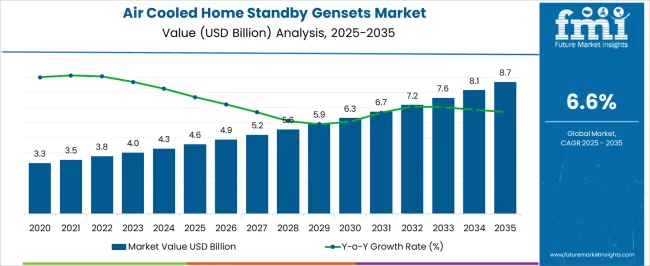

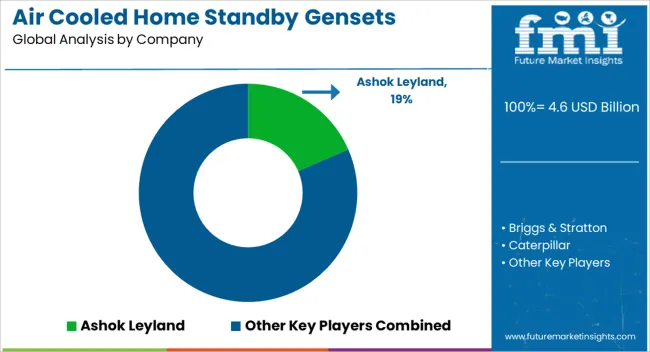

The air cooled home standby gensets market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 8.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

Growth is influenced by rising power outage incidents, increasing residential demand for reliable backup power, and cost advantages of air-cooled systems compared to liquid-cooled alternatives. Advancements in fuel efficiency, noise reduction, and remote monitoring are further enhancing adoption. Acceleration and deceleration patterns across the forecast period highlight distinct phases of market development. From 2025 to 2029, acceleration is evident as consumer awareness, coupled with rising grid instability, drives adoption in North America and Europe. Demand is supported by increasing natural disasters, which push households to invest in reliable standby power solutions.

The mid-phase from 2030 to 2032 reflects peak acceleration, as adoption spreads in Asia Pacific and Latin America, driven by rapid urban housing expansion and higher electrification needs. However, from 2033 to 2035, growth shows mild deceleration as penetration levels increase in early-adopting markets, and competition intensifies with hybrid and renewable backup power alternatives. Overall, the USD 4.1 billion opportunity reflects both acceleration in early and mid-phase growth and stabilization in the later years of the forecast period.

| Metric | Value |

|---|---|

| Air Cooled Home Standby Gensets Market Estimated Value in (2025 E) | USD 4.6 billion |

| Air Cooled Home Standby Gensets Market Forecast Value in (2035 F) | USD 8.7 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The air cooled home standby gensets market is primarily supported by the residential power backup sector, which accounts for about 40% of the market share due to rising demand for reliable electricity during outages. The commercial segment contributes nearly 25%, with small businesses and offices adopting gensets to ensure uninterrupted operations. The healthcare sector represents around 15%, where standby gensets provide critical backup for medical equipment. Industrial users contribute approximately 10%, applying gensets for small-scale operations. The remaining 10% comes from telecom and data centers, where gensets are used to maintain power continuity in communication and digital infrastructure.

The air cooled home standby gensets market is evolving with innovations in efficiency, connectivity, and fuel use. Compact and quieter models are being introduced to improve user convenience in residential environments. Smart monitoring systems that integrate with mobile applications are becoming standard, allowing users to track performance and maintenance needs remotely. Dual-fuel and cleaner-burning engines are gaining adoption as customers look for alternatives that reduce emissions. Companies are investing in product diversification to serve both urban and rural demand. Collaborations with energy solution providers and distributors are expanding market reach while addressing growing concerns about energy reliability.

The market is experiencing consistent expansion as a result of rising power outages, increased electrification of residential areas, and heightened awareness regarding energy security. A surge in extreme weather conditions has placed further strain on power infrastructure, leading to greater adoption of backup power systems in both urban and semi-urban areas.

Air cooled gensets are being preferred due to their compact design, ease of installation, and lower maintenance requirements compared to liquid cooled systems. Growing residential construction, particularly in off-grid or unstable-grid regions, has also supported demand.

Additionally, the focus on cost-effective energy resilience solutions and the increasing need for uninterrupted power supply for remote work and smart home systems are shaping future growth prospects The market outlook remains strong as consumer behavior continues to shift toward reliable, self-contained power solutions that are suitable for residential applications with minimal environmental and structural impact.

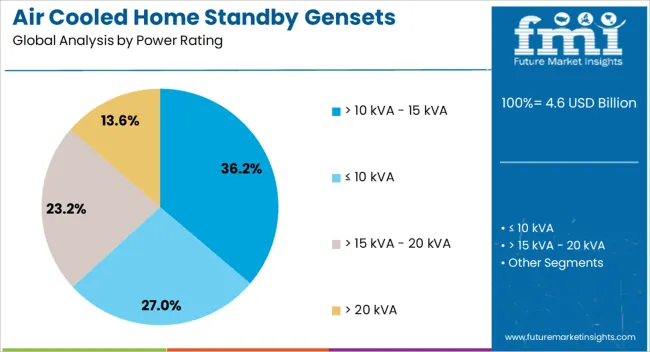

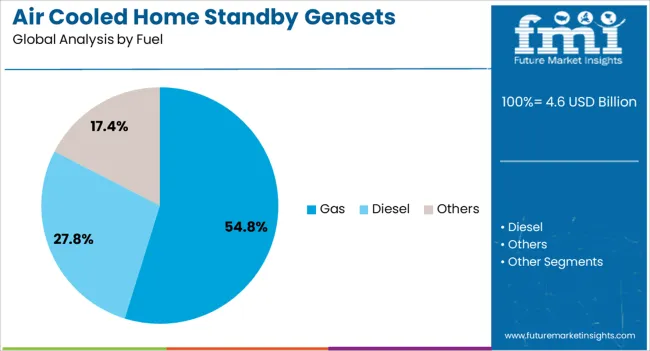

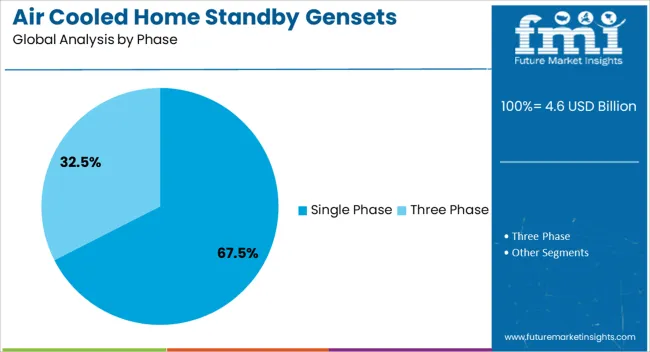

The air cooled home standby gensets market is segmented by power rating, fuel, phase, and geographic regions. By power rating, air cooled home standby gensets market is divided into > 10 kVA - 15 kVA, ≤ 10 kVA, > 15 kVA - 20 kVA, and > 20 kVA. In terms of fuel, air cooled home standby gensets market is classified into gas, diesel, and others. Based on phase, air cooled home standby gensets market is segmented into single phase and three phase. Regionally, the air cooled home standby gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 10 kVA - 15 kVA power rating segment is expected to account for 36.2% of the air cooled home standby gensets market revenue in 2025, making it the leading power class. This segment’s dominance is being driven by the balance it offers between power capacity and system affordability, which suits the typical requirements of medium to large residential properties.

Units within this range provide sufficient backup for critical home appliances, HVAC systems, and home office setups, without requiring complex electrical upgrades. As power demands increase in modern households, gensets with this rating are being selected for their compatibility with energy-efficient devices and minimal fuel consumption.

The segment is also benefiting from ease of integration with automated transfer switches and home energy management systems, improving overall user convenience The preference for resilient power solutions capable of handling partial home loads reliably has played a key role in solidifying the segment's leadership position.

The gas-fueled genset segment is projected to hold 54.8% of the market share in 2025, establishing it as the dominant fuel type in the Air Cooled Home Standby Gensets market. This leadership is being supported by the widespread availability of piped natural gas and the increasing consumer inclination toward cleaner fuel alternatives. Gas gensets offer quieter operation, lower emissions, and reduced running costs compared to their diesel counterparts, making them highly attractive for residential use.

As environmental concerns and regulatory frameworks evolve, households are opting for solutions that align with sustainability goals. Gas-powered gensets are also favored for their ability to run longer without manual refueling, enhancing reliability during extended outages.

Their low maintenance and smooth performance in cold weather conditions have further contributed to their popularity Overall, the combination of operational efficiency and environmental compliance has positioned gas gensets as the preferred choice in residential standby applications.

The single phase genset segment is expected to contribute 67.5% of the market revenue in 2025, leading the market by a significant margin. This leadership is attributed to its widespread compatibility with standard residential electrical infrastructure, which typically operates on single phase power. Single phase gensets meet the backup power needs of most households, including essential lighting, refrigeration, heating, and communication systems.

Their lower installation complexity and cost advantage make them more accessible to homeowners, particularly in suburban and rural areas. In addition, manufacturers are increasingly offering compact and digitally enabled single phase gensets that support smart control and remote diagnostics, enhancing user experience.

The continued emphasis on residential power reliability, combined with the ongoing electrification of rural housing and development projects, has ensured sustained demand for single phase units Their dominance is expected to persist as homeowners prioritize cost-effective, plug-and-play backup power systems.

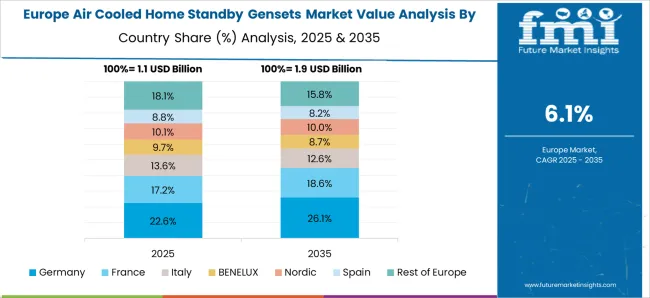

The air cooled home standby gensets market is expanding with rising residential demand for uninterrupted power supply during outages. Global revenue crossed USD 2.6 billion in 2024, with North America holding 42% share due to frequent weather-related blackouts and grid instability. Europe accounts for 27%, led by Germany, UK, and France with growing residential backup power installations. Asia Pacific contributes 24%, driven by India, China, and Japan where rising urbanization and unreliable grids support adoption. Air cooled gensets up to 25 kW dominate installations, accounting for nearly 70% of units. Compact size, lower cost, and ease of installation make them a preferred choice for households.

Households increasingly adopt air cooled standby gensets to secure uninterrupted electricity during grid failures. North America leads with 42% share, where weather-related outages affect millions annually. Europe contributes 27%, supported by rising adoption in suburban and rural housing. Asia Pacific is growing at a CAGR of 5.8% with demand from India and China, where power reliability remains a challenge. Air cooled gensets under 25 kW meet most household energy requirements, covering HVAC systems, lighting, and essential appliances. Demand is higher in regions with extreme weather conditions. Convenience, affordability, and reduced installation complexity continue to strengthen residential genset adoption worldwide.

Air cooled gensets are benefiting from advancements in fuel efficiency, noise reduction, and remote monitoring. Modern units provide up to 15–20% lower fuel consumption compared to older models. Noise levels have reduced to 65–70 dB, supporting installation in residential zones. Smart controllers and Wi-Fi-enabled systems allow homeowners to monitor performance and fuel usage remotely. North America emphasizes premium features such as load management and self-diagnostic functions. Europe prioritizes compact, eco-friendly gensets for dense urban settings. Asia Pacific adoption is focused on cost-efficient models. Improvements in durability, automation, and efficiency are enhancing adoption across multiple residential applications worldwide.

Air cooled home standby gensets are widely used in single-family houses, multi-unit residential complexes, and vacation homes. Single-family homes account for 55% of installations, followed by 30% in multi-unit residences, and 10–12% in seasonal or secondary homes. North America leads with widespread adoption across suburban households. Europe emphasizes installations in rural and semi-urban housing where outages are common. Asia Pacific demand is expanding due to urbanization and unreliable grid connectivity in India and Southeast Asia. Affordable pricing, compact size, and adequate capacity for residential loads ensure strong adoption. Growth in housing development and rising awareness of backup power benefits continue to expand market demand.

Air cooled home standby gensets face challenges due to high upfront costs and reliance on fuel supply. Average unit costs range from USD 2,500–5,500, limiting affordability in price-sensitive regions. Fuel dependency on natural gas, propane, or diesel increases operational costs by 12–18% annually. Supply chain issues for engines and electronic controllers extend lead times in emerging markets. Installation requires skilled labor, adding to overall expenses. Noise restrictions and emission standards in urban regions further challenge adoption. Manufacturers are addressing these issues with cost-efficient models, low-emission engines, and smart load management. Despite progress, costs and fuel dependency remain key barriers globally.

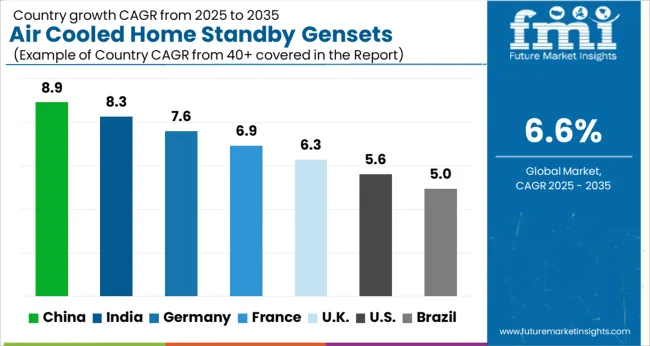

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The air cooled home standby gensets market is projected to grow at a global CAGR of 6.6% through 2035, driven by increasing residential demand for reliable backup power, expansion of housing infrastructure, and growing weather-related outages. China leads at 8.9%, 35% above the global benchmark, supported by BRICS-led investments in residential infrastructure, manufacturing capacity, and adoption of backup power solutions. India follows at 8.3%, 26% above the global average, reflecting rising installation in urban and semi-urban housing, growth in small residential projects, and higher reliance on backup power. Germany records 7.6%, 15% above the benchmark, shaped by OECD-driven innovation in energy-efficient gensets, advanced control systems, and integration with residential applications. The United Kingdom posts 6.3%, 5% below the global rate, influenced by selective adoption in high-density housing areas, modern residential projects, and premium applications. The United States stands at 5.6%, 15% below the benchmark, with steady demand in suburban housing, niche residential uses, and regions with frequent grid instability. BRICS economies drive volume growth, OECD markets emphasize product efficiency and technological advancement, while ASEAN nations contribute through expanding residential infrastructure and increasing demand for backup power.

The air cooled home standby gensets market in China is anticipated to grow at a CAGR of 8.9%, above the global CAGR of 6.6%, driven by expansion of residential construction and higher power reliability needs. In 2024, installations of air cooled gensets increased by 18% with demand concentrated in tier 2 and tier 3 cities. Local manufacturers enhanced production capacities in Shandong, Jiangsu, and Zhejiang to serve growing domestic consumption. Global and regional brands such as Honda, Cummins, and Generac focused on introducing fuel-efficient and compact gensets suitable for urban households. Rising household backup requirements are sustaining long-term demand.

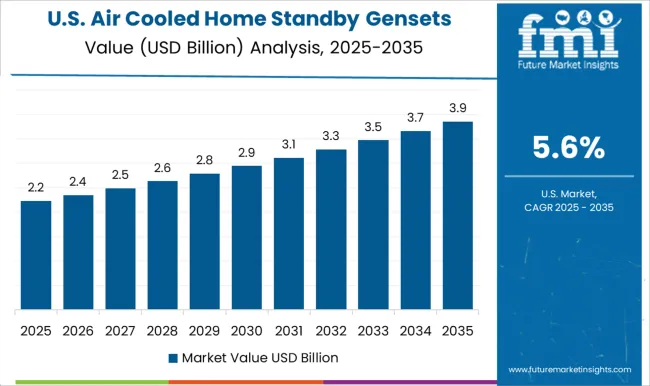

The air cooled home standby gensets market in the United States is set to grow at a CAGR of 5.6%, below the global CAGR of 6.6%, reflecting maturity in adoption. In 2024, installations grew by 8%, with demand seen in states experiencing weather-related outages such as Texas, Florida, and California. Domestic producers including Generac, Briggs & Stratton, and Kohler dominated the market with advancements in quiet operation and dual-fuel systems. Expansion is influenced by consumer focus on performance reliability and automated transfer capabilities.

The air cooled home standby gensets market in India is projected to expand at a CAGR of 8.3%, above the global average of 6.6%, due to grid stability concerns and rising backup adoption across households. In 2024, installations grew by 15% with uptake observed in both rural and semi-urban markets. Manufacturing hubs in Pune, Chennai, and Hyderabad scaled up output to meet regional demand. Firms such as Kirloskar, Cummins India, and Mahindra Powerol launched new compact gensets targeting residential end users. Consumer adoption is being shaped by preference for automated and fuel-efficient models with lower noise levels.

The air cooled home standby gensets market in Germany is estimated to advance at a CAGR of 7.6%, higher than the global 6.6%, influenced by residential preparedness initiatives and renewable energy integration. In 2024, household genset installations rose by 12% as backup needs increased during power fluctuations. Production centers in Bavaria and Baden-Württemberg introduced improved air cooled models with advanced emission control systems. Companies such as Bosch, Siemens, and Generac expanded their portfolios with smart control-enabled gensets. Demand is concentrated in suburban households with emphasis on reliability and compliance with European emission standards.

The United Kingdom’s air cooled home standby gensets market is forecast to grow at a CAGR of 6.3%, nearly matching the global CAGR of 6.6%, with demand shaped by residential backup solutions in rural and semi-urban households. In 2024, installations increased by 10% as weather-driven power disruptions influenced adoption. Manufacturing bases in Northern England and Scotland focused on compact designs for smaller households. Firms including Cummins UK, Caterpillar, and Honda introduced models with higher fuel efficiency and smart switching capabilities. Growth is supported by rising need for continuous household power supply.

Competition in the air cooled home standby gensets market is being shaped by efficiency, installation flexibility, and cost-effective power backup solutions. Market positions are being maintained through product certification, aftersales service, and dealer networks that ensure uninterrupted availability for households and small enterprises. Ashok Leyland is being represented with gensets designed for stable power delivery and fuel adaptability, while Briggs & Stratton is being promoted with compact units structured for residential backup. Caterpillar is being applied with models tailored for long operating life and durability in demanding conditions. Champion Power Equipment is being showcased with solutions designed for quick start-up and user convenience. Cummins is being advanced with air cooled gensets optimized for consistent performance and low emissions. Eaton is being highlighted with models designed for reliable switching and home integration.

Generac Power Systems is being positioned with a broad portfolio engineered for household power needs. HIMOINSA is being promoted with gensets structured for flexibility and noise reduction. Kirloskar is being recognized with fuel-efficient designs suited for regional requirements. Kohler is being applied with premium models built for endurance and quiet operation. Mahindra Powerol is being represented with gensets engineered for reliability and service support. Pinnacle Generators is being highlighted with air cooled solutions tailored for customized applications. PR Industrial srl is being promoted with high-quality gensets designed for European standards. Prakash is being advanced with compact units built for affordability and consistent operation. Sichuan XinYici Power Machinery is being showcased with models designed for durability and regional adaptability. Strategies are being directed toward expanding dealer support, improving service reliability, and strengthening local distribution.

Product brochures are being structured with specifications covering power output, fuel type, cooling method, noise level, and control features. Features such as automatic start systems, digital monitoring, and safety mechanisms are being emphasized to support decision-making for residential buyers. Each brochure is being arranged to present operational limits, maintenance guidelines, and certification compliance. Technical information is being provided in a clear format to assist homeowners, contractors, and procurement teams in evaluating air cooled home standby gensets that align with performance, reliability, and installation requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.6 billion |

| Power Rating | > 10 kVA - 15 kVA, ≤ 10 kVA, > 15 kVA - 20 kVA, and > 20 kVA |

| Fuel | Gas, Diesel, and Others |

| Phase | Single Phase and Three Phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ashok Leyland, Briggs & Stratton, Caterpillar, Champion Power Equipment, Cummins, Eaton, Generac Power Systems, HIMOINSA, Kirloskar, Kohler, Mahindra Powerol, Pinnacle Generators, PR Industrial srl, Prakash, and Sichuan XinYici Power Machinery |

| Additional Attributes | Dollar sales by genset type and residential application, demand dynamics across backup power and emergency use, regional trends in home electrification and grid reliability, innovation in fuel efficiency and noise control, environmental impact of emissions and disposal, and emerging use cases in smart homes and hybrid energy systems. |

The global air cooled home standby gensets market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the air cooled home standby gensets market is projected to reach USD 8.7 billion by 2035.

The air cooled home standby gensets market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in air cooled home standby gensets market are > 10 kva - 15 kva, ≤ 10 kva, > 15 kva - 20 kva and > 20 kva.

In terms of fuel, gas segment to command 54.8% share in the air cooled home standby gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA