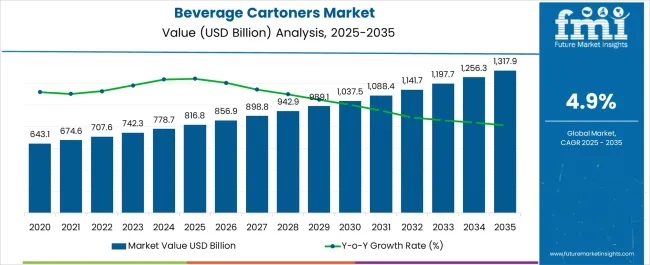

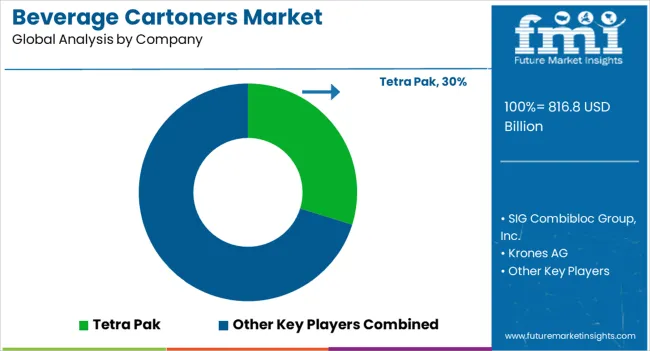

The Beverage Cartoners Market is estimated to be valued at USD 816.8 billion in 2025 and is projected to reach USD 1317.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Beverage Cartoners Market Estimated Value in (2025 E) | USD 816.8 billion |

| Beverage Cartoners Market Forecast Value in (2035 F) | USD 1317.9 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The beverage cartoners market is experiencing consistent growth supported by the rising demand for convenient packaging solutions, sustainability initiatives, and enhanced shelf appeal in the beverage sector. Increasing consumption of ready to drink products and the shift toward lightweight, recyclable carton packaging are shaping adoption trends across global markets.

Technological innovations in automation, precision filling, and smart carton designs are enabling manufacturers to achieve higher efficiency while meeting stringent food safety standards. Regulatory pressures to minimize plastic usage are further boosting the role of paper based carton formats.

Moreover, growing consumer preference for on the go beverages and fortified drinks is reinforcing the need for efficient and sustainable carton packaging systems. The market outlook remains promising as beverage brands focus on balancing operational efficiency with environmentally responsible packaging solutions.

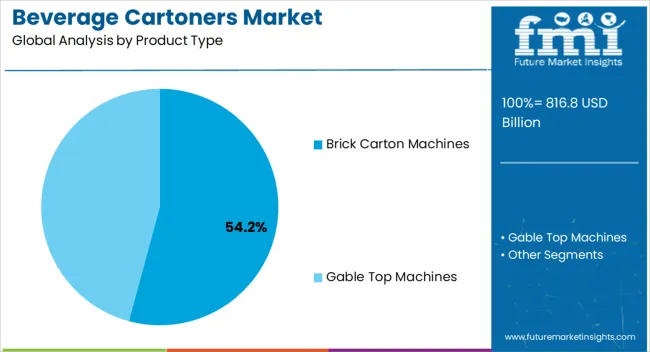

The brick carton machines segment is anticipated to represent 54.20% of total market revenue by 2025 within the product type category, making it the leading segment. Its dominance is attributed to operational efficiency, high packaging precision, and compatibility with long shelf life beverages.

Brick carton machines are favored for their ability to provide uniform package structures that enhance stacking, storage, and logistics efficiency. They also enable integration of aseptic packaging technologies, which is crucial for preserving product integrity in milk, juices, and nutritional drinks.

Their cost effectiveness, reliability, and scalability across large production lines have reinforced their adoption, ensuring continued leadership in the product type segment.

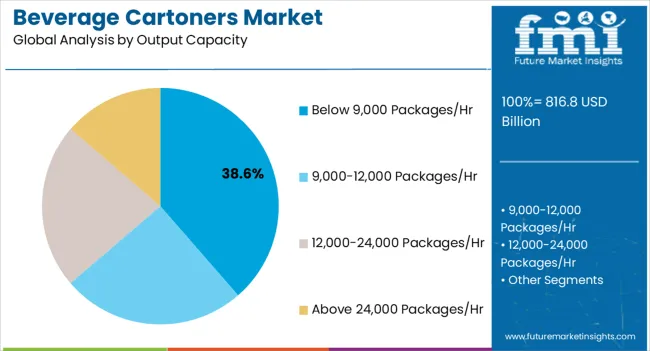

The output capacity segment of below 9,000 packages per hour is expected to hold 38.60% of the overall market revenue by 2025, positioning it as a key category. This capacity level is preferred by small and medium scale beverage manufacturers who seek cost effective automation without heavy infrastructure investment.

The segment supports flexible production runs, caters to localized beverage distribution, and facilitates customization in packaging formats. Adoption is further encouraged by the growing demand from niche and premium beverage brands that prioritize product differentiation.

With its ability to balance affordability and functionality, this output capacity segment continues to capture a substantial share of the beverage cartoners market.

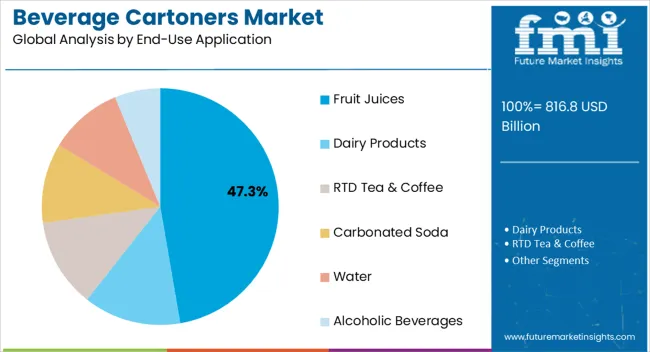

The fruit juices application segment is projected to contribute 47.30% of total market revenue by 2025, making it the largest end use segment. Growth is driven by increasing global consumption of packaged fruit juices and consumer preference for safe, portable, and recyclable packaging.

Beverage producers are leveraging carton formats to ensure product freshness, enhance branding opportunities, and meet sustainability expectations. The ability of carton packaging to protect juices from light and oxygen degradation has reinforced its adoption in this category.

With rising demand for natural, fortified, and on the go juice products, the fruit juices segment is positioned to remain the dominant end use within the beverage cartoners market.

The global demand for beverage cartoners is projected to increase at a CAGR of 2.5% during the forecast period between 2020 and 2025, reaching a total of USD 1317.9 billion in 2035.

According to Future Market Insights, a market research and competitive intelligence provider, the beverage cartoners market was valued at USD 816.8 million in 2025.

From 2020 to 2025, the global market witnessed steady growth, owing to the shift towards convenient and on-the-go packaging. In today's fast-paced lifestyle, consumers are seeking convenience in their consumption habits, including beverages. Beverage cartoners play a crucial role in meeting this demand by providing packaging solutions that are designed for ease of use and portability.

One of the key features that contribute to the convenience factor is the inclusion of resealable closures in beverage cartons. Resealable closures allow consumers to open the packaging, consume a portion of the beverage, and securely close it for later consumption. The feature ensures that the beverage remains fresh and prevents spills or leaks, enabling consumers to carry the carton with them wherever they go. Resealable closures also allow for portion control, allowing consumers to consume the desired amount and save the rest for later, reducing waste.

Beverage cartoners offer single-serve portion packaging options. The single-serve portions are designed to provide consumers with a convenient and ready-to-consume beverage without the need for additional serving utensils or containers. Single-serve portions are popular among consumers who are looking for quick and hassle-free consumption on the go, whether it's during commutes, outdoor activities, or busy work schedules. The individual packaging ensures freshness, portion control, and reduces the need for additional storage or serving vessels.

The convenience provided by beverage cartoners aligns with the changing consumer preferences and lifestyles. Busy individuals who are constantly on the move value packaging solutions that are easy to carry, open, and consume without compromising on the quality or taste of the beverage. Convenience-driven packaging solutions allow consumers to enjoy their favorite beverages anytime, anywhere, and without the need for additional preparation or equipment.

Technological Advancements in Cartoning Machinery are Likely to be Beneficial for Market Growth

Technological advancements in cartoning machinery have revolutionized the beverage cartoners market by significantly improving efficiency, productivity, and customization capabilities. The advancements have brought about numerous benefits for manufacturers, contributing to the growth and success of the industry.

One key aspect of technological advancements in cartoning machinery is the ability to handle a wide range of carton sizes and shapes. Modern cartoners are equipped with adjustable features that allow for seamless transitions between different carton formats. The flexibility enables manufacturers to meet diverse packaging requirements and cater to varying product sizes, ensuring compatibility with a wide range of beverages.

Advanced cartoning machines offer high-speed packaging capabilities, enabling manufacturers to achieve faster production rates and meet the demands of a rapidly evolving market. The machines can efficiently handle large volumes of beverage cartons, resulting in increased productivity and reduced manufacturing lead times. High-speed packaging not only improves overall operational efficiency but also enables manufacturers to respond quickly to market demands and maintain a competitive edge.

Intelligent automation features are another significant aspect of technological advancements in cartoning machinery. These features include robotic arms, vision systems, and sophisticated control systems that enhance the automation and precision of the packaging process. Robotic arms can perform various tasks, such as carton erecting, product placement, and sealing, with exceptional accuracy and consistency. Vision systems ensure proper carton alignment and quality control, minimizing errors and reducing waste. The integration of intelligent automation features streamlines production processes, reduces manual labor, and enhances overall efficiency.

Technological advancements have led to improvements in carton packaging quality. Modern cartoning machines are designed to maintain the integrity of the beverage cartons throughout the packaging process. They ensure proper carton sealing, alignment, and protection, resulting in better product presentation and reduced risk of damage during transportation and storage. Consistent and reliable carton packaging quality not only enhances consumer satisfaction but also reduces the chances of product spoilage and wastage.

Technological advancements in cartoning machinery have transformed the beverage cartoners market by offering enhanced efficiency, productivity, and customization capabilities. These advancements have empowered manufacturers to optimize their production processes, reduce downtime, improve product quality, and meet the evolving needs of consumers and the industry.

Expansion of Ready-to-Drink Beverage Industry to Fuel the Market Growth

The expansion of the ready-to-drink (RTD) beverage market is a key trend that is anticipated to propel the market growth. RTD beverages, including energy drinks, juices, flavored water, and other on-the-go beverages, have gained immense popularity among consumers worldwide. The beverages are convenient, offer a wide range of flavors, and cater to the increasing demand for healthier beverage options.

Beverage cartoners play a crucial role in the packaging of RTD beverages due to their versatility and ability to provide product protection. Carton packaging ensures that RTD beverages remain fresh and safe during transportation and on store shelves.

The cartons provide a protective barrier against light, air, and moisture, preserving the quality and taste of the beverages. The capability is especially important for RTD beverages that contain sensitive ingredients or require a longer shelf life.

Beverage cartons offer excellent shelf appeal, attracting consumers with their appealing designs and informative graphics. The cartons can be customized with vibrant colors, branding elements, and product information, effectively capturing the attention of consumers and conveying the value and qualities of the RTD beverages. The visual appeal of carton packaging plays a significant role in consumer purchasing decisions, contributing to the overall success of RTD beverage brands.

The growing demand for RTD beverages is driven by various factors. Busy lifestyles and increasing urbanization have led to a rise in on-the-go consumption habits, where consumers seek convenient and portable beverage options. RTD beverages fulfill this need by providing ready-to-consume, single-serve packages that can be easily carried and consumed anytime, anywhere.

There is a growing awareness among consumers regarding health and wellness. Many RTD beverages are formulated with natural ingredients, functional additives, and reduced sugar content to meet the preferences of health-conscious consumers. The convenience and health benefits associated with RTD beverages have contributed to their increasing popularity.

The COVID-19 pandemic has further accelerated the demand for RTD beverages as consumers have sought packaged beverages that offer safety, convenience, and hygiene. The pandemic has led to changes in consumer behavior, including a shift towards packaged beverages as a precautionary measure.

The demand for beverage cartoners is expected to rise as the RTD beverage market continues to expand. Manufacturers are investing in advanced cartoning machinery to meet the increasing production requirements of RTD beverages. They are focusing on improving speed, efficiency, and customization capabilities to cater to the evolving needs of the market.

The expansion of the ready-to-drink beverage market, driven by factors such as convenience, health consciousness, and changing consumer behavior, is expected to significantly boost the growth of the beverage cartoners market.

The versatility, product protection capabilities, and appealing aesthetics of beverage carton packaging make it an ideal choice for packaging RTD beverages. Manufacturers will continue to rely on beverage cartoners to meet the packaging needs of these popular beverages as the demand for RTD beverages continues to surge.

Brick Carton Machines to Hold Maximum Sway in the Market

The product types considered in the beverage cartoners market study include brick carton machines and gable top machines. The brick carton machine segment, of these, accounts for the 55.6% share of the global beverage cartoners market. The segment is expected to hold a CAGR of 4.8% during the forecast period.

In recent years, traditional production norms based on one-size-fits-all concepts have been phased out, which is a significant future growth factor for vendors in the worldwide beverage cartoners market. New beverages packaged in unique bottles with brick carton machines can be carried over long distances.

Brick carton machines are used in the packaging of various types of beverages, ranging from fruits juices to ready-to-drink tea & coffee. The research also suggests that the brick carton machine segment is anticipated to be one of the highest contributors to the growth of beverage cartoner suppliers.

Suppliers Ensuring Safe Distribution of Alcoholic Beverages to End-Users

On the basis of end-use application, the global beverage cartoners market has been segmented into six segments: fruit juices, dairy products, alcoholic drinks, water, ready-to-drink tea & coffee, and carbonated soda.

The alcoholic beverages segment in the global beverage cartoners market is expected to heavily dominate the market over the forecast period. Rapid economic expansion and changes in lifestyles, particularly among the middle-income group, are expected to drive demand for alcoholic beverages. The segment is expected to hold a CAGR of 4.7% during the forecast period.

Soft drink cartons have been around for quite some time. The cartons have been shaped to resemble special alcoholic beverage packing boxes. In order to appeal to a bigger market segment, as a result, suppliers of beverage cartoners are focusing on the customization of beverage canning equipment, beverage can seamers, and beverage palletizers.

The beverage cartoners industry works hand in hand with the supply and logistics industry. Adoption of high-end packaging methods has been forced by the precision of supply lines.

Beverage Can Seamers Creating Lucrative Opportunities in the United States

The United States’ beverage cartoners market has been estimated to experience high growth potential, considering that most of the manufacturing sector has been captured by the gable top machines segment of beverage cartoners.

Manufacturers are adopting beverage can seamers and beverage palletizers as these reduce labour cost and increase efficiency. The country is expected to hold a CAGR of 4.8% over the analysis period.

Advanced Packaging Technology in China Evolving at a Rapid Pace

The market in China holds a major value share in the global market and is likely to maintain its dominance over the forecast period. The country is expected to hold a CAGR of 4.7% over the analysis period.

Mass urbanization coupled with upgraded standards of packaging solutions and increased disposable income are expected to be the fundamental driving forces behind growth in demand for beverage cartoners in China.

Beverage cartoners market startup players are adopting various marketing strategies such as new product launches, geographical expansion, merger and acquisitions, partnerships and collaboration to create a larger customer base. For instance,

Key players in the beverage cartoners market are strongly focusing on profit generation from their existing product portfolios along while exploring potential new applications.

The players are emphasizing on increasing their beverage cartoners production capacities, to cater to the demand from numerous end use industries. Prominent players are also pushing for geographical expansion to decrease the dependency on imported beverage cartoners.

Recent Developments

Bosch Packaging Technology: In 2024, Bosch Packaging Technology unveiled the CUK series, a new generation of beverage cartoning machines. The CUK series features improved ergonomics, easy operation, and high-speed capabilities to meet the growing demand for efficient beverage cartoning solutions.

Serac Group: In 2024, Serac Group introduced the Innopack K-DPZ, a compact and versatile cartoning machine designed for the beverage industry. The Innopack K-DPZ offers high-speed operation, precise carton handling, and efficient integration into existing production lines, providing beverage manufacturers with enhanced productivity and flexibility.

Tetra Pak: In 2024, Tetra Pak launched the Tetra Pak® E3/Speed Hyper, a new beverage cartoning machine that offers a speed of 40,000 packages per hour. The machine incorporates high-speed automation and advanced technologies to enhance productivity and efficiency in beverage packaging.

Krones AG: In 2024, Krones AG introduced the Varioline, a modular cartoning machine for beverage packaging. The Varioline offers flexibility in carton formats, sizes, and closures, allowing beverage manufacturers to meet diverse consumer demands and achieve high production efficiency.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for value and Tons for Volume |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia & Pacific; South Asia; and Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel. |

| Key Segments Covered | Product Type, Output Capacity, End-use Application, Region |

| Key Companies Profiled | Tetra Pak; SIG Combibloc Group, Inc.; Krones AG; Econocorp, Inc.; RA Jones & Co. Inc.; Elopak AS; Gerhard Schubert; Langley Holdings plc; KHS Group; GPI Equipment; Visy Industries Holdings Pty Ltd; Shanghai Joylong Industry Co. Ltd.; Jacob White Packaging Ltd.; Syntegon Technology GmbH |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global beverage cartoners market is estimated to be valued at USD 816.8 billion in 2025.

The market size for the beverage cartoners market is projected to reach USD 1,317.9 billion by 2035.

The beverage cartoners market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in beverage cartoners market are brick carton machines and gable top machines.

In terms of output capacity, below 9,000 packages/hr segment to command 38.6% share in the beverage cartoners market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beverage Crate Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA