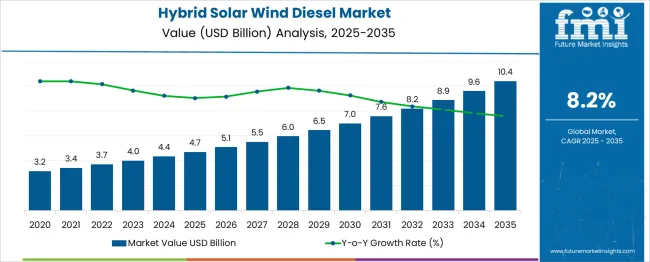

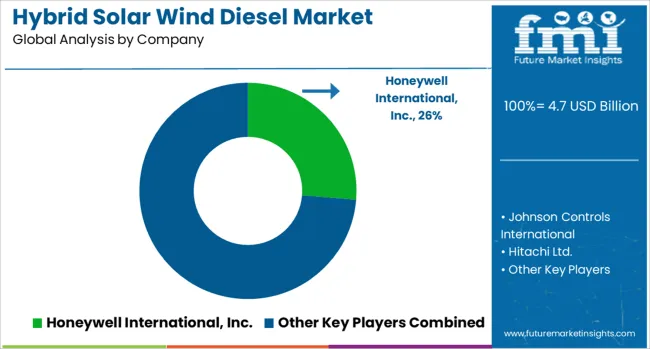

The Hybrid Solar Wind Diesel Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 10.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

The hybrid solar wind diesel market is forecasted to increase from USD 4.7 billion in 2025 to USD 10.4 billion by 2035, representing an incremental gain of USD 5.7 billion over the decade at an 8.2% CAGR. Year-on-year growth analysis shows the market reaching USD 5.5 billion in 2027, USD 6.5 billion in 2029, and crossing USD 8.9 billion by 2033, indicating a compound expansion of nearly 115% from the base year.

Between 2025 and 2030, the market will add approximately USD 2.3 billion, accounting for 40% of the total projected increase, driven by accelerated deployment of hybrid systems in remote mining operations and off-grid industrial facilities. By 2030, hybrid solutions with advanced storage integration and digital controls are expected to dominate, reducing diesel dependency by an estimated 35% compared to conventional setups.

Microgrid penetration is projected to increase at a double-digit pace in Asia-Pacific and Africa, contributing over 50% of incremental installations, while Europe and North America focus on retrofitting existing diesel-based plants. Performance optimization using predictive analytics and AI-enabled load balancing could cut operational costs by 10-15% across high-load applications. The market’s absolute opportunity highlights a strong transition toward resilient, fuel-efficient, and digitally integrated energy systems globally.

| Metric | Value |

|---|---|

| Hybrid Solar Wind Diesel Market Estimated Value in (2025 E) | USD 4.7 billion |

| Hybrid Solar Wind Diesel Market Forecast Value in (2035 F) | USD 10.4 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The hybrid solar wind diesel market is forecasted to increase from USD 4.7 billion in 2025 to USD 10.4 billion by 2035, representing an incremental gain of USD 5.7 billion over the decade at an 8.2% CAGR. Year-on-year growth analysis shows the market reaching USD 5.5 billion in 2027, USD 6.5 billion in 2029, and crossing USD 8.9 billion by 2033, indicating a compound expansion of nearly 115% from the base year.

Between 2025 and 2030, the market will add approximately USD 2.3 billion, accounting for 40% of the total projected increase, driven by accelerated deployment of hybrid systems in remote mining operations and off-grid industrial facilities.

By 2030, hybrid solutions with advanced storage integration and digital controls are expected to dominate, reducing diesel dependency by an estimated 35% compared to conventional setups. Microgrid penetration is projected to increase at a double-digit pace in Asia-Pacific and Africa, contributing over 50% of incremental installations, while Europe and North America focus on retrofitting existing diesel-based plants.

Performance optimization using predictive analytics and AI-enabled load balancing could cut operational costs by 10–15% across high-load applications. The market’s absolute opportunity highlights a strong transition toward resilient, fuel-efficient, and digitally integrated energy systems globally.

The hybrid solar wind diesel market is witnessing steady growth as global energy stakeholders pivot toward resilient, low-emission power solutions that ensure round-the-clock availability. The integration of solar and wind energy with diesel generators is being prioritized in regions where grid instability or remote locations necessitate continuous power. Policy-level incentives for hybrid microgrids, advancements in power electronics, and the falling cost of renewable components such as inverters and battery storage systems reinforce this trend.

Infrastructural investments in islanded and underserved areas have further encouraged adoption, with increasing demand from defense, mining, and rural development sectors. Key innovations in controller logic and real-time monitoring have enabled better fuel optimization and load management, significantly reducing diesel dependency.

Future market growth is expected to be shaped by decarbonization mandates, energy access programs, and a growing focus on sustainability among commercial and government stakeholders. The market outlook remains strong as hybrid architectures deliver cost-effective and environmentally viable alternatives to traditional standalone systems.

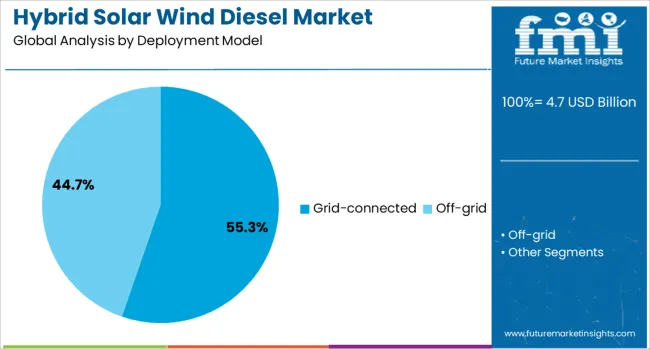

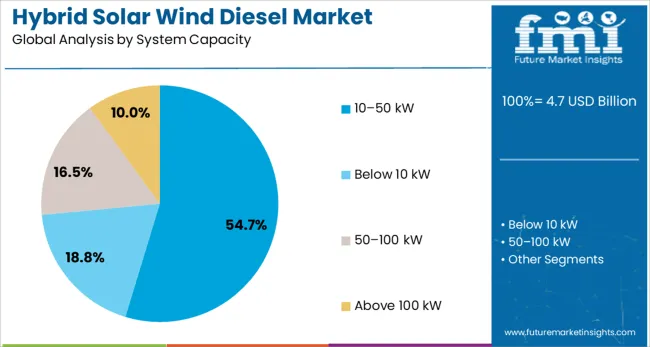

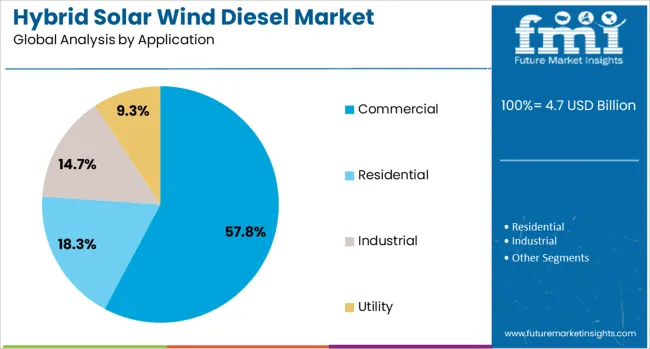

The hybrid solar wind diesel market is segmented by deployment model, system capacity, application, battery technology, and geographic regions. By deployment model, the hybrid solar wind diesel market is divided into Grid-connected and Off-grid. In terms of system capacity, the hybrid solar wind diesel market is classified into 10-50 kW, below 10 kW, 50-100 kW, and above 100 kW. Based on the application of the hybrid solar wind diesel, the market is segmented into Commercial, Residential, Industrial, and Utility.

The battery technology of the hybrid solar wind diesel market is segmented into Lithium-ion, Lead-acid, and Flow batteries. Regionally, the hybrid solar wind diesel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The grid-connected segment is anticipated to account for 55.3% of the total revenue share in the hybrid solar wind diesel market in 2025. This leading position is supported by the segment’s ability to optimize energy consumption while allowing excess renewable power to be fed back into the grid. The integration of grid-connected systems has been prioritized by commercial operators and municipalities aiming to reduce fuel costs while ensuring backup availability through grid support.

Improved net metering regulations and feed-in tariff programs have accelerated the installation of grid-synchronized hybrid systems across regions with established utility networks. Enhanced load balancing, reduced diesel generator runtime, and advanced SCADA-based control capabilities have made grid-connected models highly attractive.

Additionally, their compatibility with smart meters and demand response mechanisms has driven adoption in energy-conscious markets. The segment's continued expansion is also being supported by declining costs in power converters and utility-grade solar components, reinforcing the economic viability of such hybrid configurations.

The 10-50 kW capacity segment is projected to capture 54.7% of the hybrid solar wind diesel market revenue in 2025, establishing itself as the dominant system capacity range. The strong uptake in this segment is attributed to its optimal scalability and suitability for small commercial setups, community microgrids, and institutional energy needs. These systems offer a balanced mix of cost-efficiency and energy output, making them ideal for rural electrification and distributed power generation.

The flexibility in deployment, minimal land requirements, and simplified maintenance protocols have enhanced their appeal among users seeking mid-range power solutions with hybrid adaptability. Growing adoption in agricultural facilities, telecom towers, and public sector installations has further reinforced the segment's growth trajectory.

In addition, manufacturers have focused on modularity and plug-and-play architecture in this capacity range, enabling faster commissioning and improved operational efficiency. Supportive government programs and concessional financing schemes have also contributed to wider implementation of 10-50 kW hybrid systems.

The commercial application segment is expected to contribute 57.8% of the overall revenue share in the hybrid solar wind diesel market by 2025, reflecting its central role in hybrid energy transition. Commercial facilities such as resorts, business parks, manufacturing plants, and logistics hubs are increasingly turning to hybrid systems to meet power demand while reducing fuel dependency and operational emissions. The flexibility to integrate solar and wind generation with existing diesel infrastructure has allowed commercial users to achieve significant cost savings and operational reliability.

Enhanced energy security, real-time performance monitoring, and predictive maintenance features have encouraged deployment in regions with inconsistent grid access or high peak tariffs. Moreover, the commercial sector's push toward green building certifications and ESG compliance has accelerated investments in sustainable energy solutions.

Hybrid systems offer the advantage of continuous power supply with reduced carbon footprint, aligning with the broader sustainability targets of commercial enterprises. The scalability and return on investment in hybrid solutions continue to drive growth in this segment.

Hybrid solar wind diesel systems are being implemented to ensure continuous power supply in remote industrial operations and off-grid communities. These configurations integrate photovoltaic arrays, wind turbines and diesel gensets with energy storage to maintain load stability during variable resource conditions. Growth has been encouraged by projects requiring reduced fuel consumption and improved energy reliability in mining, telecom, and island microgrid installations.

Hybrid solar wind diesel solutions have been deployed to reduce diesel dependency and extend generator maintenance intervals. Integration of solar and wind power through advanced controllers allows dynamic load sharing and efficient battery charging sequences. Intelligent energy management systems have been introduced to monitor power flow, optimize resource utilization, and maintain voltage quality during demand fluctuations. These systems have supported power availability in critical infrastructure projects where fuel delivery constraints and logistics challenges exist. Applications in telecom towers, island resorts, and off-grid construction projects have accelerated adoption due to high operational cost savings from reduced fuel consumption and improved generator uptime.

Opportunities exist in modular hybrid system designs that enable quick deployment and scalability for diverse project sizes. Containerized hybrid units are being offered to minimize installation complexity and improve portability for seasonal or temporary power sites. Remote monitoring platforms with cloud-based diagnostics have been integrated to enable predictive maintenance and performance optimization without on-site intervention. Demand for hybrid power solutions in defense outposts, mining sites, and rural industrial facilities has provided scope for suppliers delivering pre-engineered packages with integrated energy storage and automatic dispatch controls. Manufacturers that combine renewable penetration with diesel reliability while offering digital control systems are positioned to dominate project pipelines in emerging and developed regions.

Significant opportunities have emerged for hybrid solar wind diesel systems in remote and off-grid regions where consistent energy supply remains a challenge. Integration of renewable components with diesel backup is enabling reliable power generation for mining, construction, and island communities. Industrial users are exploring hybrid configurations to reduce fuel consumption and operational costs, creating additional demand. Growing interest from telecommunications and defense sectors for uninterrupted energy in critical installations has accelerated investments. Government incentives promoting renewable adoption in rural electrification projects are encouraging deployment of hybrid systems. Advancements in modular designs and scalable architectures are expected to simplify installation and improve cost competitiveness in diverse environments globally.

A strong trend toward digitalization and remote monitoring is transforming hybrid solar wind diesel projects, enabling predictive maintenance and real-time performance optimization. Integration with microgrids and energy storage solutions is becoming a standard practice to ensure stability and efficient load management. Hybrid systems are increasingly adopting advanced controllers for automated energy balancing between renewables and diesel backup. Deployment of containerized power modules is gaining traction for rapid mobility and simplified setup in challenging terrains. The shift toward data-driven operation supported by IoT platforms is improving system reliability and lowering lifecycle costs. Strategic alliances between renewable developers and OEMs are shaping future hybrid power solutions globally.

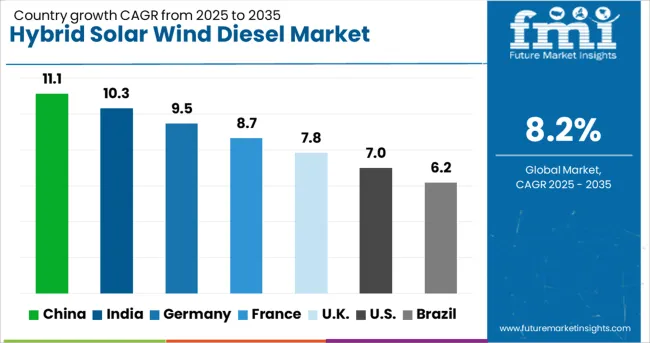

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The global hybrid solar wind diesel market is projected to grow at an 8.2% CAGR from 2025 to 2035, supported by the need for resilient energy solutions and reduced reliance on conventional power sources. China leads at 11.1%, driven by large-scale deployments in off-grid industrial zones and island electrification programs. India follows with 10.3%, supported by energy diversification initiatives and hybrid microgrid projects for remote regions.

Among OECD nations, Germany posts 9.5%, with strong adoption in industrial and commercial facilities to ensure grid stability. France records 8.7%, where hybrid systems are expanding in rural electrification projects and backup power solutions. The UK grows at 7.8%, driven by defense applications and construction site power needs. The analysis includes over 40 countries, with the top five detailed below.

The United States is advancing space robotics through mission-specific integration across government and private sector launches. China is projected to grow at 11.1% CAGR, driven by rising deployment of hybrid microgrids in industrial zones and isolated regions. Offshore oil fields, islands, and mining areas are integrating diesel with solar and wind systems for continuous power supply.

Government initiatives under renewable integration policies are encouraging hybridization to reduce fuel dependency in remote energy setups. Domestic companies are developing advanced control systems for seamless power switching across sources. Strategic partnerships between energy developers and genset manufacturers are accelerating hybrid solutions across critical infrastructure.

India is forecast to expand at a 10.3% CAGR, supported by energy access programs and microgrid adoption in rural and semi-remote areas. Demand is increasing in telecom towers, healthcare facilities, and commercial establishments seeking uninterrupted power. National electrification schemes encourage hybrid setups combining solar, wind, and diesel for stable supply. Local OEMs and EPC firms are collaborating to deliver containerized hybrid solutions for rapid deployment. Financing models such as build-own-operate agreements are improving affordability for institutional consumers.

Germany is projected to grow at 9.5% CAGR, driven by hybrid energy adoption in commercial and manufacturing facilities. Energy security concerns and grid stabilization measures are key market catalysts. Hybrid systems are being deployed in industrial parks and logistics hubs to reduce downtime during outages. Manufacturers are offering hybrid power packages integrated with smart monitoring and demand management tools. Incentives for decentralized generation encourage businesses to adopt hybrid technologies combining renewables with backup diesel capacity.

France is expected to grow at 8.7% CAGR, supported by rural grid reinforcement projects and reliance on hybrid energy for critical infrastructure. Hybrid power systems are being implemented in defense facilities, remote construction sites, and municipal projects. Manufacturers are advancing control technologies to ensure stable operations in variable wind and solar conditions.

Deployment of modular hybrid power units is accelerating, supported by funding from energy transition programs. The shift toward off-grid capability for resilience in emergency scenarios is strengthening adoption in public sector projects.

The United Kingdom is forecast to grow at 7.8% CAGR, driven by demand for reliable hybrid systems in construction, defense, and remote research facilities. Hybrid solutions are gaining ground in commercial real estate developments requiring high uptime. Energy service companies are offering performance-based contracts for hybrid installations, improving adoption among corporate clients.

Manufacturers are focusing on compact modular systems to address space constraints in urban and semi-urban applications. Integration with predictive analytics for maintenance and fuel optimization is a key differentiator in this market.

The hybrid solar wind diesel market is witnessing intense competition as companies focus on delivering integrated power solutions that combine renewable energy with diesel generation to meet energy reliability and cost-efficiency requirements in remote and off-grid locations. Honeywell International Inc. leads the market with advanced control systems and AI-driven energy optimization technologies that ensure seamless microgrid operations and superior fuel efficiency.

Johnson Controls International and Hitachi Ltd. concentrate on hybrid system integration with smart grid capabilities, enabling efficient load balancing, reduced emissions, and improved operational stability across industrial and commercial installations. Cisco Systems strengthens its presence by offering IoT-based connectivity and remote monitoring solutions that allow predictive maintenance and real-time system performance analytics for distributed hybrid power plants.

Panasonic Corporation and General Electric are enhancing renewable-diesel synchronization through innovations in energy storage integration and modular hybrid configurations, mitigating intermittency challenges and optimizing energy supply reliability. Market competition revolves around system modularity, cost optimization, digital connectivity, and turnkey deployment capabilities, with increasing emphasis on AI-powered analytics for energy management.

Demand is accelerating in sectors such as mining, oil and gas, and industrial operations located in isolated geographies, where hybrid systems provide operational resilience and reduced dependency on diesel fuel. Strategic collaborations with grid operators, investments in advanced storage technologies, and adherence to global emission standards are becoming crucial for maintaining a competitive edge. Players capable of delivering scalable, digitally connected, and fuel-efficient hybrid solutions are positioned to capture significant opportunities in the evolving distributed energy landscape.

In April 2025, Hitachi Industrial Equipment Systems (HIES) launched a next-generation Grid-Forming Inverter (GFM) at its Narashino Works facility in Chiba, Japan, which is directly tied to supporting hybrid renewable microgrids.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Deployment Model | Grid-connected and Off-grid |

| System Capacity | 10-50 kW, Below 10 kW, 50-100 kW, and Above 100 kW |

| Application | Commercial, Residential, Industrial, and Utility |

| Battery Technology | Lithium-ion, Lead-acid, and Flow batteries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International, Inc., Johnson Controls International, Hitachi Ltd., Cisco Systems, Panasonic Corporation, and General Electric |

| Additional Attributes | Dollar sales by system configuration (solar-diesel, wind-diesel, solar-wind-diesel hybrid) and end-use sector (industrial, commercial, off-grid communities), with demand driven by the need for reliable, low-emission energy in remote and island regions. Regional trends show strong adoption in Asia-Pacific and Africa due to energy access initiatives, while North America focuses on hybrid solutions for mining and military applications. Innovation centers on energy storage integration, AI-based load management, and modular microgrid designs. Regulatory policies promoting renewable integration and reduced diesel dependency further accelerate hybrid deployments across critical and remote infrastructure projects. |

The global hybrid solar wind diesel market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the hybrid solar wind diesel market is projected to reach USD 10.4 billion by 2035.

The hybrid solar wind diesel market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in hybrid solar wind diesel market are grid-connected and off-grid.

In terms of system capacity, 10–50 kw segment to command 54.7% share in the hybrid solar wind diesel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sleeve Cartridges Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wind Power Forecasting System Market Size and Share Forecast Outlook 2025 to 2035

Solar Module Recycling Service Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Diesel Parking Heater Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Wind Power Coatings Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA