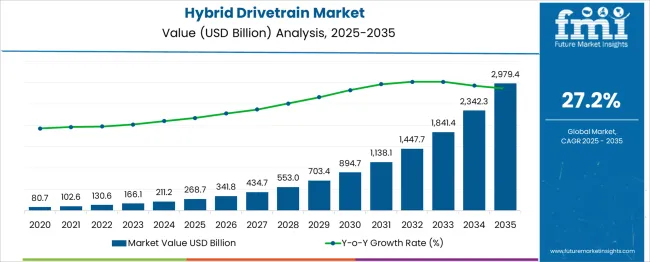

The Hybrid Drivetrain Market is estimated to be valued at USD 268.7 billion in 2025 and is projected to reach USD 2979.4 billion by 2035, registering a compound annual growth rate (CAGR) of 27.2% over the forecast period. The growth trajectory displays a sharp acceleration throughout the period, reflecting increasing adoption and technological advancement. Between 2025 and 2030, the market value rises by USD 626.0 billion, reaching USD 894.7 billion.

During this period, annual increments rise from approximately USD 73.1 billion in 2026 to around USD 191.3 billion in 2030. This growth is primarily driven by the integration of hybrid drivetrains in passenger and commercial vehicles, supported by maturing supply chains and wider consumer acceptance. From 2030 to 2035, the market adds USD 2,084.7 billion, contributing nearly 77% of the decade’s growth.

Annual increases accelerate substantially, peaking at USD 637.1 billion between 2034 and 2035. This surge reflects deeper penetration into mass-market vehicle segments, strong OEM commitments, and improvements in cost competitiveness compared to conventional drivetrains.

The data highlights a steep upward growth curve, emphasizing a transformative market phase. The increasing absolute gains underline the significant value creation potential as hybrid drivetrains transition from early adoption to mainstream dominance. This pattern indicates considerable opportunities for investment and expansion as the technology becomes a core component of future mobility solutions.

| Metric | Value |

|---|---|

| Hybrid Drivetrain Market Estimated Value in (2025 E) | USD 268.7 billion |

| Hybrid Drivetrain Market Forecast Value in (2035 F) | USD 2979.4 billion |

| Forecast CAGR (2025 to 2035) | 27.2% |

The hybrid drivetrain market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 3.4% of the global automotive powertrain market, driven by the shift toward electrified mobility. Within the electric and hybrid vehicle components sector, a share of approximately 4.1% is assessed due to rising production of hybrid cars, SUVs, and commercial vehicles. In the transmission and propulsion systems industry, around 3.0% is observed reflecting demand for integrated hybrid gearboxes and motor units.

Within the automotive energy efficiency solutions market, about 3.6% is evaluated as hybrid systems contribute to reduced fuel consumption and emissions. In the performance and premium vehicle drivetrain segment, a contribution of roughly 2.8% is calculated due to adoption in high end hybrid sports and luxury models. Market growth has been supported by advancements in battery technology, control electronics, and lightweight drivetrain components.

Developments have included multi mode hybrid systems capable of switching seamlessly between electric and combustion power, as well as regenerative braking technologies that optimize energy recovery. Interest has been growing in plug in hybrid configurations offering extended electric only ranges.

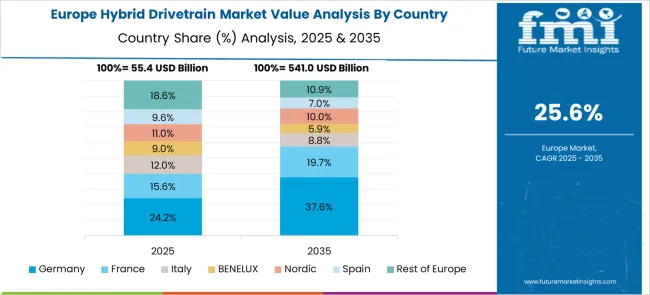

The Asia Pacific region has been observed to dominate production and adoption, while Europe and North America maintain strong demand driven by emissions regulations and consumer interest in fuel efficient performance. Strategic initiatives have included collaborations between automakers and drivetrain specialists to develop scalable hybrid architectures, improve integration of electric motors within transmissions, and enable modular designs adaptable across multiple vehicle platforms.

The hybrid drivetrain market is gaining momentum amid tightening emission regulations, fuel efficiency mandates, and growing investments in automotive electrification. Government incentives, particularly for hybrid vehicle adoption, have improved manufacturing feasibility while making hybrids accessible to a wider consumer base.

Additionally, the transitional appeal of hybrid vehicles-offering both electric and combustion functionalities- is being recognized as a key enabler in decarbonizing transport without the infrastructure burden of full electrification. Automakers are aligning strategic portfolios with hybrid variants, as cost parity between electric powertrains and ICEs narrows.

Rising R&D in energy management systems, regenerative braking, and multi-mode drivetrains is enabling enhanced performance and flexibility. With OEMs and Tier-1 suppliers forming partnerships to localize battery and drivetrain production, the market is expected to witness sustained growth and product diversity over the forecast period.

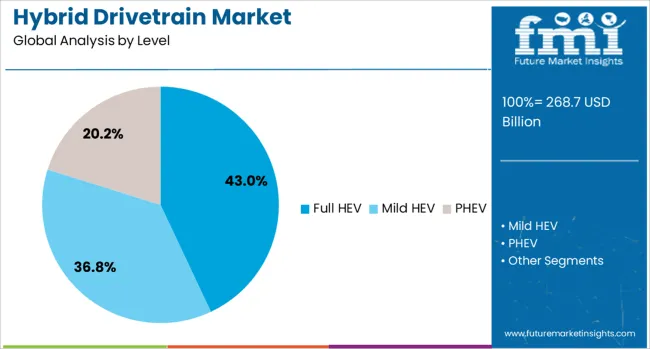

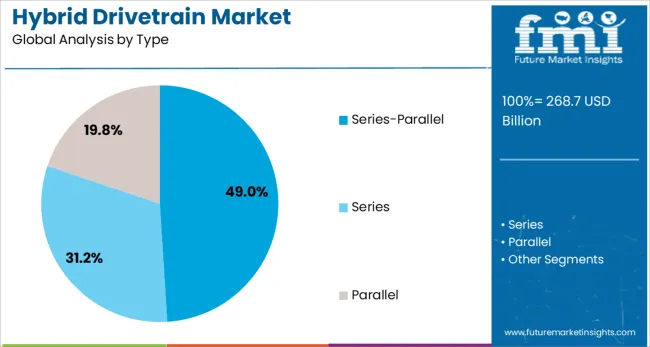

The hybrid drivetrain market is segmented by level, type, component, and geographic regions. The hybrid drivetrain market is divided into Full HEV, Mild HEV, and PHEV. In terms of the type of hybrid drivetrain, the market is classified into Series-Parallel, Series, and Parallel.

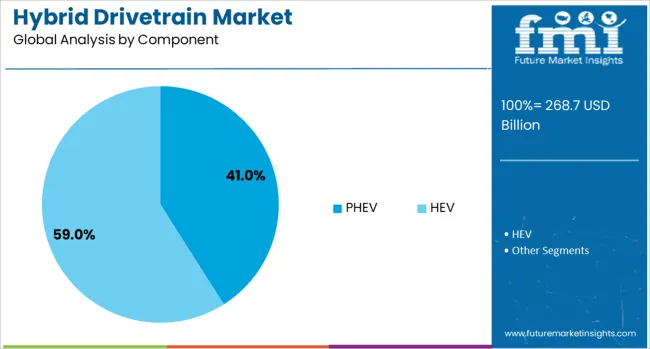

The hybrid drivetrain market is segmented into PHEV and HEV. Regionally, the hybrid drivetrain industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Full hybrid electric vehicles (Full HEVs) are projected to lead the market with a 43.00% revenue share in 2025, driven by their optimal balance between electric driving and combustion engine support. This segment’s dominance is being sustained by growing consumer demand for vehicles that deliver high fuel efficiency without range anxiety.

Advancements in regenerative braking, energy recapture, and dynamic switching between electric and ICE modes have enhanced the Full HEV appeal. Their plugless configuration ensures wider acceptance in regions lacking EV infrastructure.

Moreover, policy support and tax incentives for mid-range hybrid vehicles have promoted OEM prioritization of Full HEV offerings across compact, mid-size, and utility vehicle classes.

Series-parallel hybrid drivetrains are estimated to command 49.00% of the market share in 2025, making them the leading drivetrain architecture. Their versatility, allowing operation in electric-only, engine-only, or combined modes, has positioned this configuration as the most adaptable to varying terrain and load requirements.

Enhanced energy optimization and smooth power transitions are key technical advantages. Automakers are increasingly favoring this system due to its compatibility with both urban and highway performance demands.

As battery and control unit costs decline, series-parallel systems are being integrated into a wider range of vehicle segments, especially in SUVs and sedans that require efficient torque distribution and superior mileage.

Plug-in hybrid electric vehicles (PHEVs) are forecast to hold 41.00% of the component-level market revenue in 2025, leading among hybrid drivetrain components. Their capability to operate for extended distances on electric power before switching to ICE is driving strong consumer adoption.

Governments across North America, Europe, and the Asia-Pacific are extending favorable tax credits and congestion exemptions specifically for PHEVs. The availability of charging infrastructure and the growing appeal of dual-mode vehicles for both urban commutes and long-distance drives are enhancing the value proposition of this component segment.

OEM investments in modular battery packs and intelligent energy management software are further consolidating PHEVs’ role in hybrid architecture growth.

Hybrid drivetrains have been increasingly incorporated into passenger cars, commercial vehicles, and specialty transport systems to improve fuel efficiency and reduce exhaust emissions. These systems combine internal combustion engines with electric motors, supported by energy storage units and control electronics, to optimize power delivery. Demand has been driven by tightening emission regulations, fuel cost considerations, and advances in battery and motor technology. Automakers have focused on developing plug-in, parallel, and series hybrid configurations to meet varying performance, range, and cost requirements across global markets.

Stringent emission standards in North America, Europe, and parts of Asia have significantly influenced the adoption of hybrid drivetrains. Governments have implemented policies promoting reduced greenhouse gas output, prompting automakers to integrate hybrid systems as a compliance measure. Fuel efficiency gains of up to 30% compared to conventional combustion engines have attracted both private and fleet buyers. Hybrid taxis, delivery vans, and municipal service vehicles have been introduced to reduce operational fuel expenses. In countries offering tax incentives, registration benefits, or congestion charge exemptions, hybrid vehicles have gained faster market penetration. This regulatory and economic alignment has created a strong foundation for sustained hybrid drivetrain demand in multiple vehicle categories.

Ongoing innovations in battery chemistry, electric motor efficiency, and power electronics have enhanced hybrid drivetrain capabilities. Lithium-ion and emerging solid-state batteries have provided higher energy density and longer cycle life, enabling improved electric-only driving ranges. Regenerative braking systems have been optimized to recover more kinetic energy during deceleration, increasing overall system efficiency. Compact electric motors with higher torque output have been integrated without significantly increasing vehicle weight. Advanced hybrid control software has been used to balance engine and motor operation seamlessly, improving responsiveness and ride comfort. Automakers in Japan, Germany, and the United States have been leading development efforts, ensuring that hybrid drivetrains meet evolving consumer expectations for performance and reliability.

Hybrid drivetrains have been increasingly adopted in light commercial vehicles, buses, and utility trucks, where fuel savings and reduced emissions can yield significant operational benefits. Public transportation agencies have deployed hybrid buses to lower fuel consumption and improve air quality in urban centers. Logistics companies have adopted hybrid delivery vans to meet corporate sustainability targets while lowering running costs. In construction and mining, hybrid utility vehicles have been used to reduce idle fuel use and noise during site operations. The ability to operate in partial or full electric mode has also made hybrid systems suitable for low-emission zones in major cities. This diversification beyond passenger cars has helped stabilize market growth and reduce reliance on consumer vehicle sales alone.

Despite their advantages, hybrid drivetrains have faced challenges from high manufacturing costs and increasing competition from battery electric vehicles (BEVs). The integration of dual powertrains, complex control systems, and high-capacity batteries has increased vehicle prices, making hybrids less accessible in cost-sensitive markets. In regions with rapidly expanding charging infrastructure, BEVs have attracted buyers seeking zero-emission mobility without combustion engines. Limited consumer understanding of hybrid system benefits compared to full electrics has also slowed adoption in some areas. Additionally, servicing hybrid drivetrains requires specialized training and equipment, adding to ownership costs. Without further cost reductions and targeted consumer education, hybrid vehicles may face pressure from fully electric alternatives in the long term.

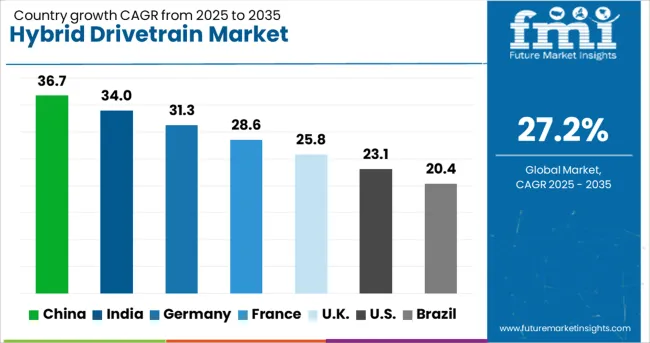

| Country | CAGR |

|---|---|

| China | 36.7% |

| India | 34.0% |

| Germany | 31.3% |

| France | 28.6% |

| UK | 25.8% |

| USA | 23.1% |

| Brazil | 20.4% |

The hybrid drivetrain market is expected to grow at a global CAGR of 27.2% between 2025 and 2035, driven by stricter emission norms, rising fuel efficiency demands, and rapid electrification of the automotive sector. China leads with a 36.7% CAGR, supported by large-scale hybrid vehicle production and government incentives for low-emission mobility. India follows at 34.0%, fueled by growing adoption of hybrid powertrains in passenger and commercial vehicles. Germany, at 31.3%, benefits from strong automotive engineering expertise and premium hybrid model launches. The UK, projected at 25.8%, sees growth from government-backed green mobility programs and increasing consumer adoption. The USA, at 23.1%, reflects steady integration of hybrid systems across SUVs, trucks, and sedans. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to grow at a CAGR of 36.7% from 2025 to 2035 in the hybrid drivetrain sector, driven by large-scale adoption in both private and public transportation fleets. Automakers including BYD, Geely, and SAIC Motor have introduced models with extended electric-only ranges and advanced regenerative braking technologies. Strategic partnerships between drivetrain manufacturers and battery suppliers such as CATL have accelerated advancements in energy recovery and power efficiency. Expansion of hybrid bus networks in major cities has further contributed to market volume, while regulatory incentives in Tier 1 and Tier 2 regions have strengthened adoption rates. The competitive landscape remains dominated by domestic brands, although foreign OEMs are increasing their presence with plug-in hybrid offerings tailored to local driving conditions.

India is forecasted to register a CAGR of 34.0% from 2025 to 2035, supported by rising adoption in both personal and commercial vehicles. Leading manufacturers such as Tata Motors, Mahindra & Mahindra, and Maruti Suzuki have focused on developing cost-effective mild and full hybrid solutions for fuel-conscious buyers. Collaborations with Japanese OEMs have enabled the integration of compact hybrid systems suitable for congested city traffic and intercity routes. Fleet operators in metropolitan hubs are increasingly adding hybrid sedans and SUVs to reduce long-term operational expenses. State-level incentives for hybrid taxis have further fueled demand, and localized component manufacturing has lowered production costs, making hybrid technology more accessible.

Germany is projected to achieve a CAGR of 31.3% from 2025 to 2035, driven by advancements in engineering and strong demand from premium vehicle segments. Automakers such as BMW, Mercedes-Benz, and Volkswagen have introduced plug-in hybrid SUVs and high-performance sedans featuring dual-clutch transmissions and high-capacity electric motors. Innovations in high-voltage battery packs and efficient thermal management systems have extended electric-only driving ranges while maintaining performance levels. Government emissions reduction targets have encouraged hybrid adoption as a bridging technology between conventional and fully electric vehicles. German suppliers are also exporting drivetrain systems to other European markets, leveraging their reputation for precision engineering and durability.

The United Kingdom is expected to expand at a CAGR of 25.8% from 2025 to 2035, supported by corporate fleet transitions and consumer demand for lower-emission vehicles. Manufacturers such as Jaguar Land Rover, Nissan UK, and Toyota UK are prioritizing plug-in hybrid offerings to meet performance and efficiency requirements. Leasing companies are actively switching to hybrids due to reduced taxation rates and long-term cost advantages. Public-sector procurement programs are also stimulating demand by integrating hybrids into municipal service fleets. The growth trajectory is further aided by improved charging infrastructure, which supports plug-in hybrid usability across both urban and rural areas.

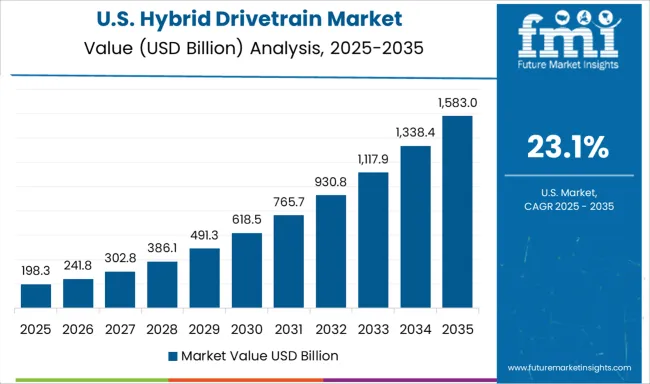

The United States is forecasted to grow at a CAGR of 23.1% from 2025 to 2035, with strong uptake in SUVs, pickup trucks, and crossovers. Automakers including Ford, Toyota, and General Motors are deploying power-split transmission systems that optimize performance in both city and highway driving. The hybridization of high-margin segments has proven commercially viable, with consumers drawn to improved fuel efficiency without sacrificing utility. Federal and state incentives have further encouraged hybrid purchases, while aftermarket solutions are expanding options for light commercial vehicle fleets. Increasing fuel price volatility has also strengthened hybrid market appeal, positioning it as a practical alternative to fully electric models.

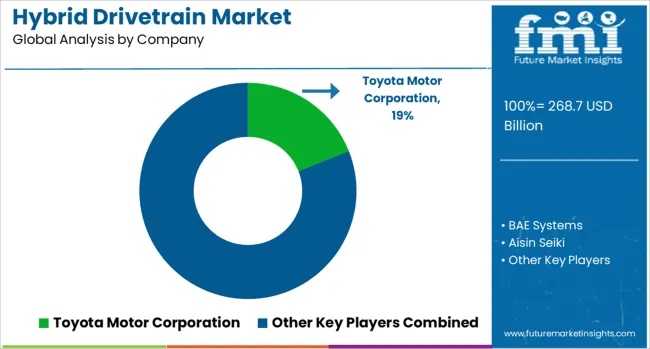

The hybrid drivetrain market is led by major automotive OEMs, Tier 1 suppliers, and specialized powertrain engineering firms developing systems that combine internal combustion engines with electric propulsion for improved efficiency and performance. Toyota Motor Corporation remains a pioneer with its Hybrid Synergy Drive technology, integrated into a wide range of passenger vehicles.

Aisin Seiki, a key Toyota affiliate, supplies hybrid transmissions and components to multiple global automakers. ZF Friedrichshafen and BorgWarner Inc. develop modular hybrid transmission systems adaptable to various vehicle platforms, while Continental AG focuses on integrated electric drive units and hybrid control electronics. BAE Systems delivers hybrid drivetrains for buses and military vehicles, emphasizing durability and operational efficiency.

Magna International and JATCO Ltd. supply hybrid transmissions and e-axles to both traditional and emerging automotive brands. Denso provides key hybrid system components such as inverters, motors, and control units, while Hofer Powertrain offers engineering services and turnkey hybrid solutions for niche and performance applications.

Delphi Automotive, now Aptiv, supports hybrid system integration with advanced electronics and power management solutions. Obrist Powertrain and Punch Powertrain Nanjing target specialized hybrid architectures, including serial hybrid and dual-clutch-based systems.

Key strategies include partnerships with automakers for platform-specific solutions, investment in compact and lightweight hybrid modules, and aligning production capabilities with the shift toward plug-in and mild hybrid configurations. Entry barriers include high R&D costs, stringent emissions regulations, and the need for proven long-term reliability in diverse driving conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD 268.7 Billion |

| Level | Full HEV, Mild HEV, and PHEV |

| Type | Series-Parallel, Series, and Parallel |

| Component | PHEV and HEV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Motor Corporation, BAE Systems, Aisin Seiki, Delphi Automotive, ZF Friedrichshafen, BorgWarner Inc., Continental AG, Hofer Powertrain, Denso, JATCO Ltd., Magna International, Obrist Powertrain, and Punch Powertrain Nanjing |

| Additional Attributes | Dollar sales by drivetrain architecture and vehicle application, demand dynamics across mild‑HEV, full HEV, and PHEV segments as well as passenger cars, commercial fleets, and industrial vehicles, regional trends in series versus parallel versus series‑parallel systems across Asia‑Pacific, North America, and Europe, innovation in solid‑state and next‑generation batteries, lightweight composite materials and modular electric motors, smart drivetrain systems with AI‑optimized power control and vehicle‑to‑grid connectivity, environmental impact of battery recycling, rare‑earth material sourcing, and energy consumption, and emerging use cases in heavy‑duty hybrid trucks, fleet electrification, and transitional urban mobility platforms. |

The global hybrid drivetrain market is estimated to be valued at USD 268.7 billion in 2025.

The market size for the hybrid drivetrain market is projected to reach USD 2,979.4 billion by 2035.

The hybrid drivetrain market is expected to grow at a 27.2% CAGR between 2025 and 2035.

The key product types in hybrid drivetrain market are full hev, mild hev and phev.

In terms of type, series-parallel segment to command 49.0% share in the hybrid drivetrain market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA