The Hybrid Memory Cube Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 12.4 billion by 2035, registering a compound annual growth rate (CAGR) of 18.0% over the forecast period. This strong pace reflects the increasing need for high-performance computing and energy-efficient memory solutions across industries such as data centers, artificial intelligence, and cloud computing. Hybrid memory cube (HMC) technology offers higher bandwidth and lower power consumption compared to traditional DRAM, making it highly attractive for handling intensive workloads. The surge in AI-driven applications, deep learning, and advanced analytics has further accelerated adoption, as conventional architectures often face bottlenecks in data transfer speeds.

The rising use of graphics processing units (GPUs) and field-programmable gate arrays (FPGAs) in advanced computing environments is creating complementary demand for HMC integration. Moreover, telecommunications and networking infrastructure upgrades, especially for 5G and edge computing, are contributing to the growing reliance on high-speed memory. Despite higher costs and design complexity compared to standard DRAM, the performance advantages are expected to outweigh constraints, particularly in mission-critical and high-performance environments.

| Metric | Value |

|---|---|

| Hybrid Memory Cube Market Estimated Value in (2025 E) | USD 2.4 billion |

| Hybrid Memory Cube Market Forecast Value in (2035 F) | USD 12.4 billion |

| Forecast CAGR (2025 to 2035) | 18.0% |

The hybrid memory cube market is gaining momentum due to the need for high bandwidth, energy-efficient memory solutions in data-intensive computing environments. Growing demand from data centers, artificial intelligence workloads, and high-performance computing applications is accelerating the transition from traditional memory architectures toward hybrid memory cube technologies.

These cubes offer significant advantages in terms of data transfer speeds, scalability, and reduced latency, which are increasingly valued in modern computing infrastructure. As enterprises continue to process exponentially growing datasets, hybrid memory cube technology is being positioned as a core component in next-generation memory ecosystems.

Additionally, advances in 3D stacking and through-silicon via technologies are enabling further integration and performance improvements, contributing to favorable market growth across computing and networking environments.

The hybrid memory cube market is segmented by product, memory, application, end-user, and geographic regions. By product, the hybrid memory cube market is divided into Central Processing Unit (CPU), Field-Programmable Gate Array (FPGA), Graphics Processing Units (GPU), Application-Specific Integrated Units (ASIC), and Accelerated Processing Units (APU). In terms of memory, the hybrid memory cube market is classified into Standard and Advanced. Based on application, the hybrid memory cube market is segmented into High-Performance Computing (HPC), Networking and Telecommunications, Data Centers & Cloud Computing, and Consumer Electronics.

By end-user, the hybrid memory cube market is segmented into IT & Telecommunications, BFSI, Retail, Automotive, Media & Entertainment, and Others. Regionally, the hybrid memory cube industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The central processing unit segment is projected to represent 48.60% of total market revenue by 2025 within the product category. This dominance is being driven by the need for faster data access and enhanced memory throughput in modern computing systems.

The ability of hybrid memory cube to support CPU architectures by delivering high speed interconnect and low power consumption has strengthened its deployment across server and workstation platforms. As performance bottlenecks in traditional memory subsystems become more evident, CPUs are increasingly paired with high-bandwidth cube memory to achieve better processing efficiency.

Industry adoption is being reinforced by the integration of these memory systems into mainstream data processing units, solidifying the CPU segment's leadership within the product category.

The standard memory subsegment is anticipated to contribute 55.20% of overall revenue within the memory category by 2025. This preference is supported by its broad compatibility with existing infrastructure and cost efficiency in mass deployments.

Organizations leveraging hybrid memory cube solutions are prioritizing scalable memory configurations that offer high performance without requiring proprietary customizations. The wide adoption of standard memory modules across consumer and enterprise devices has facilitated the use of hybrid memory cube in existing systems.

Additionally, the balance between affordability and technical performance makes standard memory the preferred choice for general purpose computing applications, securing its dominant market share..

The high performance computing segment is expected to account for 42.10% of market revenue by 2025 within the application category. This leadership is attributed to the intense processing demands of simulation, modeling, and scientific computing tasks that require memory technologies with high bandwidth and low latency.

Hybrid memory cube enables superior data transfer rates essential for real time computation and large scale parallel processing. Government funded research labs, academic institutions, and private sector innovation centers are adopting these systems to drive performance boundaries.

The ability to handle complex computations with greater efficiency has positioned hybrid memory cube as an indispensable component in high performance computing infrastructure, thereby reinforcing this segment’s dominance.

The hybrid memory cube (HMC) market is experiencing significant growth due to the increasing demand for high-performance memory solutions in sectors like data centers, cloud computing, telecommunications, and AI-driven applications. HMC is known for its high bandwidth, low power consumption, and superior efficiency compared to traditional memory architectures like DRAM. As data processing requirements continue to increase, the need for faster and more efficient memory solutions has become more crucial. The market is further driven by advancements in memory technology, as hybrid memory cubes offer improved data throughput and reliability for applications that require massive data handling capabilities.

The primary driver for the growth of the hybrid memory cube market is the rising need for higher bandwidth and faster data processing in modern computing systems. As industries such as artificial intelligence (AI), machine learning, big data analytics, and cloud computing generate ever-larger volumes of data, traditional memory solutions like DRAM struggle to meet the required performance and efficiency standards. HMC technology offers significant improvements in speed and data transfer rates, providing a solution to the bottlenecks faced by current memory systems. With its ability to support high-performance applications, HMC is becoming an integral part of advanced computing systems, driving demand across various sectors.

Despite its advantages, the hybrid memory cube market faces challenges, primarily high production costs and adoption barriers. HMC technology requires specialized manufacturing techniques and infrastructure, which increases production costs compared to conventional memory types. This can limit its adoption, especially in price-sensitive markets where the cost-benefit ratio of switching to HMC may not be justifiable. Furthermore, integrating HMC with existing systems and infrastructure can be complex and costly. Many businesses may hesitate to adopt HMC due to the need for significant upgrades to their hardware or software. Overcoming these challenges involves reducing production costs, improving compatibility, and demonstrating the long-term value of HMC for high-performance computing applications.

The hybrid memory cube market presents substantial opportunities, particularly with the increasing integration of AI, cloud computing, and edge computing applications. HMC technology is well-suited to handle the large data processing needs of AI and machine learning applications, where speed and efficiency are critical for real-time data analysis. Additionally, as cloud services grow, the need for efficient memory architectures that can handle vast amounts of data with minimal latency is increasing. The deployment of HMC in edge computing applications, which require high-speed data access and reduced power consumption, also presents a significant growth opportunity. As industries continue to prioritize high-performance, low-latency computing, the adoption of HMC is expected to increase, driving market expansion.

A key trend in the hybrid memory cube market is the increasing adoption of HMC in data centers and AI systems. As the demand for cloud storage and computing power grows, data centers are increasingly looking for memory solutions that can deliver high bandwidth while minimizing power consumption. HMC's ability to provide faster data access and higher bandwidth makes it a compelling option for these applications. Additionally, AI and machine learning systems, which require rapid access to vast amounts of data, benefit from the high-speed capabilities of HMC technology. This trend is likely to continue as businesses in these sectors seek to improve the performance and efficiency of their systems. The ongoing advancements in HMC technology are also making it more accessible and efficient, further boosting its adoption in these sectors.

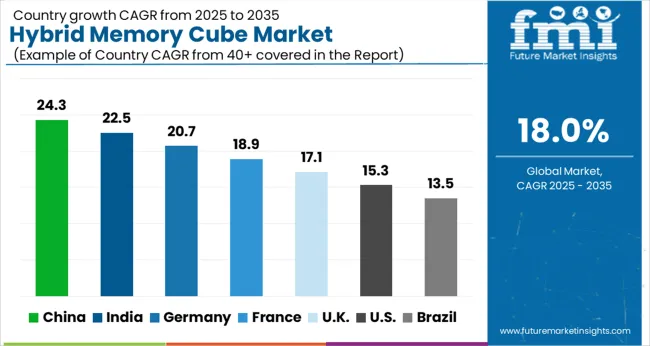

| Country | CAGR |

|---|---|

| China | 24.3% |

| India | 22.5% |

| Germany | 20.7% |

| France | 18.9% |

| UK | 17.1% |

| USA | 15.3% |

| Brazil | 13.5% |

The global hybrid memory cube market is projected to grow at a CAGR of 18% from 2025 to 2035. China leads at 24.3%, followed by India at 22.5%, and France at 18.9%, while the United Kingdom records 17.1% and the United States posts 15.3%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: the rapid growth of cloud computing, data centers, and high-performance computing in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to established infrastructure and high competition. The analysis includes over 40+ countries, with the leading markets detailed below.

The hybrid memory cube market in China is growing at a 24.3% CAGR through 2035. The rapid expansion of the data center industry, along with increasing demand for high-performance computing solutions, is driving the need for hybrid memory cube technologies. The growing focus on cloud computing, AI applications, and IoT systems in China is further accelerating the market growth. Additionally, the country’s significant investments in memory chip manufacturing and advancements in semiconductor technologies are contributing to the growing adoption of hybrid memory cubes. As China continues to modernize its digital infrastructure, demand for faster and more efficient memory solutions rises.

The hybrid memory cube market in India is projected to grow at a 22.5% CAGR through 2035. India’s growing focus on digitalization and the rise of the cloud computing industry are key factors driving market growth. As the demand for high-performance computing and data storage solutions increases, businesses are increasingly adopting hybrid memory cubes for faster data processing. India’s expanding tech ecosystem, combined with the government’s push for smart city projects and digital infrastructure, is further contributing to the growth of the market. Additionally, the growing interest in AI, machine learning, and big data analytics in India accelerates the adoption of these advanced memory solutions.

Demand for hybrid memory cubes in France is projected to grow at an 18.9% CAGR through 2035. France’s strong emphasis on digital transformation in various sectors, including IT, telecom, and manufacturing, is a major factor driving the demand for high-performance memory solutions. The growing adoption of AI, big data analytics, and machine learning technologies is contributing to the increased need for advanced memory systems like hybrid memory cubes. France’s increasing investments in data centers and cloud infrastructure further boost the demand for these solutions. Additionally, France’s role as a leading player in Europe’s tech industry supports the growth of the market.

The UK market for air insulated transformers is expected to grow at a 5.2% CAGR through 2035. The increasing demand for reliable energy systems, coupled with the country’s focus on transitioning to renewable energy sources, drives the adoption of air insulated transformers. The UK is heavily investing in electrical grid modernization to accommodate more decentralized renewable energy sources like solar and wind. Additionally, the ongoing expansion of energy-efficient infrastructure in the residential, industrial, and transportation sectors supports the market for air insulated transformers. The country’s regulatory framework and government incentives for green technologies further contribute to market growth.

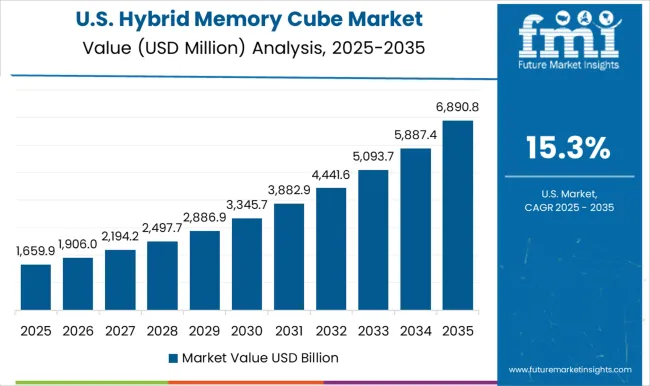

Demand for hybrid memory cubes in the USA is projected to grow at a 15.3% CAGR through 2035. The USA is a major market for hybrid memory cubes, driven by the increasing demand for advanced memory solutions in sectors like cloud computing, AI, and big data analytics. The rise of IoT applications and the growing need for faster data processing in industrial and commercial sectors are key drivers of market growth. The USA government’s investments in digital infrastructure and its strong position in the global tech industry further accelerate the adoption of high-performance memory technologies.

The hybrid memory cube (HMC) market is driven by leading technology companies offering advanced memory solutions designed to address the increasing demand for high-performance, low-power memory systems in applications such as data centers, AI, and high-performance computing. Advanced Micro Devices, Inc. (AMD) is a key player, providing HMC technology to enable faster data access and improved processing capabilities in its processors. Cadence Design Systems, Inc. specializes in software and hardware design solutions, enabling optimized memory integration in hybrid memory systems. Fujitsu Limited offers cutting-edge HMC solutions, leveraging its expertise in semiconductor technology to provide high-performance memory solutions for enterprise and supercomputing applications. IBM Corporation is a significant contributor, offering HMC technology as part of its high-performance computing solutions, focusing on providing efficient memory management and data processing. Intel Corporation plays a pivotal role, integrating HMC solutions into its processors and system architectures to enhance overall system performance and memory efficiency. Micron Technology, Inc. is a global leader in memory solutions, including HMC, providing high-bandwidth memory for a range of high-performance computing applications.

NVIDIA Corporation integrates HMC into its GPUs, enabling faster memory access for AI and deep learning workloads. Samsung Electronics Co., Ltd. offers advanced memory solutions, including HMC, for high-performance computing and data center applications, focusing on innovation and scalability. SK Hynix Inc. is a leading memory manufacturer, offering high-performance HMC solutions tailored for large-scale applications. Xilinx, Inc. provides HMC technology as part of its programmable logic devices, enhancing memory capacity and processing speed for customizable applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Product | Central Processing Unit (CPU), Field-Programmable Gate Array (FPGA), Graphics Processing Units (GPU), Application-Specific Integrated Units (ASIC), and Accelerated Processing Units (APU) |

| Memory | Standard and Advanced |

| Application | High-Performance Computing (HPC), Networking and Telecommunications, Data Centers & Cloud Computing, and Consumer Electronics |

| End-user | IT & Telecommunications, BFSI, Retail, Automotive, Media & Entertainment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Advanced Micro Devices, Inc, Cadence Design Systems, Inc., Fujitsu Limited, IBM Corporation, Intel Corporation, Micron Technology, Inc., NVIDIA Corporation, Samsung electronics co., ltd., SK Hynix Inc., and Xilinx, Inc. |

| Additional Attributes | Dollar sales by product type (3D memory, high-bandwidth memory, DRAM) and end-use segments (data centers, AI, high-performance computing, automotive, IoT). Demand dynamics are driven by the growing need for faster, more efficient memory systems in AI, machine learning, and big data applications. Regional trends show strong growth in North America, Asia-Pacific, and Europe, with advancements in memory technology and the increasing demand for high-performance computing systems fueling market expansion. |

The global hybrid memory cube market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the hybrid memory cube market is projected to reach USD 12.4 billion by 2035.

The hybrid memory cube market is expected to grow at a 18.0% CAGR between 2025 and 2035.

The key product types in hybrid memory cube market are central processing unit (cpu), field-programmable gate array (fpga), graphics processing units (gpu), application-specific integrated units (asic) and accelerated processing units (apu).

In terms of memory, standard segment to command 55.2% share in the hybrid memory cube market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cloud Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Diesel Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Seeds Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA