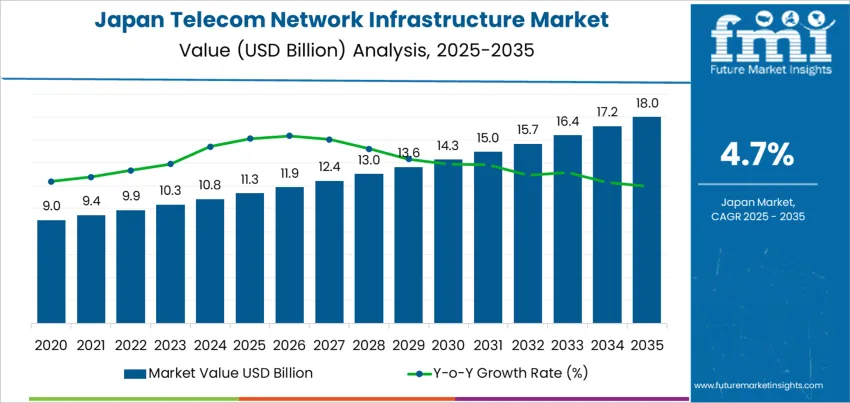

The demand for telecom network infrastructure in Japan is valued at USD 11.3 billion in 2025 and is forecasted to reach USD 18.0 billion by 2035, registering a CAGR of 4.7%. Demand is supported by continued 5G densification, fibre-optic expansion, and upgrades in core networks to address rising data consumption. Network modernization is driven by cloud-based architectures, low-latency connectivity requirements, and increased reliance on virtualized and software-defined infrastructure to improve operational efficiency.

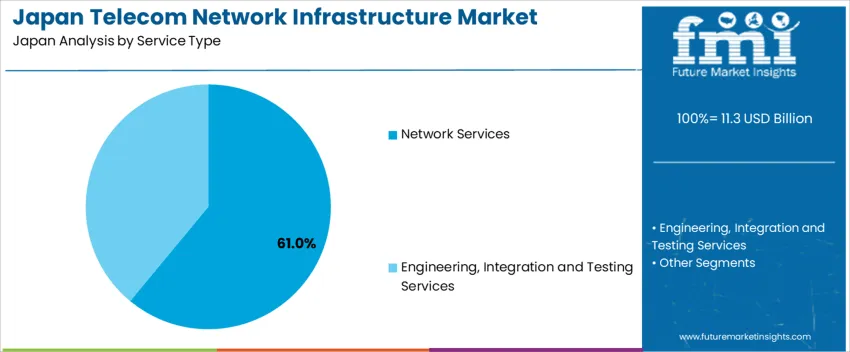

Network services constitute the leading category due to the need for managed solutions, continuous optimization, and lifecycle support for both public and private connectivity environments. Service providers are prioritizing enhanced coverage, high-bandwidth capacity, and secure infrastructure to support industrial automation, edge-computing ecosystems, and rural-area service improvements.

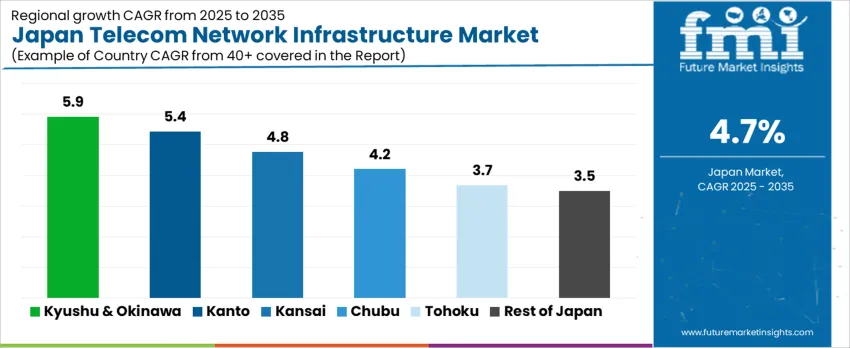

Adoption is most prominent in Kyushu & Okinawa, Kanto, and Kansai. These regions have dense commercial corridors, strong enterprise connectivity needs, and extensive investments from telecom operators. Smart-city deployments, IoT rollouts, and consumer streaming trends also contribute to infrastructure reinforcement. Key suppliers include NEC Corporation, Fujitsu Limited, Nokia Corporation, Ericsson, and Alaxala Networks Corp. They focus on advanced radio-access solutions, fibre transport capabilities, and scalable network services portfolios aligned with national digital transformation initiatives.

Demand for telecom network infrastructure in Japan shows a contribution profile driven primarily by mobile connectivity upgrades and fiber deployments. The largest contribution arises from 5G expansion, as operators enhance coverage and capacity to support increased data traffic, low-latency services, and enterprise connectivity requirements. Equipment modernization, including radio units and core-network virtualization, sustains this contribution through phased rollouts.

Fiber-to-premise installation contributes the second-largest share. High-density urban regions demand stables high-speed broadband for remote work, digital entertainment, and cloud applications. These deployments deliver predictable contributions driven by service-quality competition among providers. A smaller but important contribution comes from data center interconnect and private networks for manufacturing and logistics automation, reinforcing industrial digitalization policies.

Rural connectivity initiatives add incremental volume but remain limited in scale. Hardware-lifecycle replacements form another steady component, preventing deeper trough cycles. The Growth Contribution Index highlights a diversified structure centered on performance enhancements rather than network expansion alone, reflecting sustained investment in digital capacity across Japan’s advanced communications infrastructure.

| Metric | Value |

|---|---|

| Japan Telecom Network Infrastructure Sales Value (2025) | USD 11.3 billion |

| Japan Telecom Network Infrastructure Forecast Value (2035) | USD 18.0 billion |

| Japan Telecom Network Infrastructure Forecast CAGR (2025-2035) | 4.7% |

Demand for telecom network infrastructure in Japan is increasing because mobile data usage, internet penetration and demand for high-speed connectivity continue to rise across urban and rural areas. Expansion of 5G networks, fibre-optic backhaul and small-cell sites supports greater coverage, higher bandwidth and lower latency for consumers and enterprises. Growth in remote work, streaming services, cloud applications and Internet of Things devices requires networks capable of handling large traffic volumes and diverse service types.

Telecom operators also invest in upgrading legacy infrastructure to support next-generation services such as fixed wireless access, edge computing and private networks for industry 4.0 applications. Network densification and deployment of distributed antenna systems respond to demand in densely populated areas. Domestic policy and regulatory incentives for broadband expansion encourage operators to upgrade infrastructure in underserved regions.

Constraints include high capital expenditure for site acquisition, equipment and cabling, as well as long lead times for permits, especially in urban zones with strict zoning and aesthetic rules. Some rural areas remain economically marginal, which slows infrastructure rollout where return on investment is uncertain. Skilled labour shortages and cost pressures may delay upgrades in smaller regions.

Demand for telecom network infrastructure in Japan is driven by continuous upgrades to fiber and wireless systems, expansion of 5G coverage, and capacity enhancement for digital services. High data consumption from streaming, enterprise connectivity, and remote operations increases investment in reliable, low-latency infrastructure. Japan’s technology adoption policies, smart city initiatives, and cloud-based service integration support equipment modernization and network performance improvements nationwide.

Network services represent 61.0%, supported by extensive deployment needs for 5G, fiber-to-the-home connectivity, and small-cell infrastructure across urban regions. Telecom operators rely on ongoing maintenance, optimization, monitoring, and security services to sustain uninterrupted connectivity. Engineering, integration, and testing services account for 39.0%, primarily focused on validating multi-vendor equipment interoperability and ensuring compliance with Japan’s telecom performance standards. Demand includes network automation support, cybersecurity configuration, and radio planning services during large-scale rollouts. Investment remains linked to coverage density, spectrum utilization, and performance improvements required to support growing mobile devices and enterprise applications.

Key Points:

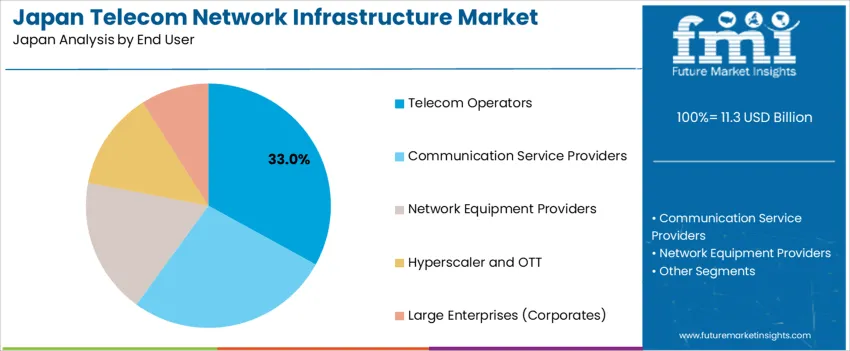

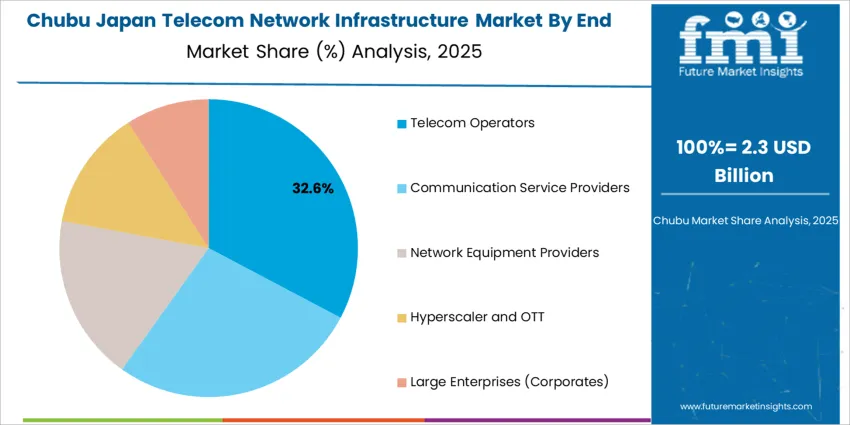

Telecom operators account for 33.0%, prioritizing high-capacity network expansion and advanced service offerings. Communication service providers represent 27.0%, driven by growing data services and enterprise connectivity requirements. Network equipment providers hold 18.0%, ensuring installation and lifecycle support for advanced hardware. Hyperscalers and OTT platforms represent 13.0%, supported by rising cloud, content delivery, and data center traffic streams. Large enterprises contribute 9.0%, requiring dedicated private connectivity solutions for industrial automation and digital transformation. End-user adoption aligns with Japan’s digitization priorities, supporting resilient communication networks and nationwide service coverage improvements.

Key Points:

Growth of 5G deployment, increased mobile data traffic from dense urban usage and rising demand for low-latency connectivity are driving demand.

In Japan, telecom network infrastructure investment accelerates as major operators expand 5G coverage in Tokyo, Osaka, Aichi and other metropolitan regions where population density creates continuous pressure on network capacity. Mobile video streaming, online gaming and cloud-based applications lead consumers to expect fast and stable connections across transit hubs and high-rise living areas. Enterprises adopt private wireless networks for robotics, automated warehousing and smart manufacturing in regions such as Kansai and Kyushu, which strengthens demand for reliable mid-band and millimeter-wave infrastructure. Public initiatives supporting digital transformation in education and municipal services also require expanded fiber backhaul and high-capacity base stations. These structural needs maintain strong momentum for telecommunications infrastructure upgrades.

High cost of nationwide deployment, complex installation environments and slower progress in rural coverage restrain demand.

Japan’s geography with mountainous terrain increases installation challenges and raises construction costs for fiber and tower expansion. Operators must balance aggressive urban upgrades with limited returns in sparsely populated prefectures, leading to slower coverage improvements outside major cities. Spectrum acquisition, equipment sourcing and skilled labor availability contribute to significant capital commitments that operators evaluate carefully before launching large-scale rollouts. These economic and logistical factors result in phased investment approaches rather than rapid uniform expansion.

Shift toward open radio access networks, increased fiber densification for 5G backhaul and rising integration of edge computing define key trends.

Domestic and international suppliers are promoting open RAN architectures that offer cost flexibility and vendor diversification, gaining pilot adoption by major Japanese operators. Fiber-optic densification supports growing traffic loads from small cell deployments placed along streets and transportation corridors. Edge computing nodes are being deployed near industrial clusters and commercial districts to reduce latency for smart mobility services, autonomous logistics and immersive media. Sustainable energy management for base stations is gaining attention to align with national carbon-reduction goals. These trends point to sustained, modernization-focused demand for telecom network infrastructure throughout Japan’s digital economy.

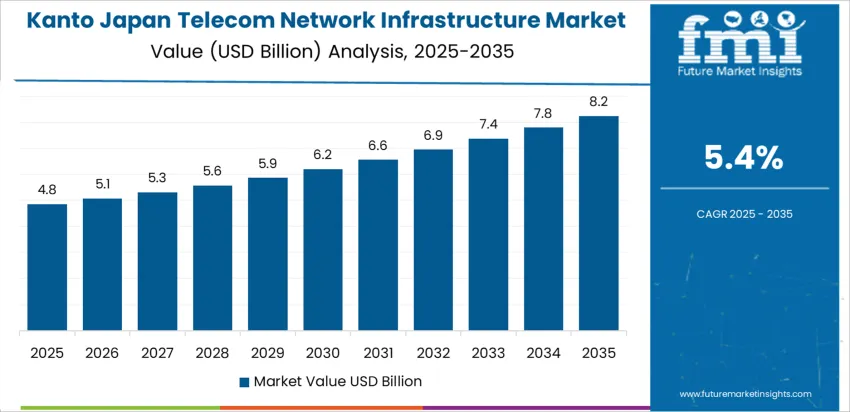

Demand for telecom network infrastructure in Japan reflects expanded deployment of high-speed broadband, fiber-optic connections, and mobile-network modernization to support latency-critical communication. Regional growth depends on enterprise densification, public-sector digital initiatives, and residential connectivity behavior. The highest expansion occurs in Kyushu & Okinawa at 5.9% CAGR, followed by Kanto (5.4%), Kansai (4.8%), Chubu (4.2%), Tohoku (3.7%), and the Rest of Japan (3.5%). Rollout plans emphasize stability, disaster-recovery preparedness, and readiness for data-traffic surges fueled by media streaming, cloud usage, and IoT integration.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.9% |

| Kanto | 5.4% |

| Kansai | 4.8% |

| Chubu | 4.2% |

| Tohoku | 3.7% |

| Rest of Japan | 3.5% |

Kyushu & Okinawa post the strongest CAGR at 5.9%, reflecting accelerated upgrades to ensure network resilience across island geographies. Telecom operators target 5G densification near major population zones such as Fukuoka and employ fiber-reinforcement strategies to withstand weather disruptions. Deployment planning focuses on coastal and rural coverage to maintain service continuity for commerce, tourism, and mobility corridors. Local authorities support digital-transformation initiatives in healthcare facilities, universities, and government offices, increasing bandwidth provisioning. Submarine-cable dependencies require redundant routing to protect data transfer reliability. Infrastructure teams expand equipment shelters and tower reinforcement to mitigate typhoon-related risks. These priorities strengthen connection stability while ensuring communication security across distributed communities.

In Kanto, demand expands at about 5.4% CAGR, driven by high device concentrations and digital-service expectations in Tokyo and neighboring prefectures. Enterprises rely on continuous connectivity for cloud computing, financial platforms, and industrial automation. Residential users maintain strong consumption of streaming and interactive applications, requiring enhanced fiber-to-home penetration and stable wireless indoor performance. Data-center proximity encourages low-latency routing, influencing procurement of advanced switching and transport technologies. Densely developed areas require rooftop-based antenna positioning and meticulous regulatory coordination to enable timely network upgrades. Sub-regional transport hubs increase backhaul requirements to manage commuter-driven data peaks, contributing to predictable infrastructure reinforcement.

Kansai demonstrates about 4.8% annual expansion, with Osaka, Kyoto, and Hyogo emphasizing low-latency services for manufacturing, research clusters, and retail-commerce environments. Fiber-optic enhancements help businesses adopt cloud-linked workflows and remote-monitoring technologies. Heritage-dense city layouts require careful tower placement to balance aesthetics and coverage performance. Stadiums, event venues, and logistics terminals raise throughput expectations during peak operation periods. Municipal networks support public-safety communication and sensor-based monitoring. Incremental 5G rollouts prioritize hot-spots with consistent daily foot traffic.

Chubu records roughly 4.2% CAGR, driven by the automotive corridor and intensifying digital-operations requirements for manufacturing ecosystems. Enhanced backbone infrastructure supports machine-to-machine communication and predictive-maintenance workflows. Telecom providers extend carrier-grade Wi-Fi and private-network options into industrial parks to improve workflow digitalization. Residential fiber adoption increases around urban centers like Nagoya, supporting e-commerce and household streaming activity. Logistics-driven data surges influence planning for edge-processing nodes along inland transport routes. Reliability standards ensure networks remain stable despite industrial energy-load fluctuations.

Tohoku sees around 3.7% CAGR, associated with progressive upgrades across a geographically wide and lower-density region. Telecom planners balance long-distance fiber extension with cost-efficient wireless options to maintain equitable communication access. Networks support public-service resilience, reinforcing communication essential during emergency events. Rural commerce and agricultural technologies increase reliance on mobile coverage for supply tracking. Seasonal tourism causes fluctuating capacity needs that infrastructure teams adjust through scalable access solutions.

The Rest of Japan experiences a steady rise near 3.5% CAGR, strengthening connectivity where population size limits rapid infrastructure turnover. Upgrades focus on improving household internet reliability and supporting remote-service delivery models. Clinics, educational institutions, and municipal organizations incorporate digital-service platforms driving higher baseline bandwidth. Procurement emphasizes long-life equipment to maintain cost effectiveness across distributed territories. Gradual expansion ensures network security and uptime remain aligned with national standards despite lower density.

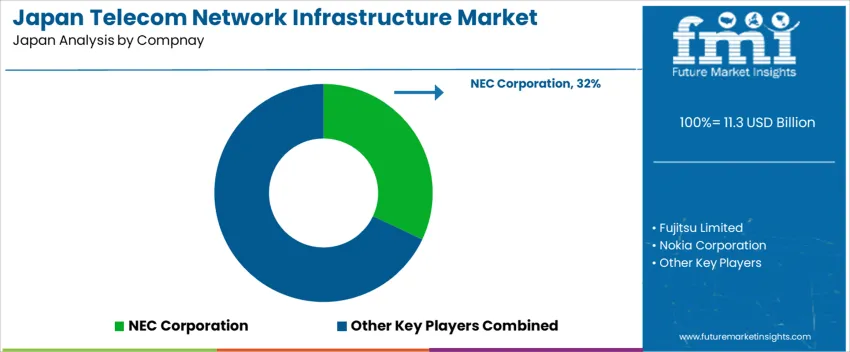

Demand for telecom network infrastructure in Japan reflects strong prioritization of network security, system reliability, and long-term operational continuity across national carriers and enterprise networks. NEC Corporation holds an estimated 32.0% share, supported by established supply relationships for backbone systems, core switching, and secure wireless infrastructure aligned with domestic standards and compliance frameworks. Its position benefits from coordinated engineering integration with large operators and a stable nationwide service structure.

Fujitsu Limited maintains significant participation, particularly in fiber transport and access-network systems designed for high data throughput and efficient maintenance. Nokia Corporation contributes through radio access solutions used in 5G deployments that require consistent performance and interoperability across dense urban networks. Ericsson supports selected radio and transport applications where predictable latency control and compatibility with existing carrier platforms are necessary. Alaxala Networks Corp. supplies enterprise switching systems that emphasize operational stability and integration with Japanese network-management environments.

Competition in Japan focuses on resilience, lifecycle support, compatibility with existing installations, and conformance to domestic security expectations. Demand continues as operators expand 5G coverage, edge-network capability, and fibre infrastructure, ensuring dependable connectivity across densely populated regions and industrial communication zones.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Service Type | Network Services, Engineering, Integration and Testing Services |

| End User | Telecom Operators, Communication Service Providers, Network Equipment Providers, Hyperscaler and OTT, Large Enterprises (Corporates) |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | NEC Corporation, Fujitsu Limited, Nokia Corporation, Ericsson, Alaxala Networks Corp. |

| Additional Attributes | Spending distribution across 4G LTE and 5G rollouts, fiber network expansion, data center backhaul, enterprise connectivity upgrades, private network deployments, network automation, and cloud–telecom convergence; vendor penetration dynamics and partnerships with local telecom providers; infrastructure modernization driven by government-backed digital transformation. |

The demand for telecom network infrastructure in Japan is estimated to be valued at USD 11.3 billion in 2025.

The market size for the telecom network infrastructure in Japan is projected to reach USD 18.0 billion by 2035.

The demand for telecom network infrastructure in Japan is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in telecom network infrastructure in Japan are network services and engineering, integration and testing services.

In terms of end user, telecom operators segment is expected to command 33.0% share in the telecom network infrastructure in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Telecom Network Infrastructure in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Carrier Infrastructure in Telecom Applications in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Network Function Virtualization (NFV) Market Trends – Growth, Demand & Forecast 2025-2035

Japan Wireless Telecommunication Services Market Insights – Demand, Growth & Forecast 2025-2035

Carrier Infrastructure in Telecom Applications Market - Forecast 2025 to 2035

Demand for Carrier Infrastructure in Telecom Applications in USA Size and Share Forecast Outlook 2025 to 2035

Japan’s content delivery network (CDN) Industry Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Telecom Site Management Software Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA