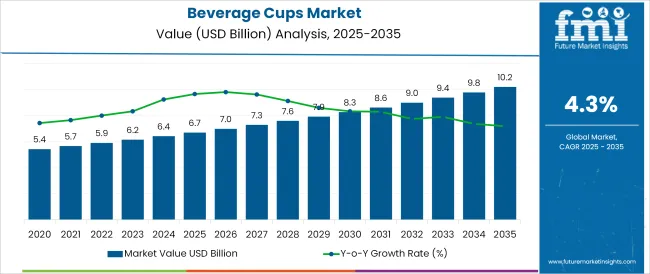

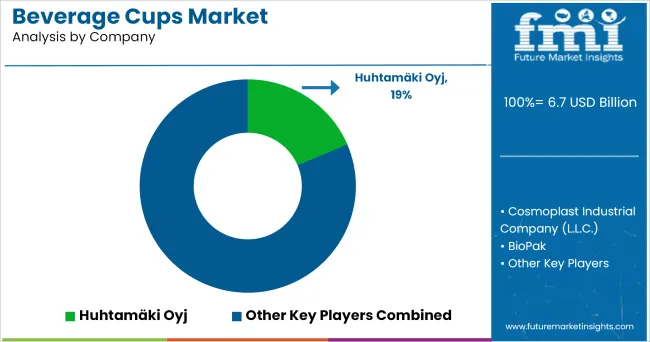

The Beverage Cups Market is estimated to be valued at USD 6.7 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The beverage cups market is witnessing steady growth due to the evolving dynamics of consumer lifestyles, increasing demand for on-the-go consumption, and the rising focus on sustainability in foodservice packaging. A growing preference for disposable and recyclable cups, especially in urban areas, is reshaping the material landscape. Simultaneously, manufacturers are navigating regulatory changes that demand eco-friendly alternatives, prompting shifts toward bio-based plastics and paper variants with barrier coatings.

The market is also benefitting from the proliferation of takeaway and delivery services, which has intensified the demand for durable and convenient beverage cup solutions. Consumer behavior is shifting toward smaller portion sizes and personalized servings, further driving the need for diversified capacity offerings.

As brands strive to balance cost, functionality, and environmental responsibility, the outlook for beverage cups continues to remain positive, particularly in regions with rising urbanization, increasing foodservice penetration, and expanding retail beverage consumption.

The market is segmented by Based on Material, Based on Capacity, and Based on End Use and region. By Based on Material, the market is divided into Plastic, Paper, Foam, Glass, and Metal. In terms of Based on Capacity, the market is classified into Up to 150 ml, 151 - 350 ml, 351 - 500 ml, and Above 500 ml.

Based on Based on End Use, the market is segmented into Household, Institutional, Corporates, and Foodservice. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

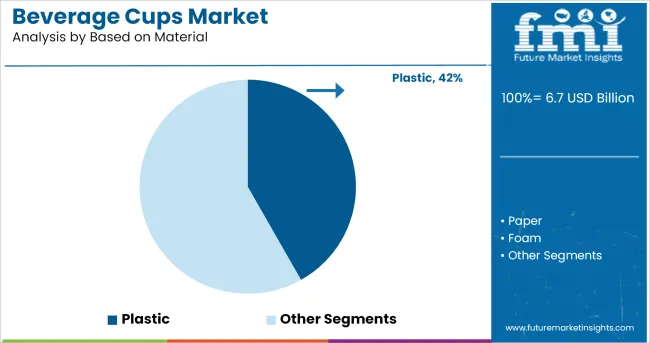

The plastic segment accounts for 41.80% of market revenue, establishing it as the leading material choice in the beverage cups market. Its dominance is attributed to its durability, cost-effectiveness, and adaptability across a range of beverage types and temperatures. Plastic cups are favored for their lightweight structure, resistance to leakage, and compatibility with both hot and cold drinks, making them versatile across service channels.

Their high-volume production scalability and compatibility with automated filling systems have further strengthened their usage, particularly in quick-service restaurants and high-traffic beverage outlets. Despite environmental scrutiny, the segment’s leadership has been sustained due to improved recycling infrastructure in key markets and advancements in the development of biodegradable and compostable plastic alternatives.

The combination of manufacturing efficiency, utility across channels, and ongoing innovation in eco-friendly resins continues to support the plastic segment’s prevailing market share.

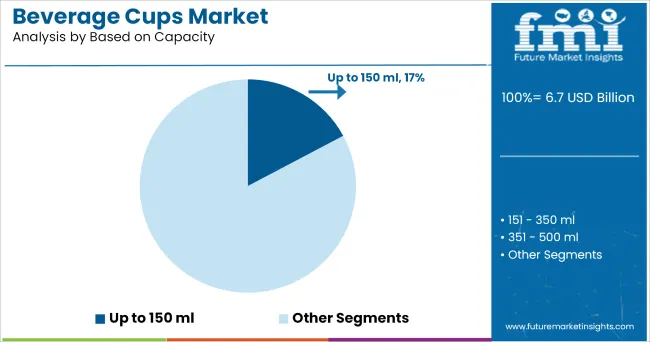

The up to 150 ml capacity segment holds 17.20% of market share, positioning it as a vital sub-category within the beverage cups landscape. This capacity format has found favor due to its suitability for single-serve applications such as espresso, sampling beverages, and children's servings. Its compact size aligns with the growing trend of portion control, especially in health-conscious consumer segments.

Additionally, it offers operational advantages for vendors and retailers seeking cost-efficient, high-throughput solutions with minimal material use. Its space-saving nature enhances storage and transportation logistics, while also allowing for faster service in high-volume environments.

Widespread use in institutional settings, airlines, and catering services has further contributed to its adoption. The combination of portion precision, cost efficiency, and multipurpose utility continues to reinforce the relevance of this segment, especially as beverage brands explore diverse formats for consumer engagement.

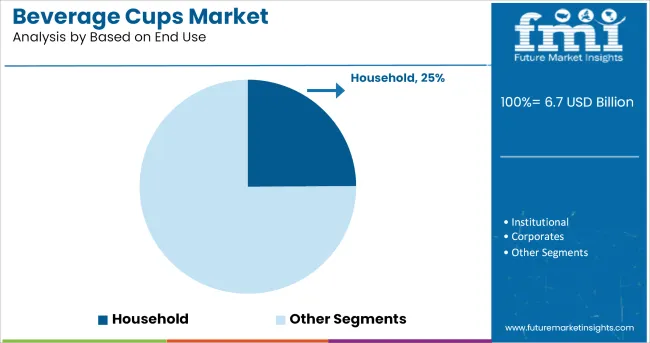

The household end-use segment represents 24.90% of total revenue, marking it as a key growth driver in the beverage cups market. This growth is being propelled by shifting consumption habits favoring in-home beverage preparation and increased demand for convenient, disposable serving options.

Consumers are increasingly opting for disposable cups for social gatherings, festive occasions, and outdoor use to avoid cleanup, which has led to sustained demand across both rural and urban households. The trend of home-based coffee brewing, specialty beverages, and DIY mixes has created consistent consumption patterns, particularly post-pandemic.

Moreover, private label and retail store brands have expanded their product offerings in household pack sizes, further reinforcing segment growth. As disposable income levels rise and lifestyles become more convenience-oriented, the household segment continues to strengthen its position through high-volume consumption and wide product availability across retail formats.

In today’s fast-developing market, cutthroat competition is almost every part of life, including the packaging industry. It becomes crucial for companies to increase productivity by using sustainable and eco-friendly materials and adopting innovative technology. The novel food packaging is now designed according to the consumer’s needs, priorities, and preferences.

The beverage cup is a drink carrier or a top-open cup for drinking, pouring, and holding liquid beverage items. The beverage cups are mainly made of glass, paper and, plastic material, whereas polypropylene is used to manufacture plastic cups. The beverage cups are widely used for drinking hot coffee, tea, fruit juices, cold drinks, soups, and other liquid beverage products.

Also, these beverage cups are disposable or recyclable designed and available in different sizes, shapes, styles, and colours as per functions and applicability.

The beverage cups, along with added insulation features, are excellent in serving hot or cold beverages. The single or double coating layers offers sturdiness and rigidity to the cup and are moisture-resistant, smooth, and stable. Therefore, the increasing demand for disposable, biodegradable cups to serve hot and cold beverages could boost the beverage cups market.

Beverage cups have become trendy due to rising consumer’s convenience and single-use consumption patterns. The consumers are aware of health, hygiene, and cleanliness.

Thus, they prefer the safest, reliable and convenient packaging solution. Most public places, restaurants, offices, and significant family events like weddings, parties, get-togethers, and beverage cups are used to serve soft drinks, hot or cold drinks, and water.

The paper or plastic beverage cups are primarily applicable for single-use purposes, which creates the safety of spreading the contamination and hand and oral infection. The beverage cups are also safe for drinking any food liquid products. It retains the food quality, flavour, taste, and hygiene and protects the contents from outside pollution and dust particles. All these factors will augment the growth of the beverage cups market.

In today’s day and age, the trend of outdoor readymade food eating and drinking is increasing rapidly due to busy lifestyle utilize the beverage cups for saving time and efforts of cleaning and can be discarded easily after use.

Online food and beverages ordering, increasing trend of a quick delivery, rising social and family functions, picnics, and outings will propel the sales of the beverage cups in the market.

The customized printed paper cups with eye-catchy designs and printing could create a brand image opportunity for the customer. The food service, restaurants, hotels, cafeterias, and food delivery companies could consider customized printing on the cups the best option for brand promotion and publicity. The consumer prefers visually appealing and attractive designs.

Additionally, serving the drinks in environment-friendly optimal packing with biodegradable or compostable properties could enhance the growth opportunity of the beverage cups market. The cost-effective, sturdy beverage cups are the best option for glass-ceramic cups due to the difficulty in carrying them around and the chances of breakages.

Furthermore, due to being unbreakable, safe, and easy to handle, the beverage cups are a perfect choice for child-friendly and older adults. Many offices, industrial units, supermarkets, malls keep the tea/coffee vending machines or juice and soft drink stations for people with disposable beverage cups.

During travel in railways, the beverage cups are served for liquid foods due to being easily disposable, safe, and convenient. Owing to this, there will be significant growth in the beverage cups market.

Key players such as

are actively involved in beverage cups market for different applications.

Key Asian players such as

are actively involved in beverage cups market for different applications.

The manufacturers involved in manufacturing beverage cups adopt various strategies such as innovation and product launch, focusing on sustainability to serve the increasing demand for the beverage cups market.

Huhtamäki Oyj recently introduced single wall and multi-wall paper cups made for PEFC certified paperboard with lid. They have also developed bioware paper cups compostable as per EN12432 compostable norms. The reCup is an exclusive recyclable paper cup made with an innovative barrier coating, EarthCoating, specially engineered to recycle the cups easily in mainstream waste facilities.

Tea is the most popular and widely accepted drink in India. Small tea shops are available in every nook and corner of the country. India is a densely populated country, and teas and coffee consumption is exceptionally high India. With the increasing number of restaurants, cafeterias, tea, and coffee shop chains, the penetration of western fast-food supply chains could enhance the growth of the beverage cups market share in India.

Indian people are fond of tea and coffee; hence the consumption of tea is extremely high. Beverage cups are also widely used in family functions, weddings, corporate events due to their lightweight, sturdiness, cost-effective, eco-friendly, and sustainable packaging solution. Therefore, the Indian market is expecting an exponential growth of beverage cups market.

The global beverage cups market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the beverage cups market is projected to reach USD 10.2 billion by 2035.

The beverage cups market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in beverage cups market are plastic, paper, foam, glass and metal.

In terms of based on capacity, up to 150 ml segment to command 17.2% share in the beverage cups market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Beverage Cups Companies

Cold Beverage Cups Market

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA