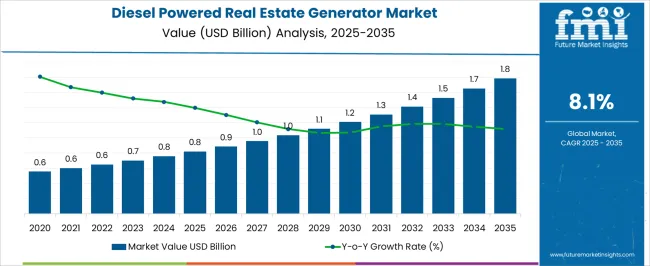

The diesel powered real estate generator market is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

This trajectory indicates a sector that is steadily expanding but positioned within a mid-stage maturity curve. Early adoption of diesel generators in real estate projects has long been established due to their reliability and ability to provide consistent backup power. The current phase reflects a broader adoption lifecycle where demand is sustained more by replacement, upgrading, and compliance-driven purchases rather than purely by first-time adoption. From an adoption lifecycle perspective, the market has shifted past the innovator and early adopter phase and is strongly entrenched within the early majority segment.

Real estate developers continue to view diesel generators as essential infrastructure, especially in regions with unstable power grids, but growth is tempered by environmental regulations and rising interest in hybrid or alternative energy-based solutions. Toward the latter half of the forecast period, adoption by the late majority will dominate, with sales driven more by regulatory conformity and long-term durability requirements. The industry is therefore not in a saturation phase yet, but gradual transitions toward cleaner technologies may redefine the curve beyond 2035.

| Metric | Value |

|---|---|

| Diesel Powered Real Estate Generator Market Estimated Value in (2025 E) | USD 0.8 billion |

| Diesel Powered Real Estate Generator Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The diesel powered real estate generator market represents a distinct segment within the power generation and backup energy systems industry, emphasizing reliability and continuous power supply for residential and commercial buildings. Within the overall generator market, it accounts for about 6.1%, reflecting consistent use in real estate projects and property management. In the residential backup power solutions segment, it holds nearly 5.4%, driven by demand for uninterrupted power in housing complexes and gated communities. Across the commercial real estate infrastructure market, the segment captures 4.6%, supporting critical operations in offices, malls, and mixed-use facilities. Within the construction and property development sector, it represents 3.8%, highlighting its role in on-site energy support. In the industrial-grade diesel engines category, it secures 3.2%, showing dependence on robust power solutions for long-term usage.

Recent developments in this market have focused on emission control, efficiency improvement, and hybrid integration. Advances include the introduction of low-emission diesel engines with improved fuel combustion and reduced particulate output. Key players are investing in generators equipped with digital monitoring systems for predictive maintenance and performance tracking. Hybrid diesel systems integrated with solar panels and energy storage units are emerging to reduce operational costs and environmental impact. Compact, soundproof designs are gaining traction for use in residential and commercial real estate. The partnerships between generator manufacturers and real estate developers are strengthening adoption in smart building projects. These advancements demonstrate how efficiency, compliance, and hybridization are shaping the market.

The diesel powered real estate generator market is experiencing steady growth, supported by the rising need for reliable backup power solutions in commercial, industrial, and residential real estate. Urban infrastructure expansion and increased dependency on continuous power supply for building operations have strengthened demand for diesel generators. Reports from industry associations and company announcements highlight the role of these systems in maintaining operational continuity during grid outages.

Advances in fuel efficiency, noise reduction technologies, and compliance with stricter emission norms have made diesel generators more appealing for property developers and facility managers. Furthermore, real estate projects in remote or developing areas without stable grid connectivity have continued to rely on diesel-powered units for both primary and backup power needs.

With increasing investment in high-value real estate projects and critical facilities such as data centers, the market outlook remains positive, particularly in regions where power reliability challenges persist.

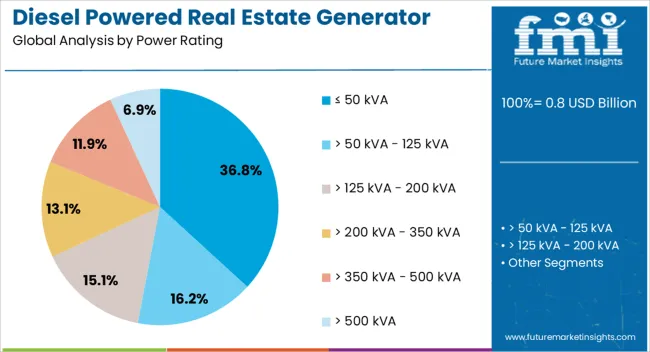

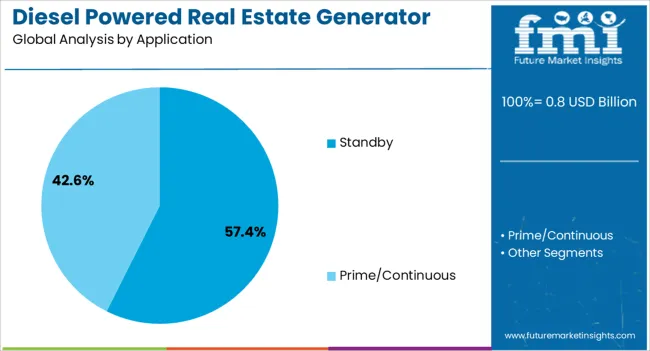

The diesel powered real estate generator market is segmented by power rating, application, and geographic regions. By power rating, diesel powered real estate generator market is divided into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 350 kVA, > 350 kVA - 500 kVA, and > 500 kVA. In terms of application, diesel powered real estate generator market is classified into standby and prime/continuous. Regionally, the diesel powered real estate generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 50 kVA segment is projected to contribute 36.8% of the diesel powered real estate generator market revenue in 2025, securing a significant share due to its suitability for small to medium-sized buildings and facilities. These generators have been preferred for their compact size, ease of installation, and ability to meet the essential backup power needs of residential complexes, retail spaces, and smaller office buildings. Real estate developers have increasingly selected ≤ 50 kVA units for projects where space constraints and budget considerations are important. Technological improvements have enhanced the fuel efficiency and durability of these systems, making them more cost-effective over their lifecycle. Additionally, the segment benefits from strong demand in emerging markets, where smaller power capacities can adequately support the electrical load of individual properties. The flexibility to use these units for both temporary and permanent installations has further reinforced their adoption in the real estate sector.

The standby segment is projected to hold 57.4% of the diesel powered real estate generator market revenue in 2025, establishing itself as the leading application category. Demand in this segment has been driven by the critical need to ensure uninterrupted operations in real estate developments during grid power failures. Standby generators have been widely deployed in commercial complexes, high-rise residential buildings, and essential service facilities to prevent downtime and protect sensitive equipment. Facility managers have prioritized standby diesel generators for their reliability, fast startup capabilities, and ability to handle varying load requirements. Regulatory requirements and building codes in many regions have further mandated the inclusion of standby power systems in large real estate projects. The segment’s growth is also supported by increased investments in premium property developments where uninterrupted power is considered a key value proposition. As urban populations grow and electrical infrastructure faces increasing strain, the Standby segment is expected to remain central to market expansion.

The market has been expanding steadily due to the growing requirement for reliable backup power solutions in commercial and residential properties. Real estate developers, facility managers, and individual property owners are adopting diesel generators to ensure uninterrupted operations during power disruptions. With increased reliance on electronic systems, security infrastructure, and smart building technologies, the demand for dependable power backup has intensified. Diesel generators are favored for their durability, fuel efficiency, and ability to provide long-duration power supply compared with alternatives.

Power stability remains a significant factor influencing the adoption of diesel generators in real estate projects. Many regions continue to experience outages caused by inadequate grid infrastructure, extreme weather conditions, and increased energy loads. Commercial spaces such as office complexes, retail centers, and industrial parks rely heavily on uninterrupted electricity to maintain operations, customer satisfaction, and safety systems. Residential properties are also increasingly dependent on continuous electricity for home appliances, climate control, and connectivity. Diesel generators are being adopted as a cost-effective solution to mitigate power interruptions. Their ability to provide immediate backup has positioned them as essential infrastructure in urban and semi-urban real estate development.

Commercial buildings represent one of the largest segments driving diesel generator demand, as enterprises prioritize uninterrupted operations. Data centers, office buildings, shopping complexes, and hospitals require stable electricity to prevent operational losses and maintain safety. Diesel generators are being installed as primary backup units in large-scale real estate projects, often integrated with advanced switchgear systems for automatic power transfer. The sector has also witnessed increasing adoption in mixed-use developments, where multi-utility demands require dependable solutions. Developers are factoring generator installations into project planning to enhance property value and attract businesses. This commercial application base continues to solidify the position of diesel powered generators within the market.

Technological innovations have been improving the efficiency and environmental performance of diesel powered generators in real estate applications. Modern systems now include noise-reduction mechanisms, improved fuel injection technologies, and emission control systems that comply with regulatory standards. Integration with IoT-enabled monitoring systems allows property managers to track performance, schedule maintenance, and optimize fuel usage in real time. Automated switching capabilities ensure seamless transition during power cuts, minimizing disruption. Hybrid models combining diesel with renewable energy inputs are also being introduced, reducing fuel dependency while ensuring reliability. These advancements are positioning diesel powered generators as more sustainable and intelligent solutions for real estate power requirements.

Regulatory frameworks governing emissions, noise control, and installation standards are having a considerable influence on the diesel powered real estate generator market. Stricter emission regulations in developed economies are prompting adoption of low-emission models and retrofitting solutions. At the same time, regions with frequent power shortages are witnessing higher demand despite regulatory challenges, as the need for backup power outweighs constraints. Real estate developers are increasingly engaging with certified generator suppliers to ensure compliance with building codes and environmental standards. Such regulatory pressures are fostering innovation among manufacturers, leading to the development of next-generation diesel generator systems that are more efficient, quieter, and environmentally responsible.

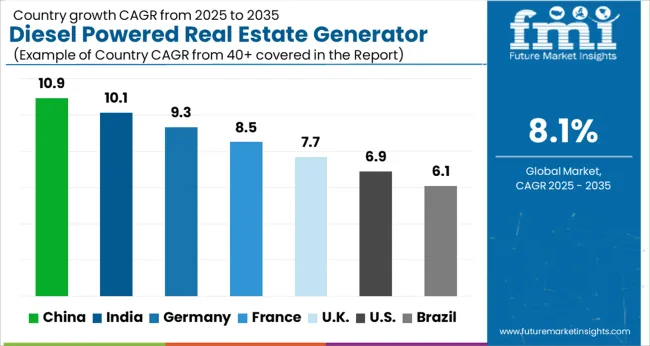

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| U.K. | 7.7% |

| U.S. | 6.9% |

| Brazil | 6.1% |

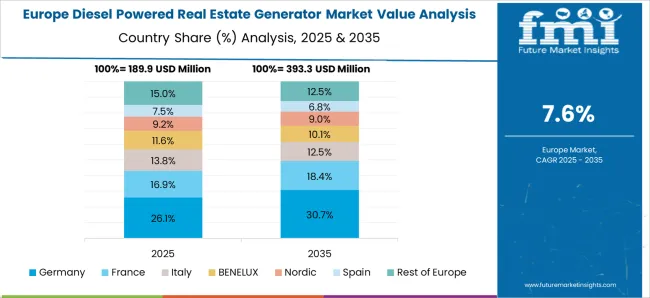

The market is positioned for steady expansion as demand for reliable backup power systems continues to intensify across residential and commercial infrastructures. China leads with a forecast growth rate of 10.9%, supported by rising construction activity and requirements for uninterrupted energy solutions. India follows at 10.1%, where rapid real estate development and frequent power outages contribute to adoption. Germany records 9.3%, driven by technology integration and efficiency-focused equipment upgrades. The United Kingdom secures 7.7% as urban developments and stringent reliability standards drive steady deployment. The United States maintains 6.9%, backed by replacement demand and consistent investments in real estate infrastructure. These leading markets collectively highlight the global shift toward dependable diesel powered generators as an essential component in modern real estate planning. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is anticipated to expand at a CAGR of 10.9%, reflecting the reliance on backup power solutions in commercial and residential projects. Demand is driven by frequent requirements for continuous power supply in large-scale real estate developments and growing urban energy needs. Manufacturers are offering generators with improved efficiency, reduced emissions, and advanced monitoring systems to meet regulatory and performance expectations. The availability of multiple capacity ranges enables adaptability for both high-rise residential complexes and industrial buildings. Local suppliers and global manufacturers are increasing investments in distribution and after-sales networks. Growing demand from real estate developers and infrastructure projects is further accelerating market penetration.

In India, the market is projected to record a CAGR of 10.1%, with steady demand from both urban housing projects and commercial real estate. Generators are being widely adopted due to the need for consistent electricity supply in areas where grid reliability remains a concern. Real estate developers are integrating diesel generators as backup solutions to ensure uninterrupted operations. Manufacturers are introducing fuel-efficient and noise-reduction technologies to align with environmental standards. Market players are enhancing accessibility through regional distributors and service providers. Promotional efforts by suppliers’ highlight durability, cost-effectiveness, and long-term reliability. Infrastructure development, rapid real estate expansion, and commercial property growth are significantly contributing to increased demand.

The market in Germany is expected to grow at a CAGR of 9.3%, influenced by the high demand for reliable backup power solutions in commercial and industrial properties. Emphasis on energy security, especially in critical infrastructure and real estate projects, supports market adoption. German manufacturers are focusing on advanced emissions control technologies to comply with strict environmental regulations. End-users are seeking durable, low-maintenance generators suited for both urban housing and large-scale commercial complexes. Distribution is supported by strong networks of specialized equipment suppliers and service providers. Promotional activities emphasize sustainability, compliance with standards, and cost-effectiveness over the long term. The demand for resilient and eco-friendly backup systems is expected to drive steady growth.

The market in the United Kingdom is set to expand at a CAGR of 7.7%, supported by demand for consistent backup systems in modern real estate developments. Real estate developers prioritize generator integration to ensure operational continuity in both residential complexes and office buildings. Manufacturers are investing in fuel efficiency, compact design, and reduced environmental impact. The market is supported by an established network of suppliers, distributors, and after-sales services. Growing awareness about the importance of backup power in commercial properties is creating stronger adoption. Promotional campaigns by key players highlight reliability, long-term performance, and compliance with environmental standards. Increasing focus on resilient real estate infrastructure continues to enhance market prospects.

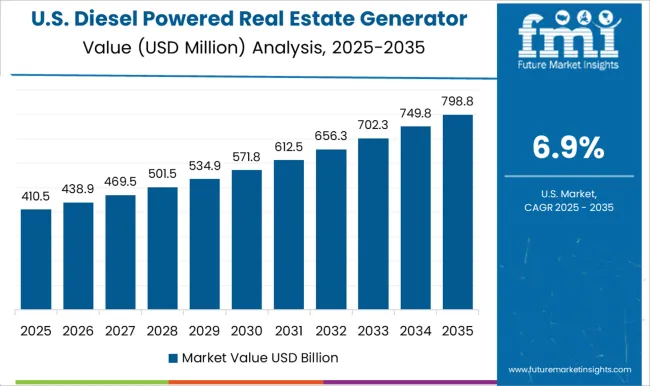

The market in the United States is forecast to grow at a CAGR of 6.9%, driven by demand from commercial properties, industrial facilities, and multi-residential complexes. End-users rely on diesel generators for uninterrupted operations during outages, especially in regions prone to power disruptions. Manufacturers are emphasizing advanced technologies such as automated monitoring, low-noise operations, and improved efficiency to meet customer expectations. Distribution through authorized dealers and retail channels provides broad market reach. Promotional strategies highlight resilience, longevity, and compliance with regulatory standards. Adoption is also reinforced by infrastructure modernization and an increasing focus on reliable power backup systems for real estate projects.

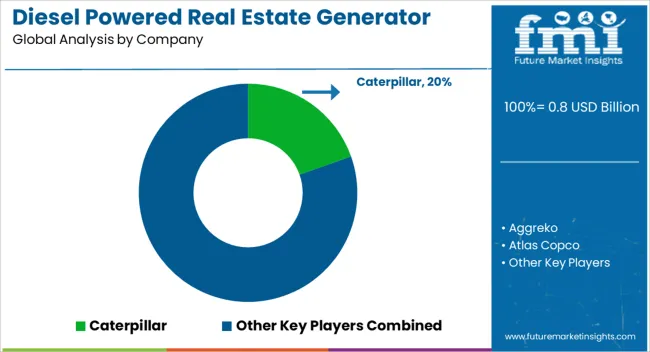

The market is driven by rising demand for uninterrupted power supply across residential complexes, commercial buildings, and real estate projects. Caterpillar continues to lead the global space with robust generator solutions designed for large-scale and high-demand applications. Aggreko plays a pivotal role in temporary and rental power solutions that support real estate development and emergency needs. Atlas Copco and Cooper contribute to efficient, durable systems engineered for cost-effectiveness and long operating life. Cummins maintains a strong position with advanced engine technologies and extensive global distribution networks, ensuring reliability in critical environments. DEUTZ Power Center and Generac Power Systems provide versatile offerings suitable for small to mid-sized real estate requirements. Other important contributors include Greaves Cotton and HIMOINSA, which cater to regional markets with localized innovations and efficient service networks.

J C Bamford Excavators, Kirloskar, and Mahindra Powerol strengthen their presence in developing markets through cost-competitive and easily serviceable generators. Rolls-Royce delivers premium-grade solutions designed for high-capacity installations, while YANMAR Holdings continues to advance compact and fuel-efficient systems. Collectively, these companies shape a highly competitive market landscape where technological advancement, energy efficiency, noise reduction, and compliance with stringent emission norms define market leadership. The growing need for reliable backup power in real estate development ensures ongoing innovation and sustained adoption of diesel-powered generators across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.8 Billion |

| Power Rating | ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 350 kVA, > 350 kVA - 500 kVA, and > 500 kVA |

| Application | Standby and Prime/Continuous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Aggreko, Atlas Copco, Cooper, Cummins, DEUTZ Power Center, Generac Power Systems, Greaves Cotton, HIMOINSA, J C Bamford Excavators, Kirloskar, Mahindra Powerol, Rehlko, Rolls-Royce, and YANMAR HOLDINGS |

| Additional Attributes | Dollar sales by generator capacity and application, demand dynamics across residential complexes, commercial buildings, and mixed-use developments, regional trends in backup power adoption, innovation in fuel efficiency, noise reduction, and automation, environmental impact of emissions and fuel consumption, and emerging use cases in hybrid backup systems and smart energy management for real estate projects. |

The global diesel powered real estate generator market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the diesel powered real estate generator market is projected to reach USD 1.8 billion by 2035.

The diesel powered real estate generator market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in diesel powered real estate generator market are ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 350 kva, > 350 kva - 500 kva and > 500 kva.

In terms of application, standby segment to command 57.4% share in the diesel powered real estate generator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Engine Management System Market

Diesel Common Rail Injection Systems Market

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

E-Diesel Market Size and Share Forecast Outlook 2025 to 2035

No.2 Diesel Fuel Market

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Marine Diesel Engine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Diesel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA