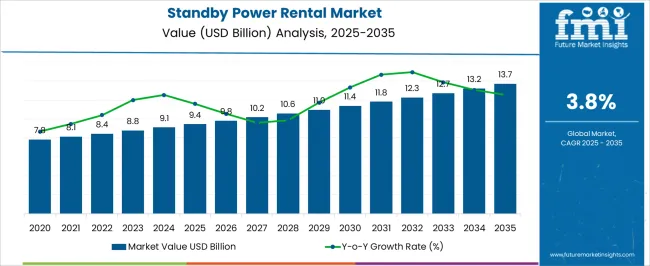

The Standby Power Rental Market is estimated to be valued at USD 9.4 billion in 2025 and is projected to reach USD 13.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period. The YoY growth rate shows fluctuations, peaking near 8.1% in 2022 and 11.4% in 2030, while dipping to 0.8% in 2026, indicating periods of cyclical slowdowns. These variations highlight how temporary demand spikes are often influenced by infrastructure developments, grid stability challenges, and regional power shortages that push reliance on rental solutions. Beyond 2027, the market maintains a stable upward trajectory, with YoY rates mostly within the 10–13% range, underscoring consistent dependence on temporary and backup power systems.

This pattern reflects the critical role of standby power rentals in ensuring operational continuity during outages, peak loads, and project-based requirements. The projected value increase demonstrates the market’s resilience and adaptability, where moderate CAGR growth still points toward significant incremental opportunities across emerging and developed economies, especially as industries prioritize reliability and flexibility in energy access.

| Metric | Value |

|---|---|

| Standby Power Rental Market Estimated Value in (2025 E) | USD 9.4 billion |

| Standby Power Rental Market Forecast Value in (2035 F) | USD 13.7 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The standby power rental market is gaining strong traction owing to the growing demand for temporary power backup across commercial, industrial, and infrastructure segments. Unpredictable power outages, aging grid infrastructure, and rising incidences of natural disasters have intensified the reliance on standby systems to ensure continuity of operations. Increased construction activities, remote site operations, and rapid urban development have further contributed to the demand for short-term power support.

Vendors are focusing on expanding their rental fleets with smart, emission-compliant generators integrated with remote monitoring capabilities, enabling predictive maintenance and optimized fuel consumption. Technological advancements in synchronization and load-sharing mechanisms are also being incorporated to improve reliability in multi-generator installations.

Moreover, the shift toward outsourcing power needs due to high capital costs associated with purchasing and maintaining generators has influenced the uptake of rental services As decarbonization goals become more prominent, rental providers are expected to gradually transition toward hybrid and cleaner fuel-based solutions, paving the way for new growth opportunities in the market.

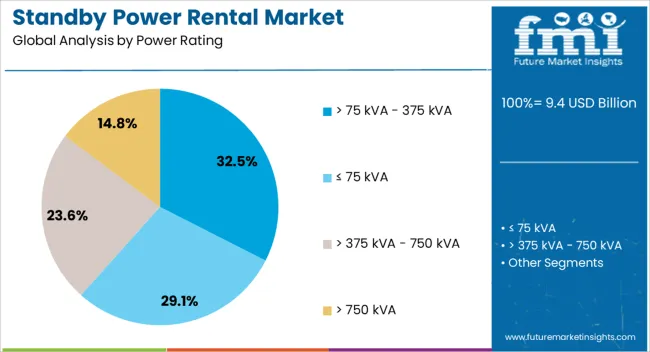

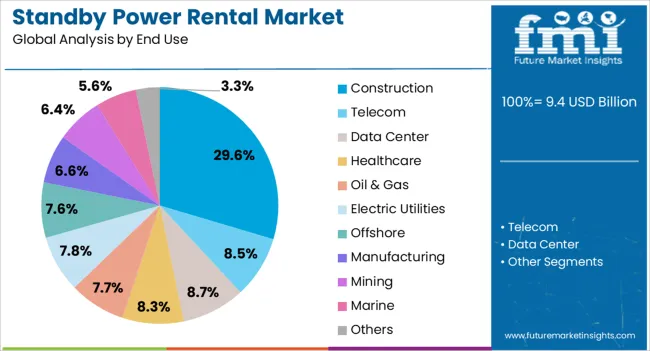

The standby power rental market is segmented by power rating, end use, fuel type, and geographic regions. By power rating, standby power rental market is divided into > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA. In terms of end use, standby power rental market is classified into Construction, Telecom, Data Center, Healthcare, Oil & Gas, Electric Utilities, Offshore, Manufacturing, Mining, Marine, and Others.

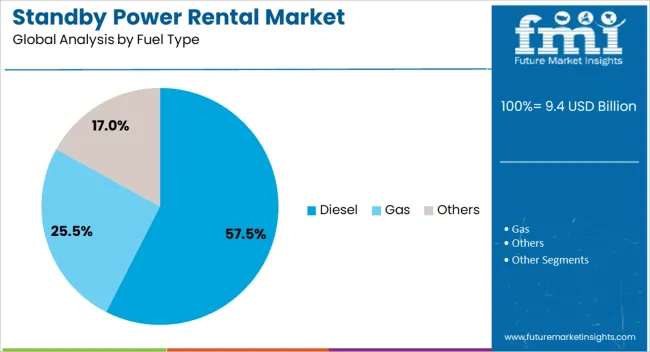

Based on fuel type, standby power rental market is segmented into Diesel, Gas, and Others. Regionally, the standby power rental industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power rating segment, ranging from greater than 75 kVA to 375 kVA, is projected to hold 32.5% of the total revenue share in the standby power rental market in 2025. This dominance is being driven by the segment’s suitability for medium-scale operations where both mobility and power reliability are essential.

Equipment in this category is widely adopted in sectors such as construction, mining, and event management due to its optimal balance of output and portability. The integration of these generators into rental fleets has been prioritized due to their flexible load-handling capacity and ease of installation across temporary sites.

Their compatibility with advanced control systems, low operating noise, and compliance with regional emission norms have contributed to their expanded deployment Additionally, the growing need for scalable power in grid-constrained and off-grid areas has further positioned this power range as a preferred choice among end users seeking dependable and cost-effective backup solutions.

The construction segment is anticipated to account for 29.6% of the total revenue share in the standby power rental market by 2025, establishing it as a leading end-use industry. The high power demands at construction sites, coupled with the frequent unavailability of permanent grid connections, have made rental power solutions essential for operations continuity.

Standby generators are being increasingly deployed to support on-site tools, lighting, machinery, and temporary offices across urban infrastructure and residential development projects. Delays in electrification and the temporary nature of construction activities have further amplified the demand for short-term, mobile power setups.

Providers are offering tailored rental contracts with rapid deployment and maintenance services, enabling efficient project execution and cost control. Furthermore, the strict timelines and high energy requirements associated with large-scale infrastructure projects have necessitated dependable backup systems, which have strengthened the preference for renting standby power solutions in the construction sector.

The diesel fuel type segment is expected to command 57.5% of the overall revenue share in the standby power rental market in 2025, reinforcing its dominant market position. The prevalence of diesel generators can be attributed to their fuel efficiency, high power output, and suitability for rugged environments. These systems are widely preferred for their long operational life, lower maintenance intervals, and ability to function under variable loads, making them ideal for a wide range of applications.

Diesel-powered units are also available in a broad capacity range, providing flexibility across short and extended rental durations. Their widespread availability and robust support infrastructure have enabled quick deployment in emergency scenarios and remote locations.

In addition, regulatory developments have led to the adoption of low-emission diesel variants and cleaner technologies, ensuring continued relevance despite growing environmental concerns. As a result, diesel remains the most relied-upon fuel source in standby rental fleets across industries.

The standby power rental market is fueled by demand for reliability, flexibility, and resilience across industries. Growth is strongly influenced by emergencies, remote projects, and regional expansion strategies by providers.

The standby power rental industry has gained importance due to increasing demand from sectors that cannot afford operational downtime. Industries such as healthcare, data centers, oil and gas, and construction have been renting standby units to maintain continuity during grid outages and project execution. Short-term rental agreements are often seen as cost-effective compared to permanent installation, especially in areas where power interruptions are frequent. Infrastructure projects across developing regions rely heavily on rental power systems to bridge gaps during grid expansion phases. Natural disasters and weather-driven blackouts have further heightened reliance on temporary power solutions. This dynamic illustrates how emergency preparedness has become a decisive factor for rental power growth across multiple industrial domains.

Large-scale construction activities and mining operations remain a primary consumer base for standby power rental solutions, as these sectors operate in remote areas with limited grid access. Rental generators provide flexibility for projects that have fluctuating energy needs and time-bound operations. The temporary power systems reduce upfront investment burdens for contractors, making them attractive alternatives. Mining activities, especially in resource-rich economies, deploy standby rental power for both drilling and processing operations. Demand is also driven by projects with high mobility requirements, where equipment relocation is frequent. With capital efficiency and scalability being priorities for contractors, standby power rental ensures reliable access to electricity without long-term infrastructure obligations or excessive financial risks.

Frequent storms, heatwaves, and unpredictable climate patterns have increased the importance of standby power rental systems. Power grid disruptions caused by natural events often necessitate rapid deployment of temporary energy solutions. Rental fleets provide hospitals, data centers, and government facilities with reliable emergency backup during critical periods. The speed of mobilization is one of the main advantages that positions rental systems as an effective disaster management tool. Regions prone to hurricanes, floods, or earthquakes have reported rising requests for immediate rental deployments. This trend highlights the market’s reliance on being a first-response utility, where the need for resilience and uninterrupted functionality during emergencies has amplified rental equipment adoption globally.

The standby power rental market has observed notable strategies from manufacturers and service providers focusing on expanding their geographic presence. Companies are investing in fleet modernization, digital monitoring, and expanding service hubs to address wider customer bases. Strategic mergers, partnerships, and acquisitions have become common as firms aim to strengthen portfolios and market presence. Rental providers are tailoring offerings to specific regional requirements, whether it is oil-driven economies in the Middle East or disaster-prone zones in Asia-Pacific. Emerging economies are witnessing new entrants deploying competitive pricing strategies to capture market share. This competitive dynamic highlights how both established and newer firms seek differentiation by ensuring faster response times, reliable service contracts, and adaptable rental solutions.

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

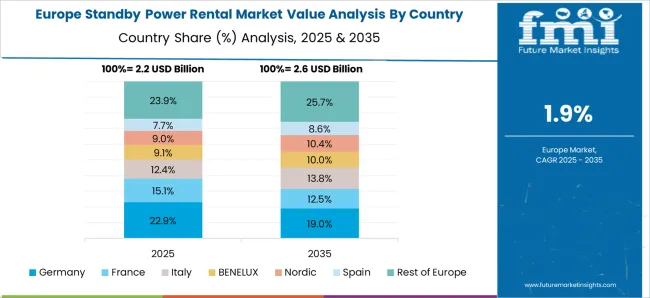

The standby power rental market, projected to grow at a global CAGR of 3.8% from 2025 to 2035, shows a mixed performance across leading economies. China leads with a 5.1% CAGR, underpinned by rapid infrastructure expansion and increasing reliance on backup power for large-scale industrial and commercial projects. India follows at 4.8%, reflecting rising demand from construction, mining, and emergency response activities across its fast-growing economy. France posts a 4.0% CAGR, supported by its investment in infrastructure upgrades and contingency planning for critical sectors. The United Kingdom records 3.6% CAGR, influenced by demand in construction projects and rising dependence on rental equipment for short-term needs. The United States posts a 3.2% CAGR, indicating maturity and stable demand driven by industries such as data centers, healthcare, and utilities requiring reliable backup systems. The report spans detailed insights into 40+ countries, with the top five highlighted above as key growth contributors within the global standby power rental landscape.

The CAGR in the United Kingdom for the standby power rental market grew from approximately 2.9% during 2020–2024 to 3.6% for the period 2025–2035, driven by increasing demand from data centers, healthcare facilities, and infrastructure projects. During 2020–2024, the market was supported by modest adoption, largely limited to construction and emergency backup needs. The 2025–2035 period reflects a higher CAGR due to a growing emphasis on business continuity, increased reliance on short-term power rentals, and greater awareness of operational risk management. Rising frequency of outages and construction activity is further fueling this growth. Service providers are also expanding fleet capacity to meet rising demand for flexible power solutions in the UK.

China’s standby power rental market has displayed a consistent growth trajectory, with CAGR rising from 4.3% during 2020–2024 to 5.1% in 2025–2035. The growth during 2020–2024 was driven by large-scale construction projects, industrial expansion, and widespread reliance on rental systems in areas with unstable grid connections. The 2025–2035 period is projected to experience a higher CAGR due to rapid industrialization, extensive infrastructure development, and rising disaster preparedness investments. Major infrastructure expansions in energy, transport, and utilities are pushing demand further. Flexible rental solutions are gaining prominence as enterprises seek cost-effective backup systems for short-term and emergency use, reinforcing China’s leadership in global standby power rentals.

India’s standby power rental industry grew at a CAGR of about 4.1% during 2020–2024, propelled by strong reliance on rentals for construction, mining, and industrial operations in grid-challenged regions. Moving forward, CAGR is set to increase to 4.8% between 2025–2035, backed by government investment in infrastructure, increasing demand from healthcare and IT facilities, and disaster management requirements. The shift reflects stronger adoption of temporary power solutions as industries prioritize flexibility and operational assurance. Market players are also expanding service coverage to capture the growing opportunities. India’s reliance on cost-effective and mobile rental fleets underlines its position as one of the fastest-growing standby power rental markets globally.

The standby power rental market in France recorded a CAGR of 3.2% during 2020–2024, driven mainly by emergency services, commercial projects, and construction activities. For 2025–2035, the CAGR increases to 4.0%, reflecting stronger emphasis on energy resilience and compliance with regulations requiring backup power preparedness. Growth is fueled by greater adoption across healthcare, transportation, and commercial facilities where continuity is critical. Service providers are enhancing their presence by offering scalable fleets that can be rapidly deployed. This transition highlights how France is strengthening its reliance on standby rentals for both contingency planning and critical projects, contributing to a more dynamic growth outlook.

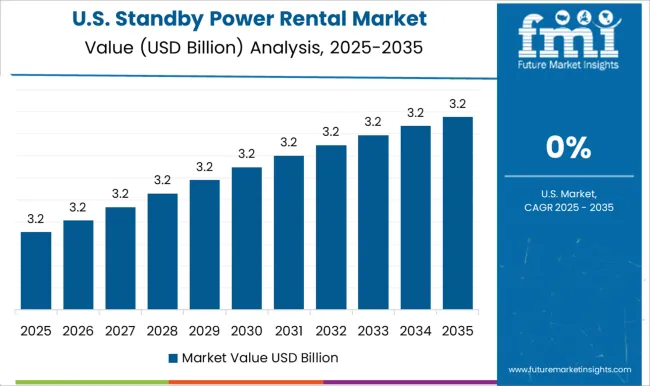

In the United States, the standby power rental market grew modestly at a CAGR of 2.6% during 2020–2024, as the country’s strong permanent power infrastructure reduced reliance on temporary solutions. However, the CAGR improves to 3.2% between 2025–2035, influenced by rising power requirements from expanding data centers, healthcare institutions, and increasing deployment for disaster recovery. Extreme weather events and regional outages have created greater awareness of the need for temporary power resilience. The USA market shows a gradual shift from a stable to a more diversified demand base, with rental companies expanding their fleets to address broader emergency and industrial requirements.

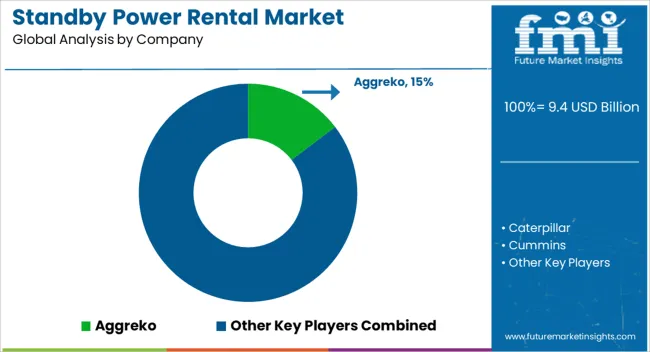

Aggreko continues to dominate by offering large-scale rental power solutions across industrial, utility, and event segments, supported by advanced monitoring and energy management platforms. Caterpillar and Cummins leverage their strong manufacturing base to provide reliable generator rental services with an emphasis on service networks and long-term supply contracts. Wärtsilä focuses on integrating high-efficiency power units into rental fleets, catering to both emergency and project-based demand. Atlas Copco expands its competitive edge with portable and mobile generator rentals, especially for construction and infrastructure projects.

HIMOINSA, part of the Yanmar Group, provides diversified rental offerings targeting Europe and Latin America, while Finning International, a major Caterpillar dealer, supports rental expansion in North America and South America with integrated service capabilities. Herc Rentals emphasizes fleet modernization and regional coverage to serve commercial and industrial clients effectively. Pon Energy Rental focuses on turnkey rental energy systems in Europe, while Bredenoord positions itself strongly in temporary and sustainable rental power, particularly in the Netherlands and Germany. Al Faris expands operations in the Middle East, targeting oil, gas, and construction projects that require large power units.

Prime Power Rentals and BPC Power Rentals strengthen their foothold by offering scalable solutions for industrial and commercial projects with competitive pricing strategies. Modern Hiring Service caters to regional demand, focusing on short-term project-based rentals, while Rehlko builds its market share by targeting localized power rental needs and expanding service availability. Collectively, these companies are competing on reliability, cost-efficiency, and rapid deployment, while strategically investing in service coverage to capture rising demand across sectors such as construction, healthcare, utilities, and disaster management.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.4 Billion |

| Power Rating | > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA |

| End Use | Construction, Telecom, Data Center, Healthcare, Oil & Gas, Electric Utilities, Offshore, Manufacturing, Mining, Marine, and Others |

| Fuel Type | Diesel, Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aggreko, Caterpillar, Cummins, Wartsila, AtlasCopco, HIMOINSA, FinningInternational, HercRentals, PonEnergyRental, Bredenoord, AlFaris, PrimePowerRentals, BPCPowerRentals, ModernHiringService, and Rehlko |

| Additional Attributes | Dollar sales by region, share by end-use sectors, share of rental vs purchase, competitor share mapping, pricing share trends, fleet utilization rates, regulatory impact on rentals, project pipeline share outlook. |

The global standby power rental market is estimated to be valued at USD 9.4 billion in 2025.

The market size for the standby power rental market is projected to reach USD 13.7 billion by 2035.

The standby power rental market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in standby power rental market are > 75 kva - 375 kva, ≤ 75 kva, > 375 kva - 750 kva and > 750 kva.

In terms of end use, construction segment to command 29.6% share in the standby power rental market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standby Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Crew boats (Standby Crew Vessels) Market

Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA