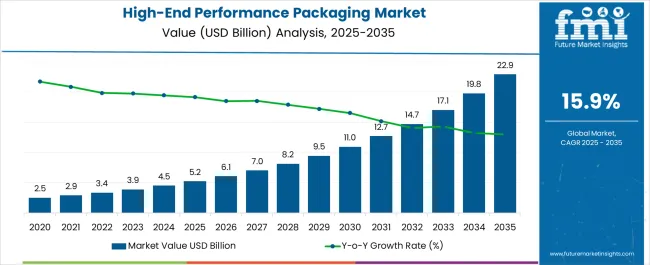

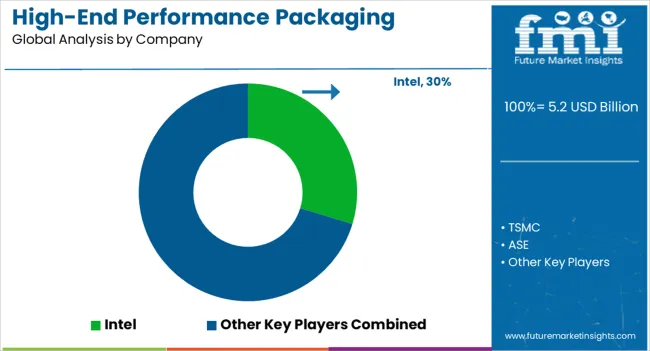

The High-End Performance Packaging Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 22.9 billion by 2035, registering a compound annual growth rate (CAGR) of 15.9% over the forecast period.

| Metric | Value |

|---|---|

| High-End Performance Packaging Market Estimated Value in (2025 E) | USD 5.2 billion |

| High-End Performance Packaging Market Forecast Value in (2035 F) | USD 22.9 billion |

| Forecast CAGR (2025 to 2035) | 15.9% |

The high end performance packaging market is advancing steadily, supported by surging demand for faster data processing, miniaturization of semiconductor devices, and the need for efficient thermal management solutions. Increasing adoption of artificial intelligence, high performance computing, and 5G infrastructure is driving innovation in advanced packaging technologies that deliver superior performance and reduced power consumption.

Continuous investments in heterogeneous integration, wafer level packaging, and chip stacking technologies are enabling enhanced device density and improved signal integrity. Global semiconductor manufacturers are aligning strategies with these technological requirements, ensuring reliable supply chains and robust capacity expansion.

With increasing pressure on industries to deliver high speed and energy efficient systems, the market outlook remains highly favorable, driven by the integration of performance packaging solutions across applications such as data centers, networking, and consumer electronics.

The UHD FO segment is projected to hold 38.60% of the total market revenue by 2025 within the technology category, making it the leading segment. Its dominance is attributed to its ability to support high density integration, reduced form factor, and improved electrical performance.

The technology enables efficient redistribution layers and provides scalability required for complex system architectures. In addition, growing demand for AI processors, advanced networking devices, and data intensive applications has increased reliance on UHD FO.

Its capacity to deliver thermal efficiency and support for higher input output density continues to make it the preferred solution among semiconductor manufacturers, reinforcing its leadership within the technology segment.

The data center networking segment is anticipated to capture 44.20% of total market revenue by 2025 within the application category, establishing it as the most prominent segment. This growth is being driven by the rapid increase in global data traffic, adoption of cloud services, and rising demand for high performance computing infrastructure.

Data centers require advanced packaging solutions that optimize speed, reliability, and power efficiency, making high end performance packaging indispensable. Continuous migration toward hyperscale data centers and the deployment of next generation servers have further intensified demand.

With enterprises and cloud providers focusing on energy efficiency and latency reduction, data center networking continues to lead as the primary application for high end performance packaging technologies..

Global sales of high-end performance packaging grew at 19.2% CAGR from 2020 to 2025. At the end of 2025, total market valuation reached USD 3.3 billion.

Between 2025 and 2035, global high-end performance packaging demand will rise at 15.9% CAGR. The worldwide market for high-end performance will create an absolute D opportunity of USD 13.1 billion.

High-end performance packaging in semiconductors plays an important role in protecting the chips from surrounding environment. It also ensures that there is an electrical connection between chip mounts on electrical boards.

The high-end performance packaging technology involves Ultra High Density Fan-Out (UHD FO) packaging technology, High Bandwidth Memory (HBM) packaging, 3DNAND, Co-EMIB, Si interposer packaging, 3D System on chip (SOC), and Foveros.

The applications of Ultra High Density Fan Out (UHD FO) packaging are in cloud computing technology, 5G telecommunication, autonomous cars, and Artificial Intelligence chips.

The High Bandwidth Memory (HBM) is the standard DRAM that helps in achieving 256 GBps bandwidth and reduces power consumption of the semiconductor devices circuitry. This packaging technology helps in lesser power consumption and more clock speed.

The 3D System on Chip integration system allows reduction of the circuit elements and thus makes the electronics circuit thinner and more compact. For instance, the Department of Defense (DOD) uses 3D SOC technology which aids 50X better performance and yields better output results.

Foveros by Intel is one of its kinds of technology that provide 3D stacking solution and helps in power efficiency and cost optimization. The compact structures of semiconductors make them fit in autonomous vehicles’ electronics circuitry. The EMIB and Co-EMIB are used in high performance computing and data center networking.

| Country | United States |

|---|---|

| Projected CAGR (2025 to 2035) | 15.2% |

| Historical CAGR (2020 to 2025) | 15.8% |

| Market Value (2035) | USD 2.8 billion |

| Country | United Kingdom |

|---|---|

| Projected CAGR (2025 to 2035) | 14.2% |

| Historical CAGR (2020 to 2025) | 14.2% |

| Market Value (2035) | USD 4522.9 million |

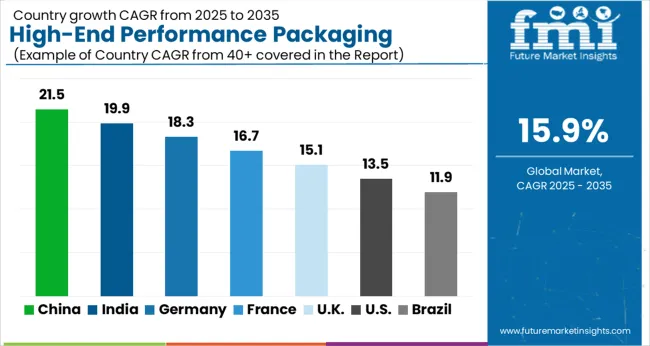

| Country | China |

|---|---|

| Projected CAGR (2025 to 2035) | 17.4% |

| Historical CAGR (2020 to 2025) | 21.5% |

| Market Value (2035) | USD 4.3 billion |

| Country | Japan |

|---|---|

| Projected CAGR (2025 to 2035) | 16.1% |

| Historical CAGR (2020 to 2025) | 19.4% |

| Market Value (2035) | USD 2.7 billion |

| Country | South Korea |

|---|---|

| Projected CAGR (2025 to 2035) | 16.4% |

| Historical CAGR (2020 to 2025) | 20.8% |

| Market Value (2035) | USD 1.0 billion |

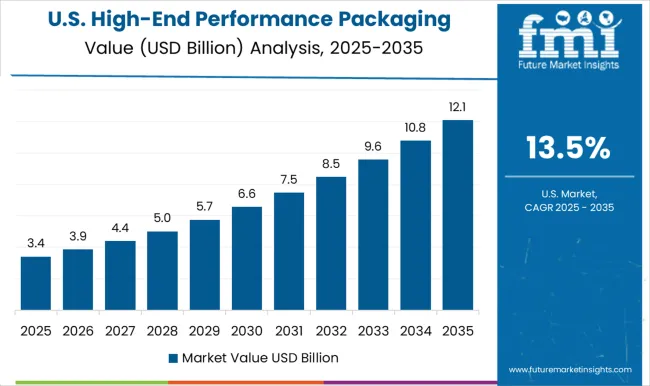

High Adoption of Advanced Packaging Technologies Boosting Sales in the United States

The USA high-end performance packaging market is set to expand at 15.2% CAGR through 2035. By 2035, total market size in the United States will reach USD 2.8 billion.

Overall high-end performance packaging demand in the USA will create an absolute D opportunity of USD 22.9 billion by 2035. The USA market grew at 15.8% CAGR from 2020 to 2025.

Growing inclination towards using advanced packaging technologies is driving the United States market. Subsequently, rising popularity of high-performance computing will propel high-end performance packaging demand.

Large presence of high-end performance packaging manufacturers is another factor boosting market development. Several USA-based companies are developing new technologies and putting efforts to advance in packaging technologies.

For instance, in July 2024, Intel Corporation, the United States-based company announced that it has developed a clear roadmap till 2025 for processes and packaging technology showcasing a series of innovations.

Such advancements in high-end performance packaging sector in the United States are helping the market to thrive rapidly.

Rapid Shift Towards High-Performance Computing Boosting the United Kingdom Market

The United Kingdom high-end performance packaging market is set to reach USD 4522.9 million in 2025. Between 2025 and 2035, demand for high-end performance packaging in the country will rise at 14.2% CAGR. Rising popularity of high-performance computing and expansion of IT & telecommunication sector are driving the United Kingdom market.

To meet growing demand, companies are developing new innovative solutions. For instance, in September 2020, ARM, a leading United Kingdom-based electronics manufacturer along with TSMC announced that they have developed industry’s first 7nm ARM-based CoWoS chiplets for high performance computing.

They have demonstrated technologies for developing a system on chip with ARM based technology operating at a 4GHz in a 7 FinFET process. This will aid in the expansion of the market.

Growing Trend of Miniaturization Creating High-End Performance Packaging Demand in China

China’s high-end performance packaging market will progress at 17.4% CAGR through 2035. Total market size in China is slated to reach USD 4.3 billion by 2035.

As per the study, high-end performance packaging demand in China will create an absolute D opportunity of USD 3.5 billion. Increasing penetration of miniaturization supported by surging need for compact electronic devices is driving the market in China.

Similarly, heavy presence of the world’s leading semiconductor and consumer electronics companies will elevate high-end performance packaging demand in China.

Leading China-based high-end performance packaging manufacturers and providers such as JCET Group offer advanced packaging technologies such as wire bond packaging, flip flop packaging, wafer level packaging, system in packages.

JCET’s XDFOI technology supports integration of multiple chips and high bandwidth memory with cost optimization features. This is positively impacting the market expansion.

By application the global market for high-end performance packaging is segmented into data center networking, high performance computing, and autonomous vehicles. Among these, high performance computing segment will lead the market.

FMI predicts applications of high-end performance packaging in high performance computing sector to increase at an impressive CAGR of 15.7% during the assessment period. From 2020 to 2025, the target segment grew at 18.5% CAGR.

Growth of the target segment is due to growing usage of high-end performance packaging for designing high energy-efficient systems for high performance computing applications.

In recent years, advanced heterogenous packaging solutions such as high-end performance packaging has made full entrance into high-performance computing sector. They enable users to achieve high speed and high performance by designing compact and energy-efficient systems.

Key high-end performance packaging companies include Intel, TSMC, ASE, Samsung, Amkor, JCET Group, Tongfu, ADI, AMD, and ARM. These leading high-end performance packaging manufacturers are developing advanced packaging solutions.

They are also forming alliances, partnerships, and collaborations. Besides this, they are acquiring other companies to gain a competitive edge in the market.

Recent Developments:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 5.2 billion |

| Projected Market Size (2035) | USD 22.9 billion |

| Anticipated Growth Rate (2025 to 2035) | 15.9% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; and the Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, and others. |

| Key Segments Covered | Technology, Application, and Region |

| Key Companies Profiled | Intel; TSMC; ASE; Samsung; Amkor; JCET Group; Tongfu; ADI; AMD; ARM |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers Restraints Opportunity Trends Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global high-end performance packaging market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the high-end performance packaging market is projected to reach USD 22.9 billion by 2035.

The high-end performance packaging market is expected to grow at a 15.9% CAGR between 2025 and 2035.

The key product types in high-end performance packaging market are uhd fo, hbm, 3ds, foveros, 3dnand, co-emib, emib, si interposer and 3d soc.

In terms of application, data center networking segment to command 44.2% share in the high-end performance packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Performance Elastomer Market Size and Share Forecast Outlook 2025 to 2035

Performance tires Market

Web Performance Optimization (WPO) Solution Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Mercury Sorbent Market Size and Share Forecast Outlook 2025 to 2035

High-performance Electric Sports Cars Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Computing Market Size and Share Forecast Outlook 2025 to 2035

High Performance Polyamides Market Size and Share Forecast Outlook 2025 to 2035

High Performance Data Analytics (HPDA) Market Size and Share Forecast Outlook 2025 to 2035

High Performance Pigments Market Size and Share Forecast Outlook 2025 to 2035

High Performance Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA