The Takeout Dinner market has been validated and is anticipated to experience a growth rate of 2025 to 2035. Busy lifestyles, increasing disposable incomes, and the growing availability of a variety of cuisines through online and offline channels are also pushing consumers to go for takeout time and again. Technological improvements in food distribution systems, an increase in ghost kitchens, and innovations in eco-friendly packaging further drive the market.

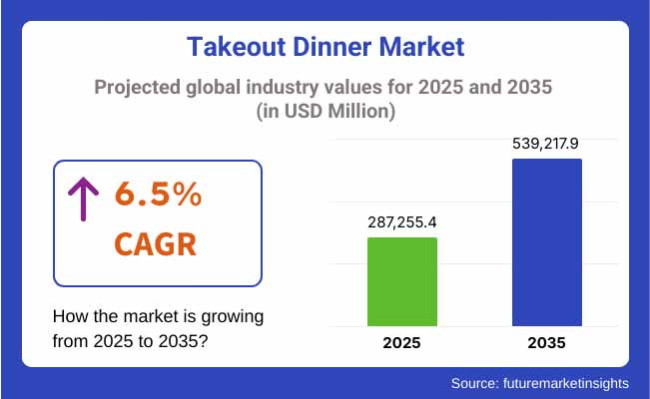

It is estimated that the market will reach USD 539,217.9 Million by 2035, with a CAGR of 6.5% during the forecast period (2025 to 2035), growing from USD 287,255.4 Million in 2025. The surge of third-party food delivery solutions including Uber Eats, Door Dash, and Zomato, along with an increasing embrace of contactless payment and AI-powered ordering systems, is revolutionizing the takeout dinner space.

Takeout dinners are most popular in North America the USA and Canada are the largest markets for online food delivery. High consumer spending on fast food, wide usage of mobile apps, and strong digital infrastructure characterize the region. Many fast-casual and QSR companies (McDonald’s, Domino’s, Chipotle) now offer delivery and takeout, as well as retail delivery-optimizations in-store, as well as AI-enabled personalization and loyalty as mechanisms to increase customer engagement.

The majority of the market is in Europe led by key players in the UK, Germany, and France. This goes with the upturn in the takeaway demand the region is experiencing with flexible work-from-home policies and revamped dining preferences. On the other hand, there is growth in sustainable food packaging, healthy dinners, or plant-based takeout options, and the market is also switching to organic and locally sourced meals.

The fastest growth is expected to come from Asia-Pacific, fuelled by urbanisation, the rising penetration of smartphones, and the growth of food delivery behemoths such as Meituan, Swiggy and GrabFood. China, India, Japan, and South Korea are embracing an accelerating digital transformation that is remaking the foodservice landscape, as AI recommendations and cloud kitchens drive significant market penetration. Also, growth of cheap takeout meal plans and government support for food tech start-ups are driving market growth in the region.

Challenge

Rising Competition and Food Quality Concerns

The increasing availability of Internet food delivery services and pickup stores is intensifying market competition, sparking price wars and squeezing profit margins. And ensuring the quality of food, separation of delivery time, and making certain that food remains fresh have become headaches especially for long-distance deliveries. Already, consumers’ demands for healthier, preservative-free and gourmet takeout are also complicating meal preparation and delivery logistics.

Opportunity

Expansion of AI-Driven Ordering and Sustainable Takeout Solutions

Rising adoption of AI-integrated order customization, robotic kitchen operations, and contactless delivery solutions represents a significant opportunity for the market players. With the trend towards sustainable biodegradable restaurant boxes and other eco-friendly food packaging, as well as robotic food preparation and drone deliveries, the takeaway business is changing. Market Evolution: Companies that prioritize sustainability, AI-driven meal suggestions, and user experience through mobile apps will have the competitive edge.

The takeout dinner market blossomed between 2020 and 2024, thanks to shifts in consumer lifestyles and the proliferation of online food delivery platforms. The lockdowns and social distancing measures caused a spike in demand for restaurant takeout, meal kits and ghost kitchens that target remote workers and busy families.

Food delivery apps like Uber Eats, DoorDash, and Grubhub only widened their audience, providing a wide range of food types from all backgrounds, while also implementing subscription-based processes for loyalty. Increased focus on sustainable packaging and healthier meal options were also reflections of changing consumer preferences.

Yet hurdles to expanding the market also remained, like increasing food costs, delivery fees and worries about packaging waste. Still, investments in automation, cloud kitchens and AI-powered order management systems increased operational efficiency.

From 2025 to 2035, we can expect the takeout dinner market to adapt with individualized meal planning powered by AI, independent delivery networks, and green initiatives that prioritize sustainability.

Intelligent, AI-driven recommendations will suggest meals tailored to users' tastes, dietary restrictions, and previous purchases, improving user satisfaction and fostering loyalty. Delivery by robots and drones will become the norm, and human couriers will be deployed only if absolutely necessary, eliminating bottlenecks in the last mile of distribution.

Sustainability continues to be a priority, making compostable, edible and biodegradable packaging solutions popular. Restaurants will adopt zero-waste practices like reusable takeout containers and rewards for eco-conscious behaviour. Smart kitchens won’t just change the way we cook, they will disrupt meal preparation altogether for faster, fresher, and more affordable takeout. Cloud kitchens will be the new normal, catering to most populated high-demand areas with little to no overhead cost.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Technology Adoption | AI-driven food delivery apps, online ordering platforms. |

| Delivery Innovations | Third-party delivery services and restaurant partnerships. |

| Sustainability Initiatives | Shift to biodegradable and compostable packaging. |

| Consumer Preferences | Rise in meal kits, healthy takeout, and contactless delivery. |

| Operational Efficiency | Expansion of ghost kitchens and third-party logistics networks. |

| Market Growth Drivers | Pandemic-driven demand, convenience, and work-from-home trends. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology Adoption | AI-powered meal customization, automated kitchens, and predictive order management. |

| Delivery Innovations | Drone, robotic, and autonomous vehicle-based meal deliveries. |

| Sustainability Initiatives | Adoption of edible packaging, zero-waste initiatives, and reusable containers. |

| Consumer Preferences | AI-driven personalized meal recommendations and nutrition-based ordering. |

| Operational Efficiency | Fully automated, AI-driven kitchen operations and demand forecasting. |

| Market Growth Drivers | Sustainability regulations, AI advancements, and autonomous delivery innovation. |

In the USA, pickup or takeout dinner business is thriving amid changing consumer lifestyles, a growing appetite for convenience and the proliferation of food delivery services. Third-party platforms like Uber Eats, DoorDash and Grubhub have radically transformed the food delivery industry, making takeout meals more accessible than ever.

The demand of restaurant-quality food at home and busy working hours have equally been common factors which has led to the demand. Some restaurants are also investing in ghost kitchens and other digital ordering anecdotes to make things more efficient and better meet the needs of consumers. In addition to this, the increasing trend for eco-friendly packaging and consumption of healthy meal options is substantially impacting the market outlook.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.3% |

Rising urbanization, increasing disposable income and strong influence of digital food delivery platforms are expanding the United Kingdom takeout dinner market. Consumer eating habits have shifted closer to convenience-based meals, and with it, demand has increased for restaurant-prepared takeout dinners.

Major food delivery services such as Deliveroo, Just Eat and Uber Eats continue to dominate growth by providing greater convenience for customers. Meanwhile, a growing demand for plant-based and healthier meal options are pushing restaurants to expand their menus. The rising interest in sustainability has also led many food businesses to invest in biodegradable packaging and better reduce food waste.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.7% |

With rising digitalization trends and changing consumer behaviours, the market for takeout dinners in the EU is growing rapidly due to areas in European cities growing more populated. Germany, France and Italy are the countries contributing the limiting share in the market, owing to the increasing number of food delivery networks and the growing adoption of online meal-ordering platforms.

The meal subscription services and chef-prepared takeout options are also making their marks on the market. A growing emphasis on sustainability practices like less plastic waste and local sourcing are also shaping forces in the industry.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.6% |

Back-growing takeout dinner market in Japan due to the nation’s long-standing concept of convenience food (for example fast food), high-speed served food, and top developed enterprise of food delivery. This has led to an increased demand for bento boxes, sushi, and ramen takeout, which is especially true in urban environments where hectic lifestyles create the need for quick meal options.

The continued growth of contactless payment and AI powered food preparation technologies are making the market more efficient. Additionally, with Japan emphasizing high-quality and fresh ingredients along with a well-packaged meal ensures consumer satisfaction, it continues to give the industry a boost.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The South Korean takeout dinner market is booming, fuelled by the rise of online food delivery platforms and changing consumer eating habits. The application of app-based and delivery services has grown since the country has a good food culture, and the smartphone penetration rate is also high in South Korea Dishes like the Korean-style fried chicken, bibimbap and tteokbokki are gaining traction among local and international consumers, including delivery orders. The growing influence of sustainable-oriented practices such as eco-conscious packaging and organic foods is also impacting market changes.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

| By Nature | Market Share (2025) |

|---|---|

| Non-Vegetarian | 58.3% |

The market is dominated by non-vegetarian takeout dinners due to the increasing consumer demand for protein-rich food, which includes poultry, beef, seafood, and pork. From fast-food joints to casual dining restaurants to even fine-dining establishments, the non-vegetarian takeout market is incredibly lucrative and offers something for single diners and families alike. This demand for non-vegetarian takeout is especially high among urban consumers leading busy lifestyles who want quick, high-protein meal solutions without sacrificing taste or nutritional value.

Thanks to the highly varied non-vegetarian options in restaurants Chinese, Italian, Indian, Mexican, etc. it was further extended. The market is driven by high-demand items, including grilled chicken, seafood platters, sushi, and gourmet burgers. The meal delivery platforms and takeout services come with extremely simple mobile applications which enable inhabitants to customize their non-vegetarian meals as per requirements of diet and size.

Health-conscious shoppers also influence demand for lean meats and sustainable seafood, persuading restaurants to include organic, antibiotic-free and ethically sourced meat options on takeout menus. In culinary trends of high-protein, low-carb diets, non-vegetarian takeout meals are slowly becoming popular choices for consumers looking for a balanced diet along with the comfort of doorstep delivery.

| By Payment Type | Market Share (2025) |

|---|---|

| Digital Wallets | 47.6% |

For takeout dinners, digital wallets top the list of the payment methods used by consumers to pay for their food, giving them a fast, internet-enabled, secure way to purchase meals. As a result of easy-to-use smartphone and mobile payment application, digital wallets like Apple Pay, Google Pay, PayPal, and Venmo are now the more used customer's choice of ordering takeout meals. These next-gen payment solutions allow you to pay without any cash or card placement, which helps not just make the checkout process quicker but also reduces mistakes.

This serves as a key factor facilitating the market growth of online food delivery market is the integration of digital wallets with online food delivery platforms which allow customers to place their order and pay just in few clicks. With exclusive discounts, cashback offers, and loyalty points, restaurants and other food service providers also promote the use of digital wallets, encouraging customers to use this payment method.

Security remains a significant benefit of digital wallets; encryption and biometric authentication features protect consumers from fraud and unauthorized transactions. Similarly, the expanded acceptance of contactless payment options as a solution to hygiene and cleanliness in the face of the pandemic has prompted more takeout restaurants to adopt digital wallet payments. With consumers wanting more convenience and safety in their transactions, we anticipate a significant increase in the use of digital wallets in the takeout dinner market.

Digital ordering, fast-food restaurants, and third-party delivery services have changed the way people dine out, contributing to the growth of the Takeout Dinner Market. A disruptive force in this field, businesses concentrate on the beaming of apps, intelligent recommendations and upgraded logistics for superior efficiency and speed. Market trends are also driven by the demand for healthy meal options and sustainable packaging.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Grubhub | 20-24% |

| Domino’s | 18-22% |

| Foodpanda | 15-19% |

| Takeaway.com | 10-14% |

| Other Companies (combined) | 27-33% |

| Company Name | Key Offerings/Activities |

|---|---|

| Grubhub | In 2024 , expanded AI-powered personalized meal recommendations, increasing customer retention. |

| Domino’s | In 2025 , introduced drone-based food delivery to enhance speed and convenience. |

| Foodpanda | In 2024 , launched an eco-friendly packaging initiative to promote sustainable takeout. |

| Takeaway.com | In 2025 , enhanced real-time tracking and expanded partnerships with local cloud kitchens. |

Key Company Insights

Grubhub (20-24%)

Grubhub leads with a strong digital presence, leveraging AI and machine learning to personalize takeout recommendations and streamline delivery.

Domino’s (18-22%)

Domino’s continues to innovate in delivery logistics, utilizing advanced tracking, autonomous vehicles, and drone deliveries to ensure faster service.

Foodpanda (15-19%)

Foodpanda differentiates itself with a focus on sustainability, incorporating biodegradable packaging and carbon-neutral delivery options.

Takeaway.com (10-14%)

Takeaway.com strengthens its market position by expanding cloud kitchen partnerships, improving delivery efficiency in high-demand regions.

Other Key Players (27-33% Combined)

Several companies contribute to the market with unique takeout and delivery solutions:

The overall market size for the Takeout Dinner Market was USD 287,255.4 Million in 2025.

The Takeout Dinner Market is expected to reach USD 539,217.9 Million in 2035.

The demand is driven by increasing consumer preference for convenience foods, rapid growth in online food delivery services, expansion of cloud kitchens, rising disposable incomes, and growing demand for diverse cuisine options in urban areas.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The Non-Vegetarian segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Number Of Serves) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (Number Of Serves) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Payment Type, 2018 to 2033

Table 6: Global Market Volume (Number Of Serves) Forecast by Payment Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Cuisine Type, 2018 to 2033

Table 8: Global Market Volume (Number Of Serves) Forecast by Cuisine Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 10: Global Market Volume (Number Of Serves) Forecast by Business Type, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Purchase Model, 2018 to 2033

Table 12: Global Market Volume (Number Of Serves) Forecast by Purchase Model, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: North America Market Volume (Number Of Serves) Forecast by Nature, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Payment Type, 2018 to 2033

Table 18: North America Market Volume (Number Of Serves) Forecast by Payment Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Cuisine Type, 2018 to 2033

Table 20: North America Market Volume (Number Of Serves) Forecast by Cuisine Type, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 22: North America Market Volume (Number Of Serves) Forecast by Business Type, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Purchase Model, 2018 to 2033

Table 24: North America Market Volume (Number Of Serves) Forecast by Purchase Model, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Latin America Market Volume (Number Of Serves) Forecast by Nature, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Payment Type, 2018 to 2033

Table 30: Latin America Market Volume (Number Of Serves) Forecast by Payment Type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Cuisine Type, 2018 to 2033

Table 32: Latin America Market Volume (Number Of Serves) Forecast by Cuisine Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 34: Latin America Market Volume (Number Of Serves) Forecast by Business Type, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Purchase Model, 2018 to 2033

Table 36: Latin America Market Volume (Number Of Serves) Forecast by Purchase Model, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 40: Western Europe Market Volume (Number Of Serves) Forecast by Nature, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Payment Type, 2018 to 2033

Table 42: Western Europe Market Volume (Number Of Serves) Forecast by Payment Type, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Cuisine Type, 2018 to 2033

Table 44: Western Europe Market Volume (Number Of Serves) Forecast by Cuisine Type, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 46: Western Europe Market Volume (Number Of Serves) Forecast by Business Type, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Purchase Model, 2018 to 2033

Table 48: Western Europe Market Volume (Number Of Serves) Forecast by Purchase Model, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 52: Eastern Europe Market Volume (Number Of Serves) Forecast by Nature, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Payment Type, 2018 to 2033

Table 54: Eastern Europe Market Volume (Number Of Serves) Forecast by Payment Type, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Cuisine Type, 2018 to 2033

Table 56: Eastern Europe Market Volume (Number Of Serves) Forecast by Cuisine Type, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 58: Eastern Europe Market Volume (Number Of Serves) Forecast by Business Type, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Purchase Model, 2018 to 2033

Table 60: Eastern Europe Market Volume (Number Of Serves) Forecast by Purchase Model, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Number Of Serves) Forecast by Nature, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Payment Type, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Number Of Serves) Forecast by Payment Type, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Cuisine Type, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Number Of Serves) Forecast by Cuisine Type, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Number Of Serves) Forecast by Business Type, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Purchase Model, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Number Of Serves) Forecast by Purchase Model, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 76: East Asia Market Volume (Number Of Serves) Forecast by Nature, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Payment Type, 2018 to 2033

Table 78: East Asia Market Volume (Number Of Serves) Forecast by Payment Type, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Cuisine Type, 2018 to 2033

Table 80: East Asia Market Volume (Number Of Serves) Forecast by Cuisine Type, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 82: East Asia Market Volume (Number Of Serves) Forecast by Business Type, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Purchase Model, 2018 to 2033

Table 84: East Asia Market Volume (Number Of Serves) Forecast by Purchase Model, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Number Of Serves) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Number Of Serves) Forecast by Nature, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Payment Type, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Number Of Serves) Forecast by Payment Type, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Cuisine Type, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Number Of Serves) Forecast by Cuisine Type, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Number Of Serves) Forecast by Business Type, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Purchase Model, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Number Of Serves) Forecast by Purchase Model, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Payment Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Cuisine Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Purchase Model, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Number Of Serve) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Volume (Number Of Serve) Analysis by Nature, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Payment Type, 2018 to 2033

Figure 16: Global Market Volume (Number Of Serve) Analysis by Payment Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Payment Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Payment Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Cuisine Type, 2018 to 2033

Figure 20: Global Market Volume (Number Of Serve) Analysis by Cuisine Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Cuisine Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Cuisine Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 24: Global Market Volume (Number Of Serve) Analysis by Business Type, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Purchase Model, 2018 to 2033

Figure 28: Global Market Volume (Number Of Serve) Analysis by Purchase Model, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Purchase Model, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Purchase Model, 2023 to 2033

Figure 31: Global Market Attractiveness by Nature, 2023 to 2033

Figure 32: Global Market Attractiveness by Payment Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Cuisine Type, 2023 to 2033

Figure 34: Global Market Attractiveness by Business Type, 2023 to 2033

Figure 35: Global Market Attractiveness by Purchase Model, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Payment Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Cuisine Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Purchase Model, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Number Of Serve) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 48: North America Market Volume (Number Of Serve) Analysis by Nature, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Payment Type, 2018 to 2033

Figure 52: North America Market Volume (Number Of Serve) Analysis by Payment Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Payment Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Payment Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Cuisine Type, 2018 to 2033

Figure 56: North America Market Volume (Number Of Serve) Analysis by Cuisine Type, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Cuisine Type, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Cuisine Type, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 60: North America Market Volume (Number Of Serve) Analysis by Business Type, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Purchase Model, 2018 to 2033

Figure 64: North America Market Volume (Number Of Serve) Analysis by Purchase Model, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Purchase Model, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Purchase Model, 2023 to 2033

Figure 67: North America Market Attractiveness by Nature, 2023 to 2033

Figure 68: North America Market Attractiveness by Payment Type, 2023 to 2033

Figure 69: North America Market Attractiveness by Cuisine Type, 2023 to 2033

Figure 70: North America Market Attractiveness by Business Type, 2023 to 2033

Figure 71: North America Market Attractiveness by Purchase Model, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Payment Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Cuisine Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Purchase Model, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Number Of Serve) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 84: Latin America Market Volume (Number Of Serve) Analysis by Nature, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Payment Type, 2018 to 2033

Figure 88: Latin America Market Volume (Number Of Serve) Analysis by Payment Type, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Payment Type, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Payment Type, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Cuisine Type, 2018 to 2033

Figure 92: Latin America Market Volume (Number Of Serve) Analysis by Cuisine Type, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Cuisine Type, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Cuisine Type, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 96: Latin America Market Volume (Number Of Serve) Analysis by Business Type, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Purchase Model, 2018 to 2033

Figure 100: Latin America Market Volume (Number Of Serve) Analysis by Purchase Model, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Purchase Model, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Purchase Model, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Payment Type, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Cuisine Type, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Business Type, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Purchase Model, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Payment Type, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Cuisine Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Purchase Model, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Number Of Serve) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 120: Western Europe Market Volume (Number Of Serve) Analysis by Nature, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Payment Type, 2018 to 2033

Figure 124: Western Europe Market Volume (Number Of Serve) Analysis by Payment Type, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Payment Type, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Payment Type, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Cuisine Type, 2018 to 2033

Figure 128: Western Europe Market Volume (Number Of Serve) Analysis by Cuisine Type, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Cuisine Type, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Cuisine Type, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 132: Western Europe Market Volume (Number Of Serve) Analysis by Business Type, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Purchase Model, 2018 to 2033

Figure 136: Western Europe Market Volume (Number Of Serve) Analysis by Purchase Model, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Purchase Model, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Purchase Model, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Payment Type, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Cuisine Type, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Business Type, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Purchase Model, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Payment Type, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Cuisine Type, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Purchase Model, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Number Of Serve) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Number Of Serve) Analysis by Nature, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Payment Type, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Number Of Serve) Analysis by Payment Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Payment Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Payment Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Cuisine Type, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Number Of Serve) Analysis by Cuisine Type, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Cuisine Type, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Cuisine Type, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Number Of Serve) Analysis by Business Type, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Purchase Model, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Number Of Serve) Analysis by Purchase Model, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Purchase Model, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Purchase Model, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Payment Type, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Cuisine Type, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Business Type, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Purchase Model, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Payment Type, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Cuisine Type, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Purchase Model, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Number Of Serve) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Number Of Serve) Analysis by Nature, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Payment Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Number Of Serve) Analysis by Payment Type, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Payment Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Payment Type, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Cuisine Type, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Number Of Serve) Analysis by Cuisine Type, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Cuisine Type, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Cuisine Type, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Number Of Serve) Analysis by Business Type, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Purchase Model, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Number Of Serve) Analysis by Purchase Model, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Purchase Model, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Purchase Model, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Payment Type, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Cuisine Type, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Business Type, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Purchase Model, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Payment Type, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Cuisine Type, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Purchase Model, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Number Of Serve) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 228: East Asia Market Volume (Number Of Serve) Analysis by Nature, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Payment Type, 2018 to 2033

Figure 232: East Asia Market Volume (Number Of Serve) Analysis by Payment Type, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Payment Type, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Payment Type, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Cuisine Type, 2018 to 2033

Figure 236: East Asia Market Volume (Number Of Serve) Analysis by Cuisine Type, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Cuisine Type, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Cuisine Type, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 240: East Asia Market Volume (Number Of Serve) Analysis by Business Type, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Purchase Model, 2018 to 2033

Figure 244: East Asia Market Volume (Number Of Serve) Analysis by Purchase Model, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Purchase Model, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Purchase Model, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Payment Type, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Cuisine Type, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Business Type, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Purchase Model, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Payment Type, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Cuisine Type, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Purchase Model, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Number Of Serve) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Number Of Serve) Analysis by Nature, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Payment Type, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Number Of Serve) Analysis by Payment Type, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Payment Type, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Payment Type, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Cuisine Type, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Number Of Serve) Analysis by Cuisine Type, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Cuisine Type, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Cuisine Type, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Number Of Serve) Analysis by Business Type, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Purchase Model, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Number Of Serve) Analysis by Purchase Model, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Purchase Model, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Purchase Model, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Payment Type, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Cuisine Type, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Business Type, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Purchase Model, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lunch Takeout Market Analysis by Payment Type, Restaurants Type, Product Type, Nature, Purchase Model and Region Through 2025 to 2035

Seafood Takeout Market Size and Share Forecast Outlook 2025 to 2035

Chinese Takeout Market analysis by Product, Restaurant Type, Nature, Purchase Model, Payment Type, and Ownership

Healthy Takeout Market Trends - Convenience & Clean Eating Growth 2025 to 2035

Breakfast Takeout Market Growth – Morning Convenience & Market Expansion 2025 to 2035

Analysis and Growth Projections for Restaurant Takeout Business

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA