will translate into competitive advantages in this evolving take away coffee paradigm.

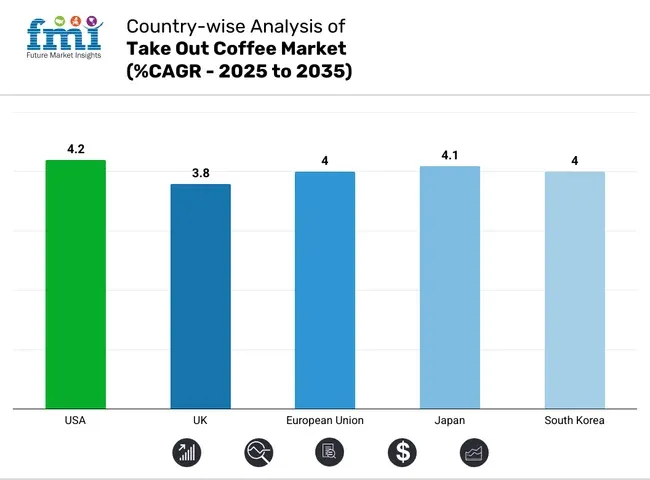

The take out coffee market in the USA is growing. People want ease with their drinks. Fancy and top-quality coffee is becoming more popular. More money is being put into eco-friendly packaging. Groups like the FDA and USDA keep an eye on food safety and labels for coffee.

Popular trends include more people choosing cold brew and ready-to-drink coffee. Plant-based milk is liked by many now. Folks are also spending more on coffee cups that break down and can be composted. Subscription plans and phone app coffee orders are changing how people buy coffee.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The take out coffee market in the UK is seeing a steady rise. This is due to the strong café culture and more people wanting ethically sourced coffee. Also, there is a growing need for dairy-free choices. The UK Food Standards Agency and the British Coffee Association oversee coffee safety, eco-friendly practices, and quality.

Trends in the market show people want good espresso drinks. Oat and almond milk coffee are becoming more popular too. Drive-thru and mobile coffee options are also growing. Plus, the government is pushing for the use of reusable cups and green packaging. This affects buying choices.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The take-out coffee market in the European Union is growing well. This growth is buoyed by a strong café culture, more people wanting special kinds of coffee, and strict EU rules on eco-friendly packaging and carbon emissions. Both the European Food Safety Authority (EFSA) and the Specialty Coffee Association (SCA) set standards for coffee quality, how much caffeine is in it, and how green it is.

Germany, France, and Italy lead the way. They drink a lot of coffee per person, want more organic and fair-trade coffee, and see more specialty coffee shops popping up. Also, EU plans to cut waste, like banning single-use plastic coffee lids, are changing the coffee scene.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

The take-out coffee market in Japan is growing thanks to a high demand for drinks on the go. People love premium and special coffee. Japan's vending machine culture offers fresh coffee too. The Ministry of Health, Labour and Welfare along with the Consumer Affairs Agency keep coffee safe and control labels.

Some key trends are the growing love for canned and bottled ready-to-drink coffee. More people want sugar-free and good-for-you coffee. Smart coffee machines are also catching on. Also, convenience stores are expanding their fresh coffee choices for busy people in a hurry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The take-out coffee market in South Korea is booming. A strong café culture, growing taste for fancy coffee, and Western coffee trends fuel this growth. Food rules and labels are checked by KFDA and MAFRA.

More people want iced and cold brew coffee. Drive-thru and delivery coffee shops are on the rise. There's also more money going into top-notch take-out coffee. Plus, South Korea's mobile pay system makes ordering coffee a breeze.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

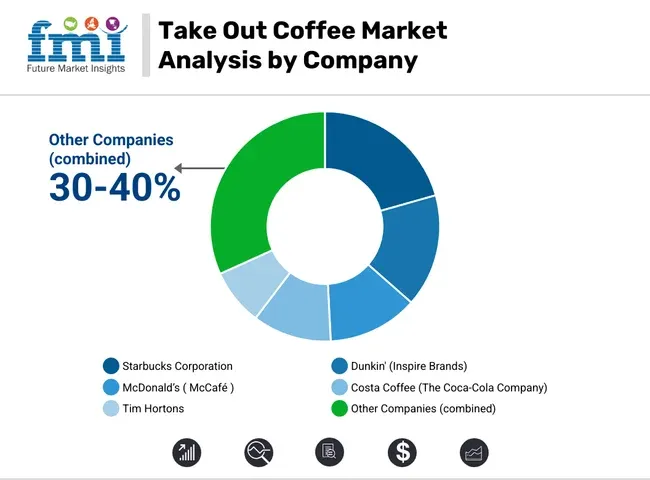

The global take out coffee market is expected to be driven by the growing consumer preference for convenience, on-take experiences, and on-the-go lifestyles. Interest is driven by innovations in sustainable packaging, specialty coffee offerings, and digital ordering platforms. Such companies operating across the agritech space are focusing on improving the quality of coffee beans, increasing drive-thru services, and adopting technology to enable seamless customer experiences.

Starbucks Corporation (22-26%)

A global leader in takeout coffee, leveraging digital innovation and drive-thru expansion to maintain market dominance.

Dunkin' (Inspire Brands) (16-20%)

Focuses on affordability, speed, and new flavor innovations, including cold brews and plant-based alternatives.

McDonald’s (McCafé) (12-16%)

Competes in the value coffee segment with a strong presence in fast food-driven takeout coffee sales.

Costa Coffee (10-14%)

Expanding its presence through Coca-Cola’s distribution network, focusing on premium blends and automation.

Tim Hortons (6-10%)

Known for its strong presence in Canada, growing internationally with a focus on high-quality yet affordable takeout coffee.

Other Key Players (30-40% Combined)

Many local coffee places, quick food spots, and small cafes help make the market grow, offering new ideas for takeaway coffee. These include:

The overall market size for the take out coffee market was USD 43,194 Million in 2025.

The take out coffee market is expected to reach USD 63,937.9 Million in 2035.

Increasing consumer preference for convenience beverages, rising urbanization, growing demand for specialty coffee, expanding coffee shop chains, and the surge in mobile ordering and delivery services will drive market growth.

The USA, China, Japan, Germany, and the UK are key contributors.

The coffee shop and café segment is expected to lead due to the growing popularity of branded coffee chains, increasing customization options, and the rising trend of premium and artisanal coffee.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Number Of Serves) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Number Of Serves) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Number Of Serves) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Number Of Serves) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (Number Of Serves) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Number Of Serves) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (Number Of Serves) Forecast by Distribution Channel, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Number Of Serves) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Western Europe Market Volume (Number Of Serves) Forecast by Distribution Channel, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Number Of Serves) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Eastern Europe Market Volume (Number Of Serves) Forecast by Distribution Channel, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Number Of Serves) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Number Of Serves) Forecast by Distribution Channel, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Number Of Serves) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: East Asia Market Volume (Number Of Serves) Forecast by Distribution Channel, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Number Of Serves) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Number Of Serves) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Number Of Serves) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Number Of Serves) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (Number Of Serves) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Number Of Serves) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Number Of Serves) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (Number Of Serves) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Number Of Serves) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Number Of Serves) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (Number Of Serves) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Number Of Serves) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Number Of Serves) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Western Europe Market Volume (Number Of Serves) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Number Of Serves) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Number Of Serves) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Number Of Serves) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Number Of Serves) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Number Of Serves) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Number Of Serves) Analysis by Distribution Channel, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Number Of Serves) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Number Of Serves) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 121: East Asia Market Volume (Number Of Serves) Analysis by Distribution Channel, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Number Of Serves) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Number Of Serves) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Number Of Serves) Analysis by Distribution Channel, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Takeaway Containers Market Report - Key Trends & Forecast 2025 to 2035

Takeout Dinner Market Trends - Convenience & Gourmet Expansion 2025 to 2035

Intake-Air Temperature Sensor Market

Lunch Takeout Market Analysis by Payment Type, Restaurants Type, Product Type, Nature, Purchase Model and Region Through 2025 to 2035

Water Intake Screens Market

Seafood Takeout Market Size and Share Forecast Outlook 2025 to 2035

Chinese Takeout Market analysis by Product, Restaurant Type, Nature, Purchase Model, Payment Type, and Ownership

Healthy Takeout Market Trends - Convenience & Clean Eating Growth 2025 to 2035

Breakfast Takeout Market Growth – Morning Convenience & Market Expansion 2025 to 2035

Analysis and Growth Projections for Restaurant Takeout Business

Compartment Take-out Container Market

Foam Hinged Take-Out Containers Market

Automotive Intake Manifold Market Growth – Trends & Forecast 2025 to 2035

Automotive Air Intake Manifold Market

Online Food Delivery Market Analysis – Trends & Forecast 2024-2034

Dopamine and Norepinephrine Reuptake Inhibitor Market

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Outbound Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

Outbound Logistics Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Commercial Grills Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA