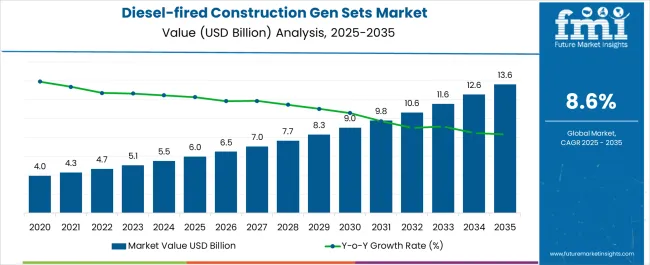

The Diesel-Fired Construction Generator Sets Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 13.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period. Between 2025 and 2030, the market is expected to increase from USD 6.0 billion to USD 9.0 billion, driven by the increasing demand for reliable power sources in construction, mining, and industrial sectors.

Year-on-year analysis shows consistent growth, with values reaching USD 6.5 billion in 2026 and USD 7.0 billion in 2027, supported by infrastructure expansion and the need for portable power solutions in remote areas. By 2028, the market is forecasted to reach USD 7.7 billion, advancing to USD 8.3 billion in 2029 and USD 9.0 billion by 2030.

Growth will be further reinforced by innovations in fuel-efficient engines, noise reduction technologies, and government incentives for the adoption of cleaner power generation methods. These dynamics position diesel-fired construction generator sets as a crucial component for meeting power demands in dynamic construction environments, offering opportunities for manufacturers to develop advanced, environmentally compliant systems.

| Metric | Value |

|---|---|

| Diesel-Fired Construction Generator Sets Market Estimated Value in (2025 E) | USD 6.0 billion |

| Diesel-Fired Construction Generator Sets Market Forecast Value in (2035 F) | USD 13.6 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The Diesel Fired Construction Generator Sets market is observing steady growth, fueled by the increasing demand for reliable power backup and prime power solutions in construction activities. The current market scenario reflects a growing reliance on diesel-based generator sets due to their durability, fuel efficiency, and ability to operate in remote and challenging environments, as noted in corporate presentations and press statements from key manufacturers.

The future outlook appears optimistic, as infrastructure development projects and urbanization initiatives continue to accelerate globally. Insights from industry news and investor updates suggest that stricter emissions regulations and technological advancements are shaping product innovation, with manufacturers focusing on higher efficiency and compliance.

Rising investments in commercial and residential construction, along with the need for uninterrupted power during grid outages, are further contributing to market expansion. The market is also benefitting from a focus on modular, scalable solutions that reduce operational costs while maintaining high performance, which is expected to strengthen its position in the years ahead.

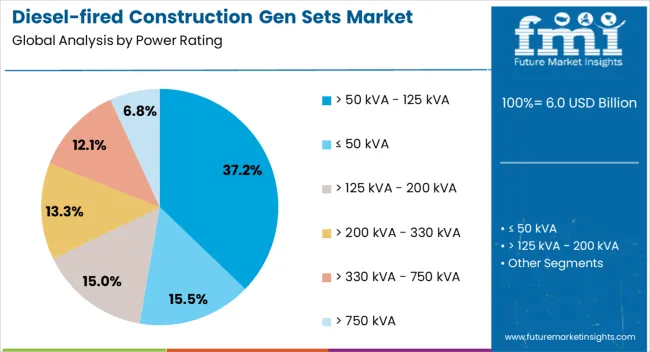

The diesel-fired construction generator sets market is segmented by power rating, application, and geographic regions. The power rating of the diesel-fired construction generator sets market is divided into > 50 kVA - 125 kVA, ≤ 50 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and> 750 kVA.

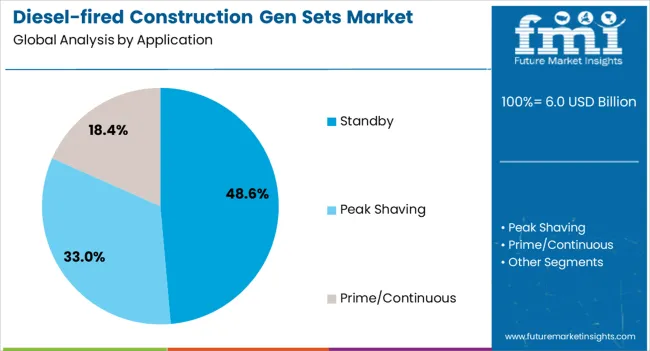

In terms of application, the diesel-fired construction generator sets market is classified into Standby, Peak Shaving, and Prime/Continuous. Regionally, the diesel-fired construction generator sets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 50 kVA - 125 kVA power rating segment is anticipated to account for 37.2% of the Diesel Fired Construction Generator Sets market revenue share in 2025, making it the leading power rating segment. This prominence is being driven by the segment’s suitability for mid-sized construction projects that demand a balance between portability and power output, as highlighted in technical brochures and industry publications.

These generator sets are being preferred because they offer adequate capacity for operating multiple tools and machinery without excessive fuel consumption or maintenance requirements. Investor communications have indicated that construction firms favor this category for its versatility and ease of deployment across varied project sites.

The segment’s growth has also been supported by product enhancements aimed at noise reduction and emissions compliance, which meet regulatory and environmental standards. These advantages have ensured strong adoption of > 50 kVA - 125 kVA generators in construction scenarios that require dependable and efficient power solutions.

The standby application segment is projected to capture 48.6% of the Diesel Fired Construction Generator Sets market revenue share in 2025, maintaining its leadership among application categories. This dominance has been attributed to the critical need for uninterrupted power in construction operations, particularly during grid outages, as emphasized in infrastructure project announcements and company updates.

Standby generator sets have been increasingly utilized for ensuring operational continuity, preventing costly delays, and safeguarding safety at construction sites. Industry journals have noted that their reliability and ability to start automatically during power loss have made them indispensable in both urban and remote construction environments.

Furthermore, enhancements in control systems and monitoring technologies have improved the operational readiness and efficiency of standby units, as discussed in corporate briefings. The segment’s growth has also been strengthened by the rising demand for compliance with construction timelines and the minimization of downtime, factors that have positioned standby applications as the preferred choice within the market.

The diesel-fired construction generator sets market is expanding, driven by growing infrastructure projects and construction needs. Major growth drivers include increased demand for reliable power sources in remote and off-grid locations. Opportunities are emerging in the expansion of renewable energy integration with diesel generators. Emerging trends focus on hybrid solutions and fuel efficiency. However, market restraints, including fuel price volatility and environmental regulations, challenge growth. The market will evolve as alternative energy solutions and cost optimization become essential factors.

The major growth driver for the diesel-fired construction generator sets market is the rising demand for reliable power in remote construction sites. In 2024 and 2025, construction projects in off-grid locations surged, necessitating reliable, mobile power generation systems. Diesel-fired generator sets continue to be preferred for their durability and performance in harsh environments. These generators provide a crucial backup solution for construction firms in remote areas, driving market growth.

Opportunities in the diesel-fired construction generator sets market arise from the growing interest in hybrid solutions and the integration of renewable energy. In 2025, a significant shift is expected toward hybrid power systems that combine diesel generators with solar and wind energy. This integration helps reduce fuel consumption and operational costs while adhering to environmental standards. The focus on fuel efficiency and cleaner energy sources will create significant market growth opportunities for manufacturers.

Emerging trends in the diesel-fired construction generator sets market include an emphasis on fuel efficiency and compliance with stringent environmental regulations. In 2024, manufacturers began focusing on improving the fuel economy of diesel-powered generators while meeting emission standards. These trends are expected to intensify in 2025, driven by regulatory pressure and the need for operational cost reduction. As construction sites seek more efficient and eco-friendly solutions, these advancements will shape the market in the coming years.

Major market restraints for the diesel-fired construction generator sets market include fuel price volatility and regulatory challenges. In 2025, fluctuating fuel prices continued to impact the cost-effectiveness of diesel-powered generators. Additionally, increasing environmental regulations around emissions and fuel consumption made it difficult for manufacturers to meet compliance standards while maintaining profitability. These factors may slow market expansion, particularly in regions with strict environmental controls and where fuel costs are rising rapidly.

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

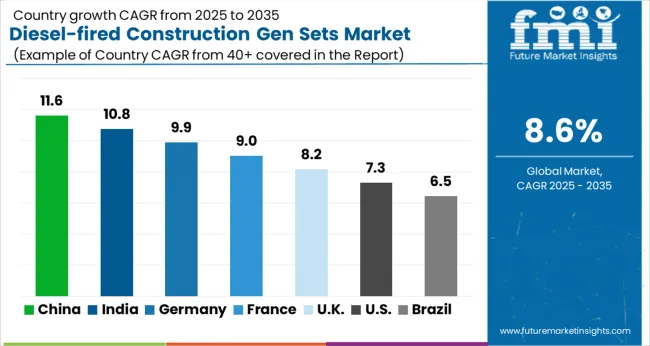

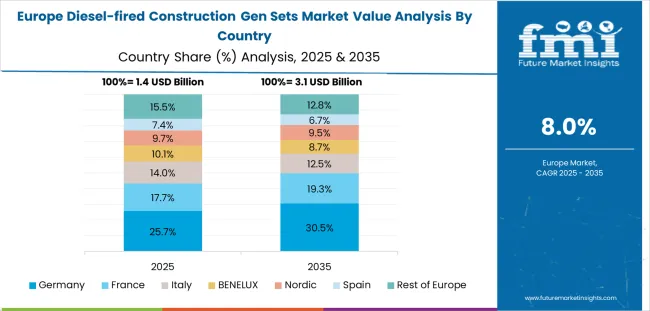

The global diesel fired construction generator sets market is projected to grow at an 8.6% CAGR from 2025 to 2035. China leads the market with an impressive growth rate of 11.6%, followed by India at 10.8%, and France at 9.0%. The United Kingdom records a growth rate of 8.2%, while the United States shows the slowest growth at 7.3%. These variations in growth rates are driven by factors such as infrastructure development, industrialization, and energy demands in construction projects. Countries like China and India are experiencing rapid industrial growth and infrastructure expansion, leading to higher demand for reliable power generation solutions in the construction industry. On the other hand, mature markets like the USA and the UK show more steady growth due to existing infrastructure and market saturation.

The diesel fired construction generator sets market in China is growing rapidly, with a projected CAGR of 11.6%. The country’s massive infrastructure development projects, particularly in urbanization and construction, are driving the demand for reliable power generation equipment. China’s focus on expanding its construction sector to meet growing industrial and residential needs leads to a higher demand for diesel-fired generators. The government’s ongoing investments in infrastructure and construction-related initiatives continue to fuel this market’s growth, as these generator sets offer flexibility and reliability for large-scale construction operations.

The diesel fired construction generator sets market in India is projected to grow at a CAGR of 10.8%. The country’s robust construction industry, driven by infrastructure projects, real estate development, and urbanization, is the key driver of this demand. Diesel-fired generators are widely used in construction sites for continuous power supply, and their demand is increasing due to the need for reliable and uninterrupted energy in remote and off-grid locations. Government initiatives focused on infrastructure development, smart cities, and renewable energy adoption further contribute to the market’s growth in India.

The diesel fired construction generator sets market in France is expected to grow at a CAGR of 9.0%. The country’s focus on infrastructure development, particularly in construction and public works, is contributing to this market’s expansion. Diesel generators remain a popular choice for construction projects due to their power reliability and efficiency. France’s investments in smart city development and large-scale construction projects further support the demand for these generators. Moreover, the country’s shift toward sustainability in construction practices has led to an increase in demand for high-performance diesel-fired generator sets that comply with environmental regulations.

The diesel fired construction generator sets market in the United Kingdom is projected to grow at a CAGR of 8.2%. The country’s construction sector, supported by infrastructure projects, urban regeneration, and commercial development, is driving the demand for reliable power generation solutions. Diesel generators are in high demand due to their ability to provide continuous power on construction sites. However, the market growth is slightly slower compared to emerging markets due to the saturation of existing infrastructure and a push toward cleaner energy sources. Despite this, ongoing construction activity and government infrastructure initiatives continue to support market stability.

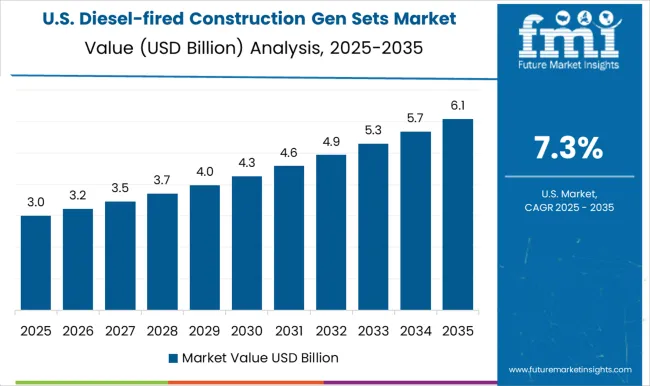

The diesel fired construction generator sets market in the United States is expected to grow at a slower pace, with a projected CAGR of 7.3%. While the USA market is mature, steady demand is driven by the construction industry’s need for reliable power supply. Diesel-fired generators remain a popular choice on construction sites due to their durability and ease of maintenance. Despite slower growth, ongoing infrastructure development, construction, and emergency power supply requirements continue to support the market. Additionally, the USA is seeing increased demand in off-grid locations and areas lacking access to a stable power grid.

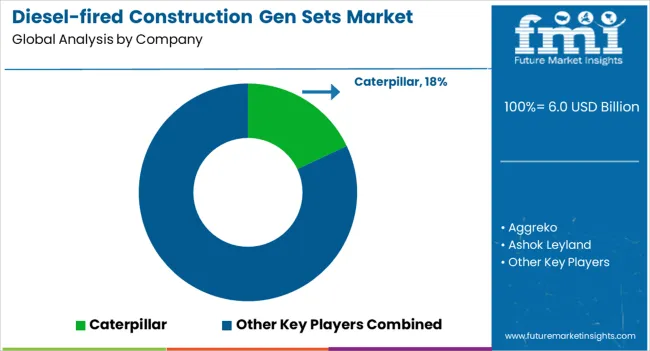

The diesel-fired construction generator sets market is dominated by Caterpillar, which leads through its comprehensive portfolio of high-performance, durable diesel-powered generators designed for construction and industrial applications. Caterpillar’s dominance is reinforced by its global brand recognition, extensive distribution network, and commitment to providing reliable power solutions for various construction projects.

Key players such as Cummins, Aggreko, Atlas Copco, and Generac Power Systems maintain significant market shares by offering efficient, high-capacity generator sets that ensure continuous operation on construction sites, even in remote or harsh environments. These companies focus on innovation in fuel efficiency, noise reduction, and emissions control to meet the growing demand for eco-friendly, reliable power solutions in the construction industry.

Emerging players like Ashok Leyland, Greaves Cotton, Kirloskar, and Mahindra Powerol are expanding their market presence by offering cost-effective, locally tailored diesel generator sets that cater to the specific power requirements of construction and mining sectors. Their strategies include enhancing performance, improving fuel efficiency, and offering extended warranty and after-sales services.

Market growth is driven by the increasing construction activities globally, the need for reliable power during construction site operations, and ongoing urban development. Innovations in hybrid power systems, fuel-efficient engines, and remote monitoring technologies are expected to continue shaping competitive dynamics and driving growth in the diesel-fired construction generator sets market.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 Billion |

| Power Rating | > 50 kVA - 125 kVA, ≤ 50 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA |

| Application | Standby, Peak Shaving, and Prime/Continuous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Aggreko, Ashok Leyland, Atlas Copco, Cummins, Generac Power Systems, Greaves Cotton, HIMOINSA, J C Bamford Excavators, Kirloskar, Kohler, Mahindra Powerol, Mitsubishi Heavy Industries, Rolls-Royce, Sterling Generators, and Wartsila |

| Additional Attributes | Dollar sales by generator type and application, demand dynamics across construction, mining, and industrial sectors, regional trends in diesel-fired generator adoption, innovation in fuel efficiency and emissions reduction technologies, impact of regulatory standards on environmental and safety concerns, and emerging use cases in off-grid and remote construction sites. |

The global diesel-fired construction generator sets market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the diesel-fired construction generator sets market is projected to reach USD 13.6 billion by 2035.

The diesel-fired construction generator sets market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in diesel-fired construction generator sets market are > 50 kva - 125 kva, ≤ 50 kva, > 125 kva - 200 kva, > 200 kva - 330 kva, > 330 kva - 750 kva and > 750 kva.

In terms of application, standby segment to command 48.6% share in the diesel-fired construction generator sets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA