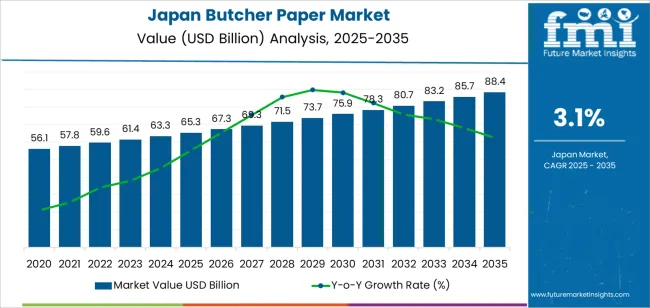

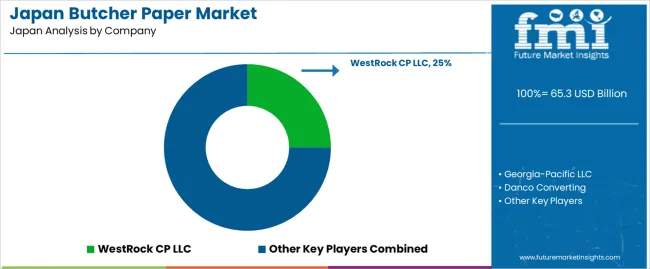

The demand for butcher paper in Japan is expected to grow from USD 65.3 billion in 2025 to USD 88.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.1%. Butcher paper, primarily used in the food packaging industry for products like meat and fresh produce, is an eco-friendly packaging material that helps preserve the quality and freshness of goods. As consumers become more environmentally conscious and prioritize biodegradable options, the demand for butcher paper is set to increase. Japan’s growing focus on environmental durability, along with rising concerns about plastic waste, further supports the shift toward natural packaging solutions like butcher paper.

The foodservice sector, including supermarkets, butcher shops, and restaurants, is a major consumer of butcher paper. As demand for fresh, high-quality products, particularly in the meat and seafood sectors, continues to rise, the need for butcher paper will expand. The broader food industry’s growing shift toward eco-friendly packaging solutions, along with increasing consumer demand for eco-friendly products, will further drive growth in this industry. Other sectors, such as retail and cosmetics, are also adopting eco-friendlier packaging options, contributing to a broader trend that enhances the demand for butcher paper. As these shifts continue, butcher paper is well-positioned to play a central role in supporting eco-friendly packaging practices in Japan.

Between 2025 and 2030, the demand for butcher paper in Japan will grow steadily from USD 65.3 billion to USD 67.3 billion. This phase will reflect consistent value accumulation, driven by incremental increases in industry adoption across the food and retail sectors. As demand for eco-friendly packaging continues to rise, the growth will be moderate but steady, with the paper industry leveraging improvements in product quality and durability to cater to the growing consumer base.

From 2030 to 2035, the demand for butcher paper is projected to continue its growth trajectory, reaching USD 88.4 billion. During this period, the demand will experience increased value accumulation, as the transition towards eco-friendly packaging solutions accelerates across industries. The rise in environmental regulations, coupled with more consumers and businesses adopting eco-friendly practices, will drive higher demand for butcher paper. Innovations in paper production and designs that enhance the performance and versatility of butcher paper will further fuel its adoption, particularly in the food industry.

| Metric | Value |

|---|---|

| Demand for Butcher Paper in Japan Value (2025) | USD 65.3 billion |

| Demand for Butcher Paper in Japan Forecast Value (2035) | USD 88.4 billion |

| Demand for Butcher Paper in Japan Forecast CAGR (2025-2035) | 3.1% |

The demand for butcher paper in Japan is growing as the foodservice and retail industries continue to prioritize eco-friendly, eco-friendly packaging solutions. Butcher paper is widely used for wrapping meat, seafood, and fresh produce, preserving freshness and ensuring food safety. As consumers and businesses in Japan become increasingly aware of environmental issues, there is a rising shift toward using biodegradable and recyclable materials, and butcher paper fits this demand perfectly.

A major factor driving this demand is Japan’s focus on reducing plastic waste and the environmental impact of packaging. As plastic bag bans and other regulations aimed at reducing plastic waste become more common, butcher paper is increasingly seen as a viable alternative. Its natural composition and biodegradability make it an appealing option for packaging food products, aligning with Japan’s strong commitment to durability and eco-conscious practices in the food and retail sectors.

The growing popularity of organic, fresh, and locally sourced food in Japan is fueling the demand for butcher paper. As more consumers seek food that is free from artificial additives and preservatives, butcher paper serves as an ideal packaging material for maintaining the quality of fresh products. Butcher paper’s versatility in use whether for wrapping, lining, or serving has further contributed to its increasing adoption. As Japan continues to prioritize environmental durability, the demand for butcher paper is expected to grow steadily through 2035.

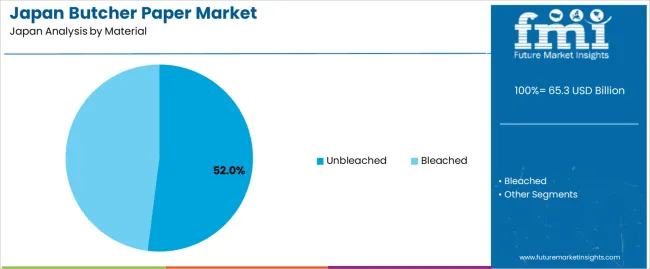

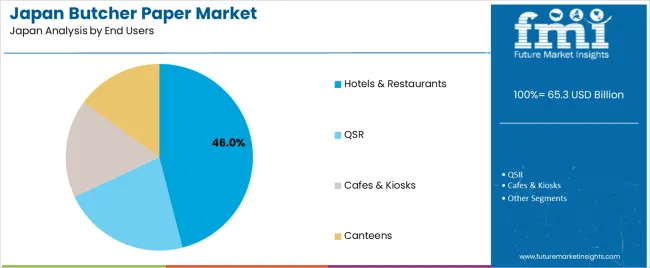

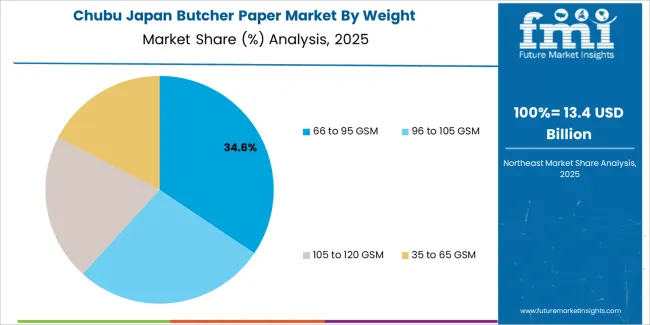

Demand for butcher paper in Japan is segmented by material, end user, and weight. By material, demand is divided into unbleached and bleached paper, with unbleached paper holding the largest share at 52%. The demand is also segmented by end user, including hotels & restaurants, quick-service restaurants (QSR), cafes & kiosks, and canteens, with hotels & restaurants leading the demand at 46%. In terms of weight, demand is divided into 66 to 95 GSM, 96 to 105 GSM, 105 to 120 GSM, and 35 to 65 GSM, with 66 to 95 GSM being the most popular weight range. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Unbleached butcher paper accounts for 52% of the demand for butcher paper in Japan. This material is highly favored due to its natural, eco-friendly appearance, making it suitable for a variety of applications, especially in the foodservice industry. Unbleached butcher paper is ideal for wrapping fresh meats, seafood, and produce, as its more absorbent properties help maintain product freshness and quality. It aligns with growing consumer demand for eco-friendly packaging, as it does not contain harmful bleaching chemicals. The rough texture of unbleached paper is also perfect for branding and printing, making it popular for businesses promoting organic and natural products. With a strong shift towards environmentally responsible practices, especially within the foodservice sector, unbleached butcher paper’s demand is expected to continue growing. As companies focus more on reducing their environmental footprint and offering eco-conscious alternatives, unbleached butcher paper will remain the material of choice for many businesses in Japan.

Hotels & restaurants account for 46% of the demand for butcher paper in Japan. In the foodservice industry, particularly in hotels and restaurants, butcher paper is crucial for packaging fresh food, including meats, poultry, and fish. Its absorbent nature helps retain moisture, ensuring that products stay fresh and of high quality. Beyond packaging, butcher paper is often used for portioning and food presentation in both casual and fine dining environments. The increasing consumer preference for organic and eco-friendly packaging within the hospitality sector has further driven demand, as businesses aim to meet the rising demand for eco-conscious practices. The versatility of unbleached butcher paper, which aligns with a natural and environmentally friendly image, makes it the preferred choice for restaurants and hotels. As the focus on durability grows, hotels and restaurants will continue to lead the demand for butcher paper in Japan, seeking functional, eco-friendly solutions for food packaging.

In Japan, demand for butcher paper is rising due to growth in meat retail (butcher counters in supermarkets), the food‑service segment (steak houses, barbecue restaurants, take‑out and delivery), and greater emphasis on presentation, food safety, and environmental responsibility. Grease‑ and moisture‑resistant kraft papers for meat wrapping, tray‑liners, and branded paper sheets are increasingly used. Environmental considerations, such as reducing plastic waste and the preference for recyclable or compostable wraps, contribute to the rising adoption of butcher paper. Restraints include the higher cost of specialty wrapping paper versus standard food wrap films, challenges in scaling up production of high‑performance paper grades, and performance limitations (barrier properties, durability) compared with plastic alternatives.

Why is Demand for Butcher Paper Growing in Japan?

Demand in Japan is growing because meat‑retailers, butcher shops, and food‑service providers are under pressure to enhance food presentation, hygiene, and consumer appeal, especially amid rising competition and premiumisation of meat products (including imported or Wagyu beef). Butcher paper allows wraps, tray‑liners, or branded sheets that appeal to consumers and allow custom printing for branding. The rise of take‑out, delivery, and home‑barbecue culture in Japan also drives the need for durable, food‑safe paper wraps. The increased focus on reducing single‑use plastic items and promoting packaging that can be easily recycled or composted is pushing the adoption of paper‑based alternatives, making butcher paper a growing choice in food packaging and retail applications.

How are Technological Innovations Driving Growth of Butcher Paper in Japan?

Technological advances are supporting the butcher paper segment in Japan by improving material properties (enhanced grease‑ and moisture‑resistance, barrier coatings), enabling custom printed, branded sheets for retailers, and supplying unbleached or eco‑certified variants that meet environmental demands. Manufacturing improvements allow higher‑quality rolls, better converting (cut‑sheets, tray‑liners), and integration of anti‑bacterial or food‑contact certified treatments all important in Japan’s high‑food‑safety environment. These innovations help butcher paper compete more effectively versus plastics, making it easier for Japanese food‑retailers and restaurants to adopt paper wraps without compromising performance.

What are the Key Challenges Limiting Adoption of Butcher Paper in Japan?

Despite favourable trends, adoption of butcher paper in Japan faces several challenges. One major issue is cost‑competitiveness: specialty butcher‑wrapping papers that meet high barrier or food‑contact standards cost more than standard plastic films or generic paper, which can deter their use in cost‑sensitive outlets. Supply‑chain and raw‑material concerns (availability of high‑grade unbleached kraft pulp, manufacturing capacity for food‑contact certified papers) can restrict availability. Also, some food‑service or meat‑processing operations may prefer plastic or film wraps for better barrier performance (moisture, oxygen) and longer shelf‑life, limiting paper substitution. The transition to paper‑based wraps requires process changes (cutting, handling, roll‑stock conversions), which may slow adoption in legacy operations.

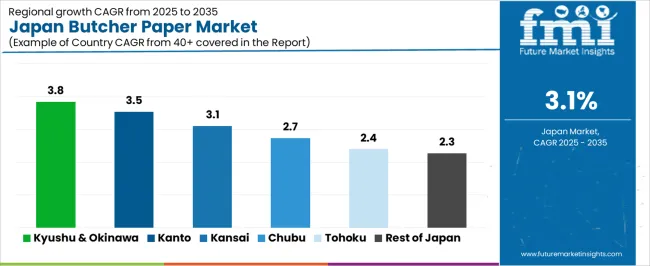

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.8% |

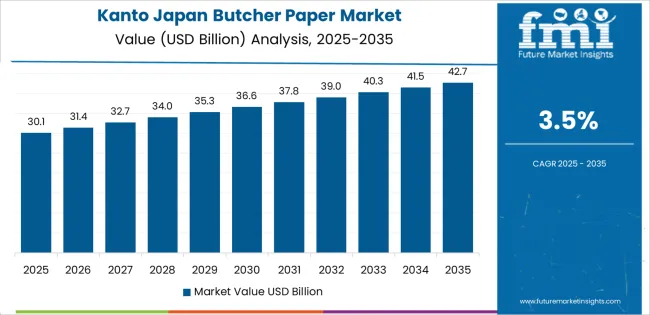

| Kanto | 3.5% |

| Kinki | 3.1% |

| Chubu | 2.7% |

| Tohoku | 2.4% |

| Rest of Japan | 2.3% |

Demand for butcher paper in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 3.8% CAGR. Kanto follows closely with a 3.5% CAGR, supported by its large food service and retail industries, where butcher paper is widely used for packaging fresh meat and produce. Kinki experiences a 3.1% CAGR, driven by the region’s strong presence in food production and distribution. Chubu shows a 2.7% CAGR, with demand coming from its large meat processing and distribution industry. Tohoku and the Rest of Japan experience more moderate growth at 2.4% and 2.3%, respectively, driven by regional food production and retail needs.

Kyushu & Okinawa lead Japan in demand for butcher paper, with a 3.8% CAGR. This demand is primarily driven by the region’s growing food processing sector, particularly in meat packaging. As local food producers focus on maintaining product freshness and reducing waste, the use of butcher paper as an eco-friendly, versatile packaging material is increasing. The region’s large fish and seafood industries also rely on butcher paper for packaging, contributing to its growing demand. With the rise of specialty and organic food industrys, there is an increasing preference for eco-friendly packaging solutions in Kyushu & Okinawa. As both the food service industry and local grocery chains continue to prioritize fresh, high-quality products, butcher paper is expected to see continued demand in this region, making it a key packaging material in the local food industry.

Kanto is experiencing steady demand for butcher paper, with a 3.5% CAGR. The region’s large and densely populated areas, particularly Tokyo, drive the demand for butcher paper, especially in supermarkets, food service chains, and restaurants. As the food retail industry grows, there is a continued need for high-quality packaging materials that maintain the freshness of meats and produce, which is where butcher paper comes into play. Kanto’s focus on durability is driving the adoption of eco-friendly packaging alternatives, further boosting the demand for butcher paper. The region’s meat and seafood industrys, particularly in food distribution and wholesale, are significant consumers of butcher paper. As urban centers in Kanto continue to expand and focus on fresh, minimally processed food options, the demand for butcher paper is expected to grow steadily in line with these trends.

Kinki is witnessing steady growth in demand for butcher paper, with a 3.1% CAGR. The region’s strong food production and distribution networks are the primary drivers of this demand. With cities like Osaka and Kobe being key food manufacturing hubs, there is an increasing need for packaging materials, especially for meat products, that preserve product quality and freshness. Butcher paper is widely used by both small-scale local butchers and large-scale meat processors in Kinki. Additionally, as consumer preference for fresh and minimally packaged products grows, the demand for butcher paper, known for its ability to maintain product quality while being eco-friendly, is rising. The region’s ongoing investment in eco-friendly food packaging solutions further supports this growth. As the demand for quality meat and fish products continues to increase in Kinki, butcher paper is expected to remain a critical component in food packaging.

Chubu is seeing moderate demand for butcher paper, with a 2.7% CAGR. The demand in this region is largely driven by its significant presence in meat processing and food distribution industries. Chubu’s large-scale meat processors and regional supermarkets rely on butcher paper to maintain the freshness of their products, particularly in urban areas like Nagoya. The increasing focus on eco-friendly packaging solutions in Chubu is also contributing to the rising demand for butcher paper. As the region continues to grow in both food production and retail distribution, there is a steady increase in the adoption of butcher paper for packaging fresh meats, seafood, and produce. While growth in Chubu is slower compared to other regions, the focus on quality packaging and maintaining food product integrity ensures that demand for butcher paper will continue to rise in the coming years.

Tohoku is experiencing steady demand for butcher paper, with a 2.4% CAGR. The demand in this region is driven by the need for packaging materials in local food production, particularly in the meat and fish sectors. Tohoku, with its emphasis on local food production and distribution, is seeing increased use of butcher paper in the packaging of fresh produce, meats, and seafood. As consumer interest in high-quality, locally sourced food products grows, there is an increasing demand for packaging that preserves freshness while being eco-friendly. The region’s smaller-scale food producers are gradually adopting butcher paper to replace less eco-friendly alternatives. As Tohoku continues to focus on improving its food production practices and expanding its food service industry, the demand for butcher paper is expected to rise steadily, supporting the region’s overall focus on eco-friendly food packaging solutions.

The Rest of Japan is seeing moderate demand for butcher paper, with a 2.3% CAGR. This demand is primarily driven by smaller-scale food production and retail operations in rural and suburban areas, where butcher paper is increasingly being adopted as a packaging solution for meats, seafood, and produce. As the demand for high-quality, fresh food products grows across these regions, there is an increasing need for eco-friendly packaging materials that preserve the quality of the products. Local butchers, fish markets, and food producers are increasingly turning to butcher paper to provide an eco-friendly and functional packaging option. While the growth rate is slower compared to more industrialized regions like Kanto and Kinki, the steady rise in consumer awareness and regional demand for fresh food ensures continued growth for butcher paper in the Rest of Japan.

In Japan, demand for butcher paper is growing steadily thanks to rising consumption of premium meat, expansion of the foodservice sector (including barbecue restaurants and steak houses), and increased focus on hygienic, food‑grade packaging solutions. Retailers and butcher shops value butcher paper for its ability to preserve freshness, support food‑presentation standards, and replace less preferred packaging materials. The trend toward custom‑printed, grease‑resistant and antibacterial papers is becoming more common in Japan’s upscale food industry.

Key producers active in the Japanese industry include WestRock CP LLC (with around 25.0% share), Georgia‑Pacific LLC, Danco Converting, Delta Paper and Oren International. WestRock stands out due to its broad product portfolio, ability to supply custom sizes and prints and established distribution in the Japanese food‑packaging segment. The other competitors differentiate through niche offerings such as waxed or coloured butcher paper, localised service, and coatings that meet Japan’s food‑safety and hygiene standards.

The competitive dynamics in Japan’s butcher paper landscape are shaped by several factors. One driver is the shift towards premium meat retailing and the growing demand for packaging that supports brand identity, custom printing and retail display. Another driver is regulatory and consumer pressure for safer, high‑quality, and visually appealing food packaging solutions. However, challenges include competition from alternative packaging materials (such as films or coated papers), raw material cost fluctuations (especially pulp and kraft paper) and the necessity of ensuring food‑grade certification and hygiene standards. Suppliers that combine reliable supply, strong local support, customisation capabilities and compliance with Japan’s rigorous food‑packaging norms will be best positioned to lead in Japan’s butcher paper segment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material | Unbleached, Bleached |

| Weight | 66 to 95 GSM, 96 to 105 GSM, 105 to 120 GSM, 35 to 65 GSM |

| End Users | Hotels & Restaurants, QSR, Cafes & Kiosks, Canteens |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | WestRock CP LLC, Georgia-Pacific LLC, Danco Converting, Delta Paper, Oren International |

| Additional Attributes | Dollar sales by material and weight; regional CAGR and adoption trends; demand trends in butcher paper; growth in hotels, restaurants, and retail sectors; technology adoption for packaging and food safety; vendor offerings including paper solutions, packaging services, and distribution; regulatory influences and industry standards |

The demand for butcher paper in Japan is estimated to be valued at USD 65.3 billion in 2025.

The market size for the butcher paper in Japan is projected to reach USD 88.4 billion by 2035.

The demand for butcher paper in Japan is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in butcher paper in Japan are unbleached and bleached.

In terms of weight, 66 to 95 gsm segment is expected to command 34.0% share in the butcher paper in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Butcher Paper Market Insights - Growth & Demand Forecast 2025 to 2035

Japan Micro Flute Paper Market Analysis – Size, Share & Industry Trends 2025-2035

Demand for Filter Paper in Japan Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Paper Loading Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA