The Europe Food Emulsifier market is set to grow from an estimated USD 1,101.9 million in 2025 to USD 1,396.0 million by 2035, with a compound annual growth rate (CAGR) of 2.4% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size ( 2025 E) | USD 1,101.9 million |

| Projected Europe Value ( 2035 F) | USD 1,396.0 million |

| Value-based CAGR ( 2025 to 2035 ) | 2.4% |

The European food emulsifier market is steadily enhancing its capacity as the need for texture enhancement, improved product stability, and shelf-life extension in different types of food products continues to grow. The food industry is continuously changing, and manufacturers are generally merging emulsifiers with their formulations to minimize variations in product quality, prevent ingredient separation, and create an appealing form in the senses.

The strictly clean-label and plant-derived emulsifiers market also contributes positively to this regard, as consumers in Europe are turning toward more natural and lesser processed food ingredients. Another considerable factor responsible for transforming the food emulsifier market in Europe is the increasing demand for the bakery and confectionery sectors, in the case of which emulsifiers are the principal factors for tough structure maintenance, aeration improvement, and even fat dispersion.

Besides, the rise of emulsifiers is also seen in dairy and functional food, with low-fat dairy being the most prominent example where emulsifiers are needed to mimic the sensory experience of real dairy products.

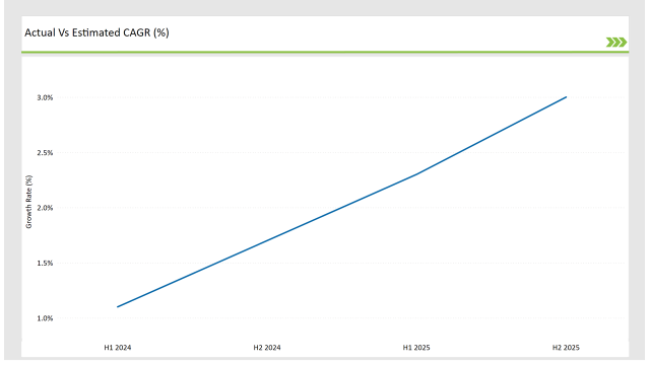

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Food Emulsifier market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.1% (2024 to 2034) |

| H2 2024 | 1.7% (2024 to 2034) |

| H1 2025 | 2.3% (2025 to 2035) |

| H2 2025 | 3.0% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Food Emulsifier market, the sector is predicted to grow at a CAGR of 1.1% during the first half of 2024, with an increase to 1.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 2.3% in H1 but is expected to rise to 3.0% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Cargill launched a new plant-based emulsifier range to cater to the clean-label trend in Europe. |

| March-24 | ADM expanded its lecithin production facility in Germany to strengthen its position in the European emulsifier market. |

| February-24 | Kerry Group introduced a natural emulsifier blend targeting plant-based dairy and functional food products. |

| January-24 | DuPont Nutrition & Biosciences collaborated with a European bakery chain to develop specialized emulsifier solutions for premium baked goods. |

Demand is Increasing for Plant-based Emulsifiers in Clean-Label and Sustainable Food Formulations

A significant trend currently driving the market in Europe is replacing synthesized food emulsifiers with plant-based emulsifiers as consumers are paying more attention to food sustainability and clean-label emissions. With the reality of the role of artificial additives on the health of good people, food companies are instantly switching to plant-based emulsifiers such as lecithin, apple seeds, and sunflower seeds instead of the former.

Head companies such as Cargill, ADM, and Sternchemie have made a significant move by expanding their plant-based emulsifier product lines which have a direct response to the surging need for sustainable and non-GMO food products. The constant growth of the segment is on the table according to the food brands' plans to reformulate their articles according to customers' demands of being clean-label and free of additives.

Functional Food Applications Advancement Sparks Innovation in Emulsifier Solutions

The rising trend of functional foods such as those added with probiotics, special vitamins, and plant-based proteins is the driving factor of surplus demand for improved emulsifier solutions. Food manufacturers that focus on producing functional foods need specific emulsifiers to enhance the distribution of ingredients, optimize texture, and stabilize nutrient-enriched formulations.

Polyglycerol esters and sorbitol esters have earned a good spot in this field due to their maintaining ingredient uniformity in fortified beverages and dairy alternatives. The companies like Kerry Group and DuPont are actively engineering multi-functional emulsifiers for sports nutrition, meal replacements, and protein-enriched functional foods.

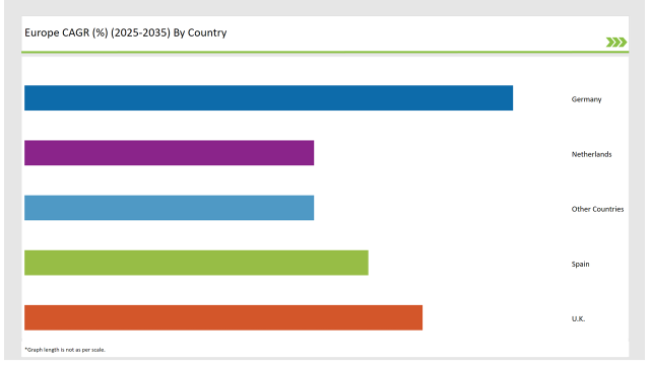

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 27% |

| Spain | 19% |

| UK | 22% |

| Netherlands | 16% |

| Other Countries | 16% |

The United Kingdom's food emulsifier market has been taking off thanks to the surge in demand for clean-label, functional, and plant-based food products among consumers. The sharp increase in the use of natural stabilizers and texturizers in bakery, dairy, and plant-based food applications has caused the leading food manufacturers and retailers to switch their formulations and use plant-derived emulsifiers.

Chains like Tesco, Sainsbury’s, and Waitrose have added their range of clean-label and organic-certified emulsifier-based products, selling mainly in the bakery sector and ready-to-eat meals. In addition, the UK’s growing number of vegan and flexitarian people has resulted in a higher demand for natural emulsifiers that improve mouthfeel and stability in lactose-free alternatives such as oat milk, almond yogurt, and coconut cheese.

Besides, rather than algae-based and pea-derived emulsifiers the food producers start to implement both algae-based and pea-derived emulsifiers as they seek new solutions to cover both functional and clean-label requirements.

The emulsifier is in great demand in Italy's vibrant artisan bakery and gourmet confectionery sector, which seeks to meet a wide range of functions such as improving dough stability, aerating, and fat dispersion. Italians, who are well known for their inclination toward top-quality food, have become the catalysts for the adaptation of emulsifiers in the preparation of baked goods, gelato, and premium chocolate.

Italian manufacturers of confectionery often prefer using mono- and diglycerides, along with lecithin, for better and consistent product quality like extended shelf-life, and improved dough elasticity level, especially in a variety of panettone, ciabatta, and brioche.

The developing interest in gluten-free and plant-based options has additionally stimulated the requirement for advanced emulsifiers that keep the product intact without using synthetic additives. The leading Italian brands including Barilla, Ferrero, and Lavazza have been using natural emulsifiers in their high-end product lines, which concentrate on clean-label and non-GMO formulations.

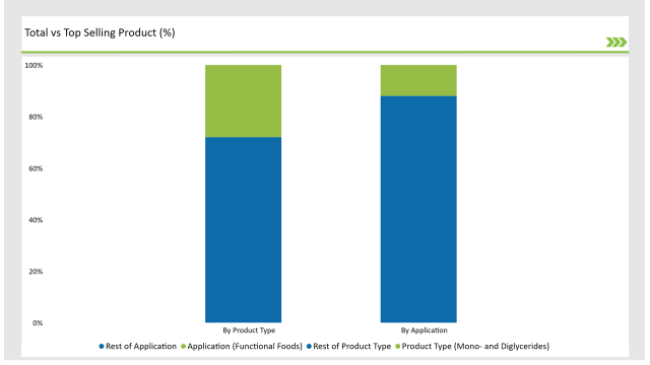

% share of Individual CategoriesProduct Type and Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type ( Mono- and Diglycerides ) | 28% |

| Remaining segments | 72% |

Mono and diglycerides are the mainstay of the emulsifier market. These surfactants consist of multifunctional dough-conditioning additives, anti-staleness agents, and oil-in-water emulsion stabilizers. Bakeries, confectioneries, and dairies that added these emulsifiers extensively are now ensuring that the products manufactured have a better consistency, homogenous fat distribution, and an improved shelf life.

Meeting the requirements of typical products in weight management and low-calorie diets has raised the demand for both mono- and diglycerides, as they are more widely utilized in light spreads, margarine, and dairy-free desserts.

The dawn of low-calorie formulations of shredded ice yogurt, ice creams, and the addition of whipped toppings on cakes has also been a factor in their embrace of fat-reduced compositions due to their role in solidity and stability, they add a creamy texture and are no different from sensory perception.

The European market has seen the entry of new brands like DuPont, Kerry Group, and Palsgaard, who have non-GMO, high-purity, and bio-engineered mono- and diglycerides available in their portfolios. Their proper use in gluten-free baking and high-protein food items has thus given them the edge in the sports nutrition and functional food markets.

| Main Segment | Market Share (%) |

|---|---|

| Application (Functional Foods) | 12% |

| Remaining segments | 88% |

Nutraceuticals are back to specialty emulsifier production focus as they are the support for both nutrient stability and texture optimization Among the various applications, the functional foods segment is becoming a veritable goldmine for the advanced emulsifiers sector, especially in, probiotic, meal replacement, and sports nutrition areas. European citizens are more and more health-conscious and they pay more attention to the foods they consume hence the energetic growth in this emulsifier segment.

Sorbitan esters and polyglycerol esters have made significant inroads into protein-enriched beverages, Vitamin-D-fortified dairy alternatives, and vegetable meat substitutes due to their emulsification and stabilizing characteristics. Food brands such as Nestlé Health Science, Danone, and Huel have used specialty emulsifiers in their food products in order to increase the nutrient bioavailability and product consistency of the foods.

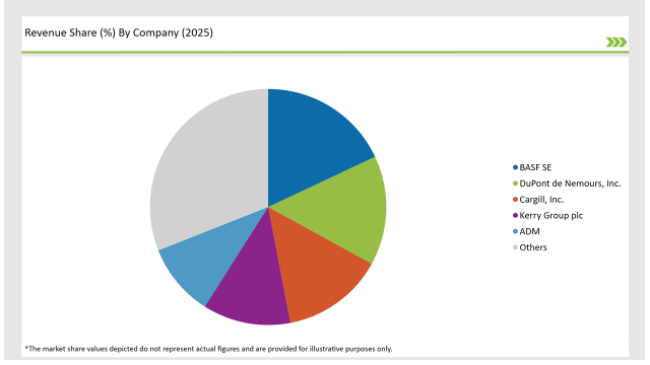

2025 Market share of Europe Food Emulsifiermanufacturers

| Manufacturer | Market Share (%) |

|---|---|

| BASF SE | 18% |

| DuPont de Nemours, Inc. | 15% |

| Cargill, Inc. | 14% |

| Kerry Group plc | 12% |

| ADM | 10% |

| Others | 31% |

Note: The above chart is indicative in nature

Companies in the emulsifier industry worldwide, like Cargill, ADM, DuPont, Kerry Group, and BASF, have aggressively targeted regional producers with the motive to strengthen supply lines and widen portfolios. Thus, being bought, the companies developed their know-how in plant-based and clean-label emulsifiers, corresponding to the expanding inhalation interval of natural and sustainable food ingredients.

Emulsifiers made of lecithin, mono- and diglycerides, and polyglycerol esters, as well as novel product investors in these products, were influential in their development of enhanced emulsifier functionality across bakery, confectionery, and dairy applications.

The firmware of the consumer's eye is being programmed through the increase of regulators as companies do the tricks to reformulate their emulsifier blends so they meet the European food safety regulations while still keeping product efficiency. Clean-label, emulsifiers that are coming from sunflower, soy, seaweed, and other plant-based resources, have become a priority for food manufacturers who are looking for natural alternatives to the traditional stabilizers.

Additionally, the industry has the potential of a technology called precision fermentation that can produce bio-based emulsifiers that have additional functional properties and sustainability benefits. Traditional emulsifier production will likely be disrupted by these innovations which thereby will empower the food manufacturers with tailor-made emulsification solutions that match the shifts in consumer wants.

As per Source, the industry has been categorized into Plant-Derived, and Animal-Derived.

As per Product Type, the industry has been categorized into Lecithin, Mono & Di-glycerides, Sorbitan Esters, Polyglycerol Esters, StearoylLactylates, and Others.

As per Application, the industry has been categorized into Bakeries, Confectionaries, Dairy Products, Functional Foods, and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Food Emulsifier market is projected to grow at a CAGR of 2.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,396.0 million.

Key factors driving the Europe food emulsifier market include the increasing demand for processed and convenience foods, which require effective emulsification for texture and stability. Additionally, the growing consumer preference for clean-label products and natural ingredients is prompting manufacturers to innovate and develop healthier emulsifier options.

Germany, France, Italy and UK are the key countries with high consumption rates in the European Food Emulsifier market.

Leading manufacturers include BASF SE, DuPont de Nemours, Inc., Cargill, Inc., Kerry Group plc, and ADM known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Europe Winter Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA