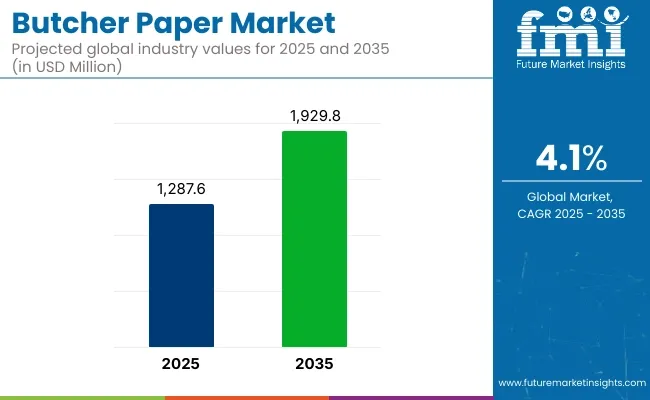

The butcher paper market is projected to grow from USD 1,287.6 million in 2025 to USD 1,929.8 million by 2035, registering a CAGR of 4.1% during the forecast period. Sales in 2024 reached USD 1,276.3 million, reflecting steady demand driven by increased consumption of fresh meat products and a growing preference for sustainable packaging.

This growth is driven by the rising popularity of barbecue culture, expanding food service establishments, and heightened awareness of eco-friendly packaging solutions. The versatility of butcher paper in applications such as meat wrapping, tray lining, and disposable work surfaces has further fueled its demand.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,287.6 million |

| Projected Market Size in 2035 | USD 1,929.8 million |

| CAGR (2025 to 2035) | 4.1% |

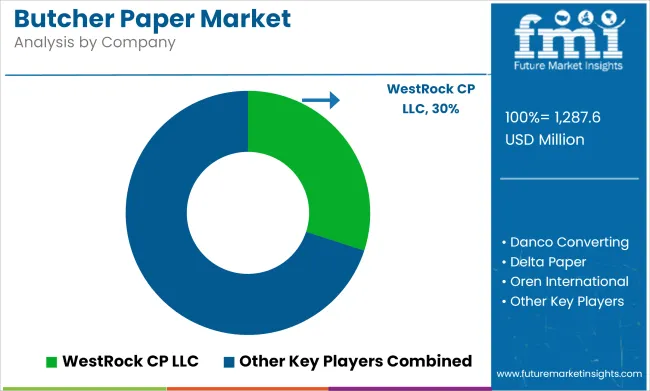

In response to the escalating demand for sustainable packaging, leading companies are investing in eco-friendly butcher paper solutions. Georgia-Pacific LLC offers CounterKraft® pink and bleached butcher paper grades, emphasizing its commitment to providing recyclable and compostable packaging options. A spokesperson from Georgia-Pacific stated, “Our focus remains on delivering high-quality, sustainable products that meet the evolving needs of our customers.”

The butcher paper market is witnessing a shift towards innovative and functional solutions. Manufacturers are developing butcher paper with enhanced grease resistance and moisture barrier properties, catering to the needs of the food service industry. Additionally, the incorporation of custom printing and branding on butcher paper offers businesses an avenue for marketing and customer engagement. These advancements align with the growing consumer preference for packaging that is both functional and environmentally responsible.

The butcher paper market is poised for sustained growth, driven by the increasing demand for sustainable packaging and the expansion of the food and beverage industry. Companies that invest in eco-friendly materials, innovative designs, and customization are likely to gain a competitive edge. As environmental regulations become more stringent and consumer awareness of sustainability grows, the adoption of compostable and recyclable butcher paper is expected to become a standard in the industry.

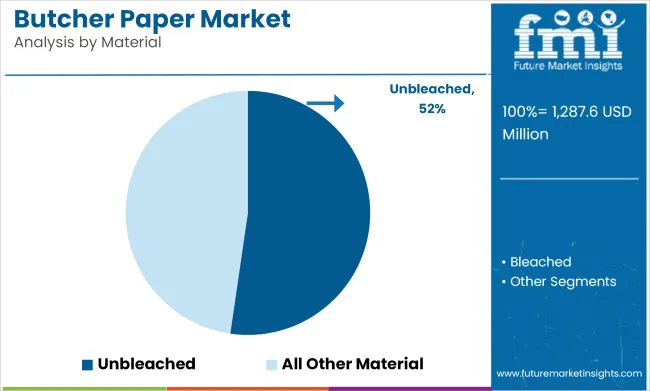

Unbleached butcher paper is set to lead the butcher paper market by 2025, accounting for an estimated 52.3% market share as operators in the foodservice industry respond to demand for natural, recyclable packaging. These papers are widely used by meat processors, grocery delis, and barbecue restaurants for wrapping fresh meats and lining trays.

Their natural texture and rustic appeal align well with current trends in artisanal food presentation and plastic-free packaging. One of the key advantages of unbleached butcher paper lies in its compatibility with flexographic and offset printing, allowing for high-quality custom logos, product information, and promotional branding.

With a growing number of manufacturers certifying their products under FSC and SFI chains of custody, butcher paper made from responsibly sourced pulp is being positioned as a low-waste alternative to polyethylene films and wax-coated wraps. Food safety and grease resistance are being improved without compromising print quality, through the use of fluorine-free barrier treatments. As foodservice and retail packaging policies tighten, unbleached butcher paper is expected to retain its dominance across both premium and bulk-purchase formats.

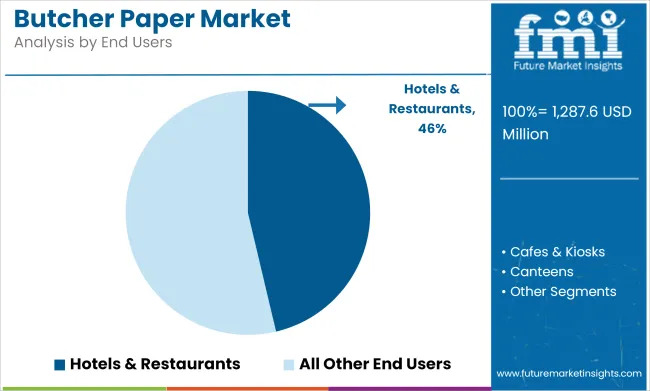

The foodservice segment is expected to account for over 46.3% of the global butcher paper market by 2025, making it the leading end-use sector. This strong demand is driven by the wide application of butcher paper in quick-service restaurants, delis, butcher shops, barbecue joints, and specialty food outlets, where it is used for wrapping meats, lining trays, and enhancing food presentation.

Butcher paper is preferred in foodservice due to its durability, breathability, and grease-resistant properties. It effectively retains moisture while allowing excess steam to escape, keeping grilled or smoked foods fresh and flavorful. Specialty variants like pink (or peach-treated) butcher paper are increasingly used in barbecue applications to wrap briskets and ribs, supporting proper smoke penetration while preserving juiciness an attribute that is enhancing their appeal among chefs and pitmasters.

Additionally, white butcher paper is widely used for sandwich wrapping, tray liners, and food parceling due to its clean appearance and customizable printability, which aids brand visibility and customer experience in food outlets. The shift toward compostable and unbleached kraft variants also reflects the growing demand for sustainable packaging solutions in the foodservice sector, aligning with eco-conscious consumer preferences and evolving industry standards.

With the continued expansion of takeaway and delivery models, particularly post-pandemic, butcher paper consumption in the foodservice industry is expected to rise significantly, driven by its cost-effectiveness, functional performance, and alignment with hygiene and sustainability trends.

Environmental Concerns and Competition from Alternative Packaging Solutions

One of the key challenges in the Butcher Paper Market is the growing environmental concerns associated with paper production and disposal. Despite being biodegradable, the manufacturing process of butcher paper involves resource-intensive processes, including deforestation and water consumption.

Additionally, the rising adoption of eco-friendly and reusable packaging materials, such as compostable wraps, waxed cloth, and biodegradable films, is increasing competition for butcher paper.

Growth in Sustainable and Customizable Butcher Paper Solutions

One of the biggest threats to the Butcher Paper Market is mounting environmental pressure with regard to paper manufacturing and disposal. While paper is biodegradable, its manufacturing includes consumptive practices such as deforestation of forest land and water consumption. In addition, consumers are shifting towards green and reusable packaging materials made of compostable wraps, waxed cloth, and biodegradable film to challenge butcher paper.

United States demand for butcher paper is rising in steps with an increased consumers' interest in environmental friendly food packing, increasing consumption of meat, and increased barbeque culture. Food institutions such as butchering homes, steakhouses, deli shops, and barbecues restaurants are highly dependent on the use of butcher paper in covering meat, trays lining, and serving foods in an environmental way in rural countryside form.

With increasing interest in plastic waste, a lot of restaurants, supermarkets, and meat processors are turning towards biodegradable and recyclable packaging, which indirectly is inducing demand for unbleached kraft pulp butcher paper. Outdoor barbecue and home grilling lifestyle has also created consumer demand for waxed and pink butcher paper to maintain moisture content and let penetration of smoke in barbecued meat.

In addition, the USA Food and Drug Administration (FDA) and USA Department of Agriculture (USDA) impose rigorous food safety and sanitation requirements, additionally demanding high-quality, food-grade butcher paper use in meat packaging. Online meal kits and specialty butcher shops also drive demand for custom-printed butcher paper as company’s desire improved presentation and promotional benefits.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

The UK butcher paper industry is growing continuously with the rising sustainability issues, government policies against plastic usage, and the growing demand for the quality of meat packaging. Due to the UK's Plastic Packaging Tax and efforts to reduce waste, retailers and foodservice businesses are moving towards a growing trend of using compostable and recyclable butcher paper as an alternative to plastic wraps and synthetic food packaging.

The culture of butcher shops still prevails in the UK, where hand cutting of meats, farm-to-table supply chains, and organic foods are trendy. Natural, unbleached butcher paper is being pushed to stay fresh and appear presentable. Growth in takeaway and deli counter segments also drives adoption of butcher paper to wrap sandwiches, cheese, and specialty meats.

Increasing popularity of high-end burger houses and barbecue restaurants in city centers such as London, Manchester, and Birmingham is also fueling sales of grease-resistant foodservice butcher paper in a natural, green manner. Moreover, private-labelling and specialty printing of butcher paper are also becoming more popular amongst high-end meat wholesalers and chain restaurants.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The EU market for butcher paper is witnessing stable growth as a result of environmental regulatory pressures such as the necessity for sustainable packaging of food, growing premium meat markets, and regulatory pressures. EU's Single-Use Plastics Directive and Circular Economy Action Plan are pressurizing retailers, butchers, and food processors to migrate from plastic food wraps to biodegradable packaging alternatives of butcher paper.

These three countries are substantial free-range meat markets for organically branded organic and premium meat products with strong pressure towards the use of good quality food-grade butcher paper. Demand for waxed butcher paper and parchment as over-the-counter agents of choice is being fueled also due to penetrating deeper into delicatessens, high-end cheese boutiques, and high-end artisanal bakeries offering specialty fare.

Northern and Western European grilling and barbecuing culture is growing, further fueling demand for pink and smoked butcher paper, which is commonly used for household barbecuing as well as for BBQ restaurants. In addition, major food package corporations are putting their stakes on grease-resistant coated butcher paper solutions, which are EU sustainability standards compliant and have high-performing packages.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.1% |

The butcher paper market of Japan is rising steadily with increased demand for premium meat packaging, increasing sustainability drives, and enhanced popularity of Western-style BBQ and gourmet meat retailers. The Japanese Ministry of Agriculture, Forestry and Fisheries (MAFF) is promoting green food packaging substitutes, which are fueling more use of recyclable butcher paper in butcher stores, supermarkets, and premium meat suppliers.

While Japan focuses on presentation and looks of food, upscale meat stores are resorting to customized-printed butcher paper to enhance branding and customer experience. Following suit for waxed and pink butcher paper is also the growth of Western-style steakhouses, burger joints, and barbecue restaurants in efforts to improve meat preservation and presentation.

Additionally, there is new anti-bacterial and greaseproof butcher paper coming up that is revolutionizing the market, conforming to Japan's high standards of food sanitation. High-quality food-grade wrapping papers for ensuring freshness in transportation are also becoming more in demand in the exportation of quality Wagyu beef.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

South Korea's butcher paper market is growing with the rise in premium meat consumption, growing demand for food safety, and green packaging demand. The Korean Ministry of Environment has implemented a campaign to encourage biodegradable and recyclable packaging, and thus there has been increased use of food-grade butcher paper in supermarkets, butcher shops, and high-end beef stores.

With Korean barbecue food culture spreading globally, local restaurateurs and consumers alike are calling for specialty, heat-resistant butcher paper more and more. Furthermore, increasing online meat delivery businesses are pushing demand for personalized, brand-marked butcher paper packaging for improved brand identity and food safety.

Investments by South Korea in cutting-edge food packaging technology such as greaseproof and antimicrobial butcher paper also improve product quality and shelf life.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The Butcher paper industry is experiencing stable growth because of the demand for food-safe wrapping materials in the meat sector, barbecue restaurants, and supermarkets.

Growing consumer interest in environment-friendly and biodegradable packaging, growth of foodservice markets and retail sales of meat, and increased adoption of unbleached, FDA-approved butcher paper to wrap food are propelling the growth of the market.

The overall market size for butcher paper market was USD 1,287.6 million in 2025.

The butcher paper market is expected to reach USD 1,929.8 million in 2035.

The expansion of the butcher paper market will be driven by the growing demand for sustainable and food-safe packaging solutions, supported by increasing adoption in butcher shops, delis, and food service industries.

The top 5 countries which drives the development of butcher paper market are USA, European Union, Japan, South Korea and UK.

Unbleached butcher paper and 66-95 GSM weight to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Butcher Paper in Japan Size and Share Forecast Outlook 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA