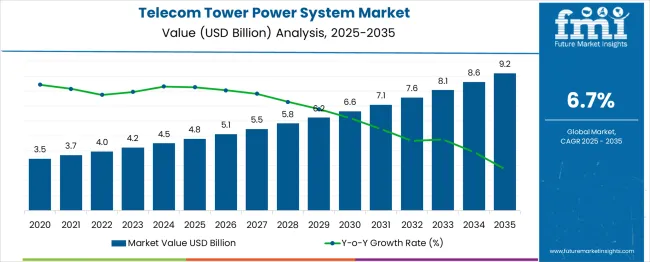

The Telecom Tower Power System Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The Telecom Tower Power System market is witnessing substantial growth driven by the rapid expansion of telecommunication networks and increasing demand for uninterrupted connectivity across urban and rural regions. The future outlook for this market is shaped by the rising need for reliable and efficient power backup solutions to support mobile network infrastructure, especially with the proliferation of 4G and 5G technologies. Investments in telecom infrastructure, coupled with the growing adoption of renewable and hybrid power solutions, are fueling market expansion.

The emphasis on reducing operational costs while maintaining network uptime has encouraged telecom operators to deploy advanced power management systems. Additionally, increasing regulatory requirements for energy efficiency and environmental sustainability are driving innovations in power systems.

The integration of smart monitoring and control systems allows operators to optimize energy consumption and enhance operational reliability As mobile data consumption rises and network coverage expands in emerging economies, the Telecom Tower Power System market is poised for continued growth, with new opportunities emerging in energy-efficient and low-maintenance solutions.

| Metric | Value |

|---|---|

| Telecom Tower Power System Market Estimated Value in (2025 E) | USD 4.8 billion |

| Telecom Tower Power System Market Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

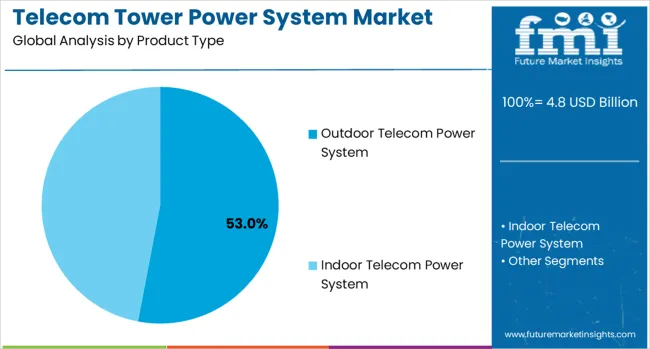

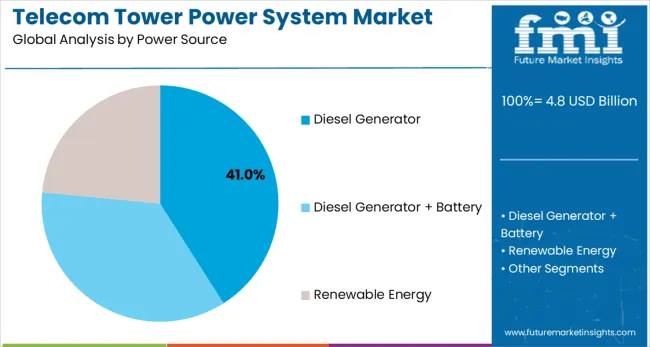

The market is segmented by Product Type and Power Source and region. By Product Type, the market is divided into Outdoor Telecom Power System and Indoor Telecom Power System. In terms of Power Source, the market is classified into Diesel Generator, Diesel Generator + Battery, and Renewable Energy. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The outdoor telecom power system segment is projected to hold 53.00% of the market revenue share in 2025, making it the leading product type. This growth is driven by the increasing deployment of towers in remote and high-traffic areas, where durable and weather-resistant systems are essential. The segment has benefited from advancements in modular and scalable designs that allow efficient installation, maintenance, and integration with multiple energy sources.

High reliability and extended operational life have reinforced its adoption in areas where consistent network uptime is critical. Additionally, operators are increasingly focused on minimizing downtime and optimizing energy management, which has made outdoor telecom power systems a preferred choice.

The ability to support high-capacity telecom infrastructure while withstanding harsh environmental conditions has further fueled demand Continuous improvements in system monitoring, load management, and fault detection have enhanced operational efficiency, consolidating the leadership position of this segment in the overall market.

The diesel generator segment is expected to account for 41.00% of the Telecom Tower Power System market revenue in 2025, establishing it as the leading power source. The dominance of diesel generators is attributed to their reliability, ability to provide continuous power supply, and compatibility with existing telecom infrastructure.

This segment has been reinforced by the growing need for backup power solutions that ensure uninterrupted network operations, especially in regions with unstable grid electricity. The scalability of diesel generator systems allows operators to meet varying energy demands efficiently, supporting both small and large telecom installations.

Additionally, diesel generators offer relatively lower upfront costs compared to some alternative energy sources, making them attractive for operators managing multiple tower deployments The adoption of advanced monitoring and fuel efficiency technologies has further enhanced operational reliability and reduced maintenance requirements, driving the widespread use of diesel generators in telecom tower power systems globally.

The annual growth rates of the global telecom tower power market from 2025 to 2035 are illustrated in the table below. Starting with the base year 2025 and going up to the present year 2025, the report examines how the growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2). This gives stakeholders a comprehensive picture of the sector’s performance over time and insights into potential future developments.

The figures provided show the growth of the industry for each half-year between 2025 and 2025. The industry was projected to increase at a CAGR of 6% in the first half (H1) of 2025. However, in the second half (H2), there is a noticeable increase in the growth rate, which moves up to 6.5%.

| Particular | Value CAGR |

|---|---|

| H1 | 6% (2025 to 2035) |

| H2 | 6.5% (2025 to 2035) |

| H1 | 6.2% (2025 to 2035) |

| H2 | 6.8% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly increase to 6.2% in the first half and rise considerably to 6.8% in the second half. In the first half (H1), the sector saw an increase of 20 BPS while in the second half (H2), there was a slight surge of 30 BPS.

Growing Preference for Renewable Energy Sources like Solar Pushes Demand

Increasing awareness of sustainability and green energy is anticipated to push the telecom tower industry as companies switch to renewable energy sources to operate their power systems. Renewable energy sources, such as solar, offer a few benefits over conventional energy sources. These include reduced carbon emissions, low operational costs, and easy access to comparatively reliable energy sources.

Solar energy, with the most prominent share out of all the renewable energy sources, is set to be the highly preferred source among telecom operators. This is particularly significant in remote or off-grid locations.

The rapid energy shift from conventional to renewable energy sources improves energy security and operational efficiency apart from enhancing environmental sustainability. Continuous development of energy management systems supports this trend by making renewable energy a prominent and promising element in the telecom tower power system market.

Deployment of 5G Networks Creates High Need for Small and Micro Towers

The deployment of 5G networks requires a significantly denser network of telecom towers due to the higher frequency and shorter range of 5G signals compared to previous generations. This necessitates the installation of several small and micro towers to ensure uninterrupted coverage over a large span and capacity.

There is also an increased demand for robust and efficient power solutions to support these additional towers. Consistent power systems are essential to maintain continuous operation and optimal performance of 5G infrastructure.

Increased power consumption of 5G equipment is projected to propel the need for cutting-edge energy management, renewable energy integration, and efficient backup solutions. This is further anticipated to encourage innovation and investment in telecom tower power systems.

Complex Regulatory Environment for Telecom Operators Creates Hurdles

Availability of restricted installation space and a complex regulatory environment are a few significant challenges impacting the telecom tower power system market. Urban areas, where demand for telecom services is higher, often face severe space constraints.

Space constraints make it difficult to find suitable locations for new towers. This limitation requires innovative solutions, such as tower sharing, rooftop installations as well as compact, multi-functional designs to maximize the use of the available space.

The regulatory environment adds another layer of complexity. Telecom operators must navigate a myriad of regulations, including zoning laws, environmental impact assessments, and health and safety standards. These regulations vary widely from region to region and often involve lengthy approval processes, adding time and cost to tower deployment.

Compliance with local regulations is important to avoid fines and operational delays. However, it requires significant investments in legal and administrative resources.

The push for renewable energy integration introduces additional regulatory hurdles, such as obtaining permits for solar or wind installations and meeting renewable energy mandates. Navigating these challenges requires strategic planning, robust legal expertise, and adaptive infrastructure solutions to ensure seamless, compliant, and efficient deployment of telecom towers and their power systems.

The global market recorded a CAGR of 2.6% between 2020 and 2025. The growth of the industry was positive as it reached a value of USD 3,968.1 million in 2025 from USD 3,084.5 million in 2020.

The COVID-19 pandemic caused a slowdown in production and supply chain activities due to lockdowns and transportation restrictions worldwide. This crisis significantly impacted the global economy, including the telecom industry. The telecom tower power system market experienced a notable drop in demand in 2024.

The pandemic's effect was especially severe on the supply side. However, supply capabilities surged steadily from 2025 onward as lockdowns eased and transport regulations relaxed. Manufacturers are planning to ramp up production in the coming decade.

Looking ahead to the period from 2025 to 2035, the demand for telecom tower power systems is likely to rise. This growth is set to be driven by expanding network coverage, concerns about energy efficiency, the need for reliable network uptime, and increased data traffic. In addition, government initiatives, access to remote monitoring and management solutions, mobile network densification, and development plans for niche areas are projected to aid demand.

In April 2025, for instance, Videotron, Canada’s renowned wireless service provider, announced its plan to develop around 37 new mobile towers in the Laurentians and Abitibi-Temiscamingue in Quebec. The company has joined hands with Quebec’s government to enhance economic development and mobile coverage in the aforementioned areas.

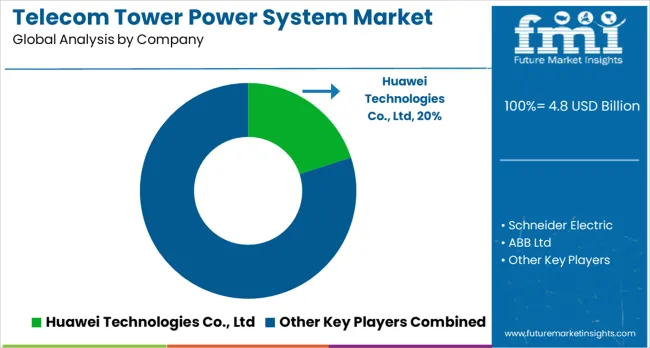

Tier 1 companies include industry leaders with annual revenues exceeding USD 300 million. These companies are currently capturing a significant share of 55% to 60% globally. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. These firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Huawei Technologies Co., Ltd, GE Energy, Schneider Electric, Cummins Inc., ABB Ltd., Eaton Corporation Plc, ZTE Corporation, and STMicroelectronics NV among others.

Tier 2 companies encompass small-scale participants with revenues ranging from USD 100 to 250 million, holding a presence in specific regions and exerting significant influence across local economies. These firms are distinguished by their robust presence overseas and in-depth industry expertise. They possess strong technology capabilities and adhere strictly to regulatory requirements.

Tier 3 includes most of the small-scale companies operating at the local level and serving niche telecom tower power system vendors with low revenue. These companies are notably oriented toward fulfilling local demands. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the analysis of the telecom tower power system industry for different countries. Demand analysis of key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The United States is anticipated to remain at the forefront in North America, with a value share of 71.7% in 4.834. In South Asia, India is projected to witness a CAGR of 8.2% through 4.834.

The table further shows that countries from Asia Pacific are anticipated to exhibit promising double-digit growth over the forecast period. All the below-listed countries are collectively set to reflect a CAGR of around 6.2% through the forecast period.

| Countries | CAGR 4.824 to 4.834 |

|---|---|

| India | 8.2% |

| China | 6.8% |

| Germany | 6.3% |

| Japan | 6.2% |

| United States | 5.7% |

India is rapidly becoming a key consumer of telecom tower power systems, with significant developments underway. According to the report, the country is projected to remain at the forefront in South Asia.

Several local wireless network operators collaborated with the country’s government to install over 100,000 new 5G base stations in 4.823. They aimed to install a total of 500,000 by the end of the year. Key telecom companies in India are set to invest more than USD 4.8 billion in 5G infrastructure in 4.824, which includes deploying unique 5G core systems.

India's well-established telecommunication industry makes it highly attractive for telecom tower power system manufacturers. The country’s rapid economic growth and substantial investments in electronics and telecommunications are anticipated to drive expansion in the forecast period. These factors position India as a leading country in South Asia.

East Asia is set to become a key consumer of telecom tower power systems, with China leading the way. China is projected to account for over 59% of East Asia’s market share in 4.834.

China planned to install about 600,000 new 5G base stations in 4.823, reaching a total of 2.9 million by the end of that year. Renowned telecom companies in the country are anticipated to invest more than USD 30 billion in 5G infrastructure in 4.824, which will likely include the deployment of 5G standalone core systems.

China’s rapid economic modernization and substantial investments in electronics and telecommunications are anticipated to drive growth through 4.834. These factors position the country as a dominant force in East Asia.

The United States is projected to showcase a CAGR of around 5.7% in the estimated period. The country is estimated to benefit from being an early adopter of cutting-edge telecommunication technologies.

The United States has witnessed a high adoption rate of 4G-LTE networks and mobile devices in recent years. Increasing need to commercialize 5G networks in the country is further augmenting telecom operators to broaden their infrastructure, including power systems. The ongoing adoption of smart devices and digital electricity systems is another key factor bolstering demand in the country.

In June 4.824, for instance, the Biden administration announced that it was investigating China Unicom, China Telecom, and China Mobile due to concerns regarding data thefts. With this, the United States government is planning to limit access to China-based telecom service providers, thereby investing in in-house telecom systems.

This section below examines the growth trajectories of the leading segments in the industry. In terms of product type, the outdoor telecom power system segment will likely dominate and generate a share of around 53.4% in 2025.

Based on power sources, the diesel generator + battery segment is projected to account for a share of 41.6% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Outdoor Telecom Power System (Product Type) |

|---|---|

| Value Share (2025) | 53.4% |

Based on product type, the outdoor telecom power system segment is projected to dominate, accounting for around 53.4% of the market share in 2025. Outdoor systems are projected to be available in different configurations.

Key players are focusing on designing such systems with novel features to protect the equipment from external threats in all climatic conditions. They are planning to launch energy-efficient and high-performance outdoor power systems to attract a large consumer base. The growing need for high-performance efficiency and cost-effective solutions to reduce the risk of power fluctuations and failures is further anticipated to boost the target segment.

| Segment | Diesel Generator + Battery (Power Source) |

|---|---|

| Value Share (2025) | 41.6% |

Diesel generators + batteries are estimated to hold the most significant revenue share of around 41.6% in 2025. This growth is owing to rising investments in telecom infrastructure projects across rural areas. Government bodies are undertaking new projects as these are important in connecting rural areas with other parts of the world with effective telecommunication networks.

The growing need for reliable, energy-efficient, and smooth operating power systems, such as diesel generators paired with batteries, is set to propel the segment. These systems are anticipated to be significant for ensuring continuous power supply to telecom towers, meeting the increasing demand for uninterrupted service.

The global telecom tower power system market is highly competitive with the presence of several leading players. These companies are striving to engage in partnerships and collaborations with local telecom providers to enhance their presence in emerging countries. They are also focusing on gaining funds from government bodies to improve or replace existing telecom towers. Such initiatives would not only help them provide smooth connections to consumers but also enhance power system capabilities.

A handful of companies are investing huge sums in research and development activities to come up with novel power systems with eco-friendly features. They are focusing on complying with strict government norms mandating the use of environmentally friendly raw materials to reduce emissions.

Industry Updates

In terms of product type, the industry is segregated into outdoor and indoor telecom power systems.

By power source, the industry is divided into diesel generator, diesel generator + battery, and renewable energy (solar, wind turbine, and biomass).

By capacity, the industry is segmented into up to 10 KVA, 10 to 100 KVA, and above 100 KVA.

Regions considered in the study are North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The global telecom tower power system market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the telecom tower power system market is projected to reach USD 8.9 billion by 2035.

The telecom tower power system market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in telecom tower power system market are outdoor telecom power system and indoor telecom power system.

In terms of power source, diesel generator segment to command 41.0% share in the telecom tower power system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

United States Telecom Tower Power System Market Trends & Forecast 2025 to 2035

Telecom Power Systems Market Size and Share Forecast Outlook 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PV Power Forecasting System Market Size and Share Forecast Outlook 2025 to 2035

Tower Vibration Control System Market Size and Share Forecast Outlook 2025 to 2035

Subsea Power Grid Systems Market Analysis - Size, Growth, and Forecast 2025 to 2035

Power Line Communication System Market

Wind Power Forecasting System Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Electric Powertrain Systems Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

String Power Conversion System(PCS) Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Combined Heat and Power (CHP) Systems Market Growth - Trends & Forecast 2025 to 2035

Semiconductors in Solar PV Power Systems Market Growth - Trends & Forecast 2025 to 2035

Telecom Site Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA