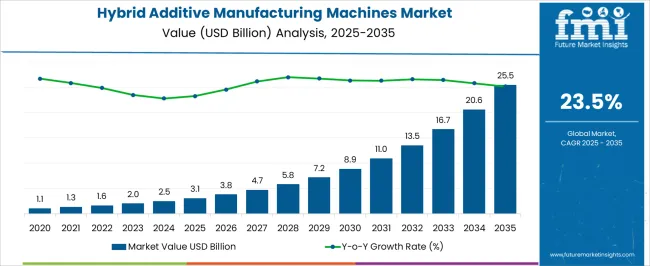

The hybrid additive manufacturing machines market is at USD 3.1 billion in 2025 and is expected to reach USD 25.5 billion by 2035, growing at a CAGR of 23.5%, with a multiplying factor of about 8.2x. A 5-year growth block analysis highlights how market expansion occurs in distinct phases over the decade, reflecting technological adoption, industrial integration, and regional uptake. In the first block, from 2025 to 2030, growth is driven by early adoption in aerospace, automotive, and medical device manufacturing.

Manufacturers focus on integrating additive and subtractive processes to achieve precision, speed, and material efficiency, creating strong initial momentum. The second block, from 2030 to 2035, sees accelerated expansion as hybrid machines gain wider adoption across multiple industrial sectors, including tooling, defense, and energy. Technological improvements, such as multi-material capabilities, enhanced process control, and higher build volumes, further stimulate growth.

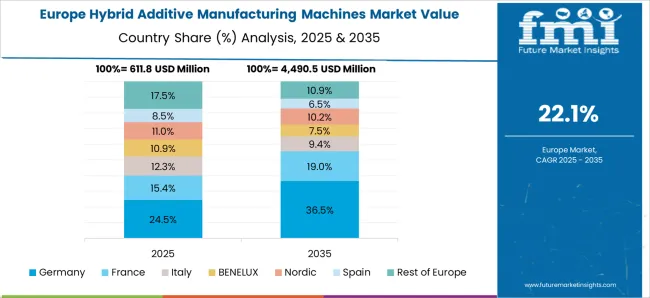

Regional demand shifts toward Asia Pacific and Europe, where industrial modernization, R&D investment, and automation strategies encourage large-scale deployment. Each 5-year block demonstrates a clear pattern: initial adoption lays the foundation, while the latter period drives faster growth through broader commercialization and advanced capabilities.

| Metric | Value |

|---|---|

| Hybrid Additive Manufacturing Machines Market Estimated Value in (2025 E) | USD 3.1 billion |

| Hybrid Additive Manufacturing Machines Market Forecast Value in (2035 F) | USD 25.5 billion |

| Forecast CAGR (2025 to 2035) | 23.5% |

The hybrid additive manufacturing machines market is shaped by multiple upstream sectors. Industrial machinery manufacturers account for approximately 38%, producing hybrid systems that combine additive and subtractive processes. Aerospace and defense companies contribute around 27%, adopting hybrid machines for lightweight structural components and high-strength parts. Automotive OEMs represent roughly 16%, leveraging these machines for prototyping, tooling, and functional components. Metal and polymer material suppliers hold close to 11%, providing powders, filaments, and feedstocks optimized for hybrid operations.

Research institutions and service providers make up the remaining 8%, supporting process development, customization, and testing. The market is evolving with the adoption of hybrid systems for improved precision, speed, and part complexity. Aerospace and defense sectors are increasingly using hybrid machines for components that require tight tolerances and complex geometries, accounting for over 30% of installations. Multi-material capabilities are growing, with combined metal-polymer processing expanding by ~12% year-on-year.

Advanced monitoring and control systems are reducing material waste and rework by 10–15%, while multi-axis hybrid platforms are enabling intricate part designs previously unachievable with traditional methods. Automation and digital integration are also enhancing production consistency, while demand for rapid prototyping and low-volume high-value production continues to rise in automotive and industrial applications.

The hybrid additive manufacturing machines market is experiencing steady expansion, driven by the integration of additive and subtractive manufacturing processes into a single platform, enabling greater design flexibility and production efficiency. Industry publications and company press releases have emphasized the role of hybrid systems in reducing production time, minimizing material waste, and delivering complex geometries with high precision.

Adoption has been particularly strong in sectors requiring customized, high-performance components, supported by advances in multi-material printing capabilities and process automation. Growing investment in advanced manufacturing infrastructure, combined with the increasing use of Industry 4.0 technologies, has further enhanced the capabilities of hybrid systems.

Additionally, the ability to produce functional prototypes and end-use parts in a single setup has appealed to industries seeking cost-effective, short-run production solutions. Market momentum is expected to be shaped by technological improvements in process control, expanded material compatibility, and rising demand from aerospace, defense, and medical sectors, where precision and performance are critical.

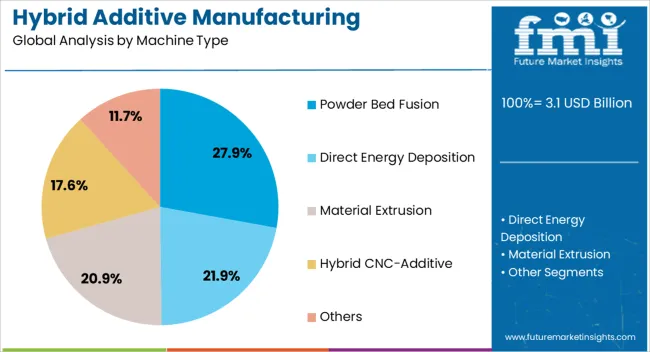

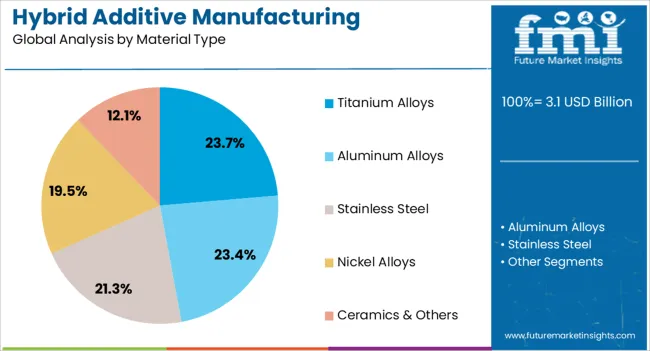

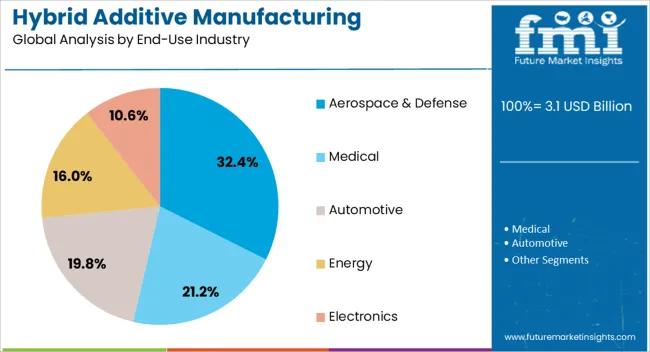

The hybrid additive manufacturing machines market is segmented by machine type, material type, end-use industry, application, and geographic regions. By machine type, hybrid additive manufacturing machines market is divided into Powder Bed Fusion, Direct Energy Deposition, Material Extrusion, Hybrid CNC-Additive, and Others. In terms of material type, hybrid additive manufacturing machines market is classified into Titanium Alloys, Aluminum Alloys, Stainless Steel, Nickel Alloys, and Ceramics & Others.

Based on end-use industry, hybrid additive manufacturing machines market is segmented into Aerospace & Defense, Medical, Automotive, Energy, and Electronics. By application, hybrid additive manufacturing machines market is segmented into Repair, Production, Prototyping, Tooling, and Custom Parts. Regionally, the hybrid additive manufacturing machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Powder Bed Fusion segment is projected to hold 27.9% of the hybrid additive manufacturing machines market revenue in 2025, maintaining its position as a leading machine type. Its growth has been supported by its capability to produce intricate, high-strength components with exceptional dimensional accuracy.

Engineering journals and manufacturing reports have noted that powder bed fusion enables layer-by-layer fabrication using metal powders, making it well-suited for applications requiring complex geometries and tight tolerances. The process has gained adoption in industries such as aerospace and medical devices, where component performance is highly dependent on precision.

Hybrid systems incorporating powder bed fusion have allowed for post-processing operations, such as milling, within the same machine, improving part quality and reducing lead times. The combination of superior mechanical properties, material efficiency, and integration with subtractive processes has solidified the segment’s role in advancing hybrid manufacturing capabilities.

The Titanium Alloys segment is projected to account for 23.7% of the hybrid additive manufacturing machines market revenue in 2025, reflecting its critical importance in high-performance applications. Titanium alloys are valued for their exceptional strength-to-weight ratio, corrosion resistance, and biocompatibility, making them essential in aerospace, defense, and medical sectors.

Industry sources have highlighted that hybrid additive manufacturing enables more efficient use of costly titanium powders through precise deposition and reduced material waste. The ability to manufacture lightweight, complex structures from titanium alloys has supported advancements in aircraft components, defense equipment, and surgical implants.

Furthermore, the integration of additive and subtractive processes has improved surface finish and dimensional accuracy, reducing the need for extensive post-processing. As industries continue to prioritize lightweight, durable, and corrosion-resistant materials, titanium alloys are expected to maintain a significant share in hybrid additive manufacturing applications.

The Aerospace & Defense segment is projected to contribute 32.4% of the hybrid additive manufacturing machines market revenue in 2025, securing its role as the leading end-use industry. Demand in this segment has been fueled by the need for complex, lightweight components that meet stringent performance and safety standards.

Defense and aerospace manufacturers have adopted hybrid systems to produce parts with reduced lead times, optimized weight, and improved mechanical performance. Press releases from leading aerospace firms have emphasized the role of hybrid additive manufacturing in enabling on-demand production, reducing supply chain dependencies, and supporting design innovation.

The technology has also facilitated repair and remanufacturing of critical components, extending their service life and lowering maintenance costs. With the aerospace and defense sector prioritizing advanced manufacturing solutions to meet evolving mission requirements, hybrid additive manufacturing is expected to remain a cornerstone technology for high-value part production.

The hybrid additive manufacturing machines market is expanding as industries adopt combined additive and subtractive manufacturing for enhanced production flexibility. These machines enable precise, complex component fabrication with reduced material waste and shorter lead times. Aerospace, automotive, and medical device sectors are major adopters due to demand for lightweight, high-strength parts and custom designs. Technological advancements in multi-axis machining, laser deposition, and process monitoring improve efficiency and surface quality. Integration with digital design and production planning systems allows optimized workflows.

The need for high-precision components in aerospace, automotive, and medical sectors is driving hybrid additive manufacturing adoption. These machines enable fabrication of geometrically complex parts with tight tolerances, which is challenging with traditional methods. Reduced material consumption and rework enhance cost-effectiveness. Industries leverage hybrid systems to produce lightweight structures, functional prototypes, and replacement components. Integration with CAD/CAM systems and automated monitoring ensures consistent quality and repeatability. Increasing requirements for shorter production cycles, customized products, and high-strength materials reinforce the adoption of hybrid additive manufacturing machines globally.

Hybrid machines capable of processing multiple materials and operating across multiple axes offer significant growth potential. Multi-material printing allows production of functionally graded components with tailored mechanical properties. Multi-axis machining improves surface finish, dimensional accuracy, and reduces post-processing needs. These capabilities are particularly attractive to industries requiring high-performance parts and prototypes. Manufacturers focusing on modular, scalable, and software-integrated solutions are well-positioned to capture market opportunities. Adoption of hybrid systems in research, aerospace, automotive, and medical applications is expected to increase as industries seek precision, efficiency, and material versatility in manufacturing operations.

Hybrid additive manufacturing machines are increasingly used in research and custom manufacturing. Universities, research institutions, and industrial R&D departments employ hybrid systems for experimental components, tooling, and specialized parts. The combination of additive flexibility with subtractive precision supports innovation in aerospace, automotive, and biomedical engineering. Emerging trends include integration with AI for process optimization, IoT-enabled monitoring for real-time adjustments, and automation for high-volume production. These trends enable faster prototyping, improved material utilization, and enhanced customization, expanding adoption beyond traditional industrial manufacturing.

High upfront costs and technical complexity of hybrid additive manufacturing machines limit adoption among small and medium enterprises. Integration with CAD/CAM systems, material handling, and multi-axis operations requires specialized expertise. Maintenance, calibration, and training add to operational expenditures. Manufacturers focusing on scalable solutions, operator training, and process standardization are better positioned to mitigate adoption barriers. Efficient production planning, cost optimization, and technological support are critical to sustaining growth and maximizing ROI for hybrid additive manufacturing systems across industrial, medical, and research applications.

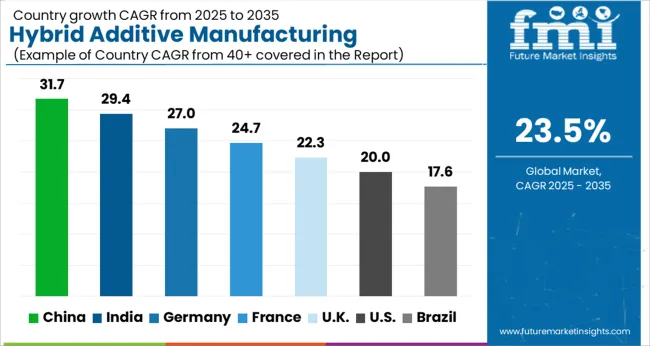

| Country | CAGR |

|---|---|

| China | 31.7% |

| India | 29.4% |

| Germany | 27.0% |

| France | 24.7% |

| UK | 22.3% |

| USA | 20.0% |

| Brazil | 17.6% |

The hybrid additive manufacturing machines market is growing at a global CAGR of 23.5% from 2025 to 2035, driven by rising adoption in aerospace, automotive, and industrial manufacturing, as well as the push for rapid prototyping and precision engineering. China leads with a CAGR of 31.7%, +35% above the global benchmark, supported by BRICS-driven investments in advanced manufacturing technologies, government-backed industrial initiatives, and large-scale adoption in high-tech sectors. India follows at 29.4%, +25% over the global average, reflecting strong growth in industrial production, research in additive technologies, and rising domestic demand for precision manufacturing. Germany records 27.0%, +15% above the global CAGR, shaped by OECD-supported innovation, integration of hybrid systems, and applications in premium manufacturing segments. The United Kingdom posts 22.3%, slightly below the global rate, influenced by selective adoption in aerospace and defense sectors. The United States stands at 20.0%, −15% under the global benchmark, reflecting mature industrial applications but steady uptake in high-value production. BRICS nations are driving scale, while OECD markets emphasize technological refinement and precision manufacturing.

China is experiencing a CAGR of 31.7%, which is 8.2% higher than the global CAGR of 23.5%, reflecting rapid adoption of hybrid additive manufacturing in industrial and aerospace sectors. Domestic manufacturers are investing heavily in multi-functional machines that combine subtractive and additive processes, improving precision, production speed, and material efficiency. Strong government support for advanced manufacturing technologies and incentives for high-tech industries are accelerating market growth. Collaborations between research institutes and industrial enterprises are fostering innovation and scaling production capabilities. Increasing demand from automotive, aerospace, and medical device manufacturers is boosting machine deployment. Rising exports of high-performance hybrid manufacturing systems further strengthen China’s global market position.

India is recording a CAGR of 29.4%, 5.9% above the global CAGR, fueled by adoption of hybrid additive machines in aerospace, automotive, and medical sectors. Investment in advanced multi-process machines that integrate additive and subtractive manufacturing is improving efficiency, material utilization, and production speed. Government initiatives promoting high-tech manufacturing clusters and R&D programs accelerate deployment. Partnerships with global machine tool providers enable faster technology transfer and scale-up. Growing demand for prototyping and precision manufacturing across industrial sectors strengthens market adoption. India’s focus on industrial automation and advanced manufacturing capabilities positions it as a leading growth market within the Asia-Pacific region.

Germany is growing at a CAGR of 27.0%, 3.5% above the global CAGR, driven by adoption in automotive, aerospace, and industrial manufacturing sectors. Advanced multi-functional machines for hybrid additive and subtractive processes are increasingly used to reduce production time and enhance precision. Strong R&D infrastructure and industrial collaborations support innovation and high-quality machine manufacturing. Regulatory standards in precision engineering and materials compliance further enhance adoption. Export of high-performance hybrid machines to Europe and North America contributes to steady growth. Germany’s focus on industrial automation, precision engineering, and high-value manufacturing sustains market expansion above the global average.

The United Kingdom is expanding at a CAGR of 22.3%, slightly below the global CAGR of 23.5%, reflecting moderate adoption. Hybrid additive manufacturing is used primarily in aerospace, medical, and industrial prototyping sectors. Adoption is supported by collaboration with international technology providers and local research institutions. Investments in R&D and automation solutions enhance the performance and efficiency of hybrid machines. Demand for precision manufacturing, rapid prototyping, and high-performance components drives steady market activity. Import of advanced hybrid machines supplements domestic capabilities, supporting incremental growth. The UK market reflects gradual adoption, with steady expansion in aerospace and industrial prototyping applications.

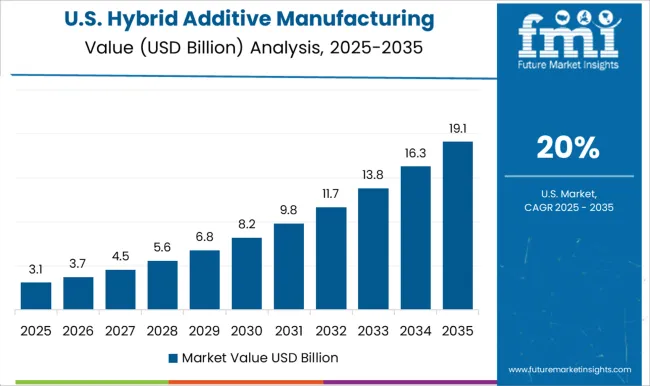

The United States is progressing at a CAGR of 20.0%, 3.5% below the global CAGR, reflecting slower expansion relative to Asia and Europe. Growth is driven by aerospace, automotive, and industrial manufacturing sectors, with focus on multi-process hybrid additive machines to improve precision and reduce lead time. Domestic production is complemented by imports of advanced equipment from Europe and Asia. Investment in R&D and digital integration improves efficiency and reduces operational costs. The market is mature in terms of industrial adoption, with growth concentrated in high-value manufacturing, prototyping, and aerospace applications.

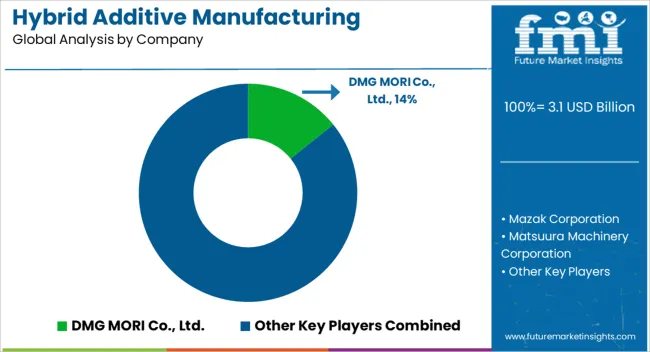

The hybrid additive manufacturing machines market is driven by manufacturers and suppliers providing precision equipment that combines additive and subtractive processes for aerospace, automotive, medical, and industrial applications. DMG MORI Co., Ltd. is assumed to be the leading player, offering a portfolio of hybrid machines designed for high-accuracy part production, complex geometries, and multi-material compatibility. Mazak Corporation and Matsuura Machinery Corporation maintain competitive positions with integrated milling-additive systems, emphasizing surface finish, repeatability, and productivity. Stratasys Ltd and voxeljet AG focus on polymer and metal 3D printing solutions with post-processing capabilities that enhance part functionality. Optomec provides directed energy deposition systems for repair and prototype applications, while SLM SOLUTIONS GROUP AG delivers laser-based additive platforms for aerospace and industrial manufacturing. Materialise supports manufacturers with software-driven additive solutions and process optimization, and GE Additive strengthens the market with turnkey machines, service packages, and application-specific configurations. Product brochures highlight hybrid machining capabilities, high-precision additive layering, multi-axis milling, software-controlled process integration, and material versatility. Features such as dimensional accuracy, surface quality, repeatable output, and process reliability are emphasized. Technical datasheets and application notes provide guidance for metal alloys, polymers, and composite materials, enabling manufacturers to optimize production workflows and achieve complex designs efficiently. Collectively, these offerings focus on precision, reliability, and adaptability, supporting industrial and aerospace operators in producing high-performance components with reduced lead times and enhanced material utilization.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Machine Type | Powder Bed Fusion, Direct Energy Deposition, Material Extrusion, Hybrid CNC-Additive, and Others |

| Material Type | Titanium Alloys, Aluminum Alloys, Stainless Steel, Nickel Alloys, and Ceramics & Others |

| End-Use Industry | Aerospace & Defense, Medical, Automotive, Energy, and Electronics |

| Application | Repair, Production, Prototyping, Tooling, and Custom Parts |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DMG MORI Co., Ltd., Mazak Corporation, Matsuura Machinery Corporation, Stratasys Ltd, voxeljet AG, Optomec, SLM SOLUTIONS GROUP AG, Materialise, and GE Additive |

| Additional Attributes | Dollar sales by machine type and material application, demand dynamics across aerospace, automotive, and medical industries, regional trends across North America, Europe, and Asia-Pacific, innovation in multi-material printing, precision machining integration, and high-speed production, environmental impact of energy consumption and material efficiency, and emerging use cases in complex component fabrication, repair, and customized manufacturing. |

The global hybrid additive manufacturing machines market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the hybrid additive manufacturing machines market is projected to reach USD 25.5 billion by 2035.

The hybrid additive manufacturing machines market is expected to grow at a 23.5% CAGR between 2025 and 2035.

The key product types in hybrid additive manufacturing machines market are powder bed fusion, direct energy deposition, material extrusion, hybrid cnc-additive and others.

In terms of material type, titanium alloys segment to command 23.7% share in the hybrid additive manufacturing machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA