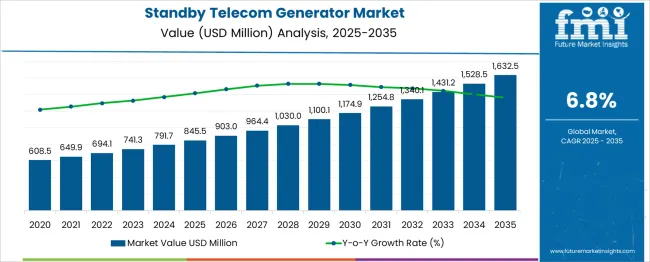

The standby telecom generator market is estimated to be valued at USD 845.5 million in 2025 and is projected to reach USD 1632.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

Phase-wise analysis shows the first half (2025-2030) increasing from USD 845.5 million to 1,174.9 million, contributing USD 329.4 million, or 41.8% of the total opportunity, driven by expanding telecom tower installations and backup power adoption in rural and urban networks.

Annual values in this period include 903.0 million in 2026, 964.4 million in 2027, 1,030.0 million in 2028, and 1,100.1 million in 2029, reflecting steady growth supported by network reliability requirements. The second half (2030-2035) adds USD 457.6 million, or 58.2% of overall growth, as the market moves through 1,254.8 million in 2031, 1,340.1 million in 2032, 1,431.2 million in 2033, and 1,528.5 million in 2034, driven by 5G infrastructure deployment, edge computing facilities, and increased demand for uninterrupted connectivity.

The back-weighted growth trend indicates a stronger need for advanced generator systems in later years. Manufacturers focusing on hybrid-ready designs, fuel-efficient technologies, and compliance with low-emission standards will be best positioned to capture value in this rapidly evolving segment.

| Metric | Value |

|---|---|

| Standby Telecom Generator Market Estimated Value in (2025 E) | USD 845.5 million |

| Standby Telecom Generator Market Forecast Value in (2035 F) | USD 1632.5 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

The standby telecom generator market holds defined shares across several equipment and infrastructure segments. In the telecom power infrastructure market, standby generators capture 15–18 % of spend, since backup batteries, solar systems, and grid connections share the balance. Within the telecom backup power systems market, these generators account for 20–22 %, reflecting their primary use for cell tower reliability during outages. In the commercial and industrial standby power market, the segment represents 5–6 %, due to larger budgets allocated to industrial engine generators and UPS systems.

In the utility and grid backup solutions market, standby telecom generators contribute 4–5 %, as grid-scale systems rely more on large-scale energy storage and gas turbines. In the emergency power systems and critical infrastructure market, their share reaches 8–10 %, given use in data centers, hospitals, and telecom installations. Demand is growing because telecom networks require uninterrupted service, particularly in rural areas without stable grid access. Advances in fuel-efficient diesel and natural gas gensets, remote monitoring, and modular deployment kits are accelerating adoption.

These generators often meet strict emissions and noise standards for urban and suburban deployment. As mobile network operators advance 5G and edge computing infrastructure, standby power solutions remain a critical component in ensuring uptime and regulatory compliance for telecom sites.

Growing deployment of telecom towers in remote and off-grid locations has increased dependency on robust backup solutions, ensuring continuous connectivity and service quality. Heightened concerns over grid reliability and regulatory emphasis on network uptime have further accelerated the adoption of standby generators within the telecom infrastructure. Innovations in fuel efficiency, noise reduction, and emission compliance are enhancing the appeal of modern generators, aligning them with sustainability goals and operational needs.

Future growth is expected to be supported by expanding 5G rollouts, increasing rural coverage, and integration of hybrid power systems that combine conventional generators with renewable energy sources to optimize cost and reliability.

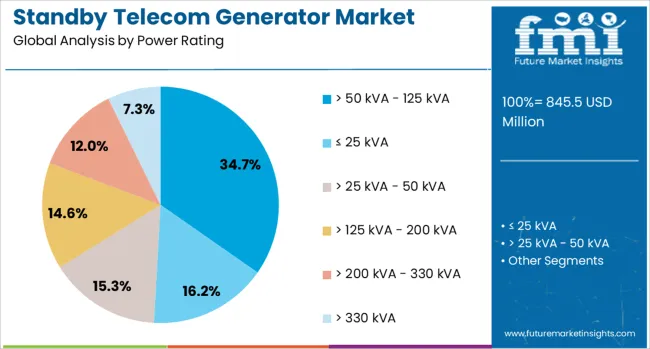

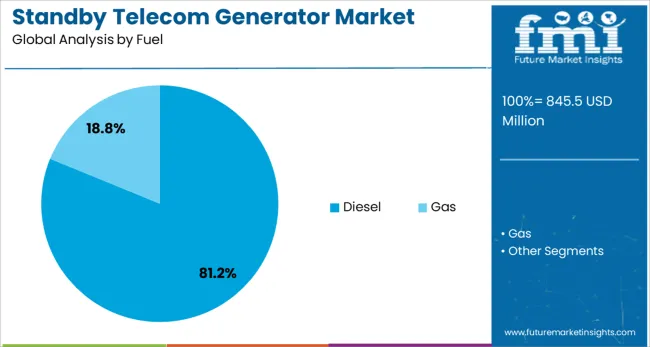

The standby telecom generator market is segmented by power rating, fuel, and geographic regions. The standby telecom generator market is divided by power rating into > 50 kVA - 125 kVA, ≤ 25 kVA, > 25 kVA - 50 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, and > 330 kVA. In terms of fuel, the standby telecom generator market is classified into Diesel and Gas. Regionally, the standby telecom generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by power rating, the > 50 kVA 125 kVA category is anticipated to hold 34.70% of the total market revenue in 2025, securing its position as the leading segment. This dominance has been attributed to its suitability for medium-sized telecom installations that require a balance between power capacity and operational efficiency.

The segment has benefited from being versatile enough to support a wide range of tower configurations without overburdening operational costs or infrastructure. Its reliability in sustaining critical equipment during prolonged outages while maintaining manageable fuel consumption and maintenance requirements has strengthened its adoption.

Advancements in modular generator designs within this power range have improved deployment flexibility, enabling operators to optimize backup solutions for diverse site conditions. These combined factors have reinforced the > 50 kVA 125 kVA segment as the preferred choice for telecom operators striving to balance cost, performance, and scalability.

Segmented by fuel type, diesel-powered generators are projected to capture 81.2% of the total market revenue in 2025, firmly establishing their leadership in the market. This prominence has been supported by the widespread availability of diesel, its proven reliability under demanding conditions, and the mature supply chain that ensures uninterrupted fuel delivery even in remote areas.

Diesel generators have continued to dominate because of their ability to deliver high torque at low speeds, making them ideal for heavy duty, long duration backup applications in telecom infrastructure. Their robustness and relatively low upfront cost compared to alternative fuels have made them the preferred option for operators prioritizing operational resilience and cost control.

Ongoing enhancements in diesel engine efficiency and emissions compliance have further solidified their role in meeting evolving regulatory and environmental requirements while maintaining dependable performance, thereby reinforcing the dominance of the diesel segment.

Standby telecom generators provide backup power to communication networks, ensuring uninterrupted service during grid failures. These generators typically use diesel, natural gas, or hybrid fuel systems to maintain power at telecom towers, data centers, and base stations. Demand is driven by increasing connectivity requirements, expansion of network infrastructure in remote areas, and rising expectations for reliable uptime. Manufacturers offering compact systems with rapid-start capability, low emission output, and ease of maintenance are positioned to serve telecom operators and infrastructure service providers. Equipment intended for continuous readiness and resilient operation under extreme conditions is preferred in procurement choices.

Deployment of standby telecom generators has been driven by the expansion of telecom infrastructure into underserved and remote regions, where grid reliability is inconsistent. Increased volume of data traffic and services has heightened the need for continuous network availability even during power outages. Regulatory stipulations concerning emergency communication resilience have strengthened demand for backup power systems. Growth in tower-based deployments and edge data facilities has further supported generator adoption. Providers offering quick-start generator models with remote monitoring interfaces and low maintenance intervals are gaining traction. Rising emphasis on operational resilience and uninterrupted coverage continues to stimulate recurring demand for standby power systems across urban and rural deployments.

Adoption has been constrained by high capital expenditure requirements for standby generator units and installation infrastructure. Operational cost concerns have arisen from fuel consumption and periodic maintenance needs, especially for diesel-based systems. Emission standards in certain regions have restricted deployment of generators that exceed permitted levels, driving demand for cleaner-burning options. Availability of fuel logistics in remote areas adds complexity to deployment and reliability. Inconsistency in fuel quality across markets has impacted generator performance and lifecycle expectations. Additionally, long procurement cycles and extended lead times for custom configurations have resulted in delayed project rollouts, affecting rapid expansion of telecom power infrastructure.

Opportunities are being identified in hybrid generator systems combining fossil fuel and battery storage to reduce fuel usage and maintenance overhead. Retrofitting telecom sites with upgraded backup power equipment offers recurring service and replacement business opportunities. Specialized systems designed for extreme climates such as high heat, humidity, or subzero environments are gaining interest. Partnerships with telecom infrastructure providers and site management firms support integrated rollout and lifecycle support services. Offerings that combine remote diagnostics and predictive health monitoring of generators are appealing. Demand from regions undergoing telecom network upgrades and rural connectivity initiatives presents growth potential for suppliers providing robust standby generator solutions.

Compact generator models with modular configurations have grown in preference due to ease of transport and installation at remote or tower sites. Adoption of cleaner fuel options like natural gas or low-sulfur diesel has increased to meet tightening emission regulation requirements. Systems featuring quick-start capability and automated shutdown in idle states have gained popularity among operators, supporting operational efficiency. High resistance to environmental stressors such as corrosion, dust, and high-altitude operation is becoming a standard expectation. Interest in integrated battery-genset systems supporting uninterrupted power without fuel burn is rising. Emphasis on remote condition reporting and service scheduling is guiding market evolution toward smarter backup power offerings.

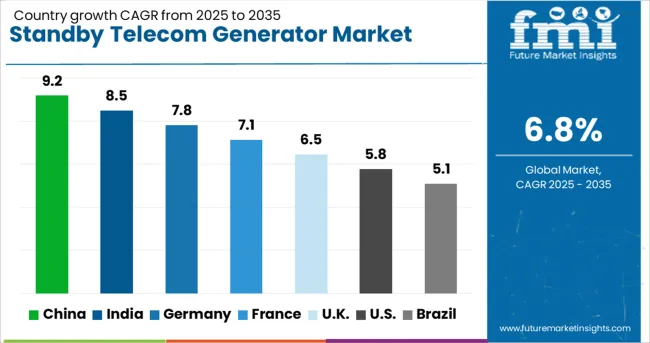

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

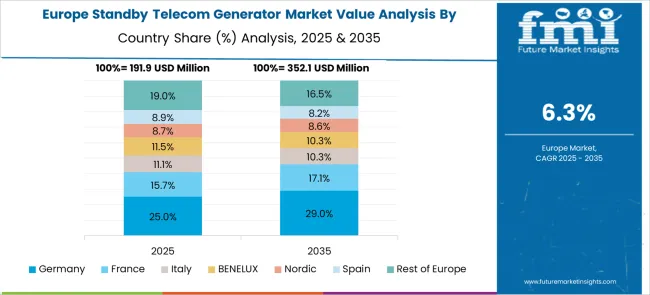

The standby telecom generator market is projected to grow at a CAGR of 6.8% between 2025 and 2035, driven by the increasing need for uninterrupted telecom power supply, 5G network densification, and the adoption of hybrid energy backup solutions. China, part of BRICS, leads with a 9.2% CAGR, supported by massive 5G deployment, data center expansion, and rural connectivity projects. India, also within BRICS, follows at 8.5% CAGR, driven by telecom tower growth, broadband initiatives, and generator integration for off-grid coverage. Germany, a core OECD economy, posts 7.8%, emphasizing low-emission generator technology and smart load-sharing systems for telecom networks. France records 7.1%, supported by eco-compliant generator adoption and digital controls for high-capacity backup systems. The United Kingdom grows at 6.5%, influenced by standby telecom generator installations for edge data centers and 5G tower resilience. Insights for five major markets are provided below. The analysis includes over 40 countries, with the top five detailed below.

China is projected to grow at a 9.2% CAGR, well above the global average of 6.8%, driven by major telecom infrastructure investments and expanding backup power requirements. Adoption of standby telecom generators has surged with large-scale 5G deployment and rural connectivity programs. Domestic manufacturers are introducing hybrid generator systems integrating diesel with battery storage to improve energy reliability. Compliance with energy efficiency norms is encouraging advanced designs with automated load management features. Export-oriented strategies position China as a dominant supplier of telecom power solutions across the Asia-Pacific markets.

India is forecast to register 8.5% CAGR, fueled by rapid telecom network expansion and unreliable grid conditions in rural areas. Increased use of standby telecom generators ensures consistent connectivity for broadband and mobile services. Compact and fuel-efficient generator units are gaining traction for small tower installations, while hybrid solutions integrating renewable energy are preferred in remote networks. Partnerships between generator makers and telecom operators enhance supply for large-scale deployments. Service-driven models for predictive maintenance are also strengthening generator uptime performance in India’s evolving telecom ecosystem.

Germany is expected to grow at 7.8%, supported by stringent network uptime requirements and large-scale 5G deployments. Demand for standby telecom generators in telecom infrastructure is rising as operators seek resilience during outages. Low-emission natural gas and biofuel-based generators are gaining traction under EU environmental regulations. Hybrid systems combining diesel generators with renewable integration are increasingly adopted in high-density telecom zones. Advanced digital monitoring features and predictive diagnostics ensure reliable operations and compliance with safety standards in critical communication networks across Germany.

France is projected to achieve 7.1% CAGR, driven by telecom modernization and 5G network reinforcement projects. Deployment of standby telecom generators is essential for fiber connectivity and high-speed networks in urban hubs. Compact modular generators with remote control and auto-start capabilities are in demand for space-limited sites. Compliance with EU environmental guidelines drives adoption of low-emission backup solutions. Manufacturers focus on integrating smart monitoring systems for predictive maintenance to minimize downtime risks and optimize operational performance across diverse telecom installations.

The United Kingdom is forecast to post 6.5% CAGR, slightly below the global average, yet supported by growing telecom site upgrades and edge computing expansion. Increased adoption of standby telecom generators ensures uninterrupted operations for distributed network nodes. Dual-fuel and hybrid generator systems are preferred by operators for energy reliability and flexibility. Digital maintenance platforms offering real-time monitoring are gaining traction to minimize outages and reduce lifecycle costs. These developments position the UK as an evolving market for advanced telecom backup power solutions.

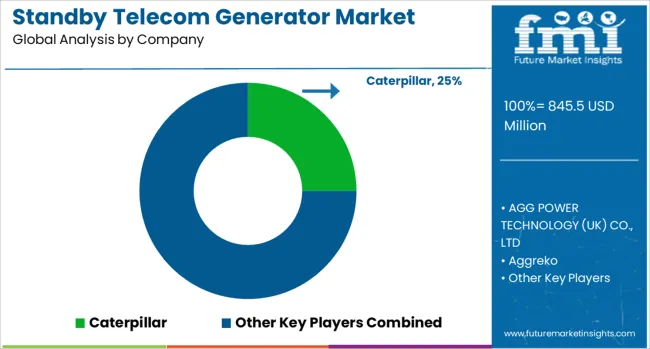

The standby telecom generator market is competitive, driven by global OEMs and regional manufacturers providing reliable backup power for telecom infrastructure in urban and remote areas. Leading players such as Caterpillar, Cummins Inc., Kohler Energy, and Generac Power Systems, Inc. dominate through robust portfolios of diesel and gas generators designed for telecom applications requiring high uptime, fuel efficiency, and remote monitoring. Atlas Copco AB and Aggreko strengthen their market presence with modular and rental-based solutions tailored for rapid deployment in emerging regions.

AGG Power Technology (UK) Co., Ltd., HIMOINSA, and Green Power Systems focus on cost-effective units with advanced control systems for network resilience. Regional players such as MAHINDRA POWEROL, The Pai Kane Group, and Chroma Power Systems India cater to local demand with customized offerings that comply with regulatory norms and environmental requirements. Competitive differentiation hinges on fuel flexibility, noise reduction, compact designs, and integration with hybrid and renewable systems for telecom towers.

Market rivalry intensifies as telecom operators prioritize uninterrupted connectivity and expand into rural areas where grid reliability is low. Entry barriers are moderate due to certification standards and capital-intensive production, favoring established brands with global service networks.

Future growth will be driven by the integration of IoT-enabled predictive maintenance, hybrid systems combining batteries and generators, and government mandates for energy efficiency in telecom infrastructure. Companies investing in digital monitoring, low-emission technologies, and regional partnerships are best positioned to capture opportunities as 5G and network expansion accelerate globally.

Recent developments in the standby telecom generator market highlight a clear focus on efficiency and hybridization. Leading manufacturers have introduced hybrid power solutions combining diesel generators with lithium-ion battery systems to reduce fuel dependency and improve runtime reliability.

There is an increased emphasis on generators integrated with smart control systems for remote monitoring and predictive maintenance, supporting uninterrupted telecom operations. OEMs are also investing in low-emission engines to meet stricter environmental standards. Additionally, modular and compact generator designs are gaining popularity to address space constraints at dense telecom tower sites.

| Item | Value |

|---|---|

| Quantitative Units | USD 845.5 Million |

| Power Rating | > 50 kVA - 125 kVA, ≤ 25 kVA, > 25 kVA - 50 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, and > 330 kVA |

| Fuel | Diesel and Gas |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, AGG POWER TECHNOLOGY (UK) CO., LTD, Aggreko, Atlas Copco AB, Chroma Power Systems India Private Limited, cshpower, Cummins, Inc., Generac Power Systems, Inc., Green Power Systems s.r.l., HIMOINSA, Kohler Energy, MAHINDRA POWEROL, SWT, The Pai Kane Group, and Total Energy Solutions |

| Additional Attributes | Dollar sales segmented by fuel type (diesel, natural gas, and hybrid) and application (telecom towers, data centers, and network hubs), with demand driven by grid instability, 5G rollout, and rural connectivity projects. Regional trends highlight strong growth in Asia-Pacific and Africa due to telecom infrastructure expansion, while North America and Europe focus on hybrid generators for sustainability compliance. Innovation emphasizes IoT-enabled monitoring, remote diagnostics, and integration with renewable energy sources to optimize operational efficiency and reduce lifecycle costs. |

The global standby telecom generator market is estimated to be valued at USD 845.5 million in 2025.

The market size for the standby telecom generator market is projected to reach USD 1,632.5 million by 2035.

The standby telecom generator market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in standby telecom generator market are > 50 kva - 125 kva, ≤ 25 kva, > 25 kva - 50 kva, > 125 kva - 200 kva, > 200 kva - 330 kva and > 330 kva.

In terms of fuel, diesel segment to command 81.2% share in the standby telecom generator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Prime Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Telecom Site Management Software Market Size and Share Forecast Outlook 2025 to 2035

Generator Bushing Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Analytics Market Size and Share Forecast Outlook 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Standby Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Standby Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA