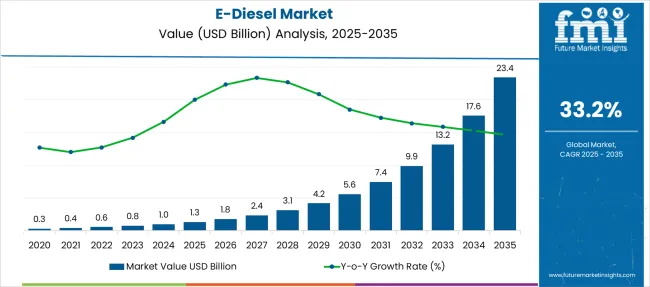

The E-Diesel Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 23.4 billion by 2035, registering a compound annual growth rate (CAGR) of 33.2% over the forecast period. Historic figures of USD 0.3 billion in 2020 reflect its niche beginnings as synthetic fuel alternatives gained prominence. Rapid acceleration is anticipated post-2028, with demand driven by decarbonization imperatives within heavy transportation and marine sectors. Integration of renewable electricity with Fischer-Tropsch synthesis underpins production scalability, while cost curves improve through green hydrogen adoption. Government policy frameworks favoring carbon credits and blending mandates will accelerate market take-up across Europe and North America, with Asia emerging as a key refining hub.

Strategic pivots by oil majors toward electro-fuel portfolios and co-processing facilities will dominate capital allocation trends. Anticipated industry disruptions include distributed e-fuel plants supporting localized fleets, reducing dependency on long-haul fuel logistics. Differentiation will center on lifecycle emission benchmarks, energy density optimization, and compliance certification, positioning e-diesel as a competitive enabler for energy transition targets over the next decade.

The market growth signals a shift toward synthetic fuels as governments and corporations seek compliance with carbon neutrality targets without fully abandoning combustion infrastructure.

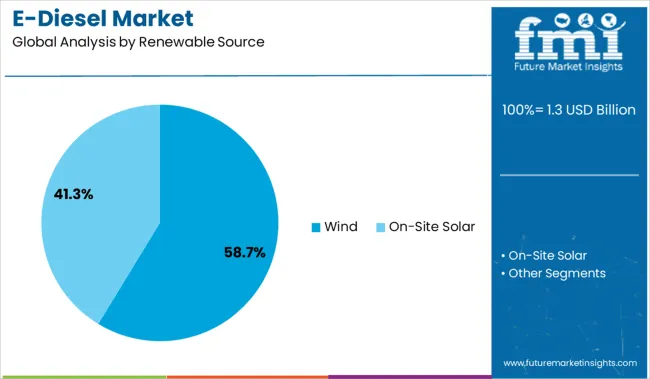

The dominance of wind-based production, accounting for a 58.7% share, underscores the sector’s dependence on renewable electricity economics. Regions with surplus green power, particularly Asia-Pacific and Europe, are well-positioned for scale, while North America is aligning with federal incentives for clean fuel adoption. Unlike hydrogen, which demands costly infrastructure overhaul, e-diesel offers compatibility with existing distribution and engine systems, accelerating adoption in shipping, aviation, and off-road machinery.

Future competitiveness will hinge on cost parity with fossil diesel, achievable only through large-scale electrolyzer deployment, advanced carbon capture integration, and access to low-cost renewables.

| Metric | Value |

|---|---|

| E-Diesel Market Estimated Value in (2025E) | USD 1.3 billion |

| E-Diesel Market Forecast Value in (2035F) | USD 23.4 billion |

| Forecast CAGR (2025 to 2035) | 33.2% |

The E-Diesel market is witnessing substantial growth momentum as global emphasis intensifies on carbon-neutral fuels and renewable energy integration. This momentum is being shaped by government mandates targeting net-zero emissions, rising fossil fuel displacement strategies, and heightened investments in clean energy infrastructure.

Advances in carbon capture, green hydrogen, and power-to-liquid technologies have made E-Diesel an increasingly viable alternative to conventional diesel in long-haul transportation and industrial logistics. The use of excess renewable electricity to synthesize fuel during off-peak hours is further enhancing energy system efficiency and economic feasibility.

Strategic partnerships among energy companies, automakers, and technology providers are accelerating commercial deployment, supported by pilot projects and policy-backed subsidies. As nations pursue energy independence and circular carbon economies, future growth is expected to emerge from scalable, grid-integrated E-Diesel production plants capable of leveraging diverse renewable inputs and catering to sectors that are hard to electrify.

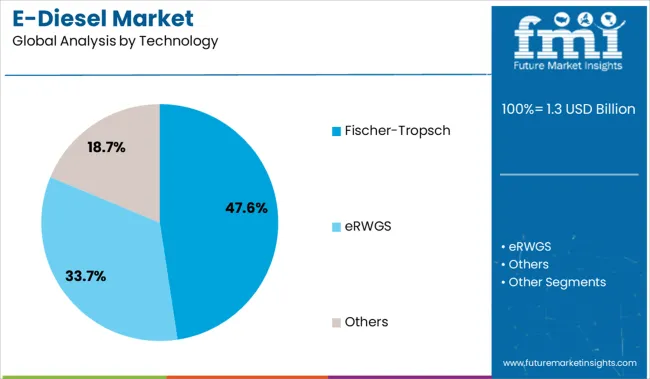

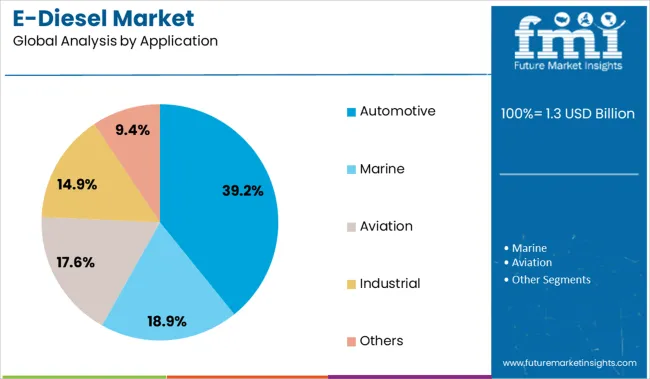

The e-diesel market is segmented by renewable source, technology, application, and region. By renewable source, it includes wind and on-site solar, providing sustainable energy inputs for e-diesel production. In terms of technology, the segmentation comprises Fischer-Tropsch, eRWGS, and other advanced processes that convert renewable energy into synthetic fuels. Based on application, the market covers automotive, marine, aviation, industrial, and other sectors requiring clean energy alternatives. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The wind energy segment is anticipated to contribute 58.7% of the E-Diesel market revenue from renewable sources in 2025, positioning it as the dominant input. This leadership is being driven by the high availability, grid stability, and cost competitiveness of wind-generated electricity in regions with mature infrastructure.

The consistency of wind output, especially in offshore and high-altitude onshore locations, supports a continuous power supply essential for large-scale electrolysis operations and synthetic fuel synthesis. Furthermore, integration with smart grid systems enables optimized load balancing and maximizes utilization of intermittent energy, which is crucial for sustainable E-Diesel production.

The long-standing investment landscape for wind farms, coupled with declining levelized cost of energy, has made wind a preferred feedstock for power-to-liquid processes, reinforcing its top share in renewable input selection.

Fischer-Tropsch synthesis is projected to hold a 47.6% revenue share in the technology category of the E-Diesel market by 2025, making it the leading conversion pathway. This dominance is attributed to its proven industrial scalability, high fuel quality output, and compatibility with existing infrastructure.

The process enables the conversion of syngas derived from green hydrogen and captured carbon dioxide into long-chain hydrocarbons that closely mimic fossil diesel in performance. Advances in catalyst efficiency, reactor design, and thermal integration have improved yield and lowered energy consumption, supporting commercial viability.

Its adaptability to a range of renewable inputs and its drop-in compatibility with existing fuel distribution networks have positioned Fischer-Tropsch as the most commercially adopted and policy-backed technology for synthetic diesel production.

The automotive application segment is expected to account for 39.2% of total E-Diesel market revenue in 2025, ranking it as the leading end-use category. This segment’s dominance is being driven by strong regulatory pressure to decarbonize transportation, especially in commercial and heavy-duty fleets where electrification remains challenging.

E-Diesel provides a near-zero emission alternative compatible with internal combustion engines, allowing automotive operators to transition without overhauling vehicle platforms. Fleets across logistics, public transportation, and delivery services are being increasingly incentivized to adopt cleaner fuels through tax benefits, emissions credits, and procurement mandates.

The drop-in nature of E-Diesel, which enables immediate use within existing refueling and engine systems, has reduced switching costs and accelerated uptake. As governments expand low-carbon fuel standards and automakers partner in sustainable mobility projects, the automotive sector is projected to retain its lead in E-Diesel consumption.

Production technologies involving CO₂ capture and hydrogen electrolysis have gained traction, supported by pilot-scale projects and public-private collaboration. Investment momentum has been observed in Europe and North America, where net-zero targets and green fuel mandates have encouraged early adoption of synthetic diesel. The e-diesel market is being shaped by escalating demand for renewable transportation fuels, rising regulatory scrutiny of fossil diesel, and efforts to decarbonize heavy-duty mobility.

E-diesel has been positioned as a viable transitional fuel for sectors that face electrification challenges, particularly in long-haul trucking, maritime shipping, and off-road equipment. The fuel is synthesized through the reaction of hydrogen produced via electrolysis using renewable electricity and captured carbon dioxide, resulting in a drop-in, carbon-neutral alternative to fossil diesel.

Regulatory incentives, such as Low Carbon Fuel Standards (LCFS) and Renewable Energy Directives (RED II/RED III), have supported project development in the EU, the USA, and Japan. Adoption has also been driven by compatibility with existing diesel engines and distribution infrastructure, which reduces capital investment requirements.

Blending mandates, carbon pricing frameworks, and pressure from ESG-focused investors have further accelerated interest in synthetic fuels. As net-zero timelines tighten, governments and energy firms have aligned efforts to expand e-fuel capacity.

Opportunities for growth in the e-diesel sector are centered around industrial symbiosis models that leverage CO₂ captured from cement, steel, or ethanol facilities. By co-locating e-diesel production with such emitters, cost-effective feedstock utilization has been achieved.

Declining cost of PEM and solid oxide electrolysers has improved hydrogen yield efficiency, making commercial-scale synthesis more viable. Investment in modular e-fuel plants and off-grid renewable power systems has been supported by energy transition funds and innovation grants. Demand from defence logistics, mining operations, and remote infrastructure projects has highlighted the value of synthetic diesel where charging infrastructure is impractical.

Pilot procurement programs and strategic partnerships with engine OEMs are being initiated to validate operational reliability. This convergence of renewable energy, carbon utilization, and fuel security priorities has created favourable conditions for the expansion of e-diesel pathways.

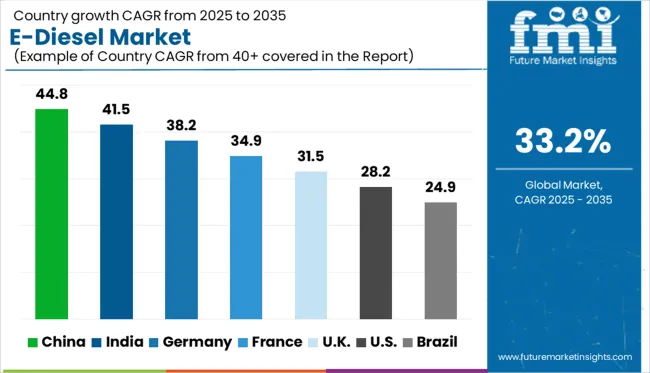

| Countries | CAGR |

|---|---|

| China | 44.8% |

| India | 41.5% |

| Germany | 38.2% |

| France | 34.9% |

| UK | 31.5% |

| USA | 28.2% |

| Brazil | 24.9% |

The global e-diesel market is projected to surge at a 33.2% CAGR from 2025 to 2035, driven by decarbonisation mandates, electrofuel integration, and synthetic diesel commercialization. China leads at 44.8%, fueled by strategic pilot plants, CO₂-to-liquid projects, and heavy transport electrification gaps.

India follows at 41.5%, driven by refinery retrofits, renewable hydrogen blending, and public-sector fleet trials. Germany grows at 38.2%, with OEM-led synthetic diesel trials, advanced Fischer-Tropsch R&D, and EU decarbonization alignment. France posts 34.9% CAGR, supported by airline sector mandates, municipal fleet decarbonization, and bioenergy cluster investments.

The UK records 31.5%, shaped by defense-grade e-diesel pilots, e-fuel import pathways, and policy alignment with low-carbon transport targets. These five countries represent a mix of demand-side momentum and supply chain localization across a broader review of 40+ nations.

China is projected to lead the global e-diesel market with a CAGR of 44.8%, anchored by strong investments in synthetic fuel manufacturing and large-scale CO₂ utilization plants. State-owned energy enterprises have initiated partnerships for pilot-scale Fischer-Tropsch facilities that convert renewable hydrogen and carbon emissions into liquid fuels.

Regional transport corridors are being prioritized for e-diesel integration, particularly where battery-electric adoption remains limited. Policy support for heavy-duty vehicle decarbonization has accelerated technology validation in industrial zones.

Strategic alignment with carbon neutrality objectives has influenced national oil companies to co-develop synthetic diesel with green hydrogen suppliers. E-diesel is being viewed not just as a fuel alternative but as a bridge solution in sectors where electrification remains unfeasible.

India is expected to record a CAGR of 41.5%, driven by increasing focus on energy diversification and refinery-based e-fuel retrofits. Public-sector units have been tasked with exploring renewable hydrogen integration into diesel production workflows. Institutional fleets are being targeted for early-stage trials, especially in rail and long-haul road transport. The Ministry of Petroleum and Natural Gas has signaled interest in co-funding e-diesel research centers across emerging industrial belts.

Interest from fertilizer and steel sectors in sourcing byproduct CO₂ is creating feedstock synergies. E-diesel is being positioned as a transitional molecule to meet ambitious transport emission reduction goals without overhauling existing infrastructure. High fuel consumption density across logistics and mining fleets reinforces the long-term relevance of synthetic diesel.

Germany is projected to grow at a CAGR of 38.2%, reflecting aggressive policy support for e-fuels and established competence in hydrogen electrolysis. Domestic OEMs are working with energy majors to co-develop e-diesel prototypes for internal combustion engines that align with EU zero-emission directives. Aviation, shipping, and specialty logistics are viewed as anchor markets, particularly under blending mandates.

Public funding mechanisms are being channeled toward regional e-diesel plants using carbon capture units and high-purity hydrogen from PEM electrolyzers. Germany’s role in standard-setting for electrofuel certification is positioning it as a regulatory reference point. The country’s engineering base ensures that e-diesel compatibility is being engineered directly into next-generation combustion platforms.

France is forecast to expand at a CAGR of 34.9%, with growth underpinned by clean mobility mandates, aviation decarbonization policies, and municipal fleet reform. Local governments are providing grants for e-diesel pilots in city-run buses and refuse collection trucks. National research centers are aligning electrofuel production with biogenic CO₂ from ethanol plants and agricultural waste processors.

Commercial aviation, under pressure from domestic climate targets, has emerged as a major end-user segment for drop-in synthetic diesel alternatives. Strong collaboration between energy firms and aerospace suppliers is creating demand certainty. France is betting on decentralized, modular production units that co-locate with hydrogen hubs, minimizing transport and storage costs for precursors.

The United Kingdom is expected to post a CAGR of 31.5%, shaped by defense sector interest, e-fuel import logistics, and low-carbon policy frameworks. Military vehicle retrofits have begun using blended e-diesel in off-road and tactical platforms to test performance under extreme conditions.

Import partnerships are being evaluated with North Sea and Nordic-based electrofuel producers, reflecting constraints in domestic hydrogen production. Heavy construction and civil works fleets are being positioned as the next use case, especially in decarbonization zones.

Government-backed trials are testing blending ratios with conventional diesel to ensure drop-in compatibility. Strategic prioritization of non-electric alternatives in complex use cases is shaping e-diesel’s inclusion in national clean transport roadmaps.

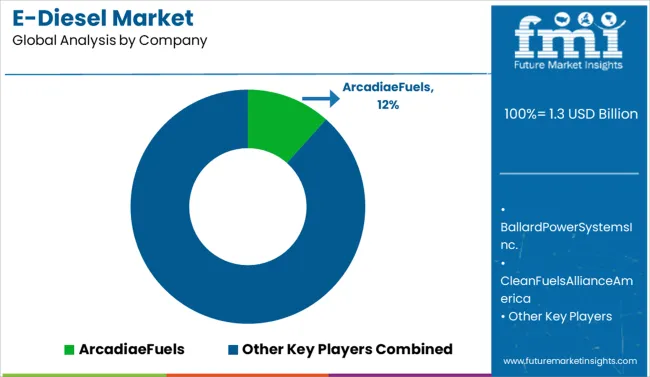

The e-diesel industry is led by Arcadia eFuels, holding a significant market share through its proprietary synthesis processes and strategic collaborations with aviation and heavy-duty transport stakeholders. HIF Global, Liquid Wind, and Norsk e-Fuel are expanding pilot-to-commercial-scale projects by leveraging renewable electricity and captured CO₂.

Porsche and MAN Energy Solutions invest heavily in synthetic fuel R&D to decarbonize internal combustion engines. Companies like Ballard Power Systems, Ceres Power, and FuelCell Energy contribute core electrolysis and fuel cell technologies. Sunfire GmbH and Electrochaea GmbH drive methanation and Fischer-Tropsch conversions.

ExxonMobil and Clean Fuels Alliance America are pursuing longer-term e-fuel integration within existing infrastructure. Market competitiveness hinges on production scalability, carbon intensity reduction, and strategic alignment with clean transport mandates globally.

In December 2024, Liquid Wind partnered with Samsung E&A to develop eFuel production facilities across Asia, Africa, and the Middle East, combining engineering expertise and expanding global deployment capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Renewable Source | Wind and On-Site Solar |

| Technology | Fischer-Tropsch, eRWGS, and Others |

| Application | Automotive, Marine, Aviation, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ArcadiaeFuels, BallardPowerSystemsInc., CleanFuelsAllianceAmerica, CeresPowerHoldingPlc, ClimeworksAG, ExxonMobil, eFuelPacificLimited, ElectrochaeaGmbH, FuelCellEnergyInc., HIFGlobal, LiquidWind, LanzaJet, MANEnergySolutions, NorskE-FuelAS, Porsche, and SunfireGmbH |

| Additional Attributes | Dollar sales of e‑diesel are segmented by feedstock source waste biomass, green hydrogen, and synthetic CO₂ with biomass-based variants leading. Demand is escalating for low-carbon, drop-in fuel alternatives. CDMOs and EPC contractors support turnkey production plants. Adoption is strongest in Europe and North America, driven by decarbonisation mandates and sustainable aviation initiatives. |

The global e-diesel market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the e-diesel market is projected to reach USD 23.4 billion by 2035.

The e-diesel market is expected to grow at a 33.2% CAGR between 2025 and 2035.

The key product types in e-diesel market are wind and on-site solar.

In terms of technology, fischer-tropsch segment to command 47.6% share in the e-diesel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA