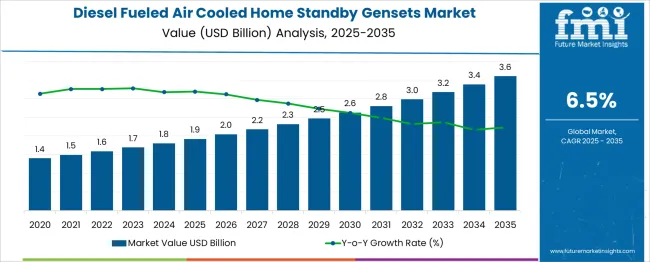

The Diesel Fueled Air Cooled Home Standby Gensets Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. Saturation point analysis indicates that the market will experience robust adoption in the early period (2025–2030), adding USD 0.7 billion as it moves from USD 1.9 billion to USD 2.6 billion, driven by frequent power outages, growing residential electrification demand, and cost advantages of diesel-based systems in regions with unreliable grids. During this phase, penetration rates remain high in North America and Asia-Pacific, supported by expanding distribution networks and enhanced product features such as remote monitoring and low-noise operation.

However, from 2030 onward, growth begins to moderate as the market approaches maturity, contributing USD 1.0 billion to reach USD 3.6 billion by 2035, with deceleration linked to competitive substitution from gas-powered and hybrid gensets amid tightening emissions regulations. Despite this, opportunities persist in regions with delayed grid modernization and in premium segments where reliability and long service life remain priorities. Manufacturers focusing on fuel efficiency optimization, compliance-ready emission technologies, and IoT-based performance diagnostics will capture incremental gains even as the market trends toward saturation in developed economies.

| Metric | Value |

|---|---|

| Diesel Fueled Air Cooled Home Standby Gensets Market Estimated Value in (2025 E) | USD 1.9 billion |

| Diesel Fueled Air Cooled Home Standby Gensets Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The diesel fueled air cooled home standby gensets market is gaining traction as a reliable backup power option across residential energy ecosystems. Within the residential standby generator market, these gensets account for 30–32%, primarily due to their ability to provide consistent performance during prolonged outages in rural and suburban settings. In the broader diesel generator equipment segment, their share is 6–8%, as commercial and industrial diesel gensets dominate overall volumes. Across the home backup power systems category, they represent 8–10%, competing with battery-based and hybrid solar solutions that serve the growing demand for energy resilience. In the emergency and critical power infrastructure segment, these units contribute 5–7%, acting as dependable contingency power where centralized grids may fail. For off-grid and remote backup applications, the share reaches 12–14%, reflecting strong demand in regions with limited grid connectivity. Market expansion is supported by rising concerns over grid instability, increased frequency of outages, and affordability relative to liquid-cooled alternatives. Recent advancements, including noise-reduction technologies, automatic transfer switching, and smart load optimization, are enhancing operational efficiency and user convenience. These trends position diesel-fueled air-cooled gensets as a critical component in residential energy security strategies, bridging reliability with cost-effective backup power solutions.

The Diesel Fueled Air Cooled Home Standby Gensets market is witnessing steady growth due to increasing occurrences of grid failures, rising demand for uninterrupted power supply, and the expanding base of residential installations in rural and semi-urban areas. The reliability and low maintenance characteristics of diesel air-cooled gensets have led to their continued preference for home use.

Growth is also being supported by favorable regulatory frameworks for backup power installations and rising awareness regarding preparedness for extreme weather events. Manufacturers are increasingly focusing on compact, cost-effective, and emission-compliant gensets, further enhancing their suitability for residential applications.

As households seek energy independence and protection against power disruptions, particularly in regions prone to grid instability, the adoption of diesel-powered home standby gensets is expected to increase. Additionally, improvements in noise suppression, fuel efficiency, and remote monitoring capabilities are being incorporated into new models, ensuring long-term growth potential for the market across developed and emerging economies..

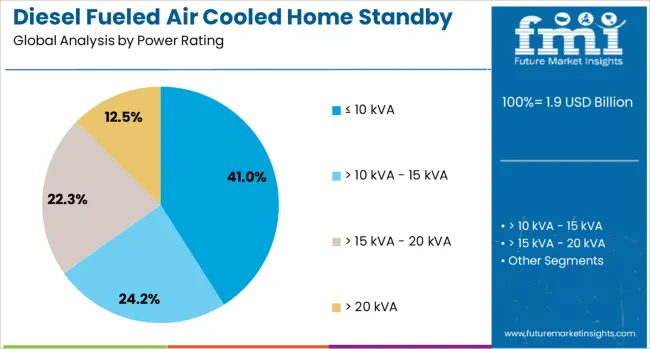

The diesel-fueled air-cooled home standby gensets market is segmented by power rating and phase, and geographic regions. The power rating of the diesel-fueled air-cooled home standby gensets market is divided into ≤ 10 kVA, > 10 kVA - 15 kVA, > 15 kVA - 20 kVA, and > 20 kVA. In terms of the phase of the diesel-fueled air-cooled home standby gensets market, it is classified into single-phase and three-phase. Regionally, the diesel-fueled air-cooled home standby gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power rating segment of ≤ 10 kVA is projected to account for 41% of the Diesel Fueled Air Cooled Home Standby Gensets market revenue share in 2025, making it the dominant subsegment in terms of demand. This growth has been supported by the rising requirement for low-capacity backup power solutions in single-family homes and smaller residential units. Gensets in this range are well-suited for powering essential home appliances, making them ideal for typical household applications.

Their compact size, ease of installation, and fuel efficiency have further contributed to their popularity. The segment has also benefited from cost advantages and minimal space requirements, which align with the preferences of homeowners seeking practical and affordable solutions.

Moreover, as energy consumption awareness grows and efficiency becomes a purchasing factor, gensets within this power range have been selected for their ability to deliver dependable power without overcapacity or waste. Continuous improvements in performance, emissions control, and operational life have reinforced the segment’s stronghold in the market..

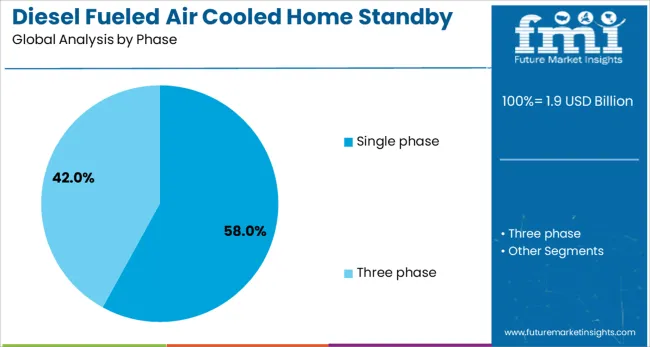

The single-phase segment is expected to hold 58% of the diesel-fueled air-cooled home Standby Gensets market revenue share in 2025, securing its position as the leading configuration. Its dominance has been driven by widespread use in residential settings, where electrical loads typically require single phase supply for lighting, small appliances, and essential equipment. The simplicity of installation, lower cost, and compatibility with standard household systems have made single phase gensets the preferred choice among homeowners.

Additionally, these gensets provide sufficient capacity for typical residential backup needs without the complexity associated with three phase configurations. As power outage frequency increases due to climate variability and infrastructure constraints, homeowners are opting for dependable and easy-to-operate gensets.

Manufacturers have responded by offering technologically enhanced single phase models equipped with automation, remote diagnostics, and better fuel control. This has not only improved user convenience but also contributed to the strong uptake of single phase units, ensuring their continued leadership within the market..

Diesel fueled air cooled home standby gensets are automated backup power systems designed to supply electricity to residential settings during outages. These units are preferred for their simplicity, lightweight construction, and ease of maintenance. Growth has been supported by increasing power outage frequency and expanding residential development. Manufacturers offering gensets with low noise engines, remote monitoring capability, and quick start reliability have been prioritized. Systems featuring modular engine cooling, streamlined footprint, and integrated control continue to shape selection by homeowners and residential installers seeking dependable and convenient standby power solutions.

Concerns about power interruption, particularly during extreme weather or aging grid conditions, have driven demand for standby genset systems. Residential communities and luxury home developments have prioritized generators that provide seamless transition during blackout events. Diesel air cooled units are favored in moderate climate zones due to reduced cooling complexity and lower installation cost. Remote and rural regions with unstable grid supply have also accelerated interest in dependable alternatives. Features such as automatic transfer switch integration, self-test routines, and quiet operation have strengthened acceptance among homeowners prioritizing preparedness and uninterrupted comfort.

Growth has been hindered by the high upfront cost associated with diesel gensets that include air cooled engines, transfer switches, and automatic control systems. Ongoing fuel supply requirements for diesel create operational cost concerns, especially in regions where diesel prices fluctuate. Compliance with emissions regulations and noise standards adds design constraints. Many homeowners may lack familiarity with generator maintenance, increasing reliance on service contracts. Installation requires space and ventilation clearance, which may be limited in dense residential zones. These factors collectively slow expansion in budget sensitive and regulated communities.

New opportunities are emerging through bundles that include remote monitoring, automated maintenance alerts, and fuel level management systems. Integration with smart home platforms and app-based control interfaces provides added convenience. Partnerships with residential integrators and builder packages for pre-wired installations enable quicker rollouts. Expansion into regions with unreliable grid access or frequent outages supports growing use of standalone reliability systems. Development of hybrid systems combining solar with diesel standby backup is being explored to reduce runtime and emissions impact. Subscription-based maintenance services and performance warranty packages offer recurring value and owner confidence in generator longevity.

Usage of remote control systems and onboard diagnostics has increased, enabling condition monitoring, battery status alerts, and automatic fault detection. Advances in engine design and fuel injection systems have improved noise reduction, emission performance, and fuel consumption. Compact models fit smaller suburban lots and simplify installation in emerging residential layouts. Push for lower emissions compliance is prompting the introduction of alternative exhaust control systems for air-cooled diesel engines. Standard compatibility with transfer switches, smart grids, and energy storage endpoints is enhancing flexibility. Rolling out quieter, more efficient gensets continues to influence homeowner selection criteria.

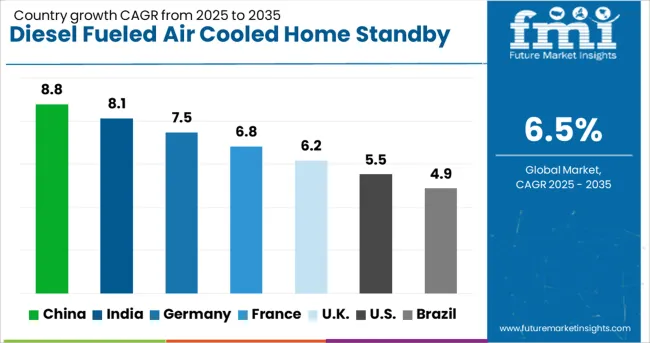

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

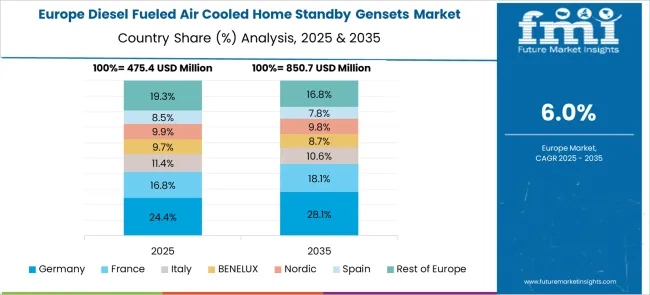

The diesel fueled air cooled home standby gensets market is projected to grow at a CAGR of 6.5% from 2025 to 2035, increasing from USD 1.9 billion in 2025 to USD 3.6 billion by 2035. Growth is driven by rising power reliability needs, extended power outage preparedness, and increased adoption in residential sectors. China, a BRICS economy, leads with 8.8% CAGR, supported by urban energy demand and off-grid residential installations. India follows at 8.1%, driven by expanding residential infrastructure and frequent grid fluctuations. Among OECD countries, France records 6.8%, the United Kingdom posts 6.2%, and the United States grows at 5.5%, propelled by backup power demand during extreme weather and grid modernization efforts. The analysis includes over 40 countries, with the top five detailed below.

China is projected to achieve a CAGR of 8.8% through 2035, driven by growing demand for residential power backup systems amid increased energy consumption in urban and semi-urban areas. Domestic manufacturers are scaling production of compact and fuel-efficient air-cooled gensets for multi-apartment complexes and high-rise residential units. Integration of smart controllers with remote monitoring features is boosting consumer adoption for convenience and reliability. Partnerships between local players and global OEMs ensure access to advanced engine technologies for low-emission gensets. The push for decentralized power solutions in regions prone to grid instability further strengthens China's market leadership.

India is forecasted to record a CAGR of 8.1% through 2035, supported by frequent power disruptions in suburban and rural areas. The market benefits from the expansion of affordable housing projects and gated residential communities, creating consistent demand for compact standby gensets. Domestic manufacturers are introducing cost-optimized solutions with advanced fuel economy to meet middle-income segment needs. High adoption of gensets in multi-story apartments and remote housing clusters reflects growing backup power requirements. Strategic initiatives promoting decentralized energy generation further amplify market penetration in tier-two and tier-three cities.

France is projected to grow at a CAGR of 6.8% through 2035, driven by increasing focus on residential energy resilience and demand for eco-compliant power solutions. Homeowners are prioritizing gensets with noise reduction features and low-emission technology to comply with environmental standards. Demand for gensets integrated with automatic transfer switches (ATS) is rising for uninterrupted power supply in modern households. Manufacturers are investing in compact, modular designs to cater to space-constrained residential properties. Integration with home energy management systems also positions gensets as a key backup option in smart home ecosystems.

The United Kingdom is expected to post a CAGR of 6.2% through 2035, supported by increasing grid reliability concerns and growth in luxury residential developments. Demand for gensets with remote control and fuel optimization capabilities is rising to meet energy security requirements during prolonged outages. Local manufacturers focus on premium-grade units with enhanced durability and low-noise operation, targeting upscale housing segments. Expansion in suburban housing and vacation properties creates consistent demand for compact gensets. Advancements in hybrid configurations integrating diesel gensets with renewable backup systems also add to future market opportunities.

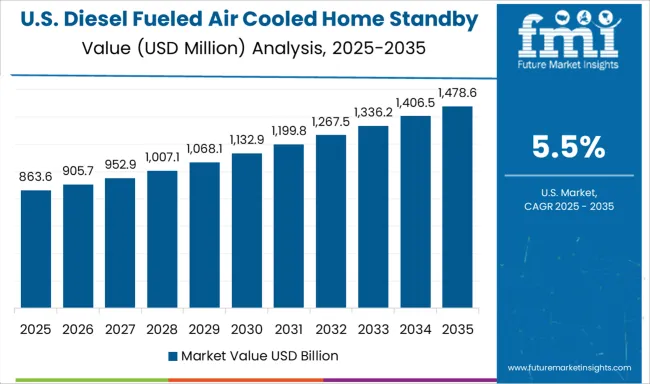

The United States is projected to grow at a CAGR of 5.5% through 2035, driven by climate-driven outages and strong demand for home backup systems. Residential consumers prioritize gensets with high fuel efficiency, automatic load management, and IoT-based monitoring. Leading manufacturers are introducing gensets integrated with real-time performance tracking systems to improve reliability and minimize downtime. Expansion of residential projects in hurricane-prone regions boosts demand for durable, weather-resistant gensets. Partnerships between genset OEMs and home automation companies create new growth avenues through integrated power management solutions.

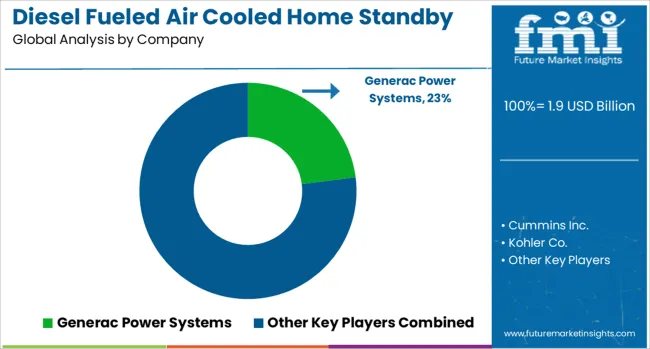

The diesel fueled air-cooled home standby gensets market is led by major power equipment manufacturers such as Generac Power Systems, Cummins Inc., Kohler Co., Briggs & Stratton, and Honda Power Equipment. Generac Power Systems dominates with a broad portfolio of residential standby generators known for durability, remote monitoring features, and integration with smart home systems. Cummins Inc. leverages its expertise in engine technology to deliver high-performance gensets that ensure reliable backup power, particularly in regions prone to power outages. Kohler Co. focuses on premium residential solutions with advanced voltage regulation and noise reduction technology, appealing to high-end homeowners.

Briggs & Stratton offers cost-effective, compact air-cooled gensets designed for quick installation and easy maintenance, targeting value-conscious consumers. Honda Power Equipment emphasizes energy efficiency and quieter operation, positioning its products for residential users seeking reliability and lower emissions. Competitive strategies in this market revolve around improving fuel efficiency, reducing operational noise, and incorporating digital monitoring systems for remote diagnostics and predictive maintenance. Entry barriers are moderate, driven by compliance with emissions regulations and the need for established distribution and service networks. Companies are increasingly investing in automation, IoT connectivity, and advanced engine designs to enhance performance while meeting environmental standards.

On January 21, 2025, Generac Holdings announced its latest home standby generator lineup, introducing a 28kW model—the most powerful air-cooled home standby generator on the market. The expanded range, from 10 to 28kW, integrates seamlessly with Generac products such as ecobee smart thermostats and PWRcell battery systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Power Rating | ≤ 10 kVA, > 10 kVA - 15 kVA, > 15 kVA - 20 kVA, and > 20 kVA |

| Phase | Single phase and Three phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Cummins Inc., Kohler Co., Briggs & Stratton, and Honda Power Equipment |

| Additional Attributes | Dollar sales by capacity range (5–15 kW, 15–25 kW, above 25 kW) and application (single-family homes, multi-family residences, vacation properties), with demand driven by frequent power interruptions and increasing reliance on home automation systems. Regional dynamics highlight strong adoption in North America due to grid reliability concerns and severe weather events, while Asia-Pacific shows rising demand from expanding residential infrastructure. Innovation trends include low-emission engine designs, integration of mobile app-based controls, improved cooling systems for extended runtime, and modular genset configurations for scalable backup solutions. |

The global diesel fueled air cooled home standby gensets market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the diesel fueled air cooled home standby gensets market is projected to reach USD 3.6 billion by 2035.

The diesel fueled air cooled home standby gensets market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in diesel fueled air cooled home standby gensets market are ≤ 10 kva, > 10 kva - 15 kva, > 15 kva - 20 kva and > 20 kva.

In terms of phase, single phase segment to command 58.0% share in the diesel fueled air cooled home standby gensets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Parking Heater Market Size and Share Forecast Outlook 2025 to 2035

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Diesel Engine Management System Market

Diesel Common Rail Injection Systems Market

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

E-Diesel Market Size and Share Forecast Outlook 2025 to 2035

No.2 Diesel Fuel Market

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Marine Diesel Engine Market Size and Share Forecast Outlook 2025 to 2035

Demand for Diesel Parking Heater in USA Size and Share Forecast Outlook 2025 to 2035

Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA