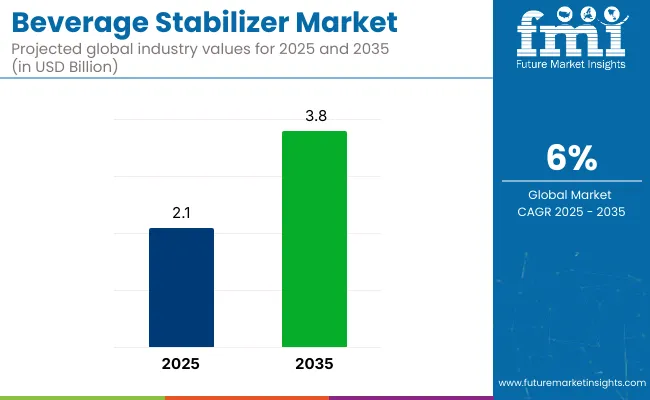

The global beverage stabilizer market is expected to reach USD 2.1 billion by 2025. Global sales are set to grow at 6% CAGR and reach USD 3.8 billion by 2035. Beverage stabilizers operate at the intersection of the global hydrocolloids market, valued at over USD 11 billion in 2025, and the broader functional beverage sector, expected to exceed USD 330 billion by 2030.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2.1 billion |

| Projected Market Size in 2035 | USD 3.8 billion |

| CAGR (2025 to 2035) | 6% |

These ingredients represent less than 2% of total beverage input by volume but account for over 15% of formulation R&D cost. Positioned within the food additives industry, stabilizers contribute directly to the USD 60 billion clean-label ingredients movement. As plant-based and low-sugar drinks gain market share, stabilizers become essential not just for product performance but for brand positioning across every tier of the global beverage supply chain.

Demand is increasing, led by a rise in functional, plant-based, and shelf-stable beverages across mature consumer markets. Stabilizers have moved from supporting roles to critical components in product formulation. texture, clarity, and consistency are no longer negotiable.

Functional drinks now fill entire retail walls, yet proteins, botanicals and minerals refuse to remain homogenous without viscosity control. Plant-based milks show the same fragility; oat or pea particles settle fast unless a hydrocolloid network intervenes. Carbonated energy drinks push acidity and carbonation beyond what legacy emulsifiers can tolerate, so new stabilizer systems get drafted into service. Sugar reduction strengthens the case. When sucrose is cut, mouthfeel thins, color drifts, aroma fades.

Stabilizers bridge that sensory gap and leave calorie counts intact. Global regulators are intensifying the trend by taxing added sugar and encouraging simpler labels. Reformulation budgets grow, natural gums and citrus fibers displace synthetic blends, cost per kilogram rises, market value expands. Shelf-stable stock-up items gained favor, chilled distribution faced disruption. Extended shelf life demands water activity management, phase stability and haze control across wide temperature swings. Stabilizers sit at the center of those tasks.

Growth migrates from North America and Western Europe to East Asia, Latin America and the Gulf as taste profiles diversify yet technical hurdles remain identical. In that landscape a stabilizer ceases to be a minor cost line; it becomes a strategic lever that decides whether a concept becomes a global SKU or stays an underperforming regional novelty. Investors watching ingredient markets will treat reliable hydrocolloid supply as a proxy for beverage innovation health and will reward suppliers that couple technical support with resilient, traceable sourcing.

Beverage Stabilizer Market Analysis by Top Investment Segments: The market is structured by product type into Gum Arabic, Carboxymethyl Cellulose, Xanthan Gum, Carrageenan, Pectin, and Others; by application into Fruit Drinks, Dairy Beverages, Soft Drinks, Alcoholic Beverages, and Others; and by region into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

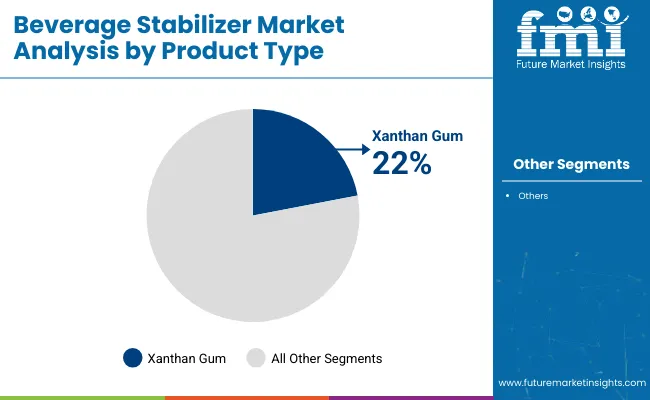

USD 1.1 billion in 2025 marks xanthan gum’s value in beverage applications and holds nearly 22% share of the market. Volume data collected from major bottling facilities indicates xanthan accounts for roughly 40 percent of all hydrocolloids dosed into ready-to-drink beverages. Shear-stable viscosity at low inclusion rates drives the preference.

Global formulators have shifted toward xanthan to compensate for sugar-reduction mouthfeel loss and to hold insoluble botanicals in suspension. Between 2026 and 2035 the segment is projected to expand at 6.3 annually as dairy-alternative coffees and high-acid energy tonics scale.

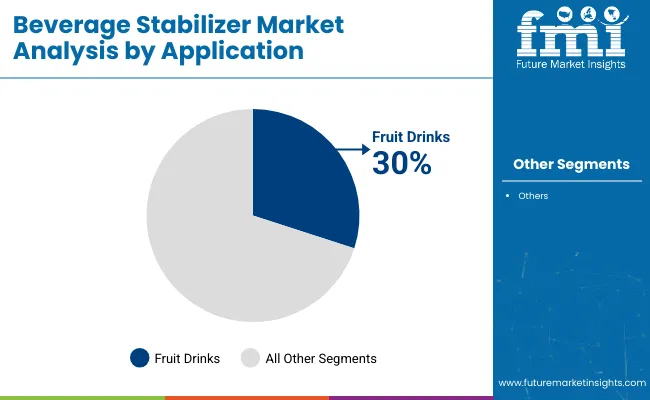

Fruit drinks lead stabilizer demand with a 30% share in 2025, largely because they require continuous suspension of pulp, fiber, and added nutrients without compromising visual clarity or mouthfeel. These beverages often operate in acidic environments where natural sedimentation is high, making stabilizers like xanthan gum and pectin indispensable.

From shelf-stable juices to fortified blends, stabilizers help maintain texture uniformity, extend shelf life, and prevent phase separation. Moreover, fruit drinks enjoy universal consumption across demographics, driving consistent volume in both developed and emerging markets. Their high sugar content has also prompted brands to experiment with low-calorie versions, where stabilizers play a key role in rebuilding lost viscosity and body.

Beverage stabilizers are no longer behind-the-scenes additives, they’ve become essential to the success of modern formulations. The rise in demand is fueled by three converging shifts: clean-label expectations, plant-based and protein-rich product innovation, and the explosion of ready-to-drink (RTD) formats. Consumers now demand low-sugar, low-calorie beverages that look good, taste consistent, and remain stable over time.

Without stabilizers like xanthan gum, pectin, and gellan, categories such as oat milk, vitamin water, or RTD cocktails would struggle to survive shelf-life, transport, or retail display. Clean-label trends further push adoption of natural gums like guar and gum Arabic, which are perceived as safer and more familiar. At the same time, beverage brands are leaning into stabilizers to maintain clarity, texture, and flavor without artificial thickeners.

Yet, growth isn’t frictionless. Natural stabilizers face serious raw material volatility especially gum Arabic, which is heavily dependent on politically unstable African sourcing regions. Regulatory hurdles across markets complicate global rollouts, with some ingredients approved in the USA or EU but restricted in Asia or the Middle East. Premium stabilizers also cost more, making adoption harder in price-sensitive regions or for challenger brands. Still, the role of stabilizers is evolving fast.

Ingredient suppliers are no longer just vendors they’re co-development partners, engineering custom gum systems for high-viscosity, high-acid, or micronutrient-rich beverage formats. Sustainability is also reshaping procurement: traceability, upcycled inputs, and carbon labeling are influencing brand decisions. Country-level trends reflect these dynamics Thailand and South Korea outpace mature economies like the USA, Germany, or Japan, thanks to their dynamic RTD and functional drink sectors.

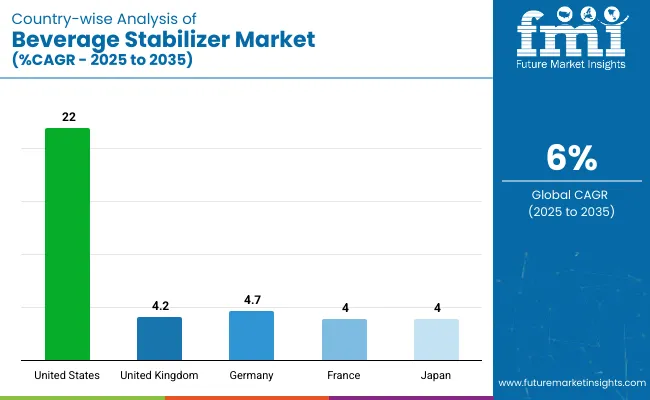

Sales of beverage stabilizers in the USA are projected to reach USD 462 million in 2025, making up 22% of global market share. Demand for xanthan gum, gellan gum, and pectin remains strong due to their widespread use in plant-based milks, protein-enriched smoothies, and sugar-reduced sodas.

Per capita RTD beverage intake stands at 38 liters. Major players focus on clean-label hydrocolloids to comply with FDA-recommended sugar reduction guidelines. Production facilities in Illinois, California, and Texas streamline stabilizer blending for national distribution. Beverage emulsion systems, especially for flavored waters and citrus-based energy drinks, rely on custom gum and starch blends for stable dispersion and visual clarity.

The UK beverage stabilizer market is expected to generate USD 88 million in sales in 2025, representing 4.2% of global revenue. Demand for gum Arabic and xanthan gum is high among manufacturers of low-sugar soft drinks and premium non-alcoholic beverages. Average per capita intake of sugar-free beverages is 27 liters.

Reformulation efforts surged following the sugar levy, leading to increased usage of high-efficiency natural stabilizers. Brands use EU-sourced ingredients to meet traceability and sustainability goals. Beverage emulsion usage is growing in adult mixers, botanical sodas, and cloudy tonics where flavor oils require stable dispersion.

Germany is forecasted to produce USD 99 million in beverage stabilizer sales by 2025, contributing 4.7% to the global market. Per capita functional beverage consumption stands at 22 liters, led by fortified waters, RTD protein drinks, and botanical infusions. Demand for citrus fiber and gum Arabic is high, with over 60% of new beverage SKUs labeled additive-free.

Local R&D partnerships support gum innovation for high-solid syrups and premium beverages. The beverage emulsion segment sees steady growth in vitamin-enriched and plant-based clear drinks requiring stable oil-phase dispersion and clarity maintenance.

France’s beverage stabilizer market is projected to generate USD 152 million in sales by 2025, accounting for 4.0% of the global stabilizer market. Per capita functional beverage consumption is approximately 22 liters, largely driven by low-sugar sodas, fortified waters, and botanical soft drinks.

Demand is particularly strong for pectin and xanthan gum, which are favored in clean-label or additive-light premium products. French beverage brands increasingly partner with European suppliers to meet stringent traceability and sustainability expectations. Meanwhile, beverage emulsions are growing in importance for crafted mixers, botanical tonics, and vitamin-fortified clear beverages where stable oil dispersion and clarity are essential.

Japan’s beverage stabilizer market will reach USD 84 million in sales by 2025, representing 4.0% of global revenue. Demand is concentrated in low-acyl gellan gum and xanthan for green tea, fiber beverages, and senior-focused nutritional drinks. Per capita green tea beverage intake is 45 liters.

Temperature-sensitive vending formats require gums with high thermal tolerance. Soluble fiber and stabilizer blends are used to formulate gut-health beverages with gentle viscosity. Beverage emulsion applications focus on clear functional teas and citrus-based vitamin drinks, where phase separation must be minimized.

Hydrocolloid pure-plays CP Kelco and Nexira prioritize technical depth in gellan, pectin, and gum Arabic. Agribusiness scale leaders ADM and Cargill leverage integrated supply chains to pair stabilizers with sweeteners and fibers. Clean-label and fiber specialists Ingredion and Tate & Lyle push tapioca starches and soluble fibers for sugar-reduced drinks.

Emulsifier-stabilizer experts Palsgaard and Ashland target high-fat or acidic formulations with carbon-neutral, cellulose-based blends. Nutrition-system providers DuPont, DSM, and Glanbia bundle gums with proteins, probiotics, or micronutrients for medical and sports beverages. Custom solution firms Actaris and Advanced Food Systems serve small-batch brands, while W. R. Grace supplies processing aids for industrial beverages.

| Attribute | Coverage & Parameters |

|---|---|

| Market size (2025) | USD 2.1 billion |

| Market size (2035) | USD 3.8 billion |

| CAGR (2025 to 2035) | 6.0% |

| Base year / Historical range | 2024 base |

| Forecast period | 2025 to 2035 |

| Unit of measurement | Revenue, USD billion |

| Product-type segments | Gum Arabic, Carboxymethyl Cellulose, Xanthan Gum, Carrageenan, Pectin, Others (gellan, guar, blends) |

| Application segments | Fruit Drinks, Dairy Beverages, Soft Drinks, Alcoholic/RTD Beverages, Others (sports, nutraceutical shots) |

| Regional coverage | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Deep-dive country cuts | United States, United Kingdom, Germany, France, Japan and 40+ countries |

| Key players profiled | CP Kelco, Cargill, Ingredion, Kerry Group, Tate & Lyle, Palsgaard, IFF (DuPont), Givaudan |

| Additional attributes | Revenue share by distribution channel (B2B ingredients vs. contract blending), regulatory landscape summary (FDA, EFSA, Codex); supply-chain risk assessment for natural gums |

The market is valued at USD 2.1 billion in 2025 and is projected to reach USD 3.8 billion by 2035, expanding at a 6.0% compound annual growth rate during the forecast period.

Xanthan gum leads with roughly 22% of global revenue because it performs reliably across a wide pH and temperature range, making it a versatile choice for dairy, fruit, and low-sugar formulations.

Fruit drinks command about 30% of stabilizer demand in 2025. They need strong suspension systems to keep pulp and nutrients evenly dispersed while preserving clarity and shelf life.

Clean-label reformulation, growth in plant-based and protein-rich drinks, and the surge of ready-to-drink (RTD) formats all require advanced gum systems to maintain texture, flavor distribution, and visual appeal without added sugars or synthetic ingredients.

Volatile supplies of natural gums, regional regulatory discrepancies, and the higher cost of premium clean-label stabilizers can delay product launches, increase formulation costs, and squeeze margins especially in price-sensitive markets.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Clarifier and Stabilizer Market

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA