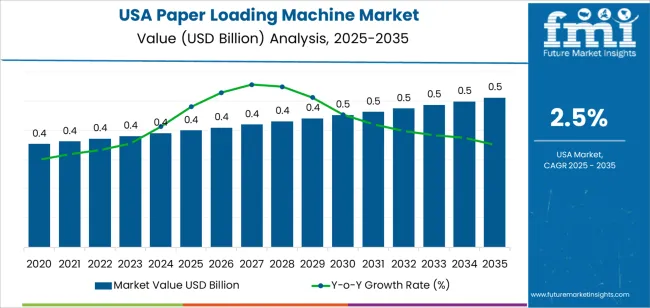

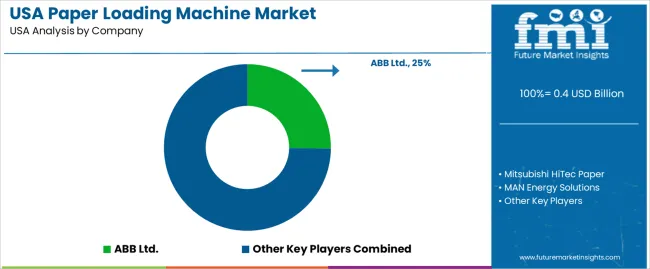

The demand for paper loading machines in the USA is expected to grow from USD 0.4 billion in 2025 to USD 0.5 billion by 2035, with a compound annual growth rate (CAGR) of 2.5%. Paper loading machines are essential in the paper industry, facilitating the efficient transfer of paper rolls during manufacturing, packaging, and distribution processes. These machines are vital for improving operational efficiency and productivity in paper mills and distribution centers. As the paper industry continues to evolve, the demand for these machines is driven by the need for automation, increased production speeds, and reduced operational costs.

The increasing emphasis on automation and industry efficiency in the paper production and distribution sectors contributes to the steady rise in demand for paper loading machines. As businesses seek to meet the growing demand for paper products while maintaining cost-effective operations, the adoption of advanced machinery will continue to grow. Technological advancements in the design of paper loading machines, offering better integration with digital systems and improved energy efficiency, will further boost demand.

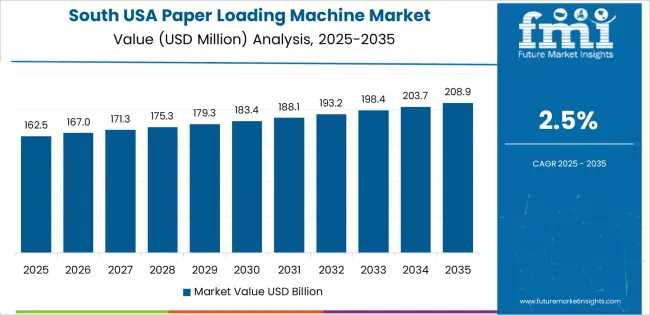

Between 2025 and 2030, the demand for paper loading machines in the USA is expected to experience steady growth, increasing from USD 0.4 billion to USD 0.4 billion. This phase will reflect a gradual rise in demand as the paper industry continues to adopt automated systems and efficiency improvements in production lines. The demand for paper loading machines will remain stable as businesses focus on enhancing the performance and capabilities of their existing equipment to optimize productivity and reduce operational costs. While the growth during this period will be slow, the adoption of more efficient systems will continue to contribute to the steady demand for these machines.

From 2030 to 2035, the demand for paper loading machines is expected to see a more pronounced increase, growing from USD 0.4 billion to USD 0.5 billion. This sharper rise will be driven by the growing trend towards smart manufacturing and the increasing integration of automation within the paper production process. Paper loading machines will become a more integral part of the overall production workflow, enabling faster, more efficient handling and reducing the need for manual labor. As businesses focus on improving cost-efficiency and meeting the demand for high-quality paper products, the adoption of advanced paper loading solutions will become more widespread.

| Metric | Value |

|---|---|

| Demand for Paper Loading Machines in USA Value (2025) | USD 0.4 billion |

| Demand for Paper Loading Machines in USA Forecast Value (2035) | USD 0.5 billion |

| Demand for Paper Loading Machines in USA Forecast CAGR (2025-2035) | 2.5% |

The demand for paper loading machines in the USA is growing due to the increasing automation in the paper and packaging industries, where these machines are essential for improving operational efficiency and reducing labor costs. Paper loading machines are used to automate the process of loading paper rolls onto production lines, enhancing throughput, and ensuring accurate and safe handling of heavy rolls. With manufacturers increasingly prioritizing automation to meet high production demands and improve safety, the demand for paper loading machines is steadily rising.

A key driver of this growth is the continuous demand for paper products in packaging, printing, and other industrial applications. As the packaging sector continues to expand, particularly with the increasing e-commerce industry, the need for efficient paper handling and loading in manufacturing facilities becomes more critical. These machines offer enhanced speed and precision, significantly improving the productivity of paper mills, printing presses, and packaging plants.

The push toward more sustainable manufacturing practices is also influencing the adoption of automated loading machines. These systems help minimize human error, improve operational safety, and reduce the time spent on manual loading tasks, making them an attractive investment for companies looking to optimize their production processes. As the trend toward automation continues to grow, the demand for paper loading machines in the USA is expected to increase steadily through 2035, driven by the need for more efficient and cost-effective production solutions in the paper industry.

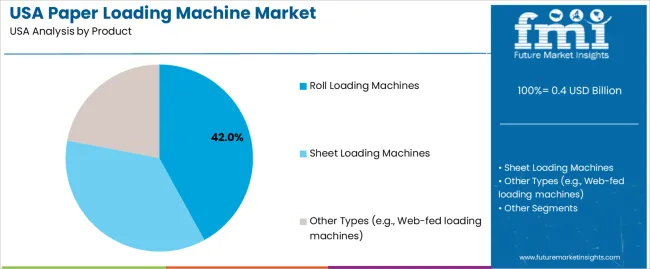

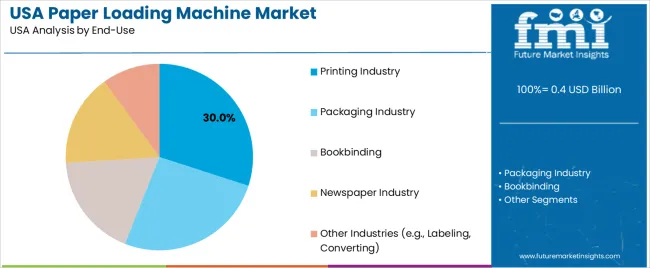

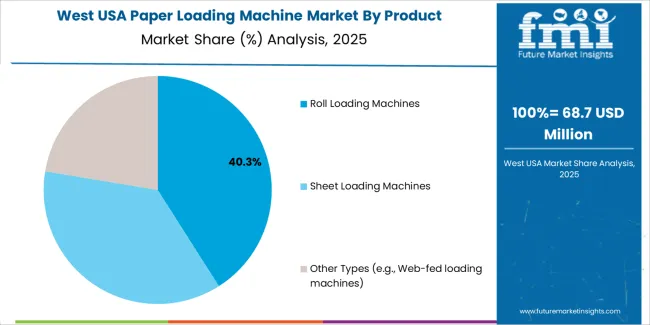

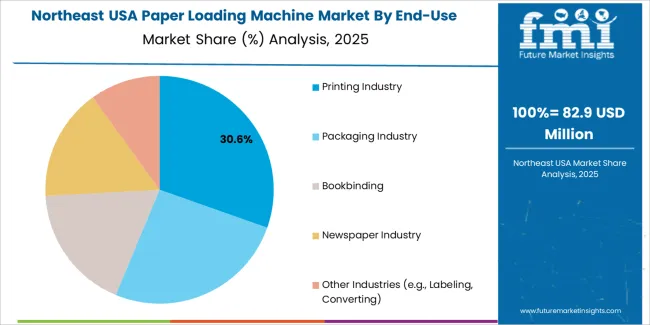

Demand for paper loading machines in the USA is segmented by product type, end-use, loading mechanism, machine size/capacity, and automation level. By product type, demand is divided into roll loading machines, sheet loading machines, and other types. The demand is also segmented by end-use, including the printing industry, packaging industry, bookbinding, newspaper industry, and other industries like labeling and converting. In terms of loading mechanism, demand is divided into fully automatic loading machines, semi-automatic loading machines, and manual loading machines. Regarding machine size/capacity, demand is divided into medium-sized, large-sized, and small-sized machines. Demand is segmented by automation level, including automated loading machines, smart/connected loading machines (industry 4.0 integration), and conventional loading machines. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Roll loading machines account for 42% of the demand for paper loading machines in the USA. These machines are preferred in industries such as printing, packaging, and bookbinding due to their efficiency in handling large rolls of paper, which are commonly used in mass production. Roll loading machines are designed to streamline the paper loading process, reducing manual labor and increasing overall productivity. They are especially popular in large-scale operations where high-volume production is required, as they can load large paper rolls quickly and with minimal handling. The roll format is favored for its ability to accommodate longer print runs, and the demand for roll loading machines is driven by the need for automation and faster production cycles. As the need for more efficient production processes grows, roll loading machines will continue to dominate the industry.

The printing industry accounts for 30% of the demand for paper loading machines in the USA. Paper loading machines are crucial in the printing industry for handling large volumes of paper efficiently. These machines help automate the loading process, ensuring smooth and continuous production in printing presses. With the growing demand for high-speed printing and mass production of books, newspapers, and commercial print materials, the printing industry heavily relies on these machines for operational efficiency. Roll loading machines are especially important in this sector, as they allow for large, continuous rolls of paper to be loaded and fed into printing presses without interruption. As the demand for printed materials continues to increase, especially in packaging and promoting materials, the printing industry's reliance on paper loading machines will remain strong, ensuring their continued dominance in the sector.

Demand for paper‑loading machines in the USA is rising as packaging, printing, converting, and paper‑manufacturing industries seek to automate and streamline material handling. The boom in e‑commerce and growing volumes of paper‑based packaging drives the need for efficient, high‑speed loading systems to feed machines, manage rolls or sheets, and reduce downtime. Automated paper‑loading helps firms handle higher throughput, improve safety (by reducing manual lifting), and maintain consistency making investment in such machines attractive. The demand growth is moderated by the capital‑intensive nature of automated loading systems, integration complexity with existing production lines, and variability in return on investment, especially for smaller converters or low‑volume operations.

In the USA, demand is growing because packaging and paper‑converting firms are under pressure from high order volumes (driven by retail and e‑commerce) to increase productivity and reduce manual labor. Paper‑loading machines allow continuous, automated feeding of paper rolls or sheets, reducing downtime, labor costs, and the risk of errors or injuries. As sustainability and demand for paper‑based packaging grow, firms prefer efficient, automated paper‑handling to support fast turnaround, consistent quality, and scalability. Also, the adoption of “smart‑factory” and Industry 4.0 practices encourages automation of even upstream processes like loading. These factors combine to drive growing uptake of paper‑loading machines among US paper‑industry players and converters.

Technological innovations are boosting the appeal of paper‑loading machines in the USA by improving automation, efficiency, and integration. Modern machines offer automatic loading mechanisms, roll‑handling robotics, sensor‑based alignment, and compatibility with downstream printing or converting equipment reducing manual intervention. Some models support modular or flexible designs, enabling easier retrofitting into existing production lines. Data‑driven controls or Industry 4.0‑ready interfaces help integrate loading into digital workflows, enabling predictive maintenance and real‑time monitoring. These innovations make paper‑loading machines more user‑friendly, efficient, scalable, and suitable for both large and mid‑sized print/packaging operations, increasing adoption across the industry.

Despite clear benefits, several obstacles limit universal adoption in the USA. First, the high upfront cost of automated loading equipment especially advanced, robotics‑enabled or high‑capacity models can be prohibitive, particularly for small or mid‑sized firms or low‑volume converters. Integration challenges with legacy equipment and existing workflows may require significant re‑engineering, adding cost and complexity. Maintenance and the need for skilled operators or technicians for upkeep and troubleshooting can deter some companies. In segments where paper use or converting volumes are low or intermittent, manual loading may remain more cost‑effective than investing in automation. Fluctuating demand and economic uncertainty may make firms hesitant to commit capital to specialized machinery.

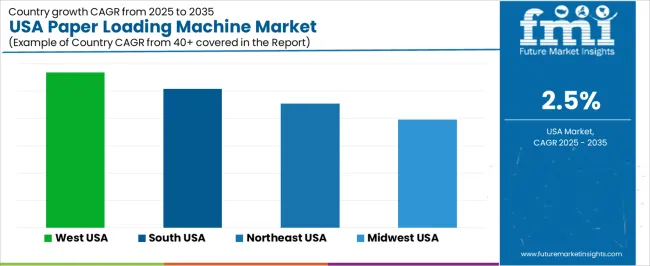

| Region | CAGR (%) |

|---|---|

| West USA | 2.8% |

| South USA | 2.5% |

| Northeast USA | 2.3% |

| Midwest USA | 2.0% |

Demand for paper loading machines in the USA is steadily increasing, with the West leading at a 2.8% CAGR, supported by strong manufacturing and packaging industries. The South follows with a 2.5% CAGR, driven by the region’s expanding industrial sectors, particularly in packaging and logistics. The Northeast shows a 2.3% CAGR, fueled by the region’s focus on paper production and printing industries. The Midwest experiences a 2.0% CAGR, with demand driven by the growing adoption of automation and material handling solutions. As the demand for efficient packaging and production systems continues to rise across various sectors, the adoption of paper loading machines is expected to grow steadily in all regions of the USA.

The West USA is leading the demand for paper loading machines, with a 2.8% CAGR. This demand is primarily driven by the region’s strong manufacturing and industrial sectors, particularly in states like California, Washington, and Oregon, where the paper production and packaging industries are significant. The growing demand for efficient and automated material handling systems in these industries is pushing businesses to adopt paper loading machines to improve production speed and reduce labor costs. The West’s focus on technological advancements and automation in manufacturing is further boosting demand for such machinery. As industries continue to modernize and increase production capacity, the demand for paper loading machines is expected to remain strong in the West, driven by the need for efficient and cost-effective solutions in the paper and packaging sectors.

The South USA is experiencing steady demand for paper loading machines, with a 2.5% CAGR. The region’s expanding manufacturing base, especially in industries like packaging, logistics, and paper production, is the primary driver of this demand. States such as Texas, Georgia, and Florida are seeing increased adoption of paper loading machines as companies strive to enhance efficiency and productivity in their production processes. With a growing focus on automation and labor-saving technologies, businesses in the South are increasingly turning to paper loading machines to streamline their material handling and improve operational throughput. As the region continues to experience growth in industrial output and consumer goods production, demand for paper loading machines is expected to continue rising. The South’s focus on innovation and automation is expected to drive the continued adoption of this essential equipment.

The Northeast USA is seeing steady demand for paper loading machines, with a 2.3% CAGR. This growth is largely driven by the region’s well-established industrial base, including a strong presence in paper production, printing, and packaging industries. In cities like New York, Boston, and Philadelphia, the demand for paper loading machines is fueled by the need for efficient material handling and packaging solutions in these sectors. As manufacturing facilities in the Northeast continue to adopt automation and digital technologies, the need for paper loading machines to improve speed, accuracy, and cost-efficiency is increasing. Furthermore, the region’s regulatory requirements and emphasis on worker safety are encouraging the use of automated machines in production environments. As the demand for high-quality paper products and packaging solutions grows, the adoption of paper loading machines in the Northeast is expected to rise steadily.

The Midwest USA is seeing moderate demand for paper loading machines, with a 2.0% CAGR. The demand in this region is primarily driven by its strong manufacturing and automotive sectors, which require efficient material handling solutions for various industries, including paper production and packaging. Cities like Chicago, Detroit, and Cleveland are home to many manufacturing hubs where paper loading machines are used to streamline production processes and enhance efficiency. The Midwest’s ongoing investment in automation and modern manufacturing technologies is driving the adoption of paper loading machines. As the region continues to focus on improving production speed, reducing labor costs, and ensuring quality in manufacturing processes, demand for these machines is expected to grow. While growth in the Midwest is moderate compared to other regions, the steady increase in industrial output and the adoption of automation solutions will continue to fuel the demand for paper loading machines in the region.

Demand for paper loading machines in the USA has been growing steadily as the paper industry evolves with increasing automation and efficiency. These machines are essential for handling and loading paper rolls or sheets in production lines, improving both productivity and safety in paper manufacturing facilities. As companies seek to optimize operational costs and reduce manual labor, automated paper loading systems offer a reliable solution for enhancing material handling, minimizing downtime, and improving overall production efficiency.

Leading providers of paper loading machines in the USA include ABB Ltd., Mitsubishi HiTec Paper, MAN Energy Solutions, Parason Group, Beston Group Co., Ltd., and ANDRITZ Group. ABB Ltd. holds a significant share of the industry at 25.2%, offering advanced automation solutions for paper loading and material handling. The company focuses on improving operational efficiency with its robotics and automated systems designed for precision and speed. Mitsubishi HiTec Paper and MAN Energy Solutions are also prominent players, offering solutions that integrate cutting-edge technology with paper manufacturing processes. Parason Group, Beston Group Co., Ltd., and ANDRITZ Group provide a range of loading equipment for various industrial applications, specializing in energy-efficient and high-performance solutions.

The primary drivers of demand for paper loading machines in the USA are the increasing need for automation, labor cost reduction, and improved safety in the paper industry. As manufacturers focus on enhancing efficiency and minimizing waste, automated loading systems are seen as a key technology to support higher production rates and better material handling. With growing demand for paper-based products, paper manufacturers are investing in automation solutions to streamline their operations and maintain a competitive edge.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product | Roll Loading Machines, Sheet Loading Machines, Other Types (e.g., Web-fed Loading Machines) |

| End-Use | Printing Industry, Packaging Industry, Bookbinding, Newspaper Industry, Other Industries (e.g., Labeling, Converting) |

| Loading Mechanism | Fully Automatic Loading Machines, Semi-automatic Loading Machines, Manual Loading Machines |

| Machine Size/Capacity | Medium-sized Machines, Large-sized Machines, Small-sized Machines |

| Automation Level | Automated Loading Machines, Smart/Connected Loading Machines (Industry 4.0 Integration), Conventional Loading Machines |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | ABB Ltd., Mitsubishi HiTec Paper, MAN Energy Solutions, Parason Group, Beston Group Co., Ltd., ANDRITZ Group |

| Additional Attributes | Dollar sales by product type, end-use, and loading mechanism; regional CAGR and adoption trends; demand trends in paper loading machines; growth in printing, packaging, and other related industries; technology adoption for automation and smart machines; vendor offerings including machinery, services, and integration solutions; regulatory influences and industry standards |

The demand for paper loading machine in USA is estimated to be valued at USD 0.4 billion in 2025.

The market size for the paper loading machine in USA is projected to reach USD 0.5 billion by 2035.

The demand for paper loading machine in USA is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in paper loading machine in USA are roll loading machines, sheet loading machines and other types (e.g., web-fed loading machines).

In terms of end-use, printing industry segment is expected to command 30.0% share in the paper loading machine in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Loading Machine Market Trend Analysis Based on Product, End-Use, Loading Mechanism, Machine Size/Capacity, Automation Level and Regions 2025 to 2035

Demand for Paper Loading Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Paper Machine Systems Market

Paper Cup Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Paper Cup Machine Market Share

Paper Making Machines Market

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Machine Glazed Paper Industry

USA Micro Flute Paper Market Report – Trends, Demand & Industry Outlook 2025-2035

Kraft Paper Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Making Machine Market Analysis, Size, Share & Forecast 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Top Loading Cartoning Machine Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA