The demand for filter paper in Japan is valued at USD 6.7 billion in 2025 and is projected to reach USD 8.6 billion by 2035, reflecting a compound annual growth rate of 2.5%. Growth is influenced by continued use of filtration media across laboratories, industrial processes, food handling and environmental monitoring. As testing volumes rise and quality-control procedures expand, filter paper remains a core consumable due to its consistency, porosity range and compatibility with varied analytical and separation tasks. Industries including chemicals, pharmaceuticals and beverages maintain steady procurement cycles, supported by routine testing and production workflows. The market benefits from incremental improvements in paper strength and uniformity, ensuring stable demand across both single-use and continuous filtration applications over the forecast window.

The growth curve shows a gradual upward trajectory, beginning at USD 5.9 billion in earlier years and moving to USD 6.7 billion in 2025 before progressing toward USD 8.6 billion by 2035. Yearly values increase at modest but reliable intervals, rising from USD 6.9 billion in 2026 to USD 7.0 billion in 2027 and continuing evenly through later periods. This pattern reflects stable reliance on filter paper where consistency and material cost-efficiency remain priorities. As laboratories expand sample volumes and industrial users refine purification steps, procurement continues at a steady pace. The market’s progression indicates a mature category with predictable demand supported by ongoing analytical requirements and the broad integration of filtration routines across Japan’s scientific and industrial operations.

Demand in Japan for filter paper is projected to rise from USD 6.7 billion in 2025 to USD 8.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 2.5%. Starting at USD 5.9 billion in 2020, the demand increases to USD 6.7 billion by 2025. From 2025 onward, the value continues to rise gradually, reaching USD 7.4 billion by around 2030 and ultimately USD 8.6 billion by 2035. Growth is supported by the expanding use of filtration in industrial, healthcare and environmental applications as Japan addresses stricter air and liquid quality standards and upgrades manufacturing and processing facilities.

Over the forecast period the total value uplift is approximately USD 1.9 billion (from USD 6.7 billion in 2025 to USD 8.6 billion in 2035). Early growth is volume led, driven by more units and installations, while later years increasingly reflect higher value per unit through advanced filter paper grades, higher performance materials and special purpose formats. As manufacturers shift toward high efficiency, specialty filter media and more stringent regulatory requirements take effect, the per unit spend rises. Suppliers focusing on differentiated materials and premium applications are positioned to capture the additional value across the forecast period.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 6.7 billion |

| Forecast Value (2035) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

The demand for filter paper in Japan is rising as industries place stronger emphasis on consistent filtration and quality control. Automotive manufacturers use filter paper to support engine testing, fluid assessment and material analysis, which reflects the country’s steady vehicle production and parts supply activity. The chemical and pharmaceutical sectors rely on filter paper for separation, clarification and routine laboratory work, creating stable repeat demand. Food and beverage processors require reliable filtration for teas, coffees and ingredient extraction, and this need is reinforced by Japan’s large beverage industry and strong culture of product refinement. Laboratories and research institutions across Japan continue to use filter paper for sample preparation and analytical workflows, which supports ongoing procurement across public and private facilities.

Further growth is shaped by the expansion of precision manufacturing, where consistent particle control and clean processing environments are considered essential. Electronics producers use filter paper in certain material checks and solution preparation, and this role increases as production scales. Urban foodservice networks require dependable filtration for brewing systems, which adds to the uptake of specialised grades that maintain flavour stability and clarity. At the same time, manufacturers offering higher strength, heat-resistant or chemically compatible filter papers are seeing interest from industrial buyers seeking materials that support consistent performance. These combined requirements indicate steady demand for filter paper across Japan’s industrial, laboratory and beverage sectors.

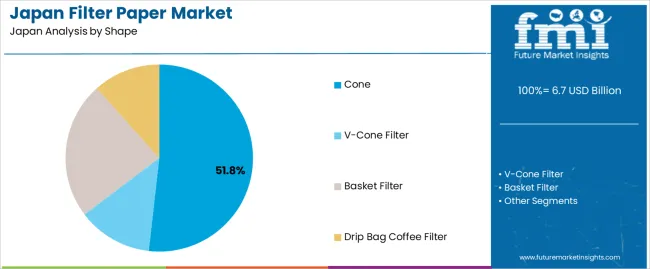

The demand for filter paper in Japan is shaped by the range of shapes used in brewing and filtration and the thickness levels required for different extraction needs. Shapes such as cone, V-cone, basket filter and drip bag coffee filter support varied brewing methods in household, café and commercial settings. Thickness categories including below 30 GSM, 30 to 60 GSM and above 60 GSM influence filtration speed, strength and flavor clarity. As consumers and businesses prioritize consistent extraction and ease of handling, the combination of shape suitability and paper density guides overall adoption across Japan’s beverage and filtration applications.

Cone-shaped filter paper accounts for 52% of total demand in Japan. Its leading role reflects strong use in pour-over brewing methods that emphasize controlled extraction and flavor clarity. Cone filters support predictable water flow and even saturation, making them preferred by specialty cafés and home brewers seeking precise brewing outcomes. Their compatibility with popular dripper devices contributes to steady demand across beginner and experienced users. The shape also allows efficient filtration without channeling, improving consistency across different grind sizes. These characteristics reinforce continuous selection of cone filters throughout Japan’s coffee-focused retail and household markets.

Demand for cone filters increases as pour-over brewing remains central to Japan’s café culture and home brewing routines. Many consumers value the clean flavor profile supported by cone filters, which helps maintain interest in premium coffee preparation. Their availability in multiple diameters suits a wide range of drippers, enhancing convenience for buyers who experiment with different brewing volumes. Reliable performance across both single-cup and multi-cup formats further strengthens their role. As precision brewing techniques continue to shape consumer habits, cone-shaped filters maintain their leading position in the filter paper segment.

Below 30 GSM filter paper accounts for 45.2% of total demand in Japan. This leading share reflects the preference for thin, fast-flowing filter paper used in brewing styles that highlight brightness and clarity. Thin paper supports efficient liquid flow while still capturing fine particles, making it suitable for light and medium roasts commonly enjoyed by Japanese consumers. Manufacturers adopt below 30 GSM options for their balance between structural integrity and high filtration speed. These papers help achieve clean extraction with minimal sediment, which aligns with household and café priorities for clarity and consistency.

Demand for below 30 GSM paper is also driven by its compatibility with cone and V-cone drippers that rely on quick drainage for optimized brewing control. The lightweight structure supports even extraction across varying pour techniques, which appeals to users refining their brewing skills. Its adaptability across manual devices makes it a practical choice for both single-serve and multi-cup preparation. As precise, efficient brewing remains central to consumer expectations, below 30 GSM filter paper continues to hold a strong position in Japan’s filtration market.

Demand for filter paper in Japan is influenced by growth in laboratory testing, analytical chemistry, environmental monitoring and life-sciences applications, as well as by industries such as food & beverage and pharmaceuticals that require filtration and quality control. Another driver is the increasing focus on air and water purity, leading to more frequent use of filtration materials. However, barriers include high cost of premium filter papers, competition from alternative filtration media (such as membranes or woven filters) and regulatory or certification demands for specific grades. These factors collectively shape how quickly filter paper uptake grows in Japan.

How Are Industry Standards and Quality Requirements Driving Demand for Filter Paper in Japan?

Japanese laboratories and quality-control facilities often require high-purity filter papers with tight specifications, reproducible performance and certified chemistry. The stringent standards of pharmaceutical manufacturing, environmental monitoring (water and air), and food processing set high demands on filtration materials. As quality control budgets expand and testing frequencies increase, the need for reliable filter paper rises. In addition, Japan’s ageing infrastructure and maintenance cycles drive industrial filtration needs. These dynamics make filter paper a key component in quality-assurance and compliance activities across multiple sectors.

Where Are Growth Opportunities Emerging for Filter Paper in Japan’s Market?

Growth opportunities for filter paper in Japan lie in emerging analytical fields such as microplastics testing, advanced environmental monitoring, genomics labs and IoT-enabled sensor systems where filtration is essential. Food-safety trends and stricter product-traceability requirements open demand in food & beverage processing and packaging lines. Also, the shift toward more frequent maintenance in industrial sectors (automotive, electronics, chemicals) provides opportunities for replacement filter-paper usage. Suppliers who can offer specialised filter-paper grades, smaller lot sizes and technical support are well positioned to capture these emerging segments in Japan.

What Challenges Are Limiting Broader Adoption of Filter Paper in Japan?

Despite favourable demand drivers, several challenges moderate broader uptake of filter paper in Japan. Cost sensitivity in large-volume industrial filtration applications may favour lower-cost alternative media. Some laboratories may switch to membrane filters or synthetic filters with finer porosity or better throughput, reducing traditional filter paper demand. Supply-chain issues such as imports of specialty grades or need for certification of materials may delay procurement. These factors slow how rapidly filter paper is adopted across all potential use-cases in Japan.

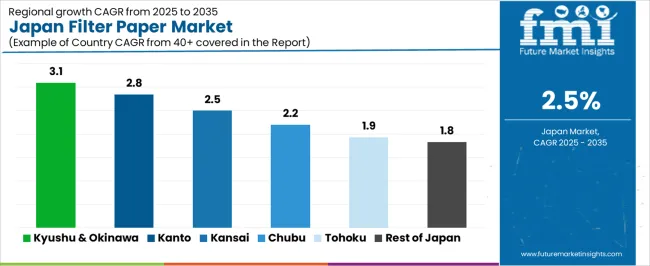

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.1% |

| Kanto | 2.8% |

| Kinki | 2.5% |

| Chubu | 2.2% |

| Tohoku | 1.9% |

| Rest of Japan | 1.8% |

Demand for filter paper in Japan is rising gradually across regions. Kyushu and Okinawa lead at 3.1%, supported by steady use in laboratories, food processing, and industrial applications. Kanto follows at 2.8%, driven by its concentration of research institutions, manufacturers, and commercial users that rely on filtration materials. Kinki records 2.5%, shaped by active industrial zones and consistent demand from educational and testing facilities. Chubu grows at 2.2%, influenced by regional production activity and routine commercial use. Tohoku reaches 1.9%, where adoption increases at a measured pace. The rest of Japan posts 1.8%, reflecting stable but modest demand across smaller markets.

Kyushu & Okinawa is projected to grow at a CAGR of 3.1% through 2035 in demand for filter paper. Laboratories, chemical plants, and industrial facilities in Fukuoka are adopting high-quality cellulose, glass fiber, and synthetic filter papers for analytical, filtration, and laboratory applications. Rising demand for precision, durability, and efficiency drives adoption. Manufacturers provide standard and specialty grades suitable for various chemical, environmental, and research uses. Retailers and distributors expand product accessibility. Growth in research centers, industrial operations, and quality control laboratories supports steady adoption of filter paper across Kyushu & Okinawa.

Kanto is projected to grow at a CAGR of 2.8% through 2035 in demand for filter paper. Tokyo and neighboring industrial and research hubs are adopting cellulose, glass fiber, and synthetic filter papers for laboratory, environmental, and industrial filtration applications. Rising focus on analytical accuracy, quality control, and operational efficiency drives adoption. Manufacturers provide a range of standard and specialty filter paper grades. Distributors and retailers ensure widespread access across laboratories and industrial facilities. Urban industrial density, research activity, and growing chemical and environmental testing contribute to steady demand for filter paper across Kanto.

Kinki is projected to grow at a CAGR of 2.5% through 2035 in demand for filter paper. Cities including Osaka and Kyoto are adopting cellulose, glass fiber, and synthetic filter papers in laboratories, chemical plants, and industrial facilities. Rising need for high-precision filtration, quality control, and laboratory efficiency drives adoption. Manufacturers supply both standard and specialty grades for analytical, industrial, and research purposes. Retailers and distributors expand product availability across urban and semi-urban centers. Industrial growth, research activity, and chemical processing needs ensure steady adoption of filter paper in Kinki.

Chubu is projected to grow at a CAGR of 2.2% through 2035 in demand for filter paper. Urban centers, particularly Nagoya, are adopting cellulose, glass fiber, and synthetic filter papers for laboratories, chemical processes, and industrial filtration. Rising focus on operational efficiency, precision, and quality control drives adoption. Manufacturers provide various grades suitable for research, analytical, and industrial applications. Retailers and distributors ensure access across urban and semi-urban facilities. Industrial expansion, laboratory development, and environmental testing initiatives support steady adoption of filter paper across Chubu.

Tohoku is projected to grow at a CAGR of 1.9% through 2035 in demand for filter paper. Regional laboratories, chemical plants, and industrial facilities in Sendai and surrounding areas are gradually adopting cellulose, glass fiber, and synthetic filter papers for filtration, analytical, and environmental applications. Rising need for precision, quality control, and durability drives adoption. Manufacturers supply standard and specialty grades suitable for research and industrial uses. Retailers and distributors expand access to smaller urban and semi-urban facilities. Steady laboratory growth, industrial activity, and environmental testing support gradual adoption in Tohoku.

The Rest of Japan is projected to grow at a CAGR of 1.8% through 2035 in demand for filter paper. Smaller towns and rural facilities are gradually adopting cellulose, glass fiber, and synthetic filter papers for laboratory, chemical, and environmental applications. Rising awareness of quality control, durability, and analytical accuracy drives adoption. Manufacturers provide standard and specialty grades compatible with small-scale research and industrial operations. Retailers and distributors ensure accessibility across semi-urban and rural areas. Gradual growth in industrial activity, research facilities, and environmental monitoring supports steady adoption of filter paper across the Rest of Japan.

The demand for filter paper in Japan is driven by growth in sectors such as life sciences, pharmaceuticals, environmental monitoring and industrial filtration. As regulations around air and water quality tighten and laboratory testing requirements increase, there is greater need for high-performance filter media. Additionally, the expansion of biopharmaceutical manufacturing and academic research in Japan boosts consumption of specialty filter paper for sample preparation and analytical workflows. The manufacturing base in the country also ensures demand for industrial filtration solutions that protect equipment and maintain operational efficiency. These combined factors elevate filter paper as a critical consumable in Japan’s broader testing and manufacturing ecosystem.

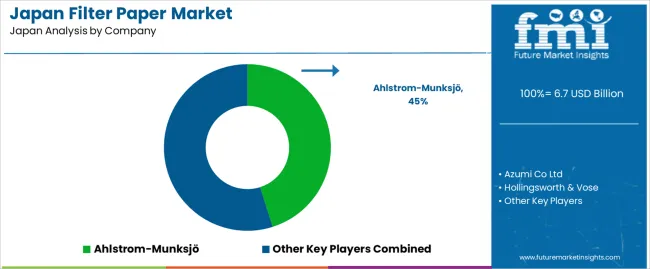

Key companies shaping the filter paper segment in Japan include Ahlstrom-Munksjö, Azumi Co Ltd, Hollingsworth & Vose, Thermo Fisher Scientific Inc. and Merck KGaA. These firms supply a variety of filter paper products from laboratory grade membranes and specialty analytical sheets to industrial-filtration media and environmental monitoring belts. Ahlstrom-Munksjö and Hollingsworth & Vose lead in high-volume industrial media; Azumi focuses on niche and regional distribution; Thermo Fisher and Merck serve laboratory and life-science filtration needs. Together, their technical expertise, regional presence and product breadth enable them to influence how filter-paper solutions are selected and applied within Japan’s scientific, industrial and environmental sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Shape | Cone, V-Cone Filter, Basket Filter, Drip Bag Coffee Filter |

| Thickness | Below 30 GSM, 30 To 60 GSM, Above 60 GSM |

| Paper Type | Bleached, Unbleached |

| Application | Alcoholic, Non-alcoholic |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Ahlstrom-Munksjö, Azumi Co Ltd, Hollingsworth & Vose, Thermo Fisher Scientific Inc., Merck KGaA |

| Additional Attributes | Dollar by sales by shape, thickness, and paper type; regional CAGR and growth patterns; market share evolution across laboratory, industrial, and beverage segments; volume versus value growth trends; premium versus standard paper grades; adoption in analytical labs, food & beverage, environmental monitoring, and industrial filtration; performance attributes such as porosity, strength, and chemical compatibility; technical support services; specialty and custom paper formats; distribution and e-commerce penetration; regulatory and certification compliance. |

The demand for filter paper in japan is estimated to be valued at USD 6.7 billion in 2025.

The market size for the filter paper in japan is projected to reach USD 8.6 billion by 2035.

The demand for filter paper in japan is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in filter paper in japan are cone, v-cone filter, basket filter and drip bag coffee filter.

In terms of thickness, below 30 gsm segment is expected to command 45.2% share in the filter paper in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share Analysis for Filter Paper Companies

Filter Paper Market Trends – Growth, Demand & Forecast through 2035

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Japan Micro Flute Paper Market Analysis – Size, Share & Industry Trends 2025-2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Automotive Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Global Laboratory Filter Paper Market Growth – Trends & Forecast 2024-2034

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Filter Bag Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA