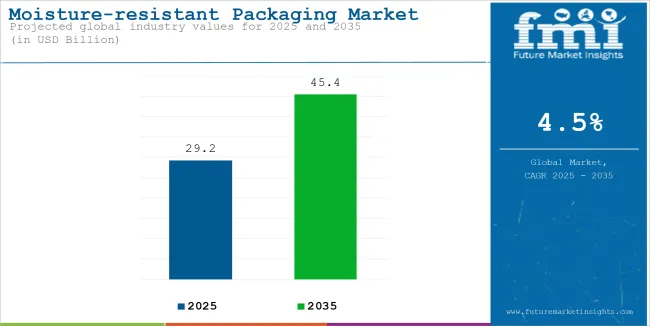

The moisture-resistant packaging market is projected to grow from USD 29.2 billion in 2025 to USD 45.4 billion by 2035, registering a CAGR of 4.5% during the forecast period. Sales in 2024 reached USD 27.9 billion, reflecting consistent demand driven by supply chain and environmental needs. This expansion is being driven by increased applications in food & beverage, pharmaceuticals, electronics, and personal care sectors that require moisture protection to preserve quality and shelf life.

This development demonstrates a commitment to delivering high-barrier, eco-conscious solutions in moisture-sensitive packaging. In March 2025, ProAmpac, a leader in flexible packaging and material science, is advancing its ProActive Intelligence platform by launching innovative solutions in its Moisture Protect series. “ProAmpac’s Moisture Protect series represents a significant step forward in flexible packaging technology,” said Samuel Kessler, senior innovation engineer Active/Intelligent Packaging at ProAmpac.

“By expanding our offerings, we provide our customers with options that balance high-performance moisture protection with their sustainability objectives.” MP-2000 series is a foil-free option with the same moisture adsorption capacity and performance as the MP-1000 series. The MP-3000 series, a mono-polyolefin-based structure, is designed for Recycle Ready and shows significant improvement in product stability compared with a regular foil-based structure.

Sustainability considerations have driven the evolution of moisture-resistant packaging materials and coatings. Automation in coating and lamination technologies has enabled precise control of barrier properties and reduced material waste. These innovations align with global packaging regulations and help manufacturers balance product protection with circular economy goals.

Moisture‑resistant papers are being increasingly coated with water-based, repulpable dispersions to preserve composability and facilitate fiber recovery. This trend is being bolstered by collaborations between paper producers and coating technology firms to eliminate plastic lamination while maintaining barrier functionality.

| Attributes | Key Insights |

|---|---|

| Estimated Market Value, 2025 | USD 29.2 billion |

| Projected Market Value, 2035 | USD 45.4 billion |

| Value CAGR (2025 to 2035) | 4.5% |

Strong demand is expected to continue in the moisture-resistant packaging market due to growth in e-commerce, healthcare and processed food volumes. Companies that prioritize recyclable barrier films and paper-based solutions are anticipated to gain a competitive advantage.

Stringent regulatory frameworks such as plastic reduction policies, compost ability standards, and packaging waste directives are likely to influence design and supply-chain strategies. Investment in R&D, partnership with material innovators, and certification for recycled content will be key to differentiation. As consumers and brands seek sustainable preservation solutions, next-gen moisture-resistant packaging is expected to deliver both functional performance and environmental compliance.

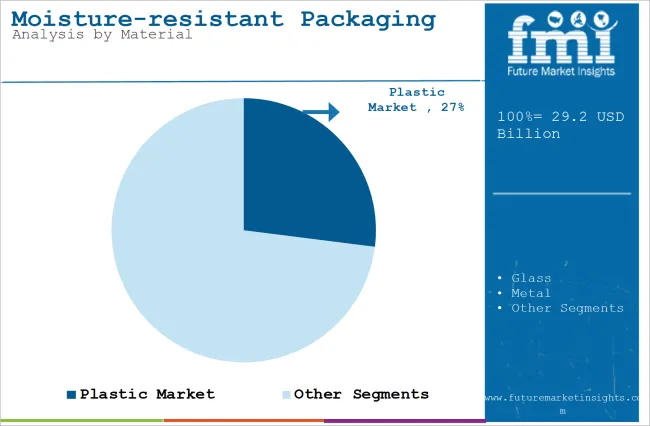

The market is segmented based on material type, packaging type, end use, and region. By material type, the market includes plastic such as polyethylene (PE) and polypropylene (PP) as well as glass, metal, and paper. In terms of packaging type, the market is categorized into flexible packaging (including bags and pouches, films, wraps, and laminations), rigid packaging (comprising bottles & jars, trays & clamshells, and cans), and corrugated packaging.

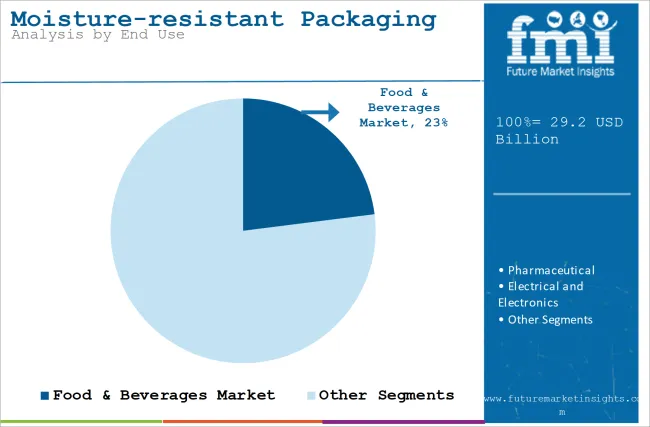

By end use, the market spans food & beverages, pharmaceuticals, electrical & electronics, cosmetics & personal care, chemical & fertilizer, and other consumer goods. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Plastic has been projected to account for 27% of the moisture-resistant packaging market in 2025, owing to its superior barrier properties, cost-effectiveness, and scalability in mass packaging applications. Polyethylene (PE), polypropylene (PP), and PET have been most frequently utilized to inhibit moisture infiltration in both rigid and flexible packaging formats.

High moisture barrier films have been developed using multilayer extrusion, coatings, and lamination techniques, ensuring longer shelf life and reduced spoilage. Thermoform able and sealable grades have been deployed extensively for packaging dry foods, frozen meals, medical products, and industrial components sensitive to humidity.

Plastic has also been preferred for its compatibility with automation and custom mold designs, which has streamlined packaging line efficiency in high-output manufacturing. Although sustainability concerns have emerged, moisture-resistant biodegradable plastics and recyclable mono-material films have been increasingly adopted.

Due to its balance of functionality, protection, and printability, plastic is expected to retain dominance in sectors where barrier integrity is critical. Investments in advanced resin formulations and recycling infrastructure are likely to support plastic’s relevance in the moisture-resistant packaging market through the forecast period.

The food & beverages sector has been estimated to represent 23% of the total demand for moisture-resistant packaging solutions in 2025, owing to the need for extended shelf life, hygiene preservation, and product safety. Packaging formats such as pouches, trays, sachets, and barrier films have been extensively utilized to prevent moisture ingress across frozen, dehydrated, and ready-to-eat categories.

Modified atmosphere packaging (MAP), vacuum-sealed wraps, and foil-lined cartons have been widely adopted by producers to ensure that products remain fresh during transit and storage. Sensitive ingredients such as spices, cereals, powdered beverages, and baked goods have especially required high-barrier packaging to avoid caking and microbial growth.

Brand differentiation, regulatory compliance, and consumer trust have all been supported through clear labelling and tamper-evident closures combined with moisture protection. Flexible multilayer films and coated paperboard formats have seen rising demand across both retail and institutional food supply chains.

With the growth of e-commerce grocery delivery and increasing food safety awareness among consumers, the food & beverage sector is projected to continue driving demand for moisture-resistant packaging. Global supply chain complexities and climate conditions will further reinforce this sector’s reliance on reliable moisture barriers.

The Food & Beverage Industry: The Kingpin of Demand

If you’re in the moisture-resistant packaging industry, the food and beverage sector is your key target audience. Processed and ready-to-eat foods are growing in sales, especially in urban areas.

Consumers are obsessed with fresh and safe food. That’s forcing manufacturers to step up with high-performance packaging. Add in some tech wizardry-like oxygen and moisture barrier films-and you’ve got a formula that’s not just keeping food fresh but also making packaging indispensable.

Sustainability: The Buzzword That’s Changing the Game

Let’s talk about the s word-sustainability. Everyone’s chasing eco-friendly materials, and governments are cracking down on plastic waste. Biodegradable and recyclable materials like paper are the new kids on the block, and they’re killing it in the moisture-resistant category.

Big brands are dropping serious cash into R&D to create packaging that doesn’t just work but also feels good for the planet. It’s not just a trend; it’s table stakes now if you want to stay in the game.

Pharma is the New MVP

Moisture-resistant packaging is the MVP in pharma packaging. Think about it&-tablets, capsules, biologics, and vaccines all need to stay safe, and these packages make it happen.

The pandemic made everyone sit up and realize how critical high-quality pharma packaging is. Biologics and temperature-sensitive drugs? Yep, they’re driving the demand too, especially in emerging markets. This is where the growth is.

Tech is Making Packaging Sexy

Who knew packaging could be so high-tech? With advanced barrier coatings, nanotech, and multi-layer films, we’re seeing packaging that’s not just functional but also durable, cost-effective, and honestly, pretty slick.

Automation is cutting costs and boosting efficiency, making these solutions a no-brainer for manufacturers. If you’re not riding the tech wave in packaging, you’re missing out.

Urbanization & Disposable Incomes: The Rocket Fuel

Urbanization is blowing up, and people have more money to spend. That means convenience is king, and packaged goods are thriving.

Whether it’s food, personal care, or electronics, consumers want quality and hygiene. Throw in lifestyle changes like on-the-go snacking and e-commerce, and you’ve got a market that’s absolutely crushing it. Emerging economies? They’re the next big playground for moisture-resistant packaging.

High Cost of Advanced Packaging Materials

The main activities associated with making moisture-resistant packaging range from the use of specialized materials and technologies, which significantly increase costs. Most high-performance barrier coatings, multi-layered films, and sustainable alternatives such as biodegradable plastics or paper are more expensive than conventional materials used in packaging.

These costs normally trickle down to end-users, making the adoption of such packaging material less feasible for SMEs. Price-sensitive markets, especially in developing regions, experience difficulties in adopting due to their high costs.

Environmental Concerns of Plastic Packaging

Though plastic is dominant in the market for moisture-resistant packaging because of its excellent barrier properties, its negative environmental impact remains a serious issue. Widespread use of non-recyclable and single-use plastics increases pollution, forcing regulatory authorities to enact stringent measures.

Governments and environmentalists across the world are forcing plastic use reduction from manufacturers' sides by compelling the use of eco-friendly alternatives. This transition would be challenging mainly because of increased costs, fewer biodegradable materials available in the market, and huge alterations in infrastructure.

The Recycling Process itself is Quite Complicated

The multi-layered composition of moisture-resistant packaging presents a challenge for recycling. Barrier films and composite materials are often non-recyclable or require specialized processes to separate the layers. This complexity deters recycling and also creates problems in disposal for both manufacturers and consumers.

Limited recycling infrastructure in various regions worsens this situation and spurs environmental issues and regulatory requirements for manufacturers to seek more sustainable solutions.

Economic Volatility and Raw Material Shortages

Raw material price fluctuation, particularly of polymers and resins, is the greatest challenge. Economic instability, supply chain interruptions, and geo-political unrest often cause scarcity or increased prices of raw materials, which are often used in a process.

Fluctuations cause higher production costs and reduced margins for profit, causing manufacturers to look for other options, which sometimes cannot meet the required performance level or cost efficiency.

Low Awareness in New Markets

The advanced moisture-resistant packaging solutions are still unknown to the consumers and small-scale enterprises in developing economies. Consumers and small businesses do not consider it because of its cost and lack of awareness of its benefits.

The other factor is that many small manufacturers in the regions prefer reducing the cost instead of adopting new packaging technology, which hampers the growth of the market. The industry players find it difficult to bridge this gap by education and incentives.

Adoption of Biodegradable and Sustainable Materials

Sustainability has been an emerging core trend for the moisture-resistant packaging market. Manufacturers have switched to biodegradable and recyclable materials like paper, starch-based plastics, and plant-based resins due to demand for eco-friendly packaging from the consumer side.

Besides, stringent environmental regulations are promoting biodegradability and recycling. Water-based coatings and biofilms with the desired moisture barrier are gaining significant market share in their pursuit to find a more sustainable alternative than conventional materials.

Technological Advances in Barriers Coating

Advanced barriers coating has given a new wave to the world of packaging industries. Nanotechnology-based coatings, bio-based polymer-based coatings, and vapor deposited films are contributing to improved water resistance while maintaining transparence and flexibility.

While these innovations add performance to water-resistant packaging, they also create opportunities for packaging manufacturers to make use of the minimum amount of material, saving them production cost and increasing their sustainability.

E-commerce and On-the-Go Packaging

The rapid growth of e-commerce has influenced packaging trends, with a greater emphasis on durability and moisture resistance. Online shopping, especially for food, electronics, and personal care products, requires strong packaging to avoid damage during transit.

On-the-go consumption has also increased demand for convenient, portable, and moisture-resistant solutions, especially in urban areas. Packaging designs now focus on functionality and aesthetic appeal to meet this growing segment.

Packaging Customization and Branding

Customization is fast becoming a critical trend as brands look to stand out in a competitive market. Moisture-resistant packaging solutions are designed with unique shapes, sizes, and branding elements to make the product more appealing and engaging to the consumer.

Flexible packaging, such as pouches and resealable bags, is particularly popular because of its versatility in design and functionality. Brands are also using digital printing techniques for high-quality graphics and personalized messaging on moisture-resistant packaging.

Incorporation of Intelligent Packaging Attributes

Moisture-resistant packaging has been on an increasing trend regarding the incorporation of smart technologies. QR codes, RFID tags, and sensors have been added for enhanced functionality and traceability. These technologies enable monitoring of real-time conditions such as temperature and humidity, thus assuring the product's safety and quality.

Such packaging is invaluable in industries that include pharmaceutical and food products due to their vulnerability to loss of integrity. Smart moisture-resistant packaging will increase in demand with increasing adoption of IoT.

Demand is Increasing in Emerging Economies.

Growth prospects for moisture-resistant packaging appear immense in countries such as India, China, and Brazil, the emerging markets. Urbanization and rising levels of disposable income drive consumer demand in packaged goods from these regions, leading to consumption shifts in these emerging markets with rising processed foods, beverages, and pharmaceuticals usage.

Manufacturers would seize this as a great business opportunity by promoting inexpensive and innovative designs, which reflect regional needs and concerns.

Expansion of the Pharmaceutical Industry

The growth of the pharmaceutical industry, especially in the emerging markets, represents a vast opportunity for the company to increase moisture-resistant packaging. Increased production of generic drugs, increased expenditure in healthcare, and higher demand for biologics and temperature-sensitive medicines require robust packaging solutions.

Moisture-resistant packaging is vital in ensuring drug efficacy and safety for patients. All companies would see extraordinary returns on investment by funding innovative, compliance-focused designs for pharmaceuticals in the respect of packaging.

Opportunities in Sustainable Packaging

The global push for sustainability creates a huge opportunity for eco-friendly moisture-resistant packaging. Governments and organizations across the globe are promoting green initiatives, offering incentives for adopting recyclable and biodegradable materials.

Companies that invest in sustainable solutions, such as paper-based packaging with moisture barriers or bio-plastic alternatives, can differentiate themselves and capture a growing segment of environmentally conscious consumers. Partnering with recycling initiatives and circular economy programs further amplifies market presence.

Technological Advancements in Smart Packaging

Moisture-resistant packaging is an opportunity to enhance product functionality and value with the incorporation of smart technologies. Features such as humidity sensors, freshness indicators, and tamper-proof seals address industries such as food, beverages, and electronics where quality assurance is of prime importance.

The smart packaging solution can also increase supply chain visibility through real-time tracking, thus giving companies using these advanced technologies a competitive advantage.

Niche Market Untapped Potential

Moisture-resistant packaging applications include areas like electronics, personal care, and specialty chemicals, where such innovations are waiting to be unleashed.

Niche areas present tailored requirements, from safeguarding delicate electronic components against moisture damage to delivering premium-looking, durable personal care and high-value electronics packages. Innovation coupled with cooperation by niche players has immense market opportunities waiting to be seized

United States holds the majority market share globally for moisture-resistant packaging due to increased demand by the food and beverage, and pharmaceutical industries. Its superior manufacturing, innovative prowess, and tendency to adopt greener material contributes to a majority of market shares. On the other hand, e-commerce continues to advance in popularity as demand for products also increases its requirements for resistant packaging in ensuring a safe delivery process.

China is a critical market for moisture-resistant packaging, mainly due to the rapid expansion of its industrial base and growing urbanization. Rising consumer awareness about food safety and hygiene is boosting growth in food delivery and e-commerce sectors. In addition, government initiatives for sustainable packaging offer vast opportunities for bio-based and recyclable materials in China.

India's moisture-resistant packaging market is growing with the increasing demand for packaged foods, pharmaceuticals, and personal care products. The growth in the consumption of convenience goods is driven by urbanization and rising disposable incomes. Furthermore, government initiatives in Make in India and sustainability have boosted local manufacturing and innovation in eco-friendly packaging solutions.

Germany is a vital market in Europe, especially in the industrialized context of Germany, where the industry has continually invested in enhancing the environment. This means that products need to be recyclable or biodegradable. The food and pharmaceutical industries mainly require this packaging due to the importance of product safety and quality.

Technological advancement and precision in Japan are reflected in its market for moisture-resistant packaging. The country has an aging population, which causes an increased demand for pharmaceuticals. The pharmaceutical industry requires moisture-resistant formulations to prevent drug degradation. In addition, the country adheres to a potent culture of high-quality, functional, and pleasing packaging products.

The UK market is driven by the country's robust e-commerce and retail sectors, which demand durable packaging to protect products during transit. Growing consumer preference for sustainable packaging solutions, along with strict environmental regulations, is pushing manufacturers toward innovative materials and designs. The food and beverage sector remains a major contributor to market growth.

Demand for moisture-proof packaging in Canada is driven by the growth in packaged food and pharmaceutical industries. Increasing sustainable practices drive the adoption of recyclable and biodegradable packaging across the country. In addition, e-commerce sector growth and customer demands for convenient products increase market demand.

Brazil is also an emerging important market for moisture-resistant packaging in Latin America, based on the increasing food processing and export industries of the country. The growth of the urban population and awareness regarding food safety standards are key drivers. Another reason is Brazil's focus on sustainability, opening up opportunities for eco-friendly packaging materials.

The market is characterized by intense competition among established players, regional manufacturers, and emerging startups. Major companies such as Amcor plc, Mondi Group, and Berry Global Group dominate the market with their robust product portfolios, global reach, and advanced technological capabilities.

These players leverage economies of scale and continuous investments in R&D to innovate high-performance, sustainable packaging solutions. Their ability to cater to diverse industries such as food, pharmaceuticals, and e-commerce further strengthens their market position.

Sustainability is a major focus for companies across the competitive landscape. Key players are prioritizing eco-friendly materials like recyclable plastics, paper-based laminates, and biodegradable options to meet regulatory requirements and rising consumer demand for green products.

For instance, companies like Smurfit Kappa and DS Smith are leading the push towards paper-based alternatives, particularly in regions with stringent environmental regulations such as Europe and North America. Their emphasis on a circular economy and waste reduction has helped them secure a competitive edge.

Regional and mid-sized players, particularly in emerging markets like Asia Pacific and Latin America, are gaining traction by offering cost-effective and customized solutions.

These players cater to local industries by focusing on lightweight, flexible, and moisture-resistant designs that align with specific market needs. Their agility in addressing regional challenges and opportunities allows them to compete effectively with global leaders, particularly in price-sensitive markets.

Startups are playing a pivotal role in reshaping the competitive dynamics of the market. Companies like TIPA Corp. (Israel) and Notpla (UK) are introducing innovative, sustainable packaging made from materials such as seaweed and compostable bioplastics.

These startups are addressing niche market needs and partnering with environmentally conscious brands, disrupting traditional business models with their eco-centric innovations.

Overall, the competitive landscape is shaped by innovation, sustainability, and regional adaptability. The growing demand for advanced packaging solutions, coupled with stringent environmental regulations, ensures continuous evolution and competition among both established leaders and disruptive newcomers.

The overall market size for Moisture-resistant Packaging was USD 28.0 billion in 2024.

The global sales of Moisture-resistant Packaging are expected to reach USD 29.2 billion in 2025.

The growing demand for packaged foods, pharmaceuticals, and personal care products, coupled with increasing e-commerce penetration, will drive market growth.

The global Moisture-resistant Packaging Market is projected to reach USD 45.4 billion by 2035.

Plastic will remain the dominant material type due to its superior barrier properties and versatility, though sustainable alternatives like paper and biodegradable plastics will gain traction during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA