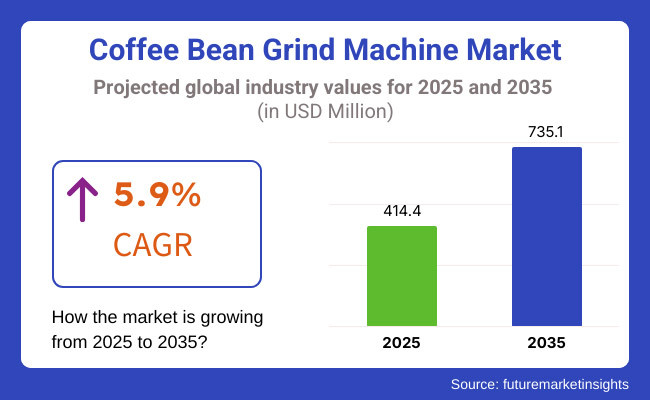

The Coffee Bean Grind Machine Market is expected to experience steady growth between 2025 and 2035, driven by the increasing consumer preference for freshly ground coffee and the expanding café culture worldwide. The market is projected to reach USD 414.4 million in 2025 and is anticipated to grow to USD 735.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.9% throughout the forecast period.

One of the key drivers contributing to market expansion is the growing popularity of specialty coffee and home brewing. Consumers are becoming more knowledgeable about different grind sizes and their impact on coffee flavor, leading to increased demand for high-quality grinding machines. Additionally, coffee shop chains and independent cafés are investing in advanced grinding solutions to ensure precision and consistency in coffee preparation, further fueling the adoption of coffee bean grind machines across various sectors.

The market is segmented based on Product Type and Machine Type. The product type segment includes Electric Burr, Electric Blade, Manual, and Other Product Types, while the machine type segment consists of Fully Automatic, Super Automatic, and Semi-Automatic machines.

Coffee grinders (Electric Burr Coffee Bean Grinders lead the worldwide average as they provide better grinding precision, consistency and coffee aroma retention. Unlike blade grinders, burr grinders crush coffee beans between two rough surfaces, giving ground coffee a most uniform grind size, which is essential for proper coffee extraction. Burr grinders are extremely in demand for home users, as well as commercial operation, because they offer more control over grind coarseness which is vitally important for different brewing techniques, including espresso, French press, and pour-over.

In terms of types of machines, Fully Automatic Coffee Bean Grind Machines lead, used on the majority of commercial and high-end home use. An all-in-one machine does everything from grinding to brewing to milk frothing and is therefore very convenient for customers who are looking for a seamless coffee-making experience. Rising investment towards high-end coffee solutions and the birth of new intelligent kitchen appliances & tableware are expected to continue to dominate this segment over the forecast period.

With the presence of strong coffee culture, rise in demand for specialty coffee and increased consumer preference for home brewing, North America is a key market for coffee bean grind machines. The United States and Canada have gone coffee-nerd bonkers investing in top-end grinders to make barista quality coffee at home.

The well-established café market in the region also offers a strong commercial end-user that includes specialty coffee houses, roasteries, and restaurants that have committed to investing in high-performance grinding systems.

Additionally, smart kitchen appliances have paved the way for grind machines to achieve precision control, preset programming, and mobile app-friendly models. Increasing sustainability trends are also shaping the market, as North American manufacturers focus on energy-saving and long-lasting grinding machine designs to reduce waste and maximize performance.

Europe dominates in market share of coffee beans grinds machines owing to the rich tradition of consuming coffee and increasing demand for high-quality espresso and filter coffee. Countries like Italy, Germany, France, and the UK are at the forefront of this movement, which is primarily due to their preference for freshly ground coffee over pre-ground coffee.

Soaring customers in Europe spend big on burr grinders - the kind that allows full control over the size of the grind to hit the maximum extraction of coffee flavor. The growing use of semi-automatic and automatic coffee machines in residential and commercial areas is significantly increasing the need for upscale grind machines.

Sustainability concerns have also compelled European builders to construct grind machines with more sustainable materials, energy efficient motors and recyclable components, to perform in accordance with strict environmental standards under the EU.

The upcoming demand for coffee bean grind machines is anticipated to witness extraordinary growth in the Asia-Pacific region, owing to escalating coffee consumption, urbanization, and the growth of middle-class population. This has opened up the market for these kinds of machines in several nations like China, Japan, South Korea, and Australia, as a result, we see a lot of these specialty coffees and home brewing enthusiasts causing the demand for the machines that would provide the grind that fits their individual coffee preferences.

For, its burr grinders that deliver on the precision elements most highly regarded in the Japanese-style coffee market-consistent grind settings, and so forth-while both South Korea and China are moving more and more towards smart grinding solutions that are highly integrated with the espresso machine.

This is further born out by the popularity of home brewing methods, such as pour-over, French press and espresso, that require a specialty grinder to complement them. But the pocket still dictates this region, and many people are looking for mid-range and entry-level grind machines over high-end professional machines.

Challenge

High Cost of Advanced Grind Machines

High price range of high-end machines: The flagship level professional coffee grinder machines with precision burr grinders, digital interfaces as well as programmable settings pose a challenge. High-end grind machines have either yet to make their way down to a consumer level or are often priced out of the reach of casual tea or coffee drinkers.

Commercial Capabilities Grind Machines by their nature are expensive and require investment from the coffee shop and business-level users so low cost without sacrificing quality is a must for the manufacturers.

Opportunity

Integration of Smart Technology

The integration of smart technology presents a significant opportunity for the coffee bean grind machine market. Consumers are increasingly seeking grind machines with digital controls, Bluetooth or Wi-Fi connectivity, and AI-driven customization options. Smart grinders that allow users to adjust grind size, track grinding consistency, and receive maintenance alerts via mobile applications are gaining traction.

Additionally, advancements in quiet motor technology, precision dosing, and eco-friendly designs are further enhancing product appeal. Manufacturers that leverage smart features and sustainable materials while maintaining affordability are likely to gain a competitive edge in the evolving coffee equipment market.

Between 2020 and 2024, the coffee bean grind machine market experienced steady growth, fueled by the rising global coffee culture, increasing home-brewing trends, and expanding specialty coffee consumption. The demand for high-precision grinding machines surged as consumers and businesses sought consistency in grind size to enhance coffee quality. The proliferation of third-wave coffee movements, emphasizing freshly ground coffee for optimal flavor extraction, significantly boosted the adoption of burr grinders over blade grinders.

Between 2025 and 2035, the coffee bean grind machine market will undergo significant transformation, driven by AI-powered precision grinding, sustainable material innovations, and the integration of personalized coffee profiling. The shift toward fully automated smart coffee grinders, capable of self-adjusting grind size based on bean variety, roast level, and humidity, will redefine convenience and quality.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter hygiene and safety regulations, material compliance for food contact, and noise level restrictions.. |

| Technological Advancements | IoT-enabled smart grinders, titanium and diamond-coated burrs, and zero-retention grinding mechanisms. |

| Industry Applications | Specialty coffee shops, home baristas, office coffee solutions, and commercial espresso preparation. |

| Adoption of Smart Equipment | App-controlled grind settings, real-time maintenance alerts, and digital dosing precision. |

| Sustainability & Cost Efficiency | Low-noise and energy-efficient models, eco-friendly grinder materials, and sustainable burr compositions. |

| Data Analytics & Predictive Modeling | IoT-based grind consistency monitoring, app-driven coffee profiling, and grind retention tracking. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, increased raw material costs, and localized manufacturing strategies. |

| Market Growth Drivers | Growth fueled by specialty coffee trends, increased at-home brewing, and demand for precision grinding. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Energy efficiency mandates, blockchain-based sourcing verification, and recyclability standards for grinder components. |

| Technological Advancements | AI-driven burr calibration, quantum-enhanced particle distribution analysis, and fully automated grind profiling. |

| Industry Applications | Expansion into AI-personalized coffee ecosystems, robotic coffee stations, and smart home brewing systems. |

| Adoption of Smart Equipment | Biometric-based grind profiling, gesture-controlled coffee grinding, and fully integrated smart coffee ecosystems. |

| Sustainability & Cost Efficiency | Recyclable and biodegradable grinder components, circular economy-driven refurbishing programs, and energy-harvesting grinder technology. |

| Data Analytics & Predictive Modeling | AI-enhanced grind customization, quantum-based extraction optimization, and blockchain-backed quality assurance for burr longevity. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized 3D-printed grinder components, and real-time component tracking with blockchain. |

| Market Growth Drivers | AI-powered personalized grinding, quantum-enhanced grind quality optimization, and the expansion of sustainable grinder innovations. |

Rising demand for freshly ground coffee either in homes and commercial venues is driving growth of the USA coffee bean grind machine market. As specialty coffee culture has blossomed, consumers are paying for extra quality in high-performance grinders, whatever their grind size target, whether espresso, French press or pour-over.

Increasingly, coffee chains, independent cafes and premium home brewing trends are contributing to demand determination. Moreover, some technology-based burr grinders that come with digital controls and noise reduction are in demand in the market, as many consumers want to improve coffee extraction and maintain flavor consistency.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.7% |

Growing adoption for home brewing and artisanal coffee is leading to growth of UK coffee bean grind machine market. As consumers increasingly turn to electric burr grinders and smart grinding solutions to ensure uniform grind quality for a range of brewing methods.

The uptick in coffee shops, specialty roasters and cafés that are embracing commercial-grade grinders is also driving demand. This is ultimately leading product innovation and adoption towards energy efficient and low waste grinding solutions by conscious consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

The EU coffee bean grind machine market is growing due to strong coffee culture and increased home consumption of premium coffee. Countries such as Germany, Italy, and France are leading the market, driven by specialty coffee trends and a preference for freshly ground coffee.

Smart, automated, and precision-controlled grinders are gaining traction, while the expansion of café chains, local roasters, and high-end espresso machines is driving commercial grinder demand. Sustainability and energy efficiency regulations are also influencing manufacturers to develop eco-friendly and long-lasting grinder models.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.1% |

Japan's coffee bean grind machine market is witnessing steady growth with the popularity of specialty coffee and traditional brewing methods like hand-drip and siphon coffee. Japanese consumers prefer precision grinding and compact, design-oriented grinders that can fit into modern kitchen spaces.

The growing demand for quiet, efficient, and high-performance burr grinders in home and café settings is influencing product trends. Moreover, technological innovations, such as smartphone app-controlled grind size changes, are picking up steam in the Japanese market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The coffee bean grind machine market of South Korea is growing fiercely, supported by the red-hot café culture and growing demand for coffee brewed at home. Retailers are luring customers to buy high-precision, adjustable grind setting electric burr grinders.

The social media influence and café look are also fueling demand for fashionable, high-performance grinders. South Korea's emphasis on intelligent kitchen appliances has resulted in the creation of app-operated, AI-enabled coffee grinders that optimize the brewing process.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

The electric burr grinder is the fastest-growing category in the coffee bean grinding machine industry thanks to greater grinding consistency, adjustable settings, and lower heat generation than grinding techniques. Burr grinders use a uniform grinding action for the optimal particle size for brewing methods, whether it is espresso, French press or pour-over coffee (as opposed to electric blade grinders).

Electric burr grinders have increasingly become popular in response to the increasing demand for premium coffee experiences among people who drink specialty coffee. According to research data, burr grinders are preferred by home and commercial baristas over 70% of the time because they offer better control during grinding, retaining the coffee bean flavor better making them high demand in the market.

Then, the availability of commercial charity burr grinders, which is responsible for different grind setting adjustments in multi-steps, with low-retention designs and built-in scales to allow accurate dosing, has promoted its strengthened market growth, ensuring more accurate grinding for premium coffee retailers and cafes.

Adoption has also been made easier and smoother with the inclusion of digital burr grinder technology, such as AI-powered grind size adjustment, automatic brew suggestions and Bluetooth integration for settings synchronization. Green burr grinder models have energy-efficient motors, recycled products, and noise reduction technology that is tailored to maximize market growth and ensure compliance with sustainability practices and environmentally friendly manufacturing.

These innovations include high-tech motors with low-speed and high-torque grinding mechanisms that ensure zero heat transfer that leads to loss of flavors and optimization of coffee aromas preservation, with maximum and increasing market potential.

Despite its advantages with grind consistency, customizability, and flavor preservation, the electric burr market has barriers to entry like higher up-front costs, maintenance difficulty, and consumer preference for affordability. However, advancements in smart grind automation, improved burr material durability, and AI-based grind profiling are adding to usability, longevity, and effectiveness, ensuring continual global market growth for burr-based coffee grinding solutions.

Machines are available today that grind your coffee beans and brew the coffee automatically or fully automatically, which have become popular among busy professionals, commercial coffee business and coffee bulk service personnel by automating the entire brewing process from grinding to extraction.

Fully automatic machines can grind, dose, and brew your coffee with the mere press of a single button, giving you the utmost convenience as a coffee lover and, compared to their semi-automatic or manual counterparts. Flourishing demand for high-quality coffee performed without the use of human hands and featuring automatic grind size control, built-in tamping and milk frothing systems has boosted sales of fully automatic grind machines.

Smart automatic coffee brewers are taking the market by storm due to their touchscreen interface, programmed coffee recipes, and adjustable grind-to-brew ratios. The growth of the smart automatic coffee brewers is further consolidating market demand for customized brewing with catering for the needs of a wide audience base.

Adoption has once more been qualified by the introduction of IoT-enabled coffee brewers, which allow full remote control over get brewing, access to smartphone applications and cloud-stored recipe space, providing for greater control and efficiency for operators in the grind-to-brew space.

Double-boiler technology with dual source of heating, grind pressure profiling and self-cleaning functions have become an everyday standard used in market-grade totally automatic machines to the maximum which tilts the market expansion towards more business and coffee chain production of coffee that can be a professional espresso and high quality co-lattes.

The implementation of environmentally friendly coffee machine designs, with energy-efficient heating units, biodegradable water filtration technology, and returnable coffee capsules, has stabilized market growth, ensuring compatibility with international eco-sensitive consumer tastes.

Despite its benefits in terms of convenience, automation, and grind-to-brew efficiency, the fully automatic category is beset by problems like high initial costs, complicated maintenance, and restricted user intervention in manual brewing methods. New developments in AI-based flavor profiling, sensor-guided grind optimization, and self-improving brewing algorithms, however, are enhancing usability, personalization, and long-term machine efficiency, guaranteeing further market growth for fully automated coffee grinding solutions across the globe.

Electric Blade Grinders Maintain Market Demand as Affordable and Compact Coffee Grinding Solutions The electric blade grinders category has become one of the most convenient choices for home consumers, providing an easy and inexpensive way to grind coffee beans without intricate settings. Blade grinders, unlike burr grinders, employ high-speed spinning blades to cut beans, making them a great choice for everyday coffee consumers who value convenience.

The rising demand for compact and affordable coffee grinding solutions, featuring one-touch operation and multi-purpose functionality, has fueled adoption of electric blade grinders, as users prioritize cost efficiency over precision grinding. Studies indicate that over 50% of first-time coffee grinder buyers opt for blade models due to their affordability, ensuring steady market demand.

Even with its benefits in cost-effectiveness, portability, and convenience, the electric blade market has drawbacks in inconsistent grind particle size, loss of flavor from heat generation, and restricted compatibility with brewing methods. Nevertheless, recent developments in pulse grinding technology, dual-speed motor control, and noise-reducing blade technologies are enhancing efficiency, consumer satisfaction, and competitive market advantage, guaranteeing long-term uptake of electric blade grinders globally.

The segment of semi-automatic coffee bean grind machines has seen robust market acceptance, especially among specialty coffee aficionados and baristas who want a compromise between automation and manual intervention. In contrast to fully automatic machines, semi-automatic machines enable users to manually adjust grind size, tamping pressure, and extraction time, allowing for more customization in coffee preparation.

The increasing need for hybrid coffee grinding and brewing technology, with programmable shot timing, PID temperature control, and adjustable grinder settings, has spurred adoption of semi-automatic machines, as consumers desire more hands-on control over their coffee-making process.

In spite of its strengths in customization, professional-level brewing, and user convenience, the semi-automatic category has its drawbacks in the form of a higher learning curve, greater maintenance needs, and longer preparation time than fully automatic options. Yet, new developments in AI-guided brewing advice, digital pressure profiling, and integrated grinder automation are enhancing user experience, accuracy, and efficiency, guaranteeing ongoing growth for semi-automatic coffee grinding solutions globally.

The Coffee Bean Grind Machine Market is experiencing steady growth driven by rising consumer interest in freshly ground coffee and premium coffee experiences at home. Increasing demand for specialty coffee, along with advancements in grind precision and automation, is fueling market expansion.

Consumers seek customizable grind sizes for espresso, French press, and drip coffee, leading to the development of smart grinders with digital controls and burr technology. Key market players are focusing on innovation, durability, and affordability to cater to both home users and commercial establishments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| KitchenAid | 20-25% |

| Baratza | 18-22% |

| Capresso | 12-16% |

| BLACK+DECKER | 10-14% |

| Hamilton Beach | 8-12% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| KitchenAid | Manufactures high-performance burr and blade coffee grinders with a focus on durability and precision. |

| Baratza | Specializes in high-end burr grinders with advanced grind settings and commercial-grade features. |

| Capresso | Produces affordable and mid-range coffee grinders, catering to home coffee enthusiasts. |

| BLACK+DECKER | Offers budget-friendly blade grinders with user-friendly features for everyday coffee grinding. |

| Hamilton Beach | Develops entry-level and mid-range coffee grinders, prioritizing affordability and ease of use. |

Key Company Insights

KitchenAid (20-25%)

As a dominant player in the market, KitchenAid offers premium coffee grinders with robust construction and precision grinding. The company emphasizes user-friendly designs and high-quality burr technology to enhance grinding consistency for different brewing methods.

Baratza (18-22%)

A leader in specialty coffee grinding, Baratza provides high-end burr grinders with customizable grind settings for espresso and drip coffee enthusiasts. The brand is widely favored by coffee professionals and home baristas, known for its durability and repairable parts.

Capresso (12-16%)

Capresso targets mid-range coffee grinders that balance performance and price. Capresso provides burr and blade grinders to casual coffee users who are looking for an improvement from pre-ground coffee.

BLACK+DECKER (10-14%)

The popular brand of kitchen appliances, BLACK+DECKER, offers low-end blade grinders that are compact, low-priced, and convenient. The brand appeals to cost-sensitive consumers seeking instant and easy grinding solutions.

Hamilton Beach (8-12%)

Hamilton Beach has a range of affordable electric coffee grinders. The focus is on ease of use, with such aspects as one-touch operation and removal of grinding chambers, which is appealing to newcomers.

Other Key Players (20-30% Combined)

The coffee bean grind machine market is also supported by a mix of emerging brands and regional manufacturers, including:

The overall market size for coffee bean grind machine market was USD 414.4 Million in 2025.

The coffee bean grind machine market is expected to reach USD 735.1 Million in 2035.

The increasing consumer preference for freshly ground coffee and the expanding café culture worldwide fuels Coffee bean grind machine Market during the forecast period.

The top 5 countries which drives the development of Coffee bean grind machine Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of product type, electric burr to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Machine Type, 2023 to 2033

Figure 28: Global Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Machine Type, 2023 to 2033

Figure 58: North America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Machine Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Machine Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Machine Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Machine Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Coffee Capsules and Pods Market

Coffee Decoction Maker Market

Coffee Brewers Market

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA