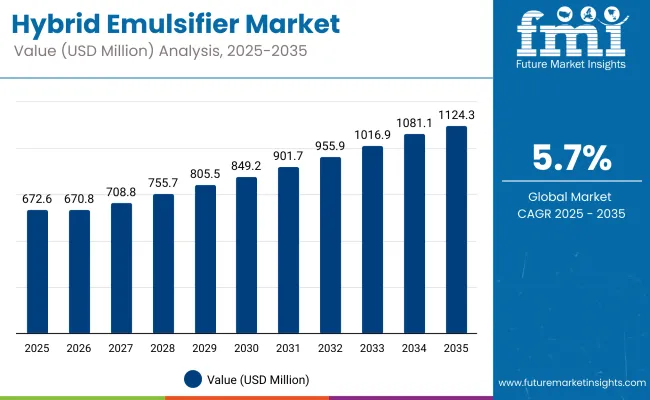

The Hybrid Emulsifier Market is expected to record a valuation of USD 672.60 million in 2025 and USD 1.12 billion in 2035, with an increase of USD 442.56 million, which equals a growth of 65.7% over the decade. The overall expansion represents a CAGR of 5.7% and a 1.65X increase in market size.

Hybrid Emulsifier Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 672.60 Million |

| Market Forecast Value in (2035F) | USD 1.12 Billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

During the first five-year period from 2025 to 2030, the market is projected to increase from USD 672.60 million to USD 849.92 million, adding USD 177.32 million, which accounts for 40% of the total decade growth. This phase is expected to see steady adoption in food & beverage emulsions, cosmetics, and nutraceuticals, driven by the demand for multifunctional, clean-label, and high-performance ingredients. Protein-Polysaccharide Hybrid Emulsifiers are anticipated to dominate, catering to over 29% of applications requiring enhanced stability, texture, and sensory profiles.

The second half from 2030 to 2035 is forecast to contribute USD 265.24 million, equal to 60% of total growth, as the market advances from USD 849.92 million to USD 1.12 billion. This acceleration will likely be powered by large-scale deployment in AI-driven food formulation, plant-based product stabilization, and next-generation personal care emulsions. Demand for hybrid systems enabling reduced dosage, extended shelf life, and compatibility with automated processing is projected to surge. Application-led innovation, coupled with software-based formulation optimization, is expected to enhance recurring value streams and strengthen supplier-customer integration across regions.

From 2020 to 2024, the Hybrid Emulsifier Market expanded steadily, driven by the rising adoption of multifunctional emulsifiers across food, beverage, personal care, and nutraceutical sectors. During this period, the competitive landscape was dominated by global ingredient manufacturers controlling a substantial share of revenue, with leaders such as Cargill, DuPont Nutrition & Health, and Kerry Group focusing on innovation pipelines tailored for clean-label, plant-based, and performance-optimized applications. Competitive differentiation was achieved through formulation versatility, dosage efficiency, and regulatory compliance capabilities.

By 2025, demand is projected to reach USD 672.60 million, with the revenue mix expected to shift toward advanced hybrid systems enabling extended shelf life, improved sensory profiles, and reduced formulation complexity. Traditional market leaders are anticipated to face intensifying competition from agile, innovation-driven entrants offering enzyme-modified, bio-based, and application-specific hybrid emulsifiers. Strategic advantage is expected to transition from product functionality alone to the strength of technical support ecosystems, co-development capabilities, and integration into digital formulation platforms, ensuring scalability and long-term customer retention.

Growth in the Hybrid Emulsifier Market is being propelled by rising demand for multifunctional, clean-label ingredients capable of enhancing stability, texture, and sensory appeal across diverse formulations. Integration of protein-polysaccharide systems has enabled superior emulsification performance under complex processing conditions, meeting the evolving needs of food, beverage, personal care, and nutraceutical manufacturers. Advances in bio-based and enzyme-modified technologies have improved functionality while aligning with sustainability and regulatory compliance trends.

Expansion of plant-based and reduced-fat product portfolios has created new opportunities for hybrid emulsifiers to replace synthetic or single-function agents without compromising quality. Demand is being further driven by increasing formulation complexity in high-value categories such as premium dairy alternatives, fortified beverages, and advanced skincare products. Strategic collaborations between ingredient suppliers and brand owners are fostering co-development of tailored solutions, ensuring consistent performance across global markets. This innovation-led trajectory is expected to sustain strong market growth through the forecast horizon.

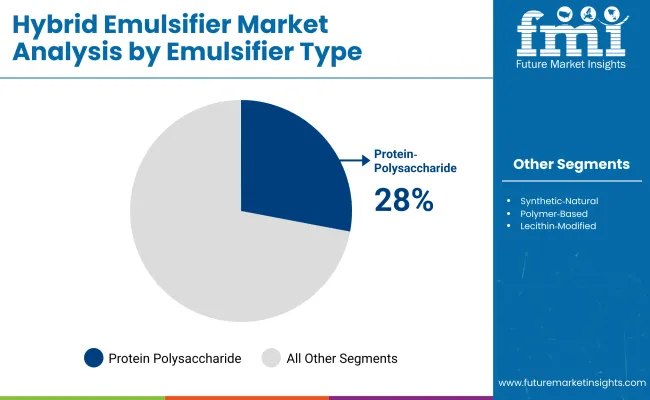

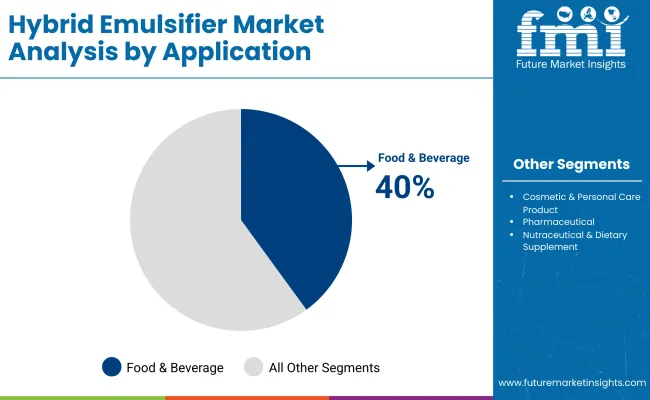

The Hybrid Emulsifier Market is segmented by Emulsifier Type, Application, and Product Form, reflecting the diversity of formulations and end-use requirements driving demand. The Emulsifier Type category includes protein-polysaccharide hybrids, synthetic-natural blends, polymer-based systems, lecithin-modified variants, and enzyme-modified solutions each designed to deliver enhanced stability, texture, and performance. Applications span food & beverage emulsions, cosmetics & personal care, pharmaceuticals, nutraceuticals, and industrial uses, catering to both functional and sensory needs.

Product Forms include liquid, powdered, and concentrated blends, enabling customization for processing efficiency and product integration. Regional dynamics influence adoption rates, with mature markets emphasizing clean-label compliance and emerging economies focusing on cost-effective functionality. Continuous innovation in ingredient sourcing and processing technologies is expected to drive balanced growth across all segments through 2035.

Emulsifier Type Segment Market Value Share, 2025

| Emulsifier Type | 2025 Share% |

|---|---|

| Protein Polysaccharide Hybrid Emulsifiers | 28% |

| Synthetic Natural Hybrid Emulsifiers | 20% |

| Polymer Based Hybrid Emulsifiers | 18% |

| Lecithin Modified Hybrid Emulsifiers | 17% |

| Enzyme Modified Hybrid Emulsifiers | 17% |

| Total | 100% |

| Emulsifier Type | CAGR (2025 to 2035) |

|---|---|

| Protein Polysaccharide Hybrid Emulsifiers | 9.10% |

| Synthetic Natural Hybrid Emulsifiers | 9.00% |

| Polymer Based Hybrid Emulsifiers | 9.30% |

| Lecithin Modified Hybrid Emulsifiers | 8.80% |

| Enzyme Modified Hybrid Emulsifiers | 9.20% |

The protein-polysaccharide hybrid emulsifier segment is projected to contribute 28% of the Hybrid Emulsifier Market revenue in 2025, maintaining its lead due to its superior stability and performance under complex processing conditions. This dominance is being driven by rising demand for clean-label, multifunctional solutions that align with both consumer preferences and industry compliance standards.

The segment’s growth is supported by ongoing research into bio-based polymers and advanced structuring techniques, which enhance emulsion stability across diverse pH and temperature ranges. Strategic collaborations between suppliers and manufacturers are fostering tailored solutions for high-value applications in dairy alternatives, premium beverages, and personal care products. With sustained innovation and process adaptability, this category is expected to remain central to the market’s expansion.

Application Segment Market Value Share, 2025

| Application | 2025 Share% |

|---|---|

| Food & Beverage Emulsions | 40% |

| Cosmetic & Personal Care Products | 20% |

| Pharmaceuticals | 12% |

| Nutraceuticals & Dietary Supplements | 15% |

| Industrial & Technical Applications | 13% |

| Total | 100% |

| Application | CAGR (2025 to 2035) |

|---|---|

| Food & Beverage Emulsions | 9.20% |

| Cosmetic & Personal Care Products | 9.00% |

| Pharmaceuticals | 8.90% |

| Nutraceuticals & Dietary Supplements | 9.10% |

| Industrial & Technical Applications | 8.70% |

The food & beverage emulsions segment is forecasted to hold 40% of the market share in 2025, driven by its critical role in enhancing texture, stability, and shelf life in diverse product categories. This dominance is being sustained by the rapid expansion of plant-based and functional food markets, where hybrid emulsifiers enable reformulation without compromising sensory appeal. Demand is further propelled by clean-label trends and regulatory shifts limiting synthetic emulsifier usage, creating space for multifunctional hybrid systems.

Advancements in droplet size control and oxidative stability are enabling higher performance in low-fat and fortified products. As manufacturers increasingly integrate hybrid emulsifiers into high-growth categories such as dairy alternatives, sauces, and premium beverages, this segment is expected to retain its leadership.

Product Form Segment Market Value Share, 2025

| Product Form | 2025 Share% |

|---|---|

| Liquid Emulsifiers | 45% |

| Powdered Emulsifiers | 35% |

| Concentrates & Blends | 20% |

| Total | 100% |

| Product Form | CAGR (2025 to 2035) |

|---|---|

| Liquid Emulsifiers | 9.00% |

| Powdered Emulsifiers | 9.20% |

| Concentrates & Blends | 9.40% |

The liquid emulsifiers segment is expected to account for 45% of the Hybrid Emulsifier Market revenue in 2025, reflecting its versatility in both large-scale manufacturing and small-batch production environments. This segment’s position is supported by ease of dispersion, faster integration into processing lines, and compatibility with automated dosing systems. Growing adoption in high-volume food processing and personal care manufacturing is reinforcing its dominance.

Innovations in stabilization and preservation have enhanced shelf life and functionality, making liquid forms increasingly attractive for global supply chains. As industries seek reduced processing times and lower operational complexity, liquid hybrid emulsifiers are projected to maintain a commanding share, supported by continuous investment in formulation optimization and production efficiency improvements.

Rising input costs and formulation complexities are challenging Hybrid Emulsifier Market adoption, even as demand expands in food, personal care, and nutraceutical applications for multifunctional, high-performance emulsification systems tailored to diverse processing and sensory requirements.

Shift Toward Clean-Label and Plant-Based Formulations

Growth in the Hybrid Emulsifier Market is being fueled by the accelerated shift toward clean-label, plant-based, and allergen-free product portfolios across food, beverage, and personal care industries. Consumer demand for recognizable, minimally processed ingredients has driven reformulation efforts, replacing synthetic or single-function emulsifiers with multifunctional hybrid solutions.

These systems deliver enhanced stability, texture, and shelf life while meeting strict regulatory and labeling requirements. Rising adoption in premium dairy alternatives, fortified beverages, and eco-friendly cosmetics is strengthening this trend. As health-conscious and sustainability-focused consumers expand their influence, manufacturers are expected to prioritize bio-based, traceable ingredient sourcing, reinforcing long-term demand for hybrid emulsifiers that offer both performance and transparency.

High Production Costs and Process Optimization Challenges

Market expansion is being tempered by the high production costs and technical complexity associated with developing advanced hybrid emulsifiers. The need for precision blending, controlled particle sizing, and multi-stage processing increases operational expenses, particularly for bio-based and enzyme-modified variants. Manufacturers face additional challenges in ensuring consistency across diverse processing environments and scaling lab-proven formulations to industrial volumes without performance loss.

These cost and efficiency pressures can hinder adoption among small and mid-sized producers, especially in price-sensitive regions. While process innovations and automation investments are gradually addressing these limitations, cost competitiveness remains a critical factor influencing procurement decisions and overall market penetration.

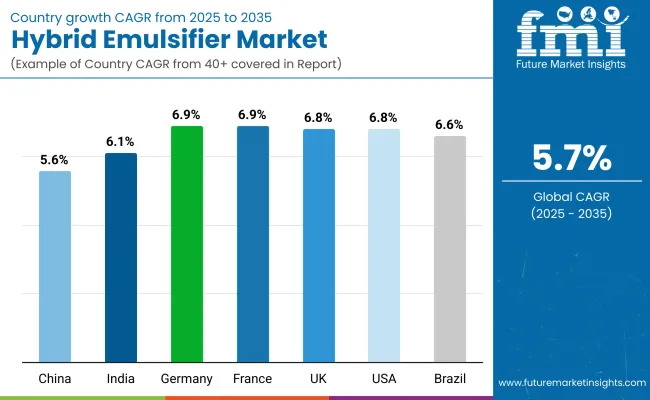

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.63% |

| India | 6.17% |

| Germany | 6.91% |

| France | 6.98% |

| UK | 6.89% |

| USA | 6.89% |

| Brazil | 6.60% |

The global Hybrid Emulsifier Market exhibits distinct growth trajectories across major economies, shaped by dietary trends, regulatory frameworks, and manufacturing innovation. Asia-Pacific is projected to witness robust expansion, with India achieving a 6.17% CAGR and China growing at 5.63% CAGR. India’s momentum is being driven by increased investment in processed food manufacturing, fortified nutrition segments, and export-oriented nutraceutical production, supported by government-backed food safety initiatives. In China, growth is being anchored by the scale of its food and beverage industry, alongside modernization in personal care manufacturing, despite price sensitivity moderating adoption rates.

Europe maintains a competitive growth profile, with France (6.98% CAGR), Germany (6.91% CAGR), and the UK (6.89% CAGR) leading due to stringent food labeling regulations, clean-label adoption, and advanced R&D capabilities in ingredient innovation. The region’s regulatory rigor is expected to continue fostering high-value product differentiation and sustainable sourcing practices.

North America shows steady expansion, with the USA forecast at 6.89% CAGR, driven by premiumization in functional foods, dairy alternatives, and personal care emulsions. In Latin America, Brazil’s 6.60% CAGR reflects rising middle-class consumption of value-added packaged foods and growing investment in health-focused product lines. Across all markets, suppliers integrating region-specific compliance, localized formulations, and co-development capabilities are expected to secure competitive advantage.

| Year | USA Hybride Emulsifier Market (USD Million) |

|---|---|

| 2025 | 152.54 |

| 2026 | 163.1 |

| 2027 | 172.9 |

| 2028 | 182.9 |

| 2029 | 194.1 |

| 2030 | 205.1 |

| 2031 | 219.1 |

| 2032 | 233.4 |

| 2033 | 248.3 |

| 2034 | 262.3 |

| 2035 | 279.4 |

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 | 6.19% |

| 2026 | 6.93% |

| 2027 | 6.02% |

| 2028 | 5.7% |

| 2029 | 6.10% |

| 2030 | 5.70% |

| 2031 | 6.81% |

| 2032 | 6.53% |

| 2033 | 6.36% |

| 2034 | 5.63% |

| 2035 | 6.56% |

The USA Hybrid Emulsifier Market is projected to grow at a CAGR of 6.2%, driven by sustained demand in food & beverage reformulation, personal care innovation, and nutraceutical product development. Functional food manufacturers are increasingly incorporating hybrid emulsifiers to meet clean-label and performance requirements. Premium dairy alternatives, fortified beverages, and plant-based protein products have emerged as core growth categories, supported by R&D investments in advanced emulsification technologies. Regulatory compliance and consumer transparency trends are shaping ingredient sourcing, with suppliers focusing on non-GMO, allergen-free, and bio-based inputs.

Rising adoption in skincare and cosmetic formulations is strengthening the market’s value share in personal care, as stability and sensory performance become brand differentiators. In the nutraceutical space, hybrid emulsifiers are being integrated into delivery systems for enhanced bioavailability. Strategic supplier-brand partnerships, bundling technical support with product supply, are enabling faster market penetration.

The UK Hybrid Emulsifier Market is forecast to expand at a CAGR of 6.89%, supported by the nation’s strong packaged food, premium beverage, and personal care sectors. Clean-label regulations and sustainability commitments are driving reformulation efforts across leading FMCG brands. Premium bakery, dairy alternatives, and ready-meal segments are increasingly utilizing hybrid emulsifiers for improved stability and texture. Advanced R&D centers in the UK are fostering co-innovation between suppliers and food manufacturers to meet consumer demands for both performance and transparency.

| Countries / Subregion | 2025 |

|---|---|

| UK | 19.37% |

| Germany | 20.20% |

| Italy | 9.88% |

| France | 12.22% |

| Spain | 9.77% |

| BENELUX | 6.40% |

| Nordic | 5.15% |

| Rest of Europe | 17% |

| Total | 100% |

| Countries / Subregion | 2035 |

|---|---|

| UK | 19.04% |

| Germany | 21.35% |

| Italy | 9.48% |

| France | 13.48% |

| Spain | 11.10% |

| BENELUX | 5.90% |

| Nordic | 5.33% |

| Rest of Europe | 14% |

| Total | 100% |

The India Hybrid Emulsifier Market is expected to grow at a CAGR of 6.17%, propelled by the expansion of the processed food industry and increasing penetration of health-oriented products. Rising consumption of fortified beverages, plant-based dairy alternatives, and functional snacks is creating demand for hybrid emulsifiers that meet cost and performance criteria. Local manufacturing investments are improving availability and reducing lead times for high-quality emulsifiers. Export-oriented production in processed foods and nutraceuticals is further accelerating adoption.

The China Hybrid Emulsifier Market is projected to expand at a CAGR of 5.63%, with growth driven by the country’s large-scale food processing industry and evolving personal care sector. Rising demand for premium and health-focused packaged foods is encouraging the shift from synthetic emulsifiers to hybrid systems. E-commerce-led FMCG distribution is increasing market reach, particularly for functional beverages and ready-to-eat products. Local ingredient producers are investing in bio-based and enzyme-modified technologies to align with global export standards.

The Germany Hybrid Emulsifier Market is anticipated to grow at a CAGR of 6.91%, supported by stringent food safety regulations and strong demand in bakery, confectionery, and dairy sectors. Clean-label and organic product trends are accelerating hybrid emulsifier usage as an alternative to synthetic options. High R&D investment in food technology and partnerships between ingredient suppliers and major food brands are enabling faster adoption of advanced emulsification systems. Sustainability initiatives are encouraging the use of plant-based and traceable raw materials.

Emulsifier Type Segment Market Value Share, 2025

| Japan Emulsifier Type | 2025 Share% |

|---|---|

| Protein Polysaccharide Hybrid Emulsifiers | 29% |

| Synthetic Natural Hybrid Emulsifiers | 21% |

| Polymer Based Hybrid Emulsifiers | 18% |

| Lecithin Modified Hybrid Emulsifiers | 16% |

| Enzyme Modified Hybrid Emulsifiers | 16% |

| Total | 100% |

| Japan Emulsifier Type | CAGR (2025 to 2035) |

|---|---|

| Protein Polysaccharide Hybrid Emulsifiers | 9.00% |

| Synthetic Natural Hybrid Emulsifiers | 8.90% |

| Polymer Based Hybrid Emulsifiers | 9.20% |

| Lecithin Modified Hybrid Emulsifiers | 8.70% |

| Enzyme Modified Hybrid Emulsifiers | 9.10% |

The Hybrid Emulsifier Market in Japan is projected at USD 43 million in 2025. Protein-polysaccharide hybrids hold the largest share at 29%, reflecting their superior stability and compatibility with premium food and personal care formulations. Synthetic-natural hybrids follow with 21%, offering balanced performance for mid-tier applications where cost and functionality must align. Polymer-based emulsifiers contribute 18%, finding strong adoption in specialized applications requiring enhanced viscosity control and emulsification resilience.

Demand is being strengthened by Japan’s high standards for food safety, consumer preference for clean-label products, and the country’s leadership in precision manufacturing for both food and cosmetics. Innovation in hybrid systems is being accelerated through collaborations between domestic research institutes and multinational ingredient suppliers, with a focus on bio-based and enzyme-enhanced formulations. As automation in food processing and cosmetics manufacturing deepens, hybrid emulsifiers tailored for stable performance under varied processing conditions are expected to gain prominence.

Application Segment Market Value Share, 2025

| S Korea Application | 2025 Share% |

|---|---|

| Food & Beverage Emulsions | 41% |

| Cosmetic & Personal Care Products | 21% |

| Pharmaceuticals | 12% |

| Nutraceuticals & Dietary Supplements | 14% |

| Industrial & Technical Applications | 12% |

| Total | 100% |

| S Korea Application | CAGR (2025 to 2035) |

|---|---|

| Food & Beverage Emulsions | 9.10% |

| Cosmetic & Personal Care Products | 8.90% |

| Pharmaceuticals | 8.80% |

| Nutraceuticals & Dietary Supplements | 9.00% |

| Industrial & Technical Applications | 8.60% |

The Hybrid Emulsifier Market in South Korea is projected at USD 21 million in 2025, with food & beverage emulsions leading at 41% due to the country’s dynamic packaged food and premium beverage sectors. Clean-label and functional product demand is driving hybrid emulsifier integration in sauces, dairy alternatives, and fortified drinks. The cosmetic and personal care segment holds 21%, supported by South Korea’s global leadership in skincare and beauty innovation, where hybrid emulsifiers are valued for texture enhancement and stability. Nutraceuticals contribute 14%, reflecting growing consumer interest in fortified health products and functional supplements.

Adoption is being accelerated by South Korea’s strong export-driven manufacturing base, where hybrid emulsifiers enable competitive differentiation in both domestic and international markets. High standards in product quality, coupled with rapid R&D cycles in the beauty and health sectors, are expected to keep innovation rates high. Strategic supplier partnerships with K-beauty and functional food brands are poised to strengthen market penetration further.

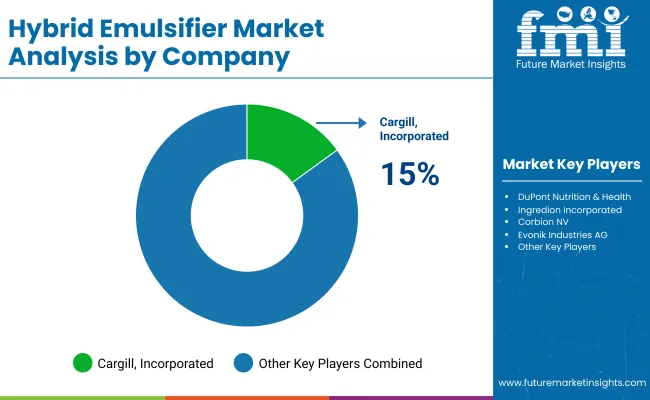

The Hybrid Emulsifier Market is moderately consolidated, with global ingredient leaders, mid-sized innovators, and specialized formulation providers competing across a diverse range of applications. Global leaders such as Cargill, Incorporated, DuPont Nutrition & Health, Ingredion Incorporated, Kerry Group, and BASF SE command a significant portion of the global market share, collectively estimated at 45-50%. Their dominance is supported by extensive product portfolios, advanced application labs, and strong co-development partnerships with multinational food, personal care, and nutraceutical brands. Strategic priorities include scaling bio-based production, enhancing clean-label compliance, and developing multifunctional emulsifiers with broader processing compatibility.

Established players such as ADM (Archer Daniels Midland), Corbion NV, and Dow Chemical Company strengthen their competitive positions by leveraging integrated supply chains and ingredient diversification strategies, ensuring consistent quality and cost efficiency. These companies also focus on custom formulation services, targeting niche segments like fortified foods and enzyme-modified systems. Specialized chemical and functional ingredient providers such as Evonik Industries AG and Lubrizol Corporation emphasize high-performance emulsifiers tailored for personal care, pharmaceuticals, and technical applications. Their competitive edge lies in deep R&D expertise, stability enhancement technologies, and regulatory alignment for premium markets.

Competitive differentiation is shifting from price and basic functionality toward ecosystem-based solutions, where performance, sustainability credentials, and technical support integration define market leadership. As demand for hybrid emulsifiers accelerates, companies embedding innovation into collaborative value chains are expected to capture long-term growth advantages.

Key Developments in Berberine Market

| Item | Value |

|---|---|

| Quantitative Units | USD 672.60 million (2025) - USD 1.12 Billion (2035) |

| Component | Protein-Polysaccharide Hybrid Emulsifiers, Synthetic-Natural Hybrid Emulsifiers, Polymer-Based Hybrid Emulsifiers, Lecithin-Modified Hybrid Emulsifiers, Enzyme-Modified Hybrid Emulsifiers |

| Application | Food & Beverage Emulsions, Cosmetic & Personal Care Products, Pharmaceuticals, Nutraceuticals & Dietary Supplements, Industrial & Technical Applications |

| Product Form | Liquid Emulsifiers, Powdered Emulsifiers, Concentrates & Blends |

| End-use Industry | Packaged Food & Beverages, Dairy & Dairy Alternatives, Bakery & Confectionery, Personal Care & Cosmetics, Nutraceuticals, Pharmaceuticals, Industrial Processing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Cargill, Incorporated; DuPont Nutrition & Health; Ingredion Incorporated; Kerry Group; BASF SE; ADM (Archer Daniels Midland); Corbion NV; Dow Chemical Company; Evonik Industries AG; Lubrizol Corporation |

| Additional Attributes | Market sizing by emulsifier type, application, and product form; adoption trends in clean-label and plant-based formulations; rising demand for multifunctional emulsifiers with enhanced stability; sector-specific growth in dairy alternatives, fortified beverages, and premium personal care; regulatory impacts driving reformulation; regional growth patterns influenced by sustainability initiatives; innovations in bio-based and enzyme-modified emulsifier systems; expansion of co-development partnerships between suppliers and manufacturers. |

The global Hybrid Emulsifier Market is estimated to be valued at USD 672.60 million in 2025.

The market size for the Hybrid Emulsifier Market is projected to reach USD 1.12 billion by 2035.

The Hybrid Emulsifier Market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in the Hybrid Emulsifier Market are Protein-Polysaccharide Hybrid Emulsifiers, Synthetic-Natural Hybrid Emulsifiers, Polymer-Based Hybrid Emulsifiers, Lecithin-Modified Hybrid Emulsifiers, and Enzyme-Modified Hybrid Emulsifiers.

In terms of application, Food & Beverage Emulsions are expected to command 40% share in the Hybrid Emulsifier Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Emulsifier Blends / Self-Emulsifying Bases Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Emulsifiers in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Emulsifiers, Stabilizers, and Thickeners Market Size and Share Forecast Outlook 2025 to 2035

Emulsifier-Free Skincare Market Growth – Size, Trends & Forecast 2024-2034

Demulsifier Market

Co-Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Lab Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

AKD Emulsifier Market Growth - Trends & Forecast 2025 to 2035

Evaluating Egg Emulsifier Market Share & Provider Insights

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analyzing Food Emulsifier Market Share & Growth Trends

Bread Emulsifier Market Analysis by Source, Product Type and Application Through 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

United States Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA