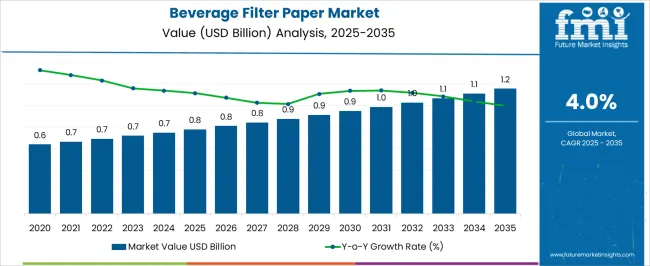

The Beverage Filter Paper Market is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 1.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Beverage Filter Paper Market Estimated Value in (2025 E) | USD 0.8 billion |

| Beverage Filter Paper Market Forecast Value in (2035 F) | USD 1.2 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The beverage filter paper market is advancing steadily with rising demand for high-quality filtration solutions in hot and cold beverage preparation. Current dynamics are shaped by increasing coffee and tea consumption, growing consumer awareness regarding purity and flavor retention, and technological improvements in paper processing and fiber treatment. Market expansion is being supported by eco-friendly product innovations and regulatory emphasis on sustainability in packaging and food-contact materials.

Producers are focusing on optimizing porosity, strength, and compatibility with diverse brewing systems to enhance performance. The future outlook is promising as premiumization trends in beverages and the expansion of specialty coffee and tea outlets drive higher consumption of filter-based products.

Household adoption is expanding in parallel with commercial demand due to changing lifestyle patterns and the influence of convenience-oriented product formats Growth rationale is reinforced by the ability of beverage filter paper to deliver consistent filtration efficiency, support diverse beverage applications, and align with global sustainability standards, ensuring continued adoption across end-use sectors.

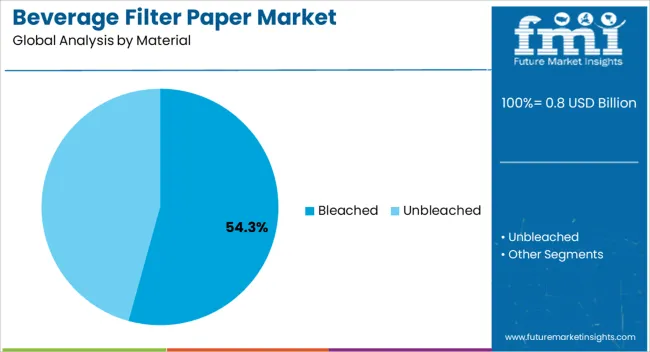

The bleached segment, holding 54.30% of the material category, is leading the market due to its clean appearance, uniform texture, and ability to ensure consistent flavor outcomes in beverages. Its dominance is reinforced by broad usage across both commercial and household applications, where visual appeal and reliable performance are critical.

Manufacturing improvements in chlorine-free and oxygen-bleached processes have increased adoption by addressing environmental concerns while maintaining high functional efficiency. Consumer preference for products with a premium aesthetic has also supported share retention.

Distribution channels catering to large-scale coffee chains and packaged retail products have further accelerated adoption Future growth for bleached paper is expected to be supported by rising demand for sustainable options, coupled with ongoing innovations in fiber sourcing and water-based coatings that improve durability and filtration consistency.

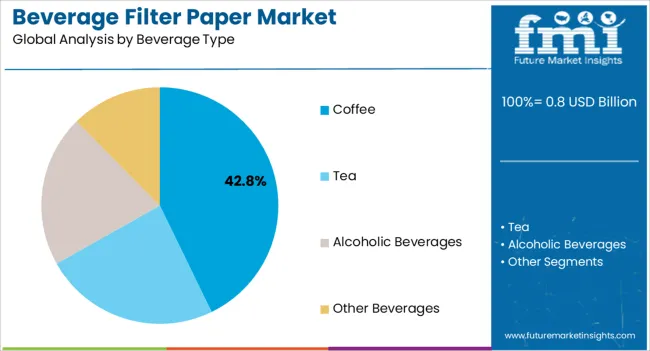

The coffee segment, representing 42.80% of the beverage type category, has secured leadership due to the global surge in coffee consumption and the proliferation of specialty coffee chains. Demand stability has been supported by the consistent use of filter paper in both drip and pour-over brewing methods.

The segment benefits from strong consumer loyalty and the cultural significance of coffee consumption in multiple regions. Technological advancements in paper permeability and structural strength have ensured enhanced flavor extraction and improved brewing efficiency.

Market expansion has been accelerated by the rising popularity of home brewing devices and premium coffee blends, creating a steady need for high-quality filter papers The segment’s sustained share is expected to be reinforced by growing penetration of premium coffee markets in emerging economies and the shift toward eco-friendly, compostable filter papers that align with consumer sustainability expectations.

From 2020 to 2025, the beverage filter paper market experienced significant growth, witnessing a surge in specialty applications. During this period, the market expanded at a 1.9% CAGR. This period saw a pronounced shift towards specialty and artisanal beverages, driving the demand for tailored filter papers to suit diverse brewing techniques and flavor profiles. Technological advancements played a pivotal role during this phase, with manufacturers focusing on improving filtration efficiency and consistency in brewed beverages.

| CAGR from 2020 to 2025 | 1.9% |

|---|---|

| CAGR from 2025 to 2035 | 4.2% |

The market also witnessed a notable emphasis on health and wellness. Filter papers were engineered to maintain the nutritional elements of beverages while effectively filtering out impurities and sediments, aligning with consumer preferences for healthier drink options.

Moving forward to the forecasted period of 2025 to 2035, these trends are expected to amplify further. Specialty applications are projected to continue their upward trajectory, with an increased emphasis on tailored filter papers for the burgeoning Market of specialty coffees, teas, and other unique beverages. Technological advancements will persist, focusing on enhancing filtration precision and brewing quality.

The market anticipates substantial expansion, particularly in emerging Industries due to rising disposable incomes and an evolving café culture. These factors collectively suggest a continued evolution and steady growth for the beverage filter paper market, catering to diverse consumer demands and evolving market landscapes.

The table below displays revenues in terms of the top five leading countries spearheaded by China.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| China | 5.9% |

| France | 4.1% |

| Japan | 3.5% |

| Germany | 3.2% |

| The United States | 2.9% |

Growing beverage market in China fuels demand for specialized filter papers, especially in tea and coffee segments, driving technological innovations and fostering a diverse product range.

Manufacturers prioritize eco friendly solutions, developing biodegradable filter papers to align with its sustainability goals and consumer preferences for environmentally conscious products.

Continuous research and development efforts lead to enhanced filtration precision and efficiency, addressing the demand for high quality filter papers and supporting its forecasted 5.9% CAGR until 2035.

France appreciation for gourmet beverages presents an opportunity for specialized filter papers tailored to enhance the taste profiles of premium coffees and teas, catering to discerning consumers.

Collaborations with upscale restaurants, cafes, and luxury hotels offer a niche Market for high quality filter papers, aligning with its gastronomic culture and emphasizing refinement in brewing experiences.

The urgeoning trend of artisanal brewing creates opportunities for filter paper manufacturers to supply specialized papers that cater to small scale, craft beverage producers seeking distinct filtration solutions. A CAGR of 4.1% is expected for the market from 2025 to 2035.

Japan’s reverence for tea ceremonies and traditional brewing methods stimulates demand for specialized filter papers, aligning with cultural practices and emphasizing precision in tea preparation.

Rising health consciousness fosters demand for filter papers that maintain beverage nutritional values, meeting consumer preferences for healthier drink options. A CAGR of 3.5% is expected through 2035.

The evolution of convenient, on the go beverage formats in Japan creates opportunities for innovative filter paper applications in portable brewing systems, catering to modern lifestyles.

Ensuring uniform quality across filter paper batches poses a challenge. Implementing stringent quality control measures and advanced production techniques can address variations, maintaining consistent filtration performance.

Intense market competition demands innovation. Research and development investments in novel materials and improved designs can offer distinct advantages, securing Market relevance.

Meeting stringent environmental standards requires sustainable solutions. Developing biodegradable filter papers and eco friendly materials complies with regulations, aligning with sustainability objectives.

Meeting sustainability demands while maintaining filter paper efficiency challenges the Market. Developing recyclable or biodegradable filter papers addresses eco conscious consumer preferences.

Intense competition necessitates differentiation. Innovation in materials or designs can create unique selling propositions, ensuring Market relevance.

Balancing quality and affordability is critical. Streamlining manufacturing processes or exploring cost effective materials can mitigate price concerns while maintaining product quality.

| Category | Market Share in 2025 |

|---|---|

| Unbleached | 61.3% |

| Institutional | 46.2% |

The unbleached category is anticipated dominance, projected to secure a substantial 61.3% market share until 2025, stems from evolving consumer preferences favoring eco friendly and natural products. Unbleached filter papers align with sustainability trends, appealing to conscientious consumers seeking environmentally responsible options.

Their natural appearance, devoid of chemical treatments, resonates with those valuing authenticity and purity in their beverages. The unbleached variety often retains more of the paper is innate properties, potentially enhancing the taste and overall quality of brewed beverages, further cementing its stronghold in the Market.

The institutional segment is anticipated to rise, set to secure a substantial 46.2% market share by 2025, is driven by heightened demand from cafes, restaurants, and hospitality sectors.

This surge results from their consistent need for high quality beverage filter papers to maintain standards in brewing. As the foodservice market expands, coupled with growing consumer preferences for specialty coffees and teas in these settings, its reliance on filter papers for consistent taste and quality amplifies, propelling its expected dominance in the beverage filter paper Market.

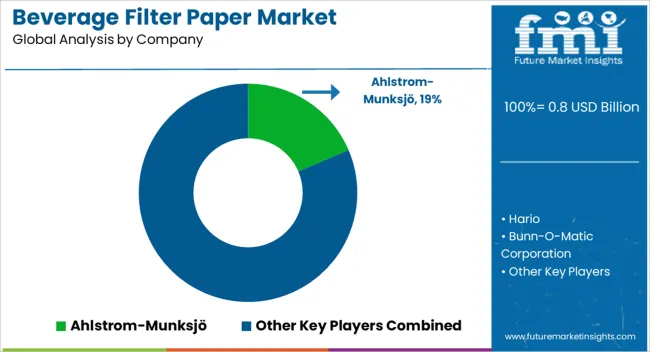

The competitive landscape in the beverage filter paper market is dynamic, marked by intense rivalry among key players striving for innovation and market differentiation.

Established brands invest significantly in technological advancements, aiming to enhance filtration precision and sustainability. New entrants focus on niche segments, catering to evolving consumer preferences for specialty beverages and eco friendly solutions.

Price competitiveness, product quality, and unique value propositions dictate Market standings, driving constant innovation. Collaborations and strategic partnerships to access diversified distribution channels and global Industries characterize this landscape, intensifying competition and encouraging continuous evolution to meet the dynamic demands of the beverage market.

Product Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 0.8 billion |

| Projected Market Valuation in 2035 | USD 1.2 billion |

| Value-based CAGR 2025 to 2035 | 4.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Material, Beverage Type, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Ahlstrom-Munksjö; Hario; Bunn-O-Matic Corporation; AeroPress; Chemex; Melitta; Flair Espresso; Toddy; Wilbur Curtis; Brewista; Kalita |

The global beverage filter paper market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the beverage filter paper market is projected to reach USD 1.2 billion by 2035.

The beverage filter paper market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in beverage filter paper market are bleached and unbleached.

In terms of beverage type, coffee segment to command 42.8% share in the beverage filter paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share Analysis for Filter Paper Companies

Filter Paper Market Trends – Growth, Demand & Forecast through 2035

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Food & Beverages Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Demand for Filter Paper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Filter Paper in Japan Size and Share Forecast Outlook 2025 to 2035

Automotive Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Global Laboratory Filter Paper Market Growth – Trends & Forecast 2024-2034

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Filter Bag Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA