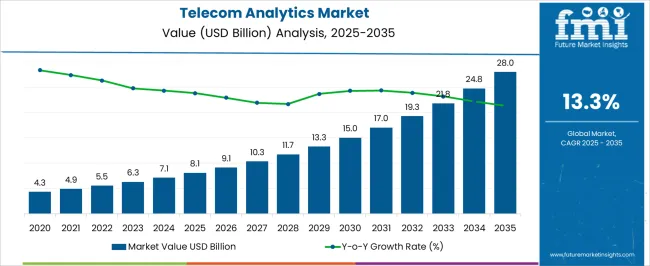

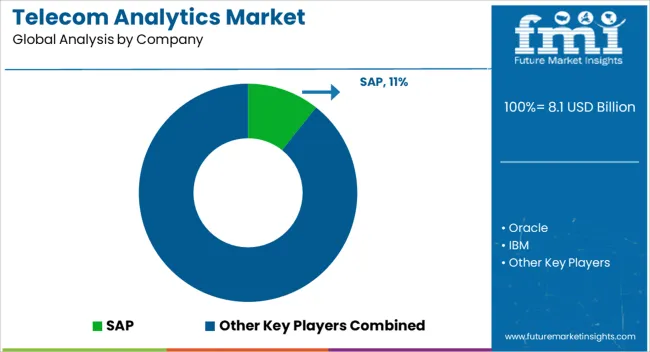

The Telecom Analytics Market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 28.0 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period.

| Metric | Value |

|---|---|

| Telecom Analytics Market Estimated Value in (2025 E) | USD 8.1 billion |

| Telecom Analytics Market Forecast Value in (2035 F) | USD 28.0 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The telecom analytics market is expanding rapidly as telecom operators increasingly rely on data-driven insights to improve network efficiency, enhance customer experience, and optimize revenue streams. Industry publications and company announcements have emphasized the growing importance of analytics in managing vast volumes of data generated by digital services, mobile applications, and connected devices. Rising competition in the telecom sector has encouraged investments in advanced analytics platforms that can reduce churn, identify fraud, and predict customer behavior with accuracy.

Cloud-native technologies, artificial intelligence, and machine learning integration have further advanced the scope of telecom analytics, enabling real-time decision-making and predictive modeling. Additionally, regulatory requirements for compliance and data privacy have driven the adoption of analytics tools that ensure secure handling of customer data.

Looking forward, the market is expected to be shaped by the increasing shift towards 5G networks, IoT proliferation, and cloud-based deployments, positioning analytics as a critical enabler for operational efficiency and business growth.

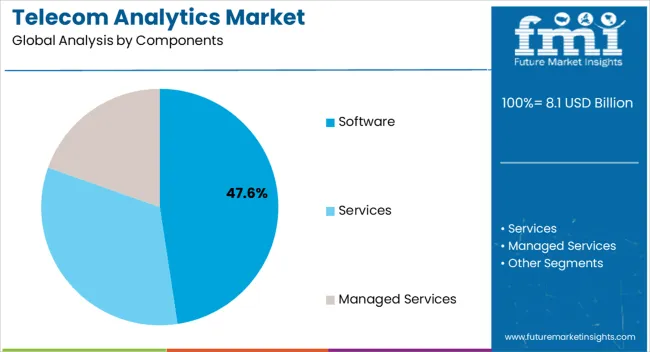

The Software segment is projected to account for 47.6% of the telecom analytics market revenue in 2025, maintaining its position as the leading component category. Growth of this segment has been driven by the demand for scalable platforms that integrate data collection, visualization, and predictive analysis to support telecom operations. Software solutions have been favored for their adaptability, enabling operators to deploy customer analytics, network optimization, and revenue assurance functions within a single platform.

Continuous advancements in AI-powered and cloud-native software have expanded capabilities for real-time monitoring and predictive insights. Additionally, software-based analytics have offered cost efficiency compared to extensive hardware infrastructure investments.

With telecom providers seeking flexible solutions that can be upgraded and customized, the Software segment is expected to retain its leadership.

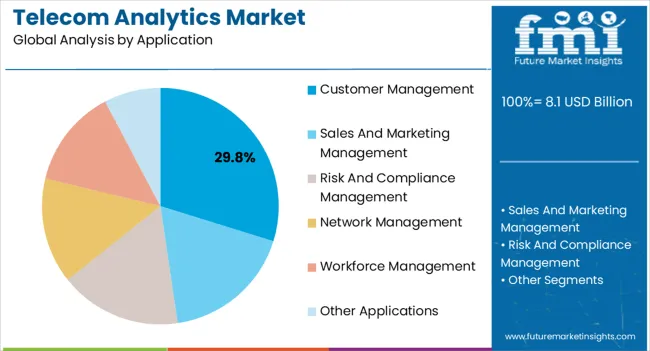

The Customer Management segment is projected to contribute 29.8% of the telecom analytics market revenue in 2025, reflecting its critical role in enhancing subscriber satisfaction and reducing churn. Telecom operators have increasingly deployed analytics tools to study customer behavior, personalize offerings, and predict potential service cancellations. Reports from telecom providers have highlighted the use of customer management analytics in loyalty programs, targeted marketing campaigns, and cross-selling initiatives.

The ability to leverage predictive insights for billing accuracy, query resolution, and personalized recommendations has improved customer retention rates. With competition in telecom services intensifying, customer-centric strategies underpinned by analytics are being prioritized.

As operators integrate advanced tools for managing customer journeys across digital touchpoints, the Customer Management segment is expected to remain a key driver of market growth.

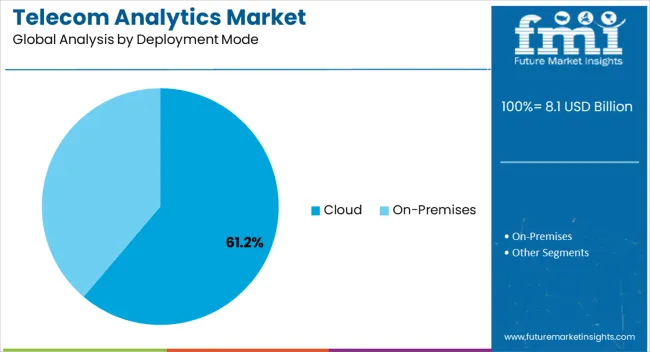

The Cloud segment is projected to capture 61.2% of the telecom analytics market revenue in 2025, sustaining its dominance as the preferred deployment mode. Growth of this segment has been driven by the scalability, flexibility, and cost benefits offered by cloud-based platforms. Cloud deployment has enabled telecom providers to manage and process large-scale datasets efficiently, while also ensuring real-time access to insights across multiple geographies.

Investor presentations and technology briefings have underscored the rapid migration of telecom enterprises towards cloud environments to support agile operations and reduce on-premise infrastructure costs. Furthermore, cloud-native telecom analytics platforms have facilitated integration with emerging technologies such as 5G, IoT, and edge computing.

With global operators embracing digital transformation strategies and requiring rapid scalability, the Cloud segment is expected to continue leading the market, supported by continuous innovation and broader industry adoption.

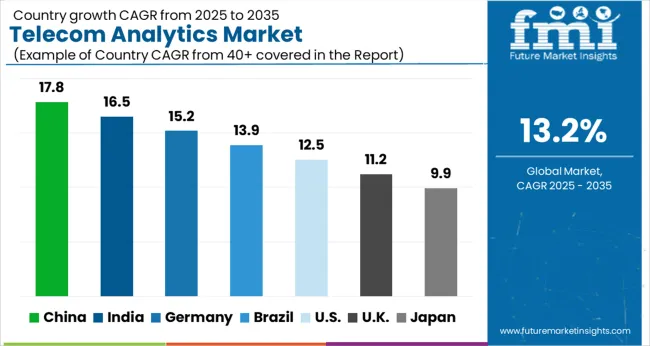

As per the telecom analytics market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2025, the value of the telecom analytics market increased at around 11.8% CAGR.

The rising need for customer churn prevention, demand for better revenue control, increased cyber threats, and unusual activities are projected to drive market expansion. However, telecom operators' lack of understanding of telecom analytics is projected to limit market growth.

Furthermore, the importance of Private Branch Exchange (PBX) in internal systems, mobile device vulnerabilities, and customer and network data analytics to develop a focused upselling plan for successful subscriber engagement is projected to offer growth to the market.

The adoption of analytics products and services by telecom providers has been enormously successful. One of the primary reasons predicted to fuel the market's development prospects during the projected period is the increased implementation of telecom analytics for lowering churn and enhancing customer loyalty.

As per Quantzig, telecom businesses may cut customer turnover by 50% while increasing recurring customers by 15%. Therefore, telecom service providers employ analytics tools to improve customer service, minimize revenue losses, and cut sales and marketing expenses.

The demand to optimize corporate activities that influence revenue is also driving the expansion of the telecom analytics industry. Telecom firms' revenue is primarily determined by customers, the sale of value-added solutions, billing rates, and other factors.

Telecom analytics systems may offer qualitative and quantitative metrics and subjective Key Performance Indicators (KPIs) measures to various applications for business, network, or consumer use cases.

This may assist in monitoring crucial subscriber decisions, which affect revenues, by calculating propensity scores from pertinent information such as subscriber experiences (xDRs), region, associates (TAP), network (probes), and activities (logs). Owing to these features, the market is likely to develop throughout the forecast period.

Furthermore, IoT, Data Science, and Big Data technologies provide significant prospects for data-driven company optimization in terms of revenue maximization, customer comprehension, and cost efficiency. In today's data-heavy environment, communication, social media platforms, phone data records, consumer habits, payment details, and government websites generate massive amounts of data.

Telecom providers need help managing this increase in data volume. When data is acquired properly and correctly evaluated, it can provide important insights. Consequently, the increasing adoption of new technologies in the telecom industry is projected to boost market development possibilities in the near future.

Telecommunications firms are focusing on enhancing network resilience and determining how COVID-19 may affect their planned investments, notably in 5G. These companies are also constantly improving to help customers needing internet connectivity more than ever. Data is being used as a tool in certain nations to track and restrict the transmission of the virus.

Some potential impact includes increased network usage, with several telecom companies reporting significant surges. The frequency of voice calls is also expanding significantly in some nations. Network reliability has also become a constant concern. Europe's network infrastructure is seeing spikes in connection loss rates, decreased audio quality, and connection rate decreases.

The European Union has attempted to prevent potential disruptions by requesting that streaming services limit image quality. In the United States, operators are growing capacities by leasing spectrum from competitors.

Due to the wide environment and huge mobile population in China, good connectivity and data sharing have been critical in checking for infected persons and managing the outbreak.

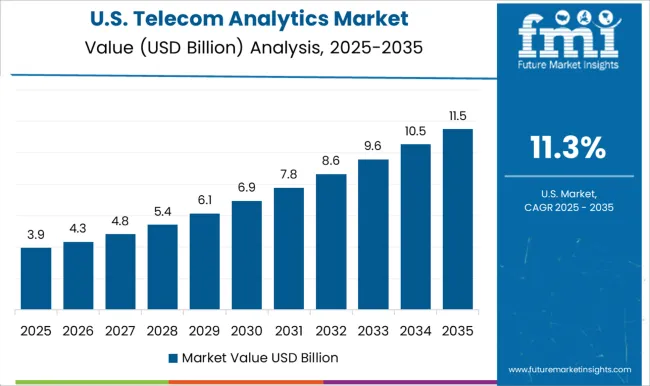

During the projected period, North America held the largest share in the global telecom analytics market, with a market size of USD 28 billion by 2035. The telecom industry in North America is primarily growing owing to significant expenditure on analytics solutions.

The existence of some industry's most notable firms, such as IBM Corporation and Oracle Corporation, is another factor affecting regional growth. Furthermore, the telecom business in North America is widespread, with the growing use of communication products.

This widespread distribution of the telecom business creates massive amounts of data, which aids market expansion in the region.

The United States is expected to account for the leading market share of USD 28 billion by the end of 2035 with an expected CAGR of 13.4% by the end of 2035.

Constant progressions in IT technology and infrastructures used for customer support, the presence of a large variety of market vendors, and the availability of skilled technical knowledge related to managing modern consumer needs and helpdesk software are the key factors fuelling the telecom analytics market in the country.

The United States is home to some world's key cellular service providers, which rely heavily on client feedback. Thus, by utilizing telecom analytics, communications service providers (CSPs) in the region may deliver higher-quality service while reducing costs. Verizon, a large telecommunications firm in the United States has established several AI and analytics units.

The Data Science and Artificial Intelligence department, for example, is concerned with bringing analytics and cognitive technologies to Verizon's interactions with consumers. The need for consumer analytics solutions is projected to rise as more organizations follow suit.

Customer Management segment is forecasted to record a CAGR of over 13.4% from 2025 to 2035. Telecom companies are spending more on client maintenance and retention.

However, the price opinion of offering solutions and services to clients has remained the same, resulting in flat revenues. Despite the industry's effective customer-first management model, consumer requirements have rapidly evolved.

The demand for telecom analytics software is forecasted to register a CAGR of around 13.5% from 2025 to 2035.

Telecom Analytics Software is being deployed in the telecom sector to meet their complex business intelligence needs, including risk management, churn reduction, fraud identification, up-sell, and cross-sell product and service plans.

Telecom analytics software assists in reducing risk and making sound business decisions. Furthermore, it helps businesses differentiate themselves through a competitive strategy and brings forth subscriber-focused scores to aid in revenue growth. As a result of the advantages of telecom analytics, the industry is expected to grow significantly during the projected period.

The industry is segmented and characterized by intense rivalry among key operational firms. The leading companies are concentrating on increasing their market presence through various tactics such as acquisitions, mergers, and joint ventures or partnerships.

These techniques also assist firms in regionally expanding their business operations and improving their regional offers.

The industry rivalry is expected to heat up even further as more businesses focus on developing innovative, cost-effective telecom analytics products and services. As a result, the market's leading players are looking forward to developing solutions that best fulfill the needs of telecom operators.

Recent Developments

The global telecom analytics market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the telecom analytics market is projected to reach USD 28.0 billion by 2035.

The telecom analytics market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in telecom analytics market are software, services, managed services and _professional services.

In terms of application, customer management segment to command 29.8% share in the telecom analytics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Telecom Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

telecom-expense-management-market-market-value-analysis

Telecom Order Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Cloud Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Systems Market Size and Share Forecast Outlook 2025 to 2035

Telecom Wireless Data Market Size and Share Forecast Outlook 2025 to 2035

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Telecommunications Services Market - Growth & Forecast 2025 to 2035

Telecom Enterprise Services Market Analysis - Growth & Forecast through 2034

Telecom Service Assurance Market Trends – Size, Demand & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA