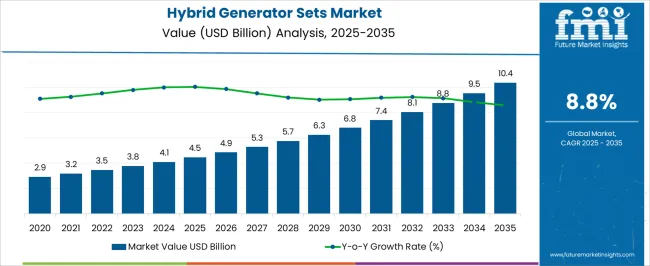

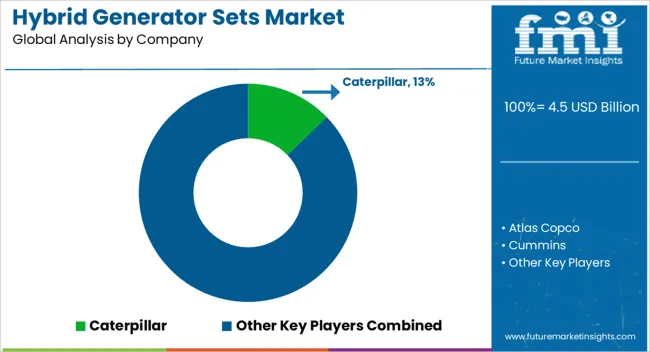

The hybrid generator sets market, valued at USD 4.5 billion in 2025 and projected to reach USD 10.4 billion by 2035 at a CAGR of 8.8%, demonstrates strong growth momentum supported by evolving technology contributions. The market is shaped by the integration of conventional fuel engines with renewable sources such as solar and wind, as well as advanced energy storage solutions.

Diesel-solar hybrid generators remain dominant due to their reliability and applicability in off-grid and remote operations, contributing a significant portion of early adoption. Gas-solar hybrids are increasingly favored in regions with stricter emission norms and are expected to expand their share through the forecast period. Battery-integrated hybrid generators play a transformative role, particularly as lithium-ion and next-generation storage systems enhance efficiency and reduce operational costs. Wind-diesel and fuel cell-supported hybrids remain niche but hold long-term potential where renewable infrastructure is advancing.

The overall contribution by technology reveals a shift from reliance on fossil-dominant combinations toward systems emphasizing renewable integration and storage. This transition positions the market for stronger adoption in regions prioritizing cleaner and more resilient power generation architectures.

| Metric | Value |

|---|---|

| Hybrid Generator Sets Market Estimated Value in (2025 E) | USD 4.5 billion |

| Hybrid Generator Sets Market Forecast Value in (2035 F) | USD 10.4 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The hybrid generator sets market represents a growing segment of the global power generation industry, reflecting its importance in delivering efficient and flexible energy solutions. Within the broader genset market, it holds about 6.1%, supported by the transition toward cleaner power options. In the distributed energy generation space, it accounts for nearly 4.7%, driven by applications in remote sites, construction, and telecom infrastructure. Across the renewable energy and backup power integration sector, the share stands at 5.2%, highlighting its ability to combine conventional fuel with solar or wind inputs. Within the industrial and commercial standby power equipment category, it secures 3.9%, showcasing its relevance in reducing fuel costs and emissions. In the off grid electrification equipment segment, the market maintains about 4.3%, underlining its role in rural and island power supply solutions. Recent developments show notable advancements in fuel efficiency, control systems, and hybrid integration.

Manufacturers are launching gensets with advanced energy management software capable of balancing diesel, gas, and renewable sources in real time. Lithium-ion battery banks are increasingly paired with gensets to provide peak shaving, reduced idling, and silent operations during low-load periods. Compact modular designs are being favored to allow scalability in commercial and industrial projects.

The adoption of smart remote monitoring technologies is enabling operators to track performance and optimize maintenance schedules. Furthermore, sustainability-linked developments such as biofuel-compatible gensets and hybrid systems designed for microgrids are gaining traction, reflecting the ongoing shift toward cost-effective and environmentally responsible power solutions.

The hybrid generator sets market is expanding steadily, driven by the need for reliable, fuel-efficient, and low-emission power solutions across multiple sectors. Industry publications and manufacturer updates have pointed to growing adoption in regions with unstable grid infrastructure and high demand for backup power. Hybrid generator sets, which integrate conventional engines with renewable energy sources and advanced storage systems, have gained traction due to their ability to optimize fuel consumption while reducing operating costs and environmental impact.

Technological advancements, such as smart load management and remote monitoring capabilities, have improved operational efficiency and lifecycle performance. Additionally, government incentives promoting clean and efficient energy generation have encouraged uptake in both developed and emerging markets.

The market outlook remains positive, supported by industrial sector expansion, increased deployment for standby power in mission-critical applications, and rising interest from commercial and residential users seeking energy resilience and cost control.

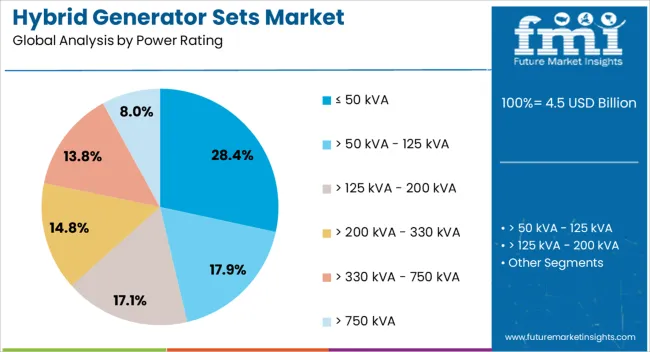

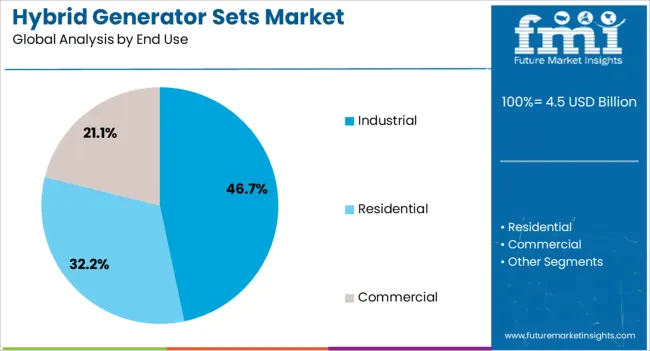

The hybrid generator sets market is segmented by power rating, end use, application, and geographic regions. By power rating, the hybrid generator sets market is divided into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA. In terms of end use, the hybrid generator sets market is classified into Industrial, Residential, and Commercial.

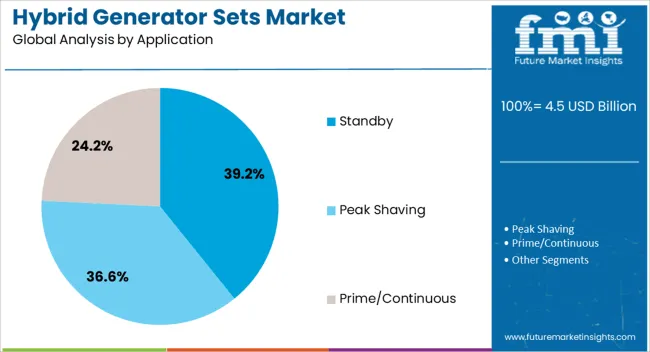

Based on application, the hybrid generator sets market is segmented into Standby, Peak Shaving, and Prime/Continuous. Regionally, the hybrid generator sets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 50 kVA segment is projected to contribute 28.4% of the hybrid generator sets market revenue in 2025, maintaining a strong share due to its suitability for small-scale, decentralized power needs. This rating range has been widely utilized in applications requiring portable or compact power solutions, including small industrial units, commercial establishments, and remote sites.

Manufacturers have focused on improving fuel efficiency and incorporating hybrid energy management systems into these lower-rated units, enabling them to deliver cost-effective and environmentally friendly performance.

The segment’s appeal is also linked to ease of transportation, quick installation, and minimal maintenance requirements. In emerging markets, the ≤ 50 kVA units have been preferred for rural electrification projects and small business operations, where grid access is limited. With increasing demand for flexible, low-capacity power systems, this segment is expected to sustain growth, particularly in regions prioritizing energy reliability and reduced carbon emissions.

The industrial segment is projected to hold 46.7% of the hybrid generator sets market revenue in 2025, retaining its leadership due to the sector’s high and continuous power requirements. Industrial operations, including manufacturing, mining, and construction, have adopted hybrid generator sets to ensure uninterrupted power supply while optimizing fuel use.

Energy cost savings and reduced environmental footprint have been key drivers for adoption, especially in industries facing regulatory pressure to curb emissions.

Industrial facilities have also integrated hybrid generator systems with renewable sources like solar PV to enhance operational efficiency and meet sustainability targets. Furthermore, the ability to provide stable power in remote or off-grid industrial sites has strengthened the segment’s position. As industrialization accelerates in emerging economies and global industries invest in greener power infrastructure, the industrial segment is expected to remain a major revenue contributor to the hybrid generator sets market.

The standby segment is projected to account for 39.2% of the hybrid generator sets market revenue in 2025, leading the application landscape due to the rising importance of backup power in critical operations. Standby hybrid generator sets have been favored for their ability to automatically engage during grid outages, ensuring minimal downtime for facilities such as hospitals, data centers, and manufacturing plants.

Technological enhancements, including fast-start capability, intelligent load sharing, and integration with energy storage systems, have improved the reliability and responsiveness of standby units.

This segment has benefited from increasing investment in infrastructure resilience, especially in regions prone to power interruptions. Additionally, industries with zero-tolerance policies for downtime have prioritized standby systems to protect productivity and prevent losses. With growing emphasis on operational continuity and disaster preparedness, the standby segment is expected to sustain its leadership in the hybrid generator sets market.

The market has gained prominence as industries, commercial facilities, and residential projects seek reliable and efficient backup power solutions. Hybrid gensets combine conventional fuel-based engines with renewable energy sources or battery storage systems, ensuring steady power while reducing fuel consumption and emissions. They are increasingly deployed in regions where grid reliability is limited or intermittent. Integration with solar, wind, or advanced storage systems has positioned hybrid gensets as a preferred choice for off-grid and remote installations. Growing demand from telecom towers, mining operations, construction sites, and military applications has accelerated adoption.

Hybrid generator sets have witnessed strong adoption in the telecom sector and remote applications where continuous power availability is critical. Telecom operators rely on hybrid gensets to reduce diesel dependency and operating expenses, particularly in rural and off-grid sites. The combination of renewable integration and energy storage allows gensets to optimize fuel efficiency while reducing downtime. Mining and oilfield operations have also adopted hybrid systems due to their ability to function in harsh environments with limited grid connectivity. Remote military bases favor hybrid gensets for their silent operation, enhanced mobility, and reduced logistical burden in transporting fuel. The market benefits from infrastructure development in emerging economies where grid extension remains challenging. By providing resilience and energy autonomy, hybrid gensets have positioned themselves as a reliable solution in critical applications.

The integration of renewable power generation and battery storage has enhanced the performance and market potential of hybrid generator sets. Solar-diesel hybrid gensets are widely deployed in areas with abundant sunlight, reducing diesel usage significantly. Similarly, wind integration supports installations in coastal and high-wind regions. Battery storage systems enable load leveling, peak shaving, and smooth power supply during fluctuating demand. Hybrid gensets with advanced energy management systems ensure efficient utilization of available resources while maintaining grid stability. These features appeal to industries seeking lower carbon footprints and energy independence. Technological improvements in lithium-ion and advanced lead-acid batteries have enhanced hybrid genset efficiency and lifecycle economics. The growing global push for renewable integration further boosts demand for hybrid solutions, ensuring hybrid generator sets remain strategically positioned in decentralized energy generation.

Despite their advantages, hybrid generator sets face challenges related to high initial investment and infrastructure requirements. The integration of renewable components and energy storage increases the upfront cost compared to traditional gensets, which discourages adoption in cost-sensitive markets. Limited awareness about lifecycle cost benefits adds to the challenge. In addition, inadequate infrastructure for renewable integration in certain regions hampers wider deployment. The complexity of energy management systems and skilled workforce requirements can also pose operational hurdles. Regulatory barriers and lack of uniform emission compliance frameworks further slowdown adoption. However, as fuel costs rise and emission regulations tighten, these challenges are expected to ease over time. Broader acceptance will depend on government incentives, financing options, and collaborative models to reduce the financial burden on end users.

Construction and industrial sectors have emerged as strong contributors to hybrid generator sets market growth. Large construction projects increasingly adopt hybrid gensets to manage varying power demands while minimizing fuel usage. Portable and mobile hybrid gensets are particularly valued at temporary sites. Industrial operations in manufacturing and processing facilities prefer hybrid systems for their efficiency and reduced operational expenditure. The ability to maintain uninterrupted power without overloading the grid has made hybrid gensets attractive in regions experiencing frequent power shortages. With increasing emphasis on green building certifications and sustainable construction practices, hybrid gensets have found greater traction. Industrial decarbonization targets further support their market role as companies invest in cleaner and more efficient backup solutions. These applications underline the broader industrial transition toward hybrid energy systems.

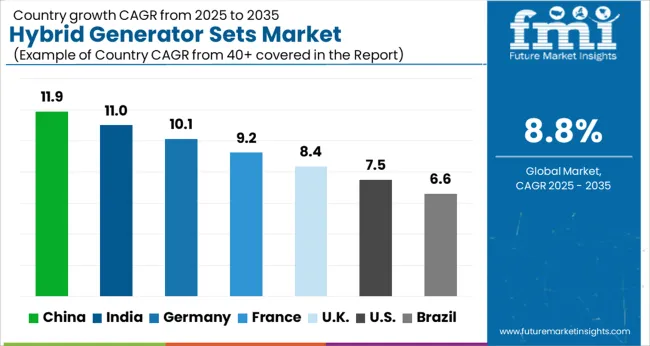

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

China leads the market with a forecasted growth rate of 11.9%, supported by the country’s investments in energy efficiency and demand for reliable backup solutions. India follows closely at 11.0%, where hybrid systems are increasingly deployed to address power shortages and integrate renewable energy. Germany posts a growth rate of 10.1%, with rising adoption across commercial and industrial facilities seeking to reduce carbon intensity. The United Kingdom shows 8.4% growth, driven by its emphasis on clean energy infrastructure and standby power reliability. The United States registers 7.5% growth, influenced by higher adoption in residential, construction, and critical facilities. Together, these leading markets highlight the transition toward sustainable, efficient, and resilient power generation systems worldwide. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 11.9%, influenced by rapid industrialization and infrastructure expansion. Rising energy demand across construction sites, remote facilities, and commercial hubs is driving the shift toward hybrid systems that combine renewable sources with conventional generators. Strong government emphasis on reducing fuel dependency and emissions is fostering adoption. In addition, advancements in battery storage technologies are enabling wider deployment of hybrid generator solutions across multiple sectors, ensuring consistent growth in this market.

India is anticipated to register a CAGR of 11.0%, supported by increasing power demand in semi-urban and rural areas. Frequent grid unreliability is prompting businesses and households to invest in hybrid solutions that combine renewable energy with diesel or gas-based generators. Policy-driven initiatives toward cleaner energy use are also encouraging adoption. The ability of hybrid sets to reduce operational costs and fuel consumption is making them attractive across telecom, healthcare, and commercial applications. This trend is expected to accelerate as renewable deployment expands further.

Germany is forecasted to expand at a CAGR of 10.1%, driven by the country’s strong renewable energy ecosystem. Hybrid generators are being increasingly deployed to complement solar and wind power generation, especially in decentralized energy setups. The focus on emission reduction and energy efficiency is pushing industries and commercial facilities to adopt hybrid solutions. Growing application in temporary power supply for events and construction projects is also adding momentum. The German market benefits from advanced technological integration, particularly in storage and smart energy management systems.

The market in the United Kingdom is projected to record a CAGR of 8.4%, supported by increasing demand for cleaner backup power systems. Rising adoption of hybrid sets in remote sites, defense operations, and temporary installations is a key growth factor. Government commitment to lower carbon emissions is encouraging industries to shift away from conventional diesel-only solutions. Hybrid generators are also finding growing use in supporting renewable integration with storage technologies, ensuring reliable electricity in diverse applications.

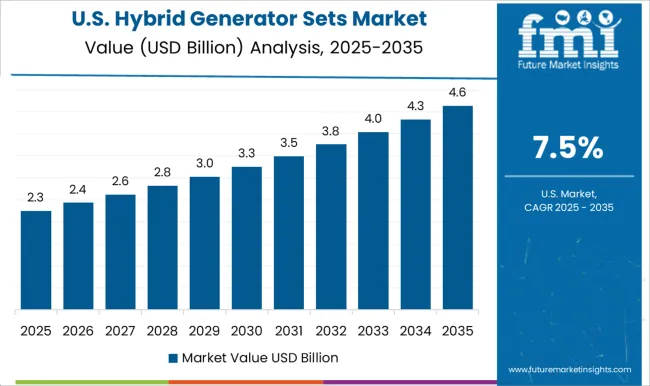

The market in the United States is expected to grow at a CAGR of 7.5%, influenced by increasing reliance on resilient power supply. The need for backup solutions in data centers, healthcare facilities, and critical infrastructure is stimulating demand for hybrid generators. Market growth is further supported by rising investments in renewable energy, which hybrid sets can complement effectively. A growing preference for fuel-efficient and low-maintenance power solutions is steering businesses toward hybrid systems that ensure both cost savings and reduced emissions.

The market is shaped by a balanced mix of global leaders and specialized regional firms that focus on energy-efficient and reliable power generation. Caterpillar, Cummins, and Atlas Copco dominate the space with advanced hybrid solutions that integrate conventional engines with renewable technologies for optimized fuel consumption. Generac Power Systems, Kohler, and DEUTZ contribute with scalable models that are widely adopted in residential, commercial, and industrial settings.

HIMOINSA and Genesal Energy maintain strong positions in Europe with tailored hybrid solutions for backup and continuous power needs. Asian and emerging market players are also gaining traction. Jakson and Mahindra Powerol have enhanced their portfolios with hybrid gensets targeted at telecom, construction, and remote applications. Shenzhen NYY Technology and Starkgen Generator emphasize competitive pricing and adaptability for regional demand. Fischer Panda and Teksan provide compact hybrid systems with a focus on marine, defense, and mobile applications. Dawsongroup extends the market scope by offering hybrid generators as part of its rental fleet services.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Power Rating | ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA |

| End Use | Industrial, Residential, and Commercial |

| Application | Standby, Peak Shaving, and Prime/Continuous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Atlas Copco, Cummins, Dawsongroup, DEUTZ, Fischer Panda, Generac Power Systems, Genesal Energy, HIMOINSA, Jakson, Kohler, MAHINDRA POWEROL, Shenzhen NYY Technology, Starkgen Generator, and Teksan |

| Additional Attributes | Dollar sales by generator type and capacity, demand dynamics across residential, commercial, and industrial sectors, regional trends in hybrid power adoption, innovation in fuel efficiency, energy storage integration, and automation, environmental impact of reduced emissions and fuel consumption, and emerging use cases in off-grid power, remote operations, and renewable energy backup systems. |

The global hybrid generator sets market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the hybrid generator sets market is projected to reach USD 10.4 billion by 2035.

The hybrid generator sets market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in hybrid generator sets market are ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 330 kva, > 330 kva - 750 kva and > 750 kva.

In terms of end use, industrial segment to command 46.7% share in the hybrid generator sets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cloud Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA