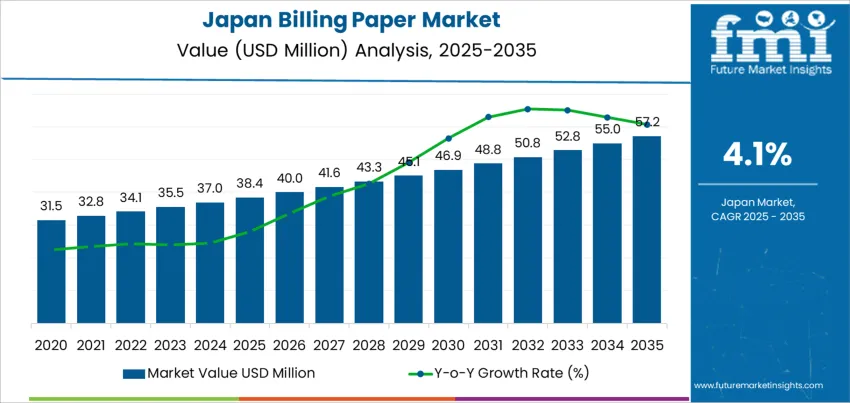

The Japan billing paper demand is valued at USD 38.4 million in 2025 and is forecasted to reach USD 57.2 million by 2035, reflecting a CAGR of 4.1%. Demand remains linked to transactional documentation requirements across logistics, retail, healthcare, and field-service operations. Although digital billing is expanding, sectors with regulatory retention needs and cash-handling workflows continue to rely on physical records. Procurement preferences emphasize print clarity, resistance to smudging, and compatibility with thermal and dot-matrix printers used at point-of-sale counters and dispatch centers.

2-part NCR paper leads the product landscape due to its ability to generate instant duplicate copies without carbon sheets. Its adoption supports proof-of-delivery slips, invoicing forms, and check-out receipts in businesses that require multi-copy traceability for auditing or logistics handovers. Performance features include strong image longevity, reduced paper dust, and lower printer maintenance.

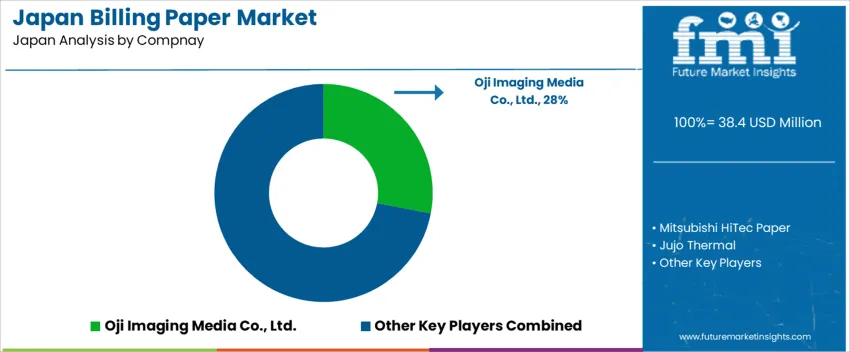

Kyushu & Okinawa, Kanto, and Kansai account for the highest utilization due to their concentration of distribution hubs, retail chains, clinics, and administrative offices. Key suppliers include Oji Imaging Media Co., Ltd., Mitsubishi HiTec Paper, Jujo Thermal, TPJ Co., Ltd., and Nippon Paper Industries Co., Ltd. These companies provide coated and uncoated NCR formats with varied basis weights tailored to billing automation systems and continuous-form printing environments.

Demand for billing paper in Japan reflects uneven contribution levels across retail, healthcare, and administrative environments. Retail point-of-sale systems remain the primary contributor due to receipt-issuance requirements, supporting a stable baseline. Healthcare facilities add a secondary share through documentation and patient-record printouts where digital conversion progresses cautiously. Public-sector offices sustain additional volume through formal paper-archiving practices that continue under regulated retention rules.

Lower contribution comes from logistics and banking, where digital invoicing and electronic statements reduce routine print volumes. These shifts gradually redistribute contribution toward segments where paper continuity is required for compliance or customer-confirmation purposes. Environmental policies encourage usage reduction, but change is incremental due to established workflows and consumer preference for printed proof of payment in several service interactions. The growth contribution index therefore indicates resilience built on necessity-driven use rather than expansion. Retail and healthcare dominate incremental gains, while digital transformation moderates’ growth in other sectors. The structure remains balanced, but long-term contribution increasingly depends on segments with verified documentation needs.

| Metric | Value |

|---|---|

| Japan Billing Paper Sales Value (2025) | USD 38.4 million |

| Japan Billing Paper Forecast Value (2035) | USD 57.2 million |

| Japan Billing Paper Forecast CAGR (2025-2035) | 4.1% |

Demand for billing paper in Japan is increasing because retail shops, convenience stores and small restaurants continue to rely on printed receipts as part of daily transaction records. Many point-of-sale systems in Japan still require thermal billing paper for customer proof of purchase and store-level accounting. Businesses use printed receipts to support loyalty systems, returns processing and tax documentation, which maintains steady consumption. Public institutions and medical facilities also rely on printed billing information for patient communication and reimbursement procedures that require standardized documentation.

Growth in takeout services and parcel deliveries contributes to expanded use of billing paper for order slips and delivery confirmations. Japan’s large network of vending machines also uses receipt rolls in models that include purchase tracking features. Manufacturers improve paper quality to support clear print results and longer legibility, which aligns with consumer expectations for durable records. Constraints include ongoing adoption of digital receipts and mobile payment systems that reduce paper output in certain retail formats. Cost sensitivity can influence product choice when thermal paper prices fluctuate. Some organizations delay upgrades to newer printing technologies, maintaining existing paper-based systems until operational priorities change.

Demand for billing paper in Japan is shaped by continued reliance on printed transaction documentation in retail, healthcare, logistics, and regulated commercial sectors. Despite digital invoicing growth, secure physical billing records remain essential in compliance-driven workflows. Buyers prioritize print clarity, durability, and compatibility with high-speed printers used in point-of-sale systems, delivery verification, and administrative accounting environments. Ecofriendly initiatives also influence material preferences, supporting increased recycled content adoption.

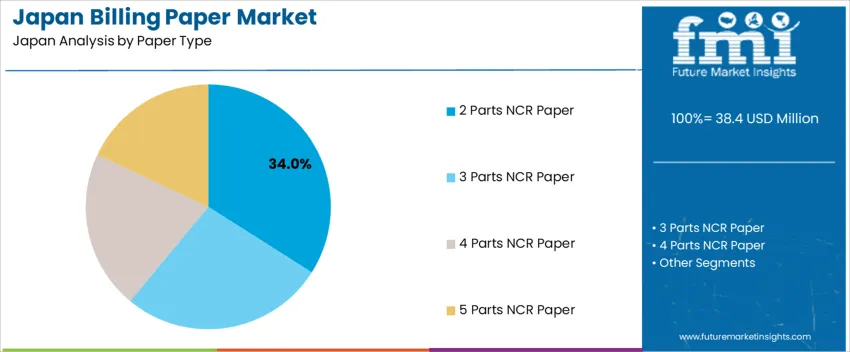

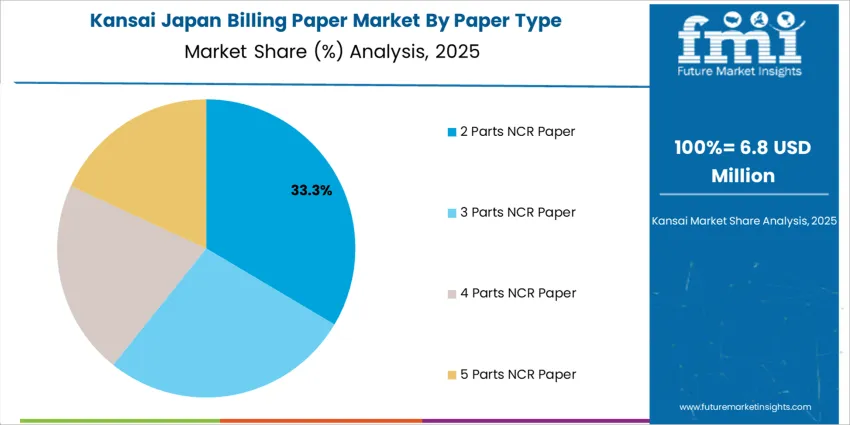

2-part NCR (No Carbon Required) paper holds 34.0%, as dual-copy formats suit retail receipts, delivery acknowledgments, and hotel or clinic billing where both issuer and customer maintain a record. 3-part NCR accounts for 27.0%, enabling multi-department processing in distribution and supply chain operations. 4-part NCR represents 21.0%, supporting regulated documentation where audit trails are critical. 5-part formats hold 18.0%, serving archival or multi-approval environments including transportation and warehouse tracking. Multi-part paper selection reflects workflow complexity, signature verification needs, and distribution of physical records across Japanese organizations.

Key Points:

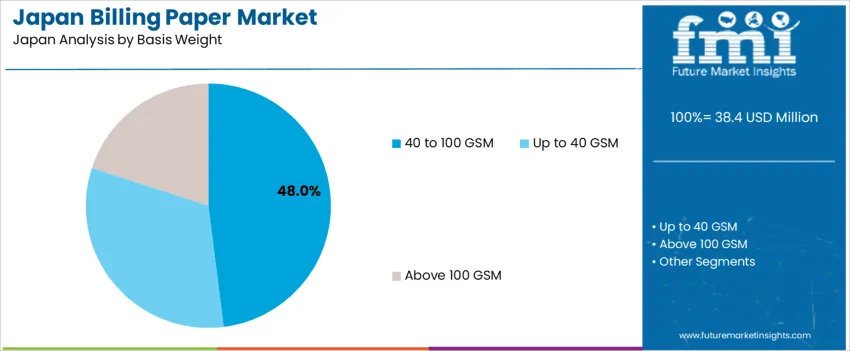

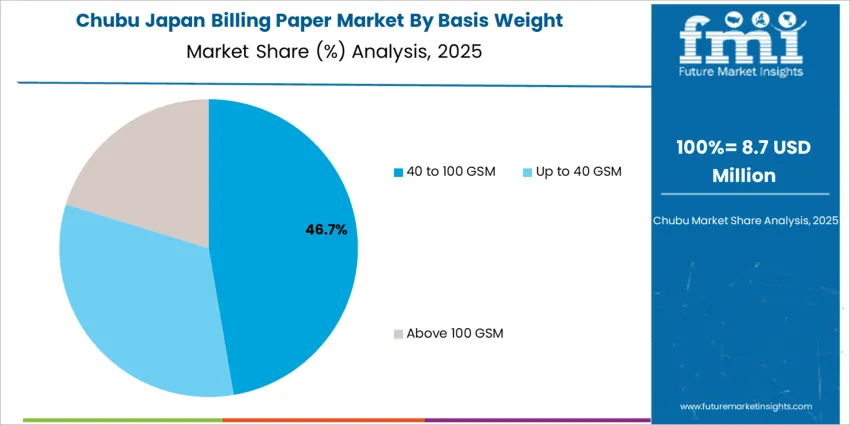

Papers within 40–100 GSM hold 48.0%, balancing strength and printer compatibility for thermal and impact printing systems widely used across Japan. They maintain sufficient opacity and tear resistance for frequent handling. Up to 40 GSM paper holds 32.0%, supporting low-cost volume printing for courier receipts and mass retail needs. Above 100 GSM accounts for 20.0%, used in high-durability formats requiring long-term storage or enhanced perception quality. Weight selection is influenced by equipment performance, image retention durability, and cost sensitivity within high-volume billing operations.

Key Points:

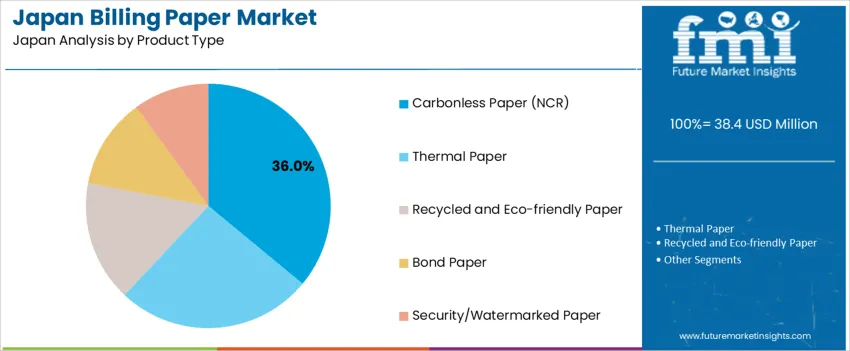

Carbonless paper represents 36.0%, driven by its role in multipart billing and signature-based verification within Japan’s retail, logistics, and medical administration. Thermal paper holds 26.0%, widely used in fast-printing POS systems though affected by print fade over time. Recycled and eco-friendly paper accounts for 16.0%, supported by ecofriendly certifications and environmental procurement mandates. Bond paper holds 12.0%, serving office-grade invoicing. Security or watermarked paper holds 10.0%, used where fraud protection is required. Product category decisions reflect print durability, sensitivity to storage conditions, and operational compliance priorities.

Key Points:

Continued use of printed receipts in retail, regulatory documentation in medical and public services, and reliability needs in legacy POS systems are driving demand.

In Japan, billing paper demand remains stable because convenience stores, supermarkets and specialty retail locations continue issuing printed receipts to support returns, tax records and expense reimbursement. Healthcare providers, including clinics and pharmacies, print visit summaries and prescription details for patients under national insurance guidelines, reinforcing usage of thermal billing paper. Government offices and transportation operators rely on printed proof-of-payment and transaction slips in settings where digital systems are not universally adopted across age groups. Legacy POS terminals widely deployed in small family-run shops, restaurants and municipal facilities depend on consistent thermal roll compatibility, sustaining baseline procurement volumes. Regional distributors ensure reliable supply to support dense retail networks, particularly near rail stations and commercial districts.

Gradual transition to digital receipts, environmental concerns about paper waste and slower adoption among new minimal-service retail formats restrain demand.

Retailers in major cities are promoting digital receipt options linked to loyalty programs and smartphone wallets, reducing the frequency of printed receipts for younger consumers who favor cashless payment. Municipal waste-reduction initiatives encourage businesses to limit unnecessary receipt printing, influencing behavioral shifts in certain prefectures. Some emerging retail formats, including unmanned stores and vending-based services, rely primarily on mobile confirmation without printed output. These evolving practices contribute to a slow decline in long-term print volume despite widespread current usage.

Shift toward phenol-free and recyclable thermal grades, increased customization for branding and rising demand in logistics documentation define key trends.

Manufacturers expand phenol-free thermal papers to address safety concerns related to chemical coatings, aligning with Japan’s preference for consumer-friendly materials. Retailers and service companies are adopting branded receipts that incorporate QR codes for promotions, customer feedback and digital onboarding. Parcel carriers and third-party logistics providers continue using thermal documentation for label printing and delivery confirmations, supporting demand linked to e-commerce. Compact roll formats tailored for mobile POS systems are becoming more common in pop-up shops and outdoor events. These trends indicate steady but gradually modernizing demand for billing paper in Japan.

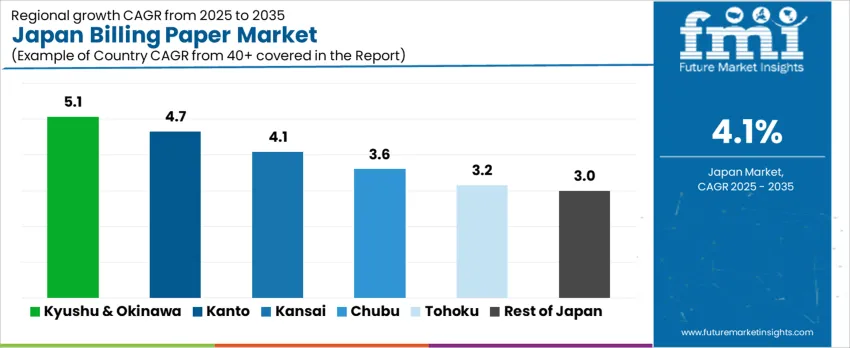

Demand for billing paper in Japan connects to retail invoicing, logistics documentation, restaurant POS usage, and administrative printing within offices that still maintain hybrid digital–paper workflows. Transaction-based sectors contribute recurring procurement due to continuous consumption. Growth varies by region based on retail density, tourism activity, and the operational structure of SMEs. Kyushu & Okinawa leads at 5.1%, followed by Kanto (4.7%), Kansai (4.1%), Chubu (3.6%), Tohoku (3.2%), and the Rest of Japan (3.0%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.1% |

| Kanto | 4.7% |

| Kansai | 4.1% |

| Chubu | 3.6% |

| Tohoku | 3.2% |

| Rest of Japan | 3.0% |

Kyushu & Okinawa record 5.1% CAGR due to retail and hospitality businesses requiring steady billing paper replenishment across food service, transport, and small-format stores. Restaurants and tourism-linked outlets generate continuous printed receipts for dine-in and takeaway orders, sustaining POS paper purchases. Consumer-goods retailers rely on thermal rolls and duplicate formats compatible with commercial checkout systems. Local offices in logistics corridors maintain billing documentation for freight and warehouse operations, reinforcing baseline usage. Shops focus on reliable print clarity and paper composition that withstands handling without smudging. Distributors in port cities ensure access to standardized roll sizes supporting uninterrupted system operation. Budget-oriented procurement emphasizes bulk supply based on monthly usage cycles. Billing paper forms remain embedded in workflow routines where digital receipts adoption is gradual, maintaining consistent demand from SMEs across daily transaction processes.

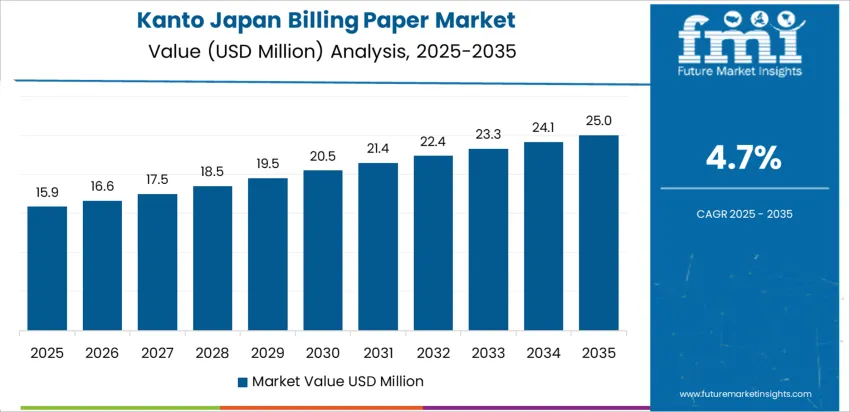

Kanto posts 4.7% CAGR driven by dense commercial activity in Tokyo, Kanagawa, Saitama, and Chiba. Transaction-heavy retail zones maintain stable consumption of thermal receipt rolls and multi-copy papers supporting high-traffic POS lanes. Supermarkets, convenience stores, and pharmacies depend on billing paper for clear transactional records aligned with regulatory documentation practices. Office environments preserve printed billing archives for audit-readiness, combining digital systems with physical filing. E-commerce packaging hubs in the region continue paper labeling use for operational verification, supporting recurring volume. Replacement cycles follow large order batching to minimize downtime across checkout counters. Buyers evaluate print durability and smooth surface performance for efficient thermal-head operation. Central warehouse networks manage logistics, offering short-lead fulfillment to keep business continuity intact.

Kansai records 4.1% CAGR with demand centered on Osaka, Kyoto, and Hyogo’s retail and service hubs. POS-dependent businesses maintain continuous billing paper use for transaction logs required by standardized store operations. Small enterprises such as specialty shops and cafés rely on billing rolls sized for compact terminals. Regional transportation and delivery services support thermal printing for billing confirmation linked to daily distribution activity. Office printing remains operational where physical copies support vendor reconciliation and expense tracking. Procurement behavior favors cost-stable paper options with acceptable print contrast. Local wholesalers serve shops with direct resupply aligned to weekly consumption. Training institutions and healthcare facilities implement billing documentation supporting service verification.

Chubu achieves 3.6% CAGR with usage anchored in manufacturing-linked service providers around Nagoya and surrounding prefectures. Production facilities interacting with vendor networks maintain printed billing tags for goods-handling checkpoints. Retail activity remains a reliable consumption driver as stores depend on compatible POS paper for receipt issuance. Offices maintain hybrid documentation practices where billing sheets remain part of standardized accounting procedures. Regional buying decisions emphasize paper longevity and stable thermal response to reduce waste. Distribution centers ensure supply availability for varied business types including hospitality and automotive after-sales. Procurement aligns with invoice processing schedules reinforcing reorder predictability.

Tohoku reaches 3.2% CAGR with regional SMEs operating stores, service counters, and administrative offices that continue printing billing documents for customer communication and verification. Retailers prioritize durable paper that maintains legibility under varied climate exposure. Local distribution centers and convenience outlets form routine procurement channels supporting straightforward restocking cycles. Billing paper remains integral across municipal services and public facilities managing payment documentation. Buyers review price consistency to maintain operational budget control. Seasonal fluctuations occur when tourism peaks increase dining and hospitality receipts.

The Rest of Japan posts 3.0% CAGR with demand sustained in provinces where retail and public offices operate POS devices requiring printed output. Billing paper offers predictable transaction records supporting daily trade. Smaller-scale logistics operations print shipment confirmations and collection notices. Cost-focused procurement favors standard roll sizes enabling compatibility across entry-level printers. Paper quality that prevents misprints remains important to avoid repeated receipts during busy hours. Availability through e-commerce supports steady access for businesses located away from major commercial zones.

Demand for billing paper in Japan is driven by suppliers of thermal and coated receipt rolls used in POS terminals, kiosks, ticketing systems, and public-transport payment stations. Oji Imaging Media Co., Ltd. holds an estimated 28.0% share, supported by controlled coating-layer uniformity, stable print-density performance, and strong distribution across Japanese retailers and service operators. Its products maintain legibility and abrasion resistance under continuous daily receipt printing. Mitsubishi HiTec Paper maintains strong participation through thermal grades with BPA/BPS-free chemistry, delivering consistent head-sensitivity and clean image retention required by regulated retail applications. Jujo Thermal supports targeted demand with specialized substrates for transport ticketing and logistics labeling where durability and chemical resistance are priorities.

TPJ Co., Ltd. provides steady supply of POS rolls for independent stores and regional retail chains, emphasizing reliable core alignment and smooth printer feeding. Nippon Paper Industries Co., Ltd. adds capacity in coated-paper grades where receipt durability, moisture tolerance, and domestic availability must remain secure. Competition in Japan focuses on print-clarity stability, coating-layer adherence, POS-mechanism compatibility, environmental compliance, and consistent national distribution. Demand remains stable as receipting and billing workflows continue across retail and transportation networks in Japan’s service-driven economy.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Paper Type | 2 Parts NCR Paper, 3 Parts NCR Paper, 4 Parts NCR Paper, 5 Parts NCR Paper |

| Basis Weight | 40 to 100 GSM, Up to 40 GSM, Above 100 GSM |

| Product Type | Carbonless Paper (NCR), Thermal Paper, Recycled and Eco-friendly Paper, Bond Paper, Security/Watermarked Paper |

| Application | Retail, E-commerce & Packaging, Banking, Government & Legal Documentation, Healthcare, Educational |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Oji Imaging Media Co., Ltd., Mitsubishi HiTec Paper, Jujo Thermal, TPJ Co., Ltd., Nippon Paper Industries Co., Ltd. |

| Additional Attributes | Demand driven by POS systems, financial documentation, compliance-related printing, and e-commerce logistics; growth in thermal printing for digital receipts and automated billing; focus on eco-friendly and BPA-free thermal rolls; alignment with government records security standards including watermark technology; regional consumption varies with concentration of retail chains and financial institutions in Kanto and Kansai. |

The demand for billing paper in Japan is estimated to be valued at USD 38.4 million in 2025.

The market size for the billing paper in Japan is projected to reach USD 57.2 million by 2035.

The demand for billing paper in Japan is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in billing paper in Japan are 2 parts ncr paper, 3 parts ncr paper, 4 parts ncr paper and 5 parts ncr paper.

In terms of basis weight, 40 to 100 gsm segment is expected to command 48.0% share in the billing paper in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Billing Paper Market Analysis - Growth & Industry Trends 2025 to 2035

Japan Micro Flute Paper Market Analysis – Size, Share & Industry Trends 2025-2035

Demand for Billing Paper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Filter Paper in Japan Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Paper Loading Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Butcher Paper in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA