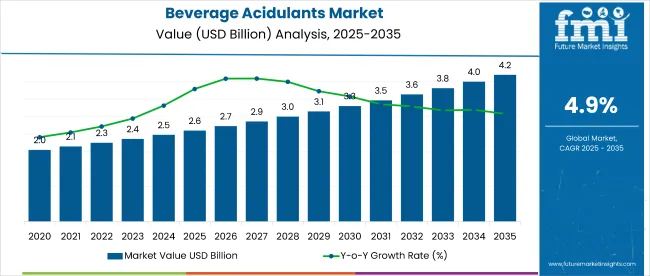

The global beverage acidulants market is projected to grow from USD 2.6 billion in 2025 to USD 4.2 billion by 2035, registering a CAGR of 4.9%. The market expansion is driven by the increasing demand for functional beverages, improved shelf life, and enhanced flavors in a wide range of beverages.

Consumer preferences for healthier, low-calorie, and organic drinks are propelling the growth of beverage acidulants, especially in fruit juices, soft drinks, and smoothies. With the rising focus on product innovation, manufacturers are incorporating advanced acidulants to achieve distinct taste profiles and improve drink texture.

The market holds significant shares within its parent markets. In the beverage ingredients market, it commands 7-10%, reflecting its key role in flavor enhancement and preservation. Within the food & beverage additives market, it contributes around 5-8%, driven by its use in improving beverage characteristics. In the functional food ingredients market, the share is around 3-5%, as acidulants are increasingly used in health-focused beverages.

The food preservatives market witnesses a contribution of 2-3%, while the organic food ingredients market accounts for about 1-2%. Additionally, the market holds 4-6% within the flavoring agents market and 2-3% in the food & beverage processing market, underlining its broad application in the food and beverage industry.

Regulatory frameworks play a crucial role in shaping the market, particularly with respect to food safety and product labeling. In countries like the United States and those in the European Union, the Food and Drug Administration (FDA) and European Food Safety Authority (EFSA) set guidelines for the permissible levels of acidulants in beverages.

These regulations ensure consumer safety and product consistency, fostering trust and encouraging the consumption of beverages containing safe and regulated acidulants. Furthermore, with growing awareness about health and sustainability, the demand for non-toxic, clean-label acidulants is increasing, supporting the shift toward natural, plant-based, and organic beverage formulations.

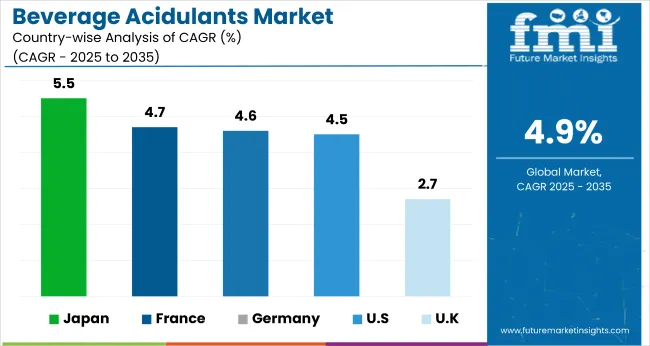

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 5.5% from 2025 to 2035. Synthetic will dominate the nature segment with a 60% share, while liquid will lead the form segment with a 45% share. The UK and USA markets are also expected to grow steadily at CAGRs of 2.7% and 4.5%, respectively. Germany and France will experience moderate growth at CAGRs of 4.6% and 4.7%, respectively.

The regulatory framework demonstrates stable acceptance of traditional beverage acidulants while showing increased scrutiny of synthetic additives that may affect product formulations in adjacent categories. Food safety agencies maintain established safety profiles for common acidifying agents while developing enhanced oversight for controversial additives that may require reformulation in specific applications. These differentiated regulatory approaches allow beverage manufacturers to maintain core acidulating functionality while adapting to restrictions on other ingredient categories.

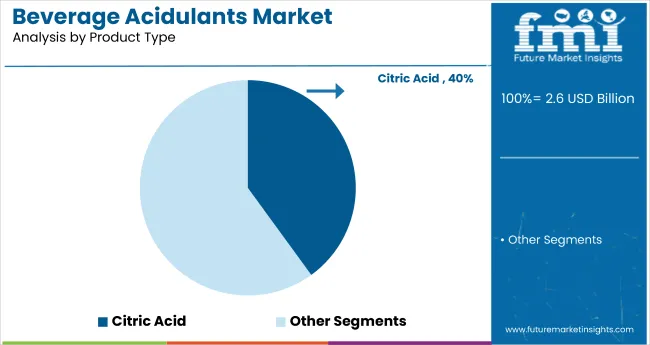

The market is segmented by product type, form, nature, application, and region. By product type, the market is divided into acetic acid, citric acid, fumaric acid, lactic acid, malic acid, phosphoric acid, tartaric acid, and other product types (succinic acid, gluconic acid, and ascorbic acid).

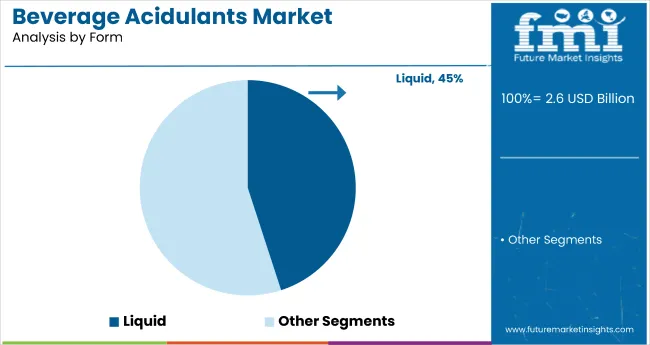

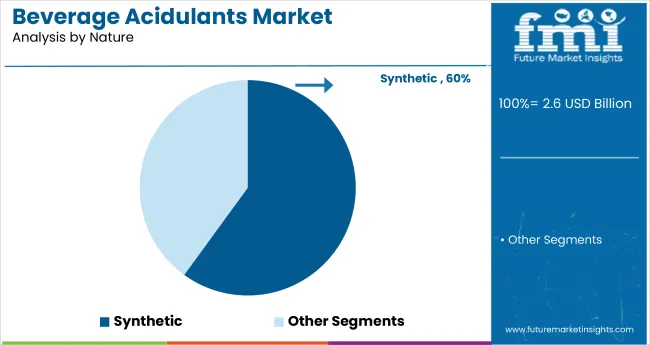

In terms of form, the market is classified into granule, liquid, and powder. Based on nature, the market is bifurcated into organic and synthetic. By application, the market is segmented into alcoholic beverages, dairy-based beverages, energy drinks, fruit juices & concentrates, and soft drinks. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and Middle East and Africa.

Citric acid is expected to lead the product type segment, holding a 40% market share by 2025, driven by its widespread use in both conventional and organic beverages for flavor enhancement and preservation.

Liquid is anticipated to dominate the form segment, capturing 45% of the share by 2025, due to its ease of integration, consistency in flavor, and widespread use across various beverage categories.

Synthetic is projected to lead the nature segment, securing 60% of the global market share by 2025, owing to its cost-effectiveness, consistent quality, and widespread use in mass-produced beverages.

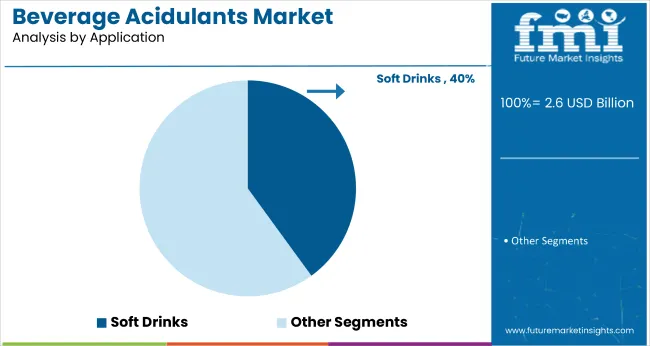

Soft drinks are expected to dominate the application segment, capturing 40% of the market share by 2025, driven by the demand for flavor enhancement, preservation, and the increasing popularity of low-calorie and flavored beverage options.

The global beverage acidulants market is experiencing steady growth, driven by the increasing demand for healthier, functional beverages and the need for improved flavor profiles and shelf life. Beverage acidulants play a critical role in enhancing taste, preserving freshness, and ensuring product consistency across various beverage categories.

Recent Trends in the Beverage Acidulants Market

Challenges in the Beverage Acidulants Market

Japan’s momentum is driven by the rising demand for functional beverages, particularly in health-conscious sectors like energy drinks, dairy-based beverages, and fruit juices. Germany and France maintain consistent demand driven by EU health regulations and funding for beverage innovation under the Green Deal. In contrast, developed economies such as the USA (4.5% CAGR), UK (2.7%), and Japan (5.5%) are expected to expand at 0.91x to 1.12x the global growth rate.

The growth rates of beverage acidulants in key markets differ slightly but are primarily driven by health trends and regulatory pressures. Japan leads with strong demand for functional, organic, and low-calorie beverages. Germany and France follow closely, with both markets driven by EU health goals, beverage innovation, and sustainability mandates.

The USA shows a slightly lower growth rate, influenced by evolving beverage formulations and health-conscious trends. The UK has the slowest growth, impacted by post-Brexit regulatory changes and cautious investment, though demand for clean-label, low-calorie products is on the rise.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan beverage acidulants revenue is growing at a CAGR of 5.5% from 2025 to 2035. Growth is driven by high demand in health-focused beverages like energy drinks, dairy-based beverages, and fruit juices. As a technology-driven economy, Japan prioritizes the use of natural and synthetic acidulants for product innovation, particularly in functional beverages.

The sales of beverage acidulants in Germany are expected to expand at a 4.6% CAGR during the forecast period, aligned with the global growth rate but strongly regulation-driven. EU health and sustainability goals, beverage innovation, and functional product demands are pushing adoption of natural and synthetic acidulants.

The French beverage acidulants market is projected to grow at a 4.7% CAGR during the forecast period, mirroring Germany in its policy-backed adoption trajectory. Demand is driven by national health initiatives, food safety regulations, and the growing trend for organic beverages.

The USA beverage acidulants market is projected to grow at a 4.5% CAGR from 2025 to 2035, translating to 0.96x the global rate. Unlike emerging markets focused on new installations, USA demand is heavily tied to the evolution of beverage formulations and health-conscious consumption trends. High demand exists for low-calorie and organic drinks, particularly in the soft drink and energy drink segments.

The UK beverage acidulants revenue is projected to grow at a 2.7% CAGR from 2025 to 2035, representing the slowest growth among the top OECD nations, at 0.55 times the global pace. Growth is supported by regulatory pressures in industries like soft drinks, energy drinks, and dairy-based beverages.

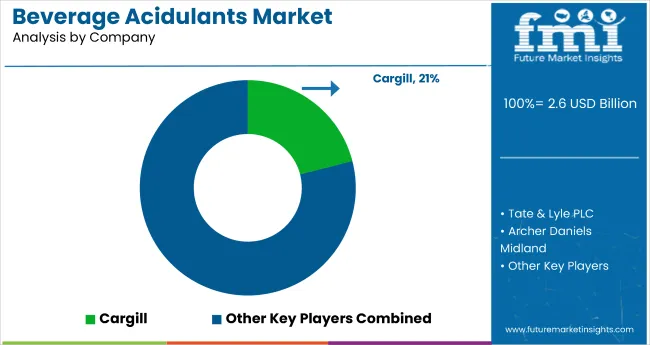

The Beverage Acidulants Market is witnessing consistent growth as beverage manufacturers focus on enhancing flavor stability, microbial safety, and shelf life while aligning with consumer preferences for natural and clean-label ingredients. Leading producers such as Tate & Lyle PLC, Cargill Incorporated, and Archer Daniels Midland Company (ADM) are at the forefront, offering citric, malic, and phosphoric acid-based formulations tailored for carbonated drinks, fruit juices, energy beverages, and functional drinks. These firms are also investing in bio-based production technologies to meet the growing demand for sustainable and non-synthetic acidulants.

Corbion N.V. and Parry Enterprises India Ltd. are strengthening their portfolios with organic acidulants derived from fermentation processes, targeting the expanding natural beverage segment. Their focus on lactic and malic acid solutions aligns with global shifts toward healthier beverage profiles with balanced acidity and enhanced flavor notes.

Batory Foods Inc. and FBC Industries Inc. are serving as key formulation partners for mid-sized beverage brands and private-label producers, offering customizable acid blends designed for flavor consistency and beverage clarity. Meanwhile, Northeast Pharmaceutical Group Co. Ltd. and DairyChem Inc. contribute competitively priced and high-purity ingredients for both conventional and functional beverage applications, particularly across the Asia-Pacific and North American markets.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.6 billion |

| Projected Market Size (2035) | USD 4.2 billion |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Product Types Analyzed | Acetic Acid, Citric Acid, Fumaric Acid, Lactic Acid, Malic Acid, Phosphoric Acid, Tartaric Acid, Other Product Types (Succinic Acid, Gluconic Acid, Ascorbic Acid). |

| Form Analyzed | Granule, Liquid, and Powder |

| Nature Analyzed | Organic and Synthetic |

| Application Analyzed | Alcoholic Beverages, Dairy-based Beverages, Energy Drinks, Fruit Juices and Concentrates, Soft Drinks |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market |

Tate & Lyle PLC, Cargill Incorporated, Archer Daniels Midland Company, Corbion N.V., Parry Enterprises India Ltd., Batory Foods Inc., Northeast Pharmaceutical Group Co. Ltd., DairyChem Inc., FBC Industries Inc. |

| Additional Attributes | Dollar sales by product type, market share by form, regional demand growth, regulatory impact, clean-label trends, competitive benchmarking |

The global beverage acidulants market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the beverage acidulants market is projected to reach USD 4.2 billion by 2035.

The beverage acidulants market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in beverage acidulants market are acetic acid, citric acid, fumaric acid, lactic acid, malic acid, phosphoric acid, tartaric acid and other products.

In terms of foam, granule segment to command 54.2% share in the beverage acidulants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA